Olive Oil Market size was valued at US$ 10.03 Bn. in 2022 and the total revenue is expected to grow at 6.13 % through 2023 to 2029, reaching nearly US$ 15.22 Bn.Olive Oil Market Overview:

The Olive oil is natural oil that is obtained by pressing olives. Olive oil is said to have a slew of health advantages. Olive oil is a form of lipid that comes from the fruit of the olive tree and contains healthy fatty acids such as monounsaturated fatty acids, hexadecanoic acid, and linolic acid. Vegetable oil is widely utilised and readily available all around the world. It's well-known for its ability to lower cholesterol levels in the body, which helps to avoid heart disease. It's utilised in a number of skincare and personal care products because of its moisturising and exfoliating properties. Vegetable oil can be used in a variety of ways, such as a spray for dressing, cosmetics, and personal care, as well as in foods and pharmaceuticals. As a result of these circumstances, there is a huge demand for vegetable oil on the market.To know about the Research Methodology :- Request Free Sample Report

Olive Oil Market Dynamics:

During the forecast period, the global market is expected to be driven by steady demand for vegetable oil from end-user industries. Vegetable oil is used in the food and beverage industry, as well as in the sweetness care and cosmetics sector and, as a result, in the pharmaceutical sector. The need for vegetable oil will most likely increase as those industries continue to grow. Due to increased consumer knowledge of the multiple benefits of ingesting vegetable oil and a robust economic process, the global market for vegetable oil is seeing substantial growth. The population of wealthy countries is progressively adopting Western lifestyles. One of the most important factors propelling the global vegetable oil industry is generally linked to this Olive oil is gluten-free, making it a healthier and more delicious alternative to other edible oils. It's high in oleic acid and antioxidants, which aid to reduce inflammation and reduce the incidence of chronic and cardiac illnesses. Olive oil also aids in the treatment of rheumatoid arthritis and osteoporosis, as well as the prevention of type 2 diabetes, stomach cancer, and stomach ulcers. The demand for olive oil is expected to rise as a result of all of the above reasons for the health benefits linked with its intake. Due to the onset of the COVID-19 pandemic, the demand for and supply of olive organic product oil has dropped dramatically. The suspension of commercial activity caused by cross-country shutdown in different countries has hampered the development of this industry. According to the US Census Bureau, the United States' imports of olive organic product oil decreased by 13% in 2022 compared to 2022. The COVID-19 pandemic has had a significant impact on olive oil production and distribution; firms have suffered losses, sales have slowed, and profits have decreased. Olive Oil Market Growth is fueled by the growing adoption of a Healthy Lifestyle: The global Olive Oil market is expected to grow due to rising health awareness and adoption of healthier lifestyles as a result of an increase in heart disease cases around the world. Cardiovascular diseases (CVDs) are the largest cause of death globally, killing an estimated 17.9 million people each year, according to the World Health Organization (WHO). Four out of every five CVD deaths are caused by heart attacks and strokes, with one-third of those under the age of 70. Furthermore, due to increased demand for olive oils, global production is rising. Global olive oil output averaged 2.87 