Remote Healthcare Market size was valued at USD 8.70 Billion in 2023 and the total Remote Healthcare Revenue is expected to grow at a CAGR of 18.2 % from 2024 to 2030, reaching nearly USD 28.04 Billion in 2030.Remote Healthcare Market Overview:

Remote Healthcare allows patients to receive medical care and consultation from the comfort of their own homes, eliminating the need to travel to a healthcare facility. They particularly appealing to individuals with limited mobility living in remote areas with limited access to healthcare, and busy individuals who find it difficult to take time off work to visit a doctor. The global market is likely to be driven by the rising use of smartphones, mHealth apps, wearable technology, and digital healthcare. In addition, an increasing number of investments in the remote healthcare industry are driving category growth.To know about the Research Methodology:- Request Free Sample Report Increasing healthcare costs have generated space for low-cost provisions driven by advancements in digital technologies, and an increase in access to electronic health data and various data analytics tools and thus have been the key to providing more personalized patient care. The reduction of in-person consultations, travel restrictions, and lockdowns imposed by the government provided a much-needed boost to the adoption of virtual care solutions and digital health platforms. Primary care facilities and outpatient hospitals are two promising areas delivered by digital health services, which are expected to boost the market growth. Social distancing norms led to a transition of virtual fitness from the traditional workout in gyms, which increased the health and fitness apps demand. The growing government investments to improve healthcare IT infrastructure and promote remote healthcare services are also anticipated to fuel the market growth. The remote patient monitoring segment is expected to witness significant growth through the forecast period. The growing adoption of wearable devices, the internet, and smartphones is driving the growth of the remote patient monitoring segment. According to the International Telecommunication Union, 12.1 billion people are estimated to have smartphones globally by 2030. Market players are investing in the development of new digital healthcare technologies. Moreover, they are involved in strategic collaborations, partnerships, and mergers and acquisitions to increase the adoption of remote healthcare technologies and expand their company market share.

Remote Healthcare Market Dynamics:

Driving Factors Behind the Growth of Remote Healthcare Solutions in the Digital Era Technological advancement has played a pivotal role in driving the growth and adoption of remote healthcare solutions. The continuous improvement and availability of advanced technologies have revolutionized the way healthcare services are delivered. The widespread adoption of high-speed internet and the increasing penetration of smartphones have created a solid foundation for remote healthcare to thrive. The increased deployment of virtual care platforms is likely to improve remote healthcare business profit. In addition, an increase in sedentary lifestyle factors, like tobacco use, unhealthy diet, physical inactivity, and harmful alcohol consumption, raises the prevalence of chronic disease in the population. Nearly 7.2 million, 1.6 million, and 4.1 million deaths yearly are attributed to tobacco consumption, physical inactivity, and excessive sodium/salt intake. Consequently, the rise in the prevalence of chronic diseases and the rise in lifestyle disorders are the primary factors driving the escalation in demand for digital health services.Transformative Role of AI and RPM in Remote Healthcare Artificial intelligence (AI) and machine learning (ML) algorithms are being increasingly employed in remote healthcare. The technologies enable efficient analysis of patient data, early detection of diseases, and personalized treatment recommendations. AI-powered chatbots and virtual assistants also enhance patients’ engagement and provide round-the-clock support. In RPM, wearable gadgets that track a patient's vitals—like heart rate and blood pressure are becoming more popular. The gadgets give healthcare professionals real-time data, enabling more prompt and efficient care. Patients will have additional tools this year to receive care at home, ranging from smartwatches & Fitbit to monitor heart rate & oxygen levels to more sophisticated gadgets like pulse oximeters, ECGs, and blood pressure monitors. Caregivers & pediatric patients use RPM to manage medical disorders, like diabetes, asthma, genetic diseases, neonatal care, mental health, etc. Children's health outcomes may be improved by giving them care in places where they feel most comfortable. RPM also offers families with time & location constraints flexibility, & improved access. Navigating Security and Privacy Challenges in Remote Healthcare Security and privacy concerns may significantly impede the remote healthcare market growth. With the increasing adoption of virtual care platforms and telehealth services, the cases of data breaches and unauthorized access to sensitive patient information are noted to increase. Also, the implementation of telemedicine solutions without proper security leads to huge losses of confidential and critical information. It adversely affects the results and credibility of operations. High installation costs for required systems, devices, and equipment connected with real-time monitoring of healthcare parameters are significant market restrictions. Additionally, the high installation costs of information and communication technology (ICT) and the lack of skills to handle advanced equipment are major factors restricting the growth of the remote healthcare market.

