Polypropylene Market was valued at USD 221.23 Bn in 2023 and is expected to reach USD 328.50 Bn by 2030, at a CAGR of 5.81 percent during the forecast period.Polypropylene Market Overview

Polypropylene (PP) is a thermoplastic polymer widely used in various applications due to its unique combination of properties. It is a type of plastic that belongs to the polyolefin group, which also includes polyethylene. Polypropylene is produced through the polymerization of propylene, a monomer derived from petroleum or natural gas. Polypropylene is one of the most widely produced and consumed plastics globally. The Polypropylene market size has been consistently large and has shown steady growth over the years. Factors contributing to this growth include its versatile applications, increasing demand in end-use industries, and the overall growth of the plastics and packaging sectors.To know about the Research Methodology :- Request Free Sample Report The polypropylene market, with key production and consumption centers in regions such as Asia-Pacific, North America, Europe, and the Middle East. Asia-Pacific has been a major contributor to the growth of the polypropylene market, driven by rapid industrialization, urbanization, and a rising middle class in countries such as China and India. The Polypropylene market is highly dependent on commodity prices, and has a large number of global and regional manufacturers. Competition in this market is considered to be on one of the highest levels among other markets of polymeric materials. To succeed in the global polypropylene market, key market participants are actively investing in the modernization of production assets and R&D.

Polypropylene Market Dynamics

Versatility and Wide Range of Applications to boost Polypropylene Market growth Polypropylene is renowned for its versatility, making it suitable for a broad spectrum of applications. Its adaptability ranges from packaging materials and textiles to automotive components and medical devices. The ability of polypropylene to meet diverse industry requirements significantly contributes to its market demand. The packaging industry is a major driver of the polypropylene market. The material is extensively used in the production of films, containers, and other packaging materials due to its lightweight nature, excellent moisture resistance, and durability. With the global increase in e-commerce, food packaging, and consumer goods, the demand for polypropylene in the packaging sector continues to rise. The automotive industry is a significant consumer of polypropylene, utilizing it in various components such as bumpers, interior trims, dashboards, and other injection-molded parts. As global automotive production and sales continue to grow, especially in emerging markets, the demand for polypropylene in the automotive sector remains robust. Polypropylene finds applications in the construction sector, particularly in the production of pipes, sheets, and other construction materials. The growing construction and infrastructure development activities worldwide, driven by urbanization and population growth, contribute to the increased demand for polypropylene in this sector, which is expected to boost the Polypropylene Market growth over the forecast period. Polypropylene finds applications in the construction sector, particularly in the production of pipes, sheets, and other construction materials. The increasing focus on sustainable practices and environmental consciousness is driving the demand for recyclable materials. Polypropylene's recyclability and potential for use in the production of recycled plastics align with the growing emphasis on sustainability, circular economy principles, and the reduction of plastic waste.Environmental Concerns and Plastic Waste to restrain the Polypropylene Market growth Polypropylene market is the increasing global concern over plastic pollution and its environmental impact. Polypropylene is a non-biodegradable material, and improper disposal lead to environmental degradation. Regulatory pressures and public awareness campaigns are pushing industries to adopt more sustainable practices and explore alternatives to traditional plastics. The polypropylene market is sensitive to fluctuations in the prices of raw materials, primarily derived from petrochemical sources. The cost of propylene monomer, a key raw material for polypropylene production, is influenced by factors such as crude oil prices, geopolitical events, and supply-demand dynamics. This volatility in raw material prices impact the overall production costs for manufacturers. The growing emphasis on sustainability has led to increased interest in bio-based plastics and alternative materials. Bio-based polymers, derived from renewable resources, are gaining traction as environmentally friendly alternatives to traditional plastics. The polypropylene market faces competition from such materials, especially in applications where environmental considerations play a significant role in decision-making. Stringent regulations related to the use and disposal of plastics, along with evolving standards for recyclability and environmental impact, pose challenges for the polypropylene market. Compliance with changing regulations requires continuous adaptation and investments in research and development to meet new standards and requirements. Polypropylene, like many conventional plastics, has limited biodegradability, contributing to concerns about its persistence in the environment. While efforts are underway to improve recycling rates, challenges remain in effectively managing end-of-life options for polypropylene products, especially in regions with inadequate recycling infrastructure. Economic uncertainties, such as recessions, trade tensions, and geopolitical events, impact the overall demand for polypropylene. Reduced consumer spending and industrial activities during economic downturns lead to a decline in demand for products manufactured using polypropylene.