million tonnes in 2005–2006 and 2021–2022, according to the International Olive Council (IOC). The sector is gaining traction as people's discretionary income rises. As shown in the UN's 2022 World Economic Survey and Outlook, more than half of the world's main economies expanded in 2017 and 2022. Emerging economies increased at a steady 2.2 percent rate in both years, with growth rates in some countries reaching their potential. The availability of low-cost alternative oils, on the other hand, may limit the global olive oil market's development. Despite this, the rise of the e-commerce business in emerging nations may provide more prospects for the market's future growth.Olive Oil Market Segment Analysis:

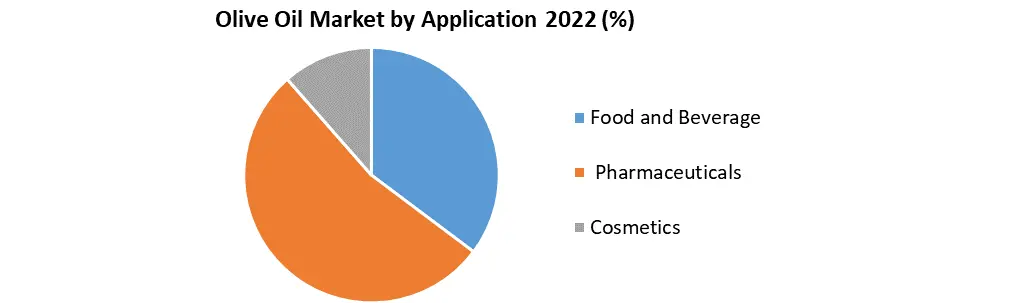

The global Olive Oil Market is segmented by Temperature Type, Type, Packaging Type, and Application. Based on the Type, the global Olive Oil market is sub-segmented into Virgin olive oil, Extra-Virgin Olive Oil, Pomace Olive Oil, and Others. The Virgin olive oil segment held the largest market share of xx% in 2022. This is due to rising demand from health-conscious customers since it includes natural vitamins and minerals and is beneficial against cardiovascular disorders, osteoporosis (bones), elevated vital signs, diabetes, and Alzheimer's disease. Also, the pomance olive oil segment held the 2nd largest market share of 6.13% in 2022. This is due to the fact that pomace olive oil is more affordable and widely available olive oil. Despite the fact that pomace olive oil has been processed, it is still seen as a superior option to other oils on the market and is thus in great demand when compared to other olive oils. Based on the Application, the global Olive Oil market is sub-segmented into Food and Beverage, Pharmaceuticals, and Cosmetics. The Food and Beverage segment held the largest market share of 6.13% in 2022 and it is expected to grow at the highest CAGR of 6.13% in the global olive oil market during the forecast period. Consumers' desire to live a healthy lifestyle has escalated the use of vegetable oil in a variety of food items as a cost-effective substitute. Vegetable oil is also used to season salads in order to preserve the antioxidants and phenols in vegetables and legumes. The product has become an important element of diabetic patients' diets since it is the primary source of healthy fats for diabetics.

Olive Oil Market Regional Insights:

Europe held the largest market share of 39% in 2022. Due to the great output of olive fruit oil in this region, Europe dominates the olive oil industry, and this oil is widely utilized in Mediterranean cuisine. Italy and Spain, which produce a lot of olive fruit oil, are the main contributors to this region. Global olive oil output reached 2.87 million tonnes during crop decades 2005–2006 and 2021–2022, as per figures from the International Olive Council (IOC), with 72 percent of it generated in the European Union (EU). Spain, Italy, and Greece produced almost 2 million tonnes of olive oil, contributing to 96 percent of all olive oil produced in the EU. Demand in the EU's non-producing countries increased considerably in countries like the United Kingdom and Germany. Asia Pacific is expected to grow at the highest CAGR of 6.13% in the global Olive Oil market during the forecast period. This signifies that throughout the projection period, the region will have the highest compound annual growth rate. This is due to an increase in the adoption of a healthier lifestyle, increased awareness of the health benefits of olive oil, and more personal discretionary money. Residents' discretionary income increased