Mobile Payment Technology Market is expected to grow at a CAGR of 29% during the forecast period and market is expected to reach US$ 1968.63 Bn. by 2029. The report includes an analysis of the impact of COVID-19 lockdown on the revenue of market leaders, followers, and disruptors. Since the lockdown was implemented differently in various regions and countries; the impact of the same is also seen differently by regions and segments. The report has covered the current short-term and long-term impact on the market, and it would help the decision-makers to prepare the outline and strategies for companies by region.To know about the Research Methodology:-Request Free Sample Report

Mobile Payment Technology Market Dynamics:

Mobile payment can be used for the payment of goods or services and the transfer of money through mobiles or smartphones. Growth in E-commerce, the introduction of innovative facilities by the key players are the main driving factors for the growth of the global mobile payment technology market. However, it has been observed that the number of users is increasing day by day as everything is available online so the most efficient way to pay for anything or purchasing things is provided by mobile payment technology. But, network issues or connection failure, a power failure will be limiting the growth of the market. Instead of going to stores and purchasing things, it is most convenient for today’s generation to pay online and order whatever you wish to. We can order food online, book hotel rooms, e-banking, e-tickets, and many other options, which require mobile payment methods. The risks associated with processing mobile payments including the financial details of the card owner during the transaction pose a major challenge for the market growth. Government initiatives in promoting digital payment create new opportunities in the mobile payment technology market.Mobile Payment Technology Market Segment Analysis

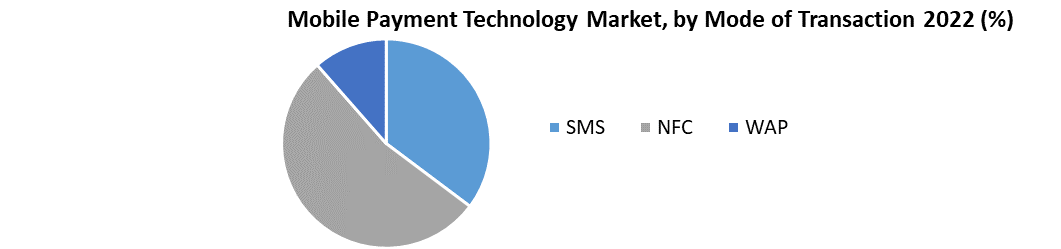

NFC segment is anticipated to boost the mobile payment technology market on account of NFC-enabled smartphones. Various applications pertaining to mobile payment technology are BFSI, retail, healthcare, entertainment, IT and telecom, energy & utilities, hospitality & tourism, and others. The increasing adoption of mobile payments in the banking sector is expected to boost BFSI’s in the estimated timeframe. Mobile wallets dominated the mobile payment technology market because of the increased penetration of digitalization. Mobile wallets are a relatively new payment option that can offer some serious benefits. Apple Pay, Samsung Pay, and Android Pal work across all major devices. Mobile wallet reduces fraud and reduces content in the wallet. Other popular wallet apps are retailer or brand-specific, such as Wal-Mart stores, Walmart pay, capital one financial corporation's (COF) Capital One Wallet, and the ubiquitous Starbucks wallet app from Starbucks Corporation (SBUX). The entertainment application segment dominated the market in 2022 and will continue its dominance throughout the forecast period. Digital entertainment is undergoing a revolution. The proliferation of smartphones, rapid product innovations, increased consumer connectivity and the growth of social media have powered the digital entertainment revolution. This has drastically changed the way that customers purchase and consume games, movies, and music.

