NPK Fertilizers Market size was valued at US$ 2.81 Bn. in 2022 and the total revenue is expected to grow at a CAGR of 4.3% from 2023 to 2029, reaching nearly US$ 3.78 Bn.Global NPK Fertilizers Market Overview:

NPK Fertilizers Market is expected to reach US$ 3.78 Bn. by 2029. In general, fertilisers are labelled N, P, or K to show their nitrogen (N), phosphorus (P), and potassium (K) content (K). All three are necessary for plant development. Potassium, commonly known as potash, is necessary for flower and fruit growth as well as disease resistance in plants. Look for a fertiliser with a high potassium and low nitrogen content for fruiting and flowering plants. This will encourage fruit and flower production while limiting leaf growth. This report focuses on the different segments of the NPK Fertilizers market (Type, Form, Application, and Region). The leading industry players and regions are thoroughly examined in this report (North America, Asia Pacific, Europe, Middle East & Africa, and South America). It's a thorough examination of today's quick advances in a variety of sectors. Facts and figures, visualisations, and presentations are used to highlight the primary data analysis from 2018 to 2022. The market drivers, restraints, opportunities, and challenges for NPK Fertilizers are examined in this report. The MMR report's investment suggestions are based on a thorough examination of the current competitive environment in the NPK Fertilizers market.To know about the Research Methodology:-Request Free Sample Report

COVID-19 Impact on the NPK Fertilizers Market:

Since the breakout of COVID-19 in the NPK Fertilizers Market, the disease has spread around the globe. So, in order to regulate and stop the spread, the government and the WHO have imposed various limits. To speak of the constraint, there was no transportation facility to carry the raw materials and finished goods. As a result, the raw materials and product were in high demand for the manufacturing company and its employees. The COVID-19 has increased the market value of NPK Fertilizers as a result of the increasing demand. Furthermore, there was a labor scarcity as well as a dearth of raw resources to manufacture the products.NPK Fertilizers Market Dynamics:

Food demand in main dominant regions such as North America and Asia Pacific has paved the way for prospects in the NPK Fertilizers Market to grow. However, as the demand for fruits and vegetables grew, so did the demand for more cultivation. People nowadays think of employing modern technology because of its low cost, but the yield is higher, and you can profit from it. Because of its low cost efficiency, this medium is becoming more popular and is being supplied at a higher level. Which is also within everyone's budget. Demand for highly effective fertilisers is increasing, and precision farming is being used. The growth of NPK fertilisers has been spurred by advancements in agricultural and farming techniques. The market is expected to be boosted by the rising need for high-efficiency fertilisers for improved crop yield and quality, as most leading manufacturers are well aware of consumer demand for high-quality food grains and foodstuff. Furthermore, precision farming has resulted in crop enhancement, reduced time consumption, and increased water conservation in several countries. As a result, these factors are expected to continue to drive the NPK market growth. Unawareness of the advantages of NPK fertilisers and prohibitively high manufacturing costs. Despite the market for NPK fertilisers being driven by a number of growth factors, the market is expected to be hampered by a few problems. The market is constrained by scepticism and a lack of information among farmers regarding the benefits and applications of NPK fertilisers. Government regulations governing fertiliser production are also hindering the growth of the NPK fertiliser market. Furthermore, the expensive investments connected with the production of NPK fertilisers are expected to hinder the market's growth.NPK Fertilizers Market Segment Analysis:

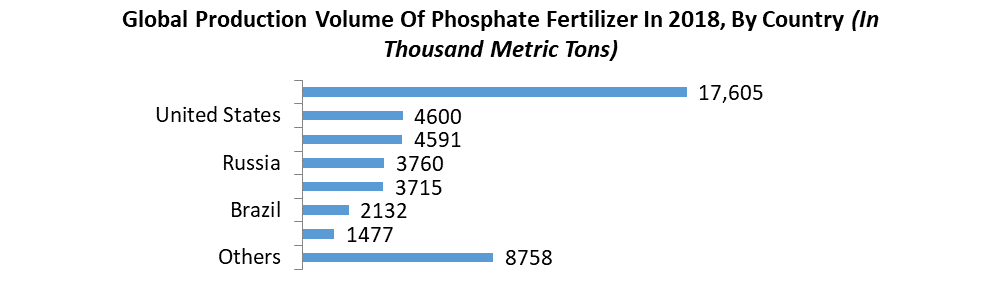

The NPK Fertilizers Market is segmented by Type, Form, and Application. Based on the Type, the market is segmented into Phosphorus, Nitrogen, Potassium, and Others (secondary nutrients and micronutrient). Phosphorus segment is expected to hold the largest market share of xx% by 2029. Phosphate is being more widely used in the food sector as a result of its reduced cost when compared to other food additives. Phosphorus is a nutrient that is necessary for plant growth. Root development, plant maturation, and seed development are all aided by it. Phosphorus is one of the most crucial elements for plant life, alongside nitrogen and potassium. Phosphorus levels in soil are depleted for a variety of reasons, including being carried away by rain. As a result, modern agriculture is reliant on phosphorus-based fertilisers. Phosphate rock is used to make commercial phosphate fertilisers. Sedimentary and marine phosphate rock formations account for roughly two-thirds of the world's phosphate resources. In the past, ground rock phosphate was employed as a source of phosphorus for soils. The use of rock phosphate in agriculture has decreased significantly due to the low concentration of phosphorous in this natural material, high transportation costs, and weak crop responses. The use of phosphorus-based fertilisers, on the other hand, has increased significantly. Diammonium Phosphate (DAP), Monoammonium Phosphate (MAP), NPKs, and SSP are the most commonly used phosphatic fertilisers. Nitrogen segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2029. These fertilisers improve overall crop output and offer nitrogen supplements to irrigated land where the soil is deficient in nitrogen. Based on the Form, the market is segmented into Powder, Liquid, and Others (crystals, prills, and pellets. Powder NPK Fertilizers segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2029. Compared to liquid NPK fertilisers (food-grade), powdered NPK fertilisers (food-grade) have a longer shelf life and are easier to apply and carry. The powder segment of NPK fertilisers is driven by these factors.

NPK Fertilizers Market Regional Insights:

Asia Pacific region is expected to dominate the NPK Fertilizers Market during the forecast period 2023-2029. Asia Pacific region is expected to hold the largest market share of xx% by 2029. Food patterns are changing as a result of increased urbanisation and rising consumer income, notably in South Asia. Furthermore, the demand for high-quality fertilisers has increased as farm sizes have shrunk and the population has grown. There are a lot of competitors in the NPK Fertilizers Market, and there are a lot of major companies. The primary goal of firms is to help them achieve the pinnacles of the market. Even though there are many essential players, the region's leading players are focusing on market progress and innovation. They are putting in a lot of effort to get market share in NPK Fertilizers. The North American region is expected to grow rapidly at a CAGR of 3.4% during the forecast period 2023-2029. This is due to a decrease in arable land availability, increased farmer awareness of the need for nutrients for improved crop output, and increased urbanisation.The objective of the report is to present a comprehensive analysis of the Global NPK Fertilizers Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global NPK Fertilizers Market dynamic and structure by analyzing the market segments and projecting the Global NPK Fertilizers Market size. Clear representation of competitive analysis of key players by Distribution Channel, price, financial position, product portfolio, growth strategies, and regional presence in the NPK Fertilizers Market make the report investor’s guide.

NPK Fertilizers Market Scope: Inquire before buying

Global NPK Fertilizers Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 2.81 Bn. Forecast Period 2023 to 2029 CAGR: 4.3% Market Size in 2029: US $ 3.78 Bn. Segments Covered: by Type Phosphorus Nitrogen Potassium Others (secondary nutrients and micronutrient) by Form Powder Liquid Others (crystals, prills, and pellets) by Application Dairy products Meat & meat products Bakery products Beverages NPK Fertilizers Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)NPK Fertilizers Market Key Players

1.Yara 2.Euro Chem 3.Acron 4.Rossosh 5.ZAT 6.ICL 7.Coromandel 8.Gresik 9.Phosagro 10.Roullier 11.Grupa Azoty 12.Grupo Villar Mir S.A. 13.Kingenta 14.Xinyangfeng 15.Stanley 16.Luxi Chem 17.Aboolo 18.SACF 19.Batian 20.Huachang Chem Frequently Asked Questions: 1] Which region is expected to hold the highest share in the NPK Fertilizers Market? Ans. Asia Pacific region is expected to hold the highest share in the NPK Fertilizers Market. 2] Who are the top key players in the NPK Fertilizers Market? Ans. Yara, Euro Chem, Acron, Rossosh, ZAT, and ICL are the top key players in the NPK Fertilizers Market. 3] Which segment is expected to hold the largest market share in the NPK Fertilizers Market by 2029? Ans. Phosphorus segment is expected to hold the largest market share in the NPK Fertilizers Market by 2029. 4] What is the market size of the NPK Fertilizers Market by 2029? Ans. The market size of the NPK Fertilizers Market is expected to reach US $ 3.78 Bn. by 2029. 5] What was the market size of the NPK Fertilizers Market in 2022? Ans. The market size of the NPK Fertilizers Market was worth US $ 2.81 Bn. in 2022.