by 5.8% in 2022, according to the State Council of the People's Republic of China. China's disposable income per capita is 30,733 yuan ($ 4,461.95), up 5.5 percent over the previous year. The objective of the report is to present a comprehensive analysis of the global Olive Oil Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also helps in understanding the global Olive Oil Market dynamic, structure by analyzing the market segments and project the global Olive Oil Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Olive Oil Market make the report investor’s guide.Olive Oil Market Scope: Inquire before buying

Global Olive Oil Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2023: US $ 10.03 Bn. Forecast Period 2023 to 2029 CAGR: 6.13 % Market Size in 2029: US $ 15.22 Bn. Segments Covered: by Type Virgin olive oil Extra-Virgin Olive Oil Pomace Olive Oil Others by Source Organic Conventional by Application Food and Beverage Pharmaceuticals Cosmetics by Distribution Channel Supermarket/Hypermarket Convenience Store Online Channel Others Olive Oil Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Olive Oil Market Key Players are:

1.DEOLEO 2.SOVENA 3.BORGES INTERNATIONAL GROUP 4.Minerva 5.Gallo 6.Vendors covered 7.Vendor classification 8.Market positioning of vendors 9.AVRIL 10.Bright Food 11.Almazaras de la Subbetica SL 12.Salov SpA 13.Avenida Rafael Ybarra 14.Cargill 15.Rafael Salgado 16.World Excellent Productions S.A. 17.POMPEIAN. 18.MONINI 19.Antonio Celentano Extra Virgin Olive Oil 20.Colavita.Frequently Asked Questions:

1] What segments are covered in Olive Oil Market report? Ans. The segments covered in Olive Oil Market report are based on Type, Source Application and Distribution Channel. 2] Which region is expected to hold the highest share in the global Olive Oil Market? Ans. Europe is expected to hold the highest share in the global Olive Oil Market. 3] What is the market size of global Olive Oil Market by 2029? Ans. The market size of global Olive Oil Market by 2029 is US $ 15.22Bn. 4] Who are the top key players in the global Olive Oil Market? Ans. DEOLEO, SOVENA, BORGES INTERNATIONAL GROUP, Minerva, Gallo and Vendors covered are the top key players in the global Olive Oil Market. 5] What was the market size of global Olive Oil Market in 2022? Ans. The market size of global Olive Oil Market in 2022 was US $ 10.03 Bn.

1. Olive Oil Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Olive Oil Market: Dynamics 2.1. Olive Oil Market Trends by Region 2.1.1. North America Olive Oil Market Trends 2.1.2. Europe Olive Oil Market Trends 2.1.3. Asia Pacific Olive Oil Market Trends 2.1.4. Middle East and Africa Olive Oil Market Trends 2.1.5. South America Olive Oil Market Trends 2.2. Olive Oil Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Olive Oil Market Drivers 2.2.1.2. North America Olive Oil Market Restraints 2.2.1.3. North America Olive Oil Market Opportunities 2.2.1.4. North America Olive Oil Market Challenges 2.2.2. Europe 2.2.2.1. Europe Olive Oil Market Drivers 2.2.2.2. Europe Olive Oil Market Restraints 2.2.2.3. Europe Olive Oil Market Opportunities 2.2.2.4. Europe Olive Oil Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Olive Oil Market Drivers 2.2.3.2. Asia Pacific Olive Oil Market Restraints 2.2.3.3. Asia Pacific Olive Oil Market Opportunities 2.2.3.4. Asia Pacific Olive Oil Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Olive Oil Market Drivers 2.2.4.2. Middle East and Africa Olive Oil Market Restraints 2.2.4.3. Middle East and Africa Olive Oil Market Opportunities 2.2.4.4. Middle East and Africa Olive Oil Market Challenges 2.2.5. South America 2.2.5.1. South