Global Power Semiconductor Market size was valued at US$ 37.90 Bn. in 2020 and the total revenue is expected to grow at a CAGR of 3.18% through 2021 to 2027, reaching nearly US$ 47.19 Bn.Global Power Semiconductor Market Overview:

The Global Power Semiconductor market was valued at US $37.90 Bn. in 2020, and it is expected to reach US $47.19 Bn. by 2027 with a CAGR of 3.18% during the forecast period. Power semiconductor is utilizing as a switch or rectifier in power electronics. This type of semiconductor device is also known as power devices. This power devices are also used to handle the large voltages as well as large currents. This device is used to control motors and lighting systems and convert electric power.To know about the Research Methodology :- Request Free Sample Report Though market forecasting through 2027 is based on real output, demand and supply of 2020, 2020 numbers are also estimated on real numbers published by key players as well all important players across the world. Market forecasting till 2027 is done based on past data from 2016 to 2019 with the impact of global lock down on the market in 2020 and 2021.

Global Power Semiconductor Market Dynamics:

The adoption of power semiconductor devices in the IT and consumer electronics industry, automotive, power distribution, and rail transportation industries is rising due to the growing utilization of non-conventional energy sources like tidal, solar, photovoltaic and increasing demand for better power efficient management and newly safety features in the automotive sectors. Power semiconductor devices have the ability to handle high voltages, high currents, and frequencies. Our household appliances contain power semiconductor devices, electric cars, airplanes, spaceships are also containing power semiconductor devices. Power semiconductor devices are continuing to grow, develop, and push everything around us to the next stages due to the boom of electric cars, green energy initiatives, 5G, and data centres spreading all over the globe. Mobile phones, laptop, computers, digital cameras, television, washing machines, refrigerators, LED bulbs are also used power semiconductors as it performs an important role in these devices. These are the key benefits that drives the growth of the Global power semiconductor market during the forecast period 2021-2027. Power semiconductor devices are easily failed or stop if they are exposed to large voltages, large currents, and large frequencies at the same time. This is the major restraining factor that hamper the growth of the global power semiconductor market during the forecast period 2021-2027.Global Power Semiconductor Market Segment Analysis:

The Global Power Semiconductor Market is segmented by Component, Material, Module, and End-Use. Based on the Component, the market is segmented into Power MOSFET, Rectifiers, Thyristors, IGBT, and Diode. IGBT segment is expected to hold the largest market shares of xx% by 2027. For the conversion of DC to AC in the inverter circuit, IGBT is commonly utilizing as a switching device for driving the small to large motors. For inverter applications, IGBT is utilizes in the household appliances like air conditioners and refrigerators, industrial motors, and automotive main motor controllers to boost their efficiency. IGBT segment is expected to grow at a faster rate because the high-power applications of these transistors in solar inverters, electric vehicle motor drives, uninterruptible power supplies, high-frequency welders, induction heaters, and power factor correction converters. Use of IGBTs offers advantages like high voltage capability, comparatively fast switching speeds, and ease with which it can be turned on. These transistors are finding applications for high voltage and moderate speed applications like switch mode power supplies, pulse width modulated variable speed control, and solar-powered inverters operating in hundreds of kilohertz range. Diode segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2021-2027. Diodes offers plenty of benefits such as rectifying a voltage, drawing signals from a supply, the size of a signal is control, mixing signal and others benefits. Diodes allowed the current to flow through them in single direction only. So, we can use diodes to block reversed voltages from moving current backwards through a system, careful penetrating parts elsewhere in the device..Based on the Material, the market is segmented into Silicon Carbide (SiC), Silicon/ Germanium, and Gallium Nitride (GaN). Silicon/ Germanium material segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2021-2027. Silicon is much older than SiC and GaN, so it’s been utilized in manufacture for many decades. Due to this, Silicon is more available on the market. As compared to silicon carbide and gallium nitride, Silicon is much cheaper. Diodes, thyristors, and transistors are the most widely used silicon power semiconductor devices.

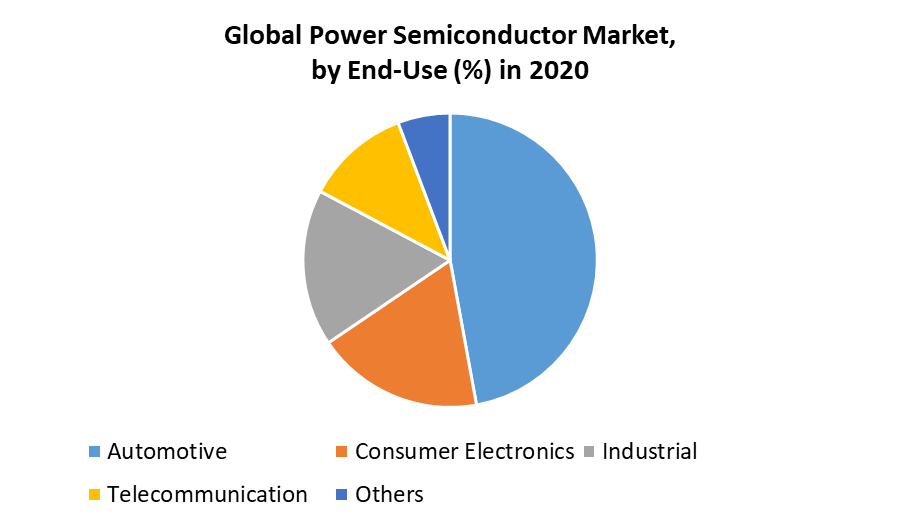

Based on the End-Use, the market is segmented into Telecommunication, Aerospace & Defense, Healthcare, Automotive, Industrial, Consumer Electronics, and Others. Automotive end-use industry segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2021-2027. Power semiconductor devices play an important role in automotive industries. Power semiconductor devices are used to control the automotive electronics. HEV main inverter, central body control, braking system, seat control, modern electric power steering, and others are some of the examples of the automotive electronics. In electric vehicles, power semiconductor devices are used in the efficient conduction and control of electric power.

