The Thawing System Market size was valued at USD 244.93 Million in 2023 and the total Thawing System revenue is expected to grow at a CAGR of 11.8% from 2024 to 2030, reaching nearly USD 534.73 Million by 2030Thawing System Market Overview:

A thawing system is a device designed to safely and efficiently thaw frozen biological samples, such as tissue, blood, and cell cultures, to room or incubator temperatures while maintaining sample integrity. These systems utilize various thawing methods, including controlled temperature water baths, microwave irradiation, and air circulation, to accelerate the thawing process without causing damage to the samples. Thawing systems find widespread applications across biomedical research, pharmaceutical development, clinical diagnostics, and biobanking facilities. In biomedical research, thawing systems are utilized to thaw frozen cells and tissues for experiments and assays, ensuring accurate and reproducible results. Pharmaceutical companies use thawing systems to thaw frozen drug formulations, enabling efficient drug development and testing processes. In clinical diagnostics, these systems are employed in laboratories to thaw frozen patient samples, such as blood and serum, for diagnostic testing, aiding in disease diagnosis and monitoring. Moreover, biobanking facilities utilize thawing systems to thaw cryopreserved biological samples for research, transplantation, and therapeutic purposes.To know about the Research Methodology :- Request Free Sample Report With the increasing demand for efficient sample thawing solutions across biomedical, pharmaceutical, and clinical research sectors, the market is expanding rapidly. Key growth drivers include the rising adoption of automated thawing systems to streamline processes, reduce sample thawing time, and minimize the risk of contamination. Additionally, advancements in technology, such as the integration of precise temperature control features and user-friendly interfaces, are further fueling Thawing System Market growth. Moreover, the COVID-19 pandemic has underscored the importance of rapid and reliable sample thawing methods, driving the demand for thawing systems in diagnostic laboratories and vaccine development facilities. In recent developments, Thawing System Market players such as Helmer Scientific, Boekel Scientific, and Biocision have been focusing on innovative product launches, strategic collaborations, and expansions to enhance their market presence and meet the evolving needs of customers. These initiatives include the introduction of advanced thawing systems equipped with RFID technology for sample tracking, customization options to accommodate various sample types, and expansions in distribution networks to strengthen their global footprint. Overall, the Thawing System Market is poised for continued growth, driven by technological advancements, increasing research activities, and the growing need for efficient sample preparation methods.

Thawing System Market Dynamics:

The expansion of biomedical research propelling the Thawing System Market Growth The expansion of biomedical research necessitates efficient sample thawing solutions. For instance, Thermo Fisher Scientific's CryoMed™ Controlled-Rate Thawing System caters to researchers requiring precise thawing protocols for cell cultures and biological samples, contributing to market growth. Additionally, the pharmaceutical sector's increasing demand for sample thawing to test and develop frozen drug formulations propels market expansion. Merck KGaA, for example, utilizes thawing systems to ensure accurate results and accelerate drug development processes, reflecting the Thawing System Market response to the pharmaceutical industry's needs. Technological advancements further boost Thawing System Market growth, with companies like Helmer Scientific offering innovative solutions such as the QuickThaw Plasma Thawing System, meeting the demand for efficient thawing solutions in clinical laboratories and blood banks. The development of clinical diagnostics and biobanking activities drives the adoption of thawing systems. Biocision's ThawSTAR® automated sample thawing system caters to clinical laboratories requiring standardized thawing processes for patient samples, while Boekel Scientific offers solutions tailored to the needs of biobanks, supporting the safe and efficient thawing of cryopreserved samples for research and therapeutic applications. Compliance with stringent regulatory standards also fuels Thawing System Market growth, as seen with Brooks Life Sciences' BioStore™ III Cryo Equipment Suite, ensuring regulatory compliance while providing reliable thawing solutions for cryopreserved samples. As the geriatric population grows and the biotechnology sector rapidly expands, the demand for thawing systems in healthcare and research settings escalates. For instance, Panasonic Healthcare's LABXPERT™ Thawing Station offers precise temperature control for handling