Tungsten Carbide Market size was valued at USD 23.58 Billion in 2024 and the total Tungsten Carbide revenue is expected to grow at a CAGR of 5.5% from 2025 to 2032, reaching nearly USD 36.20 Billion.Tungsten Carbide Market Overview:

Tungsten carbide are chemical compounds comprising of equal parts of tungsten and carbon atoms. The tungsten carbide powders offer consistent purity and uniform particle size distribution and are in great demand from the manufacturer of high-performance Applications. The tungsten carbide is used for circuit board drills, nozzles and mills. Fine powders are used in cutting tools and inserts. The Tungsten Carbide is created when tungsten hexachloride reacts with methane or methanol, the reaction's carbon source. Physically, tungsten carbide takes the shape of a fine, grey powder and is an inorganic chemical compound with the chemical formula WC.To know about the Research Methodology :- Request Free Sample Report In addition, the report explores the Global Tungsten Carbide Market's segments (Application, End-user Industry and Region). Data has been provided by market participants, and regions (North America, Asia Pacific, Europe, Middle East & Africa, and South America). The report also investigates the Global Tungsten Carbide Market's drivers, limitations, prospects, and barriers. This MMR report includes investor recommendations based on a thorough examination of the Global Tungsten Carbide Market's contemporary competitive scenario. 2024 is considered as a base year to forecast the market from 2025 to 2032. 2024’s market size is estimated on real numbers and outputs of the key players and major players across the globe. The past five years' trends are considered while forecasting the market through 2032. 2020 is a year of exception and analysis, especially with the impact of lockdown by region.

Tungsten Carbide Market Dynamics:

Innovations in machine tools has improved the efficiency and productivity throughout the industrial revolution, The machine tool market is transformed into becoming one of the most important submarkets of the industrial productions. The demand for machine tool doubled in the year 2020 reaching roughly 200 billion U.S. Dollar, As the tungsten carbide can withstand high temperatures than standard high speed steel tools these carbides are greatly used for machining tough materials such as stainless steel and carbon steel, they have great demand when it comes for manufacturing machine tools. It has a strong resilience to wear and tear, thus the tools and equipment created from it last longer without experiencing losses. Due to the expansion of the oil and gas, agricultural, and other industries, rotary drilling and mining have increased significantly. Thus, the aforementioned factors have driven the Tungsten Carbide Market. The Tungsten carbide has been proven as a superior material for protecting both human tissues and electronic equipment, this material performs flawlessly during Chemotherapy and are widely used to create a viable equipment barrier and are used to provide syringe protection for any type of radioactive injections. Thus, continuous efforts in R&D on delivering innovations to the customers from both new product and process technology development has enabled to drive the Tungsten Carbide market in forecasted period. Changes in the regulatory environment, including environmental, health and safety regulations are subjected to increased compliance and manufacturing cost which have adverse effect on the Tungsten Carbide market. As the primary health risk associated with tungsten carbide relates in inhalation of dust, leads Pulmonary Fibrosis, also anticipated to human carcinogen government has imposed strict laws for the manufacturing of tungsten carbide market. The aerospace and defense industries have experienced rapid expansion and a huge increase in spending. Due to its lower cost and capacity to be recycled, tungsten carbide has been proving to be a very successful diamond alternative. In addition, because to its superior friction and heat resistance, tungsten carbide has been considered by the aerospace industry as an excellent replacement material for a number of aircraft parts leading to the growth opportunity in tungsten carbide market.Tungsten Carbide Market Segment Analysis:

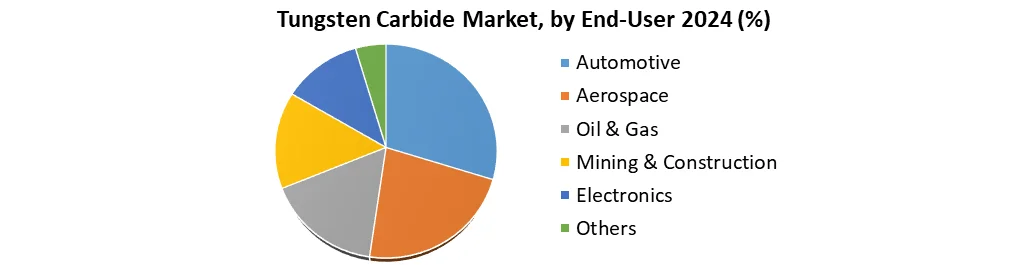

Based on Application, since cemented carbide is a metallurgical material in powder form that is a composite of tungsten carbide particles and binder rich in metallic cobalt, cemented carbide application is projected to boost the market demand among other application divisions. The items that are used in the production of aluminium cans, glass bottles, plastic tubes, copper wires, and steel wires are popular in a variety of applications. Cemented carbide is also used for wood machining, metal cutting, composite materials, soft ceramics, plastics, chipless shaping in the mining and building industries, structural parts, wear parts, and military parts. Nearly 65% of the tungsten used in the United States was used in the cemented carbide parts for cutting and wear -resistant applications, primarily in construction, metalworking, mining and oil and gas drilling industries. The estimated consumption of tungsten carbide in the year 2020 was approximately $550 million. Due to its distinctive mechanical and physical characteristics, such as its high temperature wear resistance, abrasion resistance, tensile strength, and compressive strength, this product is the first choice for many industries. Based on End-User industry, the automotive industry is dominating the tungsten carbide market accounting 41 percent growth share of the global tungsten carbide market by the year 2032 due to increased pressure for innovation and flexibility in development and manufacturing new machines. The amount of tungsten carbide contained in the U.S exports was 25% more in the year 2024 than the previous year. aerospace industry is anticipated to be the second dominating sector for the growth of the Tungsten carbide market, owing to the large scale demands for the commercial planes.

Regional Insights:

The need for cemented carbide is predicted to increase in Asia Pacific, which is boosting market expansion. Additionally, the most populous nations, like China and India, have increased their oil and gas-related operations to fulfil their rising energy needs, which has had a substantial impact on the demand for tungsten carbide in the oil and gas industry. The biggest consumers of tungsten carbide in this region are China, India, and Japan. Another key location in the tungsten carbide industry is North America. Approximately six companies in the United States used chemical processes to convert the tungsten concentrates to tungsten carbide powders. The developed end-user industries, including those in the construction, transportation, and electronics sectors, among others, are mostly responsible for the market's expansion. The developing electrical and electronics, building, and automotive industries are the key drivers of the profitable European market. Additionally, the main element contributing to the market's growth is the expansion of the oil and gas industry together with the expansion of the infrastructure. The expansion of R&D in the automotive industry in European region has increased the usage of tungsten carbide because of its capacity to lower dust emissions and boost system performance. The objective of the report is to present a comprehensive analysis of the global Tungsten Carbide Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global Tungsten Carbide Market dynamic, and structure by analyzing the market segments and projecting the Global Tungsten Carbide Market size. Clear representation of competitive analysis of key players by Design, price, financial position, Instrumentation Technology portfolio, growth strategies, and regional presence in the Global Tungsten Carbide Market make the report investor’s guide.Tungsten Carbide Market Scope: Inquiry Before Buying

Tungsten Carbide Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: US$ 23.58 Bn. Forecast Period 2025 to 2032 CAGR: 5.5% Market Size in 2032: US$ 36.20 Bn. Segments Covered: by Application Cemented Carbide Mill Products Metal alloy by End-User Automotive Aerospace Oil & Gas Mining & Construction Electronics Others Tungsten Carbide Market by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (razil, Argentina Rest of South America)Tungsten Carbide Key Players are:

1. Sandvik AB 2. GuangDong XiangLu Tungsten Co. Ltd 3. Kennametal Inc 4. Umicore 5. Xiamen Tungsten Co. Ltd 6. China Minmetals Corporation 7. Nanchang Cemented Carbide Limited Liability Company 8. Jiangxi Yaosheng Tungsten Co. Ltd 9. CERATIZIT S.A 10. Sumitomo Corporation 11. Hitachi Metals 12. Mitsubishi Materials Corporation 13. Japan New Metals Co. Ltd 14. OC Oerlikon Corporation AG 15. Chongyi Zhangyuan Tungsten Co. Ltd 16. Extramet products,LLC. 17. American Elements 18. Federal Carbide Company 19. Manu. & Sales Corp. 20. Eurotungstene Frequently Asked Questions: 1. What is the study period of the market? Ans. The Global Tungsten Carbide Market is studied from 2024-2032. 2. What is the growth rate of Global Tungsten Carbide Market? Ans. The Global Tungsten Carbide Market is growing at a CAGR of 5.5% over forecast period. 3. What is the market size of the Global Tungsten Carbide Market by 2032? Ans. The market size of the Global Tungsten Carbide Market by 2032 is expected to reach at US$ 36.20 Bn. 4. What is the forecast period for the Global Tungsten Carbide Market? Ans. The forecast period for the Global Tungsten Carbide Market is 2025-2032. 5. What was the market size of the Global Tungsten Carbide Market in 2024? Ans. The market size of the Global Tungsten Carbide Market in 2024 was valued at US$ 23.58 Bn.

1. Global Tungsten Carbide Size: Research Methodology 2. Global Tungsten Carbide Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Tungsten Carbide Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Tungsten Carbide Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region 3.12. COVID-19 Impact 4. Global Tungsten Carbide Size Segmentation 4.1. Global Tungsten Carbide Size, by Application (2024-2032) 4.2. Global Tungsten Carbide Size, by End-User (2024-2032) 5. North America Tungsten Carbide (2024-2032) 5.1. North America Tungsten Carbide Size, by Application (2024-2032) 5.2. North America Tungsten Carbide Size, by End-User (2024-2032) 5.3. North America Tungsten Carbide, by Country (2024-2032) 6. Europe Tungsten Carbide (2024-2032) 6.1. Europe Tungsten Carbide, by Application (2024-2032) 6.2. Europe Tungsten Carbide, by End-User (2024-2032) 6.3. Europe Tungsten Carbide, by Country (2024-2032) 7. Asia Pacific Tungsten Carbide (2024-2032) 7.1. Asia Pacific Tungsten Carbide, by Application (2024-2032) 7.2. Asia Pacific Tungsten Carbide, by End-User (2024-2032) 7.3. Asia Pacific Tungsten Carbide, by Country (2024-2032) 8. The Middle East and Africa Tungsten Carbide (2024-2032) 8.1. The Middle East and Africa Tungsten Carbide, by Application (2024-2032) 8.2. The Middle East and Africa Tungsten Carbide, by End-User (2024-2032) 8.3. The Middle East and Africa Tungsten Carbide, by Country (2024-2032) 9. Latin America Tungsten Carbide (2024-2032) 9.1. Latin America Tungsten Carbide, by Application (2024-2032) 9.2. Latin America Tungsten Carbide, by End-User (2024-2032) 9.3. Latin America Tungsten Carbide, by Country (2024-2032) 10. Company Profile: Key players 10.1. Umicore 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Sandvik AB 10.3. GuangDong XiangLu Tungsten Co. Ltd 10.4. Kennametal Inc 10.5. Xiamen Tungsten Co. Ltd 10.6. China Minmetals Corporation 10.7. Nanchang Cemented Carbide Limited Liability Company 10.8. Jiangxi Yaosheng Tungsten Co. Ltd 10.9. CERATIZIT S.A 10.10. Sumitomo Corporation 10.11. Hitachi Metals 10.12. Mitsubishi Materials Corporation 10.13. Japan New Metals Co. Ltd 10.14. OC Oerlikon Corporation AG 10.15. Chongyi Zhangyuan Tungsten Co. Ltd 10.16. Extramet products,LLC. 10.17. American Elements 10.18. Federal Carbide Company 10.19. Manu. & Sales Corp. 10.20. Eurotungstene