Global Proximity Displacement Sensors Market size was valued at USD 5.46 Billion in 2024 and the total Proximity Displacement Sensors revenue is expected to grow at a CAGR of 7.5% from 2025 to 2032, reaching nearly USD 9.74 Billion.Proximity Displacement Sensors Market Overview

Proximity displacement sensors are non-contact electronic devices that detect the presence, position, or movement of objects and measure minute changes in distance with high precision. They utilize technologies like inductive, capacitive, ultrasonic, or optical sensing for applications in automation, quality control, and predictive maintenance across industries. These sensors enable real-time monitoring in harsh environments where physical contact is impractical or unsafe. Demand for proximity displacement sensors is surging due to industrial automation, electric vehicle production, and predictive maintenance needs, while supply is expanding with advancements in sensor technologies and increased manufacturing capacity from key players in Asia and Europe. Asia-Pacific dominates the proximity displacement sensor market, led by industrial automation in China, Japan, and South Korea. Key players include Omron (Japan), known for high-precision inductive sensors, and Keyence (Japan), a leader in optical and laser-based displacement sensors, driving innovation in smart manufacturing. The report explores the Proximity Displacement Sensors Market's segments (Type, Application, End-Use Industry, and Region). Data has been provided by market participants, and regions (North America, Asia Pacific, Europe, Middle East & Africa, and South America). It provides a thorough analysis of the rapid advances that are currently taking place across all industry sectors. Facts and figures, illustrations, and presentations are used to provide key data analysis for the historical period from 2019 to 2024. The report investigates the Proximity Displacement Sensors Market's drivers, limitations, prospects, and barriers. This MMR report includes investor recommendations based on a thorough examination of the Methacrylate Monomers market's contemporary competitive scenario.To know about the Research Methodology :- Request Free Sample Report

Proximity and Displacement Sensors Market Dynamics

Growing Demand for Industrial Automation to Drive the Proximity Displacement Sensors Market The rapid adoption of smart factories and robotics is fueling demand for proximity and displacement sensors. These sensors enhance precision in assembly lines, quality control, and predictive maintenance, particularly in automotive and electronics manufacturing. With industries increasingly investing in automation to improve efficiency, sensor manufacturers are experiencing steady growth. Emerging economies in Asia-Pacific are leading this trend, driven by government initiatives promoting advanced manufacturing technologies.High Initial Costs and Technical Complexity to Create Restrain in the Proximity Displacement Sensors Market

Despite their benefits, advanced proximity sensors—such as laser and eddy-current variants—remain expensive to develop and deploy. Small and mid-sized manufacturers often hesitate to adopt these technologies due to budget constraints and the need for specialized expertise, slowing market penetration in cost-sensitive sectors.Expansion in Electric Vehicles and Renewable Energy to Create Opportunity in the Proximity Displacement Sensors Market

The market are poised for significant growth, driven by transformative trends across multiple industries. In the electric vehicle (EV) sector, these sensors play a critical role in battery assembly, motor positioning, and charging systems, with global EV sales expected to triple over the next five years. The renewable energy sector equally presents substantial opportunities, particularly in wind turbine condition monitoring and solar panel alignment systems, where precise displacement measurement is essential for maximizing energy output. Additionally, emerging applications in medical robotics, collaborative automation (cobots), and smart infrastructure are creating new demand vectors. The integration of AI and IoT with sensor technologies further enhances predictive maintenance capabilities, opening doors for premium, high-value solutions. As industries continue prioritizing efficiency and automation, sensor manufacturers have a vast opportunity to innovate and capture market share in these high-growth verticals.Proximity Displacement Sensors Market Segment Analysis