Remote Healthcare Market Segmentation:

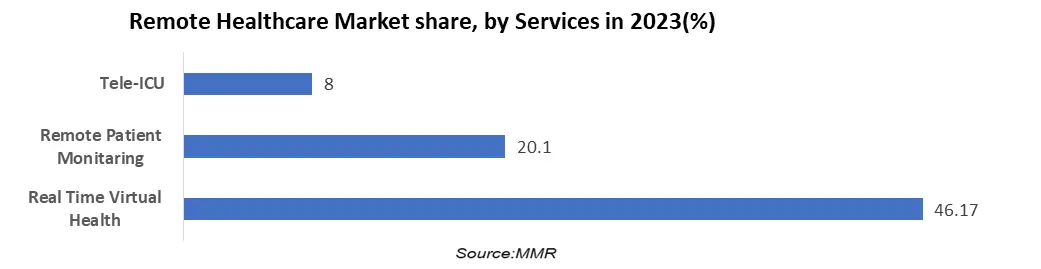

By Services, Remote Patient Monitoring, and IoT-enabled monitoring devices have added more functionalities to RPM. By combining AI with the Internet of Things (IoT) and RPM, healthcare organizations and practitioners better serve their patients and provide opportunities for improved healthcare outcomes. Service and remote patient monitoring costs per patient were between $275 and $7963 in 2023. Nearly half of adults have hypertension (48.1%, 119.9 million), defined as a systolic blood pressure greater than 130 mmHg or a diastolic blood pressure greater than 80 mmHg or are taking medication for hypertension. Hypertension added increases the risk of heart disease. Heart Association (AHA) also supports initiatives that increase access to the use of Remote Patient Monitoring technologies (RPM) for better health management. 100Plus is the fastest-growing remote patient monitoring provider. They are one of only a few vendors who take care of the heavy lifting to get a practice's remote patient monitoring program up and keep it on track. 1. In August 2023, EPIC Health, collaborated to address health inequities and reduce heart attack and stroke risk in underserved Detroit communities. The program is expected to feature VitalSight, OMRON's first remote patient monitoring service designed specifically for patients afflicted by high blood pressure and especially those with uncontrolled Stage 2 hypertension. Prominent players in the remote patient monitoring market are Koninklijke Philips N.V. (Netherlands), Medtronic (Ireland), GE Healthcare (US), Oracle (US), Siemens Healthineers AG (Germany), Omron Healthcare (Japan), Boston Scientific Corporation (US), Abbott Laboratories (US), Clear Arch, Inc (US), Vivify Health, Inc. (US), Alten Calsoft Labs (France), Bio-Beat (Israel), VitalConnect (US), VivaLNK Inc. (US), Bardy Diagnsotics, Inc. (US), Biotronik SE & Co. KG (Germany), Brook Inc. (US), Blue Spark Technology (US), Welch Allyn (US), Health Beats (Singapore), Alive Cor, Inc. (US), TytoCare Ltd. (US), Teledoc Health Inc. (US), and iRhythm Technologies (US).

Remote Healthcare Market Regional Insight:

North America holds a significant share of the remote healthcare market, with the United States holding a substantial share in the North American region. The US digital market is expected to be driven by the rising prevalence of chronic diseases and with advancing geriatric population. By extending access to treatment and allowing patients to get care remotely, digital healthcare assists satisfy their needs. The U.S. remote patient monitoring market is in a state of intense competition. The industry includes providers of a range of products and services, from diagnosis and treatment to delivery of healthcare applications. Companies operating in the segment are continually forced to innovate and improve to gain a competitive edge. The remote patient monitoring market in the western U.S. and states like California is fast-growing and evolving. As the nation's largest and most populous state, the opportunities for meaningful collaboration on remote care through digital health tools are virtually limitless. Remote health monitoring or telehealth is a rapidly expanding healthcare segment, allowing clinicians, care providers, and other health professionals to connect with and monitor patient populations remotely. FDA is developing policies to regulate AI as software for medical devices (SaDM), which also has implications for RPM. Owing to the rapid policy changes, the medical device industry needs information on current AI RPM development and a regulatory perspective. The FDA-approved RPM AI solutions in the US market and critically analyze them based on 16 characteristics.Remote Healthcare Market Competitive Landscape: 1. In January 2024, Apollo Hospital a renowned multi-specialty hospital in India, announced a ground-breaking alliance with LifeSigns, a premier AI-powered health monitoring technology firm. 2. In May 2023, Philips launched Virtual Care Management, a comprehensive portfolio of flexible solutions and services for health systems, providers, payers, and employers to motivate and engage patients from anywhere. 3. In August 2023, GE HealthCare received approval from the U.S. FDA for a portrait patient monitoring system. The system comprises wearable sensors that detect and wirelessly transmit vital patient signs to a monitor. 4. in October 2023, Ricoh USA, Inc. launched the RICOH Remote Patient Monitoring (RPM) service. The service is expected to ease the healthcare staffing challenges. 5. In 2023, Accuhealth announced the launch of Amazon Alexa Skill by empowering patients to access healthcare services through Amazon. It allows the patients to request a callback via the Amazon Connect system with a daily reminder.

Remote Healthcare Market Scope: Inquire before buying

Global Remote Healthcare Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 8.70 Bn. Forecast Period 2024 to 2030 CAGR: 18.2% Market Size in 2030: US $ 28.04 Bn. Segments Covered: by Services Remote Patient Monitoring Real-Time Virtual Health Tele-ICU by End Users Payer Provider Patient Employer Groups & Government Organizations Remote Healthcare Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Remote Healthcare Key Players:

1. Evernorth Health, Inc (US) 2. BioTelemetry (US) 3. Teladoc Health(US) 4. Vivify Health (US) 5. AirStrip Technologies (US) 6. InTouch Technologies (US) 7. American Well (US) 8. Cisco (US) 9. AMD Global Telemedicine (US) 10. MDLIVE (US) 11. Biotricity (US) 12. Babylon Inc (US) 13. Care Innovations, LLC (US) 14. Abbott Laboratories (US) 15. CERNER - oracle (US) 16. CHI HEALTH (US) 17. ACCUHEALTH TECHNOLOGIES (US) 18. Medtronic Corporation (Ireland) 19. Aerotel Medical Systems (Israel) 20. Binah.ai (Israel) 21. Biotronik (Germany) 22. ANALOG ECLIPSE CONSULTANTS (India) 23. CallHealth Services Pvt Ltd (India) 24. COMARCH (Poland) 25. ALTIBBI (Jordan) Frequently Asked Questions: 1] What segments are covered in the Remote Healthcare Market report? Ans. The segments covered in the Remote Healthcare Market report are based on Services, and End Users. 2] Which region is expected to hold the highest share in the Remote Healthcare Market? Ans. The North American region is expected to hold the highest share of the Remote Healthcare Market. 3] What is the market size of the Remote Healthcare Market by 2030? Ans. The market size of the Remote Healthcare Market by 2030 will be $ 28.04 Billion. 4] What is the forecast period for the Remote Healthcare Market? Ans. The Forecast period for the Remote Healthcare Market is 2024- 2030.

