Global Smart Airport Market size was valued at USD 5.60 Billion in 2023 and the total Global Smart Airport Revenue is expected to grow at a CAGR of 16.1 % from 2024 to 2030, reaching nearly USD 15.92 Billion in 2030.Smart Airport Market Overview:

Smart Airports based on the use of intelligent systems such as sensors and devices configured for specific purposes in different areas in order to control, manage and plan their operations in a centralised digital environment. Smart Airports rely on the use of connected technologies such as Internet of Things (IoT) devices, GPS and sensors to perform planning and operations tasks digitally and support operational staff, optimising passenger flows and the activities of the airport staff across the airport. The Smart Airport Market is a rapidly evolving sector within the aviation industry, driven by advancements in technology and the growing demand for enhanced passenger experiences, operational efficiency, and security. Governments in developed countries are designing and developing smart airports with the collaborations of key companies. The advanced technologies installed at airports simplify the passenger travelling experience at the airports. Smart airports invest in innovative airside technologies gain a competitive edge by offering superior operational efficiency, safety standards, and passenger-centric services. Airports, global, have started diversifying their financial gain and are spending huge amount to implement non-aeronautical operations, such as providing parking facilities, lounges, conference rooms, and boarding and lodging facilities. 1.Dubai Airport makes use of a smart tunnel which, thanks to facial recognition and AI, allows passengers to pass through passport control in just 15 seconds without any human intervention. 2.Singapore Changi Airport was awarded the title of World’s Best Airport in 2023 at the World Airport Awards. Changi Airport also won awards for the World’s Best Airport Dining and World’s Best Airport Leisure Amenities. It’s the 12th time that Singapore Changi Airport has won the title. 3.Hamad International Airport is an award-winning complex known for some of the world’s best airport shopping, luxury pop-ups, and exemplary dining options. It’s also been described as one of the most luxurious and architecturally significant airport complex designs in the world.To know about the Research Methodology :- Request Free Sample Report

Smart Airport Market Dynamics:

Driving Forces and Innovations Shaping Growth of the Smart Airports Industry The increased demand for real-time information throughout the world is one of the primary factors driving the growth of the smart airports industry. The use of sophisticated technology allows for the use of renewable energy sources to minimize pollution and accomplish sustainable goals, while a spike in air travel by passengers all over the world for speedier transportation and travel benefits accelerates market growth. The increasing adoption of AI technologies by businesses of all sizes is the major driver for the global smart airports market. AI-driven solutions optimize ground handling and baggage management, reducing delays and errors. Efficiency gains in areas such as security screening for improving the overall passenger experience and maintaining the attractiveness of air travel. As airports strive to enhance efficiency, the smart airport market is set to grow.Transformative Technologies and Innovations Driving Industry Growth The Internet of Things (IoT) is considered a notable trend that is driving market growth. The emerging technologies lead the airport industry towards Smart airports. Latest smart technology airport solutions practice smart gates, check-in, baggage monitoring, facial recognition, biometric identifications, and airport terminal navigation through mobile devices, IP-based security, and data analytics, data mining to study passenger behaviour, AI adaptations, and many other operational quality enhancements. Similarly, airports are installing automated baggage handling systems to ease the pressure on airport ground support personnel, helping airports, airlines, and ground handlers achieve passenger satisfaction. Most airports in Europe and Asia have already installed automated baggage handling systems. Navigating the Complexities of Privacy and Regulation in the Evolution of Smart Airports Passenger privacy is at risk because of the usage of biometric technology like as facial recognition. Smart airports face a problem in finding the right balance of convenience and privacy. Aviation is one of the highly regulated industries mainly owing to the risks associated with its operations. A multitude of bilateral, national, and international regulations and standards bind the actions of aviation stakeholders, such as system manufacturers, service providers, and airports. Emerging technologies such as block chain and artificial intelligence could disrupt the market, resulting in the emergence of new competitors or a fundamental shift in the competitive landscape. A smart blend of leisure, dining, and retail offers to encourage passengers to spend more time at the airport before departure is an integral part of the smart airport before departure is an integral part of the smart airport concept. The biggest challenge is understanding the needs and preferences of passengers and offering personalized services in the absence of collaborated data.

