In 2022, the Organic Almond Market was valued at US$ 110.4 Million. During the forecast period, the market is expected to increase at a CAGR of 9.54% by 2029, the market is anticipated to be worth US$ 208.9 Million.Organic Almond Market Overview:

Almonds are high in vitamins, minerals, protein, and fibre, and have been linked to a variety of health compensation. A handful of almonds, weighing around 1 ounce, provide one-eighth of daily protein necessities. Organic Almonds are sourced from certified natural farms and are of Indian origin. Almonds are a great resource of Omega-3, antioxidants, vitamins, calcium, iron, and magnesium, and they come immediately from farmer's fields to cupboard. Almond expenditure daily is necessary for a healthy and long life. Organic almonds include a variety of minerals, including magnesium, protein, calcium, iron, vitamin E, vitamin B6, vitamin B2, unsaturated fats, potassium, fibre, biotin, phosphorus, copper, and antioxidants, all of which donate to their therapeutic properties. However, because almonds are sprayed with a variety of insecticides and medicines to keep them vigorous, eating them regularly can be hazardous.To know about the Research Methodology:-Request Free Sample Report 2022 is considered as a base year to forecast the market from 2023 to 2029. 2022’s market size is estimated on real numbers and outputs of the key players and major players across the globe. Past five years' trends are considered while forecasting the market through 2029. 2022 is a year of exception and analysis, especially with the impact of lockdown by region.

Organic Almond Market Dynamics:

Consumer desire for organically farmed products continues to rise, which is one of the primary driving factors in the Organic Almond market. Organic products are the fastest-growing purchaser trend in the market, as new goods are urbanized and merchants which can make available organic products for their labels. Almonds are devoted in almost every country on the planet and have economic, medical, and dietary compensation. The population's growing health doubts have encouraged them to adopt a healthy lifestyle and diet. As a result, a huge section of the populace now consumes organic almonds daily. Organic almonds are gratifying more widely available, and industry companies are ongoing to engage in R&D to bring natural almonds to market. Its markets have grown fast in the forecast periods, in line with the constant rise in the organic food retail sector which is a major reason for driving the growth of the market. However, Market restrictions will come from food safety and shifting consumer preferences. Bitter almonds and sweet almonds are two major types of almonds that are genetically tremendously similar. Sweet almonds have a somewhat nutty flavour and are commonly seen on the grocery shelf or in almond-based items like nougat and marzipan. Until a genetic mutation caught up the almond tree's ability to produce amygdaline the substance that gives bitter almonds their bitter flavour bitter almonds were the most common variety grown in which these substances are not considered for human health which is the major reason for hampering the growth of the market. To lower pest plague rates, organic almond cultivation relies on a variety of selection or cultural behaviour. Organic almond markets have been quickly increasing in the anticipated periods, in line with the constant rise in the retail organic food sector. Disease concerns will impact organic almond yields more severely than conventional yields and growth factors for the organic almond market in bad weather circumstances, such as an abnormally wet or protracted rainy season which is giving a huge opportunity to the market.Recent Trends in Organic Almond Market:

• Almonds are normally used in confectionery baking and come in a variety of forms, including raw, faded, and roasted. Almonds are widely used in Europe to make marzipan, a sweet paste used in pastries and candies, and they are repeatedly used in Asian beef, chicken, fish, and vegetarian cuisines. • Almonds are obsessive in practically every country on the planet and have economic, medical, and nutritional profits. Even though the almond tree is native to western Asia, the United States produces the most almonds in the world, accounting for about 80% of global manufacture. • Malk Organics introduced Organic Plant-Based Creamers, a plant-based beverage substitute, in September 2022. Unsweetened Oat and Vanilla Almond are two flavours obtainable on the market which is in high demand among consumers in various countries like U.S and Canada..Organic Almond Market Segment Analysis:

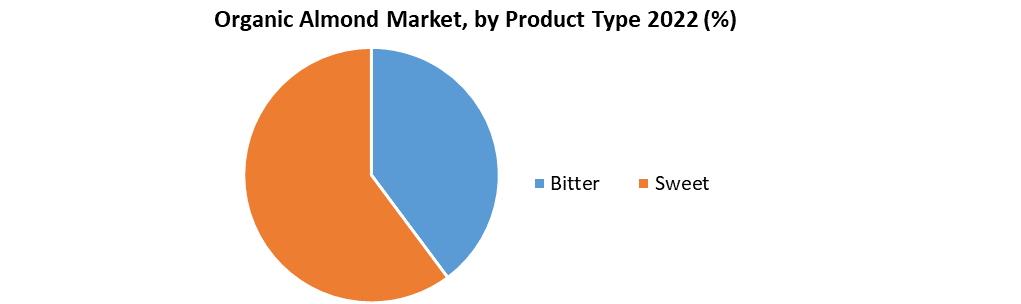

By Product Type, the market is segmented into Bitter and Sweet. The Sweet type segment is expected to hold the highest market share in terms of revenue by 2029. The most popular healthy food is sweet almonds. Many scientists are particularly fascinated by their levels of monounsaturated fats, which app is ear to get better blood lipids. Almonds appear to be safe for most non-allergic people when obsessive regularly in their diet. Sweet almonds may interrelate with medication used to treat cardiovascular disease, infertility, or oestrogen movement, opening up new markets for organic almonds. Sweet Almonds are being pressed in new instructions by the plant-based movement. However, the Bitter segment is expected to grow at a CAGR of 5.6% during the forecast period. Bitter almonds are ones that logically contain a toxin that your body converts to cyanide, a poisonous substance that can kill the human body. As a result, raw bitter almonds should be avoided. Bitter almonds can be cooked, roasted, or microwaved to lower their toxin content and make them safer to eat. By Application, the market is segmented into Edible, Medicinal, and Personal Care Products. The Edible segment is expected to hold 38.5% of the overall market share in terms of revenue by 2029. The majority of almonds formed now are naturally delicious and healthy to guzzle. However, many of them were bitter and lethal back then. Even these days, eating 50 wild, bitter almonds or fewer might kill an adult, and only a handful contains enough cyanide to kill a youngster in which edible almond products are used to make this safe into the human body, which is the major reason for driving the growth of this segment. However, the Personal Care Products segment is expected to grow at a CAGR of 6.6% through the forecast period. Two B vitamins play a role in maintaining healthy skin. Riboflavin is 25% of the Daily Value in almonds, and niacin is 6% of the Daily Value in almonds. Copper, which plays a function in skin and hair pigmentation, is abundant in almonds. Linoleic acid, an important fatty acid, aids in the prevention of dry skin.

Organic Almond Market Regional Insights:

The North American region accounted for the largest market share in 2022 for the market. Almonds are grown in greater quantities in the United States than anywhere else on the planet. Almonds are grown commercially in North America. The harvest is usually sufficient to feed the country as well as to export in large quantities to other countries. North American countries such as the U.S and Canada delivered the most almonds, both shelled and in-shell, during the forecast period, more than two-thirds (69.6%) of the worldwide total. The objective of the report is to present a comprehensive analysis of the market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the market dynamics, structure by analyzing the market segments and projecting the market size. Clear representation of competitive analysis of key players by Technology, price, financial position, product portfolio, growth strategies, and regional presence in the market makes the report investor's guide.Organic Almond Market Scope: Inquire before buying

Organic Almond Market Base Year 2022 Forecast Period 2023-2029 Historical Data CAGR Market Size in 2022 Market Size in 2029 2018 to 2022 9.54% US$ 110.4 Mn US$ 208.9 Mn Segments Covered by Product Type Bitter Sweet by Application Edible Medicinal Personal Care Products by Form Butter Milk Oil Powder Roasted & Fried by Distribution Channel Online Offline Regions Covered North America United States Canada Mexico Europe UK France Germany Italy Spain Sweden Austria Rest of Europe Asia Pacific China S Korea Japan India Australia Indonesia Malaysia Vietnam Taiwan Bangladesh Pakistan Rest of APAC Middle East and Africa South Africa GCC Egypt Nigeria Rest of ME&A South America Brazil Argentina Rest of South America Organic Almond Market Key Players