1. Remote Healthcare Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Remote Healthcare Market: Dynamics 2.1. Remote Healthcare Market Trends by Region 2.1.1. North America Remote Healthcare Market Trends 2.1.2. Europe Remote Healthcare Market Trends 2.1.3. Asia Pacific Remote Healthcare Market Trends 2.1.4. Middle East and Africa Remote Healthcare Market Trends 2.1.5. South America Remote Healthcare Market Trends 2.2. Remote Healthcare Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Remote Healthcare Market Drivers 2.2.1.2. North America Remote Healthcare Market Restraints 2.2.1.3. North America Remote Healthcare Market Opportunities 2.2.1.4. North America Remote Healthcare Market Challenges 2.2.2. Europe 2.2.2.1. Europe Remote Healthcare Market Drivers 2.2.2.2. Europe Remote Healthcare Market Restraints 2.2.2.3. Europe Remote Healthcare Market Opportunities 2.2.2.4. Europe Remote Healthcare Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Remote Healthcare Market Drivers 2.2.3.2. Asia Pacific Remote Healthcare Market Restraints 2.2.3.3. Asia Pacific Remote Healthcare Market Opportunities 2.2.3.4. Asia Pacific Remote Healthcare Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Remote Healthcare Market Drivers 2.2.4.2. Middle East and Africa Remote Healthcare Market Restraints 2.2.4.3. Middle East and Africa Remote Healthcare Market Opportunities 2.2.4.4. Middle East and Africa Remote Healthcare Market Challenges 2.2.5. South America 2.2.5.1. South America Remote Healthcare Market Drivers 2.2.5.2. South America Remote Healthcare Market Restraints 2.2.5.3. South America Remote Healthcare Market Opportunities 2.2.5.4. South America Remote Healthcare Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Remote Healthcare Industry 2.8. Analysis of Government Schemes and Initiatives For Remote Healthcare Industry 2.9. Remote Healthcare Market Trade Analysis 2.10. The Global Pandemic Impact on Remote Healthcare Market 3. Remote Healthcare Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Remote Healthcare Market Size and Forecast, by Services (2023-2030) 3.1.1. Remote Patient Monitoring 3.1.2. Real-Time Virtual Health 3.1.3. Tele-ICU 3.2. Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 3.2.1. Payer 3.2.2. Provider 3.2.3. Patient 3.2.4. Employer Groups & Government Organizations 3.3. Remote Healthcare Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Remote Healthcare Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Remote Healthcare Market Size and Forecast, by Services (2023-2030) 4.1.1. Remote Patient Monitoring 4.1.2. Real-Time Virtual Health 4.1.3. Tele-ICU 4.2. North America Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 4.2.1. Payer 4.2.2. Provider 4.2.3. Patient 4.2.4. Employer Groups & Government Organizations 4.3. North America Remote Healthcare Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Remote Healthcare Market Size and Forecast, by Services (2023-2030) 4.3.1.1.1. Remote Patient Monitoring 4.3.1.1.2. Real-Time Virtual Health 4.3.1.1.3. Tele-ICU 4.3.1.2. United States Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 4.3.1.2.1. Payer 4.3.1.2.2. Provider 4.3.1.2.3. Patient 4.3.1.2.4. Employer Groups & Government Organizations 4.3.2. Canada 4.3.2.1. Canada Remote Healthcare Market Size and Forecast, by Services (2023-2030) 4.3.2.1.1. Remote Patient Monitoring 4.3.2.1.2. Real-Time Virtual Health 4.3.2.1.3. Tele-ICU 4.3.2.2. Canada Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 4.3.2.2.1. Payer 4.3.2.2.2. Provider 4.3.2.2.3. Patient 4.3.2.2.4. Employer Groups & Government Organizations 4.3.3. Mexico 4.3.3.1. Mexico Remote Healthcare Market Size and Forecast, by Services (2023-2030) 4.3.3.1.1. Remote Patient Monitoring 4.3.3.1.2. Real-Time Virtual Health 4.3.3.1.3. Tele-ICU 4.3.3.2. Mexico Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 4.3.3.2.1. Payer 4.3.3.2.2. Provider 4.3.3.2.3. Patient 4.3.3.2.4. Employer Groups & Government Organizations 5. Europe Remote Healthcare Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Remote Healthcare Market Size and Forecast, by Services (2023-2030) 5.2. Europe Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 5.3. Europe Remote Healthcare Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Remote Healthcare Market Size and Forecast, by Services (2023-2030) 5.3.1.2. United Kingdom Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 5.3.2. France 5.3.2.1. France Remote Healthcare Market Size and Forecast, by Services (2023-2030) 5.3.2.2. France Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Remote Healthcare Market Size and Forecast, by Services (2023-2030) 5.3.3.2. Germany Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Remote Healthcare Market Size and Forecast, by Services (2023-2030) 5.3.4.2. Italy Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Remote Healthcare Market Size and Forecast, by Services (2023-2030) 