Smart Airport Market Segmentation:

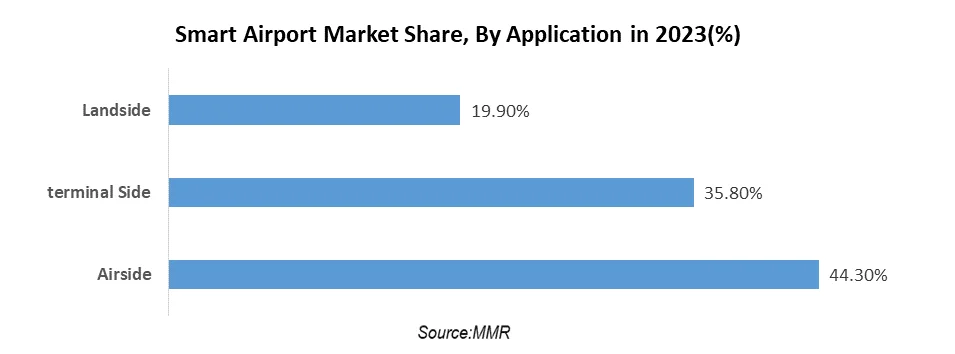

By application, Airside holds largest market share of 44.30 %. Smart airports utilize various technologies such as airport collaborative decision-making (A-CDM) systems, advanced surface movement guidance and control systems (A-SMGCS), and automated weather monitoring to enhance the efficiency of airside operations. The systems help optimize runway and gate allocation, reduce taxiing times, and improve overall aircraft movements. Smart airports deploy automated ground handling equipment, such as baggage handling systems, aircraft towing vehicles, and fuelling systems, to streamline aircraft turnaround times. The technologies minimize delays, reduce fuel consumption, and enhance operational safety. Advanced ATC systems, including radar surveillance, communication networks, and navigation aids, ensure safe and efficient aircraft movements within the airport airspace and on the ground. Smart airports integrate these systems with data analytics and predictive modelling to optimize airspace capacity and manage traffic flow. Efficient airside operations contribute to a seamless passenger experience, with reduced boarding times, minimal delays, and enhanced punctuality. Smart airports leverage data-driven insights to provide personalized services, such as gate notifications and baggage tracking, enhancing passenger satisfaction and loyalty.

Smart Airport Market Regional Insight:

North America dominates the global smart airport market share of 37 %. The United States is projected to dominate the Smart AirPort Market through the Forecast Period. Source in the US, airports have introduced RFID/NFC-based luggage tracking, automated immigration systems, smart security gates, and mobile Products Type providing notification, among others. The Miami International Airport (MIA) has developed a mobile Product Type provider updates on flight timings, gate numbers, and customized information regarding others. MIA is considered a leading player in terms of adopting mobile technologies, including broadly distributed Bluetooth beacons, which collect data to improve passenger satisfaction and the efficiency of airport operations. The US Federal Aviation Administration (FAA) awarded USD 20 million from President Biden's Bipartisan Infrastructure Law to 29 airport-owned traffic control towers nationwide. The investment was used to upgrade and build control towers in small towns and regional airports.The presence of global brands in the airport optimization industries such as IBM, SITA, and Cisco Systems INC. as well as the presence of the biggest international airport- Hartsfield-Jackson Atlanta International Airport (ALT) are significant factors driving the market growth in North America. In Canada, many airports are adopting Geo-location to reduce passenger traffic by providing navigation from boarding to terminal gates. Various other products such as Track and Trace help passengers to track their baggage and to be connected with their luggage throughout the journey.

