The Global Vehicle Analytics Market size was valued at USD 2.66 Billion in 2023 and the total Global Vehicle Analytics Market revenue is expected to grow at a CAGR of 23% from 2024-2030, reaching nearly USD 11.17 Billion. Vehicle analytics is an advanced technology that empowers users and manufacturers to extract real-time insights from their vehicles' current status, encompassing features such as vehicle counting and direction detection. This technology provides users with valuable information about their vehicles' health and offers insights into driving habits.To know about the Research Methodology :- Request Free Sample Report The comprehensive monitoring of both vehicle and driver activities in real-time is beneficial for market players, including insurance firms, automotive manufacturers, and automobile dealerships. The increasing demand for connected mobility technology, which is fuelled by the rising adoption of C-V2X technology and the rise in tech-savvy individuals, is expected to be a key driver for the expansion of the vehicle analytics market during the forecast period. The C-V2X market particularly, was estimated to reach USD 1.3 Billion by 2022. In addition, Audi and Ducati are the major adopters of C-V2X technology, and also collaborating with Qualcomm. The increasing connectivity solutions in the automotive industry and the cutting-edge innovation in vehicle analytics in autonomous automobiles are augmenting the growth of the vehicle analytics market. For instance, in 2022 91.9 % of connected cars were sold in the USA, same as 51.22% in Asia-Pacific and 37.11% in Latin America. High-tech technology comes with high investment and high purchasing costs, which is expected to be one of the major constraints in the vehicle analytics market. Another threat of cyber-attacks on the vehicle networks is rising, which is one of the major restraining factors of the market.

Global Vehicle Analytics Market Dynamics:

Growing Demand for Connectivity Solutions in the Automotive Sector The integration of data exchange in automobiles offers them internet access to various devices both within and outside the vehicle, which is increasing the adoption of connected vehicles in the market, and boosting the growth of the vehicle analytics market. Connected vehicles offer distinctive experiences to consumers and generate cost and revenue benefits for mobility organizations, including original equipment manufacturers (OEMs), dealers, insurance companies, suppliers, fleets, and other stakeholders. In addition, government authorities are taking the initiative for connectivity solutions in the automotive sector by investing in and supporting the organization's projects, which are contributing to the vehicle analytics market growth and are expected to continue throughout the forecast period. For instance, the UK’s Centre for Connected and Autonomous Vehicles has helped to acquire over USD 434.41 million in joint industry-government financing, supporting more than 90 projects involving 200 organizations. The UK government has invested USD 36.90 in the Department of Transport to promote the commercial deployment of connected and self-driving vehicles and the creation of safety and assurance. In addition, the C-V2X technology is a technique that enables connection between the connected vehicles and the other connected road users. The C-V2X offers direct vehicle-to-vehicle communication, vehicle-to-infrastructure, and vehicle to pedestrian. Several automotive industries are adopting the V2X technology, which is increasing the growth of the connected vehicle market, and contributing to the growth of the vehicle analytics market. 1. For instance, Ford is the leading adopter of V2X technology, as Ford has announced the accelerated commercial deployment of C-V2X technology in Ford vehicles from 2021 in China and C-V2X technology in all new models from 2022 in the United States. In the initial stage of C-V2X, 5G plays a vital role in establishing out range of all 5G applications and infrastructure. Several telecom industries in China have announced their plan for 5G commercial deployment and are rapidly developing 5G cellular networks. Major players in the market are adopting the 5G and C-V2X technology, which is a major factor contributing to the growth of the vehicle analytics market, and the emerging technology is expected to continue the growth of the market during the forecast period. For instance, BMW Group, Ericsson, and Vodafone have collaborated to urge for faster 5G and C-V2X adoption in the European Union. High Installation Cost The implementation of vehicle analytics requires cutting-edge digital infrastructure, communication devices, LiDAR and radar systems, the Internet of Things (IoT), and GPS receivers. The high cost of these systems is limiting the growth of the vehicle analytics market. The cost of a long LiDAR system is around USD 500 and the short-range LiDAR is USD 300. The cost of the Internet of Things (IoT) estimated for any project starts from USD 2,50,000. The average cost of Cloud Computing in an organization with more than 1000 employees is between USD 2.4m to USD 6m. Therefore, the high cost of implementation of vehicle analytics hampers the growth of the vehicle analytics market.Global Vehicle Analytics Market Trends:

The Dedicated Short-Range Communication (DSRC) technology enables the innovation of mobility deployments such as cooperative cruise control and vehicle platooning, enhancing traffic efficiency and lowering overcrowding. The coordination between the vehicles and infrastructure will decrease wasteful breaking and halting at intersections, which results in lower fuel consumption and emissions, thus the adoption of mobility in vehicles is an emerging trend in the vehicle analytics market and is expected to increase the market growth during the forecast period. For instance, ITS JPO has selected three pilot sites for the first wave of CV Pilot's deployment program. The program provides financial and technical support to the deployers as they develop and implement connected car applications and technology in the real world. The first three sites are located in Tampa, New York City, and Interstate 85 in Southern.Global Vehicle Analytics Market Segment Analysis:

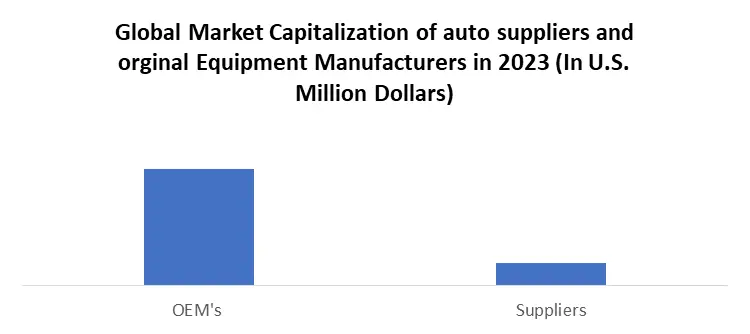

Based on the Application, Predictive Management is substantially dominating the global vehicle analytics market and is expected to continue to grow throughout the forecast period with a CAGR of 25.3% by 2030. Predictive maintenance is used in advanced analytics to detect the correct potential vehicle defects and breakdowns before they occur. Predictive maintenance optimizes the end-to-end servicing procedures, resulting in increased vehicle reliability and performance. Therefore, the predictive maintenance segment is dominating the vehicle analytics market. In addition, the rising adoption of connected vehicles is boosting the growth of the predictive management segment in the vehicle analytics market. Based on End-User, the Original Equipment Manufacturer (OEM) segment is dominating the global vehicle analytics market with the highest market share. The original equipment manufacturers are adopting automotive data analytics to enhance the driving experience and product offerings, which is fuelling the growth of the segment in the market. The automakers are competing to offer innovative services like personalized driving experiences, road safety features, and predictive maintenance are expected to boost the growth of the OEM segment during the forecast period.

Global Vehicle Analytics Market Regional Insights:

North America is substantially dominating the global vehicle analytics market with highest market share and is expected to continue its dominance during the forecast period. The region has high adoption of connected vehicles and e-mobility is boosting the growth of global vehicle analytics market in the region. The major players in the market in the region are Tesla Inc., Microsoft, and IBM are contributing to the market growth in the region. For instance, Tesla Inc. is the leading automotive OEM in the world, and the company has reported a market capitalization of USD 656,425 million and revenue of USD 81, 462 million for the fiscal year December 2022.Asia-Pacific is expected to be fastest growing region during the forecast period. The overcrowded public transport and increased demand for efficient traffic control system to ensure smooth traffic flow is driving the growth of vehicle analytics market in the region. The technological advancement and usage-based insurance are likely to boost the global vehicle analytics market in emerging countries like India, China, Japan, and South Korea. The major players in the region are contributing to the growth of the market. For instance, Denso Corporation Japan-based company, manufactures and supplies advanced automotive technology, systems, and components. It offers a wide range of original equipment manufacturing (OEM) automobile components.

Vehicle Analytics Market Scope: Inquire before buying

Global Vehicle Analytics Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.16 Bn. Forecast Period 2024 to 2030 CAGR: 23 % Market Size in 2030: US $ 11.17 Bn. Segments Covered: by Component Software Services Professional Services Deployment and Integration Support and Maintenance Consulting Service Managed Services by End User Original Equipment Manufacturers Service Providers Automotive Dealers Fleet Owners Regulatory Bodies Insures by Deployment Model On-Premises On-Demand by Application Predictive Maintenance Warranty Analytics Traffic Management Safety and Security Management Driver and User Behavior Analysis Dealer Performance Analysis Infotainment Usage-Based Insurance Road Charging Vehicle Analytics Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Vehicle Analytics Market Key Players:

North America 1. Agnik LLC (U.S) 2. Automotive Rentals (U.S) 3. INRIX (U.S) 4. SAS Institute (U.S) 5. Teletrac Navman (U.S) 6. Xevo Inc (U.S) 7. Harman International Industries Inc (U.S) 8. Genetec Inc (Canada) 9. Microsoft (U.S) 10. IBM (U.S) 11. Inseego Corp (U.S) 12. WEX Inc (U.S) 13. PROCON ANALYTICS (U.S) 14. IMS Software Inc (U.S) 15. The Infinova Group (U.S) Europe 1. SAP (Germany) 2. Inquiron (U.K) 3. Cloudmade(U.K) Asia-Pacific 1. Amodo (Japan) 2. Coatex Industries (India) FAOs 1. What are the growth drivers for the Market? Ans. Growing demand for connectivity solutions and connected cards are expected to be the major drivers for the Vehicle Analytics market. 2. What are the major restraining factors for the Vehicle Analytics market growth? Ans. The major restraining factors for the Vehicle Analytics market growth include the high installation cost of systems and devices of Vehicle Analytics. 3. Which region is expected to lead the Global Vehicle Analytics market during the forecast period? Ans. The North American region is expected to lead the Global Vehicle Analytics market during the forecast period, driven by the high adoption of connected cars and e-mobility in the region. 4. What is the projected market size and growth rate of the Vehicle Analytics Market? Ans. The Global Vehicle Analytics Market size was valued at USD 2.66 Billion in 2023 and the total Vehicle Analytics revenue is expected to grow at a CAGR of 23% from 2024 to 2030, reaching nearly USD 11.17 Billion. 5. What segments are covered in the Vehicle Analytics Market report? Ans. The segments covered in the Vehicle Analytics market report are by component application, deployment mode, end-user and Region.

