Respiratory Disease Testing Market size was valued at USD 6.50 Billion in 2023 and Respiratory Disease Testing Revenue is expected to grow at a CAGR of 5.8% from 2024 to 2030, reaching nearly USD 9.65 Billion in 2030.Respiratory Disease Testing Market Overview:

Precise and timely diagnosis of respiratory disease requires primary care pathways that ensure rapid access to diagnostic tests, in particular spirometry and fractional exhaled nitric oxide (FeNO) testing for asthma and chronic obstructive pulmonary disease (COPD). Spirometry Diagnostic tests have not been performed commonly across primary care at the moment.To know about the Research Methodology :- Request Free Sample Report 1. In May 2023, according to the Centres for Disease Control and Prevention, a US-based national public health agency, there were around 28.3 million adults aged 18 years or older in the US smoking cigarettes, and around 16 million Americans live with smoking-related diseases. 2. An estimated 65 million people have moderate to severe chronic obstructive pulmonary disease (COPD), from which about 3 million die each year, making it the third leading cause of death globally. The Respiratory Disease Testing market has increased with the rising adoption of strategies by key players, the market is expected to rise through the forecast period. Respiratory Disease Testing Market Forecast by regions, type, application, and revenue, from 2023 to 2030. The Respiratory Disease Testing Market research report provides the latest updates on the trend. The research methodology involves a combination of primary research, secondary research, and expert panel reviews. Secondary research includes consulting sources such as press releases, company annual reports, and industry research. In addition, industry journals, pdf, trade journals, government websites, and associations are other valuable sources of accurate information about growth opportunities for Respiratory Disease Testing companies in the market.

Respiratory Disease Testing Market Dynamics:

Impact of Tobacco Smoking and Indoor Air Quality on Rising Incidence of Respiratory Disease The rising incidence of respiratory diseases boosts the respiratory disease testing market. Respiratory diseases refer to medical conditions that affect the respiratory systems, including the lungs, bronchi, trachea, larynx, pharynx, and nasal passages. The rising incidence of tobacco smoking is expected to drive the growth of the respiratory disease testing market through the forecast period. Respiratory disease testing plays a crucial role in the care of tobacco smokers by tracking changes in lung function, allowing healthcare professionals to assess the effectiveness of smoking cessation efforts and adjust treatment plans as needed. Poor indoor air quality is an important contributor to the Respiratory Disease Market. The WHO attributes 1.6 million deaths and 38.5 million illnesses annually to indoor smoke experiences.Advancements in Biosensing Technologies and Diagnostic Tools for Respiratory Infections Increasing chronic or acute respiratory infections are frequently occurs in both children and adults and resulted in economic burden on healthcare systems, has driven the Respiratory Disease Testing Market. Most respiratory infections are caused by bacteria, viruses, parasites, smoking, or air pollution. considerable improvements have been made in understanding and identifying respiratory infections. Various biosensing techniques have been developed with a range of targets to identify the infection at earlier stages. Recently, nanomaterials have been effectively applied to improve biosensors and their analytical performances. The review discusses recent biosensor developments for identifying respiratory infections caused by viruses and bacteria assisted by different types of nanomaterials and target molecules. To test for the presence of certain viral or bacterial infections, a swab sample from the nose or throat is obtained. Identifying the organism responsible for the infection. A complete blood count (CBC) or C-reactive protein (CRP) test also reveals the presence and severity of illness. The tests look for inflammatory indicators or the body's immunological response. On the other hand, a chest X-ray aids in the diagnosis of lung abnormalities such as pneumonia or lung infiltrates. A computed tomography (CT) scan produces detailed cross-sectional images of the lungs, allowing for a more exact assessment of lung abnormalities and infection severity. Recently, the detection of the genetic material or particular proteins of viruses by viral antigen tests and polymerase chain reaction (PCR) has been developed. The tests are often used to identify respiratory viral diseases such as influenza, respiratory syncytial virus (RSV), and COVID-19. Pulmonary function testing (PFT) is often the starting point of assessment in the physical examination of respiratory disease. Common elements of PFT are spirometry, lung volumes, and diffusing capacity. Spirometry entails measuring the volume and flow rates of exhaled and inhaled breath. The most frequently used spirometric measures are forced vital capacity (FVC, in liters), which is the largest volume of air that is exhaled forcefully from a maximal inhalation, and the forced expiratory volume in 1 second (FEV1, in liters), which is the volume exhaled during the first second of a maximal forceful expiratory effort a maximal inhalation. The ratio of FEV1/FVC is an important indicator of the presence of airflow obstruction, e.g., of asthma or chronic obstructive lung disease.