America Olive Oil Market Drivers 2.2.5.2. South America Olive Oil Market Restraints 2.2.5.3. South America Olive Oil Market Opportunities 2.2.5.4. South America Olive Oil Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Olive Oil Industry 2.8. Analysis of Government Schemes and Initiatives For Olive Oil Industry 2.9. Olive Oil Market price trend Analysis (2021-22) 2.10. Olive Oil Market Trade Analysis 2.10.1. Global Import Analysis 2.10.1.1. Top Importer of Olive Oil 2.10.2. Global Export Analysis 2.10.2.1. Top Exporter of Olive Oil 2.11. Olive Oil Production Analysis 2.12. The Global Pandemic Impact on Olive Oil Market 3. Olive Oil Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) 2022-2029 3.1. Olive Oil Market Size and Forecast, by Type (2022-2029) 3.1.1. Virgin olive oil 3.1.2. Extra-Virgin Olive Oil 3.1.3. Pomace Olive Oil 3.14. Others 3.2. Olive Oil Market Size and Forecast, by Source (2022-2029) 3.2.1. Organic 3.2.2. Conventional 3.2.3. 3.3. Olive Oil Market Size and Forecast, by Application (2022-2029) 3.3.1. Food and Beverage 3.3.2. Pharmaceuticals 3.3.3. Cosmetics 3.4. Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 3.4.1. Supermarket/Hypermarket 3.4.2. Convenience Store 3.4.3. Online Channel 3.4.4. Others 3.5. Olive Oil Market Size and Forecast, by Region (2022-2029) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Olive Oil Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 4.1. North America Olive Oil Market Size and Forecast, by Type (2022-2029) 4.1.1. Virgin olive oil 4.1.2. Extra-Virgin Olive Oil 4.1.3. Pomace Olive Oil 4.1.4. Others 4.2. North America Olive Oil Market Size and Forecast, by Source (2022-2029) 4.2.1. Organic 4.2.2. Conventional 4.2.3. 4.3. North America Olive Oil Market Size and Forecast, by Application (2022-2029) 4.3.1. Food and Beverage 4.3.2. Pharmaceuticals 4.3.3. Cosmetics 4.4. North America Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.1. Supermarket/Hypermarket 4.4.2. Convenience Store 4.4.3. Online Channel 4.4.4. Others 4.7. North America Olive Oil Market Size and Forecast, by Country (2022-2029) 4.5.1. United States 4.5.1.1. United States Olive Oil Market Size and Forecast, by Type (2022-2029) 4.5.1.1.1. Virgin olive oil 4.5.1.1.2. Extra-Virgin Olive Oil 4.5.1.1.3. Pomace Olive Oil 4.5.1.1.4. Others 4.5.1.2. United States Olive Oil Market Size and Forecast, by Source (2022-2029) 4.5.1.2.1. Organic 4.5.1.2.2. Conventional 4.5.1.2.3. 4.5.1.3. United States Olive Oil Market Size and Forecast, by Application (2022-2029) 4.5.1.3.1. Food and Beverage 4.5.1.3.2. Pharmaceuticals 4.5.1.3.3. Cosmetics 4.5.1.4. United States Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 4.5.1.4.1. Supermarket/Hypermarket 4.5.1.4.2. Convenience Store 4.5.1.4.3. Online Channel 4.5.1.4.4. Others 4.5.2. Canada 4.5.2.1. Canada Olive Oil Market Size and Forecast, by Type (2022-2029) 4.5.2.1.1. Virgin olive oil 4.5.2.1.2. Extra-Virgin Olive Oil 4.5.2.1.3. Pomace Olive Oil 4.5.2.1.4. Others 4.5.2.2. Canada Olive Oil Market Size and Forecast, by Source (2022-2029) 4.5.2.2.1. Organic 4.5.2.2.2. Conventional 4.5.2.2.3. 4.5.2.3. Canada Olive Oil Market Size and Forecast, by Application (2022-2029) 4.5.2.3.1. Food and Beverage 4.5.2.3.2. Pharmaceuticals 4.5.2.3.3. Cosmetics 4.5.2.4. Canada Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 4.5.2.4.1. Supermarket/Hypermarket 4.5.2.4.2. Convenience Store 4.5.2.4.3. Online Channel 4.5.2.4.4. Others 4.5.3. Mexico 4.5.3.1. Mexico Olive Oil Market Size and Forecast, by Type (2022-2029) 4.5.3.1.1. Virgin olive oil 4.5.3.1.2. Extra-Virgin Olive Oil 4.5.3.1.3. Pomace Olive Oil 4.5.3.1.4. Others 4.5.3.2. Mexico Olive Oil Market Size and Forecast, by Source (2022-2029) 4.5.3.2.1. Organic 4.5.3.2.2. Conventional 4.5.3.2.3. 