Global Power Semiconductor Market Regional Insights:

Asia Pacific dominates the Global Power Semiconductor market during the forecast period 2021-2027. Asia Pacific is expected to hold the largest market shares of xx% by 2027. In Asia Pacific region, power semiconductor market is mainly driven by the countries such as China, Japan, Taiwan, and South Korea, which together account for around 65% of the global discrete semiconductor market. Asia Pacific is an electronics centre with millions of electronics devices made every year for the consumption in the region and transferred to other places. These are the major drivers that boost the growth of this region in the Global market during the forecast period 2021-2027. North America is expected to grow rapidly at a CAGR of xx% during the forecast period 2021-2027. Strong financial position of North America enables it to invest heavily in advanced consumer electronic devices and technologies. So that, region is perceiving a noticeable growth, in power semiconductor market. North America is a major investor in global electric vehicle market. Also, the region appreciates the occurrence of various significant vendors in power electronics market, which are also investing considerably in development of advanced power semiconductors. The United States have a highest investment in aerospace & defense industry. Previously, decreasing costs related with various devices, extending from 3D printers to smart watches and fitness trackers, is expected to enlarge the demand for power semiconductors, among domestic manufacturers. Region is also the initial and fastest adopter of IoT trends, among all major industries. Key Players in this industry are trying to bring advanced solutions which implements the latest technologies. In 2018, Fuji announced the launch of Fuji IGBT Simulator version 6 for loss and temperature calculation of company’s IGBT devices. Companies are focusing on R&D of power semiconductors will contribute to the power semiconductor market growth. In 2018, Infineon Technologies declared that company will be investing in a 300mm chip factory in Austria. Increase in competition among key players to offer high-performance solutions will boost the growth of power semiconductor market. Europe is expected to grow rapidly at a CAGR of xx% during the forecast period 2021-2027. This is due to the presence of major key players in the region and an increasing demand for power semiconductor devices as it offers plenty of benefits. These are the major factors that drives the growth of this region in the Global market during the forecast period 2021-2027. The objective of the report is to present a comprehensive analysis of the Global Power Semiconductor Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global Power Semiconductor Market dynamic, structure by analyzing the market segments and project the Global Power Semiconductor Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Global Power Semiconductor Market make the report investor’s guide.Global Power Semiconductor Market Scope: Inquire before buying

Global Power Semiconductor Market Report Coverage Details Base Year: 2020 Forecast Period: 2021-2027 Historical Data: 2016 to 2020 Market Size in 2020: US $ 37.90 Bn. Forecast Period 2021 to 2027 CAGR: 3.18% Market Size in 2027: US $ 47.19 Bn. Segments Covered: by Component • Power MOSFET • Rectifiers • Thyristors • IGBT • Diode by Material • Silicon Carbide (SiC) • Silicon/ Germanium • Gallium Nitride (GaN) by Module • Power Modules • Power Discrete by End-Use • Telecommunication • Aerospace & Defense • Healthcare • Automotive • Industrial • Consumer Electronics • Others Global Power Semiconductor Market, by Region

• North America • Europe • Asia Pacific • South America • Middle East and AfricaGlobal Power Semiconductor Market Key Players

• Semikron International GmbH • Fuji Electric Co., Ltd. • Mitsubishi Electric Group • Texas Instruments • Infineon Technologies AG • ST Microelectronics N.V. • Toshiba Corporation • ABB Ltd • Qualcomm Inc. • NXP Semiconductor • Cree Inc. • ON Semiconductor Corporation • Renesas Electronic Corporation • Broadcom Limited • Fairchild Semiconductor • Hitachi • ROHM • GaN Systems • FormFactorFrequently Asked Questions:

1] What segments are covered in Global Power Semiconductor Market report? Ans. The segments covered in Global Power Semiconductor Market report are based on Component, Material, Module, and End-Use. 2] Which region is expected to hold the highest share in the Global Power Semiconductor Market? Ans. Asia Pacific is expected to hold the highest share in the Global Power Semiconductor Market. 3] Who are the top key players in the Global Power Semiconductor Market? Ans. Semikron International GmbH, Fuji Electric Co., Ltd., Mitsubishi Electric Group, Texas Instruments, Infineon Technologies AG, and ST Microelectronics N.V. are the top key players in the Global Power Semiconductor Market. 4] Which segment holds the largest market share in the Global Power Semiconductor market by 2027? Ans. IGBT segment hold the largest market share in the Global Power Semiconductor market by 2027. 5] What is the market size of the Global Power Semiconductor market by 2027? Ans. The market size of the Global Power Semiconductor market is US $47.19 Bn. by 2027. 6] What was the market size of the Global Power Semiconductor market in 2020? Ans. The market size of the Global Power Semiconductor market was worth US $37.90 Bn. in 2020.

