Global Procurement Software Market size was valued at USD 7.38 Bn in 2023 and is expected to reach USD 15.13 Bn by 2030, at a CAGR of 10.8 % over the forecast period.Procurement Software Market Overview

In today's world, businesses can be fully automated with the help of procurement software, which automates supply chain operations. This software can complete all the tasks like purchase orders, invoice matching, and payment verifications. With the integration of e-procurement, speeding up the procedure is easy, offering features for streamlined inventory management. This is essential for businesses that make large acquisitions, and these software programs optimize purchasing and pricing activities. This technology unlocks ways to automate various procurement functions and enhances efficiency.To know about the Research Methodology :- Request Free Sample Report

Procurement Software Market Dynamics

Cost Optimization and Efficiency Gains to boost the Procurement Software Market growth: Organizations across industries are under constant pressure to reduce costs and enhance operational efficiency. Procurement software helps automate manual processes, streamline workflows, and improve spend visibility, enabling businesses to identify cost-saving opportunities and optimize their procurement strategies. The globalization of supply chains has made procurement more complexand procurement software provides tools for managing suppliers across different regions, currencies, and languages, ensuring supply chain resilience and efficiency, which is expected to boost the Procurement Software Market growth. Procurement software offers advanced analytics and reporting capabilities. Businesses leverage these tools to gain real-time insights into their procurement operations, track key performance indicators (KPIs), and make data-driven decisions. Effective SRM is crucial for mitigating supply chain risks and ensuring a reliable supply of goods and services. Procurement software helps organizations build and maintain strong supplier relationships, fostering collaboration and innovation. Regulatory compliance and risk management are top priorities for businesses. Procurement software assists in monitoring and managing compliance with various regulations, reducing the risk of legal issues and reputational damage. Integration with Enterprise Resource Planning (ERP) systems is becoming essential for seamless procurement operations. Procurement software integration enhances data consistency and enables end-to-end visibility, from procurement to payment. Artificial Intelligence (AI) and Machine Learning (ML) capabilities are being integrated into procurement software to enable predictive analytics, demand forecasting, and intelligent automation. This enhances decision-making and reduces manual tasks. The shift towards remote work has accelerated the need for cloud-based procurement solutions that enable collaboration from anywhere. Procurement software with collaborative features supports remote teams in their procurement activities, and significantly contribute to the Procurement Software Industry growth. As digital procurement becomes more prevalent, cyber security threats also increase. Procurement software includes security features to protect sensitive procurement data and transactions. Many organizations are prioritizing supplier diversity and inclusion. Procurement software help track and promote diverse supplier networks, fostering inclusivity and social responsibility. High Initial Cost to Limit the Procurement Software Market Growth Implementing a comprehensive procurement software solution is expensive, particularly for small and medium-sized enterprises (SMEs). This cost includes software licensing, hardware infrastructure, customization, training, and ongoing maintenance expenses. The deployment of procurement software is complex and time-consuming process. It often involves integrating with existing enterprise systems, which leads to disruptions in procurement workflows and operations and is expected to restrain the Procurement Software Market growth. Employees and procurement teams resist to adopt new software and changing established procurement processes. Overcoming this resistance and ensuring user adoption is a significant challenge for the Procurement Software Industry growth. The procurement process involves handling sensitive data, such as supplier information, contract details, and financial data. Ensuring data security and compliance with regulations such as GDPR and HIPAA is essential and is challenging. Managing and maximizing the potential of procurement software requires skilled personnel who understand both the software and procurement processes. The shortage of skilled professionals hinder effective utilization. Integrating procurement software with existing Enterprise Resource Planning (ERP) systems, financial systems, and other software is technically difficult. Incompatibilities and data synchronization issues arise during technical faults. Customizing procurement software to meet specific business needs is complex and costly. It often requires the expertise of developers or consultants, which adds to the overall expense. Encouraging suppliers to use the same procurement software platform can be a challenge. Suppliers are reluctant to change their processes or invest in new technology, leading to limited collaboration. In multinational organizations, cultural differences and language barriers are complicate the implementation and adoption of procurement software across different regions.Procurement Software Market Segmentation

