The PC Processor Market size was valued at USD 120.17 Billion in 2024 and the total PC Processor revenue is expected to grow at a CAGR of 4.5% from 2025 to 2032, reaching nearly USD 170.90 Billion.Global PC Processor Market Overview

A large variety of processors made specifically for personal computers, such as desktops, laptops, and servers, are included in the Global PC Processor Market. These processors are essential parts that fuel computers' functionality and performance, enabling everything from sophisticated gaming and content production to routine office work. The rising need for high-performance computers that handles demanding computer workloads is one of the major factors influencing the worldwide PC processor industry. The increased popularity of activities like playing games, video editing, and data analysis, together with improvements in software and programs that demand greater processing capacity, are the main drivers of this development. In order to fulfil these needs, processor manufacturers are concentrating on creating chips with more cores, faster clock rates, and more energy efficiency. In order to enable new capabilities and improve overall performance, the integration of modern technologies like machine learning (ML) and artificial intelligence (AI) into processors is another significant development.To know about the Research Methodology :- Request Free Sample Report PC processors are used in many different sectors. Processors are utilized in desktop and laptop computers in the consumer market for activities including online surfing, multimedia usage, and gaming. Business applications, cloud computing, and data processing all need CPU power servers in the corporate market. PC processors are also necessary for a variety of computer requirements in sectors including healthcare, banking, and education. Geographically, the PC processors market is concentrated in the United States, Europe, and the Asia-Pacific region, and major companies are deliberately increasing their footprint in these areas to take advantage of the increasing demand. Key companies in this market include Intel Corporation, known for its Core and Xeon processor brands, and Advanced Micro Devices, Inc. (AMD), which offers processors under the Ryzen and Threadripper brands, among others. The market scope includes both consumer and enterprise segments, with demand driven by factors such as technological advancements, evolving user needs, and the increasing integration of computing devices into everyday life.

Global PC Processor Market Dynamics:

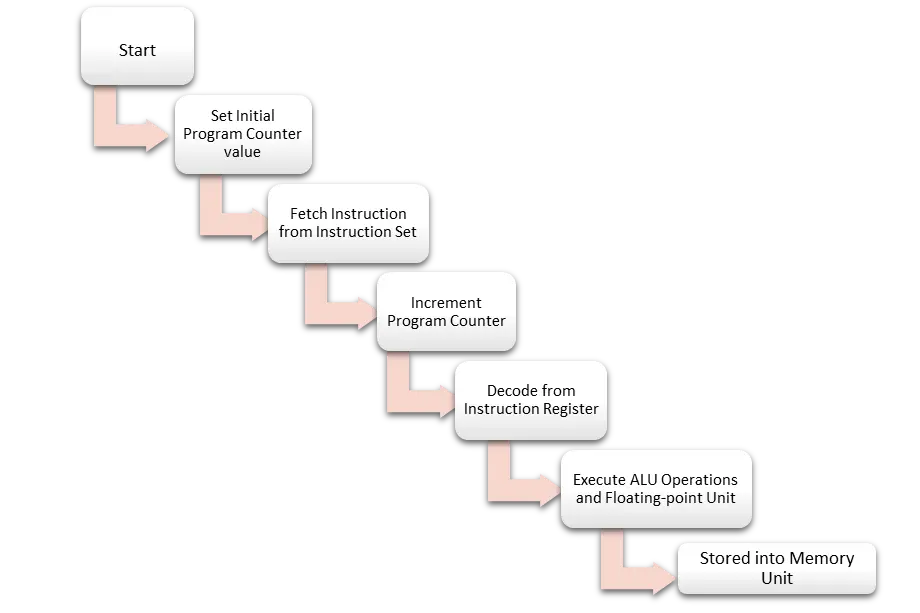

Increasing Demand for Multimedia and Gaming Applications The rising demand for gaming and multimedia applications is reshaping the CPU market, driving the need for high-performance processors. This surge is spurring innovation in CPU technology, with a focus on developing chips capable of handling complex graphics and data-intensive tasks. Manufacturers are increasing their production capacities and investing in advanced manufacturing processes to meet this demand. This trend is also influencing global trade patterns, with countries importing and exporting CPUs to meet domestic and international market needs. Thus, the growing demand for gaming and multimedia applications is fueling significant growth in the CPU market and driving advancements in processor technology. 1. NVIDIA's latest graphics cards for laptops offer desktop-level performance, catering to the growing demand for high-performance hardware among gamers and content creators 2. Sony's latest gaming console, the PlayStation 5, has seen strong demand since its release, indicating a high level of interest in gaming hardware and experiences. 3. MGI acquires AxesInMotion, a fast-growing, profitable, and leading free-to-play mobile games developer with a strong portfolio of visually stunning racing games and over 700 million downloads Proliferation of Digital Devices The proliferation of Information and Communication Technologies (ICT) and digital technologies is significantly impacting the PC processor market, leading to substantial growth. These advancements, such as Building Information Modelling (BIM) and innovative digital engineering systems, are revolutionizing the design, construction, and operation of large-scale projects and various ICT systems throughout a project life-cycle and across its supply chain. The adoption of these technologies is driving the need for more powerful and efficient processors to handle the complex computations and data processing required. This has created a new challenge for construction firms to reconfigure their resources to meet the demands of these technologies, thereby fueling the demand for more advanced PC processors. The integration of ICT tools like BIM and Building Management Systems (BMS) is reshaping how construction firms manage their projects, driving the need for more robust and efficient ICT management systems. 1.Case studies, such as the New Royal Adelaide Hospital project, highlight the critical role of ICT in enhancing the dynamic capabilities of construction firms and their supply chains, ultimately contributing to their reputational assets and branding in the global market. Increase In Demand for Low Power Processors The semiconductor industry has seen rapid growth due to the increasing demand for computational power, leading to higher CPU performance and transistor density on chips. This trend has also resulted in higher power consumption, prompting a need for low-power processors. To address this, multithreaded and multicore CPUs have become popular, offering improved performance efficiency. This report focuses on analysing factors affecting power consumption in these CPUs and explores power-saving techniques. It also reviews recent advancements in power-efficient micro-architectural features in multi-core processors, providing insights for low-power applications and processor design. Always-on devices like the ARC and EM5D/EM7D processors employ low-power CPUs. 1. Cisco predicted that there will be 1,105 million wearable devices by 2022 compared to 835 million in 2020, which will increase demand for CPUs. 2. Advancements in chip manufacturing processes, such as the transition to more power-efficient 5nm and 3nm process nodes. Companies like Intel, AMD, and Apple are continuously working on improving the power efficiency of their processors to meet the demands of modern devices. 3. Examples of low-power CPUs are AMD 5600G, 7600x, i5-12400F, 65W desktop CPUs, i9-13900, and i5-11400. Flowchart of Processor

Global PC Processor Market Segment Analysis:

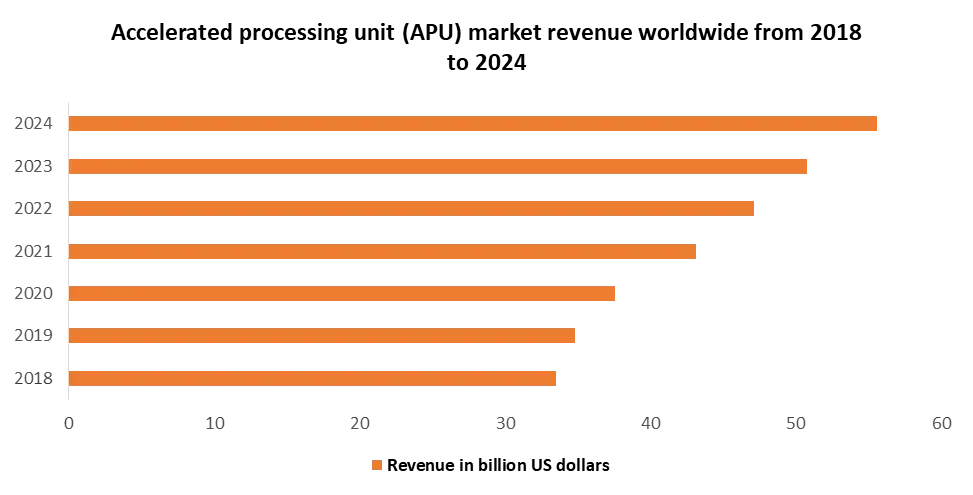

Based on Type of Product the APU’s segment holds the largest market share in the Global PC Processor Market in 2024. One of the main drivers of the APU market's development is the increasing use of mobile devices like smartphones and tablets. 1. For example, Ericsson estimates that by the end of 2022, there will be 6.6 billion smartphone subscribers or around 79% of all smartphone subscriptions. By 2028, this should account for 7.8 billion, roughly 84 percent of all mobile subscribers. APUs are leading the market in integrated processors, offering a unique combination of CPU and GPU functionalities in a single chip. This segment targets users looking for compact systems with adequate graphics performance, especially budget-friendly laptops and desktops used for everyday tasks, multimedia consumption, and light gaming. APUs provide a cost-effective solution compared to separate CPU and GPU configurations, making them popular among mainstream consumers and entry-level gamers. Their integration enhances power efficiency and thermal management in smaller systems, adding value to the entire computing value chain. In terms of power consumption, APUs are more efficient than CPUs. Since they combine both a CPU and a GPU onto a single chip, they require less power to run than a separate CPU and graphics card. This can be especially important in laptops and other portable devices where battery life is a concern.

Global PC Processor Market Regional Analysis:

North America is the top-selling PC processor in the market and it holds the largest share in 2024. North America is currently leading the global PC processor market, boasting a substantial sales volume that contributes significantly to its dominance in the industry. This leadership position is attributed to several key factors, including a strong consumer demand for computing devices, technological innovation, and the presence of major industry players. North America sets a high industry benchmark, with leading companies continuously pushing the boundaries of innovation and performance in the PC processor market. This commitment to excellence has solidified North America's position as a leader in the global PC processor market, with the region expected to continue driving growth and setting standards for the industry as a whole. After North America, Asia Pacific is leading the global PC processor market, showcasing a remarkable sales volume that underscores its strong position in the industry. The Asia Pacific region's leadership can be attributed to several factors, including the rapid growth of the IT industry, increasing demand for computing devices in emerging markets, and significant technological advancements. Moreover, key players in Asia Pacific, particularly in countries like Taiwan and China, are setting high industry benchmarks, driving innovation and performance in the PC processor market. With its robust market presence and a growing consumer base, Asia Pacific is poised to continue leading the global PC processor market, shaping its future trajectory. Competitive Landscape of the Global PC Processor Market: The market for PC processors is extremely competitive worldwide, and Intel Corporation is the industry leader thanks to its Central and Xeon CPU lines. With its Ryzen and Threadripper lines, AMD provides competitive options, especially in the gaming and high-performance computer domains. Apple, which creates its CPUs for Mac computers, and Qualcomm, which specializes in mobile processing units for laptops and 2-in-1 devices, are two other significant companies. As a crucial part of the global computer environment, the industry is dynamic, with competitors always developing to fulfill customer requirements. 1. In August 2021, AMD unveiled two of its new products- Ryzen 7 5700 G and Ryzen 5 5600G for the retail market. These integrated graphics processors were developed for system builders equipped with advanced features such as remote management and additional security functions. 2. In 2022, Intel acquired Mobileye, a company that designs chips for autonomous driving, for $15.3 billion.The objective of the report is to present a comprehensive analysis of the PC Processor to the stakeholders in the industry. The past and current status of the industry with the forecasted Market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include Market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the Market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the PC Processor dynamics, and structure by analyzing the Market segments and projecting the PC Processor size. Clear representation of competitive analysis of key players by Type, price, financial position, Type portfolio, growth strategies, and regional presence in the PC Processor make the report an investor’s guide.

PC Processor Market Scope: Inquire before buying

Global PC Processor Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 120.17 Bn. Forecast Period 2025 to 2032 CAGR: 4.5% Market Size in 2032: USD 170.90 Bn. Segments Covered: by Type of Product CPU Client (Desktop and Laptop) Server APU Smartphone Tablet Smart Television Smart Speakers Other End-Uses (Smartwatch, Notebook, AR/VR, Automotive, etc.) by Application Desktop Laptop Server Others by End Use Residential Commercial Industrial PC Processor Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Global PC Processor Market, Key Players

