6G Market Size was valued at USD 5.3 Bn. in 2023 and the 6G Market is expected to grow by 34.8 % from 2024 to 2030, reaching nearly USD 281.45 Bn. by 2030.6G Market Overview:

The evolution to 6G technology has witnessed a rapid surge in demand driven by the desire for faster, more efficient connectivity. This demand is bolstered by the growing reliance on data-heavy applications like augmented reality, autonomous vehicles, and the Internet of Things (IoT). To boost popularity, tech giants and telecommunication companies are actively engaging in extensive marketing campaigns and education initiatives to highlight the benefits of 6G. Their efforts aim to create widespread awareness and anticipation for the upcoming technology, thereby fueling public interest and excitement.To know about the Research Methodology :- Request Free Sample Report The impact of these strategies on the 6G market growth is substantial. Anticipation and eagerness generated by these campaigns have led to a surge in investment, research, and development in the telecommunications sector. This surge, in turn, is propelling the advancement of 6G technology at an accelerated pace, setting the stage for a robust market upon its launch. In recent years, the 6G market has been burgeoning with innovation and collaboration. Companies are forging partnerships and alliances to pool resources and expertise, fostering a collaborative environment that expedites the development of key technologies required for 6G implementation. Research institutions, academia, and industry leaders are actively engaged in exploring the potential applications and technical requirements of 6G, preparing the groundwork for its seamless integration into various sectors. Key players in the industry are undertaking multifaceted approaches to solidify their positions in the burgeoning 6G landscape. They are investing significantly in research and development, aiming to push the boundaries of technology to meet the lofty expectations set for 6G. Simultaneously, these entities are exploring strategic alliances, acquisitions, and partnerships to bolster their capabilities and ensure a competitive edge in the evolving market. The 6G market is on an exponential growth trajectory, fueled by the convergence of technological advancements and heightened consumer expectations. As the technology inches closer to reality, the market is witnessing an unprecedented surge in interest, investments, and collaborative efforts. This growth is underpinned by the concerted actions of key industry players, who are steering the evolution of 6G toward a future of boundless possibilities.

6G Market Dynamics:

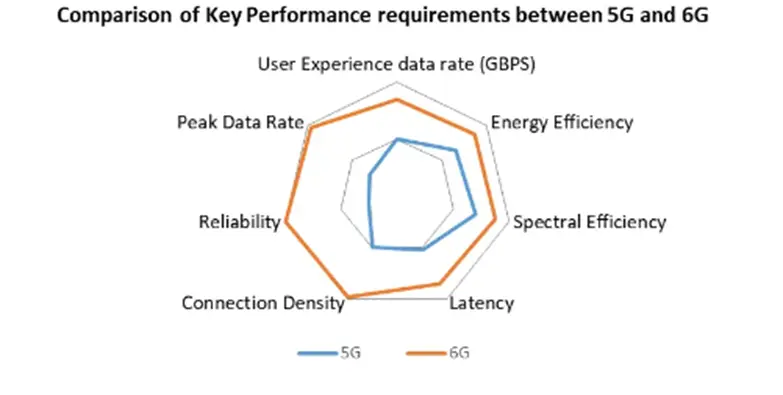

Unprecedented Data Demand to Boost the 6G Market Growth The proliferation of data-intensive applications such as augmented reality (AR), virtual reality (VR), ultra-HD streaming, and the Internet of Things (IoT) is generating an insatiable appetite for data. 6G is expected to provide data rates multiple times faster than 5G, enabling seamless and high-quality user experiences in real-time. 6G envisions connecting trillions of devices, far beyond what 5G can accommodate. This hyper-connected IoT ecosystem will encompass everything from smart cities and autonomous vehicles to wearables and industrial sensors. 6G's increased capacity and coverage will be essential to support this massive interconnection seamlessly. Applications like remote surgery, industrial automation, and vehicular communication require ultra-low latency. 6G's potential to deliver sub-millisecond latency will unlock new use cases that demand real-time responsiveness and reliability. With 6G, there's a focus on utilizing new frequency bands, including terahertz (THz) frequencies. These higher frequencies provide ample bandwidth for ultra-high data rates. Exploiting these frequencies requires breakthroughs in materials, components, and signal processing techniques, driving innovation and research. 6G's utilization of higher frequencies demands sophisticated beam forming and antenna technologies. Massive MIMO (Multiple Input Multiple Output) and intelligent adaptive beam forming will enable focused and efficient communication, even in complex environments. 6G aims to integrate AI and edge computing into its architecture. This convergence will enable intelligent decision-making at the network's edge, reducing latency and enhancing user experiences. AI-driven network optimization will dynamically adapt to changing demands and conditions. Industries like healthcare, manufacturing, transportation, and entertainment are embracing digital transformation. 6G's capabilities can unlock novel applications, such as remote medical procedures, real-time factory automation, and immersive entertainment experiences. 