sensitive biological samples, supporting advancements in personalized medicine research. These growth drivers collectively underscore the significant opportunities and advancements within the Thawing System Market. Advancing Thawing Systems Adoption in Research, Healthcare, and Pharmaceuticals The high initial investment costs associated with purchasing thawing systems deter adoption, particularly among smaller research laboratories or healthcare facilities with limited budgets. Moreover, some thawing systems may have limited compatibility with diverse sample types, necessitating users to seek alternative thawing methods, and hindering Thawing System Market growth. Additionally, the complex maintenance requirements of thawing systems, along with the risk of sample contamination from improper thawing techniques, pose significant challenges for users. Regulatory compliance requirements, especially in regulated industries like pharmaceuticals or clinical diagnostics, further add to the complexity, potentially delaying product launches and Thawing System Market entry. The limited awareness about the benefits and proper usage of thawing systems among end-users, infrastructure limitations in certain regions, and the environmental impact of thawing systems contribute to the challenges faced by the Thawing System Market. These restraints are crucial for fostering Thawing System Market growth and maximizing the potential of thawing systems in various applications across research, healthcare, and pharmaceutical sectors. Eppendorf's Tailored Thawing Solutions Boost the Thawing System Market Growth The emergence of biotechnology innovations, such as novel cell therapies and biologics, creates a demand for thawing systems capable of handling sensitive biological samples. Companies like Eppendorf can capitalize on this trend by introducing specialized thawing solutions tailored to these emerging applications, thereby expanding their market reach. Additionally, the expansion of biobanking facilities globally presents significant growth opportunities for the Thawing System Market. As biobanks accumulate a diverse range of cryopreserved samples for research and clinical applications, there is a growing need for efficient and reliable thawing systems. Companies like Taylor-Wharton can leverage this trend by offering thawing solutions designed specifically for biobanking facilities, catering to the unique requirements of sample handling and preservation. The technological advancements offer avenues for innovation and market expansion within the Thawing System Market. Integration of advanced temperature control systems and automation features enhances the efficiency and precision of thawing processes. Companies like Helmer Scientific can leverage such advancements to develop next-generation thawing systems that offer improved performance and user experience, thereby attracting new customers and expanding Thawing System Market share. Additionally, the increasing demand for point-of-care testing in healthcare settings creates opportunities for portable and easy-to-use thawing systems. Companies like Biocision can develop compact and user-friendly thawing devices for point-of-care testing applications, tapping into new market segments and driving revenue growth. These growth opportunities underscore the potential for continued expansion and innovation within the Thawing System Market.Thawing System Market Segment Analysis:

Based on Type, the market is divided into Manual and Automated. Manual witnessed the highest market share in 2023 and is expected to continue its dominance over the forecast period. Despite the advancements in automated technology, Manual thawing systems continue to dominate the market due to several factors. Manual systems are often more cost-effective, making those accessible to a wider range of laboratories and facilities, especially those with limited budgets. Additionally, manual methods provide flexibility and simplicity in sample handling, allowing users to adapt thawing protocols according to specific sample requirements. While automated systems offer advantages in terms of efficiency and precision, the widespread adoption of manual systems underscores their continued relevance and importance in various laboratory settings. A small research laboratory focusing on basic science experiments or academic research opts for manual thawing methods due to limited budget constraints. For instance, a biology research lab in a university setting uses manual methods like water baths or countertop thawing to thaw small volumes of samples for experiments. In field research expeditions, where access to electricity or sophisticated equipment is limited, manual thawing methods are often preferred. For example, scientists conducting fieldwork in remote locations use portable coolers or ambient temperature conditions to manually thaw samples, ensuring the continuity of their research activities despite challenging environments.