Polypropylene Market Segment Analysis

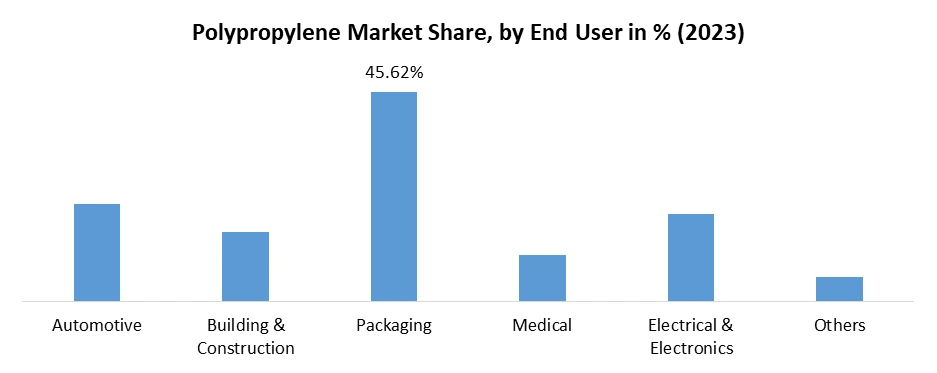

Based on Type, the market is segmented into Homopolymer, and Copolymer. Homopolymer segment dominated the market in 2023 and is expected to hold the largest Polypropylene Market share over the forecast period. A homopolymer is a type of polypropylene where the polymer chain consists of only propylene monomers. It is a pure form of polypropylene made from the polymerization of propylene without the incorporation of any other monomers. Homopolymers have a high degree of purity because they are composed solely of propylene units. They typically have a more crystalline structure, providing enhanced mechanical properties such as stiffness and strength. The homopolymer segment is a significant part of the overall polypropylene market, and its demand is often driven by applications where the specific properties of homopolymers are advantageous.Based on Process, the market is segmented into Injection Molding, Blow Molding, Extrusion, and Other. Injection molding segment dominated the market in 2023 and is expected to hold the largest Polypropylene Market share over the forecast period. The injection molding segment in the polypropylene market refers to the use of polypropylene (PP) in the injection molding process, which is a widely used manufacturing method for producing plastic parts and products. Injection molding involves melting plastic resin and injecting it into a mold cavity to shape the final product. Polypropylene is commonly used in the injection molding of various automotive components, including interior parts, door panels, dashboards, and bumpers. Polypropylene is a cost-effective material for injection molding, making it a preferred choice for large-scale production, which is expected to boost the Injection molding segment growth on Polypropylene Market. The injection molding segment is a significant contributor to the overall polypropylene market, and its growth is influenced by trends in industries such as automotive, packaging, and consumer goods.

Polypropylene Market Regional Insights

Packaging Industry to boost Polypropylene Market growth The packaging industry is a major consumer of polypropylene, and the booming e-commerce sector in the Asia Pacific region has significantly increased the demand for packaging materials. As more consumers shift towards online shopping, there is a greater need for flexible packaging, containers, and films, all of which often incorporate polypropylene. Ongoing infrastructure development projects in the Asia Pacific region, driven by urbanization and government investments, contribute to the demand for polypropylene in construction materials. Polypropylene pipes, sheets, and other construction products are widely used in these projects. The rapid industrialization and economic growth in many countries across the Asia Pacific region, including China and India, are key drivers of the polypropylene market. As these economies, increased demand for polypropylene in various industries, including packaging, automotive, construction, and consumer goods. Several countries in the Asia Pacific region are major exporters of polypropylene products. The presence of established manufacturing facilities and the ability to meet global demand contribute to the growth of the polypropylene market in the region. China is growing its influence as a key, low-cost provider of PE, due to its production additions from new CTO technology. China is expected to add approximately 17 MMT of new PE/PP capacity during the next five years, which is expected to drive further market volatility. Chinese government may increase domestic PP capacities even more than needed to satisfy domestic demand to promote employment in downstream manufacturing facilities.Polypropylene Market Scope: Inquire before buying