Mobile Payment Technology Market Regional Insights

North America contributed a major share in the global mobile payment technology market in terms of revenue, owing to the significant adoption of mobile phones in the U.S. Asia Pacific will exhibit growth at a faster pace. In India, the “Digital India” initiative by the government will be giving major acceleration to the growing Asia Pacific region. While in China contributing factors include the rapid growth of e-commerce, the relatively low adoption of other payment methods such as credit cards, and the availability of mobile payment services. The technology is increasingly being used in BFSI and government sectors, as it offers both security and transparency along with a quick payment preprocess. The objective of the report is to present a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, industry-validated market data, and projections with a suitable set of assumptions and methodology. The report also helps in understanding mobile payment technology market dynamics, structure by identifying and analyzing the market segments and project the global market size. Further, the report also focuses on the competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence. The report also helps in understanding Mobile Payment Technology Market dynamics, structure by analyzing the market segments and project the Mobile Payment Technology Market size. Clear representation of competitive analysis of key players by type, price, financial position, product portfolio, growth strategies, and regional presence in the Mobile Payment Technology Market make the report investor’s guide.Mobile Payment Technology Market Scope: Inquire before buying

Mobile Payment Technology Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 331.15 Bn. Forecast Period 2023 to 2029 CAGR: 29% Market Size in 2029: US $ 1968.63 Bn. Segments Covered: by Mode of Transaction • SMS • NFC • WAP by Type of Mobile Payment • Mobile Wallet • Bank Cards • Mobile Money by Application • Entertainment • Energy & Utilities • Healthcare • Retail • Hospitality • Transportation by Purchase Type • Airtime Transfers & Top-ups • Money Transfers & Payments • Merchandise & Coupons • Travel & Ticketing Mobile Payment Technology Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Mobile Payment Technology Market Key Players

• Orange S.A. • Vodacom Group Limited • MasterCard Incorporated • Bharti Airtel Limited • MTN Group Limited • Safaricom Limited • PayPal Holdings Inc. • Econet Wireless Zimbabwe Limited • Millicom International Cellular SA • Mahindra Comviva • AT &T’S • JIO • Apple Inc. • Google LLC. • One97 Communications Limited. • Venmo. • Vodafone Group Plc Frequently Asked Questions: 1. Which region has the largest share in Global Mobile Payment Technology Market? Ans: North America region held the highest share in 2022. 2. What is the growth rate of Global Mobile Payment Technology Market? Ans: The Global Mobile Payment Technology Market is growing at a CAGR of 29% during forecasting period 2023-2029. 3. What is scope of the Global Mobile Payment Technology Market report? Ans: Global Mobile Payment Technology Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Mobile Payment Technology Market? Ans: The important key players in the Global Mobile Payment Technology Market are – Orange S.A., Vodacom Group Limited, MasterCard Incorporated, Bharti Airtel Limited, MTN Group Limited, Safaricom Limited, PayPal Holdings Inc., Econet Wireless Zimbabwe Limited, Millicom International Cellular SA, Mahindra Comviva, AT &T’S, JIO, Apple Inc., Google LLC., One97 Communications Limited., Venmo., Vodafone Group Plc 5. What is the study period of this Market? Ans: The Global Mobile Payment Technology Market is studied from 2022 to 2029.

Mobile Payment Technology Market