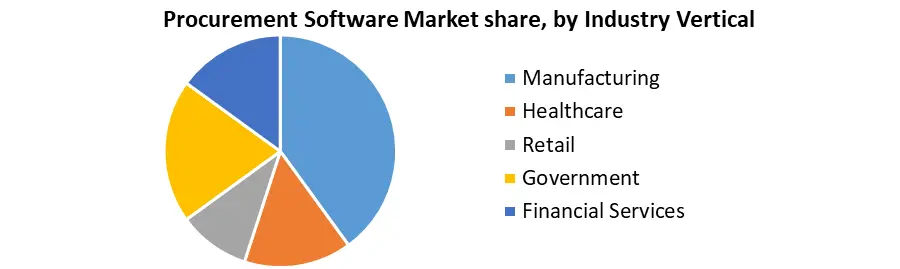

Based on Deployment Type: The market is segmented into On-Premises, and Cloud-Based. The on-premises deployment model segment dominated the market with a 54.10 % share in 2023. However, the market is anticipated to decline in the forecast period as the organizations have started adopting cloud procurement software solutions as of its cost efficiency, agility, and flexibility. Additionally, the essential for heavy initial and ongoing investments in hardware, software updates, servers, and hiring of skilled professionals in terms of on-premises deployment will more drive the demand for cloud procurement software solutions. On-premises procurement software is highly customized to meet the specific needs and workflows of the organization. This level of customization is advantageous for companies with unique or complex procurement processes. Organizations that need to comply with data localization laws, which require data to be stored within a specific geographic region, prefer on-premises deployments to ensure compliance, which significantly contribute for the growth of the Procurement Software Market. Implementing an on-premises procurement software solution typically involves a significant upfront capital investment. This includes the cost of hardware, software licenses, and IT infrastructure setup. On-premises solutions is less flexible and scalable compared to cloud-based alternatives. Scaling up or down may require additional hardware purchases and infrastructure adjustments. Organizations are responsible for ongoing maintenance, including software updates, security patches, and hardware maintenance. This can require a dedicated IT team or external support services. On-premises deployments often take longer to implement compared to cloud-based solutions. This is due to the need for infrastructure setup and customization. Based on Industry Vertical: Manufacturing, Healthcare, Retail, Government, and Financial Services. The Manufacturing segment dominated the market with a 30.3% share in 2023. Manufacturing companies are progressively adopting procurement outsourcing and technology-driven solutions that enable them to focus on their competence areas, such as manufacturing skills, production, and on-time delivery. Streamline manufacturing processes and achieve significant cost savings. These factors are driving the Procurement Software market growth. Procurement software designed for manufacturing is customized to address the specific requirements of this industry. It takes into account the complex and diverse supply chains, sourcing strategies, and compliance standards that manufacturers deal with. Manufacturing organizations often have extensive and intricate supply chains involving multiple suppliers, parts, and components. Procurement software in this segment assists in managing and optimizing these supply chains for efficiency and cost-effectiveness. The retail industry is expected to grow at a CAGR of 6 % through the forecast period. It helps integrate business processes, improve the overall value, facilitates transparency in financial supply chains, and enables retail companies to automate procurement tasks and procure best rates from vendors for their tender, making it essential for retail companies that need to procure a large volume of goods. These factors are expected to drive the market growth through the forecast period. With the implementation of procurement software, organizations can collaborate with suppliers, track events and get alerts, and analyze business intelligence data to gain insights into the procurement process for forecasting and planning purposes.