North America 1. Intel Corporation (United States) 2. Advanced Micro Devices, Inc. (AMD) (United States) 3. NVIDIA Corporation (United States) 4. Qualcomm Incorporated (United States) 5. IBM Corporation (United States) 6. Apple Inc. (United States) 7. VIA Technologies, Inc. (United States) 8. Transmeta Corporation (United States) 9. Silicon Integrated Systems Corp. (United States) 10. Microcontrollers (MCUs) & processors (Texas) Europe: 1. ARM Holdings (United Kingdom) 2. STMicroelectronics (Switzerland) 3. Infineon Technologies AG (Germany) Asia Pacific 1. Samsung Electronics Co., Ltd. (South Korea) 2. MediaTek Inc. (Taiwan) 3. TSMC (Taiwan) 4. Realtek Semiconductor Corp. (Taiwan) 5. Allwinner Technology (China) 6. Rockchip Electronics Co., Ltd. (China) 7. Zhaoxin (China) 8. Loongson (China) 9. Huawei Technologies Co., Ltd. (China) 10. Spreadtrum Communications (China) 11. Renesas Electronics Corporation. FAQs: 1. What are the growth drivers for the Global PC Processor Market? Ans. Increasing Demand for Multimedia and Gaming applications driving the Global PC Processor Market. 2. What are the major restraining factors for the Global PC Processor Market growth? Ans. The increase in Demand for Low Power Processor is a restraining factor in the Global PC Processor Market. 3. Which region is expected to lead the Global PC Processor Market during the forecast period? Ans. North America is expected to lead the Global PC Processor Market during the forecast period 4. What is the projected market size and growth rate of the Air Source Heat Pumps Market? Ans. The PC Processor Market size was valued at USD 120.17 Billion in 2024 and the total PC Processor revenue is expected to grow at a CAGR of 4.5% from 2025 to 2032, reaching nearly USD 170.90 Billion. 5. What segments are covered in the Global PC Processor Market report? Ans. The segments covered in the Global PC Processor Market report are Product Type, Application, End-Use and Region.