Global Power Semiconductor Market

1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Power Semiconductor Market, by Market Value (US$ Bn) 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. Porter’s Analysis 4.4. Value Chain Analysis 4.5. Market Risk Analysis 4.6. SWOT Analysis 4.7. Industry Trends and Emerging Technologies 5. Supply Side and Demand Side Indicators 6. Global Power Semiconductor Market Analysis and Forecast 6.1. Global Power Semiconductor Market Size & Y-o-Y Growth Analysis 6.1.1. North America 6.1.2. Europe 6.1.3. Asia Pacific 6.1.4. Middle East & Africa 6.1.5. South America 7. Global Power Semiconductor Market Analysis and Forecast, by Component 7.1. Introduction and Definition 7.2. Key Findings 7.3. Global Power Semiconductor Market Value Share Analysis, by Component 7.4. Global Power Semiconductor Market Size (US$ Bn) Forecast, by Component 7.5. Global Power Semiconductor Market Analysis, by Component 7.6. Global Power Semiconductor Market Attractiveness Analysis, by Component 8. Global Power Semiconductor Market Analysis and Forecast, by Material 8.1. Introduction and Definition 8.2. Key Findings 8.3. Global Power Semiconductor Market Value Share Analysis, by Material 8.4. Global Power Semiconductor Market Size (US$ Bn) Forecast, by Material 8.5. Global Power Semiconductor Market Analysis, by Material 8.6. Global Power Semiconductor Market Attractiveness Analysis, by Material 9. Global Power Semiconductor Market Analysis and Forecast, by Module 9.1. Introduction and Definition 9.2. Key Findings 9.3. Global Power Semiconductor Market Value Share Analysis, by Module 9.4. Global Power Semiconductor Market Size (US$ Bn) Forecast, by Module 9.5. Global Power Semiconductor Market Analysis, by Module 9.6. Global Power Semiconductor Market Attractiveness Analysis, by Module 10. Global Power Semiconductor Market Analysis and Forecast, by End-Use 10.1. Introduction and Definition 10.2. Key Findings 10.3. Global Power Semiconductor Market Value Share Analysis, by End-Use 10.4. Global Power Semiconductor Market Size (US$ Bn) Forecast, by End-Use 10.5. Global Power Semiconductor Market Analysis, by End-Use 10.6. Global Power Semiconductor Market Attractiveness Analysis, by End-Use 11. Global Power Semiconductor Market Analysis, by Region 11.1. Global Power Semiconductor Market Value Share Analysis, by Region 11.2. Global Power Semiconductor Market Size (US$ Bn) Forecast, by Region 11.3. Global Power Semiconductor Market Attractiveness Analysis, by Region 12. North America Power Semiconductor Market Analysis 12.1. Key Findings 12.2. North America Power Semiconductor Market Overview 12.3. North America Power Semiconductor Market Value Share Analysis, by Component 12.4. North America Power Semiconductor Market Forecast, by Component 12.4.1. Power MOSFET 12.4.2. Rectifiers 12.4.3. Thyristors 12.4.4. IGBT 12.4.5. Diode 12.5. North America Power Semiconductor Market Value Share Analysis, by Material 12.6. North America Power Semiconductor Market Forecast, by Material 12.6.1. Silicon Carbide (SiC) 12.6.2. Silicon/ Germanium 12.6.3. Gallium Nitride (GaN) 12.7. North America Power Semiconductor Market Value Share Analysis, by Module 12.8. North America Power Semiconductor Market Forecast, by Module 12.8.1. Power Modules 12.8.2. Power Discrete 12.9. North America Power Semiconductor Market Value Share Analysis, by End-Use 12.10. North America Power Semiconductor Market Forecast, by End-Use 12.10.1. Telecommunication 12.10.2. Aerospace & Defense 12.10.3. Healthcare 12.10.4. Automotive 12.10.5. Industrial 12.10.6. Consumer Electronics 12.10.7. Others 12.11. North America Power Semiconductor Market Value Share Analysis, by Country 12.12. North America Power Semiconductor Market Forecast, by Country 12.12.1. U.S. 12.12.2. Canada 12.13. North America Power Semiconductor Market Analysis, by Country 12.14. U.S. Power Semiconductor Market Forecast, by Component 12.14.1. Power MOSFET 12.14.2. Rectifiers 12.14.3. Thyristors 12.14.4. IGBT 12.14.5. Diode 