Pharmaceutical Excipients Market size was valued at USD 10 Billion in 2023 and the Pharmaceutical Excipients Market revenue is expected to reach USD 15.85 Billion by 2030, at a CAGR of 6.8 % over the forecast period.Pharmaceutical Excipients Market Overview

Pharmaceutical excipients are inert substances added to pharmaceutical formulations alongside active ingredients (APIs) to facilitate the manufacturing process, enhance stability, improve bioavailability, control release rates, mask taste or odor, and ensure patient safety and efficacy. They serve various purposes such as bulking agents, binders, disintegrants, lubricants, colorants, flavorings, preservatives, and solvents. Excipients play a crucial role in formulating dosage forms like tablets, capsules, creams, ointments, suspensions, and injections. These substances are carefully selected based on their compatibility with the active ingredient and their safety profile for human consumption. Regulatory authorities often provide guidelines and specifications for excipients to ensure their quality, safety, and efficacy in pharmaceutical products.To know about the Research Methodology:-Request Free Sample Report The pharmaceutical excipients market is an important component of the pharmaceutical industry, encompassing a wide range of substances used in drug formulations to improve stability, bioavailability, manufacturability, and patient acceptability. This market has seen significant growth in recent years, driven by factors such as the increasing demand for pharmaceutical products, technological advancements in drug delivery systems, and the rising prevalence of chronic diseases globally. The increasing adoption of biopharmaceuticals, including monoclonal antibodies, vaccines, and gene therapies, is creating new opportunities for excipient manufacturers. Excipients are used in biopharmaceutical formulations for stabilization, lyophilization, and delivery, contributing to the growth of the Pharmaceutical Excipients market.

Pharmaceutical Excipients Market Dynamics

Technological advancements in drug delivery systems to boost Pharmaceutical Excipients Market growth Technological advancements in drug delivery systems and formulation techniques have significantly impacted the pharmaceutical excipients market. Innovations such as nanotechnology, controlled release systems, and targeted drug delivery have created new opportunities for excipient manufacturers. These technologies often require specialized excipients to achieve the desired drug release profiles, enhance bioavailability, and improve patient compliance. Consequently, the demand for advanced excipients that meet the requirements of innovative drug delivery systems is on the rise. The pharmaceutical industry's growth is drivers of the excipients market. With increasing global healthcare expenditure, growing populations, and rising incidences of chronic diseases, the demand for pharmaceutical products continues to surge. As pharmaceutical companies develop new drugs and expand their product portfolios, the need for excipients to optimize drug formulations also increases, driving the growth of the Pharmaceutical excipients market. Regulatory authorities worldwide impose stringent requirements on pharmaceutical products to ensure their safety, quality, and efficacy. Excipients play a crucial role in meeting these regulatory standards by ensuring the stability, compatibility, and performance of drug formulations. The implementation of quality-by-design (QbD) principles in pharmaceutical development has further emphasized the importance of excipients in optimizing drug formulations and manufacturing processes to meet regulatory requirements. As regulatory scrutiny continues to intensify, the demand for high-quality excipients that comply with regulatory standards is expected to increase. The growing Pharmaceutical Excipients Market for generic drugs, particularly in emerging economies, is driving the demand for pharmaceutical excipients. Generic drug manufacturers rely on excipients to develop cost-effective formulations that are bioequivalent to branded drugs. Excipients play a crucial role in ensuring the consistency, quality, and performance of generic drugs, enabling manufacturers to meet regulatory standards and gain market acceptance. With the increasing adoption of generic drugs worldwide, the demand for excipients is expected to grow. Stringent Regulatory Requirements to limit the Pharmaceutical Excipients Market growth Regulatory compliance is a significant challenge for excipient manufacturers. Regulatory authorities impose stringent requirements on excipients to ensure their safety, quality, and compatibility with active pharmaceutical ingredients (APIs). Compliance with various regulations, such as Good Manufacturing Practices (GMP), Good Distribution Practices (GDP), and International Council for Harmonization of Technical Requirements for Pharmaceuticals for Human Use (ICH) guidelines, adds complexity and costs to the manufacturing process. Failure to meet regulatory standards lead to product recalls, fines, and reputational damage, thereby restraining market growth. Developing new excipients or modifying existing ones to meet specific formulation requirements entails significant investment in research and development (R&D). Pharmaceutical Excipient manufacturers invest in extensive testing, characterization, and validation studies to demonstrate the safety, efficacy, and regulatory compliance of their products. High development costs, coupled with the uncertainty of market acceptance, pose challenges for smaller players and startups in the Pharmaceutical Excipients Market, limiting innovation and product diversification. Maintaining consistent quality and performance of excipients is essential to ensure the safety and efficacy of pharmaceutical products. Excipient manufacturers face various challenges related to quality control, including batch-to-batch variability, impurities, and contamination issues. Implementing robust quality control measures, such as analytical testing, process validation, and quality assurance systems, requires significant investments in infrastructure, technology, and expertise. Failure to address quality control challenges leads to product recalls, regulatory sanctions, and loss of customer trust, which significantly boosts the Pharmaceutical Excipients Market growth. The absence of patent protection exposes excipient formulations to generic competition, price erosion, and commoditization, thereby limiting profit margins and inhibiting investment in R&D. The availability of generic or alternative excipients lead to substitution by cost-conscious pharmaceutical companies, further intensifying pricing pressures in the market.Pharmaceutical Excipients Market Segment Analysis

