Global Cloud Workload Protection Market was valued at US$ 3.94 Bn. in 2022 and is expected to reach US$ 16.16 Bn. by 2029, at a CAGR of 22.3% during a forecast period.Cloud Workload Protection Market Overview:

Cloud Workload Protection Market was valued at US$ 3.94 Bn. in 2022. The technique of continuously monitoring for and removing threats from cloud workloads and containers is known as cloud workload protection (CWP). A Cloud Workload Protection Platform (CWPP) is a security solution that protects all types of workloads in any location while providing unified cloud workload protection across various providers. Cloud adoption continues to be a crucial engine of digital transformation and growth for today's organizations, enabling them to deliver applications and services to customers at the speed and scale that only the cloud can give. However, safeguarding the cloud entails securing this ever attack surface that includes everything from cloud workloads to virtual servers and other technologies that power your cloud environment.To know about the Research Methodology:- Request Free Sample Report

COVID-19 impact on Cloud Workload Protection Market:

The dynamics of global industries are altering as a result of the pandemic. The COVID 19 outbreak is also hurting the cloud workload protection business. Moreover, technology adoption is becoming more complex during this time period. During this time, there is a slowdown in output. Governmental limitations and lockdowns are also having an impact on market activities. However, in recent years, there has been an increase in the utilization of cloud workload protection. Because of the increased use of work-from-home options, more employee computers are being outfitted with cloud workload protection. Enterprises must deal with advanced dangers and cyber tasks. There may be less security programmers on personal computers. Furthermore, most businesses are implementing cloud protection in a centralized architecture.Cloud Workload Protection Market Dynamics:

• Benefits of Cloud Workload Protection: 1. Visibility: CWP gives total insight into workload and container events, ensuring that nothing goes unnoticed in the cloud environment and allowing for faster and more accurate detection, response, threat hunting, and investigation. 2. Protection: CWP protects to the whole cloud-native stack, including workloads, containers, and Kubernetes apps on any cloud. A platform for cloud workload protection will automate security while also identifying and preventing suspicious activity. 3. Frictionless: A CWPP should support continuous integration/continuous delivery (CI/CD) processes, allowing to protect workloads at the speed of DevOps without losing performance. A key factor is the increased use of a multi-cloud strategy in the enterprise. The enterprise's security requirements are always changing. The demand for integrating cloud workload with cloud management solutions is growing. Enterprises must have access to cloud security services. The multi-cloud environment is a low-cost security offering provided to businesses. Furthermore, the extraordinary benefits of the cloud system are beneficial to every organisation. Adoption of a multi-cloud strategy is increasing as a result of all of these issues. It is a critical market driver that will lead to increased Cloud Workload Protection Market Sales. The utilisation of big data in businesses is increasing today. It exposes organisational data to significant cyber risks. There is a huge need to protect all of this data. As a result, the need for a security platform is growing. Cloud workload protection can even protect against advanced threats. With cloud workload protection, identifying and fixing security issues is a breeze. It leads to a greater use of cloud security systems in major companies. Cloud Workload Protection Challenges: 1. Expanded Attack Surface: More systems and instances spread across several off-premises sites equals more risk and a larger attack surface. It is no longer enough to protect physical data centers and servers. Having a cloud presence adds the burden of protecting virtual servers, remote apps, cloud workloads, containers, and network interactions between environments. There's also the problem of having more users with varying levels of security competence but the same ability to design and use cloud workloads. 2. Visibility: Blind spots result in silent failure and, eventually, breaches. variety of reasons, cloud workloads are difficult to monitor. For standard security technologies are not intended to provide granular visibility. For example, because visibility is confined to the host, technologies like Linux logs make it impossible to distinguish between events made by containers and those generated by the host. Then, because containers are short-lived, they provide additional visibility difficulties, making data collecting and incident investigation difficult because forensic evidence is lost when a container is terminated. 3. Performance: Traditional solutions and manual methods are no longer adequate due to the dynamic nature of cloud workloads, particularly containers. Because of rapid deployment and scalability, the threat surface is continuously evolving, and security solutions must keep up with DevOps without losing performance. Many small businesses are unaware of the importance of cloud workload protection. SMEs' demand is likely to drive market growth throughout the forecast period. In many businesses, however, there is still a lack of understanding about the programme and its benefits. These businesses consider network security issues to be minor. Many firms do not realise the danger of cyber assaults until revenue is lost or data is lost. In this market, a significant impediment is a lack of awareness. It has the potential to reduce market demand in the coming years. Furthermore, there are a number of regulatory criteria that must be followed when adopting cloud workload protection. It causes the entire deployment procedure to be delayed. These constraints may have a negative influence on the market. Popular cloud workload protection vendors and platforms: CloudGuard, with CloudGuard IaaS Cloud Network Security Google, with Google Cloud Platform Security Overview Qualys, with Qualys Cloud Platform Trend Micro, with Trend Micro Deep Security Symantec, with Symantec Cloud Workload Protection.Cloud Workload Protection Market Segment Analysis:

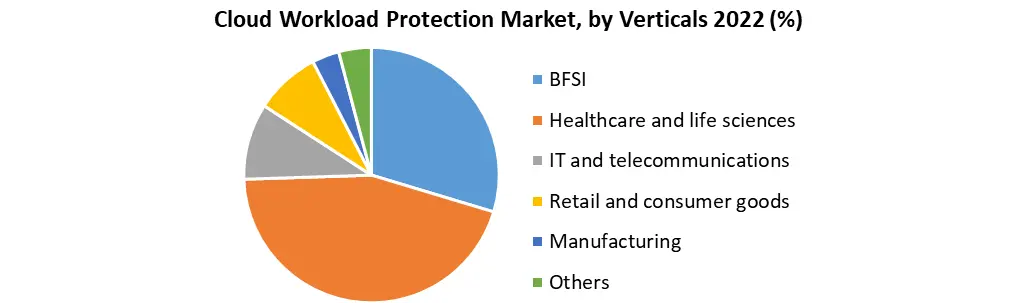

Based on deployment Mode, hybrid cloud segment held largest market share of xx% in 2022. It has several advantages and it including the ability to manage enormous amounts of data and provide the high processing speed that businesses require. Organizations are turning to hybrid cloud computing to scale computer resources and decrease the costs associated with managing high data processing demand. With the increased use of hybrid cloud across businesses, a cloud workload protection platform is in high demand. A hybrid cloud security platform gives a dependable approach for information security and aids in policy management as well as monitoring of concerns such as threats and intrusions. Based on Verticals, BFSI segment held largest market share of xx% in 2022. Because of rising security concerns in the BFSI industry and there has been an increase in demand for cloud workload protection which is helpful for growing the market. The financial services industry can use cloud workload security solutions to secure, monitor, and store instances as well as the control plane. Cloud workload protection simplifies and streamlines security against various ransom ware, lateral threats, and malware, which is projected to fuel market growth.

Regional Insight:

APAC region is the dominant region and it held largest market share of xx% in 2022 .The increasing acceptance of cloud services and more security compliance products by vendors, and the requirement for greater control and visibility methods all contribute to the region's market growth. Rising adoption of cloud workload protection solutions and services, as well as increased cyber security attacks, are likely to be important driving forces in the growth of this domain's cloud workload protection market. Increased ICT investment in government infrastructure, cloud protection measures, and the requirement to prevent unauthorized network access are some of the factors driving market growth in the APAC region. The need to comply with numerous regulatory compliances, as well as a shortage of technical skills among business workers, are two important market hurdles and difficulties. Recent Developments: Guardicore, a data centre and cloud security startup, announced the introduction of the Botnet Encyclopedia in June 2021. The Guardicore Global Sensors Network (GGSN) Botnet Encyclopedia, a network of detection sensors placed in data centres and cloud settings throughout the world, can capture and record whole assault flows at the highest detail. The Botnet Encyclopedia can help IT teams, security teams, researchers, and the cybersecurity community better understand and defend against persistent and advanced threats known as campaigns. CloudPassage, a cloud computing security and compliance firm, announced additional packaging and pricing options for its Halo cloud security platform in June 2021. The additional options enable more businesses to put Halo's proven capabilities to work in a larger range of deployment situations while achieving even better economics. The objective of the report is to present a comprehensive analysis of the Cloud Workload Protection market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Cloud Workload Protection market dynamics, structure by analyzing the market segments and projects the Cloud Workload Protection market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Cloud Workload Protection market make the report investor’s guide.Cloud Workload Protection Market Scope :Inquire before buying

Cloud Workload Protection Market Base Year 2022 Forecast Period 2023-2029 Historical Data CAGR Market Size in 2022 Market Size in 2029 2018 to 2022 22.3% US$ 3.94 Bn US$ 16.16 Bn Segments Covered by Solution Monitoring and logging Policy and compliance management Vulnerability assessment Threat detection and incident response Others by Deployment Public cloud Private cloud Hybrid cloud by Organization Size Small and Medium-sized Enterprises Large enterprises by Verticals BFSI Healthcare and life sciences IT and telecommunications Retail and consumer goods Manufacturing Others Regions Covered North America United States Canada Mexico Europe UK France Germany Italy Spain Sweden Austria Rest of Europe Asia Pacific China S Korea Japan India Australia Indonesia Malaysia Vietnam Taiwan Bangladesh Pakistan Rest of APAC Middle East and Africa South Africa GCC Egypt Nigeria Rest of ME&A South America Brazil Argentina Rest of South America Key Players