Global Polypropylene Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US$ 221.23 Bn. Forecast Period 2024 to 2030 CAGR: 5.81% Market Size in 2030: US$ 328.50 Bn. Segments Covered: by type Homopolymer Copolymer by Process Injection Molding Blow Molding Extrusion Other by end user Automotive Building & Construction Packaging Medical Electrical & Electronics Others Polypropylene Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Polypropylene Leading Key Players include:

North America: 1. ExxonMobil (USA) 2. PolyOne Corporation (USA) 3. Eastman Chemical Company (USA) 4. New Process Fibre Company, Inc (USA) 5. Accel Polymers LLC (Missouri, US) Europe: 1. LyondellBasell (Netherlands) 2. TotalEnergies (France) 3. INEOS (UK) 4. Borealis AG (Austria) 5. Repsol (Spain) 6. ENI (Italy) Asia-Pacific: 1. Sinopec (China) 2. Formosa Plastics Corporation (Taiwan) 3. Lotte Chemical (South Korea) 4. Haldia Petrochemicals (India) 5. PTT Global Chemical (Thailand) 6. China National Offshore Oil Corporation (CNOOC) (China) 7. Indorama Ventures (Thailand) Middle East: 1. SABIC (Saudi Arabia) 2. Qatar Petrochemical Company (QAPCO) (Qatar) South America: 1. Braskem (Brazil) Africa: 2. SASOL (South Africa) Frequently asked Question: 1. What is Polypropylene (PP) and how is it produced? Ans: Polypropylene is a thermoplastic polymer derived from propylene through polymerization, with the monomer sourced from petroleum or natural gas. It is widely used due to its unique properties. 2. What factors contribute to the growth of the Polypropylene market? Ans: The growth is fueled by versatile applications, increasing demand in end-use industries, and overall expansion of the plastics and packaging sectors. Key production and consumption centers are in Asia-Pacific, North America, Europe, and the Middle East. 3. How is the Polypropylene market segmented? Ans: The market is segmented into Homopolymer and Copolymer based on type, with the Homopolymer segment dominating. In terms of process, segments include Injection Molding, Blow Molding, Extrusion, and Others, with Injection Molding dominating. 4. What role does China play in the global Polypropylene market? Ans: China significantly influences the market, contributing to market volatility. It is a major player in both production and demand, with plans to add substantial PE/PP capacity in the coming years, potentially affecting global dynamics. 5. How does Polypropylene contribute to the circular economy and sustainability? Ans: Polypropylene's recyclability aligns with the growing emphasis on sustainability and the reduction of plastic waste. However, challenges remain in effectively managing end-of-life options, especially in regions with inadequate recycling infrastructure.