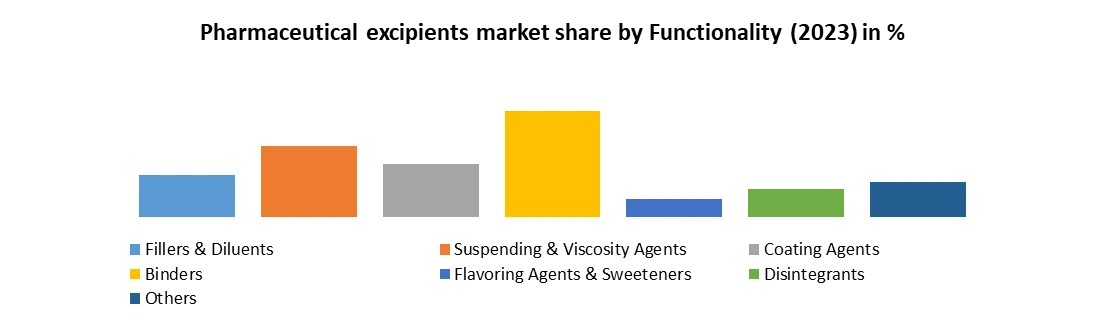

Based on Formulation, the market is segmented into Fillers & Diluents, Suspending and viscosity Agents, Coating Agents, Binders, Flavoring Agents and sweeteners, Disintegrants, and Others. The binders segment dominated the market in 2023 and is expected to hold the largest Pharmaceutical Excipients Market share over the forecast period. Binders are a crucial segment that plays a fundamental role in the formulation of solid dosage forms such as tablets and granules. Binders, also known as adhesives or granulating agents, are substances added to pharmaceutical formulations to impart cohesive properties, thereby allowing the granulation of powders into compact, cohesive units. This segment of excipients serves to ensure the integrity, uniformity, and mechanical strength of the final dosage form, which is expected to boost the Pharmaceutical Excipients Market growth. The primary function of binders is to bind or adhere the powdered ingredients together to form cohesive granules or compacts. This binding action helps to create solid dosage forms with sufficient mechanical strength and integrity to withstand handling, packaging, and transportation without crumbling or disintegrating. Based on Formulation, the market is segmented into Oral Formulations, Tablets, Capsules, Liquid Formulations, and Others. The oral formulation segment dominated the market in 2023 and is expected to hold the largest Pharmaceutical Excipients Market share over the forecast period. The oral formulation segment is a significant component of the pharmaceutical excipients industry, encompassing excipients used in the development of oral dosage forms such as tablets, capsules, powders, and solutions intended for oral administration. Oral formulations are among the most widely used and preferred dosage forms due to their convenience, ease of administration, patient acceptance, and cost-effectiveness. Excipients play a crucial role in oral formulations by providing essential functionalities and characteristics necessary for the formulation, manufacturing, and performance of these dosage forms. There is increasing emphasis on developing patient-centric oral formulations that cater to individual patient needs, preferences, and therapeutic requirements. Excipient manufacturers are focusing on developing excipients with improved taste-masking properties, reduced tablet size, and enhanced swallow ability to enhance patient acceptance and compliance.