1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 1.4. Key Questions Answered 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations Used 2.3. Research Methodology 3. Executive Summary 3.1. Global Mobile Payment Technology Market Size, By Market Value (US$ Mn) and Market, By Region 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.3. Drivers and Restraints Snapshot Analysis 4.3.1. Drivers 4.3.2. Restraints 4.3.3. Opportunities 4.3.4. Porter’s Analysis 4.3.5. Value Chain Analysis 4.3.6. SWOT Analysis 5. Global Mobile Payment Technology Market Analysis and Forecast 5.1. Global Mobile Payment Technology Market Analysis and Forecast 5.2. Global Mobile Payment Technology Market Size& Y-o-Y Growth Analysis 5.2.1. North America 5.2.2. Europe 5.2.3. Asia Pacific 5.2.4. Middle East & Africa 5.2.5. Latin America 6. Global Mobile Payment Technology Market Analysis and Forecast, By Mode of Transaction 6.1. Introduction and Definition 6.2. Key Findings 6.3. Global Mobile Payment Technology Market Value Share Analysis, By Mode of Transaction 6.4. Market Size (US$ Mn) Forecast, By Mode of Transaction 6.5. Mobile Payment Technology Market Analysis, By Mode of Transaction 6.6. Global Mobile Payment Technology Market Attractiveness Analysis, By Mode of Transaction 7. Global Mobile Payment Technology Market Analysis and Forecast, By Type of Mobile Payment 7.1. Introduction and Definition 7.2. Global Mobile Payment Technology Market Value Share Analysis, By Type of Mobile Payment 7.3. Market Size (US$ Mn) Forecast, By Type of Mobile Payment 7.4. Global Mobile Payment Technology Market Analysis, By Type of Mobile Payment 7.5. Global Mobile Payment Technology Market Attractiveness Analysis, By Type of Mobile Payment 8. Global Mobile Payment Technology Market Analysis and Forecast, By Application 8.1. Introduction and Definition 8.2. Global Mobile Payment Technology Market Value Share Analysis, By Application 8.3. Market Size (US$ Mn) Forecast, By Application 8.4. Global Mobile Payment Technology Market Analysis, By Application 8.5. Global Mobile Payment Technology Market Attractiveness Analysis, By Application 9. Global Mobile Payment Technology Market Analysis and Forecast, By Purchase Type 9.1. Introduction and Definition 9.2. Global Mobile Payment Technology Market Value Share Analysis, By Purchase Type 9.3. Market Size (US$ Mn) Forecast, By Purchase Type 9.4. Global Mobile Payment Technology Market Analysis, By Purchase Type 9.5. Global Mobile Payment Technology Market Attractiveness Analysis, By Purchase Type 10. Global Mobile Payment Technology Market Analysis, By Region 10.1. Global Mobile Payment Technology Market Value Share Analysis, By Region 10.2. Market Size (US$ Mn) Forecast, By Region 10.3. Global Mobile Payment Technology Market Attractiveness Analysis, By Region 11. North America Mobile Payment Technology Market Analysis 11.1. Key Findings 11.2. North America Mobile Payment Technology Market Overview 11.3. North America Mobile Payment Technology Market Value Share Analysis, By Mode of Transaction 11.4. North America Mobile Payment Technology Market Forecast, By Mode of Transaction 11.4.1. SMS 11.4.2. NFC 11.4.3. WAP 11.5. North America Mobile Payment Technology Market Value Share Analysis, By Type of Mobile Payment 11.6. North America Mobile Payment Technology Market Forecast, By Type of Mobile Payment 11.6.1. Mobile Wallet 11.6.2. Bank Cards 11.6.3. Mobile Money 11.7. North America Mobile Payment Technology Market Value Share Analysis, By Application 11.8. North America Mobile Payment Technology Market Forecast, By Application 11.8.1. Entertainment 11.8.2. Energy & Utilities 11.8.3. Healthcare 11.8.4. Retail 11.8.5. Hospitality 11.8.6. Transportation 11.9. North America Mobile Payment Technology Market Value Share Analysis, By Purchase Type 11.10. North America Mobile Payment Technology Market Forecast, By Purchase Type 11.10.1. Airtime Transfers & Top-ups 11.10.2. Money Transfers & Payments 11.10.3. Merchandise & Coupons 11.10.4. Travel & Ticketing 11.11. North America Mobile Payment Technology Market Value Share Analysis, By Country 11.12. North America Mobile Payment Technology Market Forecast, By Country 11.12.1.1. U.S., 2022–2029 11.12.1.2. Canada, 2022–2029 11.13. North America Mobile Payment Technology Market Analysis, By Country 11.14. U.S. Mobile Payment Technology Market Forecast, By Mode of Transaction 11.14.1. SMS 11.14.2. NFC 11.14.3. WAP 11.15. U.S. Mobile Payment Technology Market Forecast, By Type of Mobile Payment 11.15.1. Mobile Wallet 11.15.2. Bank