The Epistaxis Market size was valued at USD 200.02 Million in 2025 and the total Epistaxis revenue is expected to grow at a CAGR of 5.4% from 2025 to 2032, reaching nearly USD 289.04 Million by 2032.Epistaxis Market Overview:

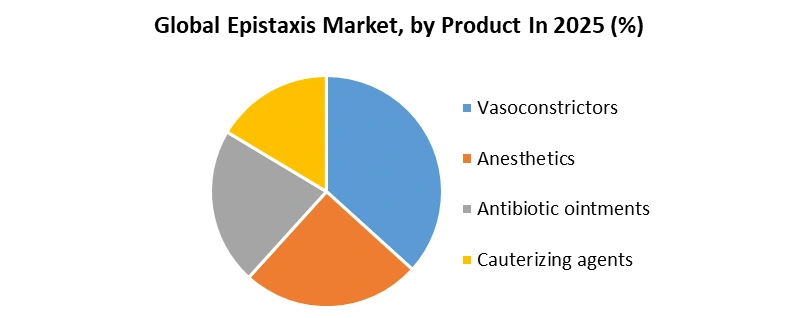

Acute haemorrhage from the nostril, nasal cavity, or nasopharynx is known as epistaxis. It's a common emergency department (ED) problem that causes patients and professionals a lot of anxiety. Vasoconstrictors, Anesthetics, Antibiotic ointments, and Cauterizing agents are the product types of the epistaxis. Anterior Epistaxis, and Posterior Epistaxis are the indication types of the epistaxis. Hospital, Specialty Clinics, and Retail Pharmacies are the types of the distribution channels of the epistaxis market.To know about the Research Methodology :- Request Free Sample Report

Global Epistaxis Market Dynamics:

Dry and less humid weather, as well as an increase in the prevalence of hypertension, are factors that predispose a person to nosebleeds. According to the World Health Organization (WHO), hypertension is responsible for about 12% of all fatalities globally. Nosebleeds are becoming more common as the number of people with hypertension rises. Besides, high blood pressure in pregnant women causes increased blood flow to the mucosal membrane. As a result of these reasons, demand for epistaxis products in the global market continues to rise. Epistaxis is still a widespread health condition in both adults and children. Extreme weather conditions can cause crusting of the mucous secretion processes, resulting in cracks in the nose lining. Extreme dryness and heat in the air can cause a dry nasal membrane, which reduces the quantity of moisture required to keep the nose moist. Dry nasal membranes become more common as environmental circumstances vary frequently, such as less humid weather and bitterly cold winters. During hot, cold, and dry conditions, a dry nasal membrane increases the likelihood of nosebleeds. During the forecast period, rising incidences of dry nasal membrane and abnormal nosebleeds are expected to raise demand for epistaxis products. Manufacturers are concentrating their efforts on producing epistaxis products with enhanced performance and outcomes. The incorporation of innovation in epistaxis products has resulted in more effective and sophisticated epistaxis treatment processes. Surgical and non-surgical interventional techniques are among the innovative therapy procedures. Non-interventional operations include nasal packing, embolization, and warm water irrigation, to name a few. The new treatments that entail surgical intervention include endoscopic litigation of the sphenopaletine artery, maxillary artery litigation, and nasal cauterization. The global epistaxis market is evolving dramatically as a result of the adoption of revolutionary operations. Besides, producers are increasingly concentrating their efforts on producing epistaxis solutions for the treatment of individuals with unique medical problems such as asthma, pregnancy, diabetes, and cancer. During the forecast period, these factors are expected to contribute to the global epistaxis market's growth.Global Epistaxis Market Segment Analysis:

The Global Epistaxis Market is segmented by Product, Indication, and Distribution Channel. Based on the Product, the market is segmented into Vasoconstrictors, Anesthetics, Antibiotic ointments, and Cauterizing agents. Antibiotic ointments segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2025-2032. The bacteria's growth is slowed or stopped. Antibiotic ointments work by stimulating natural substances in the skin to relieve swelling, redness, and itching. These are the key benefits of the antibiotic ointments that are expected to drive the growth of this segment in the epistaxis market during the forecast period 2025-2032.Based on the Indication, the market is segmented into Anterior Epistaxis, and Posterior Epistaxis. Anterior Epistaxis segment is expected to hold the largest market share of xx% by 2032. This is due to the increasing cases of the anterior epistaxis in the world. An anterior nosebleed begins on the bottom section of the wall that divides the two sides of the nose in the front of the nose (called the septum). Capillaries and small blood vessels in the front of the nose are brittle and easily break, causing bleeding. Pinching the nares closed for 10 minutes can be used to treat anterior epistaxis. If pinching does not work and the bleeding site is evident and localised, cautery is used to control anterior epistaxis.

Global Epistaxis Market Regional Insights:

North America region is expected to dominate the Global Epistaxis market during the forecast period 2025-2032. North America region is expected to hold the largest market shares of xx% by 2032. The rising prevalence of diabetes in the North America region is expected to boost the market share of North America. Asia Pacific is expected to grow rapidly at a CAGR of xx% during the forecast period 2025-2032. This is due to the rise in the prevalence of hypertension in the Asia Pacific region.The objective of the report is to present a comprehensive analysis of the Global Epistaxis Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global Epistaxis Market dynamic, structure by analyzing the market segments and project the Global Epistaxis Market size. Clear representation of competitive analysis of key players by Product Type, price, financial position, product portfolio, growth strategies, and regional presence in the Global Epistaxis Market make the report investor’s guide.