1. Vehicle Analytics Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Vehicle Analytics Market: Dynamics 2.1. Vehicle Analytics Market Trends by Region 2.1.1. North America Vehicle Analytics Market Trends 2.1.2. Europe Vehicle Analytics Market Trends 2.1.3. Asia Pacific Vehicle Analytics Market Trends 2.1.4. Middle East and Africa Vehicle Analytics Market Trends 2.1.5. South America Vehicle Analytics Market Trends 2.2. Vehicle Analytics Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Vehicle Analytics Market Drivers 2.2.1.2. North America Vehicle Analytics Market Restraints 2.2.1.3. North America Vehicle Analytics Market Opportunities 2.2.1.4. North America Vehicle Analytics Market Challenges 2.2.2. Europe 2.2.2.1. Europe Vehicle Analytics Market Drivers 2.2.2.2. Europe Vehicle Analytics Market Restraints 2.2.2.3. Europe Vehicle Analytics Market Opportunities 2.2.2.4. Europe Vehicle Analytics Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Vehicle Analytics Market Drivers 2.2.3.2. Asia Pacific Vehicle Analytics Market Restraints 2.2.3.3. Asia Pacific Vehicle Analytics Market Opportunities 2.2.3.4. Asia Pacific Vehicle Analytics Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Vehicle Analytics Market Drivers 2.2.4.2. Middle East and Africa Vehicle Analytics Market Restraints 2.2.4.3. Middle East and Africa Vehicle Analytics Market Opportunities 2.2.4.4. Middle East and Africa Vehicle Analytics Market Challenges 2.2.5. South America 2.2.5.1. South America Vehicle Analytics Market Drivers 2.2.5.2. South America Vehicle Analytics Market Restraints 2.2.5.3. South America Vehicle Analytics Market Opportunities 2.2.5.4. South America Vehicle Analytics Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Vehicle Analytics Industry 2.8. Analysis of Government Schemes and Initiatives For Vehicle Analytics Industry 2.9. Vehicle Analytics Market Trade Analysis 2.10. The Global Pandemic Impact on Vehicle Analytics Market 3. Vehicle Analytics Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 3.1.1. Software 3.1.2. Services 3.1.3. Professional Services 3.1.4. Deployment and Integration 3.1.5. Support and Maintenance 3.1.6. Consulting Service 3.1.7. Managed Services 3.2. Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 3.2.1. Original Equipment Manufacturers 3.2.2. Service Providers 3.2.3. Automotive Dealers 3.2.4. Fleet Owners 3.2.5. Regulatory Bodies 3.2.6. Insures 3.3. Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 3.3.1. On-Premises 3.3.2. On-Demand 3.4. Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 3.4.1. Predictive Maintenance 3.4.2. Warranty Analytics 3.4.3. Traffic Management 3.4.4. Safety and Security Management 3.4.5. Driver and User Behavior Analysis 3.4.6. Dealer Performance Analysis 3.4.7. Infotainment 3.4.8. Usage-Based Insurance 3.4.9. Road Charging 3.5. Vehicle Analytics Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Vehicle Analytics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 4.1.1. Software 4.1.2. Services 4.1.3. Professional Services 4.1.4. Deployment and Integration 4.1.5. Support and Maintenance 4.1.6. Consulting Service 4.1.7. Managed Services 4.2. North America Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 4.2.1. Original Equipment Manufacturers 4.2.2. Service Providers 4.2.3. Automotive Dealers 4.2.4. Fleet Owners 4.2.5. Regulatory Bodies 4.2.6. Insures 4.3. North America Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 4.3.1. On-Premises 4.3.2. On-Demand 4.4. North America Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 4.4.1. Predictive Maintenance 4.4.2. Warranty Analytics 4.4.3. Traffic Management 4.4.4. Safety and Security Management 4.4.5. Driver and User Behavior Analysis 4.4.6. Dealer Performance Analysis 4.4.7. Infotainment 4.4.8. Usage-Based Insurance 4.4.9. Road Charging 4.5. North America Vehicle Analytics Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 4.5.1.1.1. Software 4.5.1.1.2. Services 4.5.1.1.3. Professional Services 4.5.1.1.4. Deployment and Integration 4.5.1.1.5. Support and Maintenance 4.5.1.1.6. Consulting Service 4.5.1.1.7. Managed Services 4.5.1.2. United States Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 4.5.1.2.1. Original Equipment Manufacturers 4.5.1.2.2. Service Providers 4.5.1.2.3. Automotive Dealers 4.5.1.2.4. Fleet Owners 4.5.1.2.5. Regulatory Bodies 4.5.1.2.6. Insures 4.5.1.3. United States Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 4.5.1.3.1. On-Premises 4.5.1.3.2. On-Demand 4.5.1.4. United States Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 4.5.1.4.1. Predictive Maintenance 4.5.1.4.2. Warranty Analytics 4.5.1.4.3. Traffic Management 4.5.1.4.4. Safety and Security Management 4.5.1.4.5. Driver and User Behavior Analysis 4.5.1.4.6. Dealer Performance Analysis 4.5.1.4.7. Infotainment 4.5.1.4.8. Usage-Based Insurance 4.5.1.4.9. Road Charging 4.5.2. Canada 4.5.2.1. Canada Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 4.5.2.1.1. Software 4.5.2.1.2. Services 4.5.2.1.3. Professional Services 4.5.2.1.4. Deployment and Integration 4.5.2.1.5. Support and Maintenance 4.5.2.1.6. Consulting Service 4.5.2.1.7. Managed Services 4.5.2.2. Canada Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 4.5.2.2.1. Original Equipment Manufacturers 4.5.2.2.2. Service Providers 4.5.2.2.3. Automotive Dealers 4.5.2.2.4. Fleet Owners 4.5.2.2.5. Regulatory Bodies 4.5.2.2.6. Insures 4.5.2.3. Canada Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 4.5.2.3.1. On-Premises 4.5.2.3.2. On-Demand 4.5.2.4. Canada Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 4.5.2.4.1. Predictive Maintenance 4.5.2.4.2. Warranty Analytics 4.5.2.4.3. Traffic Management 4.5.2.4.4. Safety and Security Management 4.5.2.4.5. Driver and User Behavior Analysis 4.5.2.4.6. Dealer Performance Analysis 4.5.2.4.7. Infotainment 4.5.2.4.8. Usage-Based Insurance 4.5.2.4.9. Road Charging 4.5.3. Mexico 4.5.3.1. Mexico Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 4.5.3.1.1. Software 4.5.3.1.2. Services 4.5.3.1.3. Professional Services 4.5.3.1.4. Deployment and Integration 4.5.3.1.5. Support and Maintenance 4.5.3.1.6. Consulting Service 4.5.3.1.7. Managed Services 4.5.3.2. Mexico Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 4.5.3.2.1. Original Equipment Manufacturers 4.5.3.2.2. Service Providers 4.5.3.2.3. Automotive Dealers 4.5.3.2.4. Fleet Owners 4.5.3.2.5. Regulatory Bodies 4.5.3.2.6. Insures 4.5.3.3. Mexico Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 4.5.3.3.1. On-Premises 4.5.3.3.2. On-Demand 4.5.3.4. Mexico Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 4.5.3.4.1. Predictive Maintenance 4.5.3.4.2. Warranty Analytics 4.5.3.4.3. Traffic Management 4.5.3.4.4. Safety and Security Management 4.5.3.4.5. Driver and User Behavior Analysis 4.5.3.4.6. Dealer Performance Analysis 4.5.3.4.7. Infotainment 4.5.3.4.8. Usage-Based Insurance 4.5.3.4.9. Road Charging 5. Europe Vehicle Analytics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 5.2. Europe Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 5.3. Europe Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 5.4. Europe Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 5.5. Europe Vehicle Analytics Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 5.5.1.2. United Kingdom Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 5.5.1.3. United Kingdom Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.1.4. United