Respiratory Disease Testing Market Segment Analysis:

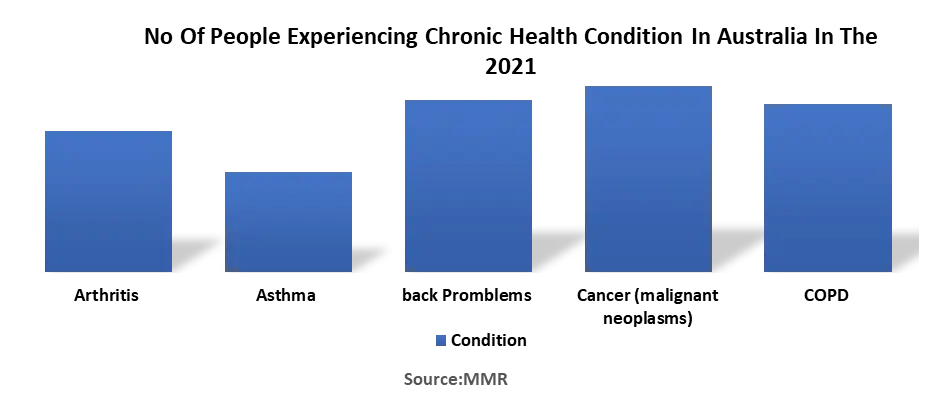

By Application, Asthma is a chronic lung disease affecting people of all ages. It is caused by inflammation and muscle tightening around the airways, which makes it harder to breathe. Asthma is a significant chronic health issue globally, affecting 1% to 18% of the global population. Asthma affects up to 334 million people globally and its incidence has been increasing. It affects all ages, races, and ethnicities, though wide variation exists in different countries and different groups within the same country. It is the most common chronic disease in children and is more severe in children living in non-affluent countries. Australia is no exception, with asthma affecting millions and accounting for 34% of Australia’s respiratory disease burden and 2.5% of the total disease burden. Asthma leads to numerous emergency department visits and urgent health care visits. Those living with asthma reported a poorer quality of life and were less likely to rate their health status as excellent or very good. When observing the total cost that asthma has on the Australian health system, it is evident that hospital-related costs outweigh non–hospital-related costs (Aus $205 million/year [approximately US $150 million] vs Aus $163 million/year [approximately US $120 million]). Theoretically, reducing exacerbations reduces the requirement for hospitalizations unplanned primary care presentations, and indirect costs, such as work absenteeism, and thus assists in reducing the costs. Key players in the Respiratory Disease Testing Market continuously focus on developing new medicines. for instance, AstraZeneca declared the owing of Caelum Biosciences, a US biotech company developing new medicines for chronic respiratory diseases such as asthma and chronic obstructive pulmonary disease (COPD). 1. About 334 million people suffer from asthma, which is the most common chronic disease of childhood, affecting 14% of children globally. The prevalence of asthma in children is rising.