1. Bracket 2. Microsoft 3. CLOUDPASSAGE 4. AO Kaspersky Lab 5. DOME9 SECURITY INC 6. Illumio 7. Guardicore 8. Cloud Raxak Inc 9. HYTRUST 10. Aqua Security Software Ltd. 11. LogRhythm 12. Carbon Black 13. McAfee 14. Tripwire 15. Sophos Ltd. 16. BroadcomFrequently Asked Questions:

1. Which region has the largest share in Cloud Workload Protection Market? Ans: Asia pacific region holds the highest share in 2022. 2. What is the growth rate of Cloud Workload Protection Market? Ans: The Cloud Workload Protection Market is growing at a CAGR of 22.3 % during forecasting period 2023-2029. 3. What segments are covered in Cloud Workload Protection market? Cloud Workload Protection Market was valued at US$ 3.94 Bn. in 2022 and is expected to reach US$ 16.16 Bn. by 2029, at a CAGR of 22.3% during a forecast period.

1. Global Cloud Workload Protection Market: Research Methodology 2. Global Cloud Workload Protection Market: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Cloud Workload Protection Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Cloud Workload Protection Market: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12. COVID-19 Impact 4. Global Cloud Workload Protection Market Segmentation 4.1. Global Cloud Workload Protection Market, by Solution (2022-2029) • Monitoring and logging • Policy and compliance management • Vulnerability assessment • Threat detection and incident response • Others 4.2. Global Cloud Workload Protection Market, by Deployment (2022-2029) • Public cloud • Private cloud • Hybrid cloud 4.3. Global Cloud Workload Protection Market, by Organization Size (2022-2029) • Small and Medium-sized Enterprises • Large enterprises 4.4. Global Cloud Workload Protection Market, by Verticals (2022-2029) • BFSI • Healthcare and life sciences • IT and telecommunications • Retail and consumer goods • Manufacturing • Others 5. North America Cloud Workload Protection Market(2022-2029) 5.1. North America Cloud Workload Protection Market, by Solution (2022-2029) • Monitoring and logging • Policy and compliance management • Vulnerability assessment • Threat detection and incident response • Others 5.2. North America Cloud Workload Protection Market, by Deployment (2022-2029) • Public cloud • Private cloud • Hybrid cloud 5.3. North America Cloud Workload Protection Market, by Organization Size (2022-2029) • Small and Medium-sized Enterprises • Large enterprises 5.4. North America Cloud Workload Protection Market, by Verticals (2022-2029) • BFSI • Healthcare and life sciences • IT and telecommunications • Retail and consumer goods • Manufacturing • Others 5.5. North America Cloud Workload Protection Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Cloud Workload Protection Market (2022-2029) 6.1. European Cloud Workload Protection Market, by Solution (2022-2029) 6.2. European Cloud Workload Protection Market, by Deployment (2022-2029) 6.3. European Cloud Workload Protection Market, by Organization Size (2022-2029) 6.4. European Cloud Workload Protection Market, by Verticals (2022-2029) 6.5. European Cloud Workload Protection Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Cloud Workload Protection Market (2022-2029) 7.1. Asia Pacific Cloud Workload Protection Market, by Solution (2022-2029) 7.2. Asia Pacific Cloud Workload Protection Market, by Deployment (2022-2029) 7.3. Asia Pacific Cloud Workload Protection Market, by Organization Size (2022-2029) 7.4. Asia Pacific Cloud Workload Protection Market, by Verticals (2022-2029) 7.5. Asia Pacific Cloud Workload Protection Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Cloud Workload Protection Market (2022-2029) 8.1. Middle East and Africa Cloud Workload Protection Market, by Solution (2022-2029) 8.2. Middle East and Africa Cloud Workload Protection Market, by Deployment (2022-2029) 8.3. Middle East and Africa Cloud Workload Protection Market, by Organization Size (2022-2029) 8.4. Middle East and Africa Cloud Workload Protection Market, by Verticals (2022-2029) 8.5. Middle East and Africa Cloud Workload Protection Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. Latin America Cloud Workload Protection Market (2022-2029) 9.1. Latin America Cloud Workload Protection Market, by Solution (2022-2029) 9.2. Latin America Cloud Workload Protection Market, by Deployment (2022-2029) 9.3. Latin America Cloud Workload Protection Market, by Organization Size (2022-2029) 9.4. Latin America Cloud Workload Protection Market, by Verticals (2022-2029) 9.5. Latin America Cloud Workload Protection Market, by Country (2022-2029) • Brazil • Argentina • Rest Of Latin America 10. Company Profile: Key players 10.1. Bracket 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Microsoft 10.3. CLOUDPASSAGE 10.4. AO Kaspersky Lab 10.5. DOME9 SECURITY INC 10.6. Illumio 10.7. Guardicore 10.8. Cloud Raxak Inc 10.9. HYTRUST 10.10. Aqua Security Software Ltd. 10.11. LogRhythm 10.12. Carbon Black 10.13. McAfee 10.14. Tripwire 10.15. Sophos Ltd. 10.16. Broadcom