6G is expected to optimize energy consumption through intelligent network management, including dynamic sleep modes for devices and base stations. This aligns with global efforts to reduce carbon footprints and promote sustainable technologies.Technological Complexity and Innovation Gap to Restraint the 6G Market Growth The transition from 5G to 6G requires ground-breaking technological advancements, particularly in areas like terahertz-frequency communication, advanced beam forming, and AI integration. Developing and integrating these complex technologies poses significant engineering challenges. The innovation gap between theoretical concepts and practical implementations could slow down the pace of development. 6G envisions utilizing high-frequency bands, including terahertz frequencies. However, these frequencies come with regulatory challenges, as they are subject to strict regulations due to potential interference concerns. Harmonizing global spectrum regulations and ensuring interference-free coexistence with existing services will be a critical challenge. Building the necessary infrastructure for 6G, including new base stations, antennas, and backhaul networks, will require substantial investment. Moreover, the deployment of 6G networks might involve costly upgrades to existing infrastructure. Balancing these costs with the expected benefits and revenue generation will be a key consideration for network operators and governments. The development and adoption of 6G will depend on the establishment of international standards to ensure interoperability and seamless connectivity. The challenge lies in preventing ecosystem fragmentation, where different regions or stakeholders adopt incompatible standards, potentially hindering the global reach and benefits of 6G. As 6G networks are expected to handle unprecedented data loads and connect a vast number of devices, energy consumption could become a significant concern. Balancing the energy demands of 6G infrastructure with sustainability goals and addressing potential environmental impacts will be crucial. As 6G integrates AI, edge computing, and IoT on a massive scale, security vulnerabilities and privacy concerns will intensify. Protecting data, devices, and communication channels from cyber threats and ensuring robust privacy measures will be paramount to maintaining user trust. Challenges in the Global 6G Market: Transitioning from 5G to 6G demands a significant leap in technology, requiring breakthroughs in areas such as terahertz communication, advanced antenna systems, and AI-driven network management. Bridging the gap between theoretical concepts and practical implementations is a formidable challenge, requiring extensive research, testing, and collaboration among multidisciplinary teams. 6G's vision of utilizing extremely high-frequency bands, including terahertz frequencies, presents challenges in spectrum allocation and regulation. These high-frequency bands are subject to strict regulatory constraints due to potential interference with existing services. Coordinating global spectrum regulations to enable harmonized deployment and preventing fragmentation is a significant hurdle. Establishing the infrastructure for 6G, including base stations, antennas, and network architecture, requires substantial investment. Furthermore, the deployment of 6G networks might necessitate the retrofitting or replacement of existing 5G or 4G infrastructure. Balancing the economic feasibility of such investments with the potential return is a challenge for stakeholders. Standardization is crucial to ensuring interoperability and seamless communication across 6G networks and devices. However, developing comprehensive global standards that encompass diverse technologies and use cases while avoiding fragmentation is a complex task. Achieving consensus among various industry players and standards bodies is a challenge that requires careful coordination. The exponential growth in data demand and device connectivity in the 6G era could strain energy resources and impact sustainability goals. Designing energy-efficient infrastructure, optimizing network operations, and exploring novel technologies to reduce energy consumption without compromising performance are pressing challenges. The integration of AI, edge computing, and massive IoT connectivity in 6G introduces heightened security and privacy risks. Protecting data, devices, and communication channels from cyber threats, ensuring robust encryption, and safeguarding user privacy in a hyper-connected ecosystem pose substantial challenges. The complex nature of 6G technology demands a skilled workforce capable of developing, implementing, and maintaining advanced systems. Addressing the skill gap requires educational initiatives, training programs, and industry-academia collaborations to produce a competent workforce equipped to handle 6G's intricacies.