Respiratory Disease Testing Market Regional Analysis:

North America holds the largest market share, thanks to increasing respiratory diseases such as Asthma, COPD and other respiratory infections are the reasons for the dominance of North America. Air pollution poses a serious threat to the nation's health by harming the lungs and increasing the risk of lung disease. The American Lung Association works to protect public health from unhealthy air pollution by supporting the Clean Air Act and pushing the U.S. Environmental Protection Agency to ensure that everyone in the country has air that is safe and healthy to breathe. More than 34 million people living in the U.S. live with chronic lung diseases like asthma and COPD, which include emphysema and chronic bronchitis. Through education and support programs for those living with a lung disease, their caregivers, and those who love them, the American Lung Association is continually working to reduce the burden of living with a lung disease. Asthma makes breathing difficult for more than 25 million people, including over 4 million children. While there is no cure, asthma is managed and treated, helping those with the disease lead a healthier life. Respiratory infections account for more than 4 million deaths annually and are the leading cause of death in developing countries. Since the deaths are preventable with adequate medical care, a much higher proportion of them occur in low-income countries. Pneumonia is the most common serious respiratory infection. In children under 5 years of age, pneumonia accounts for 18% of all deaths, or more than 1.3 million annually pneumonia kills far more than HIV or malaria. Risk factors for pneumonia include living in crowded conditions, malnutrition, lack of immunization, HIV, and exposure to tobacco or indoor smoke. In Africa, pneumonia is one of the most frequent reasons for adults being admitted to hospital, one in ten of the patients die from the disease. Streptococcus pneumonia remains the most frequent bacterial cause of pneumonia, HIV infection increases the risk of pneumonia caused by the organism twenty-fold. Pneumonia also leads to chronic respiratory disease. Viral respiratory infections occur in epidemics and spread rapidly within communities across the globe. Every year, influenza causes respiratory tract infections in 5–15% of the population and severe illness in 3–5 million people. The Asia-Pacific region is expected to be the fastest-growing region for Respiratory Disease Testing Industry through the forecast period with China, India, and Japan all projected to be lucrative in the Asia-Pacific region. It is based on the regions having ever-increasing levels of air pollution and is therefore expected to have the largest increase in the incidence of respiratory diseases. India has emerged as the world’s third most polluted country. In 2023, India’s air quality, with an average annual PM2.5 concentration of 54.4 micrograms per cubic meter, has been better than only two countries- Bangladesh and Pakistan, according to the World Air Quality Report 2023 by Swiss organization IQAir. Malaysia CRD faces challenges in the delivery of care to people that are High burden of damaging respiratory exposures including air pollution and smoking, limited health information systems, limited access to vaccines, medicines, and devices, health constraints, and challenges around the financing leadership, and governance of services. In Malaysia, the prevalence of asthma is estimated at 8.9– 13% in children (6–14 years) and 6.3% in adults for COPD in a sub-urban population, prevalence has been estimated at 3.4–5.1%. many existing healthcare providers have limited awareness of CRDs and lack the confidence to diagnose and manage the conditions. Time constraints and heavy workloads seen in the public health sector contribute to challenges around healthcare delivery. Previous work has demonstrated poor asthma control with only 1/3 of asthmatics receiving regular follow-up. For COPD, there is mislabelling of the disease as asthma by both patients and doctors. There is a lack of pulmonary rehabilitation services, and palliative care for severe COPD is scarce.Respiratory Disease Testing Market Competitive Landscape: 1. In January 2023, in the United States, Airsupra (albuterol/budesonide), formerly known as PT027, received recognition as a preventive or as-needed treatment for bronchoconstriction, as well as to lower the risk of exacerbations in individuals with asthma who are 18 years of age or older. The FDA's clearance was granted based on the outcomes of the Phase III studies for MANDALA and DENALI. 2. In February 2023, in the US, Tezspire (tezepelumab), a product of AstraZeneca and Amgen, is authorized for self-administration by patients with severe asthma who are 12 years of age or older. With its authorized label including no phenotypic (e.g., eosinophilic or allergic) or biomarker constraint, Tezspire is the only biologic licensed for severe asthma. 3. AstraZeneca and Merck revealed a partnership for a Phase 3 clinical trial evaluation done on Lynparza (olaparib), targeted therapy for metastatic pancreatic cancer patients with the combination of gemcitabine and nab-paclitaxel. The collaboration aids in extending the treatment options for the cancer with limited therapeutic options.