1. Polypropylene Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Polypropylene Market: Dynamics 2.1. Polypropylene Market Trends by Region 2.1.1. North America Polypropylene Market Trends 2.1.2. Europe Polypropylene Market Trends 2.1.3. Asia Pacific Polypropylene Market Trends 2.1.4. Middle East and Africa Polypropylene Market Trends 2.1.5. South America Polypropylene Market Trends 2.2. Polypropylene Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Polypropylene Market Drivers 2.2.1.2. North America Polypropylene Market Restraints 2.2.1.3. North America Polypropylene Market Opportunities 2.2.1.4. North America Polypropylene Market Challenges 2.2.2. Europe 2.2.2.1. Europe Polypropylene Market Drivers 2.2.2.2. Europe Polypropylene Market Restraints 2.2.2.3. Europe Polypropylene Market Opportunities 2.2.2.4. Europe Polypropylene Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Polypropylene Market Drivers 2.2.3.2. Asia Pacific Polypropylene Market Restraints 2.2.3.3. Asia Pacific Polypropylene Market Opportunities 2.2.3.4. Asia Pacific Polypropylene Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Polypropylene Market Drivers 2.2.4.2. Middle East and Africa Polypropylene Market Restraints 2.2.4.3. Middle East and Africa Polypropylene Market Opportunities 2.2.4.4. Middle East and Africa Polypropylene Market Challenges 2.2.5. South America 2.2.5.1. South America Polypropylene Market Drivers 2.2.5.2. South America Polypropylene Market Restraints 2.2.5.3. South America Polypropylene Market Opportunities 2.2.5.4. South America Polypropylene Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Polypropylene Industry 2.8. Analysis of Government Schemes and Initiatives For Polypropylene Industry 2.9. Polypropylene Market price trend Analysis (2021-22) 2.10. Polypropylene Market Trade Analysis 2.10.1. Global Import Analysis 2.10.1.1. Top Importer of Polypropylene 2.10.2. Global Export Analysis 2.10.2.1. Top Exporter of Polypropylene 2.11. Polypropylene Production Analysis 2.12. The Global Pandemic Impact on Polypropylene Market 3. Polypropylene Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2023-2030) 3.1. Polypropylene Market Size and Forecast, by Type (2023-2030) 3.1.1. Homopolymer 3.1.2. Copolymer 3.2. Polypropylene Market Size and Forecast, by Process (2023-2030) 3.2.1. Injection Molding 3.2.2. Blow Molding 3.2.3. Extrusion 3.2.4. Other 3.3. Polypropylene Market Size and Forecast, by End user (2023-2030) 3.3.1. Automotive 3.3.2. Building & Construction 3.3.3. Packaging 3.3.4. Medical 3.3.5. Electrical & Electronics 3.3.6. Others 3.4. Polypropylene Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Polypropylene Market Size and Forecast by Segmentation (by Value and Volume) (2023-2030) 4.1. North America Polypropylene Market Size and Forecast, by Type (2023-2030) 4.1.1. Homopolymer 4.1.2. Copolymer 4.2. North America Polypropylene Market Size and Forecast, by Process (2023-2030) 4.2.1. Injection Molding 4.2.2. Blow Molding 4.2.3. Extrusion 4.2.4. Other 4.3. North America Polypropylene Market Size and Forecast, by End user (2023-2030) 4.3.1. Automotive 4.3.2. Building & Construction 4.3.3. Packaging 4.3.4. Medical 4.3.5. Electrical & Electronics 4.3.6. Others 4.4. North America Polypropylene Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Polypropylene Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Homopolymer 4.4.1.1.2. Copolymer 4.4.1.2. United States Polypropylene Market Size and Forecast, by Process (2023-2030) 4.4.1.2.1. Injection Molding 4.4.1.2.2. Blow Molding 4.4.1.2.3. Extrusion 4.4.1.2.4. Other 4.4.1.3. United States Polypropylene Market Size and Forecast, by End user (2023-2030) 4.4.1.3.1. Automotive 4.4.1.3.2. Building & Construction 4.4.1.3.3. Packaging 4.4.1.3.4. Medical 4.4.1.3.5. Electrical & Electronics 4.4.1.3.6. Others 4.4.2. Canada 4.4.2.1. Canada Polypropylene Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Homopolymer 4.4.2.1.2. Copolymer 4.4.2.2. Canada Polypropylene Market Size and Forecast, by Process (2023-2030) 4.4.2.2.1. Injection Molding 4.4.2.2.2. Blow Molding 4.4.2.2.3. Extrusion 4.4.2.2.4. Other 4.4.2.3. Canada Polypropylene Market Size and Forecast, by End user (2023-2030) 4.4.2.3.1. Automotive 4.4.2.3.2. Building & Construction 4.4.2.3.3. Packaging 4.4.2.3.4. Medical 4.4.2.3.5. Electrical & Electronics 4.4.2.3.6. Others 4.4.3. Mexico 4.4.3.1. Mexico Polypropylene Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. Homopolymer 4.4.3.1.2. Copolymer 4.4.3.2. Mexico Polypropylene Market Size and Forecast, by Process (2023-2030) 4.4.3.2.1. Injection Molding 4.4.3.2.2. Blow Molding 