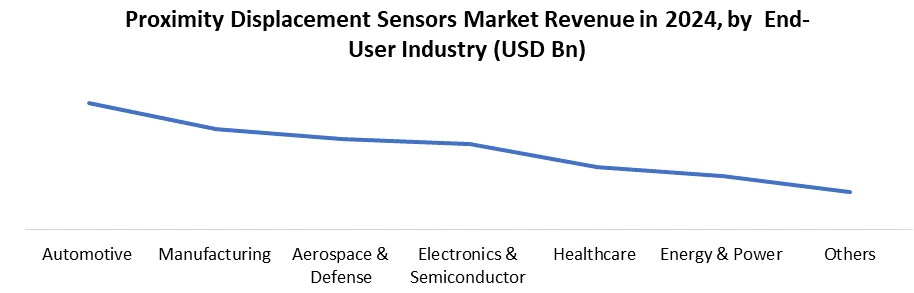

Based on Application, Proximity Displacement Sensors Market is segmented into Vibration monitoring and measurement, Anti-aircraft warfare, Parking sensor systems, Conveyor systems and Others. Vibration monitoring and measurement segment dominated the Proximity Displacement Sensors Market in 2024 and is expected to hold the largest market share over the forecast period. Dominance due to its critical role in predictive maintenance across industries like manufacturing, energy, and aerospace. These sensors prevent equipment failures by detecting minute vibrations in turbines, motors, and heavy machinery, saving billions in downtime costs. While anti-aircraft warfare uses high-precision sensors for defense systems, it remains a niche segment. Parking sensors see mass adoption in automotive but lack industrial scale, and conveyor systems rely heavily on sensors but are limited to specific sectors. The growing focus on Industry 4.0 and smart infrastructure further solidifies vibration monitoring's market leadership. Based on End-Use Industry, Proximity Displacement Sensors Market is segmented into Automotive, Manufacturing, Aerospace & Defense, Electronics & Semiconductor, Healthcare, Energy & Power, and Others. The automotive segment dominated the Proximity Displacement Sensors Market in 2024 and is expected to hold the largest market share over the forecast period. Dominance due to the leadership stems from high-volume production lines, stringent quality control demands, and the rise of electric vehicles (EVs), where these sensors ensure precision in battery assembly, robotic welding, and autonomous driving systems. The manufacturing sector follows closely, leveraging sensors for CNC machinery and automation, while electronics & semiconductor growth is fueled by miniaturization trends. Though aerospace & defense and healthcare use high-end sensors, their niche applications limit market share. Emerging sectors like energy (wind/solar monitoring) show rapid growth but remain smaller in comparison.

Proximity and Displacement Sensors Market Regional Analysis

The Asia-Pacific (APAC) region dominates the global market This leadership stems from rapid industrialization, government-led Industry 4.0 initiatives (e.g., China’s "Made in China 2025"), and booming automotive/electronics manufacturing in Japan, South Korea, and China. APAC’s cost-competitive sensor production, coupled with high demand for factory automation and electric vehicle components, fuels its dominance. North America and Europe follow, driven by advanced aerospace and smart manufacturing sectors, but their slower industrial growth and higher costs limit market expansion compared to APAC’s aggressive adoption of automation technologies.Proximity and Displacement Sensors Market Competitive Landscape

Omron Corporation and Keyence Corporation dominate the market, collectively holding 25-30% global share. Omron (2023 revenue: $7.5B) leads in industrial automation with its E2E inductive sensors and MEMS-based solutions, particularly for automotive robotics, supplying major manufacturers like Toyota. The company recently invested $200M in Vietnam to expand EV-related production. Keyence ($6.1B revenue) excels in high-precision applications with its LK laser sensors and optical inspection systems, boasting industry-leading 80% gross margins through its direct sales model. The 2024 launch of its AI-powered IV3 series further strengthened its position in semiconductor metrology. Both Japanese firms benefit from Asia-Pacific's manufacturing boom, with Omron focusing on rugged industrial applications while Keyence dominates precision measurement niches, maintaining technological leadership through significant R&D investments that keep them ahead of competitors like Sick AG and Panasonic.Proximity and Displacement Sensors Market Recent Development

15 March 2024 – Omron Corporation (Japan) launched the E2EW Series of ultra-thin inductive proximity sensors for compact robotic arms in EV manufacturing. 22 April 2024 – Keyence Corporation (Japan) introduced the LK-HD50 laser displacement sensor with 0.1µm resolution, targeting semiconductor wafer inspection. 18 June 2024 – Honeywell International (USA) released IP69K-rated proximity sensors for harsh environments in the oil & gas and renewable energy sectors.Proximity and Displacement Sensors Market Recent Trend

• AI & Smart Sensor Integration – Growing adoption of AI-powered sensors for real-time predictive maintenance and defect detection, reducing downtime in manufacturing. • Miniaturization & Higher Precision – Demand for compact, sub-micron accuracy sensors in semiconductor and medical device production. • Wireless & IIoT-Enabled Sensors – Expansion of battery-free/wireless sensors for smart factories, enabled by 5G and Industry 4.0 adoption. • Rise in EV & Battery Manufacturing – Increased use of high-speed displacement sensors for battery electrode alignment and motor assembly.Proximity and Displacement Sensors Market Scope: Inquiry Before Buying