4.5.3.3. Mexico Olive Oil Market Size and Forecast, by Application (2022-2029) 4.5.3.3.1. Food and Beverage 4.5.3.3.2. Pharmaceuticals 4.5.3.3.3. Cosmetics 4.5.3.4. Mexico Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 4.5.3.4.1. Supermarket/Hypermarket 4.5.3.4.2. Convenience Store 4.5.3.4.3. Online Channel 4.5.3.4.4. Others 5. Europe Olive Oil Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 5.1. Europe Olive Oil Market Size and Forecast, by Type (2022-2029) 5.2. Europe Olive Oil Market Size and Forecast, by Source (2022-2029) 5.3. Europe Olive Oil Market Size and Forecast, by Application (2022-2029) 5.4. Europe Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 5.5. Europe Olive Oil Market Size and Forecast, by Country (2022-2029) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Olive Oil Market Size and Forecast, by Type (2022-2029) 5.5.1.2. United Kingdom Olive Oil Market Size and Forecast, by Source (2022-2029) 5.5.1.3. United Kingdom Olive Oil Market Size and Forecast, by Application(2022-2029) 5.5.1.4. United Kingdom Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.2. France 5.5.2.1. France Olive Oil Market Size and Forecast, by Type (2022-2029) 5.5.2.2. France Olive Oil Market Size and Forecast, by Source (2022-2029) 5.5.2.3. France Olive Oil Market Size and Forecast, by Application(2022-2029) 5.5.2.4. France Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.3. Germany 5.5.3.1. Germany Olive Oil Market Size and Forecast, by Type (2022-2029) 5.5.3.2. Germany Olive Oil Market Size and Forecast, by Source (2022-2029) 5.5.3.3. Germany Olive Oil Market Size and Forecast, by Application (2022-2029) 5.5.3.4. Germany Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.4. Italy 5.5.4.1. Italy Olive Oil Market Size and Forecast, by Type (2022-2029) 5.5.4.2. Italy Olive Oil Market Size and Forecast, by Source (2022-2029) 5.5.4.3. Italy Olive Oil Market Size and Forecast, by Application(2022-2029) 5.5.4.4. Italy Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.5. Spain 5.5.5.1. Spain Olive Oil Market Size and Forecast, by Type (2022-2029) 5.5.5.2. Spain Olive Oil Market Size and Forecast, by Source (2022-2029) 5.5.5.3. Spain Olive Oil Market Size and Forecast, by Application (2022-2029) 5.5.5.4. Spain Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.6. Sweden 5.5.6.1. Sweden Olive Oil Market Size and Forecast, by Type (2022-2029) 5.5.6.2. Sweden Olive Oil Market Size and Forecast, by Source (2022-2029) 5.5.6.3. Sweden Olive Oil Market Size and Forecast, by Application (2022-2029) 5.5.6.4. Sweden Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.7. Austria 5.5.7.1. Austria Olive Oil Market Size and Forecast, by Type (2022-2029) 5.5.7.2. Austria Olive Oil Market Size and Forecast, by Source (2022-2029) 5.5.7.3. Austria Olive Oil Market Size and Forecast, by Application (2022-2029) 5.5.7.4. Austria Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Olive Oil Market Size and Forecast, by Type (2022-2029) 5.5.8.2. Rest of Europe Olive Oil Market Size and Forecast, by Source (2022-2029) 5.5.8.3. Rest of Europe Olive Oil Market Size and Forecast, by Application (2022-2029) 5.5.8.4. Rest of Europe Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 6. Asia Pacific Olive Oil Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 6.1. Asia Pacific Olive Oil Market Size and Forecast, by Type (2022-2029) 6.2. Asia Pacific Olive Oil Market Size and Forecast, by Source (2022-2029) 6.3. Asia Pacific Olive Oil Market Size and Forecast, by Application (2022-2029) 6.4. Asia