4.4.3.2.3. Extrusion 4.4.3.2.4. Other 4.4.3.3. Mexico Polypropylene Market Size and Forecast, by End user (2023-2030) 4.4.3.3.1. Automotive 4.4.3.3.2. Building & Construction 4.4.3.3.3. Packaging 4.4.3.3.4. Medical 4.4.3.3.5. Electrical & Electronics 4.4.3.3.6. Others 5. Europe Polypropylene Market Size and Forecast by Segmentation (by Value and Volume) (2023-2030) 5.1. Europe Polypropylene Market Size and Forecast, by Type (2023-2030) 5.2. Europe Polypropylene Market Size and Forecast, by Process (2023-2030) 5.3. Europe Polypropylene Market Size and Forecast, by End user (2023-2030) 5.4. Europe Polypropylene Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Polypropylene Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Polypropylene Market Size and Forecast, by Process (2023-2030) 5.4.1.3. United Kingdom Polypropylene Market Size and Forecast, by End user(2023-2030) 5.4.2. France 5.4.2.1. France Polypropylene Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Polypropylene Market Size and Forecast, by Process (2023-2030) 5.4.2.3. France Polypropylene Market Size and Forecast, by End user(2023-2030) 5.4.3. Germany 5.4.3.1. Germany Polypropylene Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Polypropylene Market Size and Forecast, by Process (2023-2030) 5.4.3.3. Germany Polypropylene Market Size and Forecast, by End user (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Polypropylene Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Polypropylene Market Size and Forecast, by Process (2023-2030) 5.4.4.3. Italy Polypropylene Market Size and Forecast, by End user(2023-2030) 5.4.5. Spain 5.4.5.1. Spain Polypropylene Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Polypropylene Market Size and Forecast, by Process (2023-2030) 5.4.5.3. Spain Polypropylene Market Size and Forecast, by End user (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Polypropylene Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Polypropylene Market Size and Forecast, by Process (2023-2030) 5.4.6.3. Sweden Polypropylene Market Size and Forecast, by End user (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Polypropylene Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Polypropylene Market Size and Forecast, by Process (2023-2030) 5.4.7.3. Austria Polypropylene Market Size and Forecast, by End user (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Polypropylene Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Polypropylene Market Size and Forecast, by Process (2023-2030) 5.4.8.3. Rest of Europe Polypropylene Market Size and Forecast, by End user (2023-2030) 6. Asia Pacific Polypropylene Market Size and Forecast by Segmentation (by Value and Volume) (2023-2030) 6.1. Asia Pacific Polypropylene Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Polypropylene Market Size and Forecast, by Process (2023-2030) 6.3. Asia Pacific Polypropylene Market Size and Forecast, by End user (2023-2030) 6.4. Asia Pacific Polypropylene Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Polypropylene Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Polypropylene Market Size and Forecast, by Process (2023-2030) 6.4.1.3. China Polypropylene Market Size and Forecast, by End user (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Polypropylene Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Polypropylene Market Size and Forecast, by Process (2023-2030) 6.4.2.3. S Korea Polypropylene Market Size and Forecast, by End user (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Polypropylene Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Polypropylene Market Size and Forecast, by Process (2023-2030) 6.4.3.3. Japan Polypropylene Market Size and Forecast, by End user (2023-2030) 6.4.4. India 6.4.4.1. India Polypropylene Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Polypropylene Market Size and Forecast, by Process (2023-2030) 6.4.4.3. India Polypropylene Market Size and Forecast, by End user (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Polypropylene Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Polypropylene Market Size and Forecast, by Process (2023-2030) 6.4.5.3. Australia Polypropylene Market Size and Forecast, by End user (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Polypropylene Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Polypropylene Market Size and Forecast, by Process (2023-2030) 6.4.6.3. Indonesia Polypropylene Market Size and Forecast, by End user (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Polypropylene Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Polypropylene Market Size and