Smart Airport Market Scope: Inquire before buying

Smart Airport Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US$ 5.60 Bn. Forecast Period 2024 to 2030 CAGR: 16.1 % Market Size in 2030: US$ 15.92 Bn. Segments Covered: by Product Type Airport 2.0 Airport 3.0 Airport 4.0 by Application Airside Terminal Side Landside by Airport Size Large Medium Small by Operation Aeronautical Non-aeronautical by End User Implementation Upgrades & Services Smart Airport Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (razil, Argentina Rest of South America)Key Players

1. Honeywell International Inc. 2. Siemens AG 3. Cisco Systems, Inc. 4. IBM Corporation 5. Thales Group 6. SITA 7. Amadeus IT Group 8. NEC Corporation 9. Collins Aerospace (formerly Rockwell Collins) 10. Indra Sistemas 11. Huawei Technologies Co., Ltd. 12. Raytheon Technologies Corporation 13. FACC AG 14. Leidos Holdings, Inc. 15. Bosch Security Systems 16. Hitachi, Ltd. 17. AirIT 18. Vanderlande Industries 19. Unisys Corporation 20. Smiths Detection Frequently Asked Questions: 1] What segments are covered in the Smart Airport Market report? Ans. The segments covered in the Smart Airport Market report are based on Product Type, Application, Airport Size, Operation, and End Users. 2] Which region is expected to hold the highest share in the Smart Airport Market? Ans. The North American region is expected to hold the highest share of the Smart Airport Market. 3] What is the market size of the Smart Airport Market by 2030? Ans. The market size of the Smart Airport Market by 2030 will be $ 15.92 Billion. 4] What is the forecast period for the Smart Airport Market? Ans. The Forecast period for the Smart Airport Market is 2024- 2030.

1. Smart Airport Market: Research Methodology 2. Smart Airport Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Smart Airport Market: Dynamics 3.1. Smart Airport Market Trends by Region 3.1.1. North America Smart Airport Market Trends 3.1.2. Europe Smart Airport Market Trends 3.1.3. Asia Pacific Smart Airport Market Trends 3.1.4. Middle East and Africa Smart Airport Market Trends 3.1.5. South America Smart Airport Market Trends 3.2. Smart Airport Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Smart Airport Market Drivers 3.2.1.2. North America Smart Airport Market Restraints 3.2.1.3. North America Smart Airport Market Opportunities 3.2.1.4. North America Smart Airport Market Challenges 3.2.2. Europe 3.2.2.1. Europe Smart Airport Market Drivers 3.2.2.2. Europe Smart Airport Market Restraints 3.2.2.3. Europe Smart Airport Market Opportunities 3.2.2.4. Europe Smart Airport Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Smart Airport Market Drivers 3.2.3.2. Asia Pacific Smart Airport Market Restraints 3.2.3.3. Asia Pacific Smart Airport Market Opportunities 3.2.3.4. Asia Pacific Smart Airport Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Smart Airport Market Drivers 3.2.4.2. Middle East and Africa Smart Airport Market Restraints 3.2.4.3. Middle East and Africa Smart Airport Market Opportunities 3.2.4.4. Middle East and Africa Smart Airport Market Challenges 3.2.5. South America 3.2.5.1. South America Smart Airport Market Drivers 3.2.5.2. South America Smart Airport Market Restraints 3.2.5.3. South America Smart Airport Market Opportunities 3.2.5.4. South America Smart Airport Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Smart Airport Industry 3.8. Analysis of Government Schemes and Initiatives For Smart Airport Industry 4. Smart Airport Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2030) 