Respiratory Disease Testing Market Scope: Inquire before buying

Global Respiratory Disease Testing Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 6.50 Bn. Forecast Period 2024 to 2030 CAGR: 5.8% Market Size in 2030: US $ 9.65 Bn. Segments Covered: by Product Imaging Tests Respiratory Measurement Devices Blood Gas Test Others by Application Chronic Obstructive Pulmonary Disease Lung Cancer Asthma Tuberculosis Other by End User Hospital Physicians Clinic Clinical Laboratories Other Respiratory Disease Testing Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Respiratory Disease Market Key Players

1. Abbott Laboratories - Abbott Park, Illinois, USA 2. BD (Becton, Dickinson and Company) - Franklin Lakes, New Jersey, USA 3. Bio-Rad Laboratories, Inc. - Hercules, California, USA 4. BioMérieux - Marcy-l'Étoile, France 5. Cepheid (Danaher Corporation) - Sunnyvale, California, USA 6. F. Hoffmann-La Roche Ltd - Basel, Switzerland 7. Fisher & Paykel Healthcare - Auckland, New Zealand 8. GlaxoSmithKline (GSK) - Brentford, United Kingdom 9. Hologic, Inc. - Marlborough, Massachusetts, USA 10. Koninklijke Philips N.V. (Philips) - Amsterdam, Netherlands 11. Masimo Corporation - Irvine, California, USA 12. Merck & Co., Inc. - Kenilworth, New Jersey, USA 13. PerkinElmer, Inc. - Waltham, Massachusetts, USA 14. Quidel Corporation - San Diego, California, USA 15. ResMed Inc. - San Diego, California, USA 16. Siemens Healthineers AG - Erlangen, Germany 17. Thermo Fisher Scientific Inc. - Waltham, Massachusetts, USA 18. Vyaire Medical, Inc. - Mettawa, Illinois, USA 19. Zimmer Biomet Holdings, Inc. - Warsaw, Indiana, USA Frequently Asked Questions: 1] What segments are covered in the Respiratory Disease Testing Market report? Ans. The segments covered in the Respiratory Disease Testing Market report are based on, Product, Application, and End Users. 2] Which region is expected to hold the highest share in the Respiratory Disease Testing Market? Ans. The North American region is expected to hold the highest share of the Respiratory Disease Testing Market. 3] What is the market size of the Respiratory Disease Testing Market by 2030? Ans. The market size of the Respiratory Disease Testing Market by 2030 will be $ 9.65 Billion. 4] What is the forecast period for the Respiratory Disease Testing Market? Ans. The Forecast period for the Respiratory Disease Testing Market is 2024- 2030.