Forecast, by Process (2023-2030) 6.4.7.3. Malaysia Polypropylene Market Size and Forecast, by End user (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Polypropylene Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Polypropylene Market Size and Forecast, by Process (2023-2030) 6.4.8.3. Vietnam Polypropylene Market Size and Forecast, by End user(2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Polypropylene Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Polypropylene Market Size and Forecast, by Process (2023-2030) 6.4.9.3. Taiwan Polypropylene Market Size and Forecast, by End user (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Polypropylene Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Polypropylene Market Size and Forecast, by Process (2023-2030) 6.4.10.3. Rest of Asia Pacific Polypropylene Market Size and Forecast, by End user (2023-2030) 7. Middle East and Africa Polypropylene Market Size and Forecast by Segmentation (by Value and Volume) (2023-2030) 7.1. Middle East and Africa Polypropylene Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Polypropylene Market Size and Forecast, by Process (2023-2030) 7.3. Middle East and Africa Polypropylene Market Size and Forecast, by End user (2023-2030) 7.4. Middle East and Africa Polypropylene Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Polypropylene Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Polypropylene Market Size and Forecast, by Process (2023-2030) 7.4.1.3. South Africa Polypropylene Market Size and Forecast, by End user (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Polypropylene Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Polypropylene Market Size and Forecast, by Process (2023-2030) 7.4.2.3. GCC Polypropylene Market Size and Forecast, by End user (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Polypropylene Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Polypropylene Market Size and Forecast, by Process (2023-2030) 7.4.3.3. Nigeria Polypropylene Market Size and Forecast, by End user (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Polypropylene Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Polypropylene Market Size and Forecast, by Process (2023-2030) 7.4.4.3. Rest of ME&A Polypropylene Market Size and Forecast, by End user (2023-2030) 8. South America Polypropylene Market Size and Forecast by Segmentation (by Value and Volume) (2023-2030) 8.1. South America Polypropylene Market Size and Forecast, by Type (2023-2030) 8.2. South America Polypropylene Market Size and Forecast, by Process (2023-2030) 8.3. South America Polypropylene Market Size and Forecast, by End user(2023-2030) 8.4. South America Polypropylene Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Polypropylene Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Polypropylene Market Size and Forecast, by Process (2023-2030) 8.4.1.3. Brazil Polypropylene Market Size and Forecast, by End user (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Polypropylene Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Polypropylene Market Size and Forecast, by Process (2023-2030) 8.4.2.3. Argentina Polypropylene Market Size and Forecast, by End user (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Polypropylene Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Polypropylene Market Size and Forecast, by Process (2023-2030) 8.4.3.3. Rest Of South America Polypropylene Market Size and Forecast, by End user (2023-2030) 9. Global Polypropylene Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Production of 2022 9.3.6. Company Locations 9.4. Leading Polypropylene Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. LyondellBasell Industries 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Exxon Mobil Corporation 10.3. SABIC 10.4. DuPont 10.5. INEOS 10.6. Formosa Plastics Corporation 10.7. China Petrochemical Corporation 10.8. LG Chem 10.9. Eastman Chemical Company 10.10. BASF SE 10.11. Reliance Industries Limited 10.12. Westlake Chemical Corporation 10.13. Braskem 10.14. Haldia Petrochemicals Limited 10.15. Lotte Chemical UK LTD. 10.16. Trinseo 10.17. HPCL- Mittal Energy Limited 10.18. Brahmaputra Cracker And Polymer Limited 10.19. SACO AEI Polymers 10.20. Borealis AG 10.21. China National Petroleum Corporation (China) 10.22. Ducor Petrochemicals (Netherlands) 10.23. Total S.A. (France) 10.24. Repsol (Spain) 10.25. Borouge (UAE) 10.26. Beaulieu International Group (Belgium) 10.27. MOL Group (Hungary) 10.28. Other Key Players 11. Key Findings 12. Industry Recommendations 13. Polypropylene Market: Research Methodology 14. Terms and Glossary