The Indian Paper & Pulp Market size was valued at at USD 14.75 Bn in 2023 and the total Indian Paper & Pulp revenue is expected to grow at a CAGR of 13.4% from 2024 to 2030, reaching nearly USD 35.57 Bn by 2030. The Indian paper & pulp market leads globally with rising demand for packaging, writing, printing, and specialty papers. Emphasizing recycling, it champions sustainability, conserving resources and minimizing environmental impact through renewable practices.Indian Paper & Pulp Market Overview

Paper and pulp are two interconnected products and processes within the paper industry. Pulp refers to a fibrous material obtained from wood or other plant-based sources through a process called pulping. Paper is a thin material made from pulp, primarily composed of cellulose fibers. The Indian paper & and pulp market is the fastest-growing in the world. The demand for paper products, including packaging, writing and printing paper, and specialty paper, has been steadily increasing. The Indian paper industry has been actively promoting recycling initiatives. The use of recycled paper helps in conserving natural resources and reducing environmental impact. The Indian paper industry is known for its sustainable practices and the use of renewable resources.To know about the Research Methodology:-Request Free Sample Report Indian Paper & Pulp Market is experiencing remarkable growth, with a notable surge in global demand. The upward trajectory is attributed to the steadily increasing domestic demand, fueled by factors such as the expanding manufacturing sector, the need for higher quality packaging in organized retail for FMCG products, and the rising demand for various paper products like tissue paper, filter paper, tea bags, lightweight online coated paper, and medical-grade coated paper. Despite this impressive growth, India's per capita paper consumption stands at just over 13 kg, significantly lower than the global average of 57 kg. However, the industry views this as an opportune transition phase, presenting both challenges and opportunities to provide affordable alternatives. Paper mills are actively engaged in trials to produce paper and paperboard tailored for specific uses such as carrying, wrapping, protecting, packing, and serving as containers. Looking ahead to the baseline scenario for 2024-25, domestic consumption is projected to rise substantially to 23.5 million tpa (tons per annum), while production is expected to reach 22.0 million tpa. To meet this growing demand, the industry recognizes the need to create an additional one million tpa of integrated pulp, paper, and paperboard capacity annually, supplementing the existing capacity. India has emerged as the fastest-growing Indian Paper and Pulp Market for paper globally, presenting an exciting scenario for the industry. As the economy continues to grow, paper consumption is poised for a significant leap forward, underscoring the potential for sustained expansion and development within the Indian paper and pulp sector.

Indian Paper & Pulp Market Dynamics

Growing Packaging Industry to Boost Indian Paper & Pulp Market Growth The packaging industry in India is growing rapidly due to increased consumerism, e-commerce growth, and organized retail. Packaging paper is a vital component for various packaging solutions, contributing to the demand for paper products. Rising literacy rates and educational activities contribute to the demand for printing and writing paper. The education sector's growth drives the need for textbooks, notebooks, and other educational materials, which significantly boosts the Indian Paper & Pulp Market growth. Investments by key players in expanding production capacities and modernizing facilities contribute to meeting the growing demand for paper and pulp products. India is the 15th largest paper producer in the world. India has emerged as the fastest-growing market when it comes to consumption, posting 10.6% growth in per capita consumption of paper in 2023-2029. The domestic market/consumption of paper is over 16 million tons per annum (TPA), with over 2 million TPA being imported. By 2025-26, under the baseline scenario, domestic consumption is expected to rise to 23.50 million TPA. While the Indian Paper & Pulp industry has made significant capital investments to ramp up capacities, the development period is long and the economic viability of the investments is impacted significantly by the availability and cost of raw materials and other inputs, and escalating imports. The paper industry in India looks extremely positive as the demand for upstream markets of paper products, like, tissue paper, tea bags, filter paper, lightweight online coated paper, medical grade coated paper, etc., is growing up. Environmental Concerns and Deforestation to restrain Indian Paper & Pulp Market growth Environmental issues, including deforestation, pose challenges to the paper industry's sustainability. Concerns about the impact on biodiversity and ecosystems lead to regulatory constraints and public opposition. Paper and pulp manufacturing, especially the production of specialty papers and environmentally friendly options like recycled paper, is costly. Higher production costs impact the competitiveness of paper products, especially in the price-sensitive Indian Paper & Pulp market. The Indian Pulp & Paper Industry has agroforestry roots and strong backward linkages with the farming community, from whom wood is sourced, which is a key raw material. Raw material expense is 45 to 50% of the revenue. Imports account for over 20% of the paper consumption in India. Domestic paper manufacturers are less competitive against imports, given the superior quality and lower prices of imported paper. As per IPMA, paper from ASEAN countries that is manufactured from raw wood is available at about USD 40 per tonne, as against USD 110 per tonne in India. Rising imports at predatory prices from surplus countries like China have been a major concern for local players in India, which limits the Indian Paper & Pulp Market growth. Demonstration of two innovative technologies at Paper Mills in India: 1. Membrane Filtration: To facilitate maximum recycling of process water by treating paper mill effluents to reduce color, total dissolved solids (TDS), chemical oxygen demand (COD), and other pollutants as per prescribed regulatory norms. 2. Black Liquor heat treatment: To improve the energy efficiency of the chemical recovery system by reducing the viscosity of black liquor, enabling the achievement of higher black liquor solids during evaporation in agro-based pulp and paper mills. The adoption of these technologies is aligned with various development programs of the Government of India (i.e. Clean India Mission) as well as the National Mission of Clean Ganga, which significantly boosts the Indian Paper & Pulp Market growth.Indian Paper & Pulp Market Segment Analysis