1. Respiratory Disease Testing Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Respiratory Disease Testing Market: Dynamics 2.1. Respiratory Disease Testing Market Trends by Region 2.1.1. North America Respiratory Disease Testing Market Trends 2.1.2. Europe Respiratory Disease Testing Market Trends 2.1.3. Asia Pacific Respiratory Disease Testing Market Trends 2.1.4. Middle East and Africa Respiratory Disease Testing Market Trends 2.1.5. South America Respiratory Disease Testing Market Trends 2.2. Respiratory Disease Testing Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Respiratory Disease Testing Market Drivers 2.2.1.2. North America Respiratory Disease Testing Market Restraints 2.2.1.3. North America Respiratory Disease Testing Market Opportunities 2.2.1.4. North America Respiratory Disease Testing Market Challenges 2.2.2. Europe 2.2.2.1. Europe Respiratory Disease Testing Market Drivers 2.2.2.2. Europe Respiratory Disease Testing Market Restraints 2.2.2.3. Europe Respiratory Disease Testing Market Opportunities 2.2.2.4. Europe Respiratory Disease Testing Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Respiratory Disease Testing Market Drivers 2.2.3.2. Asia Pacific Respiratory Disease Testing Market Restraints 2.2.3.3. Asia Pacific Respiratory Disease Testing Market Opportunities 2.2.3.4. Asia Pacific Respiratory Disease Testing Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Respiratory Disease Testing Market Drivers 2.2.4.2. Middle East and Africa Respiratory Disease Testing Market Restraints 2.2.4.3. Middle East and Africa Respiratory Disease Testing Market Opportunities 2.2.4.4. Middle East and Africa Respiratory Disease Testing Market Challenges 2.2.5. South America 2.2.5.1. South America Respiratory Disease Testing Market Drivers 2.2.5.2. South America Respiratory Disease Testing Market Restraints 2.2.5.3. South America Respiratory Disease Testing Market Opportunities 2.2.5.4. South America Respiratory Disease Testing Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Respiratory Disease Testing Industry 2.8. Analysis of Government Schemes and Initiatives For Respiratory Disease Testing Industry 2.9. Respiratory Disease Testing Market Trade Analysis 2.10. The Global Pandemic Impact on Respiratory Disease Testing Market 3. Respiratory Disease Testing Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 3.1.1. Imaging Tests 3.1.2. Respiratory Measurement Devices 3.1.3. Blood Gas Test 3.1.4. Others 3.2. Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 3.2.1. Chronic Obstructive Pulmonary Disease 3.2.2. Lung Cancer 3.2.3. Asthma 3.2.4. Tuberculosis 3.2.5. Other 3.3. Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 3.3.1. Hospital 3.3.2. Physicians Clinic 3.3.3. Clinical Laboratories 3.3.4. Other 3.4. Respiratory Disease Testing Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Respiratory Disease Testing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 4.1.1. Imaging Tests 4.1.2. Respiratory Measurement Devices 4.1.3. Blood Gas Test 4.1.4. Others 4.2. North America Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 4.2.1. Chronic Obstructive Pulmonary Disease 4.2.2. Lung Cancer 4.2.3. Asthma 4.2.4. Tuberculosis 4.2.5. Other 4.3. North America Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 4.3.1. Hospital 4.3.2. Physicians Clinic 4.3.3. Clinical Laboratories 4.3.4. Other 4.4. North America Respiratory Disease Testing Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 4.4.1.1.1. Imaging Tests 4.4.1.1.2. Respiratory Measurement Devices 4.4.1.1.3. Blood Gas Test 4.4.1.1.4. Others 4.4.1.2. United States Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Chronic Obstructive Pulmonary Disease 4.4.1.2.2. Lung Cancer 4.4.1.2.3. Asthma 4.4.1.2.4. Tuberculosis 4.4.1.2.5. Other 4.4.1.3. United States Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Hospital 4.4.1.3.2. Physicians Clinic 4.4.1.3.3. Clinical Laboratories 4.4.1.3.4. Other 4.4.2. Canada 4.4.2.1. Canada Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 4.4.2.1.1. Imaging Tests 4.4.2.1.2. Respiratory Measurement Devices 4.4.2.1.3. Blood Gas Test 4.4.2.1.4. Others 4.4.2.2. Canada Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Chronic Obstructive Pulmonary Disease 4.4.2.2.2. Lung Cancer 4.4.2.2.3. Asthma 4.4.2.2.4. Tuberculosis 4.4.2.2.5. Other 4.4.2.3. Canada Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Hospital 4.4.2.3.2. Physicians Clinic 4.4.2.3.3. Clinical Laboratories 4.4.2.3.4. Other 4.4.3. Mexico 4.4.3.1. Mexico Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 4.4.3.1.1. Imaging Tests 4.4.3.1.2. Respiratory Measurement Devices 4.4.3.1.3. Blood Gas Test 4.4.3.1.4. Others 