Thawing System Market Scope: Inquire before buying

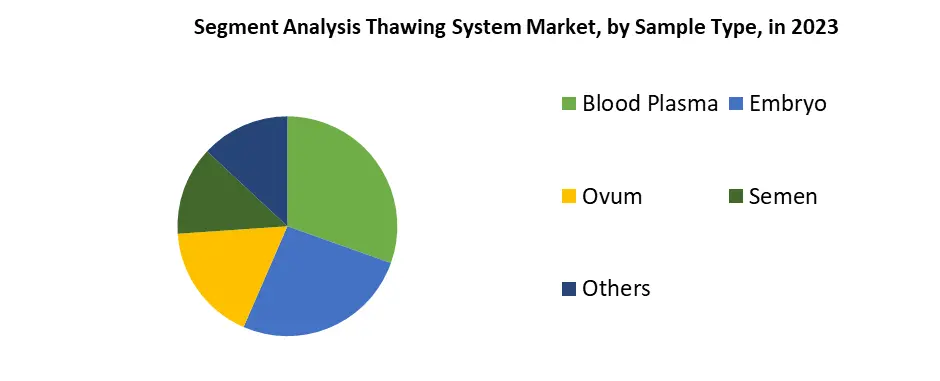

Thawing System Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2017 to 2023 Market Size in 2023: US $ 244.93 Mn. Forecast Period 2024 to 2030 CAGR: 11.8% Market Size in 2030: US $ 534.73 Mn. Segments Covered: by Type Manual Automated by Sample Type Blood Plasma Embryo Ovum Semen Others by End User Blood Banks and Transfusion Centers Hospitals and Diagnostic Laboratories Cord Blood and Stem Cell Banks Research and Academic Institutes Biotechnology and Pharmaceutical Companies Tissue Banks Thawing System Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Thawing System Market Key Players:

Major Contributors in the Thawing System Market in North America: 1. Thermo Fisher Scientific Inc. (United States) 2. Helmer Scientific (United States) 3. Boekel Scientific(United States) 4. Biocision LLC (United States) 5. Brooks Life Sciences (United States) 6. Avantor, Inc. (United States) 7. Hamilton Company (United States) 8. BioCision, LLC (United States) 9. CytoTherm LP (United States) 10. Labnet International, Inc. (United States) 11. Biomatrica, Inc. (United States) 12. Thomas Scientific (United States) 13. GE Healthcare (United States) Major Contributors in the Thawing System Market in Europe: 1. Eppendorf AG (Germany) 2. Merck KGaA (Germany) 3. SARSTEDT AG & Co. KG (Germany) 4. Barkey GmbH & Co. KG (Germany) 5. Sartorius AG (Germany) 6. B Medical Systems S.à r.l. (Luxembourg) FAQs: 1. What are the growth drivers for the Thawing System Market? Ans. The growth drivers for the Thawing System Market include increasing demand from biomedical research and pharmaceutical sectors, and technological advancements enhancing efficiency and precision. 2. What are the major restraints for the Thawing System Market growth? Ans. The major restraints for the Thawing System Market growth include high initial investment costs, limited compatibility with diverse sample types, complex maintenance requirements, risk of sample contamination, stringent regulatory compliance, limited awareness among end-users, infrastructure limitations, and environmental concerns. 3. Which region is expected to lead the global Thawing System Market during the forecast period? Ans. North America is expected to lead the global Thawing System Market during the forecast period. 4. What is the projected market size and growth rate of the Thawing System Market? Ans. The Thawing System Market size was valued at USD 244.93 Billion in 2023 and the total revenue is expected to grow at a CAGR of 11.8% from 2024 to 2030, reaching nearly USD 534.73 Billion by 2030. 5. What segments are covered in the Market report? Ans. The Thawing System report covers Type, Sample Type, End-Use, and Region.