6G Market Segment Analysis:

Based on the End User Segment, the market is segmented into Consumer Connectivity and Experience, Healthcare, government, Smart Cities and Public Services, and Industrial. Beyond individual consumers, various industries are set to harness the potential of 6G for transformative purposes. Sectors such as manufacturing, logistics, energy, and healthcare seek to leverage 6G's low latency and reliable communication to enable real-time monitoring, automation, and optimization of processes. Industrial robots, autonomous vehicles, and smart factories can benefit from the seamless communication and coordination enabled by 6G, resulting in increased efficiency, reduced downtime, and enhanced productivity. The healthcare sector presents a unique opportunity for 6G to make a substantial impact. High-resolution remote medical imaging, telemedicine, and remote patient monitoring can all be enhanced through 6G's capabilities. Surgeons could perform complex surgeries remotely with minimal latency, expanding access to specialized medical care. Additionally, 6G can support wearable devices that monitor health parameters and transmit real-time data to healthcare providers, enabling proactive interventions and personalized treatment plans. Based on the end user, the market is segmented into Multisensory extended reality, networked-enabled robotic and autonomous systems, Blockchain, Distributed sensing and communications, and Others. 6G's ultra-low latency and high reliability are poised to revolutionize industrial automation. Manufacturing processes, supply chains, and robotics can achieve unprecedented levels of efficiency, accuracy, and responsiveness. Industry 4.0 concepts, which emphasize the integration of digital and physical systems, will be significantly empowered by 6G. Real-time communication between machines, sensors, and control systems will enable agile production, predictive maintenance, and resource optimization. Precision agriculture can benefit significantly from 6G's capabilities. Real-time data from sensors, drones, and satellites can inform decisions related to crop health, irrigation, and pest management. Farmers can optimize resource allocation, leading to increased yields, reduced environmental impact, and enhanced sustainability.6G Market Regional Insights:

North America holds a prominent position in the 6G market due to its robust technological ecosystem, innovation-driven industry landscape, and influential market players. The region, notably spearheaded by the United States, is poised to play a vital role in shaping the development and deployment of 6G technology. The United States boasts a dynamic environment for technological advancements, encompassing leading research institutions, cutting-edge corporations, and a supportive regulatory framework. Major technology giants such as Qualcomm and Intel are deeply involved in driving 6G research and development, positioning the country as a center for innovation. Collaboration between academia and industry remains a cornerstone of North America's 6G landscape. Esteemed universities contribute to theoretical groundwork, while partnerships with private sector entities facilitate the practical application of ideas. Furthermore, regulatory decisions from agencies like the Federal Communications Commission (FCC) will significantly influence the allocation of spectrum and the expansion of 6G networks. North America's economic strength and consumer demand for seamless connectivity provide a fertile ground for 6G adoption. As industries pivot towards automation, IoT integration, and smart cities, the region's affinity for embracing new technologies presents ample opportunities for 6G's transformative potential.Europe is home to industry giants such as Ericsson and Nokia, which have deep-rooted expertise in network infrastructure. These companies are actively engaged in research and development efforts to drive the evolution of 6G technology. The continent's research institutions and universities play a pivotal role in shaping the 6G landscape. Collaborations between academia and industry foster an environment of innovation, where theoretical advancements are translated into practical solutions. Additionally, initiatives such as Horizon Europe fund research projects, accelerating the progress of 6G technologies. Inter-European cooperation is a hallmark of the region's approach to 6G. Cross-border partnerships and consortiums facilitate knowledge exchange, standardization, and resource sharing. This collective effort bolsters Europe's capacity to contribute to the global 6G ecosystem. Regulatory considerations also play a vital role. The European Union's regulatory bodies influence spectrum allocation, data privacy, and network security standards. These regulations impact the development and deployment of 6G networks, ensuring they align with European values. Europe's readiness for digital transformation further fuels the 6G market. With ambitions to lead in areas like Industry 4.0, autonomous transportation, and smart cities, the continent's industries demand the ultra-low latency and high data rates that 6G promises. The Asia-Pacific region is