Non-Destructive Testing Market was valued at US$ 15.78 Bn. in 2022 and is expected to reach US$ 24.69 Bn. by 2029, at a CAGR of 6.6% during a forecast period.Non-Destructive Testing Market Overview:

Non-destructive testing (NDT) is a technique for inspecting objects for defects and inadequacies in the materials, components, or system without damaging them. Governments all around the world have been focusing on safety issues and standards in recent years in order to prevent accidents. Non-destructive testing ensures dependability by preventing the loss of over-sightedness, and it is predictable to aid in the improvement of industrial institutions' efficiency. This study explores the most prominent applications in the global non-destructive testing market.Non-Destructive Testing Market Snapshot

To know about the Research Methodology :- Request Free Sample Report

Non-Destructive Testing Market Dynamics:

The market is expected to be driven by an increase in industrial activities among developing and developed countries. In addition, technological improvements have led to the development of improved non-destructive testing (NDT) procedures that improve fault detection and safety. Furthermore, as manufacturers become more aware of the benefits of NDT procedures, NDT penetration is expected to increase in the coming years. Due to defect detection at complex locations and irregular surfaces, projects utilizing non-destructive testing procedures take less time to complete. The demand for non-destructive testing is expected to increase in the next years as the risk of failure is reduced. In addition, the efficiency of defect detection and the ease of operation of ultrasonic equipment, as compared to other NDT equipment, are two of the most important factors driving the increased use of ultrasonic testing. Furthermore, due to its simplicity, developments in ultrasonic technology are likely to increase the usage of this diagnostic process during the forecast period. Over the forecast period, the market is anticipated to grow at a significant rate. This increase might be ascribed to increased urbanization in developing countries like India and China, which necessitates large-scale construction and manufacturing operations. Due to the speed of such projects, it is necessary for the executors to create testing protocols in order to ensure that the work is of high quality. This tendency is projected to have a favorable impact on the growth of non-destructive testing in these countries, increasing global market penetration. Non-destructive testing (NDT) aids in the exact detection of flaws, lowering the likelihood of product/component failure as well as the expenses associated with component repairs. NDT also helps to speed up the manufacturing process by identifying any defects early on. The market is expected to be driven by technological advancements in non-destructive testing procedures. Approaches have improved, resulting in error-free defect detection and a significant reduction in the complexity of testing operations. The ultrasonic testing market is expected to grow significantly in the coming years. This growth can be attributed to the equipment's ease of use, the availability of qualified personnel, and precise fault detection. Because of the growing knowledge of NDT techniques, the manufacturing segment is likely to utilize them substantially over the projection period.Non-Destructive Testing Market segment analysis:

Based on offering, the services category led the market in 2022, accounting for 74.8 % of total revenue, and is likely to continue to do so throughout the forecast period. The high upfront cost of non-destructive testing equipment, combined with the technical obstacles associated in its Verticals/installation, is the main reason why end-users outsource non-destructive testing. A shortage of competent workers to do non-destructive testing is another constraint limiting new non-destructive testing equipment installations around the world. Based on test methods, in 2022, the ultrasonic testing segment dominated the market, accounting for 24.7 % of total revenue. Approximately the projection period, the segment is expected to increase at a CAGR of over 7.7%, making it the fastest-growing test technique segment. This increase can be attributed to the growing use of ultrasonic detectors in manufacturing operations. When compared to typical non-destructive testing techniques, ultrasonic detectors are portable, easy to use, and deliver precise results. As a result, ultrasonic testing is becoming more widely used, and this trend is expected to continue in the coming years.Non-Destructive Testing Market, by Methods

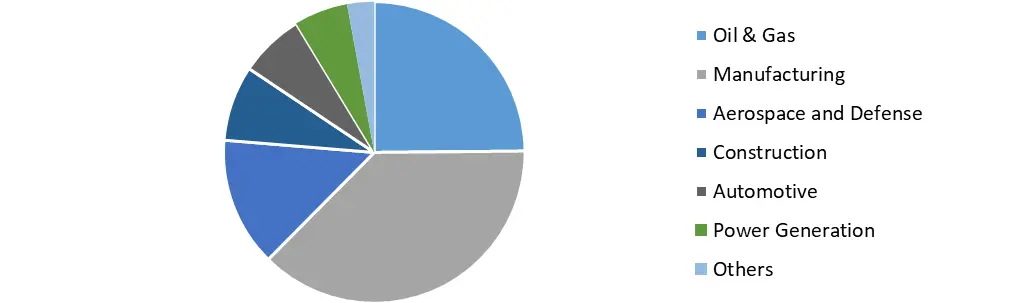

Based on verticals, in 2022, the manufacturing vertical category dominated the non-destructive testing market, accounting for 22.4 % of total revenue. Due to the ever-increasing amount of manufacturing around the world, the segment is expected to grow at a CAGR of more than 7.8% over the forecast period. The industrial industry is expected to implement a number of non-destructive testing techniques, resulting in an increase in demand for non-destructive testing services around the world. Non-destructive testing has also been employed extensively in oil and gas applications in the past. Ultrasonic and eddy current tests have been used to detect cracks in pipes both below and above ground. Non-destructive testing techniques are now being used in a variety of other areas, including aerospace, defense, and automotive, as a result of increased knowledge.