Global Proximity and Displacement Sensors Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 5.46 Bn. Forecast Period 2025 to 2032 CAGR: 7.5 % Market Size in 2032: USD 9.74 Bn. Segments Covered: by Type Capacitive sensors Photoelectric sensors Magnetic sensors Ultrasonic sensors LVDT sensors Others by Application Type Anti-aircraft warfare Parking sensor systems Vibration monitoring and measurement Conveyor systems Others by End User Industry Automotive Manufacturing Aerospace & Defense Electronics & Semiconductor Healthcare Energy & Power Others Proximity and Displacement Sensors Key Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Philippines, Thailand, and the Rest of Asia Pacific) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Proximity and Displacement Sensors Key Players

North America 1. Honeywell International Inc. (USA) 2. Rockwell Automation (USA) 3. TE Connectivity (USA) 4. Kaman Corporation (USA) 5. Micron Optics, Inc. (USA) 6. Lion Precision (USA) 7. Balluff Inc. (USA) 8. Banner Engineering Corp. (USA) 9. IFM Efector, Inc. (USA) 10. SICK, Inc. (USA) 11. Pepperl+Fuchs (USA) Europe 1. SICK AG (Germany) 2. Balluff GmbH (Germany) 3. IFM Electronic GmbH (Germany) 4. Baumer Group (Switzerland) 5. Turck Holding GmbH (Germany) 6. Hans Turck GmbH & Co. KG (Germany) 7. Leuze electronic GmbH + Co. KG (Germany) Asia Pacific 1. Omron Corporation (Japan) 2. Keyence Corporation (Japan) 3. Panasonic Corporation (Japan) 4. SICK AG (Japan) 5. IFM Electronic Pvt. Ltd. (India) 6. Baumer India Pvt. Ltd. (India) 7. Turck India Pvt. Ltd. (India) 8. Hans Turck India Pvt. Ltd. (India) Middle East and Africa 1. Siemens Middle East (UAE) 2. ABB Middle East & Africa (UAE) 3. Emerson Automation Solutions MEA (UAE) 4. Honeywell Middle East (UAE) South America 1. Schneider Electric South America (Brazil) 2. IFM Electronic South America (Brazil)Frequently Asked Questions:

1] What is the growth rate of the Global Proximity and Displacement Sensors Market? Ans. The Global Proximity and Displacement Sensors Market is growing at a significant rate of 7.5 % during the forecast period. 2] Which region is expected to dominate the Global Proximity and Displacement Sensors Market? Ans. Asia Pacific is expected to dominate the Proximity and Displacement Sensors Market during the forecast period. 3] What is the expected Global Proximity and Displacement Sensors Market size by 2032? Ans. The Proximity and Displacement Sensors Market size is expected to reach USD 9.74 Bn by 2032. 4] Which are the top players in the Global Proximity and Displacement Sensors Market? Ans. The major top players in the Global Proximity and Displacement Sensors Market are Kaman Corporation (USA), Micron Optics, Inc. (USA), Lion Precision (USA), and others. 5] What are the factors driving the Global Proximity and Displacement Sensors Market growth? Ans. The rising trend of process automation in factories and the increasing popularity of contactless sensing applications are expected to drive the Proximity and Displacement Sensors Market growth.