1. Thawing System Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Thawing System Market: Dynamics 2.1. Thawing System Market Trends by Region 2.1.1. North America Thawing System Market Trends 2.1.2. Europe Thawing System Market Trends 2.1.3. Asia Pacific Thawing System Market Trends 2.1.4. Middle East and Africa Thawing System Market Trends 2.1.5. South America Thawing System Market Trends 2.2. Thawing System Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Thawing System Market Drivers 2.2.1.2. North America Thawing System Market Restraints 2.2.1.3. North America Thawing System Market Opportunities 2.2.1.4. North America Thawing System Market Challenges 2.2.2. Europe 2.2.2.1. Europe Thawing System Market Drivers 2.2.2.2. Europe Thawing System Market Restraints 2.2.2.3. Europe Thawing System Market Opportunities 2.2.2.4. Europe Thawing System Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Thawing System Market Drivers 2.2.3.2. Asia Pacific Thawing System Market Restraints 2.2.3.3. Asia Pacific Thawing System Market Opportunities 2.2.3.4. Asia Pacific Thawing System Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Thawing System Market Drivers 2.2.4.2. Middle East and Africa Thawing System Market Restraints 2.2.4.3. Middle East and Africa Thawing System Market Opportunities 2.2.4.4. Middle East and Africa Thawing System Market Challenges 2.2.5. South America 2.2.5.1. South America Thawing System Market Drivers 2.2.5.2. South America Thawing System Market Restraints 2.2.5.3. South America Thawing System Market Opportunities 2.2.5.4. South America Thawing System Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Thawing System Industry 2.8. Analysis of Government Schemes and Initiatives For Thawing System Industry 2.9. Thawing System Market Trade Analysis 2.10. The Global Pandemic Impact on Thawing System Market 3. Thawing System Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Thawing System Market Size and Forecast, by Type (2023-2030) 3.1.1. Manual 3.1.2. Automated 3.2. Thawing System Market Size and Forecast, by Sample Type (2023-2030) 3.2.1. Blood Plasma 3.2.2. Embryo 3.2.3. Ovum 3.2.4. Semen 3.2.5. Others 3.3. Thawing System Market Size and Forecast, by End Use (2023-2030) 3.3.1. Blood Banks and Transfusion Centers 3.3.2. Hospitals and Diagnostic Laboratories 3.3.3. Cord Blood and Stem Cell Banks 3.3.4. Research and Academic Institutes 3.3.5. Biotechnology and Pharmaceutical Companies 3.3.6. Tissue Banks 3.4. Thawing System Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Thawing System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Thawing System Market Size and Forecast, by Type (2023-2030) 4.1.1. Manual 4.1.2. Automated 4.2. North America Thawing System Market Size and Forecast, by Sample Type (2023-2030) 4.2.1. Blood Plasma 4.2.2. Embryo 4.2.3. Ovum 4.2.4. Semen 4.2.5. Others 4.3. North America Thawing System Market Size and Forecast, by End Use (2023-2030) 4.3.1. Blood Banks and Transfusion Centers 4.3.2. Hospitals and Diagnostic Laboratories 4.3.3. Cord Blood and Stem Cell Banks 4.3.4. Research and Academic Institutes 4.3.5. Biotechnology and Pharmaceutical Companies 4.3.6. Tissue Banks 4.4. North America Thawing System Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Thawing System Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Manual 4.4.1.1.2. Automated 4.4.1.2. United States Thawing System Market Size and Forecast, by Sample Type (2023-2030) 4.4.1.2.1. Blood Plasma 4.4.1.2.2. Embryo 4.4.1.2.3. Ovum 4.4.1.2.4. Semen 4.4.1.2.5. Others 4.4.1.3. United States Thawing System Market Size and Forecast, by End Use (2023-2030) 4.4.1.3.1. Blood Banks and Transfusion Centers 4.4.1.3.2. Hospitals and Diagnostic Laboratories 4.4.1.3.3. Cord Blood and Stem Cell Banks 4.4.1.3.4. Research and Academic Institutes 4.4.1.3.5. Biotechnology and Pharmaceutical Companies 4.4.1.3.6. Tissue Banks 4.4.2. Canada 4.4.2.1. Canada Thawing System Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Manual 4.4.2.1.2. Automated 4.4.2.2. Canada Thawing System Market Size and Forecast, by Sample Type (2023-2030) 4.4.2.2.1. Blood Plasma 4.4.2.2.2. Embryo 4.4.2.2.3. Ovum 4.4.2.2.4. Semen 4.4.2.2.5. Others 4.4.2.3. Canada Thawing System Market Size and Forecast, by End Use (2023-2030) 4.4.2.3.1. Blood Banks and Transfusion Centers 4.4.2.3.2. Hospitals and Diagnostic Laboratories 4.4.2.3.3. Cord Blood and Stem Cell Banks 4.4.2.3.4. Research and Academic Institutes 4.4.2.3.5. Biotechnology and Pharmaceutical Companies 4.4.2.3.6. Tissue Banks 4.4.3. Mexico 4.4.3.1. Mexico Thawing System Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. Manual 4.4.3.1.2. Automated 4.4.3.2. Mexico Thawing System