Cards 11.15.3. Mobile Money 11.16. U.S. Mobile Payment Technology Market Forecast, By Application 11.16.1. Entertainment 11.16.2. Energy & Utilities 11.16.3. Healthcare 11.16.4. Retail 11.16.5. Hospitality 11.16.6. Transportation 11.17. U.S. Mobile Payment Technology Market Forecast, By Purchase Type 11.17.1. Airtime Transfers & Top-ups 11.17.2. Money Transfers & Payments 11.17.3. Merchandise & Coupons 11.17.4. Travel & Ticketing 11.18. Canada Mobile Payment Technology Market Forecast, By Mode of Transaction 11.18.1. SMS 11.18.2. NFC 11.18.3. WAP 11.19. Canada Mobile Payment Technology Market Forecast, By Type of Mobile Payment 11.19.1. Mobile Wallet 11.19.2. Bank Cards 11.19.3. Mobile Money 11.20. Canada Mobile Payment Technology Market Forecast, By Application 11.20.1. Entertainment 11.20.2. Energy & Utilities 11.20.3. Healthcare 11.20.4. Retail 11.20.5. Hospitality 11.20.6. Transportation 11.21. Canada Mobile Payment Technology Market Forecast, By Purchase Type 11.21.1. Airtime Transfers & Top-ups 11.21.2. Money Transfers & Payments 11.21.3. Merchandise & Coupons 11.21.4. Travel & Ticketing 11.22. North America Mobile Payment Technology Market Attractiveness Analysis 11.22.1. By Mode of Transaction 11.22.2. By Type of Mobile Payment 11.22.3. By Application 11.22.4. By Purchase Type 11.23. PEST Analysis 12. Europe Mobile Payment Technology Market Analysis 12.1. Key Findings 12.2. Europe Mobile Payment Technology Market Overview 12.3. Europe Mobile Payment Technology Market Value Share Analysis, By Mode of Transaction 12.4. Europe Mobile Payment Technology Market Forecast, By Mode of Transaction 12.4.1. SMS 12.4.2. NFC 12.4.3. WAP 12.5. Europe Mobile Payment Technology Market Value Share Analysis, By Type of Mobile Payment 12.6. Europe Mobile Payment Technology Market Forecast, By Type of Mobile Payment 12.6.1. Mobile Wallet 12.6.2. Bank Cards 12.6.3. Mobile Money 12.7. Europe Mobile Payment Technology Market Value Share Analysis, By Application 12.8. Europe Mobile Payment Technology Market Forecast, By Application 12.8.1. Entertainment 12.8.2. Energy & Utilities 12.8.3. Healthcare 12.8.4. Retail 12.8.5. Hospitality 12.8.6. Transportation 12.9. Europe Mobile Payment Technology Market Value Share Analysis, By Purchase Type 12.10. Europe Mobile Payment Technology Market Forecast, By Purchase Type 12.10.1. Airtime Transfers & Top-ups 12.10.2. Money Transfers & Payments 12.10.3. Merchandise & Coupons 12.10.4. Travel & Ticketing 12.11. Europe Mobile Payment Technology Market Value Share Analysis, By Country 12.12. Europe Mobile Payment Technology Market Forecast, By Country 12.12.1.1. Germany 12.12.1.2. U.K. 12.12.1.3. France 12.12.1.4. Italy 12.12.1.5. Spain 12.12.1.6. Rest of Europe 12.13. Europe Mobile Payment Technology Market Analysis, By Country/ Sub-region 12.14. Germany Mobile Payment Technology Market Forecast, By Mode of Transaction 12.14.1. SMS 12.14.2. NFC 12.14.3. WAP 12.15. Germany Mobile Payment Technology Market Forecast, By Type of Mobile Payment 12.15.1. Mobile Wallet 12.15.2. Bank Cards 12.15.3. Mobile Money 12.16. Germany Mobile Payment Technology Market Forecast, By Application 12.16.1. Entertainment 12.16.2. Energy & Utilities 12.16.3. Healthcare 12.16.4. Retail 12.16.5. Hospitality 12.16.6. Transportation 12.17. Germany Mobile Payment Technology Market Forecast, By Purchase Type 12.17.1. Airtime Transfers & Top-ups 12.17.2. Money Transfers & Payments 12.17.3. Merchandise & Coupons 12.17.4. Travel & Ticketing 12.18. U.K. Mobile Payment Technology Market Forecast, By Mode of Transaction 12.18.1. SMS 12.18.2. NFC 12.18.3. WAP 12.19. U.K. Mobile Payment Technology Market Forecast, By Type of Mobile Payment 12.19.1. Mobile Wallet 12.19.2. Bank Cards 12.19.3. Mobile Money 12.20. U.K. Mobile Payment Technology Market Forecast, By Application 12.20.1. Entertainment 12.20.2. Energy & Utilities 12.20.3. Healthcare 12.20.4. Retail 12.20.5. Hospitality 12.20.6. Transportation 12.21. U.K. Mobile Payment Technology Market Forecast, By Purchase Type 12.21.1. Airtime Transfers & Top-ups 12.21.2. Money Transfers & Payments 12.21.3. Merchandise & Coupons 12.21.4. Travel & Ticketing 12.22. France Mobile Payment Technology