12.15. U.S. Power Semiconductor Market Forecast, by Material 12.15.1. Silicon Carbide (SiC) 12.15.2. Silicon/ Germanium 12.15.3. Gallium Nitride (GaN) 12.16. U.S. Power Semiconductor Market Forecast, by Module 12.16.1. Power Modules 12.16.2. Power Discrete 12.17. U.S. Power Semiconductor Market Forecast, by End-Use 12.17.1. Telecommunication 12.17.2. Aerospace & Defense 12.17.3. Healthcare 12.17.4. Automotive 12.17.5. Industrial 12.17.6. Consumer Electronics 12.17.7. Others 12.18. Canada Power Semiconductor Market Forecast, by Component 12.18.1. Power MOSFET 12.18.2. Rectifiers 12.18.3. Thyristors 12.18.4. IGBT 12.18.5. Diode 12.19. Canada Power Semiconductor Market Forecast, by Material 12.19.1. Silicon Carbide (SiC) 12.19.2. Silicon/ Germanium 12.19.3. Gallium Nitride (GaN) 12.20. Canada Power Semiconductor Market Forecast, by Module 12.20.1. Power Modules 12.20.2. Power Discrete 12.21. Canada Power Semiconductor Market Forecast, by End-Use 12.21.1. Telecommunication 12.21.2. Aerospace & Defense 12.21.3. Healthcare 12.21.4. Automotive 12.21.5. Industrial 12.21.6. Consumer Electronics 12.21.7. Others 12.22. North America Power Semiconductor Market Attractiveness Analysis 12.22.1. By Component 12.22.2. By Material 12.22.3. By Module 12.22.4. By End-Use 12.23. PEST Analysis 12.24. Key Trends 12.25. Key Development 13. Europe Power Semiconductor Market Analysis 13.1. Key Findings 13.2. Europe Power Semiconductor Market Overview 13.3. Europe Power Semiconductor Market Value Share Analysis, by Component 13.4. Europe Power Semiconductor Market Forecast, by Component 13.4.1. Power MOSFET 13.4.2. Rectifiers 13.4.3. Thyristors 13.4.4. IGBT 13.4.5. Diode 13.5. Europe Power Semiconductor Market Value Share Analysis, by Material 13.6. Europe Power Semiconductor Market Forecast, by Material 13.6.1. Silicon Carbide (SiC) 13.6.2. Silicon/ Germanium 13.6.3. Gallium Nitride (GaN) 13.7. Europe Power Semiconductor Market Value Share Analysis, by Module 13.8. Europe Power Semiconductor Market Forecast, by Module 13.8.1. Power Modules 13.8.2. Power Discrete 13.9. Europe Power Semiconductor Market Value Share Analysis, by End-Use 13.10. Europe Power Semiconductor Market Forecast, by End-Use 13.10.1. Telecommunication 13.10.2. Aerospace & Defense 13.10.3. Healthcare 13.10.4. Automotive 13.10.5. Industrial 13.10.6. Consumer Electronics 13.10.7. Others 13.11. Others Europe Power Semiconductor Market Value Share Analysis, by Country 13.12. Europe Power Semiconductor Market Forecast, by Country 13.12.1. Germany 13.12.2. U.K. 13.12.3. France 13.12.4. Italy 13.12.5. Spain 13.12.6. Rest of Europe 13.13. Europe Power Semiconductor Market Analysis, by Country 13.14. Germany Power Semiconductor Market Forecast, by Component 13.14.1. Power MOSFET 13.14.2. Rectifiers 13.14.3. Thyristors 13.14.4. IGBT 13.14.5. Diode 13.15. Germany Power Semiconductor Market Forecast, by Material 13.15.1. Silicon Carbide (SiC) 13.15.2. Silicon/ Germanium 13.15.3. Gallium Nitride (GaN) 13.16. Germany Power Semiconductor Market Forecast, by Module 13.16.1. Power Modules 13.16.2. Power Discrete 13.17. Germany Power Semiconductor Market Forecast, by End-Use 13.17.1. Telecommunication 13.17.2. Aerospace & Defense 13.17.3. Healthcare 13.17.4. Automotive 13.17.5. Industrial 13.17.6. Consumer Electronics 13.17.7. Others 13.18. U.K. Power Semiconductor Market Forecast, by Component 13.18.1. Power MOSFET 13.18.2. Rectifiers 13.18.3. Thyristors 13.18.4. IGBT 13.18.5. Diode 13.19. U.K. Power Semiconductor Market Forecast, by Material 13.19.1. Silicon Carbide (SiC) 13.19.2. Silicon/ Germanium 13.19.3. Gallium Nitride (GaN) 13.20. U.K. Power Semiconductor Market Forecast, by Module 13.20.1. Power Modules 13.20.2. Power Discrete 13.21. U.K. Power Semiconductor Market Forecast, by End-Use 13.21.1. Telecommunication 13.21.2. Aerospace & Defense 13.21.3. Healthcare 13.21.4. Automotive 13.21.5. Industrial 13.21.6. Consumer Electronics 13.21.7. Others 13.22. France Power Semiconductor Market Forecast, by Component 