Market Size and Forecast, by Sample Type (2023-2030) 4.4.3.2.1. Blood Plasma 4.4.3.2.2. Embryo 4.4.3.2.3. Ovum 4.4.3.2.4. Semen 4.4.3.2.5. Others 4.4.3.3. Mexico Thawing System Market Size and Forecast, by End Use (2023-2030) 4.4.3.3.1. Blood Banks and Transfusion Centers 4.4.3.3.2. Hospitals and Diagnostic Laboratories 4.4.3.3.3. Cord Blood and Stem Cell Banks 4.4.3.3.4. Research and Academic Institutes 4.4.3.3.5. Biotechnology and Pharmaceutical Companies 4.4.3.3.6. Tissue Banks 5. Europe Thawing System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Thawing System Market Size and Forecast, by Type (2023-2030) 5.2. Europe Thawing System Market Size and Forecast, by Sample Type (2023-2030) 5.3. Europe Thawing System Market Size and Forecast, by End Use (2023-2030) 5.4. Europe Thawing System Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Thawing System Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Thawing System Market Size and Forecast, by Sample Type (2023-2030) 5.4.1.3. United Kingdom Thawing System Market Size and Forecast, by End Use (2023-2030) 5.4.2. France 5.4.2.1. France Thawing System Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Thawing System Market Size and Forecast, by Sample Type (2023-2030) 5.4.2.3. France Thawing System Market Size and Forecast, by End Use (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Thawing System Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Thawing System Market Size and Forecast, by Sample Type (2023-2030) 5.4.3.3. Germany Thawing System Market Size and Forecast, by End Use (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Thawing System Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Thawing System Market Size and Forecast, by Sample Type (2023-2030) 5.4.4.3. Italy Thawing System Market Size and Forecast, by End Use (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Thawing System Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Thawing System Market Size and Forecast, by Sample Type (2023-2030) 5.4.5.3. Spain Thawing System Market Size and Forecast, by End Use (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Thawing System Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Thawing System Market Size and Forecast, by Sample Type (2023-2030) 5.4.6.3. Sweden Thawing System Market Size and Forecast, by End Use (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Thawing System Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Thawing System Market Size and Forecast, by Sample Type (2023-2030) 5.4.7.3. Austria Thawing System Market Size and Forecast, by End Use (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Thawing System Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Thawing System Market Size and Forecast, by Sample Type (2023-2030) 5.4.8.3. Rest of Europe Thawing System Market Size and Forecast, by End Use (2023-2030) 6. Asia Pacific Thawing System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Thawing System Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Thawing System Market Size and Forecast, by Sample Type (2023-2030) 6.3. Asia Pacific Thawing System Market Size and Forecast, by End Use (2023-2030) 6.4. Asia Pacific Thawing System Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Thawing System Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Thawing System Market Size and Forecast, by Sample Type (2023-2030) 6.4.1.3. China Thawing System Market Size and Forecast, by End Use (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Thawing System Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Thawing System Market Size and Forecast, by Sample Type (2023-2030) 6.4.2.3. S Korea Thawing System Market Size and Forecast, by End Use (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Thawing System Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Thawing System Market Size and Forecast, by Sample Type (2023-2030) 6.4.3.3. Japan Thawing System Market Size and Forecast, by End Use (2023-2030) 6.4.4. India 6.4.4.1. India Thawing System Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Thawing System Market Size and Forecast, by Sample Type (2023-2030) 6.4.4.3. India Thawing System Market Size and Forecast, by End Use (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Thawing System Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Thawing System Market Size and Forecast, by Sample Type (2023-2030) 6.4.5.3. Australia Thawing System Market Size and Forecast, by End Use (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Thawing System Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Thawing System Market Size and Forecast, by Sample Type (2023-2030) 6.4.6.3. Indonesia