Market Forecast, By Mode of Transaction 12.22.1. SMS 12.22.2. NFC 12.22.3. WAP 12.23. France Mobile Payment Technology Market Forecast, By Type of Mobile Payment 12.23.1. Mobile Wallet 12.23.2. Bank Cards 12.23.3. Mobile Money 12.24. France Mobile Payment Technology Market Forecast, By Application 12.24.1. Entertainment 12.24.2. Energy & Utilities 12.24.3. Healthcare 12.24.4. Retail 12.24.5. Hospitality 12.24.6. Transportation 12.25. France Mobile Payment Technology Market Forecast, By Purchase Type 12.25.1. Airtime Transfers & Top-ups 12.25.2. Money Transfers & Payments 12.25.3. Merchandise & Coupons 12.25.4. Travel & Ticketing 12.26. Italy Mobile Payment Technology Market Forecast, By Mode of Transaction 12.26.1. SMS 12.26.2. NFC 12.26.3. WAP 12.27. Italy Mobile Payment Technology Market Forecast, By Type of Mobile Payment 12.27.1. Mobile Wallet 12.27.2. Bank Cards 12.27.3. Mobile Money 12.28. Italy Mobile Payment Technology Market Forecast, By Application 12.28.1. Entertainment 12.28.2. Energy & Utilities 12.28.3. Healthcare 12.28.4. Retail 12.28.5. Hospitality 12.28.6. Transportation 12.29. Italy Mobile Payment Technology Market Forecast, By Purchase Type 12.29.1. Airtime Transfers & Top-ups 12.29.2. Money Transfers & Payments 12.29.3. Merchandise & Coupons 12.29.4. Travel & Ticketing 12.30. Spain Mobile Payment Technology Market Forecast, By Mode of Transaction 12.30.1. SMS 12.30.2. NFC 12.30.3. WAP 12.31. Spain Mobile Payment Technology Market Forecast, By Type of Mobile Payment 12.31.1. Mobile Wallet 12.31.2. Bank Cards 12.31.3. Mobile Money 12.32. Spain Mobile Payment Technology Market Forecast, By Application 12.32.1. Entertainment 12.32.2. Energy & Utilities 12.32.3. Healthcare 12.32.4. Retail 12.32.5. Hospitality 12.32.6. Transportation 12.33. Spain Mobile Payment Technology Market Forecast, By Purchase Type 12.33.1. Airtime Transfers & Top-ups 12.33.2. Money Transfers & Payments 12.33.3. Merchandise & Coupons 12.33.4. Travel & Ticketing 12.34. Rest of Europe Mobile Payment Technology Market Forecast, By Mode of Transaction 12.34.1. SMS 12.34.2. NFC 12.34.3. WAP 12.35. Rest of Europe Mobile Payment Technology Market Forecast, By Type of Mobile Payment 12.35.1. Mobile Wallet 12.35.2. Bank Cards 12.35.3. Mobile Money 12.36. Rest of Europe Mobile Payment Technology Market Forecast, By Application 12.36.1. Entertainment 12.36.2. Energy & Utilities 12.36.3. Healthcare 12.36.4. Retail 12.36.5. Hospitality 12.36.6. Transportation 12.37. Rest Of Europe Mobile Payment Technology Market Forecast, By Purchase Type 12.37.1. Airtime Transfers & Top-ups 12.37.2. Money Transfers & Payments 12.37.3. Merchandise & Coupons 12.37.4. Travel & Ticketing 12.38. Europe Mobile Payment Technology Market Attractiveness Analysis 12.38.1. By Mode of Transaction 12.38.2. By Type of Mobile Payment 12.38.3. By Application 12.38.4. By Purchase Type 12.39. PEST Analysis 13. Asia Pacific Mobile Payment Technology Market Analysis 13.1. Key Findings 13.2. Asia Pacific Mobile Payment Technology Market Overview 13.3. Asia Pacific Mobile Payment Technology Market Value Share Analysis, By Mode of Transaction 13.4. Asia Pacific Mobile Payment Technology Market Forecast, By Mode of Transaction 13.4.1. SMS 13.4.2. NFC 13.4.3. WAP 13.5. Asia Pacific Mobile Payment Technology Market Value Share Analysis, By Type of Mobile Payment 13.6. Asia Pacific Mobile Payment Technology Market Forecast, By Type of Mobile Payment 13.6.1. Mobile Wallet 13.6.2. Bank Cards 13.6.3. Mobile Money 13.7. Asia Pacific Mobile Payment Technology Market Value Share Analysis, By Application 13.8. Asia Pacific Mobile Payment Technology Market Forecast, By Application 13.8.1. Entertainment 13.8.2. Energy & Utilities 13.8.3. Healthcare 13.8.4. Retail 13.8.5. Hospitality 13.8.6. Transportation 13.9. Asia Pacific Mobile Payment Technology Market Value Share Analysis, By Purchase Type 13.10. Asia Pacific Mobile Payment Technology Market Forecast, By Purchase Type 13.10.1. Airtime Transfers & Top-ups 13.10.2. Money Transfers & Payments 13.10.3. Merchandise & Coupons 13.10.4. Travel & Ticketing 13.11. Asia Pacific Mobile Payment Technology Market Value Share Analysis, By Country 