1. NPK Fertilizers Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. NPK Fertilizers Market: Dynamics 2.1. NPK Fertilizers Market Trends by Region 2.1.1. North America NPK Fertilizers Market Trends 2.1.2. Europe NPK Fertilizers Market Trends 2.1.3. Asia Pacific NPK Fertilizers Market Trends 2.1.4. Middle East and Africa NPK Fertilizers Market Trends 2.1.5. South America NPK Fertilizers Market Trends 2.2. NPK Fertilizers Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America NPK Fertilizers Market Drivers 2.2.1.2. North America NPK Fertilizers Market Restraints 2.2.1.3. North America NPK Fertilizers Market Opportunities 2.2.1.4. North America NPK Fertilizers Market Challenges 2.2.2. Europe 2.2.2.1. Europe NPK Fertilizers Market Drivers 2.2.2.2. Europe NPK Fertilizers Market Restraints 2.2.2.3. Europe NPK Fertilizers Market Opportunities 2.2.2.4. Europe NPK Fertilizers Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific NPK Fertilizers Market Drivers 2.2.3.2. Asia Pacific NPK Fertilizers Market Restraints 2.2.3.3. Asia Pacific NPK Fertilizers Market Opportunities 2.2.3.4. Asia Pacific NPK Fertilizers Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa NPK Fertilizers Market Drivers 2.2.4.2. Middle East and Africa NPK Fertilizers Market Restraints 2.2.4.3. Middle East and Africa NPK Fertilizers Market Opportunities 2.2.4.4. Middle East and Africa NPK Fertilizers Market Challenges 2.2.5. South America 2.2.5.1. South America NPK Fertilizers Market Drivers 2.2.5.2. South America NPK Fertilizers Market Restraints 2.2.5.3. South America NPK Fertilizers Market Opportunities 2.2.5.4. South America NPK Fertilizers Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For NPK Fertilizers Industry 2.8. Analysis of Government Schemes and Initiatives For NPK Fertilizers Industry 2.9. NPK Fertilizers Market Trade Analysis 2.10. The Global Pandemic Impact on NPK Fertilizers Market 3. NPK Fertilizers Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 3.1.1. Phosphorus 3.1.2. Nitrogen 3.1.3. Potassium 3.1.4. Others (secondary nutrients and micronutrient) 3.2. NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 3.2.1. Powder 3.2.2. Liquid 3.2.3. Others (crystals, prills, and pellets) 3.3. NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 3.3.1. Dairy products 3.3.2. Meat & meat products 3.3.3. Bakery products 3.3.4. Beverages 3.4. NPK Fertilizers Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America NPK Fertilizers Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 4.1.1. Phosphorus 4.1.2. Nitrogen 4.1.3. Potassium 4.1.4. Others (secondary nutrients and micronutrient) 4.2. North America NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 4.2.1. Powder 4.2.2. Liquid 4.2.3. Others (crystals, prills, and pellets) 4.3. North America NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 4.3.1. Dairy products 4.3.2. Meat & meat products 4.3.3. Bakery products 4.3.4. Beverages 4.4. North America NPK Fertilizers Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 4.4.1.1.1. Phosphorus 4.4.1.1.2. Nitrogen 4.4.1.1.3. Potassium 4.4.1.1.4. Others (secondary nutrients and micronutrient) 4.4.1.2. United States NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 4.4.1.2.1. Powder 4.4.1.2.2. Liquid 4.4.1.2.3. Others (crystals, prills, and pellets) 4.4.1.3. United States NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 4.4.1.3.1. Dairy products 4.4.1.3.2. Meat & meat products 4.4.1.3.3. Bakery products 4.4.1.3.4. Beverages 4.4.2. Canada 4.4.2.1. Canada NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 4.4.2.1.1. Phosphorus 4.4.2.1.2. Nitrogen 4.4.2.1.3. Potassium 4.4.2.1.4. Others (secondary nutrients and micronutrient) 4.4.2.2. Canada NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 4.4.2.2.1. Powder 4.4.2.2.2. Liquid 4.4.2.2.3. Others (crystals, prills, and pellets) 4.4.2.3. Canada NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 4.4.2.3.1. Dairy products 4.4.2.3.2. Meat & meat products 4.4.2.3.3. Bakery products 4.4.2.3.4. Beverages 4.4.3. Mexico 4.4.3.1. Mexico NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 4.4.3.1.1. Phosphorus 4.4.3.1.2. Nitrogen 4.4.3.1.3. Potassium 4.4.3.1.4. Others (secondary nutrients and micronutrient) 4.4.3.2. Mexico NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 4.4.3.2.1. Powder 4.4.3.2.2. Liquid 4.4.3.2.3. Others (crystals, prills, and pellets) 4.4.3.3. Mexico NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 4.4.3.3.1. Dairy products 4.4.3.3.2. Meat & meat products 4.4.3.3.3. Bakery products 4.4.3.3.4. Beverages 5. Europe NPK Fertilizers Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 5.2. Europe NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 5.3. Europe NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 5.4. Europe NPK Fertilizers Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 5.4.1.2. United Kingdom NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 5.4.1.3. United Kingdom NPK Fertilizers Market Size and Forecast, by Application(2022-2029) 5.4.2. France 5.4.2.1. France NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 5.4.2.2. France NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 5.4.2.3. France NPK Fertilizers Market Size and Forecast, by Application(2022-2029) 5.4.3. Germany 5.4.3.1. Germany NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 5.4.3.2. Germany NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 5.4.3.3. Germany NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 5.4.4. Italy 5.4.4.1. Italy NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 5.4.4.2. Italy NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 5.4.4.3. Italy NPK Fertilizers Market Size and Forecast, by Application(2022-2029) 5.4.5. Spain 5.4.5.1. Spain NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 5.4.5.2. Spain NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 5.4.5.3. Spain NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 5.4.6.2. Sweden NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 5.4.6.3. Sweden NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 5.4.7. Austria 5.4.7.1. Austria NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 5.4.7.2. Austria NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 5.4.7.3. Austria NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 5.4.8.2. Rest of Europe NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 5.4.8.3. Rest of Europe NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 6. Asia Pacific NPK Fertilizers Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 6.2. Asia Pacific NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 6.3. Asia Pacific NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 6.4. Asia Pacific NPK Fertilizers Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 6.4.1.2. China NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 6.4.1.3. China NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 6.4.2.2. S Korea NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 6.4.2.3. S Korea NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 6.4.3. Japan 6.4.3.1. Japan NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 6.4.3.2. Japan NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 6.4.3.3. Japan NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 6.4.4. India 6.4.4.1. India NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 6.4.4.2. India NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 6.4.4.3. India NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 6.4.5. Australia 6.4.5.1. Australia NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 6.4.5.2. Australia NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 6.4.5.3. Australia NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 6.4.6.2. Indonesia NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 6.4.6.3. Indonesia NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 6.4.7.2. Malaysia NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 6.4.7.3. Malaysia NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 6.4.8.2. Vietnam NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 6.4.8.3. Vietnam NPK Fertilizers Market Size and Forecast, by Application(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 6.4.9.2. Taiwan NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 6.4.9.3. Taiwan NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 6.4.10.2. Rest of Asia Pacific NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 6.4.10.3. Rest of Asia Pacific NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 7. Middle East and Africa NPK Fertilizers Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 7.2. Middle East and Africa NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 7.3. Middle East and Africa NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 7.4. Middle East and Africa NPK Fertilizers Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 7.4.1.2. South Africa NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 7.4.1.3. South Africa NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 7.4.2. GCC 7.4.2.1. GCC NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 7.4.2.2. GCC NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 7.4.2.3. GCC NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 7.4.3.2. Nigeria NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 7.4.3.3. Nigeria NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 7.4.4.2. Rest of ME&A NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 7.4.4.3. Rest of ME&A NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 8. South America NPK Fertilizers Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 8.2. South America NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 8.3. South America NPK Fertilizers Market Size and Forecast, by Application(2022-2029) 8.4. South America NPK Fertilizers Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 8.4.1.2. Brazil NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 8.4.1.3. Brazil NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 8.4.2.2. Argentina NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 8.4.2.3. Argentina NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America NPK Fertilizers Market Size and Forecast, by Type (2022-2029) 8.4.3.2. Rest Of South America NPK Fertilizers Market Size and Forecast, by Form (2022-2029) 8.4.3.3. Rest Of South America NPK Fertilizers Market Size and Forecast, by Application (2022-2029) 9. Global NPK Fertilizers Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading NPK Fertilizers Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Yara 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Euro Chem 10.3. Acron 10.4. Rossosh 10.5. ZAT 10.6. ICL 10.7. Coromandel 10.8. Gresik 10.9. Phosagro 10.10. Roullier 10.11. Grupa Azoty 10.12. Grupo Villar Mir S.A. 10.13. Kingenta 10.14. Xinyangfeng 10.15. Stanley 10.16. Luxi Chem 10.17. Aboolo 10.18. SACF 10.19. Batian 10.20. Huachang Chem 11. Key Findings 12. Industry Recommendations 13. NPK Fertilizers Market: Research Methodology 14. Terms and Glossary