4.1. Smart Airport Market Size and Forecast, by Product Type (2024-2030) 4.1.1. Airport 2.0 4.1.2. Airport 3.0 4.1.3. Airport 4.0 4.2. Smart Airport Market Size and Forecast, by Application (2024-2030) 4.2.1. Airside 4.2.2. Terminal Side 4.2.3. Landside 4.3. Smart Airport Market Size and Forecast, by Airport Size (2024-2030) 4.3.1. Large 4.3.2. Medium 4.3.3. Small 4.4. Smart Airport Market Size and Forecast, by Operational (2024-2030) 4.4.1. Aeronautical 4.4.2. Non- Aeronautical 4.5. Smart Airport Market Size and Forecast, by End-Use (2024-2030) 4.5.1. Implementation 4.5.2. Upgrades & Services 4.6. Smart Airport Market Size and Forecast, by Region (2024-2030) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Smart Airport Market Size and Forecast by Side (by Value in USD Billion) (2024-2030) 5.1. North America Smart Airport Market Size and Forecast, by Product Type (2024-2030) 5.1.1. Airport 2.0 5.1.2. Airport 3.0 5.1.3. Airport 4.0 5.2. North America Smart Airport Market Size and Forecast, by Application (2024-2030) 5.2.1. Airside 5.2.2. Terminal Side 5.2.3. Landside 5.3. North America Smart Airport Market Size and Forecast, by Airport Size (2024-2030) 5.3.1. Large 5.3.2. Medium 5.3.3. Small 5.4. North America Smart Airport Market Size and Forecast, by Operational (2024-2030) 5.4.1. Aeronautical 5.4.2. Non- Aeronautical 5.5. North America Smart Airport Market Size and Forecast, by End Use (2024-2030) 5.5.1. Implementation 5.5.2. Upgrade & Services 5.6. North America Smart Airport Market Size and Forecast, by Country (2024-2030) 5.6.1. United States 5.6.1.1. United States Smart Airport Market Size and Forecast, by Product Type (2024-2030) 5.6.1.1.1. Airport 2.0 5.6.1.1.2. Airport 3.0 5.6.1.1.3. Airport 4.0 5.6.1.2. United States Smart Airport Market Size and Forecast, by Application (2024-2030) 5.6.1.2.1. Airside 5.6.1.2.2. Terminal Side 5.6.1.2.3. Landside 5.6.1.3. United States Smart Airport Market Size and Forecast, by Airport Size (2024-2030) 5.6.1.3.1. Large 5.6.1.3.2. Medium 5.6.1.3.3. Small 5.6.1.4. United States Smart Airport Market Size and Forecast, by Operational (2024-2030) 5.6.1.5. Aeronautical 5.6.1.6. Non- Aeronautical 5.6.1.7. United States Smart Airport Market Size and Forecast, by End-use (2024-2030) 5.6.1.8. Implementation 5.6.1.9. Upgrade & Services. 5.6.2. Canada 5.6.2.1. Canada Smart Airport Market Size and Forecast, by Product Type (2024-2030) 5.6.2.1.1. Airport 2.0 5.6.2.1.2. Airport 3.0 5.6.2.1.3. Airport 4.0 5.6.2.2. Canada Smart Airport Market Size and Forecast, by Application (2024-2030) 5.6.2.2.1. Airside 5.6.2.2.2. Terminal Side 5.6.2.2.3. Landside 5.6.2.3. Canada Smart Airport Market Size and Forecast, by Airport Size (2024-2030) 5.6.2.3.1. Large 5.6.2.3.2. Medium 5.6.2.3.3. Small 5.6.2.4. Canada Smart Airport Market Size and Forecast, by Operational (2024-2030) 5.6.2.5. Aeronautical 5.6.2.6. Non- Aeronautical 5.6.2.7. Canada Smart Airport Market Size and Forecast, by End Use (2024-2030) 5.6.2.8. Implementation 5.6.2.9. Upgrade & Services. 5.6.3. Mexico 5.6.3.1. Mexico Smart Airport Market Size and Forecast, by Product Type (2024-2030) 5.6.3.1.1. Airport 2.0 5.6.3.1.2. Airport 3.0 5.6.3.1.3. Airport 4.0 5.6.3.2. Mexico Smart Airport Market Size and Forecast, by Application (2024-2030) 5.6.3.2.1. Airside 5.6.3.2.2. Terminal Side 5.6.3.2.3. Landside 5.6.3.3. Mexico Smart Airport Market Size and Forecast, by Airport Size (2024-2030) 5.6.3.3.1. Large 5.6.3.3.2. Medium 5.6.3.3.3. Small 5.6.3.3.4. Mexico Smart Airport Market Size and Forecast, by Operational (2024-2030) 5.6.3.3.5. Aeronautical 5.6.3.3.6. Non- Aeronautical 5.6.3.3.7. Mexico Smart Airport Market Size and Forecast, by End-Use (2024-2030) 5.6.3.3.8. Implementation 5.6.3.3.9. Upgrade & Services. 