Pacific Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 6.5. Asia Pacific Olive Oil Market Size and Forecast, by Country (2022-2029) 6.7.1. China 6.5.1.1. China Olive Oil Market Size and Forecast, by Type (2022-2029) 6.5.1.2. China Olive Oil Market Size and Forecast, by Source (2022-2029) 6.5.1.3. China Olive Oil Market Size and Forecast, by Application (2022-2029) 6.5.1.4. China Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.2. S Korea 6.5.2.1. S Korea Olive Oil Market Size and Forecast, by Type (2022-2029) 6.5.2.2. S Korea Olive Oil Market Size and Forecast, by Source (2022-2029) 6.5.2.3. S Korea Olive Oil Market Size and Forecast, by Application (2022-2029) 6.5.2.4. S Korea Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.3. Japan 6.5.3.1. Japan Olive Oil Market Size and Forecast, by Type (2022-2029) 6.5.3.2. Japan Olive Oil Market Size and Forecast, by Source (2022-2029) 6.5.3.3. Japan Olive Oil Market Size and Forecast, by Application (2022-2029) 6.5.3.4. Japan Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.4. India 6.5.4.1. India Olive Oil Market Size and Forecast, by Type (2022-2029) 6.5.4.2. India Olive Oil Market Size and Forecast, by Source (2022-2029) 6.5.4.3. India Olive Oil Market Size and Forecast, by Application (2022-2029) 6.5.4.4. India Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.5. Australia 6.5.5.1. Australia Olive Oil Market Size and Forecast, by Type (2022-2029) 6.5.5.2. Australia Olive Oil Market Size and Forecast, by Source (2022-2029) 6.5.5.3. Australia Olive Oil Market Size and Forecast, by Application (2022-2029) 6.5.5.4. Australia Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.6. Indonesia 6.5.6.1. Indonesia Olive Oil Market Size and Forecast, by Type (2022-2029) 6.5.6.2. Indonesia Olive Oil Market Size and Forecast, by Source (2022-2029) 6.5.6.3. Indonesia Olive Oil Market Size and Forecast, by Application (2022-2029) 6.5.6.4. Indonesia Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.7. Malaysia 6.5.7.1. Malaysia Olive Oil Market Size and Forecast, by Type (2022-2029) 6.5.7.2. Malaysia Olive Oil Market Size and Forecast, by Source (2022-2029) 6.5.7.3. Malaysia Olive Oil Market Size and Forecast, by Application (2022-2029) 6.5.7.4. Malaysia Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.8. Vietnam 6.5.8.1. Vietnam Olive Oil Market Size and Forecast, by Type (2022-2029) 6.5.8.2. Vietnam Olive Oil Market Size and Forecast, by Source (2022-2029) 6.5.8.3. Vietnam Olive Oil Market Size and Forecast, by Application(2022-2029) 6.5.8.4. Vietnam Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.9. Taiwan 6.5.9.1. Taiwan Olive Oil Market Size and Forecast, by Type (2022-2029) 6.5.9.2. Taiwan Olive Oil Market Size and Forecast, by Source (2022-2029) 6.5.9.3. Taiwan Olive Oil Market Size and Forecast, by Application (2022-2029) 6.5.9.4. Taiwan Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Olive Oil Market Size and Forecast, by Type (2022-2029) 6.5.10.2. Rest of Asia Pacific Olive Oil Market Size and Forecast, by Source (2022-2029) 6.5.10.3. Rest of Asia Pacific Olive Oil Market Size and Forecast, by Application (2022-2029) 6.5.10.4. Rest of Asia Pacific Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 7. Middle East and Africa Olive Oil Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 7.1. Middle East and Africa Olive Oil Market Size and Forecast, by Type (2022-2029) 7.2. Middle East and Africa Olive Oil Market Size and Forecast, by Source (2022-2029) 7.3. Middle East and Africa Olive Oil Market Size and Forecast, by Application (2022-2029) 7.4. Middle East and Africa Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 7.5. Middle