Global Epistaxis Market Scope: Inquire before buying

Global Epistaxis Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 200.02 Mn. Forecast Period 2026 to 2032 CAGR: 5.4% Market Size in 2032: USD 289.04 Mn. Segments Covered: by Product Vasoconstrictors Anesthetics Antibiotic ointments Cauterizing agents by Indication Anterior Epistaxis Posterior Epistaxis by Distribution Channel Hospital Specialty Clinics Retail Pharmacies Other Distribution Channels Global Epistaxis Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Global Epistaxis Market, Key Players are

1. Bristol-Myers Squibb Co. 2. Ciron Drugs & Pharmaceuticals Pvt. Ltd. 3. Pfizer Inc. 4. Medline Industries Inc. 5. Smith & Nephew Plc. 6. GlaxoSmithKline Plc. 7. Ferring B.V. 8. King Pharmaceuticals Inc. 9. DeRoyal Industries Inc. 10. Medtronic Plc. 11. Stryker Corp. 12. Teleflex Inc. 13. Summit Medical, Inc. 14. CogENT Therapeutics 15. Entellus Medical Frequently Asked Questions: 1] What segments are covered in Epistaxis Market report? Ans. The segments covered in Epistaxis Market report are based on Product, Indication, and Distribution Channel. 2] Which region is expected to hold the highest share in the Epistaxis Market? Ans. North America is expected to hold the highest share in the Epistaxis Market. 3] Who are the top key players in the Epistaxis Market? Ans. Bristol-Myers Squibb Co., Ciron Drugs & Pharmaceuticals Pvt. Ltd., Pfizer Inc., Medline Industries Inc., and Smith & Nephew Plc. are the top key players in the Epistaxis Market. 4] Which segment holds the largest market share in the Epistaxis market by 2032? Ans. Anterior Epistaxis segment hold the largest market share in the Epistaxis market by 2032. 5] What is the market size of the Epistaxis market by 2032? Ans. The market size of the Epistaxis market is USD 289.04 Mn. by 2032. 6] What was the market size of the market in 2025? Ans. The market size of the market was worth USD 200.02 Mn. in 2025.

1. Global Epistaxis Market: Research Methodology 2. Global Epistaxis Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Epistaxis Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Global Epistaxis Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12 COVID-19 Impact 4. Global Epistaxis Market Segmentation 4.1 Global Epistaxis Market, by Product (2025-2032) • Vasoconstrictors • Anesthetics • Antibiotic ointments • Cauterizing agents 4.2 Global Epistaxis Market, by Indication (2025-2032) • Anterior Epistaxis • Posterior Epistaxis 4.3 Global Epistaxis Market, by Distribution Channel (2025-2032) • Hospital • Specialty Clinics • Retail Pharmacies • Other Distribution Channels 5. North America Epistaxis Market (2025-2032) 5.1 North America Epistaxis Market, by Product (2025-2032) • Vasoconstrictors • Anesthetics • Antibiotic ointments • Cauterizing agents 5.2 North America Epistaxis Market, by Indication (2025-2032) • Anterior Epistaxis • Posterior Epistaxis 5.4 North America Epistaxis Market, by Distribution Channel (2025-2032) • Hospital • Specialty Clinics • Retail Pharmacies • Other Distribution Channels 5.4 North America Epistaxis Market, by Country (2025-2032) • United States • Canada • Mexico 6. Asia Pacific Epistaxis Market (2025-2032) 6.1. Asia Pacific Epistaxis Market, by Product (2025-2032) 6.2. Asia Pacific Epistaxis Market, by Indication (2025-2032) 6.3. Asia Pacific Epistaxis Market, by Distribution Channel (2025-2032) 6.4. Asia Pacific Epistaxis Market, by Country (2025-2032) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 7. Middle East and Africa Epistaxis Market (2025-2032) 7.1 Middle East and Africa Epistaxis Market, by Product (2025-2032) 7.2. Middle East and Africa Epistaxis Market, by Indication (2025-2032) 7.3. Middle East and Africa Epistaxis Market, by Distribution Channel (2025-2032) 7.4. Middle East and Africa Epistaxis Market, by Country (2025-2032) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 8. Latin America Epistaxis Market (2025-2032) 8.1. Latin America Epistaxis Market, by Product (2025-2032) 8.2. Latin America Epistaxis Market, by Indication (2025-2032) 8.3. Latin America Epistaxis Market, by Distribution Channel (2025-2032) 8.4. Latin America Epistaxis Market, by Country (2025-2032) • Brazil • Argentina • Rest Of Latin America 9. European Epistaxis Market (2025-2032) 9.1. European Epistaxis Market, by Product (2025-2032) 9.2. European Epistaxis Market, by Indication (2025-2032) 9.3. European Epistaxis Market, by Distribution Channel (2025-2032) 9.4. European Epistaxis Market, by Country (2025-2032) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 10. Company Profile: Key players 10.1. Bristol-Myers Squibb Co. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Ciron Drugs & Pharmaceuticals Pvt. Ltd. 10.3. Pfizer Inc. 10.4. Medline Industries Inc. 10.5. Smith & Nephew Plc. 10.6. GlaxoSmithKline Plc. 10.7. Ferring B.V. 10.8. King Pharmaceuticals Inc. 10.9. DeRoyal Industries Inc. 10.10. Medtronic Plc. 10.11. Stryker Corp. 10.12. Teleflex Inc. 10.13. Summit Medical, Inc. 10.14. CogENT Therapeutics 10.15. Entellus Medical