13.22.1. Power MOSFET 13.22.2. Rectifiers 13.22.3. Thyristors 13.22.4. IGBT 13.22.5. Diode 13.23. France Power Semiconductor Market Forecast, by Material 13.23.1. Silicon Carbide (SiC) 13.23.2. Silicon/ Germanium 13.23.3. Gallium Nitride (GaN) 13.24. France Power Semiconductor Market Forecast, by Module 13.24.1. Power Modules 13.24.2. Power Discrete 13.25. France Power Semiconductor Market Forecast, by End-Use 13.25.1. Telecommunication 13.25.2. Aerospace & Defense 13.25.3. Healthcare 13.25.4. Automotive 13.25.5. Industrial 13.25.6. Consumer Electronics 13.25.7. Others 13.26. Italy Power Semiconductor Market Forecast, by Component 13.26.1. Power MOSFET 13.26.2. Rectifiers 13.26.3. Thyristors 13.26.4. IGBT 13.26.5. Diode 13.27. Italy Power Semiconductor Market Forecast, by Material 13.27.1. Silicon Carbide (SiC) 13.27.2. Silicon/ Germanium 13.27.3. Gallium Nitride (GaN) 13.28. Italy Power Semiconductor Market Forecast, by Module 13.28.1. Power Modules 13.28.2. Power Discrete 13.29. Italy Power Semiconductor Market Forecast, by End-Use 13.29.1. Telecommunication 13.29.2. Aerospace & Defense 13.29.3. Healthcare 13.29.4. Automotive 13.29.5. Industrial 13.29.6. Consumer Electronics 13.29.7. Others 13.30. Spain Power Semiconductor Market Forecast, by Component 13.30.1. Power MOSFET 13.30.2. Rectifiers 13.30.3. Thyristors 13.30.4. IGBT 13.30.5. Diode 13.31. Spain Power Semiconductor Market Forecast, by Material 13.31.1. Silicon Carbide (SiC) 13.31.2. Silicon/ Germanium 13.31.3. Gallium Nitride (GaN) 13.32. Spain Power Semiconductor Market Forecast, by Module 13.32.1. Power Modules 13.32.2. Power Discrete 13.33. Spain Power Semiconductor Market Forecast, by End-Use 13.33.1. Telecommunication 13.33.2. Aerospace & Defense 13.33.3. Healthcare 13.33.4. Automotive 13.33.5. Industrial 13.33.6. Consumer Electronics 13.33.7. Others 13.34. Rest of Europe Power Semiconductor Market Forecast, by Component 13.34.1. Power MOSFET 13.34.2. Rectifiers 13.34.3. Thyristors 13.34.4. IGBT 13.34.5. Diode 13.35. Rest of Europe Power Semiconductor Market Forecast, by Material 13.35.1. Silicon Carbide (SiC) 13.35.2. Silicon/ Germanium 13.35.3. Gallium Nitride (GaN) 13.36. Rest of Europe Power Semiconductor Market Forecast, by Module 13.36.1. Power Modules 13.36.2. Power Discrete 13.37. Rest Of Europe Power Semiconductor Market Forecast, by End-Use 13.37.1. Telecommunication 13.37.2. Aerospace & Defense 13.37.3. Healthcare 13.37.4. Automotive 13.37.5. Industrial 13.37.6. Consumer Electronics 13.37.7. Others 13.38. Europe Power Semiconductor Market Attractiveness Analysis 13.38.1. By Component 13.38.2. By Material 13.38.3. By Module 13.38.4. By End-Use 13.39. PEST Analysis 13.40. Key Trends 13.41. Key Development 14. Asia Pacific Power Semiconductor Market Analysis 14.1. Key Findings 14.2. Asia Pacific Power Semiconductor Market Overview 14.3. Asia Pacific Power Semiconductor Market Value Share Analysis, by Component 14.4. Asia Pacific Power Semiconductor Market Forecast, by Component 14.4.1. Power MOSFET 14.4.2. Rectifiers 14.4.3. Thyristors 14.4.4. IGBT 14.4.5. Diode 14.5. Asia Pacific Power Semiconductor Market Value Share Analysis, by Material 14.6. Asia Pacific Power Semiconductor Market Forecast, by Material 14.6.1. Silicon Carbide (SiC) 14.6.2. Silicon/ Germanium 14.6.3. Gallium Nitride (GaN) 14.7. Asia Pacific Power Semiconductor Market Value Share Analysis, by Module 14.8. Asia Pacific Power Semiconductor Market Forecast, by Module 14.8.1. Power Modules 14.8.2. Power Discrete 14.9. Asia Pacific Power Semiconductor Market Value Share Analysis, by End-Use 14.10. Asia Pacific Power Semiconductor Market Forecast, by End-Use 14.10.1. Telecommunication 14.10.2. Aerospace & Defense 14.10.3. Healthcare 14.10.4. Automotive 14.10.5. Industrial 14.10.6. Consumer Electronics 14.10.7. Others 14.11. Asia Pacific Power Semiconductor Market Value Share Analysis, by Country 14.12. Asia Pacific Power Semiconductor Market Forecast, by Country 14.12.1. China 14.12.2. India 14.12.3. Japan 