13.12. Asia Pacific Mobile Payment Technology Market Forecast, By Country 13.12.1. China, 2022–2029 13.12.2. India, 2022–2029 13.12.3. Japan, 2022–2029 13.12.4. ASEAN, 2022–2029 13.12.5. Rest of Asia Pacific, 2022–2029 13.13. Asia Pacific Mobile Payment Technology Market Analysis, By Country/ Sub-region 13.14. China Mobile Payment Technology Market Forecast, By Mode of Transaction 13.14.1. SMS 13.14.2. NFC 13.14.3. WAP 13.15. China Mobile Payment Technology Market Forecast, By Type of Mobile Payment 13.15.1. Mobile Wallet 13.15.2. Bank Cards 13.15.3. Mobile Money 13.16. China Mobile Payment Technology Market Forecast, By Application 13.16.1. Entertainment 13.16.2. Energy & Utilities 13.16.3. Healthcare 13.16.4. Retail 13.16.5. Hospitality 13.16.6. Transportation 13.17. China Mobile Payment Technology Market Forecast, By Purchase Type 13.17.1. Airtime Transfers & Top-ups 13.17.2. Money Transfers & Payments 13.17.3. Merchandise & Coupons 13.17.4. Travel & Ticketing 13.18. India Mobile Payment Technology Market Forecast, By Mode of Transaction 13.18.1. SMS 13.18.2. NFC 13.18.3. WAP 13.19. India Mobile Payment Technology Market Forecast, By Type of Mobile Payment 13.19.1. Mobile Wallet 13.19.2. Bank Cards 13.19.3. Mobile Money 13.20. India Mobile Payment Technology Market Forecast, By Application 13.20.1. Entertainment 13.20.2. Energy & Utilities 13.20.3. Healthcare 13.20.4. Retail 13.20.5. Hospitality 13.20.6. Transportation 13.21. India Mobile Payment Technology Market Forecast, By Purchase Type 13.21.1. Airtime Transfers & Top-ups 13.21.2. Money Transfers & Payments 13.21.3. Merchandise & Coupons 13.21.4. Travel & Ticketing 13.22. Japan Mobile Payment Technology Market Forecast, By Mode of Transaction 13.22.1. SMS 13.22.2. NFC 13.22.3. WAP 13.23. Japan Mobile Payment Technology Market Forecast, By Type of Mobile Payment 13.23.1. Mobile Wallet 13.23.2. Bank Cards 13.23.3. Mobile Money 13.24. Japan Mobile Payment Technology Market Forecast, By Application 13.24.1. Entertainment 13.24.2. Energy & Utilities 13.24.3. Healthcare 13.24.4. Retail 13.24.5. Hospitality 13.24.6. Transportation 13.25. Japan Mobile Payment Technology Market Forecast, By Purchase Type 13.25.1. Airtime Transfers & Top-ups 13.25.2. Money Transfers & Payments 13.25.3. Merchandise & Coupons 13.25.4. Travel & Ticketing 13.26. ASEAN Mobile Payment Technology Market Forecast, By Mode of Transaction 13.26.1. SMS 13.26.2. NFC 13.26.3. WAP 13.27. ASEAN Mobile Payment Technology Market Forecast, By Type of Mobile Payment 13.27.1. Mobile Wallet 13.27.2. Bank Cards 13.27.3. Mobile Money 13.28. ASEAN Mobile Payment Technology Market Forecast, By Application 13.28.1. Entertainment 13.28.2. Energy & Utilities 13.28.3. Healthcare 13.28.4. Retail 13.28.5. Hospitality 13.28.6. Transportation 13.29. ASEAN Mobile Payment Technology Market Forecast, By Purchase Type 13.29.1. Airtime Transfers & Top-ups 13.29.2. Money Transfers & Payments 13.29.3. Merchandise & Coupons 13.29.4. Travel & Ticketing 13.30. Rest of Asia Pacific Mobile Payment Technology Market Forecast, By Mode of Transaction 13.30.1. SMS 13.30.2. NFC 13.30.3. WAP 13.31. Rest of Asia Pacific Mobile Payment Technology Market Forecast, By Type of Mobile Payment 13.31.1. Mobile Wallet 13.31.2. Bank Cards 13.31.3. Mobile Money 13.32. Rest of Asia Pacific Mobile Payment Technology Market Forecast, By Application 13.32.1. Entertainment 13.32.2. Energy & Utilities 13.32.3. Healthcare 13.32.4. Retail 13.32.5. Hospitality 13.32.6. Transportation 13.33. Rest of Asia Pacific Mobile Payment Technology Market Forecast, By Purchase Type 13.33.1. Airtime Transfers & Top-ups 13.33.2. Money Transfers & Payments 13.33.3. Merchandise & Coupons 13.33.4. Travel & Ticketing 13.34. Asia Pacific Mobile Payment Technology Market Attractiveness Analysis 13.34.1. By Mode of Transaction 13.34.2. By Type of Mobile Payment 13.34.3. By Application 13.34.4. By Purchase Type 13.35. PEST Analysis 14. Middle East & Africa Mobile Payment Technology Market Analysis 14.1. Key Findings 14.2. Middle East & Africa Mobile Payment Technology Market Overview 14.3. Middle East & Africa Mobile Payment Technology Market Value Share Analysis, By Mode of Transaction 