Non-Destructive Testing Market, by Verticals

Non-Destructive Testing Market Regional Insight:

North America region held largest market share of 34% in 2022. This is due to the widespread use of nondestructive testing techniques in a variety of applications, as well as the availability of a trained workforce and a large number of nondestructive testing training institutes in the region. Furthermore, power generation from shale oil in the United States and Canada is expected to boost the region's growth pace. Furthermore, the regional market is likely to be driven by an increasing emphasis on the use of NDT to avoid unexpected system failures. Over the forecast period, the Asia Pacific market is expected to grow at a CAGR of more than 8.0%. Manufacturing, building, and power generation activities have all increased in the region, contributing to this growth. Although the region now has a skilled labor shortage, this is projected to improve in the coming years as more people become aware of and embrace non-destructive testing procedures. Furthermore, the Middle East is considered to be a prospective market for NDT techniques due to the considerable presence of the oil and gas industry. The objective of the report is to present a comprehensive analysis of the Non-Destructive Testing market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Non-Destructive Testing market dynamics, structure by analyzing the market segments and projects the Non-Destructive Testing market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Non-Destructive Testing market make the report investor’s guide.Non-Destructive Testing Market Scope: Inquire before buying

Non-Destructive Testing Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 15.78 Bn. Forecast Period 2023 to 2029 CAGR: 6.6 % Market Size in 2029: US $ 24.69 Bn. Segments Covered: by Offering Services Equipment by Test Method Visual Testing Magnetic Particle Testing Liquid Penetrant Testing Eddy Current Testing Ultrasonic Testing Radiographic Testing by Verticals Oil & Gas Manufacturing Aerospace and Defense Construction Automotive Power Generation Others Non-Destructive Testing Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Non-Destructive Testing Market, Key Players are

1. Mistras Group Inc. 2. Olympus Corporation 3. GE Measurement & Control Solutions 4. Nikon Corporations 5. Ashtead Technology 6. Magnaflux Corporation 7. Zetec Inc. 8. Sonatest Ltd. 9. Sonotron NDT 10. Bosello High Technology SRL 11. Fischer Technology, Inc. 12. Eddyfi 13. JSR Ultrasonics 14. Source Production & Equipment Co., Inc. 15. Airstar Inc. 16. AMDATA Products (WesDyne) 17. Applus RTD 18. AT-Automation Technolo. 19. BALTEAU NDT 20. Canadian Institute for NDE 21. Controle Mesure Systemes 22. Cygnus Instruments Ltd.Frequently Asked Questions:

1. Which region has the largest share in Non-Destructive Testing Market? Ans: North America region holds the highest share in 2022. 2. What is the growth rate of Non-Destructive Testing Market? Ans: The Non-Destructive Testing Market is growing at a CAGR of 6.6% during forecasting period 2023-2029. 3. What segments are covered in Non-Destructive Testing market? Ans: Non-Destructive Testing Market is segmented into offering, test methods, verticals and region. 4. Who are the key players in Non-Destructive Testing market? Ans: The important key players in the Non-Destructive Testing Market are – Mistras Group Inc., Olympus Corporation, GE Measurement & Control Solutions, Nikon Corporations, Ashtead Technology, Magnaflux Corporation, Zetec Inc., Sonatest Ltd., Sonotron NDT, Bosello High Technology SRL, Fischer Technology, Inc., Eddyfi, JSR Ultrasonics, Source Production & Equipment Co., Inc., Airstar Inc., AMDATA Products (WesDyne), Applus RTD 5. What is the study period of this market? Ans: The Non-Destructive Testing Market is studied from 2022 to 2029.