1. Proximity and Displacement Sensors Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Proximity and Displacement Sensors Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Headquarter 2.4.3. Business Segment 2.4.4. End-user Segment 2.4.5. Revenue (2024) 2.4.6. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Global Proximity and Displacement Sensors Market: Dynamics 3.1. Proximity and Displacement Sensors Market Trends by Region 3.1.1. North America Proximity and Displacement Sensors Market Trends 3.1.2. Europe Proximity and Displacement Sensors Market Trends 3.1.3. Asia Pacific Proximity and Displacement Sensors Market Trends 3.1.4. Middle East and Africa Proximity and Displacement Sensors Market Trends 3.1.5. South America Proximity and Displacement Sensors Market Trends 3.2. Proximity and Displacement Sensors Market Dynamics 3.2.1. Proximity and Displacement Sensors Market Drivers 3.2.1.1.1. Industry 4.0 and Smart Manufacturing Adoption 3.2.1.1.2. Rising Demand for Industrial Automation 3.2.1.1.3. Growth in Electric Vehicle (EV) Production 3.2.2. Proximity and Displacement Sensors Market Restraints 3.2.3. Proximity and Displacement Sensors Market Opportunities 3.2.3.1.1. Expansion in Electric Vehicle (EV) Battery Manufacturing 3.2.3.1.2. Emerging Applications in Medical Robotics 3.2.4. Proximity and Displacement Sensors Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.4.1.1. Government policies on Industry 4.0 (e.g., "Made in China 2025," U.S. CHIPS Act) 3.4.1.2. Cost sensitivity in emerging markets vs. premium sensor adoption in developed economies 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Key Opinion Leader Analysis for Proximity and Displacement Sensors Industry 4. Global Proximity and Displacement Sensors Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 4.1. Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 4.1.1. Capacitive sensors 4.1.2. Photoelectric sensors 4.1.3. Magnetic sensors 4.1.4. Ultrasonic sensors 4.1.5. LVDT sensors 4.1.6. Others 4.2. Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 4.2.1. Anti-aircraft warfare 4.2.2. Parking sensor systems 4.2.3. Vibration monitoring and measurement 4.2.4. Conveyor systems 4.2.5. Others 4.3. Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 4.3.1. Automotive 4.3.2. Manufacturing 4.3.3. Aerospace & Defense 4.3.4. Electronics & Semiconductor 4.3.5. Healthcare 4.3.6. Energy & Power 4.3.7. Others 4.4. Proximity and Displacement Sensors Market Size and Forecast, By Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Proximity and Displacement Sensors Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 5.1. North America Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 5.1.1. Capacitive sensors 5.1.2. Photoelectric sensors 5.1.3. Magnetic sensors 5.1.4. Ultrasonic sensors 5.1.5. LVDT sensors 5.1.6. Others 5.2. North America Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 5.2.1. Anti-aircraft warfare 5.2.2. Parking sensor systems 5.2.3. Vibration monitoring and measurement 5.2.4. Conveyor systems 5.2.5. Other 5.3. North America Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 5.3.1. Automotive 5.3.2. Manufacturing 5.3.3. Aerospace & Defense 5.3.4. Electronics & Semiconductor 5.3.5. Healthcare 5.3.6. Energy & Power 5.3.7. Others 5.4. North America Proximity and Displacement Sensors Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 5.4.1.1.1. Capacitive sensors 5.4.1.1.2. Photoelectric sensors 5.4.1.1.3. Magnetic sensors 5.4.1.1.4. Ultrasonic sensors 5.4.1.1.5. LVDT sensors 5.4.1.1.6. Others 5.4.1.2. United States Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 5.4.1.2.1. Anti-aircraft warfare 5.4.1.2.2. Parking sensor systems 5.4.1.2.3. Vibration monitoring and measurement 5.4.1.2.4. Conveyor systems 5.4.1.2.5. Other 5.4.1.3. United States Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 5.4.1.3.1. Automotive 5.4.1.3.2. Manufacturing 5.4.1.3.3. Aerospace & Defense 5.4.1.3.4. Electronics & Semiconductor 5.4.1.3.5. Healthcare 5.4.1.3.6. Energy & Power 5.4.1.3.7. Others 5.4.2. Canada 5.4.2.1. Canada Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 5.4.2.1.1. Capacitive sensors 5.4.2.1.2. Photoelectric sensors 5.4.2.1.3. Magnetic sensors 5.4.2.1.4. Ultrasonic sensors 5.4.2.1.5. LVDT sensors 5.4.2.1.6. Others 5.4.2.2. Canada Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 5.4.2.2.1. Anti-aircraft warfare 5.4.2.2.2. Parking sensor systems 5.4.2.2.3. Vibration monitoring and measurement 5.4.2.2.4. Conveyor systems 5.4.2.2.5. Other 5.4.3. Canada Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 5.4.3.1.1. Automotive 5.4.3.1.2. Manufacturing 5.4.3.1.3. Aerospace & Defense 5.4.3.1.4. Electronics & Semiconductor 5.4.3.1.5. Healthcare 5.4.3.1.6. Energy & Power 5.4.3.1.7. Others 5.4.4. Mexico 5.4.4.1. Mexico Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 5.4.4.1.1. Capacitive sensors 5.4.4.1.2. Photoelectric sensors 5.4.4.1.3. Magnetic sensors 5.4.4.1.4. Ultrasonic sensors 5.4.4.1.5. LVDT sensors 5.4.4.1.6. Others 5.4.4.2. Mexico Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 5.4.4.2.1. Anti-aircraft warfare 5.4.4.2.2. Parking sensor systems 5.4.4.2.3. Vibration monitoring and measurement 5.4.4.2.4. Conveyor systems 5.4.4.2.5. Other 5.4.4.3. Mexico Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 5.4.4.3.1. Automotive 5.4.4.3.2. Manufacturing 5.4.4.3.3. Aerospace & Defense 5.4.4.3.4. Electronics & Semiconductor 5.4.4.3.5. Healthcare 5.4.4.3.6. Energy & Power 5.4.4.3.7. Others 6. Europe Proximity and Displacement Sensors Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 6.1. Europe Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 6.2. Europe Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 6.3. Europe Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 6.4. Europe Proximity and Displacement Sensors Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 6.4.1.2. United Kingdom Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 6.4.1.3. United Kingdom Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 