14.4. Middle East & Africa Mobile Payment Technology Market Forecast, By Mode of Transaction 14.4.1. SMS 14.4.2. NFC 14.4.3. WAP 14.5. Middle East & Africa Mobile Payment Technology Market Value Share Analysis, By Type of Mobile Payment 14.6. Middle East & Africa Mobile Payment Technology Market Forecast, By Type of Mobile Payment 14.6.1. Mobile Wallet 14.6.2. Bank Cards 14.6.3. Mobile Money 14.7. Middle East & Africa Mobile Payment Technology Market Value Share Analysis, By Application 14.8. Middle East & Africa Mobile Payment Technology Market Forecast, By Application 14.8.1. Entertainment 14.8.2. Energy & Utilities 14.8.3. Healthcare 14.8.4. Retail 14.8.5. Hospitality 14.8.6. Transportation 14.9. Middle East & Africa Mobile Payment Technology Market Value Share Analysis, By Purchase Type 14.10. Middle East & Africa Mobile Payment Technology Market Forecast, By Purchase Type 14.10.1. Airtime Transfers & Top-ups 14.10.2. Money Transfers & Payments 14.10.3. Merchandise & Coupons 14.10.4. Travel & Ticketing 14.11. Middle East & Africa Mobile Payment Technology Market Value Share Analysis, By Country 14.12. Middle East & Africa Mobile Payment Technology Market Forecast, By Country 14.12.1. GCC, 2022–2029 14.12.2. South Africa, 2022–2029 14.12.3. Rest of Middle East & Africa, 2022–2029 14.13. Middle East & Africa Mobile Payment Technology Market Analysis, By Country/ Sub-region 14.14. GCC Mobile Payment Technology Market Forecast, By Mode of Transaction 14.14.1. SMS 14.14.2. NFC 14.14.3. WAP 14.15. GCC Mobile Payment Technology Market Forecast, By Type of Mobile Payment 14.15.1. Mobile Wallet 14.15.2. Bank Cards 14.15.3. Mobile Money 14.16. GCC Mobile Payment Technology Market Forecast, By Application 14.16.1. Entertainment 14.16.2. Energy & Utilities 14.16.3. Healthcare 14.16.4. Retail 14.16.5. Hospitality 14.16.6. Transportation 14.17. GCC Mobile Payment Technology Market Forecast, By Purchase Type 14.17.1. Airtime Transfers & Top-ups 14.17.2. Money Transfers & Payments 14.17.3. Merchandise & Coupons 14.17.4. Travel & Ticketing 14.18. South Africa Mobile Payment Technology Market Forecast, By Mode of Transaction 14.18.1. SMS 14.18.2. NFC 14.18.3. WAP 14.19. South Africa Mobile Payment Technology Market Forecast, By Type of Mobile Payment 14.19.1. Mobile Wallet 14.19.2. Bank Cards 14.19.3. Mobile Money 14.20. South Africa Mobile Payment Technology Market Forecast, By Application 14.20.1. Entertainment 14.20.2. Energy & Utilities 14.20.3. Healthcare 14.20.4. Retail 14.20.5. Hospitality 14.20.6. Transportation 14.21. South Africa Mobile Payment Technology Market Forecast, By Purchase Type 14.21.1. Airtime Transfers & Top-ups 14.21.2. Money Transfers & Payments 14.21.3. Merchandise & Coupons 14.21.4. Travel & Ticketing 14.22. Rest of Middle East & Africa Mobile Payment Technology Market Forecast, By Mode of Transaction 14.22.1. SMS 14.22.2. NFC 14.22.3. WAP 14.23. Rest of Middle East & Africa Mobile Payment Technology Market Forecast, By Type of Mobile Payment 14.23.1. Mobile Wallet 14.23.2. Bank Cards 14.23.3. Mobile Money 14.24. Rest of Middle East & Africa Mobile Payment Technology Market Forecast, By Application 14.24.1. Entertainment 14.24.2. Energy & Utilities 14.24.3. Healthcare 14.24.4. Retail 14.24.5. Hospitality 14.24.6. Transportation 14.25. Rest of Middle East & Africa Mobile Payment Technology Market Forecast, By Purchase Type 14.25.1. Airtime Transfers & Top-ups 14.25.2. Money Transfers & Payments 14.25.3. Merchandise & Coupons 14.25.4. Travel & Ticketing 14.26. Middle East & Africa Mobile Payment Technology Market Attractiveness Analysis 14.26.1. By Mode of Transaction 14.26.2. By Type of Mobile Payment 14.26.3. By Application 14.26.4. By Purchase Type 14.27. PEST Analysis 15. Latin America Mobile Payment Technology Market Analysis 15.1. Key Findings 15.2. Latin America Mobile Payment Technology Market Overview 15.3. Latin America Mobile Payment Technology Market Value Share Analysis, By Mode of Transaction 15.4. Latin America Mobile Payment Technology Market Forecast, By Mode of Transaction 15.4.1. SMS 15.4.2. NFC 15.4.3. WAP 15.5. Latin America Mobile Payment Technology Market Value Share Analysis, By