Procurement Software Market Regional Analysis

North America: The USA has dominated the Procurement Software Market in 2023 with a share of 34.3% and is expected to hold the largest market share over the forecast period. The market in North America has experienced significant growth in recent years, driven by various factors that reflect the region's dynamic business landscape. Organizations across North America are embracing digital transformation initiatives to enhance their procurement processes. Procurement software solutions play a crucial role in automating manual tasks, streamlining workflows, and providing real-time insights into procurement operations. Procurement Software companies are constantly looking for ways to optimize costs and enhance operational efficiency. Procurement software enables better spend visibility, cost analysis, and supplier management, helping organizations identify cost-saving opportunities. The region's complex and globalized supply chains necessitate advanced procurement solutions. Procurement software helps manage suppliers across different regions, currencies, and languages, ensuring supply chain resilience. Regulatory compliance and risk mitigation are paramount. Procurement software helps organizations adhere to various regulations and manage risks, reducing legal issues and reputational damage. Integration with Enterprise Resource Planning (ERP) systems is becoming essential for seamless procurement operations. Procurement software integration enhances data consistency and end-to-end visibility. Many North American organizations prioritize sustainability and Corporate Social Responsibility (CSR). Procurement software assists in tracking and evaluating supplier sustainability practices, which significantly contribute to the Procurement Software Market growth. The shift to remote work has accelerated the adoption of cloud-based procurement solutions, allowing teams to collaborate from anywhere, which is particularly relevant in a post-pandemic world. As digital procurement becomes more prevalent, cybersecurity threats increase. Procurement software includes security features to protect sensitive procurement data and transactions. While Asia-Pacific is expected to grow at a CAGR of 4.5 % through the forecast period. The presence of several logistics firms in emerging economies such as India, China, etc. will drive the market growth of procurement software through the forecast period.Procurement Software Market Competitive Landscape

The ability to serve customers globally is a competitive advantage. Companies that can adapt their software to different languages, currencies, and legal requirements have an edge in reaching international markets. Procurement software providers are competing to offer seamless integration with other enterprise systems like ERP, financial software, and supplier networks. This helps organizations achieve end-to-end visibility and efficiency. The ability to customize software to meet the unique needs of individual organizations is a competitive differentiator. Procurement software providers are working to offer flexible and configurable solutions. Procurement Software companies with extensive supplier networks and ecosystems have a competitive advantage. These ecosystems facilitate supplier collaboration, electronic procurement, and supplier diversity initiatives. Pricing models and the overall value proposition play a significant role in competition. Companies that offer competitive pricing while delivering substantial value in terms of features and benefits attract customers. Some Procurement Software companies focus on specific industry verticals, such as healthcare or manufacturing, and provide tailored procurement solutions designed for the unique needs of those industries.Procurement Software Market Scope: Inquiry Before Buying

Procurement Software Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 7.38 Bn. Forecast Period 2024 to 2030 CAGR: 10.8 % Market Size in 2030: US $ 15.13 Bn. Segments Covered: by Deployment Type On-Premises Cloud-Based Public Cloud Private Cloud Hybrid Cloud by Industry Vertical Manufacturing Healthcare Retail Government Financial Services Procurement Software Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Procurement Software Key Players Include:

North America: 1. SAP Ariba (United States) 2. Coupa Software (United States) 3. Oracle Corporation (United States) 4. GEP (United States) 5. Jaggaer (United States) 6. Ivalua (United States) 7. Determine (United States) 8. Zycus (United States) 9. Basware (United States) 10. Vroozi (United States) 11. Basware (Finland) Europe: 12. SynerTrade (France) 13. Proactis (United Kingdom) 14. SynerTrade Accelerate (Germany) 15. Mercateo (Germany) 16. Simfoni (United Kingdom) Asia-Pacific: 17. Vroozi Asia Pacific (Singapore) 18. SAP Ariba APJ (Asia-Pacific and Japan) Latin America: 19. Ariba Commerce Cloud Frequently Asked Questions: 1] What is the growth rate of the Global Procurement Software Market? Ans. The Global Procurement Software Market is growing at a significant rate of 10.8 % over the forecast period. 2] Which region is expected to dominate the Global Procurement Software Market during the forecast period? Ans. North America region is expected to dominate the Procurement Software Market over the forecast period. 3] What is the expected Global Procurement Software Market size by 2030? Ans. The market size of the Procurement Software Market is expected to reach USD 15.13 Bn by 2030. 4] Who are the top players in the Global Procurement Software Industry? Ans. The major key players in the Global Procurement Software Market are AP Ariba, Coupa Software, Oracle, and GEP. 5] Which factors are expected to drive the Global Procurement Software Market growth by 2030? Ans. Cost Optimization and Efficiency Gains is expected to boost the Procurement Software Market growth over the forecast period (2024-2030).