6. Europe Smart Airport Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2030) 6.1. Europe Smart Airport Market Size and Forecast, by Product Type (2024-2030) 6.2. Europe Smart Airport Market Size and Forecast, by Application (2024-2030) 6.3. Europe Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 6.4. Europe Smart Airport Market Size and Forecast, by Operational(2024-2030) 6.5. Europe Smart Airport Market Size and Forecast, by End Use(2024-2030 6.6. Europe Smart Airport Market Size and Forecast, by Country (2024-2030) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Smart Airport Market Size and Forecast, by Product Type (2024-2030) 6.6.1.2. United Kingdom Smart Airport Market Size and Forecast, by Application (2024-2030) 6.6.1.3. United Kingdom Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 6.6.1.4. United Kingdom Smart Airport Market Size and Forecast, by Operational (2024-2030) 6.6.1.5. United Kingdom Smart Airport Market Size and Forecast, by End Use(2024-2030) 6.6.2. France 6.6.2.1. France Smart Airport Market Size and Forecast, by Product Type (2024-2030) 6.6.2.2. France Smart Airport Market Size and Forecast, by Application (2024-2030) 6.6.2.3. France Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 6.6.2.4. France Smart Airport Market Size and Forecast, by Operational(2024-2030) 6.6.2.5. France Smart Airport Market Size and Forecast, by End Use(2024-2030) 6.6.3. Germany 6.6.3.1. Germany Smart Airport Market Size and Forecast, by Product Type (2024-2030) 6.6.3.2. Germany Smart Airport Market Size and Forecast, by Application (2024-2030) 6.6.3.3. Germany Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 6.6.3.4. Germany Smart Airport Market Size and Forecast, by Operational(2024-2030) 6.6.3.5. Germany Smart Airport Market Size and Forecast, by End Use(2024-2030) 6.6.4. Italy 6.6.4.1. Italy Smart Airport Market Size and Forecast, by Product Type (2024-2030) 6.6.4.2. Italy Smart Airport Market Size and Forecast, by Application (2024-2030) 6.6.4.3. Italy Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 6.6.4.4. Italy Smart Airport Market Size and Forecast, by Operational (2024-2030) 6.6.4.5. Italy Smart Airport Market Size and Forecast, by End Use(2024-2030) 6.6.5. Spain 6.6.5.1. Spain Smart Airport Market Size and Forecast, by Product Type (2024-2030) 6.6.5.2. Spain Smart Airport Market Size and Forecast, by Application (2024-2030) 6.6.5.3. Spain Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 6.6.5.4. Spain Smart Airport Market Size and Forecast, by Operational(2024-2030) 6.6.5.5. Spain Smart Airport Market Size and Forecast, by End Use(2024-2030) 6.6.6. Sweden 6.6.6.1. Sweden Smart Airport Market Size and Forecast, by Product Type (2024-2030) 6.6.6.2. Sweden Smart Airport Market Size and Forecast, by Application (2024-2030) 6.6.6.3. Sweden Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 6.6.6.4. Sweden Smart Airport Market Size and Forecast, by Operational (2024-2030) 6.6.6.5. Sweden Smart Airport Market Size and Forecast, by End Use (2024-2030) 6.6.7. Austria 6.6.7.1. Austria Smart Airport Market Size and Forecast, by Product Type (2024-2030) 6.6.7.2. Austria Smart Airport Market Size and Forecast, by Application (2024-2030) 6.6.7.3. Austria Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 6.6.7.4. Austria Smart