1. Non-Destructive Testing Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Non-Destructive Testing Market: Dynamics 2.1. Non-Destructive Testing Market Trends by Region 2.1.1. North America Non-Destructive Testing Market Trends 2.1.2. Europe Non-Destructive Testing Market Trends 2.1.3. Asia Pacific Non-Destructive Testing Market Trends 2.1.4. Middle East and Africa Non-Destructive Testing Market Trends 2.1.5. South America Non-Destructive Testing Market Trends 2.2. Non-Destructive Testing Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Non-Destructive Testing Market Drivers 2.2.1.2. North America Non-Destructive Testing Market Restraints 2.2.1.3. North America Non-Destructive Testing Market Opportunities 2.2.1.4. North America Non-Destructive Testing Market Challenges 2.2.2. Europe 2.2.2.1. Europe Non-Destructive Testing Market Drivers 2.2.2.2. Europe Non-Destructive Testing Market Restraints 2.2.2.3. Europe Non-Destructive Testing Market Opportunities 2.2.2.4. Europe Non-Destructive Testing Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Non-Destructive Testing Market Drivers 2.2.3.2. Asia Pacific Non-Destructive Testing Market Restraints 2.2.3.3. Asia Pacific Non-Destructive Testing Market Opportunities 2.2.3.4. Asia Pacific Non-Destructive Testing Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Non-Destructive Testing Market Drivers 2.2.4.2. Middle East and Africa Non-Destructive Testing Market Restraints 2.2.4.3. Middle East and Africa Non-Destructive Testing Market Opportunities 2.2.4.4. Middle East and Africa Non-Destructive Testing Market Challenges 2.2.5. South America 2.2.5.1. South America Non-Destructive Testing Market Drivers 2.2.5.2. South America Non-Destructive Testing Market Restraints 2.2.5.3. South America Non-Destructive Testing Market Opportunities 2.2.5.4. South America Non-Destructive Testing Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Non-Destructive Testing Industry 2.8. Analysis of Government Schemes and Initiatives For Non-Destructive Testing Industry 2.9. Non-Destructive Testing Market Trade Analysis 2.10. The Global Pandemic Impact on Non-Destructive Testing Market 3. Non-Destructive Testing Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 3.1.1. Services 3.1.2. Equipment 3.2. Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 3.2.1. Visual Testing 3.2.2. Magnetic Particle Testing 3.2.3. Liquid Penetrant Testing 3.2.4. Eddy Current Testing 3.2.5. Ultrasonic Testing 3.2.6. Radiographic Testing 3.3. Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 3.3.1. Oil & Gas 3.3.2. Manufacturing 3.3.3. Aerospace and Defense 3.3.4. Construction 3.3.5. Automotive 3.3.6. Power Generation 3.3.7. Others 3.4. Non-Destructive Testing Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Non-Destructive Testing Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 4.1.1. Services 4.1.2. Equipment 4.2. North America Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 4.2.1. Visual Testing 4.2.2. Magnetic Particle Testing 4.2.3. Liquid Penetrant Testing 4.2.4. Eddy Current Testing 4.2.5. Ultrasonic Testing 4.2.6. Radiographic Testing 4.3. North America Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 4.3.1. Oil & Gas 4.3.2. Manufacturing 4.3.3. Aerospace and Defense 4.3.4. Construction 4.3.5. Automotive 4.3.6. Power Generation 4.3.7. Others 4.4. North America Non-Destructive Testing Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 4.4.1.1.1. Services 4.4.1.1.2. Equipment 4.4.1.2. United States Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 4.4.1.2.1. Visual Testing 4.4.1.2.2. Magnetic Particle Testing 4.4.1.2.3. Liquid Penetrant Testing 4.4.1.2.4. Eddy Current Testing 4.4.1.2.5. Ultrasonic Testing 4.4.1.2.6. Radiographic Testing 4.4.1.3. United States Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 4.4.1.3.1. Oil & Gas 4.4.1.3.2. Manufacturing 4.4.1.3.3. Aerospace and Defense 4.4.1.3.4. Construction 4.4.1.3.5. Automotive 4.4.1.3.6. Power Generation 4.4.1.3.7. Others 4.4.2. Canada 4.4.2.1. Canada Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 4.4.2.1.1. Services 4.4.2.1.2. Equipment 4.4.2.2. Canada Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 4.4.2.2.1. Visual Testing 4.4.2.2.2. Magnetic Particle Testing 4.4.2.2.3. Liquid Penetrant Testing 4.4.2.2.4. Eddy Current Testing 4.4.2.2.5. Ultrasonic Testing 4.4.2.2.6. Radiographic Testing 4.4.2.3. Canada Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 4.4.2.3.1. Oil & Gas 4.4.2.3.2. Manufacturing 4.4.2.3.3. Aerospace and Defense 4.4.2.3.4. Construction 4.4.2.3.5. Automotive 4.4.2.3.6. Power Generation 4.4.2.3.7. Others 4.4.3. Mexico 4.4.3.1. Mexico Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 4.4.3.1.1. Services 4.4.3.1.2. Equipment 4.4.3.2. Mexico Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 4.4.3.2.1. Visual Testing 4.4.3.2.2. Magnetic Particle Testing 4.4.3.2.3. Liquid Penetrant Testing 4.4.3.2.4. Eddy Current Testing 4.4.3.2.5. Ultrasonic Testing 4.4.3.2.6. Radiographic Testing 4.4.3.3. Mexico Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 4.4.3.3.1. Oil & Gas 4.4.3.3.2. Manufacturing 4.4.3.3.3. Aerospace and Defense 4.4.3.3.4. Construction 4.4.3.3.5. Automotive 4.4.3.3.6. Power Generation 4.4.3.3.7. Others 5. Europe Non-Destructive Testing Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 5.2. Europe Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 5.3. Europe Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 5.4. Europe Non-Destructive Testing Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 5.4.1.2. United Kingdom Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 5.4.1.3. United Kingdom Non-Destructive Testing Market Size and Forecast, by Verticals(2022-2029) 5.4.2. France 5.4.2.1. France Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 5.4.2.2. France Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 5.4.2.3. France Non-Destructive