Pharmaceutical Excipients Market Regional Insight

Growing Demand for Specialty Excipients to boost North America Pharmaceutical Excipients Market growth North America dominated the market in 2023 and is expected to hold the largest Pharmaceutical Excipients Market share over the forecast period. With increasing emphasis on personalized medicine and targeted drug delivery, there is a growing demand for specialty excipients that offer specific functionalities and performance attributes. Specialty excipients enable the development of advanced drug formulations tailored to meet the needs of specific patient populations or therapeutic applications. In North America, pharmaceutical companies are increasingly incorporating specialty excipients into their formulations to enhance drug efficacy, improve patient compliance, and differentiate their products in the market. In recent years, there has been a growing focus on quality and safety in the pharmaceutical industry, driven by concerns over product recalls, drug shortages, and regulatory scrutiny. Pharmaceutical companies in North America prioritize the use of high-quality excipients sourced from reputable suppliers to ensure the safety and efficacy of their products, which significantly boosts the North America Pharmaceutical Excipients Market growth. Excipient manufacturers in the region invest in quality control measures, such as Good Manufacturing Practices (GMP) and quality assurance systems, to meet the stringent quality standards expected by pharmaceutical companies and regulatory agencies. The regulatory landscape in North America, particularly in the United States, is characterized by stringent requirements for pharmaceutical products and excipients. Regulatory agencies such as the Food and Drug Administration (FDA) set standards for the safety, quality, and efficacy of excipients used in pharmaceutical formulations. Compliance with regulatory requirements is essential for excipient manufacturers to gain market approval and ensure the acceptance of their products by pharmaceutical companies. The regulatory framework in North America drives investments in research, quality control, and compliance measures to meet regulatory standards, thereby shaping the dynamics of the excipients market.Pharmaceutical Excipients Market Scope: Inquire before buying

Global Pharmaceutical Excipients Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 10 Bn. Forecast Period 2024 to 2030 CAGR: 6.8% Market Size in 2030: US $ 15.85 Bn. Segments Covered: by Product Organic Chemicals Inorganic Chemicals Others by Functionality Fillers & Diluents Suspending & Viscosity Agents Coating Agents Binders Flavoring Agents & Sweeteners Disintegrants Others by Formulation Oral Formulations Tablets Capsules Liquid Formulations Others by End-User Pharmaceutical Companies Biotechnology Companies Others Pharmaceutical Excipients Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Pharmaceutical Excipients manufacturers include:

North America: 1. Colorcon (United States) 2. Ashland Global Holdings Inc. (United States) 3. Avantor, Inc. (United States) 4. Lubrizol Corporation (United States) 5. Roquette America, Inc. (United States) 6. Dow Chemical Company (United States) Europe: 7. Croda International Plc (United Kingdom) 8. BASF SE (Germany) 9. Evonik Industries AG (Germany) 10. Meggle Pharma (Germany) 11. JRS Pharma GmbH & Co. KG (Germany) 12. DFE Pharma (Netherlands) 13. Merck KGaA (Germany) 14. Kerry Group plc (Ireland) Asia-Pacific: 15. Shin-Etsu Chemical Co., Ltd. (Japan) 16. Nipro Corporation (Japan) 17. Colorcon Asia-Pacific (Singapore) 18. Signet Chemical Corporation Pvt. Ltd. (India) 19. Associated British Foods (Australia) Latin America: 20. Blanver (Brazil) 21. Cristália (Brazil)Frequently Asked Questions:

1. What are pharmaceutical excipients, and what role do they play in drug formulations? Ans: Pharmaceutical excipients are inert substances added to pharmaceutical formulations alongside active ingredients (APIs) to facilitate the manufacturing process, enhance stability, improve bioavailability, control release rates, mask taste or odor, and ensure patient safety and efficacy. 2. What drives the growth of the pharmaceutical excipients market globally? Ans: The pharmaceutical excipients market has seen significant growth in recent years, driven by factors such as the increasing demand for pharmaceutical products, technological advancements in drug delivery systems, the rising prevalence of chronic diseases globally, and the increasing adoption of biopharmaceuticals, including monoclonal antibodies, vaccines, and gene therapies. 3. What are some challenges faced by excipient manufacturers in the pharmaceutical industry? Ans: Excipient manufacturers face challenges such as stringent regulatory requirements, high development costs, complex supply chain dynamics, quality control challenges, and limited patent protection. These challenges impact product development, innovation, and market competitiveness. 4. Which excipient segment dominates the pharmaceutical excipients market, and why? Ans: The binder segment dominates the pharmaceutical excipients market due to its crucial role in the formulation of solid dosage forms such as tablets and granules. Binders facilitate the binding or adherence of powdered ingredients together, creating cohesive granules or compacts essential for the mechanical strength and integrity of the final dosage form. 5. What are some emerging trends in the pharmaceutical excipients market? Ans: Emerging trends in the pharmaceutical excipients market include the development of advanced drug delivery systems, focus on patient-centric formulations, and adoption of biodegradable excipients, customization/personalization of formulations, and the use of sustainable excipient sources to minimize environmental impact.