an essential player in the 6G market and is expected to hold the largest market share within the forecast period this urge is fuelled by technological innovation, early adoption of new technologies, and strategic investments, the region’s powerhouse nations, including china, japan, and South Korea, and Japan, are driving the 6G research and development, positioning Asia-pacific at the forefront of the next-generation wireless connectivity revolution. China stands as a prominent force in the 6G landscape, with government-backed initiatives and substantial investments in research and development. Leading technology companies such as Huawei are driving innovation, aiming to establish the nation as a global leader in 6G technology and deployment. South Korea, known for its advanced telecommunications infrastructure, plays a vital role in shaping the 6G market. Companies such as Samsung and LG are investing heavily in research and development, striving to capitalize on 6G's potential for ultra-fast data speeds, low latency, and seamless connectivity. Japan's longstanding tradition of technological innovation is also contributing to the 6G arena. Companies such as NTT DoCoMo and NEC are actively involved in advancing 6G research, aligning with the nation's aspirations for smart cities and digital transformation. The Asia-Pacific region benefits from collaboration between neighboring countries, fostering research partnerships, knowledge exchange, and the harmonization of standards. Additionally, the region's growing middle class and increasing digitalization drive demand for higher bandwidth, making 6G's capabilities especially appealing. 6G Market Competitive Landscape: In the evolving landscape of the 6G market, key players are vying for leadership through substantial investments and research initiatives. Huawei, a global telecommunications leader, is capitalizing on its 5G expertise to drive significant 6G research and development. Samsung, a technology conglomerate, leverages its extensive experience to position itself as a significant 6G influencer, envisioning its potential for AI, virtual reality, and IoT advancements. Nokia, with a history in networking solutions, focuses on maintaining its industry leader status by contributing to 6G standards and mission-critical applications. Ericsson prioritizes sustainability and efficiency in 6G development. NTT DoCoMo, a Japanese telecom provider, collaborates to push wireless connectivity boundaries. Qualcomm's legacy in wireless tech drives its 6G research, while ZTE utilizes its telecom experience to contribute. Additionally, startups and research institutions offer fresh perspectives and innovation to the competitive landscape. The 6G race is marked by collaboration, research, and a desire to shape the global wireless technology landscape.

Rank Country 6G Patents Fastest 5G Speed 6G Ready Score 1 South Korea 760 814 8.75 2 India 265 465 7.5 3 United States 2,229 363 6.88 4 China 4.604 142 5 5 United Kingdom 115 392 5 6 Japan 155 298 3.75 7 Finland 12 452 3.75 8 Germany 77 330 3.13 9 Australia 55 296 1.25 6G Market Scope: Inquire before buying

6G Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.3 Bn. Forecast Period 2024 to 2030 CAGR: 34.8% Market Size in 2029: US $ 281.45 Bn. Segments Covered: by Component Hardware Software Services by Application Multi-sensory extended reality Networked-enabled robotic and autonomous systems Blockchain Distributed sensing and communications others by Deployment device Smartphones Tablets Wearables Internet of Things devices Others by End-User Consumer Connectivity and Experience Healthcare Government Smart Cities and Public Services Industrial 6G Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)6G Market Key Players:

1. Nokia Corporation (Finland) 2. Samsung Electronics Co., Ltd. (South Korea) 3. Huawei Technologies Co., Ltd. (China) 4. Ericsson (Sweden) 5. Qualcomm Incorporated (United States) 6. ZTE Corporation (China) 7. NTT DOCOMO, INC. (Japan) 8. Intel Corporation (United States) 9. LG Electronics Inc. (South Korea) 10. SK Telecom Co., Ltd. (South Korea) 11. Apple Inc. (United States) 12. Cisco Systems, Inc. (United States) 13. Sony Corporation (Japan) 14. Xiaomi Corporation (China) 15. AT&T Inc. (United States) 16. Verizon Communications Inc. (United States) 17. Siemens AG (Germany) 18. IBM Corporation (United States) 19. Toshiba Corporation (Japan) 20. NEC Corporation (Japan) Frequently Asked Questions: 1] What segments are covered in the Global 6G Market report? Ans. The segments covered in the 6G Market report are Component, Application, Deployment Device, End User, and Region. 2] Which region is expected to hold the highest share of the Global 6G Market? Ans. The Asia-Pacific region is expected to hold the highest share of the 6G Market. 3] What is the market size of the Global 6G Market by 2030? Ans. The market size of the 6G Market by 2030 is expected to reach USD 281.45 Bn. 4] What is the forecast period for the Global 6G Market? Ans. The forecast period for the 6G Market is 2024-2030. 5] What was the market size of the Global 6G Market in 2023? Ans. The market size of the 6G Market in 2023 was valued at USD 5.3 Bn.