East and Africa Olive Oil Market Size and Forecast, by Country (2022-2029) 7.5.1. South Africa 7.5.1.1. South Africa Olive Oil Market Size and Forecast, by Type (2022-2029) 7.5.1.2. South Africa Olive Oil Market Size and Forecast, by Source (2022-2029) 7.5.1.3. South Africa Olive Oil Market Size and Forecast, by Application (2022-2029) 7.5.1.4. South Africa Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.2. GCC 7.5.2.1. GCC Olive Oil Market Size and Forecast, by Type (2022-2029) 7.5.2.2. GCC Olive Oil Market Size and Forecast, by Source (2022-2029) 7.5.2.3. GCC Olive Oil Market Size and Forecast, by Application (2022-2029) 7.5.2.4. GCC Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.3. Nigeria 7.5.3.1. Nigeria Olive Oil Market Size and Forecast, by Type (2022-2029) 7.5.3.2. Nigeria Olive Oil Market Size and Forecast, by Source (2022-2029) 7.5.3.3. Nigeria Olive Oil Market Size and Forecast, by Application (2022-2029) 7.5.3.4. Nigeria Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Olive Oil Market Size and Forecast, by Type (2022-2029) 7.5.4.2. Rest of ME&A Olive Oil Market Size and Forecast, by Source (2022-2029) 7.5.4.3. Rest of ME&A Olive Oil Market Size and Forecast, by Application (2022-2029) 7.5.4.4. Rest of ME&A Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 8. South America Olive Oil Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 8.1. South America Olive Oil Market Size and Forecast, by Type (2022-2029) 8.2. South America Olive Oil Market Size and Forecast, by Source (2022-2029) 8.3. South America Olive Oil Market Size and Forecast, by Application(2022-2029) 8.4. South America Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 8.5. South America Olive Oil Market Size and Forecast, by Country (2022-2029) 8.5.1. Brazil 8.5.1.1. Brazil Olive Oil Market Size and Forecast, by Type (2022-2029) 8.5.1.2. Brazil Olive Oil Market Size and Forecast, by Source (2022-2029) 8.5.1.3. Brazil Olive Oil Market Size and Forecast, by Application (2022-2029) 8.5.1.4. Brazil Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 8.5.2. Argentina 8.5.2.1. Argentina Olive Oil Market Size and Forecast, by Type (2022-2029) 8.5.2.2. Argentina Olive Oil Market Size and Forecast, by Source (2022-2029) 8.5.2.3. Argentina Olive Oil Market Size and Forecast, by Application (2022-2029) 8.5.2.4. Argentina Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Olive Oil Market Size and Forecast, by Type (2022-2029) 8.5.3.2. Rest Of South America Olive Oil Market Size and Forecast, by Source (2022-2029) 8.5.3.3. Rest Of South America Olive Oil Market Size and Forecast, by Application (2022-2029) 8.5.3.4. Rest Of South America Olive Oil Market Size and Forecast, by Distribution Channel (2022-2029) 9. Global Olive Oil Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Production of 2022 9.3.6. Company Locations 9.4. Leading Olive Oil Market Companies, by market capitalization 9.5. Analysis of Organized and Unorganized Key Players in Olive Oil Industry 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. DEOLEO 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. SOVENA 10.3. BORGES INTERNATIONAL GROUP 10.4. Minerva 10.5. Gallo 10.6. Vendors covered 10.7. Vendor classification 10.8. Market positioning of vendors 10.9. AVRIL 10.10. Bright Food 10.11. Almazaras de la Subbetica SL 10.12. Salov SpA 10.13. Avenida Rafael Ybarra 10.14. Cargill 10.15. Rafael Salgado 10.16. World Excellent Productions S.A. 10.17. POMPEIAN. 10.18. MONINI 10.19. Antonio Celentano Extra Virgin Olive Oil 10.20. Colavita. 11. Key Findings 12. Industry Recommendations 13. Olive Oil Market: Research Methodology 14. Terms and Glossary