5.3.5.2. Spain Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Remote Healthcare Market Size and Forecast, by Services (2023-2030) 5.3.6.2. Sweden Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Remote Healthcare Market Size and Forecast, by Services (2023-2030) 5.3.7.2. Austria Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Remote Healthcare Market Size and Forecast, by Services (2023-2030) 5.3.8.2. Rest of Europe Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 6. Asia Pacific Remote Healthcare Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Remote Healthcare Market Size and Forecast, by Services (2023-2030) 6.2. Asia Pacific Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 6.3. Asia Pacific Remote Healthcare Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Remote Healthcare Market Size and Forecast, by Services (2023-2030) 6.3.1.2. China Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Remote Healthcare Market Size and Forecast, by Services (2023-2030) 6.3.2.2. S Korea Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Remote Healthcare Market Size and Forecast, by Services (2023-2030) 6.3.3.2. Japan Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 6.3.4. India 6.3.4.1. India Remote Healthcare Market Size and Forecast, by Services (2023-2030) 6.3.4.2. India Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Remote Healthcare Market Size and Forecast, by Services (2023-2030) 6.3.5.2. Australia Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Remote Healthcare Market Size and Forecast, by Services (2023-2030) 6.3.6.2. Indonesia Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Remote Healthcare Market Size and Forecast, by Services (2023-2030) 6.3.7.2. Malaysia Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Remote Healthcare Market Size and Forecast, by Services (2023-2030) 6.3.8.2. Vietnam Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Remote Healthcare Market Size and Forecast, by Services (2023-2030) 6.3.9.2. Taiwan Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Remote Healthcare Market Size and Forecast, by Services (2023-2030) 6.3.10.2. Rest of Asia Pacific Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 7. Middle East and Africa Remote Healthcare Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Remote Healthcare Market Size and Forecast, by Services (2023-2030) 7.2. Middle East and Africa Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 7.3. Middle East and Africa Remote Healthcare Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Remote Healthcare Market Size and Forecast, by Services (2023-2030) 7.3.1.2. South Africa Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Remote Healthcare Market Size and Forecast, by Services (2023-2030) 7.3.2.2. GCC Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Remote Healthcare Market Size and Forecast, by Services (2023-2030) 7.3.3.2. Nigeria Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Remote Healthcare Market Size and Forecast, by Services (2023-2030) 7.3.4.2. Rest of ME&A Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 8. South America Remote Healthcare Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Remote Healthcare Market Size and Forecast, by Services (2023-2030) 8.2. South America Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 8.3. South America Remote Healthcare Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Remote Healthcare Market Size and Forecast, by Services (2023-2030) 8.3.1.2. Brazil Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Remote Healthcare Market Size and Forecast, by Services (2023-2030) 8.3.2.2. Argentina Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Remote Healthcare Market Size and Forecast, by Services (2023-2030) 8.3.3.2. Rest Of South America Remote Healthcare Market Size and Forecast, by End Users (2023-2030) 9. Global Remote Healthcare Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Remote Healthcare Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Evernorth Health, Inc (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. BioTelemetry (US) 10.3. Teladoc Health (US) 10.4. Vivify Health (US) 10.5. AirStrip Technologies (US) 10.6. InTouch Technologies (US) 10.7. American Well (US) 10.8. Cisco (US) 10.9. AMD Global Telemedicine (US) 10.10. MDLIVE (US) 10.11. Biotricity (US) 10.12. Babylon Inc (US) 10.13. Care Innovations, LLC (US) 10.14. Abbott Laboratories (US) 10.15. CERNER - oracle (US) 10.16. CHI HEALTH (US) 10.17. ACCUHEALTH TECHNOLOGIES (US) 10.18. Medtronic Corporation (Ireland) 10.19. Aerotel Medical Systems (Israel) 10.20. Binah.ai (Israel) 10.21. Biotronik (Germany) 10.22. ANALOG ECLIPSE CONSULTANTS (India) 10.23. CallHealth Services Pvt Ltd (India) 10.24. COMARCH (Poland) 10.25. ALTIBBI (Jordan) 11. Key Findings 12. Industry Recommendations 13. Remote Healthcare Market: Research Methodology 14. Terms and Glossary