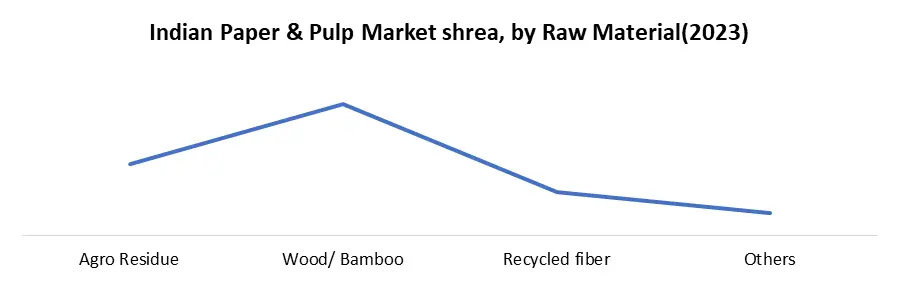

By Product Type, Packaging paper plays a pivotal role in the Indian Paper & Pulp Market, commanding approximately 35% of the market share. It is essential for various packaging applications across industries such as food and beverages, pharmaceuticals, consumer goods, and e-commerce. The growth in organized retail, coupled with the rise of e-commerce platforms, has significantly boosted the demand for packaging paper. Its versatility in providing protection, convenience, and branding opportunities has made it indispensable for both product safety and marketing purposes. The packaging paper segment continues to expand due to increasing consumer expectations for sustainable and eco-friendly packaging solutions, driving innovation and adoption of recyclable and biodegradable materials in the Indian market. Based on Raw Material, the market is segmented into Agro Residue, Wood/ Bamboo, Recycled fiber, and Others. The wood/ Bamboo segment dominated the market in 2023 and is expected to hold the largest Indian Paper & Pulp Market share over the forecast period. The wood and bamboo segment in the Indian paper & and pulp market are used as raw materials derived from wood and bamboo sources for the production of paper and pulp. Both wood and bamboo are valuable resources used in the paper industry due to their fibrous composition, which contains cellulose—a key component in papermaking. The wood used in the paper industry typically comes from various tree species. Softwood and hardwood species are utilized, depending on the desired characteristics of the paper product.

Indian Paper & Pulp Market Regional Insight

Out of 410 million tons of paper consumed globally, India consumes 22.05 million tons of paper and paper board annually, putting the national paper demand at 4.72% of the global demand. With steady growth in the country’s economy since the early 1990s, India has witnessed a steady rise in the consumption of paper. The consumption of paper in India increased from 13.96 million Tons in 2010-11 to 22.05 million tons in 2019-20. The global paper and pulp mills industry has contracted slightly over the past five years, primarily due to the shift to digital media and paperless communication across most developed economies.Location of Large Paper Units (Integrated & Non-Integrated)

India faces a shortage of wood fiber, primarily because the Government of India does not permit industrial plantations within the country. This limited availability of domestic raw materials is a major constraint for the paper industry, which significantly restraints the Indian Paper & Pulp Market growth. Furthermore, the recovery rate of wastepaper in India is notably low, standing at approximately 30%, primarily due to the absence of an efficient collection mechanism. The paper industry grapples with challenges such as obtaining quality raw materials at competitive prices. To overcome this hurdle, industry players often resort to importing pulp, wastepaper, and even pulpwood, incurring premium costs and thereby impacting both profitability and capacity addition. Addressing this significant challenge could involve the formulation of a government policy allowing access to degraded forest land for paper mills. This would enable the establishment of pulpwood plantations, thereby increasing the availability of pulp and reducing dependence on imports. Strengthening the collection mechanism for wastepaper is crucial to boost its utilization in the industry.