1. PC Processor Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. PC Processor Market: Dynamics 2.1. PC Processor Market Trends by Region 2.1.1. North America PC Processor Market Trends 2.1.2. Europe PC Processor Market Trends 2.1.3. Asia Pacific PC Processor Market Trends 2.1.4. Middle East and Africa PC Processor Market Trends 2.1.5. South America PC Processor Market Trends 2.2. PC Processor Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America PC Processor Market Drivers 2.2.1.2. North America PC Processor Market Restraints 2.2.1.3. North America PC Processor Market Opportunities 2.2.1.4. North America PC Processor Market Challenges 2.2.2. Europe 2.2.2.1. Europe PC Processor Market Drivers 2.2.2.2. Europe PC Processor Market Restraints 2.2.2.3. Europe PC Processor Market Opportunities 2.2.2.4. Europe PC Processor Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific PC Processor Market Drivers 2.2.3.2. Asia Pacific PC Processor Market Restraints 2.2.3.3. Asia Pacific PC Processor Market Opportunities 2.2.3.4. Asia Pacific PC Processor Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa PC Processor Market Drivers 2.2.4.2. Middle East and Africa PC Processor Market Restraints 2.2.4.3. Middle East and Africa PC Processor Market Opportunities 2.2.4.4. Middle East and Africa PC Processor Market Challenges 2.2.5. South America 2.2.5.1. South America PC Processor Market Drivers 2.2.5.2. South America PC Processor Market Restraints 2.2.5.3. South America PC Processor Market Opportunities 2.2.5.4. South America PC Processor Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For PC Processor Industry 2.8. Analysis of Government Schemes and Initiatives For PC Processor Industry 2.9. PC Processor Market Trade Analysis 2.10. The Global Pandemic Impact on PC Processor Market 3. PC Processor Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 3.1. PC Processor Market Size and Forecast, by Type of Product (2024-2032) 3.1.1. CPU 3.1.2. APU 3.2. PC Processor Market Size and Forecast, by Application (2024-2032) 3.2.1. Desktop 3.2.2. Laptop 3.2.3. Server 3.2.4. Others 3.3. PC Processor Market Size and Forecast, by End Use (2024-2032) 3.3.1. Residential 3.3.2. Commercial 3.3.3. Industrial 3.4. PC Processor Market Size and Forecast, by Region (2024-2032) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America PC Processor Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 4.1. North America PC Processor Market Size and Forecast, by Type of Product (2024-2032) 4.1.1. CPU 4.1.2. APU 4.2. North America PC Processor Market Size and Forecast, by Application (2024-2032) 4.2.1. Desktop 4.2.2. Laptop 4.2.3. Server 4.2.4. Others 4.3. North America PC Processor Market Size and Forecast, by End Use (2024-2032) 4.3.1. Residential 4.3.2. Commercial 4.3.3. Industrial 4.4. North America PC Processor Market Size and Forecast, by Country (2024-2032) 4.4.1. United States 4.4.1.1. United States PC Processor Market Size and Forecast, by Type of Product (2024-2032) 4.4.1.1.1. CPU 4.4.1.1.2. APU 4.4.1.2. United States PC Processor Market Size and Forecast, by Application (2024-2032) 4.4.1.2.1. Desktop 4.4.1.2.2. Laptop 4.4.1.2.3. Server 4.4.1.2.4. Others 4.4.1.3. United States PC Processor Market Size and Forecast, by End Use (2024-2032) 4.4.1.3.1. Residential 4.4.1.3.2. Commercial 4.4.1.3.3. Industrial 4.4.2. Canada 4.4.2.1. Canada PC Processor Market Size and Forecast, by Type of Product (2024-2032) 4.4.2.1.1. CPU 4.4.2.1.2. APU 4.4.2.2. Canada PC Processor Market Size and Forecast, by Application (2024-2032) 4.4.2.2.1. Desktop 4.4.2.2.2. Laptop 4.4.2.2.3. Server 4.4.2.2.4. Others 4.4.2.3. Canada PC Processor Market Size and Forecast, by End Use (2024-2032) 4.4.2.3.1. Residential 4.4.2.3.2. Commercial 4.4.2.3.3. Industrial 4.4.3. Mexico 4.4.3.1. Mexico PC Processor Market Size and Forecast, by Type of Product (2024-2032) 4.4.3.1.1. CPU 4.4.3.1.2. APU 4.4.3.2. Mexico PC Processor Market Size and Forecast, by Application (2024-2032) 4.4.3.2.1. Desktop 4.4.3.2.2. Laptop 4.4.3.2.3. Server 4.4.3.2.4. Others 4.4.3.3. Mexico PC Processor Market Size and Forecast, by End Use (2024-2032) 4.4.3.3.1. Residential 4.4.3.3.2. Commercial 4.4.3.3.3. Industrial 5. Europe PC Processor Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. Europe PC Processor Market Size and Forecast, by Type of Product (2024-2032) 5.2. Europe PC Processor Market Size and Forecast, by Application (2024-2032) 5.3. Europe PC Processor Market Size and Forecast, by End Use (2024-2032) 5.4. Europe PC Processor Market Size and Forecast, by Country (2024-2032) 5.4.1. United Kingdom 5.4.1.1. United Kingdom