Airport Market Size and Forecast, by Operational(2024-2030) 6.6.7.5. Austria Smart Airport Market Size and Forecast, by End Use(2024-2030) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Smart Airport Market Size and Forecast, by Product Type (2024-2030) 6.6.8.2. Rest of Europe Smart Airport Market Size and Forecast, by Application (2024-2030) 6.6.8.3. Rest of Europe Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 6.6.8.4. Rest of Europe Smart Airport Market Size and Forecast, by Operational(2024-2030) 6.6.8.5. Rest of Europe Smart Airport Market Size and Forecast, by End Use (2024-2030) 7. Asia Pacific Smart Airport Market Size and Forecast (by Value in USD Billion) (2024-2030) 7.1. Asia Pacific Smart Airport Market Size and Forecast, by Product Type (2024-2030) 7.2. Asia Pacific Smart Airport Market Size and Forecast, by Application (2024-2030) 7.3. Asia Pacific Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 7.4. Asia Pacific Smart Airport Market Size and Forecast, by Operational2024-2030) 7.5. Asia Pacific Smart Airport Market Size and Forecast, by End Use(2024-2030) 7.6. Asia Pacific Smart Airport Market Size and Forecast, by Country (2024-2030) 7.6.1. China 7.6.1.1. China Smart Airport Market Size and Forecast, by Product Type (2024-2030) 7.6.1.2. China Smart Airport Market Size and Forecast, by Application (2024-2030) 7.6.1.3. China Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 7.6.1.4. China Smart Airport Market Size and Forecast, by Operational(2024-2030) 7.6.1.5. China Smart Airport Market Size and Forecast, by End Use (2024-2030) 7.6.2. S Korea 7.6.2.1. S Korea Smart Airport Market Size and Forecast, by Product Type (2024-2030) 7.6.2.2. S Korea Smart Airport Market Size and Forecast, by Application (2024-2030) 7.6.2.3. S Korea Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 7.6.2.4. S Korea Smart Airport Market Size and Forecast, by Operational(2024-2030) 7.6.2.5. S Korea Smart Airport Market Size and Forecast, by End Use(2024-2030) 7.6.3. Japan 7.6.3.1. Japan Smart Airport Market Size and Forecast, by Product Type (2024-2030) 7.6.3.2. Japan Smart Airport Market Size and Forecast, by Application (2024-2030) 7.6.3.3. Japan Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 7.6.3.4. Japan Smart Airport Market Size and Forecast, by Operational(2024-2030) 7.6.3.5. Japan Smart Airport Market Size and Forecast, by End Use(2024-2030) 7.6.4. India 7.6.4.1. India Smart Airport Market Size and Forecast, by Product Type (2024-2030) 7.6.4.2. India Smart Airport Market Size and Forecast, by Application (2024-2030) 7.6.4.3. India Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 7.6.4.4. India Smart Airport Market Size and Forecast, by Operational(2024-2030) 7.6.4.5. India Smart Airport Market Size and Forecast, by End Use(2024-2030) 7.6.5. Australia 7.6.5.1. Australia Smart Airport Market Size and Forecast, by Product Type (2024-2030) 7.6.5.2. Australia Smart Airport Market Size and Forecast, by Application (2024-2030) 7.6.5.3. Australia Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 7.6.5.4. Australia Smart Airport Market Size and Forecast, by Operational(2024-2030) 7.6.5.5. Australia Smart Airport Market Size and Forecast, by End Use (2024-2030) 7.6.6. Indonesia 7.6.6.1. Indonesia Smart Airport Market Size and Forecast, by Product Type (2024-2030) 7.6.6.2. Indonesia Smart Airport Market Size and Forecast, by Application (2024-2030) 7.6.6.3. Indonesia Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 7.6.6.4. Indonesia Smart Airport Market Size