1. Pharmaceutical Excipients Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Pharmaceutical Excipients Market: Dynamics 2.1. Pharmaceutical Excipients Market Trends by Region 2.1.1. North America Pharmaceutical Excipients Market Trends 2.1.2. Europe Pharmaceutical Excipients Market Trends 2.1.3. Asia Pacific Pharmaceutical Excipients Market Trends 2.1.4. Middle East and Africa Pharmaceutical Excipients Market Trends 2.1.5. South America Pharmaceutical Excipients Market Trends 2.2. Pharmaceutical Excipients Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Pharmaceutical Excipients Market Drivers 2.2.1.2. North America Pharmaceutical Excipients Market Restraints 2.2.1.3. North America Pharmaceutical Excipients Market Opportunities 2.2.1.4. North America Pharmaceutical Excipients Market Challenges 2.2.2. Europe 2.2.2.1. Europe Pharmaceutical Excipients Market Drivers 2.2.2.2. Europe Pharmaceutical Excipients Market Restraints 2.2.2.3. Europe Pharmaceutical Excipients Market Opportunities 2.2.2.4. Europe Pharmaceutical Excipients Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Pharmaceutical Excipients Market Drivers 2.2.3.2. Asia Pacific Pharmaceutical Excipients Market Restraints 2.2.3.3. Asia Pacific Pharmaceutical Excipients Market Opportunities 2.2.3.4. Asia Pacific Pharmaceutical Excipients Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Pharmaceutical Excipients Market Drivers 2.2.4.2. Middle East and Africa Pharmaceutical Excipients Market Restraints 2.2.4.3. Middle East and Africa Pharmaceutical Excipients Market Opportunities 2.2.4.4. Middle East and Africa Pharmaceutical Excipients Market Challenges 2.2.5. South America 2.2.5.1. South America Pharmaceutical Excipients Market Drivers 2.2.5.2. South America Pharmaceutical Excipients Market Restraints 2.2.5.3. South America Pharmaceutical Excipients Market Opportunities 2.2.5.4. South America Pharmaceutical Excipients Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Pharmaceutical Excipients Industry 2.8. Analysis of Government Schemes and Initiatives For Pharmaceutical Excipients Industry 2.9. Pharmaceutical Excipients Market Trade Analysis 2.10. The Global Pandemic Impact on Pharmaceutical Excipients Market 3. Pharmaceutical Excipients Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 3.1.1. Organic Chemicals 3.1.2. Inorganic Chemicals 3.1.3. Others 3.2. Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 3.2.1. Fillers & Diluents 3.2.2. Suspending & Viscosity Agents 3.2.3. Coating Agents 3.2.4. Binders 3.2.5. Flavoring Agents & Sweeteners 3.2.6. Disintegrants 3.2.7. Others 3.3. Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 3.3.1. Oral Formulations 3.3.2. Tablets 3.3.3. Capsules 3.3.4. Liquid Formulations 3.3.5. Others 3.4. Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 3.4.1. Pharmaceutical Companies 3.4.2. Biotechnology Companies 3.4.3. Others 3.5. Pharmaceutical Excipients Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Pharmaceutical Excipients Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 4.1.1. Organic Chemicals 4.1.2. Inorganic Chemicals 4.1.3. Others 4.2. North America Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 4.2.1. Fillers & Diluents 4.2.2. Suspending & Viscosity Agents 4.2.3. Coating Agents 4.2.4. Binders 4.2.5. Flavoring Agents & Sweeteners 4.2.6. Disintegrants 4.2.7. Others 4.3. North America Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 4.3.1. Oral Formulations 4.3.2. Tablets 4.3.3. Capsules 4.3.4. Liquid Formulations 4.3.5. Others 4.4. North America Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 4.4.1. Pharmaceutical Companies 4.4.2. Biotechnology Companies 4.4.3. Others 4.5. North America Pharmaceutical Excipients Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 4.5.1.1.1. Organic Chemicals 4.5.1.1.2. Inorganic Chemicals 4.5.1.1.3. Others 4.5.1.2. United States Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 4.5.1.2.1. Fillers & Diluents 4.5.1.2.2. Suspending & Viscosity Agents 4.5.1.2.3. Coating Agents 4.5.1.2.4. Binders 4.5.1.2.5. Flavoring Agents & Sweeteners 4.5.1.2.6. Disintegrants 4.5.1.2.7. Others 4.5.1.3. United States Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 4.5.1.3.1. Oral Formulations 4.5.1.3.2. Tablets 4.5.1.3.3. Capsules 4.5.1.3.4. Liquid Formulations 4.5.1.3.5. Others 4.5.1.4. United States Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 4.5.1.4.1. Pharmaceutical Companies 4.5.1.4.2. Biotechnology Companies 4.5.1.4.3. Others 4.5.2. Canada 4.5.2.1. Canada Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 4.5.2.1.1. Organic Chemicals 4.5.2.1.2. Inorganic Chemicals 4.5.2.1.3. Others 4.5.2.2. Canada Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 4.5.2.2.1. Fillers & Diluents 4.5.2.2.2. Suspending & Viscosity Agents 4.5.2.2.3. Coating Agents 4.5.2.2.4. Binders 4.5.2.2.5. Flavoring Agents & Sweeteners 4.5.2.2.6. Disintegrants 4.5.2.2.7. Others 4.5.2.3. Canada Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 4.5.2.3.1. Oral Formulations 4.5.2.3.2. Tablets 4.5.2.3.3. Capsules 4.5.2.3.4. Liquid Formulations 4.5.2.3.5. Others 4.5.2.4. Canada Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 4.5.2.4.1. Pharmaceutical Companies 4.5.2.4.2. Biotechnology Companies 4.5.2.4.3. Others 4.5.3. Mexico 4.5.3.1. Mexico Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 4.5.3.1.1. Organic Chemicals 4.5.3.1.2. Inorganic Chemicals 4.5.3.1.3. Others 4.5.3.2. Mexico Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 4.5.3.2.1. Fillers & Diluents 4.5.3.2.2. Suspending & Viscosity Agents 4.5.3.2.3. Coating Agents 4.5.3.2.4. Binders 4.5.3.2.5. Flavoring Agents & Sweeteners 4.5.3.2.6. Disintegrants 4.5.3.2.7. Others 4.5.3.3. Mexico Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 4.5.3.3.1. Oral Formulations 4.5.3.3.2. Tablets 4.5.3.3.3. Capsules 4.5.3.3.4. Liquid Formulations 4.5.3.3.5. Others 4.5.3.4. Mexico Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 4.5.3.4.1. Pharmaceutical Companies 4.5.3.4.2. Biotechnology Companies 4.5.3.4.3. Others 5. Europe Pharmaceutical Excipients Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 5.2. Europe Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 5.3. Europe Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 5.4. Europe Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 5.5. Europe Pharmaceutical Excipients Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 5.5.1.2. United Kingdom Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 5.5.1.3. United Kingdom Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 5.5.1.4. United Kingdom Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 5.5.2. France 5.5.2.1. France Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 5.5.2.2. France Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 5.5.2.3. France Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 5.5.2.4. France Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 5.5.3.2. Germany Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 5.5.3.3. Germany Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 5.5.3.4. Germany Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 