1. Procurement Software Market: Research Methodology 2. Procurement Software Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Procurement Software Market: Dynamics 3.1. Procurement Software Market Trends by Region 3.1.2. North America Procurement Software Market Trends 3.1.3. Europe Procurement Software Market Trends 3.1.4. Asia Pacific Procurement Software Market Trends 3.1.5. Middle East and Africa Procurement Software Market Trends 3.1.6. South America Procurement Software Market Trends 3.2. Procurement Software Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Procurement Software Market Drivers 3.2.1.2. North America Procurement Software Market Restraints 3.2.1.3. North America Procurement Software Market Opportunities 3.2.1.4. North America Procurement Software Market Challenges 3.2.2. Europe 3.2.2.1. Europe Procurement Software Market Drivers 3.2.2.2. Europe Procurement Software Market Restraints 3.2.2.3. Europe Procurement Software Market Opportunities 3.2.2.4. Europe Procurement Software Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Procurement Software Market Drivers 3.2.3.2. Asia Pacific Procurement Software Market Restraints 3.2.3.3. Asia Pacific Procurement Software Market Opportunities 3.2.3.4. Asia Pacific Procurement Software Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Procurement Software Market Drivers 3.2.4.2. Middle East and Africa Procurement Software Market Restraints 3.2.4.3. Middle East and Africa Procurement Software Market Opportunities 3.2.4.4. Middle East and Africa Procurement Software Market Challenges 3.2.5. South America 3.2.5.1. South America Procurement Software Market Drivers 3.2.5.2. South America Procurement Software Market Restraints 3.2.5.3. South America Procurement Software Market Opportunities 3.2.5.4. South America Procurement Software Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis for Procurement Software Industry 3.8. Analysis of Government Schemes and Initiatives for Procurement Software Industry 3.9. The Global Pandemic Impact on Procurement Software Market 3.10. Key Technologies in Procurement Software 3.10.1. AI (Artificial Intelligence) 3.10.2. ML (Machine Learning) 3.10.3. Robotic Process Automation 3.10.4. Others 4. Procurement Software Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 4.1. Procurement Software Market Size and Forecast, by Deployment Type (2023-2030 4.1.1. On-Premises 4.1.2. Cloud-Based 4.1.2.1. Public Cloud 4.1.2.2. Private Cloud 4.1.2.3. Hybrid Cloud 4.2. Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 4.2.1. Manufacturing 4.2.2. Healthcare 4.2.3. Retail 4.2.4. Government 4.2.5. Financial Services 4.3. Procurement Software Market Size and Forecast, by region (2023-2030) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Procurement Software Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 5.1.1. On-Premises 5.1.2. Cloud-Based 5.1.2.1. Public Cloud 5.1.2.2. Private Cloud 5.1.2.3. Hybrid Cloud 5.2. North America Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 5.2.1. Manufacturing 5.2.2. Healthcare 5.2.3. Retail 5.2.4. Government 5.2.5. Financial Services 5.3. North America Procurement Software Market Size and Forecast, by Country (2023-2030) 5.3.1. United States 5.3.1.1. United States Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 5.3.1.1.1. On-Premises 5.3.1.1.2. Cloud-Based 5.3.1.1.2.1. Public Cloud 5.3.1.1.2.2. Private Cloud 5.3.1.1.2.3. Hybrid Cloud 5.3.1.2. United States Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 5.3.1.2.1. Manufacturing 5.3.1.2.2. Healthcare 5.3.1.2.3. Retail 5.3.1.2.4. Government 5.3.1.2.5. Financial Services 5.3.2. Canada 5.3.2.1. Canada Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 5.3.2.1.1. On-Premises 5.3.2.1.2. Cloud-Based 5.3.2.1.2.1. Public Cloud 5.3.2.1.2.2. Private Cloud 5.3.2.1.2.3. Hybrid Cloud 5.3.2.2. Canada Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 5.3.2.2.1. Manufacturing 5.3.2.2.2. Healthcare 5.3.2.2.3. Retail 5.3.2.2.4. Government 5.3.2.2.5. Financial Services 5.3.3. Mexico 5.3.3.1. Mexico Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 5.3.3.1.1. On-Premises 5.3.3.1.2. Cloud-Based 5.3.3.1.2.1. Public Cloud 5.3.3.1.2.2. Private Cloud 5.3.3.1.2.3. Hybrid Cloud 5.3.3.2. Mexico Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 5.3.3.2.1. Manufacturing 5.3.3.2.2. Healthcare 5.3.3.2.3. Retail 5.3.3.2.4. Government 5.3.3.2.5. Financial Services 6. Europe Procurement Software Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 6.2. Europe Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 6.3. Europe Procurement Software Market Size and Forecast, by Country (2023-2030) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 6.3.1.2. United Kingdom Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 6.3.2. France 6.3.2.1. France Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 6.3.2.2. France Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 6.3.3. Germany 6.3.3.1. Germany Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 6.3.3.2. Germany Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 6.3.4. Italy 6.3.4.1. Italy Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 6.3.4.2. Italy Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 