and Forecast, by Operational(2024-2030) 7.6.6.5. Indonesia Smart Airport Market Size and Forecast, by End Use2024-2030) 7.6.7. Malaysia 7.6.7.1. Malaysia Smart Airport Market Size and Forecast, by Product Type (2024-2030) 7.6.7.2. Malaysia Smart Airport Market Size and Forecast, by Application (2024-2030) 7.6.7.3. Malaysia Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 7.6.7.4. Malaysia Smart Airport Market Size and Forecast, by Operational(2024-2030) 7.6.7.5. Malaysia Smart Airport Market Size and Forecast, by End Use(2024-2030) 7.6.8. Vietnam 7.6.8.1. Vietnam Smart Airport Market Size and Forecast, by Product Type (2024-2030) 7.6.8.2. Vietnam Smart Airport Market Size and Forecast, by Application (2024-2030) 7.6.8.3. Vietnam Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 7.6.8.4. Malaysia Smart Airport Market Size and Forecast, by Operational(2024-2030) 7.6.8.5. Malaysia Smart Airport Market Size and Forecast, by End Use(2024-2030) 7.6.9. Taiwan 7.6.9.1. Taiwan Smart Airport Market Size and Forecast, by Product Type (2024-2030) 7.6.9.2. Taiwan Smart Airport Market Size and Forecast, by Application (2024-2030) 7.6.9.3. Taiwan Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 7.6.9.4. Taiwan Smart Airport Market Size and Forecast, by Operational(2024-2030) 7.6.9.5. Taiwan Smart Airport Market Size and Forecast, by End Use(2024-2030) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Smart Airport Market Size and Forecast, by Product Type (2024-2030) 7.6.10.2. Rest of Asia Pacific Smart Airport Market Size and Forecast, by Application (2024-2030) 7.6.10.3. Rest of Asia Pacific Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 7.6.10.4. Rest of Asia Pacific Smart Airport Market Size and Forecast, by Operational(2024-2030) 7.6.10.5. Rest of Asia Pacific Smart Airport Market Size and Forecast, by End Use(2024-2030) 8. Middle East and Africa Smart Airport Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2030) 8.1. Middle East and Africa Smart Airport Market Size and Forecast, by Product Type (2024-2030) 8.2. Middle East and Africa Smart Airport Market Size and Forecast, by Application (2024-2030) 8.3. Middle East and Africa Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 8.4. Middle East and Africa Smart Airport Market Size and Forecast, by Operational(2024-2030) 8.5. Middle East and Africa Smart Airport Market Size and Forecast, by End Use(2024-2030) 8.6. Middle East and Africa Smart Airport Market Size and Forecast, by Country (2024-2030) 8.6.1. South Africa 8.6.1.1. South Africa Smart Airport Market Size and Forecast, by Product Type (2024-2030) 8.6.1.2. South Africa Smart Airport Market Size and Forecast, by Product Type (2024-2030) 8.6.1.3. South Africa Smart Airport Market Size and Forecast, by Application (2024-2030) 8.6.1.4. South Africa Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 8.6.1.5. South Africa Smart Airport Market Size and Forecast, by Operational (2024-2030) 8.6.1.6. South Africa Smart Airport Market Size and Forecast, by End Use(2024-2030) 8.6.2. GCC 8.6.2.1. GCC Smart Airport Market Size and Forecast, by Product Type (2024-2030) 8.6.2.2. GCC Smart Airport Market Size and Forecast, by Application (2024-2030) 8.6.2.3. GCC Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 8.6.2.4. GCC Smart Airport Market Size and Forecast, by Operational(2024-2030) 8.6.2.5. GCC Smart Airport Market Size and Forecast, by End Use(2024-2030) 8.6.3. Nigeria 8.6.3.1. Nigeria Smart Airport Market Size and Forecast, by Product Type (2024-2030) 