1. 6G Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. 6G Market: Dynamics 2.1. 6G Market Trends by Region 2.1.1. North America 6G Market Trends 2.1.2. Europe 6G Market Trends 2.1.3. Asia Pacific 6G Market Trends 2.1.4. Middle East and Africa 6G Market Trends 2.1.5. South America 6G Market Trends 2.2. 6G Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America 6G Market Drivers 2.2.1.2. North America 6G Market Restraints 2.2.1.3. North America 6G Market Opportunities 2.2.1.4. North America 6G Market Challenges 2.2.2. Europe 2.2.2.1. Europe 6G Market Drivers 2.2.2.2. Europe 6G Market Restraints 2.2.2.3. Europe 6G Market Opportunities 2.2.2.4. Europe 6G Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific 6G Market Drivers 2.2.3.2. Asia Pacific 6G Market Restraints 2.2.3.3. Asia Pacific 6G Market Opportunities 2.2.3.4. Asia Pacific 6G Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa 6G Market Drivers 2.2.4.2. Middle East and Africa 6G Market Restraints 2.2.4.3. Middle East and Africa 6G Market Opportunities 2.2.4.4. Middle East and Africa 6G Market Challenges 2.2.5. South America 2.2.5.1. South America 6G Market Drivers 2.2.5.2. South America 6G Market Restraints 2.2.5.3. South America 6G Market Opportunities 2.2.5.4. South America 6G Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis for 6G Industry 2.8. Analysis of Government Schemes and Initiatives for 6G Industry 2.9. 6G Market Trade Analysis 2.10. The Global Pandemic Impact on 6G Market 3. 6G Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 3.1. 6G Market Size and Forecast, by Component (2023-2030) 3.1.1. Hardware 3.1.2. Software 3.1.3. Services 3.2. 6G Market Size and Forecast, by Application (2023-2030) 3.2.1. Multi-sensory extended reality 3.2.2. Networked-enabled robotic and autonomous systems 3.2.3. Blockchain 3.2.4. Distributed sensing and communications 3.2.5. Others 3.3. 6G Market Size and Forecast, by Deployment Device (2023-2030) 3.3.1. Smartphones 3.3.2. Tablets 3.3.3. Wearables 3.3.4. Internet of Things devices 3.3.5. Others 3.4. 6G Market Size and Forecast, by End-User (2023-2030) 3.4.1. Consumer Connectivity and Experience 3.4.2. Healthcare 3.4.3. Government 3.4.4. Smart Cities and Public Services 3.4.5. Industrial 3.5. 6G Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America 6G Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America 6G Market Size and Forecast, by Component (2023-2030) 4.1.1. Hardware 4.1.2. Software 4.1.3. Services 4.2. North America 6G Market Size and Forecast, by Application (2023-2030) 4.2.1. Multi-sensory extended reality 4.2.2. Networked-enabled robotic and autonomous systems 4.2.3. Blockchain 4.2.4. Distributed sensing and communications 4.2.5. Others 4.3. North America 6G Market Size and Forecast, by Deployment Device (2023-2030) 4.3.1. Smartphones 4.3.2. Tablets 4.3.3. Wearables 4.3.4. Internet of Things devices 4.3.5. Others 4.4. North America 6G Market Size and Forecast, by End-User (2023-2030) 4.4.1. Consumer Connectivity and Experience 4.4.2. Healthcare 4.4.3. Government 4.4.4. Smart Cities and Public Services 4.4.5. Industrial 4.5. North America 6G Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States 6G Market Size and Forecast, by Component (2023-2030) 4.5.1.1.1. Hardware 4.5.1.1.2. Software 4.5.1.1.3. Services 4.5.1.2. United States 6G Market Size and Forecast, by Application (2023-2030) 4.5.1.2.1. Multi-sensory extended reality 4.5.1.2.2. Networked-enabled robotic and autonomous systems 4.5.1.2.3. Blockchain 4.5.1.2.4. Distributed sensing and communications 4.5.1.2.5. Others 4.5.1.3. United States 6G Market Size and Forecast, by Deployment Device (2023-2030) 4.5.1.3.1. Smartphones 4.5.1.3.2. Tablets 4.5.1.3.3. Wearables 4.5.1.3.4. Internet of Things devices 4.5.1.3.5. Others 4.5.1.4. United States 6G Market Size and Forecast, by End-User (2023-2030) 4.5.1.4.1. Consumer Connectivity and Experience 4.5.1.4.2. Healthcare 4.5.1.4.3. Government 4.5.1.4.4. Smart Cities and Public Services 4.5.1.4.5. Industrial 4.5.2. Canada 4.5.2.1. Canada 6G Market Size and Forecast, by