6.4.2. France 6.4.2.1. France Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 6.4.2.2. France Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 6.4.2.3. France Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 6.4.3.2. Germany Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 6.4.3.3. Germany Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 6.4.4.2. Italy Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 6.4.4.3. Italy Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 6.4.5.2. Spain Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 6.4.5.3. Spain Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 6.4.6.2. Sweden Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 6.4.6.3. Sweden Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 6.4.7.2. Austria Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 6.4.7.3. Austria Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 6.4.8.2. Rest of Europe Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 6.4.8.3. Rest of Europe Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 7. Asia Pacific Proximity and Displacement Sensors Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 7.1. Asia Pacific Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 7.2. Asia Pacific Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 7.3. Asia Pacific Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 7.4. Asia Pacific Proximity and Displacement Sensors Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 7.4.1.2. China Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 7.4.1.3. China Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 7.4.2. S Korea 7.4.2.1. South Korea Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 7.4.2.2. S Korea Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 7.4.2.3. S Korea Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 7.4.3.2. Japan Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 7.4.3.3. Japan Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 7.4.4. India 7.4.4.1. India Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 7.4.4.2. India Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 7.4.4.3. India Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 7.4.5.2. Australia Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 7.4.5.3. Australia Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 7.4.6.2. Indonesia Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 7.4.6.3. Indonesia Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 7.4.7.2. Philippines Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 7.4.7.3. Philippines Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 7.4.8.2. Malaysia Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 7.4.8.3. Malaysia Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 7.4.9.2. Vietnam Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 7.4.9.3. Vietnam Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 7.4.10.2. Thailand Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 7.4.10.3. Thailand Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 7.4.11.2. Rest of Asia Pacific Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 7.4.11.3. Rest of Asia Pacific Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 8. Middle East and Africa Proximity and Displacement Sensors Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 8.1. Middle East and Africa Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 8.2. Middle East and Africa Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 8.3. Middle East and Africa Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 8.4. Middle East and Africa Proximity and Displacement Sensors Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 8.4.1.2. South Africa Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 8.4.1.3. South Africa Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 8.4.2.2. GCC Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 8.4.2.3. GCC Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 8.4.3.2. Nigeria Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 8.4.3.3. Nigeria Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 8.4.4.2. Rest of ME&A Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 8.4.4.3. Rest of ME&A Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 9. South America Proximity and Displacement Sensors Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 9.1. South America Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 9.2. South America Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 9.3. South America Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 9.4. South America Proximity and Displacement Sensors Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 9.4.1.2. Brazil Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 9.4.1.3. Brazil Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 9.4.2.2. Argentina Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 9.4.2.3. Argentina Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Proximity and Displacement Sensors Market Size and Forecast, By Type (2024-2032) 9.4.3.2. Rest of South America Proximity and Displacement Sensors Market Size and Forecast, By Application (2024-2032) 9.4.3.3. Rest of South America Proximity and Displacement Sensors Market Size and Forecast, By End-Users Industry (2024-2032) 10. Company Profile: Key Players 10.1. Siemens 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Honeywell International Inc. 10.3. ABB 10.4. Kaman Corporation 10.5. Micron Optics, Inc. 10.6. Lion Precision 10.7. Rockwell Automation 10.8. Emerson Automation Solutions 10.9. Schneider Electric 10.10. Omron Corporation 10.11. Keyence Corporation 10.12. SICK AG 10.13. Pepperl+Fuchs 10.14. Panasonic Corporation 10.15. TE Connectivity 10.16. Balluff 10.17. IFM Electronic 10.18. Baumer Group 10.19. Turck Holding 10.20. Hans Turck 10.21. Leuze electronic 10.22. Banner Engineering Corp. 11. Key Findings 12. Analyst Recommendations 13. Global Proximity and Displacement Sensors Market: Research Methodology