1. Wonderful Pistachios Almonds 2. Aryan International 3. Big Tree Organic Farms 4. Hilltop Ranch 5. Harris Woolf California Almonds 6. Billings Marketing 7. Royal Rifco Company 8. Sran Family Orchards 9. OHM SAI AGRO PRODUCTS 10. Royal Nut Company 11. MOLDOVAN ORGANIC ALMONDS 12. Organic Products 13. Yeshraj Agro Expert Private Limited 14. Sri Saraswati Organics Frequently Asked Questions: 1. Which region has the largest share in Global Market? Ans: North America region held the highest share in 2022. 2. What is the growth rate of Global Market? Ans: The Global Market is growing at a CAGR of 9.54% during forecasting period 2023-2029. 3. What is scope of the Global Market report? Ans: Global Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Market? Ans: The important key players in the Global Market are – Wonderful Pistachios Almonds, Aryan International, Big Tree Organic Farms, Hilltop Ranch, Harris Woolf California Almonds, Billings Marketing, Royal Rifco Company, Sran Family Orchards, OHM SAI AGRO PRODUCTS, Royal Nut Company, MOLDOVAN ORGANIC ALMONDS, Organic Products, Yeshraj Agro Expert Private Limited, and Sri Saraswati Organics 5. What is the study period of this Market? Ans: The Global Market is studied from 2022 to 2029.

1. Organic Almond Market Size: Research Methodology 2. Organic Almond Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Organic Almond Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Organic Almond Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Organic Almond Market Size Segmentation 4.1. Organic Almond Market Size, by Product Type (2022-2029) • Bitter • Sweet 4.2. Organic Almond Market Size, by Application (2022-2029) • Edible • Medicinal • Personal Care Products 4.3. Organic Almond Market Size, by Form (2022-2029) • Butter • Milk • Oil • Powder • Roasted & Fried 4.4. Organic Almond Market Size, by Distribution Channel (2022-2029) • Online • Offline 5. North America Organic Almond Market (2022-2029) 5.1. Organic Almond Market Size, by Product Type (2022-2029) • Bitter • Sweet 5.2. Organic Almond Market Size, by Application (2022-2029) • Edible • Medicinal • Personal Care Products 5.3. Organic Almond Market Size, by Form (2022-2029) • Butter • Milk • Oil • Powder • Roasted & Fried 5.4. Organic Almond Market Size, by Distribution Channel (2022-2029) • Online • Offline 5.5. North America Organic Almond Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Organic Almond Market (2022-2029) 6.1. European Organic Almond Market, by Product Type (2022-2029) 6.2. European Organic Almond Market, by Application (2022-2029) 6.3. European Organic Almond Market, by Form (2022-2029) 6.4. European Organic Almond Market, by Distribution Channel (2022-2029) 6.5. European Organic Almond Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Organic Almond Market (2022-2029) 7.1. Asia Pacific Organic Almond Market, by Product Type (2022-2029) 7.2. Asia Pacific Organic Almond Market, by Application (2022-2029) 7.3. Asia Pacific Organic Almond Market, by Form (2022-2029) 7.4. Asia Pacific Organic Almond Market, by Distribution Channel (2022-2029) 7.5. Asia Pacific Organic Almond Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. The Middle East and Africa Organic Almond Market (2022-2029) 8.1. The Middle East and Africa Organic Almond Market, by Product Type (2022-2029) 8.2. The Middle East and Africa Organic Almond Market, by Application (2022-2029) 8.3. The Middle East and Africa Organic Almond Market, by Form (2022-2029) 8.4. The Middle East and Africa Organic Almond Market, by Distribution Channel (2022-2029) 8.5. The Middle East and Africa Organic Almond Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Organic Almond Market (2022-2029) 9.1. South America Organic Almond Market, by Product Type (2022-2029) 9.2. South America Organic Almond Market, by Application (2022-2029) 9.3. South America Organic Almond Market, by Form (2022-2029) 9.4. South America Organic Almond Market, by Distribution Channel (2022-2029) 9.5. South America Organic Almond Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Wonderful Pistachios Almonds 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Aryan International 10.3. Big Tree Organic Farms 10.4. Hilltop Ranch 10.5. Harris Woolf California Almonds 10.6. Billings Marketing 10.7. Royal Rifco Company 10.8. Sran Family Orchards 10.9. OHM SAI AGRO PRODUCTS 10.10. Royal Nut Company 10.11. MOLDOVAN ORGANIC ALMONDS 10.12. Organic Products 10.13. Yeshraj Agro Expert Private Limited 10.14. Sri Saraswati Organics