Component (2023-2030) 4.5.2.1.1. Hardware 4.5.2.1.2. Software 4.5.2.1.3. Services 4.5.2.2. Canada 6G Market Size and Forecast, by Application (2023-2030) 4.5.2.2.1. Multi-sensory extended reality 4.5.2.2.2. Networked-enabled robotic and autonomous systems 4.5.2.2.3. Blockchain 4.5.2.2.4. Distributed sensing and communications 4.5.2.2.5. Others 4.5.2.3. Canada 6G Market Size and Forecast, by Deployment Device (2023-2030) 4.5.2.3.1. Smartphones 4.5.2.3.2. Tablets 4.5.2.3.3. Wearables 4.5.2.3.4. Internet of Things devices 4.5.2.3.5. Others 4.5.2.4. Canada 6G Market Size and Forecast, by End-User (2023-2030) 4.5.2.4.1. Consumer Connectivity and Experience 4.5.2.4.2. Healthcare 4.5.2.4.3. Government 4.5.2.4.4. Smart Cities and Public Services 4.5.2.4.5. Industrial 4.5.3. Mexico 4.5.3.1. Mexico 6G Market Size and Forecast, by Component (2023-2030) 4.5.3.1.1. Hardware 4.5.3.1.2. Software 4.5.3.1.3. Services 4.5.3.2. Mexico 6G Market Size and Forecast, by Application (2023-2030) 4.5.3.2.1. Multi-sensory extended reality 4.5.3.2.2. Networked-enabled robotic and autonomous systems 4.5.3.2.3. Blockchain 4.5.3.2.4. Distributed sensing and communications 4.5.3.2.5. Others 4.5.3.3. Mexico 6G Market Size and Forecast, by Deployment Device (2023-2030) 4.5.3.3.1. Smartphones 4.5.3.3.2. Tablets 4.5.3.3.3. Wearables 4.5.3.3.4. Internet of Things devices 4.5.3.3.5. Others 4.5.3.4. Mexico 6G Market Size and Forecast, by End-User (2023-2030) 4.5.3.4.1. Consumer Connectivity and Experience 4.5.3.4.2. Healthcare 4.5.3.4.3. Government 4.5.3.4.4. Smart Cities and Public Services 4.5.3.4.5. Industrial 5. Europe 6G Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. Europe 6G Market Size and Forecast, by Component (2023-2030) 5.2. Europe 6G Market Size and Forecast, by Application (2023-2030) 5.3. Europe 6G Market Size and Forecast, by Deployment Device (2023-2030) 5.4. Europe 6G Market Size and Forecast, by End-User (2023-2030) 5.5. Europe 6G Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom 6G Market Size and Forecast, by Component (2023-2030) 5.5.1.2. United Kingdom 6G Market Size and Forecast, by Application (2023-2030) 5.5.1.3. United Kingdom 6G Market Size and Forecast, by Deployment Device(2023-2030) 5.5.1.4. United Kingdom 6G Market Size and Forecast, by End-User (2023-2030) 5.5.2. France 5.5.2.1. France 6G Market Size and Forecast, by Component (2023-2030) 5.5.2.2. France 6G Market Size and Forecast, by Application (2023-2030) 5.5.2.3. France 6G Market Size and Forecast, by Deployment Device(2023-2030) 5.5.2.4. France 6G Market Size and Forecast, by End-User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany 6G Market Size and Forecast, by Component (2023-2030) 5.5.3.2. Germany 6G Market Size and Forecast, by Application (2023-2030) 5.5.3.3. Germany 6G Market Size and Forecast, by Deployment Device (2023-2030) 5.5.3.4. Germany 6G Market Size and Forecast, by End-User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy 6G Market Size and Forecast, by Component (2023-2030) 5.5.4.2. Italy 6G Market Size and Forecast, by Application (2023-2030) 5.5.4.3. Italy 6G Market Size and Forecast, by Deployment Device(2023-2030) 5.5.4.4. Italy 6G Market Size and Forecast, by End-User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain 6G Market Size and Forecast, by Component (2023-2030) 5.5.5.2. Spain 6G Market Size and Forecast, by Application (2023-2030) 5.5.5.3. Spain 6G Market Size and Forecast, by Deployment Device (2023-2030) 5.5.5.4. Spain 6G Market Size and Forecast, by End-User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden 6G Market Size and Forecast, by Component (2023-2030) 5.5.6.2. Sweden 6G Market Size and Forecast, by Application (2023-2030) 5.5.6.3. Sweden 6G Market Size and Forecast, by Deployment Device (2023-2030) 5.5.6.4. Sweden 6G Market Size and Forecast, by End-User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria 6G Market Size and Forecast, by Component (2023-2030) 5.5.7.2. Austria 6G Market Size and Forecast, by Application (2023-2030) 5.5.7.3. Austria 6G Market Size and Forecast, by