Testing Market Size and Forecast, by Verticals(2022-2029) 5.4.3. Germany 5.4.3.1. Germany Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 5.4.3.2. Germany Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 5.4.3.3. Germany Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 5.4.4.2. Italy Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 5.4.4.3. Italy Non-Destructive Testing Market Size and Forecast, by Verticals(2022-2029) 5.4.5. Spain 5.4.5.1. Spain Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 5.4.5.2. Spain Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 5.4.5.3. Spain Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 5.4.6.2. Sweden Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 5.4.6.3. Sweden Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 5.4.7.2. Austria Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 5.4.7.3. Austria Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 5.4.8.2. Rest of Europe Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 5.4.8.3. Rest of Europe Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 6. Asia Pacific Non-Destructive Testing Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 6.2. Asia Pacific Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 6.3. Asia Pacific Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 6.4. Asia Pacific Non-Destructive Testing Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 6.4.1.2. China Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 6.4.1.3. China Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 6.4.2.2. S Korea Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 6.4.2.3. S Korea Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 6.4.3.2. Japan Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 6.4.3.3. Japan Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 6.4.4. India 6.4.4.1. India Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 6.4.4.2. India Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 6.4.4.3. India Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 6.4.5.2. Australia Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 6.4.5.3. Australia Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 6.4.6.2. Indonesia Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 6.4.6.3. Indonesia Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 6.4.7.2. Malaysia Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 6.4.7.3. Malaysia Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 6.4.8.2. Vietnam Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 6.4.8.3. Vietnam Non-Destructive Testing Market Size and Forecast, by Verticals(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 6.4.9.2. Taiwan Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 6.4.9.3. Taiwan Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 6.4.10.2. Rest of Asia Pacific Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 6.4.10.3. Rest of Asia Pacific Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 7. Middle East and Africa Non-Destructive Testing Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 7.2. Middle East and Africa Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 7.3. Middle East and Africa Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 7.4. Middle East and Africa Non-Destructive Testing Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 7.4.1.2. South Africa Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 7.4.1.3. South Africa Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 7.4.2.2. GCC Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 7.4.2.3. GCC Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 7.4.3.2. Nigeria Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 7.4.3.3. Nigeria Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 7.4.4.2. Rest of ME&A Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 7.4.4.3. Rest of ME&A Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 8. South America Non-Destructive Testing Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 8.2. South America Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 8.3. South America Non-Destructive Testing Market Size and Forecast, by Verticals(2022-2029) 8.4. South America Non-Destructive Testing Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 8.4.1.2. Brazil Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 8.4.1.3. Brazil Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 8.4.2.2. Argentina Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 8.4.2.3. Argentina Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Non-Destructive Testing Market Size and Forecast, by Offering (2022-2029) 8.4.3.2. Rest Of South America Non-Destructive Testing Market Size and Forecast, by Test Method (2022-2029) 8.4.3.3. Rest Of South America Non-Destructive Testing Market Size and Forecast, by Verticals (2022-2029) 9. Global Non-Destructive Testing Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Non-Destructive Testing Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Mistras Group Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Olympus Corporation 10.3. GE Measurement & Control Solutions 10.4. Nikon Corporations 10.5. Ashtead Technology 10.6. Magnaflux Corporation 10.7. Zetec Inc. 10.8. Sonatest Ltd. 10.9. Sonotron NDT 10.10. Bosello High Technology SRL 10.11. Fischer Technology, Inc. 10.12. Eddyfi 10.13. JSR Ultrasonics 10.14. Source Production & Equipment Co., Inc. 10.15. Airstar Inc. 10.16. AMDATA Products (WesDyne) 10.17. Applus RTD 10.18. AT-Automation Technolo. 10.19. BALTEAU NDT 10.20. Canadian Institute for NDE 10.21. Controle Mesure Systemes 10.22. Cygnus Instruments Ltd. 10.23. Company23 10.24. Company24 10.25. Company25 10.26. Company26 10.27. Company27 10.28. Company28 10.29. Company29 10.30. Company30 11. Key Findings 12. Industry Recommendations 13. Non-Destructive Testing Market: Research Methodology 14. Terms and Glossary