6.3.5. Spain 6.3.5.1. Spain Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 6.3.5.2. Spain Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 6.3.6. Sweden 6.3.6.1. Sweden Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 6.3.6.2. Sweden Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 6.3.7. Austria 6.3.7.1. Austria Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 6.3.7.2. Austria Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 6.3.8.2. Rest of Europe Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 7. Asia Pacific Procurement Software Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 7.2. Asia Pacific Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 7.3. Asia Pacific Procurement Software Market Size and Forecast, by Country (2023-2030) 7.3.1. China 7.3.1.1. China Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 7.3.1.2. China Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 7.3.2. S Korea 7.3.2.1. S Korea Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 7.3.2.2. S Korea Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 7.3.3. Japan 7.3.3.1. Japan Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 7.3.3.2. Japan Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 7.3.4. India 7.3.4.1. India Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 7.3.4.2. India Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 7.3.5. Australia 7.3.5.1. Australia Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 7.3.5.2. Australia Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 7.3.6. Indonesia 7.3.6.1. Indonesia Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 7.3.6.2. Indonesia Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 7.3.7. Malaysia 7.3.7.1. Malaysia Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 7.3.7.2. Malaysia Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 7.3.8. Vietnam 7.3.8.1. Vietnam Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 7.3.8.2. Vietnam Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 7.3.9. Taiwan 7.3.9.1. Taiwan Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 7.3.9.2. Taiwan Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 7.3.10. Rest of Asia Pacific 7.3.10.1. Rest of Asia Pacific Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 7.3.10.2. Rest of Asia Pacific Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 8. Middle East and Africa Procurement Software Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030 8.1. Middle East and Africa Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 8.2. Middle East and Africa Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 8.3. Middle East and Africa Procurement Software Market Size and Forecast, by Country (2023-2030) 8.3.1. South Africa 8.3.1.1. South Africa Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 8.3.1.2. South Africa Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 8.3.2. GCC 8.3.2.1. GCC Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 8.3.2.2. GCC Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 8.3.3. Nigeria 8.3.3.1. Nigeria Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 8.3.3.2. Nigeria Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 8.3.4. Rest of ME&A 8.3.4.1. Rest of ME&A Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 8.3.4.2. Rest of ME&A Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 9. South America Procurement Software Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 9.1. South America Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 9.2. South America Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 9.3. South America Procurement Software Market Size and Forecast, by Country (2023-2030) 9.3.1. Brazil 9.3.1.1. Brazil Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 9.3.1.2. Brazil Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 9.3.2. Argentina 9.3.2.1. Argentina Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 9.3.2.2. Argentina Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 9.3.3. Rest Of South America 9.3.3.1. Rest Of South America Procurement Software Market Size and Forecast, by Deployment Type (2023-2030) 9.3.3.2. Rest Of South America Procurement Software Market Size and Forecast, by Industry Vertical (2023-2030) 10. Global Procurement Software Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Procurement Software Market Companies, by market capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. SAP Ariba (United States) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Details on Partnership 11.1.7. Recent Developments 11.2. Coupa Software (United States) 11.3. Oracle Corporation (United States) 11.4. GEP (United States) 11.5. Jaggaer (United States) 11.6. Ivalua (United States) 11.7. Determine (United States) 11.8. Zycus (United States) 11.9. Basware (United States) 11.10. Vroozi (United States) 11.11. Basware (Finland) 11.12. SynerTrade (France) 11.13. Proactis (United Kingdom) 11.14. SynerTrade Accelerate (Germany) 11.15. Mercateo (Germany) 11.16. Simfoni (United Kingdom) 11.17. Vroozi Asia Pacific (Singapore) 11.18. SAP Ariba APJ (Asia-Pacific and Japan) 11.19. Ariba Commerce Cloud 12. Key Findings 13. Industry Recommendations