Deployment Device (2023-2030) 5.5.7.4. Austria 6G Market Size and Forecast, by End-User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe 6G Market Size and Forecast, by Component (2023-2030) 5.5.8.2. Rest of Europe 6G Market Size and Forecast, by Application (2023-2030) 5.5.8.3. Rest of Europe 6G Market Size and Forecast, by Deployment Device (2023-2030) 5.5.8.4. Rest of Europe 6G Market Size and Forecast, by End-User (2023-2030) 6. Asia Pacific 6G Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Asia Pacific 6G Market Size and Forecast, by Component (2023-2030) 6.2. Asia Pacific 6G Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific 6G Market Size and Forecast, by Deployment Device (2023-2030) 6.4. Asia Pacific 6G Market Size and Forecast, by End-User (2023-2030) 6.5. Asia Pacific 6G Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China 6G Market Size and Forecast, by Component (2023-2030) 6.5.1.2. China 6G Market Size and Forecast, by Application (2023-2030) 6.5.1.3. China 6G Market Size and Forecast, by Deployment Device (2023-2030) 6.5.1.4. China 6G Market Size and Forecast, by End-User (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea 6G Market Size and Forecast, by Component (2023-2030) 6.5.2.2. S Korea 6G Market Size and Forecast, by Application (2023-2030) 6.5.2.3. S Korea 6G Market Size and Forecast, by Deployment Device (2023-2030) 6.5.2.4. S Korea 6G Market Size and Forecast, by End-User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan 6G Market Size and Forecast, by Component (2023-2030) 6.5.3.2. Japan 6G Market Size and Forecast, by Application (2023-2030) 6.5.3.3. Japan 6G Market Size and Forecast, by Deployment Device (2023-2030) 6.5.3.4. Japan 6G Market Size and Forecast, by End-User (2023-2030) 6.5.4. India 6.5.4.1. India 6G Market Size and Forecast, by Component (2023-2030) 6.5.4.2. India 6G Market Size and Forecast, by Application (2023-2030) 6.5.4.3. India 6G Market Size and Forecast, by Deployment Device (2023-2030) 6.5.4.4. India 6G Market Size and Forecast, by End-User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia 6G Market Size and Forecast, by Component (2023-2030) 6.5.5.2. Australia 6G Market Size and Forecast, by Application (2023-2030) 6.5.5.3. Australia 6G Market Size and Forecast, by Deployment Device (2023-2030) 6.5.5.4. Australia 6G Market Size and Forecast, by End-User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia 6G Market Size and Forecast, by Component (2023-2030) 6.5.6.2. Indonesia 6G Market Size and Forecast, by Application (2023-2030) 6.5.6.3. Indonesia 6G Market Size and Forecast, by Deployment Device (2023-2030) 6.5.6.4. Indonesia 6G Market Size and Forecast, by End-User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia 6G Market Size and Forecast, by Component (2023-2030) 6.5.7.2. Malaysia 6G Market Size and Forecast, by Application (2023-2030) 6.5.7.3. Malaysia 6G Market Size and Forecast, by Deployment Device (2023-2030) 6.5.7.4. Malaysia 6G Market Size and Forecast, by End-User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam 6G Market Size and Forecast, by Component (2023-2030) 6.5.8.2. Vietnam 6G Market Size and Forecast, by Application (2023-2030) 6.5.8.3. Vietnam 6G Market Size and Forecast, by Deployment Device (2023-2030) 6.5.8.4. Vietnam 6G Market Size and Forecast, by End-User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan 6G Market Size and Forecast, by Component (2023-2030) 6.5.9.2. Taiwan 6G Market Size and Forecast, by Application (2023-2030) 6.5.9.3. Taiwan 6G Market Size and Forecast, by Deployment Device (2023-2030) 6.5.9.4. Taiwan 6G Market Size and Forecast, by End-User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific 6G Market Size and Forecast, by Component (2023-2030) 6.5.10.2. Rest of Asia Pacific 6G Market Size and Forecast, by Application (2023-2030) 6.5.10.3. Rest of Asia Pacific 6G Market Size and Forecast, by Deployment Device (2023-2030) 6.5.10.4. Rest of Asia Pacific 6G Market Size and Forecast, by End-User (2023-2030) 7. Middle East and Africa 