Name of State No of Units Andhra Pradesh 4 Gujarat 10 Himachal Pradesh 1 Karnataka 1 Maharashtra 3 Odisha 2 Punjab 4 Tamil Nadu 7 Telangana 1 Uttar Pradesh 9 Uttarakhand 2 West Bengal 2 Indian Paper & Pulp Market: Inquire before buying

Indian Paper & Pulp Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 14.75 Bn. Forecast Period 2024 to 2030 CAGR: 13.4% Market Size in 2030: US $ 35.57 Bn. Segments Covered: by Product Type Printing and Writing Paper Packaging Paper Newsprint Tissue Paper Specialty Paper Others by Raw Material Wood Pulp Recycled Paper Others Indian Paper & Pulp Leading Key Players Include:

1. Emami Paper Mills Ltd 2. Hindustan Newsprint Ltd 3. Ballarpur Industries Limited 4.ITC Limited- PSPD 5. Tamil Nadu Newsprint & Papers Ltd. 6. The West Coast Paper Mills Ltd. 7. JK Paper Ltd. 8. The Andhra Pradesh Paper Mills Ltd. 9. Century Paper & Pulp 10. NR Agrawal Industries Ltd. 11. Seshasayee Paper & Boards Ltd. 12. Triden Ltd. 13. Chennai Poly Pack Private Limited 14. Nachiketa Papers Limited 15. Galaxy Forms Limited 16. Naini Group 17. Pudumjee Paper Products Limited Frequently asked Questions: 1. What is the connection between pulp and paper in the paper industry? Ans: Pulp is a fibrous material obtained from wood or plants, while paper is a thin material made from pulp. The two are interconnected products and processes in the paper industry. 2. How is the Indian paper & pulp market positioned globally? Ans: India is the 15th largest paper producer globally, and it has the fastest-growing paper & pulp market. Per capita paper consumption in India is projected to grow by 10.6% from 2023-2029. 3. How does the Indian Paper & Pulp Market address sustainability concerns? Ans: The industry emphasizes sustainable practices, including the use of recycled paper. Consumer preferences for eco-friendly products influence market dynamics. 4. How does the industry address the competition from imported paper? Ans: Imports, accounting for over 20% of paper consumption in India, pose a challenge due to superior quality and lower prices. Rising imports, especially from countries like China, impact market growth. 5. What is the role of packaging in the growth of the Indian Paper & Pulp Market? Ans: The packaging industry's rapid expansion, driven by consumerism and e-commerce growth, contributes significantly to the demand for packaging paper, boosting overall market growth.

1. Indian Paper & Pulp Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Indian Paper & Pulp Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Product Segment 2.3.3. End-users Segment 2.3.4. Revenue (2023) 2.3.5. Company Headquarter 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Indian Paper & Pulp Market: Dynamics 3.1. Indian Paper & Pulp Market Trends 3.2. Indian Paper & Pulp Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis For Indian Paper & Pulp Industry 3.7. Analysis of Government Schemes and Initiatives For the Indian Paper & Pulp Industry 4. Indian Paper & Pulp Market: Market Size and Forecast by Segmentation (by Value) (2023-2030) 4.1. Indian Paper & Pulp Market Size and Forecast, by Product Type (2023-2030) 4.1.1. Printing and Writing Paper 4.1.2. Packaging Paper 4.1.3. Newsprint 4.1.4. Tissue Paper 4.1.5. Specialty Paper 4.1.6. Others 4.2. Indian Paper & Pulp Market Size and Forecast, by Raw Material (2023-2030) 4.2.1. Wood Pulp 4.2.2. Recycled Paper 4.2.3. Others 5. Company Profile: Key Players 5.1. Emami Paper Mills Ltd 5.1.1. Company Overview 5.1.2. Business Portfolio 5.1.3. Financial Overview 5.1.4. SWOT Analysis 5.1.5. Strategic Analysis 5.1.6. Recent Developments 5.2. Hindustan Newsprint Ltd 5.3. Ballarpur Industries Limited 5.4. ITC Limited- PSPD 5.5. Tamil Nadu Newsprint & Papers Ltd. 5.6. The West Coast Paper Mills Ltd. 5.7. JK Paper Ltd. 5.8. The Andhra Pradesh Paper Mills Ltd. 5.9. Century Paper & Pulp 5.10. NR Agrawal Industries Ltd. 5.11. Seshasayee Paper & Boards Ltd. 5.12. Triden Ltd. 5.13. Chennai Poly Pack Private Limited 5.14. Nachiketa Papers Limited 5.15. Galaxy Forms Limited 5.16. Naini Group 5.17. Pudumjee Paper Products Limited 6. Key Findings 7. Industry Recommendations 8. Indian Paper & Pulp Market: Research Methodology 9. Terms and Glossary