PC Processor Market Size and Forecast, by Type of Product (2024-2032) 5.4.1.2. United Kingdom PC Processor Market Size and Forecast, by Application (2024-2032) 5.4.1.3. United Kingdom PC Processor Market Size and Forecast, by End Use (2024-2032) 5.4.2. France 5.4.2.1. France PC Processor Market Size and Forecast, by Type of Product (2024-2032) 5.4.2.2. France PC Processor Market Size and Forecast, by Application (2024-2032) 5.4.2.3. France PC Processor Market Size and Forecast, by End Use (2024-2032) 5.4.3. Germany 5.4.3.1. Germany PC Processor Market Size and Forecast, by Type of Product (2024-2032) 5.4.3.2. Germany PC Processor Market Size and Forecast, by Application (2024-2032) 5.4.3.3. Germany PC Processor Market Size and Forecast, by End Use (2024-2032) 5.4.4. Italy 5.4.4.1. Italy PC Processor Market Size and Forecast, by Type of Product (2024-2032) 5.4.4.2. Italy PC Processor Market Size and Forecast, by Application (2024-2032) 5.4.4.3. Italy PC Processor Market Size and Forecast, by End Use (2024-2032) 5.4.5. Spain 5.4.5.1. Spain PC Processor Market Size and Forecast, by Type of Product (2024-2032) 5.4.5.2. Spain PC Processor Market Size and Forecast, by Application (2024-2032) 5.4.5.3. Spain PC Processor Market Size and Forecast, by End Use (2024-2032) 5.4.6. Sweden 5.4.6.1. Sweden PC Processor Market Size and Forecast, by Type of Product (2024-2032) 5.4.6.2. Sweden PC Processor Market Size and Forecast, by Application (2024-2032) 5.4.6.3. Sweden PC Processor Market Size and Forecast, by End Use (2024-2032) 5.4.7. Austria 5.4.7.1. Austria PC Processor Market Size and Forecast, by Type of Product (2024-2032) 5.4.7.2. Austria PC Processor Market Size and Forecast, by Application (2024-2032) 5.4.7.3. Austria PC Processor Market Size and Forecast, by End Use (2024-2032) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe PC Processor Market Size and Forecast, by Type of Product (2024-2032) 5.4.8.2. Rest of Europe PC Processor Market Size and Forecast, by Application (2024-2032) 5.4.8.3. Rest of Europe PC Processor Market Size and Forecast, by End Use (2024-2032) 6. Asia Pacific PC Processor Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Asia Pacific PC Processor Market Size and Forecast, by Type of Product (2024-2032) 6.2. Asia Pacific PC Processor Market Size and Forecast, by Application (2024-2032) 6.3. Asia Pacific PC Processor Market Size and Forecast, by End Use (2024-2032) 6.4. Asia Pacific PC Processor Market Size and Forecast, by Country (2024-2032) 6.4.1. China 6.4.1.1. China PC Processor Market Size and Forecast, by Type of Product (2024-2032) 6.4.1.2. China PC Processor Market Size and Forecast, by Application (2024-2032) 6.4.1.3. China PC Processor Market Size and Forecast, by End Use (2024-2032) 6.4.2. S Korea 6.4.2.1. S Korea PC Processor Market Size and Forecast, by Type of Product (2024-2032) 6.4.2.2. S Korea PC Processor Market Size and Forecast, by Application (2024-2032) 6.4.2.3. S Korea PC Processor Market Size and Forecast, by End Use (2024-2032) 6.4.3. Japan 6.4.3.1. Japan PC Processor Market Size and Forecast, by Type of Product (2024-2032) 6.4.3.2. Japan PC Processor Market Size and Forecast, by Application (2024-2032) 6.4.3.3. Japan PC Processor Market Size and Forecast, by End Use (2024-2032) 6.4.4. India 6.4.4.1. India PC Processor Market Size and Forecast, by Type of Product (2024-2032) 6.4.4.2. India PC Processor Market Size and Forecast, by Application (2024-2032) 6.4.4.3. India PC Processor Market Size and Forecast, by End Use (2024-2032) 6.4.5. Australia 6.4.5.1. Australia PC Processor Market Size and Forecast, by Type of Product (2024-2032) 6.4.5.2. Australia PC Processor Market Size and Forecast, by Application (2024-2032) 6.4.5.3. Australia PC Processor Market Size and Forecast, by End Use (2024-2032) 6.4.6. Indonesia 6.4.6.1. Indonesia PC Processor Market Size and Forecast, by Type of Product (2024-2032) 6.4.6.2. Indonesia PC Processor Market Size and Forecast, by Application (2024-2032) 6.4.6.3. Indonesia PC Processor Market Size and Forecast, by End Use (2024-2032) 6.4.7. Malaysia 6.4.7.1. Malaysia PC Processor Market Size and Forecast, by Type of Product (2024-2032) 6.4.7.2. Malaysia PC Processor Market Size and Forecast, by Application (2024-2032) 6.4.7.3. Malaysia PC Processor Market Size and Forecast, by End Use (2024-2032) 6.4.8. Vietnam 6.4.8.1. Vietnam PC Processor Market Size and Forecast, by Type of Product (2024-2032) 6.4.8.2. Vietnam PC Processor Market Size and Forecast, by Application (2024-2032) 6.4.8.3. Vietnam PC Processor Market Size and Forecast, by End Use (2024-2032) 6.4.9. Taiwan 