6G Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Middle East and Africa 6G Market Size and Forecast, by Component (2023-2030) 7.2. Middle East and Africa 6G Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa 6G Market Size and Forecast, by Deployment Device (2023-2030) 7.4. Middle East and Africa 6G Market Size and Forecast, by End-User (2023-2030) 7.5. Middle East and Africa 6G Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa 6G Market Size and Forecast, by Component (2023-2030) 7.5.1.2. South Africa 6G Market Size and Forecast, by Application (2023-2030) 7.5.1.3. South Africa 6G Market Size and Forecast, by Deployment Device (2023-2030) 7.5.1.4. South Africa 6G Market Size and Forecast, by End-User (2023-2030) 7.5.2. GCC 7.5.2.1. GCC 6G Market Size and Forecast, by Component (2023-2030) 7.5.2.2. GCC 6G Market Size and Forecast, by Application (2023-2030) 7.5.2.3. GCC 6G Market Size and Forecast, by Deployment Device (2023-2030) 7.5.2.4. GCC 6G Market Size and Forecast, by End-User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria 6G Market Size and Forecast, by Component (2023-2030) 7.5.3.2. Nigeria 6G Market Size and Forecast, by Application (2023-2030) 7.5.3.3. Nigeria 6G Market Size and Forecast, by Deployment Device (2023-2030) 7.5.3.4. Nigeria 6G Market Size and Forecast, by End-User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A 6G Market Size and Forecast, by Component (2023-2030) 7.5.4.2. Rest of ME&A 6G Market Size and Forecast, by Application (2023-2030) 7.5.4.3. Rest of ME&A 6G Market Size and Forecast, by Deployment Device (2023-2030) 7.5.4.4. Rest of ME&A 6G Market Size and Forecast, by End-User (2023-2030) 8. South America 6G Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. South America 6G Market Size and Forecast, by Component (2023-2030) 8.2. South America 6G Market Size and Forecast, by Application (2023-2030) 8.3. South America 6G Market Size and Forecast, by Deployment Device(2023-2030) 8.4. South America 6G Market Size and Forecast, by End-User (2023-2030) 8.5. South America 6G Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil 6G Market Size and Forecast, by Component (2023-2030) 8.5.1.2. Brazil 6G Market Size and Forecast, by Application (2023-2030) 8.5.1.3. Brazil 6G Market Size and Forecast, by Deployment Device (2023-2030) 8.5.1.4. Brazil 6G Market Size and Forecast, by End-User (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina 6G Market Size and Forecast, by Component (2023-2030) 8.5.2.2. Argentina 6G Market Size and Forecast, by Application (2023-2030) 8.5.2.3. Argentina 6G Market Size and Forecast, by Deployment Device (2023-2030) 8.5.2.4. Argentina 6G Market Size and Forecast, by End-User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America 6G Market Size and Forecast, by Component (2023-2030) 8.5.3.2. Rest Of South America 6G Market Size and Forecast, by Application (2023-2030) 8.5.3.3. Rest Of South America 6G Market Size and Forecast, by Deployment Device (2023-2030) 8.5.3.4. Rest Of South America 6G Market Size and Forecast, by End-User (2023-2030) 9. Global 6G Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading 6G Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Nokia Corporation (Finland) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Samsung Electronics Co., Ltd. (South Korea) 10.3. Huawei Technologies Co., Ltd. (China) 10.4. Ericsson (Sweden) 10.5. Qualcomm Incorporated (United States) 10.6. ZTE Corporation (China) 10.7. NTT DOCOMO, INC. (Japan) 10.8. Intel Corporation (United States) 10.9. LG Electronics Inc. (South Korea) 10.10. SK Telecom Co., Ltd. (South Korea) 10.11. Apple Inc. (United States) 10.12. Cisco Systems, Inc. (United States) 10.13. Sony Corporation (Japan) 10.14. Xiaomi Corporation (China) 10.15. AT&T Inc. (United States) 10.16. Verizon Communications Inc. (United States) 10.17. Siemens AG (Germany) 10.18. IBM Corporation (United States) 10.19. Toshiba Corporation (Japan) 10.20. NEC Corporation (Japan) 11. Key Findings 12. Industry Recommendations 13. 6G Market: Research Methodology 14. Terms and Glossary