14.12.4. ASEAN 14.12.5. Rest of Asia Pacific 14.13. Asia Pacific Power Semiconductor Market Analysis, by Country 14.14. China Power Semiconductor Market Forecast, by Component 14.14.1. Power MOSFET 14.14.2. Rectifiers 14.14.3. Thyristors 14.14.4. IGBT 14.14.5. Diode 14.15. China Power Semiconductor Market Forecast, by Material 14.15.1. Silicon Carbide (SiC) 14.15.2. Silicon/ Germanium 14.15.3. Gallium Nitride (GaN) 14.16. China Power Semiconductor Market Forecast, by Module 14.16.1. Power Modules 14.16.2. Power Discrete 14.17. China Power Semiconductor Market Forecast, by End-Use 14.17.1. Telecommunication 14.17.2. Aerospace & Defense 14.17.3. Healthcare 14.17.4. Automotive 14.17.5. Industrial 14.17.6. Consumer Electronics 14.17.7. Others 14.18. India Power Semiconductor Market Forecast, by Component 14.18.1. Power MOSFET 14.18.2. Rectifiers 14.18.3. Thyristors 14.18.4. IGBT 14.18.5. Diode 14.19. India Power Semiconductor Market Forecast, by Material 14.19.1. Silicon Carbide (SiC) 14.19.2. Silicon/ Germanium 14.19.3. Gallium Nitride (GaN) 14.20. India Power Semiconductor Market Forecast, by Module 14.20.1. Power Modules 14.20.2. Power Discrete 14.21. India Power Semiconductor Market Forecast, by End-Use 14.21.1. Telecommunication 14.21.2. Aerospace & Defense 14.21.3. Healthcare 14.21.4. Automotive 14.21.5. Industrial 14.21.6. Consumer Electronics 14.21.7. Others 14.22. Japan Power Semiconductor Market Forecast, by Component 14.22.1. Power MOSFET 14.22.2. Rectifiers 14.22.3. Thyristors 14.22.4. IGBT 14.22.5. Diode 14.23. Japan Power Semiconductor Market Forecast, by Material 14.23.1. Silicon Carbide (SiC) 14.23.2. Silicon/ Germanium 14.23.3. Gallium Nitride (GaN) 14.24. Japan Power Semiconductor Market Forecast, by Module 14.24.1. Power Modules 14.24.2. Power Discrete 14.25. Japan Power Semiconductor Market Forecast, by End-Use 14.25.1. Telecommunication 14.25.2. Aerospace & Defense 14.25.3. Healthcare 14.25.4. Automotive 14.25.5. Industrial 14.25.6. Consumer Electronics 14.25.7. Others 14.26. ASEAN Power Semiconductor Market Forecast, by Component 14.26.1. Power MOSFET 14.26.2. Rectifiers 14.26.3. Thyristors 14.26.4. IGBT 14.26.5. Diode 14.27. ASEAN Power Semiconductor Market Forecast, by Material 14.27.1. Silicon Carbide (SiC) 14.27.2. Silicon/ Germanium 14.27.3. Gallium Nitride (GaN) 14.28. ASEAN Power Semiconductor Market Forecast, by Module 14.28.1. Power Modules 14.28.2. Power Discrete 14.29. ASEAN Power Semiconductor Market Forecast, by End-Use 14.29.1. Telecommunication 14.29.2. Aerospace & Defense 14.29.3. Healthcare 14.29.4. Automotive 14.29.5. Industrial 14.29.6. Consumer Electronics 14.29.7. Others 14.30. Rest of Asia Pacific Power Semiconductor Market Forecast, by Component 14.30.1. Power MOSFET 14.30.2. Rectifiers 14.30.3. Thyristors 14.30.4. IGBT 14.30.5. Diode 14.31. Rest of Asia Pacific Power Semiconductor Market Forecast, by Material 14.31.1. Silicon Carbide (SiC) 14.31.2. Silicon/ Germanium 14.31.3. Gallium Nitride (GaN) 14.32. Rest of Asia Pacific Power Semiconductor Market Forecast, by Module 14.32.1. Power Modules 14.32.2. Power Discrete 14.33. Rest of Asia Pacific Power Semiconductor Market Forecast, by End-Use 14.33.1. Telecommunication 14.33.2. Aerospace & Defense 14.33.3. Healthcare 14.33.4. Automotive 14.33.5. Industrial 14.33.6. Consumer Electronics 14.33.7. Others 14.34. Asia Pacific Power Semiconductor Market Attractiveness Analysis 14.34.1. By Component 14.34.2. By Material 14.34.3. By Module 14.34.4. By End-Use 14.35. PEST Analysis 14.36. Key Trends 14.37. Key Development 15. Middle East & Africa Power Semiconductor Market Analysis 15.1. Key Findings 15.2. Middle East & Africa Power Semiconductor Market Overview 15.3. Middle East & Africa Power Semiconductor Market Value Share Analysis, by Component 15.4. Middle East & Africa Power Semiconductor Market Forecast, by Component 15.4.1. Power MOSFET 15.4.2. Rectifiers 15.4.3. Thyristors 15.4.4. IGBT 15.4.5. Diode 15.5. Middle East & Africa Power Semiconductor Market