6.4.9.1. Taiwan PC Processor Market Size and Forecast, by Type of Product (2024-2032) 6.4.9.2. Taiwan PC Processor Market Size and Forecast, by Application (2024-2032) 6.4.9.3. Taiwan PC Processor Market Size and Forecast, by End Use (2024-2032) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific PC Processor Market Size and Forecast, by Type of Product (2024-2032) 6.4.10.2. Rest of Asia Pacific PC Processor Market Size and Forecast, by Application (2024-2032) 6.4.10.3. Rest of Asia Pacific PC Processor Market Size and Forecast, by End Use (2024-2032) 7. Middle East and Africa PC Processor Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Middle East and Africa PC Processor Market Size and Forecast, by Type of Product (2024-2032) 7.2. Middle East and Africa PC Processor Market Size and Forecast, by Application (2024-2032) 7.3. Middle East and Africa PC Processor Market Size and Forecast, by End Use (2024-2032) 7.4. Middle East and Africa PC Processor Market Size and Forecast, by Country (2024-2032) 7.4.1. South Africa 7.4.1.1. South Africa PC Processor Market Size and Forecast, by Type of Product (2024-2032) 7.4.1.2. South Africa PC Processor Market Size and Forecast, by Application (2024-2032) 7.4.1.3. South Africa PC Processor Market Size and Forecast, by End Use (2024-2032) 7.4.2. GCC 7.4.2.1. GCC PC Processor Market Size and Forecast, by Type of Product (2024-2032) 7.4.2.2. GCC PC Processor Market Size and Forecast, by Application (2024-2032) 7.4.2.3. GCC PC Processor Market Size and Forecast, by End Use (2024-2032) 7.4.3. Nigeria 7.4.3.1. Nigeria PC Processor Market Size and Forecast, by Type of Product (2024-2032) 7.4.3.2. Nigeria PC Processor Market Size and Forecast, by Application (2024-2032) 7.4.3.3. Nigeria PC Processor Market Size and Forecast, by End Use (2024-2032) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A PC Processor Market Size and Forecast, by Type of Product (2024-2032) 7.4.4.2. Rest of ME&A PC Processor Market Size and Forecast, by Application (2024-2032) 7.4.4.3. Rest of ME&A PC Processor Market Size and Forecast, by End Use (2024-2032) 8. South America PC Processor Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. South America PC Processor Market Size and Forecast, by Type of Product (2024-2032) 8.2. South America PC Processor Market Size and Forecast, by Application (2024-2032) 8.3. South America PC Processor Market Size and Forecast, by End Use(2024-2032) 8.4. South America PC Processor Market Size and Forecast, by Country (2024-2032) 8.4.1. Brazil 8.4.1.1. Brazil PC Processor Market Size and Forecast, by Type of Product (2024-2032) 8.4.1.2. Brazil PC Processor Market Size and Forecast, by Application (2024-2032) 8.4.1.3. Brazil PC Processor Market Size and Forecast, by End Use (2024-2032) 8.4.2. Argentina 8.4.2.1. Argentina PC Processor Market Size and Forecast, by Type of Product (2024-2032) 8.4.2.2. Argentina PC Processor Market Size and Forecast, by Application (2024-2032) 8.4.2.3. Argentina PC Processor Market Size and Forecast, by End Use (2024-2032) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America PC Processor Market Size and Forecast, by Type of Product (2024-2032) 8.4.3.2. Rest Of South America PC Processor Market Size and Forecast, by Application (2024-2032) 8.4.3.3. Rest Of South America PC Processor Market Size and Forecast, by End Use (2024-2032) 9. Global PC Processor Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading PC Processor Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Intel Corporation (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Advanced Micro Devices, Inc. (AMD) (United States) 10.3. NVIDIA Corporation (United States) 10.4. Qualcomm Incorporated (United States) 10.5. IBM Corporation (United States) 10.6. Apple Inc. (United States) 10.7. VIA Technologies, Inc. (United States) 10.8. Transmeta Corporation (United States) 10.9. Silicon Integrated Systems Corp. (United States) 10.10. Microcontrollers (MCUs) & processors (Texas) 10.11. ARM Holdings (United Kingdom) 10.12. STMicroelectronics (Switzerland) 10.13. Infineon Technologies AG (Germany) 10.14. Samsung Electronics Co., Ltd. (South Korea) 10.15. MediaTek Inc. (Taiwan) 10.16. TSMC (Taiwan) 10.17. Realtek Semiconductor Corp. (Taiwan) 10.18. Allwinner Technology (China) 10.19. Rockchip Electronics Co., Ltd. (China) 10.20. Zhaoxin (China) 10.21. Loongson (China) 10.22. Huawei Technologies Co., Ltd. (China) 10.23. Spreadtrum Communications (China) 10.24. Renesas Electronics Corporation. 11. Key Findings 12. Industry Recommendations 13. PC Processor Market: Research Methodology 14. Terms and Glossary