Kingdom Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 5.5.2. France 5.5.2.1. France Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 5.5.2.2. France Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 5.5.2.3. France Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.2.4. France Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 5.5.3.2. Germany Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 5.5.3.3. Germany Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.3.4. Germany Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 5.5.4.2. Italy Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 5.5.4.3. Italy Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.4.4. Italy Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 5.5.5.2. Spain Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 5.5.5.3. Spain Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.5.4. Spain Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 5.5.6.2. Sweden Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 5.5.6.3. Sweden Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.6.4. Sweden Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 5.5.7.2. Austria Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 5.5.7.3. Austria Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.7.4. Austria Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 5.5.8.2. Rest of Europe Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 5.5.8.3. Rest of Europe Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.8.4. Rest of Europe Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Vehicle Analytics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 6.2. Asia Pacific Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 6.3. Asia Pacific Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 6.4. Asia Pacific Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 6.5. Asia Pacific Vehicle Analytics Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 6.5.1.2. China Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 6.5.1.3. China Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.1.4. China Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 6.5.2.2. S Korea Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 6.5.2.3. S Korea Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.2.4. S Korea Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 6.5.3.2. Japan Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 6.5.3.3. Japan Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.3.4. Japan Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 6.5.4. India 6.5.4.1. India Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 6.5.4.2. India Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 6.5.4.3. India Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.4.4. India Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 6.5.5.2. Australia Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 6.5.5.3. Australia Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.5.4. Australia Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 6.5.6.2. Indonesia Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 6.5.6.3. Indonesia Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.6.4. Indonesia Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 6.5.7.2. Malaysia Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 6.5.7.3. Malaysia Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.7.4. Malaysia Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 6.5.8.2. Vietnam Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 6.5.8.3. Vietnam Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.8.4. Vietnam Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 6.5.9.2. Taiwan Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 6.5.9.3. Taiwan Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.9.4. Taiwan Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 6.5.10.2. Rest of Asia Pacific Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 6.5.10.3. Rest of Asia Pacific Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.10.4. Rest of Asia Pacific Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Vehicle Analytics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 7.2. Middle East and Africa Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 7.3. Middle East and Africa Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 7.4. Middle East and Africa Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 7.5. Middle East and Africa Vehicle Analytics Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 7.5.1.2. South Africa Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 7.5.1.3. South Africa Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 7.5.1.4. South Africa Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 7.5.2.2. GCC Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 7.5.2.3. GCC Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 7.5.2.4. GCC Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 7.5.3.2. Nigeria Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 7.5.3.3. Nigeria Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 7.5.3.4. Nigeria Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 7.5.4.2. Rest of ME&A Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 7.5.4.3. Rest of ME&A Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 7.5.4.4. Rest of ME&A Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 8. South America Vehicle Analytics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 8.2. South America Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 8.3. South America Vehicle Analytics Market Size and Forecast, by Deployment Mode(2023-2030) 8.4. South America Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 8.5. South America Vehicle Analytics Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 8.5.1.2. Brazil Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 8.5.1.3. Brazil Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 8.5.1.4. Brazil Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 8.5.2.2. Argentina Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 8.5.2.3. Argentina Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 8.5.2.4. Argentina Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Vehicle Analytics Market Size and Forecast, by Component (2023-2030) 8.5.3.2. Rest Of South America Vehicle Analytics Market Size and Forecast, by End User (2023-2030) 8.5.3.3. Rest Of South America Vehicle Analytics Market Size and Forecast, by Deployment Mode (2023-2030) 8.5.3.4. Rest Of South America Vehicle Analytics Market Size and Forecast, by Application (2023-2030) 9. Global Vehicle Analytics Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Vehicle Analytics Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Agnik LLC (U.S) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Automotive Rentals (U.S) 10.3. INRIX (U.S) 10.4. SAS Institute (U.S) 10.5. Teletrac Navman (U.S) 10.6. Xevo Inc (U.S) 10.7. Harman International Industries Inc (U.S) 10.8. Genetec Inc (Canada) 10.9. Microsoft (U.S) 10.10. IBM (U.S) 10.11. Inseego Corp (U.S) 10.12. WEX Inc (U.S) 10.13. PROCON ANALYTICS (U.S) 10.14. IMS Software Inc (U.S) 10.15. The Infinova Group (U.S) 10.16. SAP (Germany) 10.17. Inquiron (U.K) 10.18. Cloudmade (U.K) 10.19. Amodo (Japan) 10.20. Coatex Industries (India) 11. Key Findings 12. Industry Recommendations 13. Vehicle Analytics Market: Research Methodology 14. Terms and Glossary