Type of Mobile Payment 15.6. Latin America Mobile Payment Technology Market Forecast, By Type of Mobile Payment 15.6.1. Mobile Wallet 15.6.2. Bank Cards 15.6.3. Mobile Money 15.7. Latin America Mobile Payment Technology Market Value Share Analysis, By Application 15.8. Latin America Mobile Payment Technology Market Forecast, By Application 15.8.1. Entertainment 15.8.2. Energy & Utilities 15.8.3. Healthcare 15.8.4. Retail 15.8.5. Hospitality 15.8.6. Transportation 15.9. Latin America Mobile Payment Technology Market Value Share Analysis, By Purchase Type 15.10. Latin America Mobile Payment Technology Market Forecast, By Purchase Type 15.10.1. Airtime Transfers & Top-ups 15.10.2. Money Transfers & Payments 15.10.3. Merchandise & Coupons 15.10.4. Travel & Ticketing 15.11. Latin America Mobile Payment Technology Market Value Share Analysis, By Country 15.12. Latin America Mobile Payment Technology Market Forecast, By Country 15.12.1.1. Brazil, 2022–2029 15.12.1.2. Mexico, 2022–2029 15.12.1.3. Rest of Latin America, 2022–2029 15.13. Latin America Mobile Payment Technology Market Analysis, By Country/ Sub-region 15.14. Brazil Mobile Payment Technology Market Forecast, By Mode of Transaction 15.14.1. SMS 15.14.2. NFC 15.14.3. WAP 15.15. Brazil Mobile Payment Technology Market Forecast, By Type of Mobile Payment 15.15.1. Mobile Wallet 15.15.2. Bank Cards 15.15.3. Mobile Money 15.16. Brazil Mobile Payment Technology Market Forecast, By Application 15.16.1. Entertainment 15.16.2. Energy & Utilities 15.16.3. Healthcare 15.16.4. Retail 15.16.5. Hospitality 15.16.6. Transportation 15.17. Brazil Mobile Payment Technology Market Forecast, By Purchase Type 15.17.1. Airtime Transfers & Top-ups 15.17.2. Money Transfers & Payments 15.17.3. Merchandise & Coupons 15.17.4. Travel & Ticketing 15.18. Mexico Mobile Payment Technology Market Forecast, By Mode of Transaction 15.18.1. SMS 15.18.2. NFC 15.18.3. WAP 15.19. Mexico Mobile Payment Technology Market Forecast, By Type of Mobile Payment 15.19.1. Mobile Wallet 15.19.2. Bank Cards 15.19.3. Mobile Money 15.20. Mexico Mobile Payment Technology Market Forecast, By Application 15.20.1. Entertainment 15.20.2. Energy & Utilities 15.20.3. Healthcare 15.20.4. Retail 15.20.5. Hospitality 15.20.6. Transportation 15.21. Mexico Mobile Payment Technology Market Forecast, By Purchase Type 15.21.1. Airtime Transfers & Top-ups 15.21.2. Money Transfers & Payments 15.21.3. Merchandise & Coupons 15.21.4. Travel & Ticketing 15.22. Rest of Latin America Mobile Payment Technology Market Forecast, By Mode of Transaction 15.22.1. SMS 15.22.2. NFC 15.22.3. WAP 15.23. Rest of Latin America Mobile Payment Technology Market Forecast, By Type of Mobile Payment 15.23.1. Mobile Wallet 15.23.2. Bank Cards 15.23.3. Mobile Money 15.24. Rest of Latin America Mobile Payment Technology Market Forecast, By Application 15.24.1. Entertainment 15.24.2. Energy & Utilities 15.24.3. Healthcare 15.24.4. Retail 15.24.5. Hospitality 15.24.6. Transportation 15.25. Rest of Latin America Mobile Payment Technology Market Forecast, By Purchase Type 15.25.1. Airtime Transfers & Top-ups 15.25.2. Money Transfers & Payments 15.25.3. Merchandise & Coupons 15.25.4. Travel & Ticketing 15.26. Latin America Mobile Payment Technology Market Attractiveness Analysis 15.26.1. By Mode of Transaction 15.26.2. By Type of Mobile Payment 15.26.3. By Application 15.26.4. By Purchase Type 15.27. PEST Analysis 16. Company Profiles 16.1. Market Share Analysis, By Company 16.2. Competition Matrix 16.3. Company Profiles: Key Players 16.3.1. Orange S.A. 16.3.1.1. Company Overview 16.3.1.2. Financial Overview 16.3.1.3. Business Strategy 16.3.1.4. Recent Developments 16.3.1.5. Vodacom Group Limited 16.3.1.6. MasterCard Incorporated 16.3.1.7. Bharti Airtel Limited 16.3.1.8. MTN Group Limited 16.3.1.9. Safaricom Limited 16.3.1.10. PayPal Holdings Inc. 16.3.1.11. Econet Wireless Zimbabwe Limited 16.3.1.12. Millicom International Cellular SA 16.3.1.13. Mahindra Comviva 16.3.1.14. AT &T’S 16.3.1.15. JIO 16.3.1.16. Apple Inc. 16.3.1.17. Google LLC. 16.3.1.18. One97 Communications Limited. 16.3.1.19. Venmo. 16.3.1.20. Vodafone Group Plc 16.3.1.21. 17. Primary Key Insights