5.5.4.2. Italy Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 5.5.4.3. Italy Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 5.5.4.4. Italy Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 5.5.5.2. Spain Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 5.5.5.3. Spain Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 5.5.5.4. Spain Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 5.5.6.2. Sweden Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 5.5.6.3. Sweden Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 5.5.6.4. Sweden Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 5.5.7.2. Austria Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 5.5.7.3. Austria Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 5.5.7.4. Austria Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 5.5.8.2. Rest of Europe Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 5.5.8.3. Rest of Europe Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 5.5.8.4. Rest of Europe Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Pharmaceutical Excipients Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 6.3. Asia Pacific Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 6.4. Asia Pacific Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 6.5. Asia Pacific Pharmaceutical Excipients Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 6.5.1.2. China Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 6.5.1.3. China Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 6.5.1.4. China Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 6.5.2.2. S Korea Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 6.5.2.3. S Korea Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 6.5.2.4. S Korea Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 6.5.3.2. Japan Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 6.5.3.3. Japan Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 6.5.3.4. Japan Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 6.5.4. India 6.5.4.1. India Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 6.5.4.2. India Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 6.5.4.3. India Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 6.5.4.4. India Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 6.5.5.2. Australia Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 6.5.5.3. Australia Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 6.5.5.4. Australia Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 6.5.6.2. Indonesia Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 6.5.6.3. Indonesia Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 6.5.6.4. Indonesia Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 6.5.7.2. Malaysia Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 6.5.7.3. Malaysia Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 6.5.7.4. Malaysia Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 6.5.8.2. Vietnam Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 6.5.8.3. Vietnam Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 6.5.8.4. Vietnam Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 6.5.9.2. Taiwan Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 6.5.9.3. Taiwan Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 6.5.9.4. Taiwan Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 6.5.10.2. Rest of Asia Pacific Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 6.5.10.3. Rest of Asia Pacific Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 6.5.10.4. Rest of Asia Pacific Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Pharmaceutical Excipients Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 7.3. Middle East and Africa Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 7.4. Middle East and Africa Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 7.5. Middle East and Africa Pharmaceutical Excipients Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 7.5.1.2. South Africa Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 7.5.1.3. South Africa Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 7.5.1.4. South Africa Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 7.5.2.2. GCC Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 7.5.2.3. GCC Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 7.5.2.4. GCC Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 7.5.3.2. Nigeria Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 7.5.3.3. Nigeria Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 7.5.3.4. Nigeria Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 7.5.4.2. Rest of ME&A Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 7.5.4.3. Rest of ME&A Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 7.5.4.4. Rest of ME&A Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 8. South America Pharmaceutical Excipients Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 8.2. South America Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 8.3. South America Pharmaceutical Excipients Market Size and Forecast, by Formulation(2023-2030) 8.4. South America Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 8.5. South America Pharmaceutical Excipients Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 8.5.1.2. Brazil Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 8.5.1.3. Brazil Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 8.5.1.4. Brazil Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 8.5.2.2. Argentina Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 8.5.2.3. Argentina Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 8.5.2.4. Argentina Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Pharmaceutical Excipients Market Size and Forecast, by Product (2023-2030) 8.5.3.2. Rest Of South America Pharmaceutical Excipients Market Size and Forecast, by Functionality (2023-2030) 8.5.3.3. Rest Of South America Pharmaceutical Excipients Market Size and Forecast, by Formulation (2023-2030) 8.5.3.4. Rest Of South America Pharmaceutical Excipients Market Size and Forecast, by End User (2023-2030) 9. Global Pharmaceutical Excipients Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Pharmaceutical Excipients Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Colorcon (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Ashland Global Holdings Inc. (United States) 10.3. Avantor, Inc. (United States) 10.4. Lubrizol Corporation (United States) 10.5. Roquette America, Inc. (United States) 10.6. Dow Chemical Company (United States) 10.7. Croda International Plc (United Kingdom) 10.8. BASF SE (Germany) 10.9. Evonik Industries AG (Germany) 10.10. Meggle Pharma (Germany) 10.11. JRS Pharma GmbH & Co. KG (Germany) 10.12. DFE Pharma (Netherlands) 10.13. Merck KGaA (Germany) 10.14. Kerry Group plc (Ireland) 10.15. Shin-Etsu Chemical Co., Ltd. (Japan) 10.16. Nipro Corporation (Japan) 10.17. Colorcon Asia-Pacific (Singapore) 10.18. Signet Chemical Corporation Pvt. Ltd. (India) 10.19. Associated British Foods plc (Australia) 10.20. Blanver (Brazil) 10.21. Cristália (Brazil) 11. Key Findings 12. Industry Recommendations 13. Pharmaceutical Excipients Market: Research Methodology 14. Terms and Glossary