4.4.3.2. Mexico Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Chronic Obstructive Pulmonary Disease 4.4.3.2.2. Lung Cancer 4.4.3.2.3. Asthma 4.4.3.2.4. Tuberculosis 4.4.3.2.5. Other 4.4.3.3. Mexico Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Hospital 4.4.3.3.2. Physicians Clinic 4.4.3.3.3. Clinical Laboratories 4.4.3.3.4. Other 5. Europe Respiratory Disease Testing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 5.2. Europe Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 5.3. Europe Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 5.4. Europe Respiratory Disease Testing Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 5.4.1.2. United Kingdom Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 5.4.2.2. France Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 5.4.3.2. Germany Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 5.4.4.2. Italy Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 5.4.5.2. Spain Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 5.4.6.2. Sweden Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 5.4.7.2. Austria Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 5.4.8.2. Rest of Europe Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Respiratory Disease Testing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Respiratory Disease Testing Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 6.4.1.2. China Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 6.4.2.2. S Korea Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 6.4.3.2. Japan Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 6.4.4.2. India Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 6.4.5.2. Australia Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 6.4.6.2. Indonesia Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 6.4.7.2. Malaysia Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 6.4.8.2. Vietnam Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 6.4.9.2. Taiwan Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 6.4.10.2. Rest of Asia Pacific Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Respiratory Disease Testing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Respiratory Disease Testing Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 7.4.1.2. South Africa Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 7.4.2.2. GCC Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 7.4.3.2. Nigeria Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 7.4.4.2. Rest of ME&A Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 8. South America Respiratory Disease Testing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 8.2. South America Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 8.3. South America Respiratory Disease Testing Market Size and Forecast, by End User(2023-2030) 8.4. South America Respiratory Disease Testing Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 8.4.1.2. Brazil Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 8.4.2.2. Argentina Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Respiratory Disease Testing Market Size and Forecast, by Product (2023-2030) 8.4.3.2. Rest Of South America Respiratory Disease Testing Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Respiratory Disease Testing Market Size and Forecast, by End User (2023-2030) 9. Global Respiratory Disease Testing Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Respiratory Disease Testing Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Abbott Laboratories - Abbott Park, Illinois, USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. BD (Becton, Dickinson and Company) - Franklin Lakes, New Jersey, USA 10.3. Bio-Rad Laboratories, Inc. - Hercules, California, USA 10.4. BioMérieux - Marcy-l'Étoile, France 10.5. Cepheid (Danaher Corporation) - Sunnyvale, California, USA 10.6. F. Hoffmann-La Roche Ltd - Basel, Switzerland 10.7. Fisher & Paykel Healthcare - Auckland, New Zealand 10.8. GlaxoSmithKline (GSK) - Brentford, United Kingdom 10.9. Hologic, Inc. - Marlborough, Massachusetts, USA 10.10. Koninklijke Philips N.V. (Philips) - Amsterdam, Netherlands 10.11. Masimo Corporation - Irvine, California, USA 10.12. Merck & Co., Inc. - Kenilworth, New Jersey, USA 10.13. PerkinElmer, Inc. - Waltham, Massachusetts, USA 10.14. Quidel Corporation - San Diego, California, USA 10.15. ResMed Inc. - San Diego, California, USA 10.16. Siemens Healthineers AG - Erlangen, Germany 10.17. Thermo Fisher Scientific Inc. - Waltham, Massachusetts, USA 10.18. Vyaire Medical, Inc. - Mettawa, Illinois, USA 10.19. Zimmer Biomet Holdings, Inc. - Warsaw, Indiana, USA 11. Key Findings 12. Industry Recommendations 13. Respiratory Disease Testing Market: Research Methodology 14. Terms and Glossary