8.6.3.2. Nigeria Smart Airport Market Size and Forecast, by Application (2024-2030) 8.6.3.3. Nigeria Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 8.6.3.4. Nigeria Smart Airport Market Size and Forecast, by Operational(2024-2030) 8.6.3.5. Nigeria Smart Airport Market Size and Forecast, by End Use(2024-2030) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Smart Airport Market Size and Forecast, by Product Type (2024-2030) 8.6.4.2. Rest of ME&A Smart Airport Market Size and Forecast, by Application (2024-2030) 8.6.4.3. Rest of ME&A Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 8.6.4.4. Rest of ME&A Smart Airport Market Size and Forecast, by Operational(2024-2030) 8.6.4.5. Rest of ME&A Smart Airport Market Size and Forecast, by end Use(2024-2030) 9. South America Smart Airport Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2030 9.1. South America Smart Airport Market Size and Forecast, by Product Type (2024-2030) 9.2. South America Smart Airport Market Size and Forecast, by Application (2024-2030) 9.3. South America Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 9.4. South America Smart Airport Market Size and Forecast, by Operational(2024-2030) 9.5. South America Smart Airport Market Size and Forecast, by End Use(2024-2030) 9.6. South America Smart Airport Market Size and Forecast, by Country (2024-2030) 9.6.1. Brazil 9.6.1.1. Brazil Smart Airport Market Size and Forecast, by Product Type (2024-2030) 9.6.1.2. Brazil Smart Airport Market Size and Forecast, by Application (2024-2030) 9.6.1.3. Brazil Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 9.6.1.4. Brazil Smart Airport Market Size and Forecast, by Operational(2024-2030) 9.6.1.5. Brazil Smart Airport Market Size and Forecast, by End Use(2024-2030) 9.6.2. Argentina 9.6.2.1. Argentina Smart Airport Market Size and Forecast, by Product Type (2024-2030) 9.6.2.2. Argentina Smart Airport Market Size and Forecast, by Application (2024-2030) 9.6.2.3. Argentina Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 9.6.2.4. Argentina Smart Airport Market Size and Forecast, by Operational(2024-2030) 9.6.2.5. Argentina Smart Airport Market Size and Forecast, by End Use(2024-2030) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Smart Airport Market Size and Forecast, by Product Type (2024-2030) 9.6.3.2. Rest Of South America Smart Airport Market Size and Forecast, by Application (2024-2030) 9.6.3.3. Rest Of South America Smart Airport Market Size and Forecast, by Airport Size(2024-2030) 9.6.3.4. Rest Of South America Smart Airport Market Size and Forecast, by Operational(2024-2030) 9.6.3.5. Rest Of South America Smart Airport Market Size and Forecast, by End Use(2024-2030) 10. Global Smart Airport Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Smart Airport Market Companies, by market capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. SITA 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (small, medium, and large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Honeywell International Inc. 11.3. Siemens AG 11.4. Cisco Systems, Inc. 11.5. IBM Corporation 11.6. Thales Group 11.7. Amadeus IT Group 11.8. NEC Corporation 11.9. Collins Aerospace (formerly Rockwell Collins) 11.10. Indra Sistemas 11.11. Huawei Technologies Co., Ltd. 11.12. Raytheon Technologies Corporation 11.13. FACC AG 11.14. Leidos Holdings, Inc. 11.15. Bosch Security Systems 11.16. Hitachi, Ltd. 11.17. AirIT 11.18. Vanderlande Industries 11.19. Unisys Corporation 11.20. Smiths Detection 12. Key Findings 13. Industry Recommendations