Value Share Analysis, by Material 15.6. Middle East & Africa Power Semiconductor Market Forecast, by Material 15.6.1. Silicon Carbide (SiC) 15.6.2. Silicon/ Germanium 15.6.3. Gallium Nitride (GaN) 15.7. Middle East & Africa Power Semiconductor Market Value Share Analysis, by Module 15.8. Middle East & Africa Power Semiconductor Market Forecast, by Module 15.8.1. Power Modules 15.8.2. Power Discrete 15.9. Middle East & Africa Power Semiconductor Market Value Share Analysis, by End-Use 15.10. Middle East & Africa Power Semiconductor Market Forecast, by End-Use 15.10.1. Telecommunication 15.10.2. Aerospace & Defense 15.10.3. Healthcare 15.10.4. Automotive 15.10.5. Industrial 15.10.6. Consumer Electronics 15.10.7. Others 15.11. Middle East & Africa Power Semiconductor Market Value Share Analysis, by Country 15.12. Middle East & Africa Power Semiconductor Market Forecast, by Country 15.12.1. GCC 15.12.2. South Africa 15.12.3. Rest of Middle East & Africa 15.13. Middle East & Africa Power Semiconductor Market Analysis, by Country 15.14. GCC Power Semiconductor Market Forecast, by Component 15.14.1. Power MOSFET 15.14.2. Rectifiers 15.14.3. Thyristors 15.14.4. IGBT 15.14.5. Diode 15.15. GCC Power Semiconductor Market Forecast, by Material 15.15.1. Silicon Carbide (SiC) 15.15.2. Silicon/ Germanium 15.15.3. Gallium Nitride (GaN) 15.16. GCC Power Semiconductor Market Forecast, by Module 15.16.1. Power Modules 15.16.2. Power Discrete 15.17. GCC Power Semiconductor Market Forecast, by End-Use 15.17.1. Telecommunication 15.17.2. Aerospace & Defense 15.17.3. Healthcare 15.17.4. Automotive 15.17.5. Industrial 15.17.6. Consumer Electronics 15.17.7. Others 15.18. South Africa Power Semiconductor Market Forecast, by Component 15.18.1. Power MOSFET 15.18.2. Rectifiers 15.18.3. Thyristors 15.18.4. IGBT 15.18.5. Diode 15.19. South Africa Power Semiconductor Market Forecast, by Material 15.19.1. Silicon Carbide (SiC) 15.19.2. Silicon/ Germanium 15.19.3. Gallium Nitride (GaN) 15.20. South Africa Power Semiconductor Market Forecast, by Module 15.20.1. Power Modules 15.20.2. Power Discrete 15.21. South Africa Power Semiconductor Market Forecast, by End-Use 15.21.1. Telecommunication 15.21.2. Aerospace & Defense 15.21.3. Healthcare 15.21.4. Automotive 15.21.5. Industrial 15.21.6. Consumer Electronics 15.21.7. Others 15.22. Rest of Middle East & Africa Power Semiconductor Market Forecast, by Component 15.22.1. Power MOSFET 15.22.2. Rectifiers 15.22.3. Thyristors 15.22.4. IGBT 15.22.5. Diode 15.23. Rest of Middle East & Africa Power Semiconductor Market Forecast, by Material 15.23.1. Silicon Carbide (SiC) 15.23.2. Silicon/ Germanium 15.23.3. Gallium Nitride (GaN) 15.24. Rest of Middle East & Africa Power Semiconductor Market Forecast, by Module 15.24.1. Power Modules 15.24.2. Power Discrete 15.25. Rest of Middle East & Africa Power Semiconductor Market Forecast, by End-Use 15.25.1. Telecommunication 15.25.2. Aerospace & Defense 15.25.3. Healthcare 15.25.4. Automotive 15.25.5. Industrial 15.25.6. Consumer Electronics 15.25.7. Others 15.26. Middle East & Africa Power Semiconductor Market Attractiveness Analysis 15.26.1. By Component 15.26.2. By Material 15.26.3. By Module 15.26.4. By End-Use 15.27. PEST Analysis 15.28. Key Trends 15.29. Key Development 16. South America Power Semiconductor Market Analysis 16.1. Key Findings 16.2. South America Power Semiconductor Market Overview 16.3. South America Power Semiconductor Market Value Share Analysis, by Component 16.4. South America Power Semiconductor Market Forecast, by Component 16.4.1. Power MOSFET 16.4.2. Rectifiers 16.4.3. Thyristors 16.4.4. IGBT 16.4.5. Diode 16.5. South America Power Semiconductor Market Value Share Analysis, by Material 16.6. South America Power Semiconductor Market Forecast, by Material 16.6.1. Silicon Carbide (SiC) 16.6.2. Silicon/ Germanium 16.6.3. Gallium Nitride (GaN) 16.7. South America Power Semiconductor Market Value Share Analysis, by Module 16.8. South America Power Semiconductor Market Forecast, by