Thawing System Market Size and Forecast, by End Use (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Thawing System Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Thawing System Market Size and Forecast, by Sample Type (2023-2030) 6.4.7.3. Malaysia Thawing System Market Size and Forecast, by End Use (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Thawing System Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Thawing System Market Size and Forecast, by Sample Type (2023-2030) 6.4.8.3. Vietnam Thawing System Market Size and Forecast, by End Use (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Thawing System Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Thawing System Market Size and Forecast, by Sample Type (2023-2030) 6.4.9.3. Taiwan Thawing System Market Size and Forecast, by End Use (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Thawing System Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Thawing System Market Size and Forecast, by Sample Type (2023-2030) 6.4.10.3. Rest of Asia Pacific Thawing System Market Size and Forecast, by End Use (2023-2030) 7. Middle East and Africa Thawing System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Thawing System Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Thawing System Market Size and Forecast, by Sample Type (2023-2030) 7.3. Middle East and Africa Thawing System Market Size and Forecast, by End Use (2023-2030) 7.4. Middle East and Africa Thawing System Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Thawing System Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Thawing System Market Size and Forecast, by Sample Type (2023-2030) 7.4.1.3. South Africa Thawing System Market Size and Forecast, by End Use (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Thawing System Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Thawing System Market Size and Forecast, by Sample Type (2023-2030) 7.4.2.3. GCC Thawing System Market Size and Forecast, by End Use (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Thawing System Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Thawing System Market Size and Forecast, by Sample Type (2023-2030) 7.4.3.3. Nigeria Thawing System Market Size and Forecast, by End Use (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Thawing System Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Thawing System Market Size and Forecast, by Sample Type (2023-2030) 7.4.4.3. Rest of ME&A Thawing System Market Size and Forecast, by End Use (2023-2030) 8. South America Thawing System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Thawing System Market Size and Forecast, by Type (2023-2030) 8.2. South America Thawing System Market Size and Forecast, by Sample Type (2023-2030) 8.3. South America Thawing System Market Size and Forecast, by End Use(2023-2030) 8.4. South America Thawing System Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Thawing System Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Thawing System Market Size and Forecast, by Sample Type (2023-2030) 8.4.1.3. Brazil Thawing System Market Size and Forecast, by End Use (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Thawing System Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Thawing System Market Size and Forecast, by Sample Type (2023-2030) 8.4.2.3. Argentina Thawing System Market Size and Forecast, by End Use (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Thawing System Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Thawing System Market Size and Forecast, by Sample Type (2023-2030) 8.4.3.3. Rest Of South America Thawing System Market Size and Forecast, by End Use (2023-2030) 9. Global Thawing System Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Thawing System Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Thermo Fisher Scientific Inc. (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Helmer Scientific (United States) 10.3. Boekel Scientific (United States) 10.4. Biocision LLC (United States) 10.5. Brooks Life Sciences (United States) 10.6. Avantor, Inc. (United States) 10.7. Hamilton Company (United States) 10.8. BioCision, LLC (United States) 10.9. CytoTherm LP (United States) 10.10. Labnet International, Inc. (United States) 10.11. Biomatrica, Inc. (United States) 10.12. Thomas Scientific (United States) 10.13. GE Healthcare (United States) 10.14. Eppendorf AG (Germany) 10.15. Merck KGaA (Germany) 10.16. SARSTEDT AG & Co. KG (Germany) 10.17. Barkey GmbH & Co. KG (Germany) 10.18. Sartorius AG (Germany) 10.19. B Medical Systems S.à r.l. (Luxembourg) 11. Key Findings 12. Industry Recommendations 13. Thawing System Market: Research Methodology 14. Terms and Glossary