Module 16.8.1. Power Modules 16.8.2. Power Discrete 16.9. Cloud-Based Services South America Power Semiconductor Market Value Share Analysis, by End-Use 16.10. South America Power Semiconductor Market Forecast, by End-Use 16.10.1. Telecommunication 16.10.2. Aerospace & Defense 16.10.3. Healthcare 16.10.4. Automotive 16.10.5. Industrial 16.10.6. Consumer Electronics 16.10.7. Others 16.11. South America Power Semiconductor Market Value Share Analysis, by Country 16.12. South America Power Semiconductor Market Forecast, by Country 16.12.1. Brazil 16.12.2. Mexico 16.12.3. Rest of South America 16.13. South America Power Semiconductor Market Analysis, by Country 16.14. Brazil Power Semiconductor Market Forecast, by Component 16.14.1. Power MOSFET 16.14.2. Rectifiers 16.14.3. Thyristors 16.14.4. IGBT 16.14.5. Diode 16.15. Brazil Power Semiconductor Market Forecast, by Material 16.15.1. Silicon Carbide (SiC) 16.15.2. Silicon/ Germanium 16.15.3. Gallium Nitride (GaN) 16.16. Brazil Power Semiconductor Market Forecast, by Module 16.16.1. Power Modules 16.16.2. Power Discrete 16.17. Brazil Power Semiconductor Market Forecast, by End-Use 16.17.1. Telecommunication 16.17.2. Aerospace & Defense 16.17.3. Healthcare 16.17.4. Automotive 16.17.5. Industrial 16.17.6. Consumer Electronics 16.17.7. Others 16.18. Mexico Power Semiconductor Market Forecast, by Component 16.18.1. Power MOSFET 16.18.2. Rectifiers 16.18.3. Thyristors 16.18.4. IGBT 16.18.5. Diode 16.19. Mexico Power Semiconductor Market Forecast, by Material 16.19.1. Silicon Carbide (SiC) 16.19.2. Silicon/ Germanium 16.19.3. Gallium Nitride (GaN) 16.20. Mexico Power Semiconductor Market Forecast, by Module 16.20.1. Power Modules 16.20.2. Power Discrete 16.21. Mexico Power Semiconductor Market Forecast, by End-Use 16.21.1. Telecommunication 16.21.2. Aerospace & Defense 16.21.3. Healthcare 16.21.4. Automotive 16.21.5. Industrial 16.21.6. Consumer Electronics 16.21.7. Others 16.22. Rest of South America Power Semiconductor Market Forecast, by Component 16.22.1. Power MOSFET 16.22.2. Rectifiers 16.22.3. Thyristors 16.22.4. IGBT 16.22.5. Diode 16.23. Rest of South America Power Semiconductor Market Forecast, by Material 16.23.1. Silicon Carbide (SiC) 16.23.2. Silicon/ Germanium 16.23.3. Gallium Nitride (GaN) 16.24. Rest of South America Power Semiconductor Market Forecast, by Module 16.24.1. Power Modules 16.24.2. Power Discrete 16.25. Rest of South America Power Semiconductor Market Forecast, by End-Use 16.25.1. Telecommunication 16.25.2. Aerospace & Defense 16.25.3. Healthcare 16.25.4. Automotive 16.25.5. Industrial 16.25.6. Consumer Electronics 16.25.7. Others 16.26. South America Power Semiconductor Market Attractiveness Analysis 16.26.1. By Component 16.26.2. By Material 16.26.3. By Module 16.26.4. By End-Use 16.27. PEST Analysis 16.28. Key Trends 16.29. Key Development 17. Company Profiles 17.1. Market Share Analysis, by Company 17.2. Competition Matrix 17.2.1. Competitive Benchmarking of key players by price, presence, market share, Applications and R&D investment 17.2.2. New Product Launches and Product Enhancements 17.2.3. Market Consolidation 17.2.3.1. M&A by Regions, Investment and Applications 17.2.3.2. M&A Key Players, Forward Integration and Backward Integration 17.3. Company Profiles: Key Players 17.3.1. Semikron International GmbH 17.3.1.1. Company Overview 17.3.1.2. Financial Overview 17.3.1.3. Product Portfolio 17.3.1.4. Business Strategy 17.3.1.5. Recent Developments 17.3.1.6. Company Footprint 17.3.2. Fuji Electric Co., Ltd. 17.3.3. Mitsubishi Electric Group 17.3.4. Texas Instruments 17.3.5. Infineon Technologies AG 17.3.6. ST Microelectronics N.V. 17.3.7. Toshiba Corporation 17.3.8. ABB Ltd 17.3.9. Qualcomm Inc. 17.3.10. NXP Semiconductor 17.3.11. Cree Inc. 17.3.12. ON Semiconductor Corporation 17.3.13. Renesas Electronic Corporation 17.3.14. Broadcom Limited 17.3.15. Fairchild Semiconductor 17.3.16. Hitachi 17.3.17. ROHM 17.3.18. GaN Systems 17.3.19. FormFactor 18. Primary Key Insights