Microservices Architecture Market size was valued at US$ 4131.96 Mn. in 2022 and the total revenue is expected to grow at 18.82% through 2023 to 2029, reaching nearly US$ 13816.03 Mn.Microservices Architecture Market Overview:

Microservice architecture (MSA) is a method of designing software systems that breaks down huge monolithic applications into smaller manageable independent services that focus on effectively completing a task and interacting using language-independent protocols. This provides leadership for the code that runs under that specific personal service to a certain development team. The microservice design is based on the principle of doing one thing well. According to research, microservices architectures will be used to construct 90% of all apps. The desire for software that can rapidly build and deliver software has opened the way for a major increase in microservices. Microservices provide enterprises with the opportunity to try out new technology stacks as they continue to utilise the cloud. Microservices designs will continue to aid enterprises in reducing infrastructure costs, minimizing losses, and optimising resources in 2022.To know about the Research Methodology :- Request Free Sample Report

Microservices Architecture Market Dynamics:

Microservices design has several major advantages, including supporting consumer choice, accessibility, and engagement, extending the reach of a business, and, most critically, improving time to market by offering technology agility. Important security fixes can be deployed faster with the aid of microservices architecture because it employs smaller code structures than monolithic programmes. Microservices architecture is a digital business asset, particularly for service providers, because it keeps services competitive, current, in demand, and change-responsive. Microservices design also allows for the enhancement of service offerings for various consumer groups by supplementing or adding value to an existing service. As a result of the present COVID-19 epidemic, global demand for cloud has increased, and cloud microservices are expected to be greatly impacted until the end of 2022. Cloud services are getting more popular as a result of a labour scarcity and the requirement for remote monitoring and working. Because the use of cloud-based Software as a Service (SaaS) providers in corporate business operations has grown, so has the requirement to connect many application providers and services that support the enterprise. The growing use of the cloud is one of the driving forces behind the microservices architecture industry, as microservices are based on smaller and simpler services. The market for microservices architecture is being driven by the rise of connected devices such as wearables, smartphones, smart home appliances, tablets, drones, and fitness monitors. This is because today's commercial customers want feature upgrades on a much shorter iteration cycle than in the past. Microservices architecture is a way of creating, extending, updating, and deploying systems that is more dependent on market demands. Vulnerability management concerns are limiting the market's potential to extend. The container can boost the number of software development environments available, but it also introduces new security threats that compromise compliance. Cyber criminals can take use of weaknesses in cloud architecture's authorization settings to get access to services, including sensitive data.Microservices Architecture Market Segment Analysis:

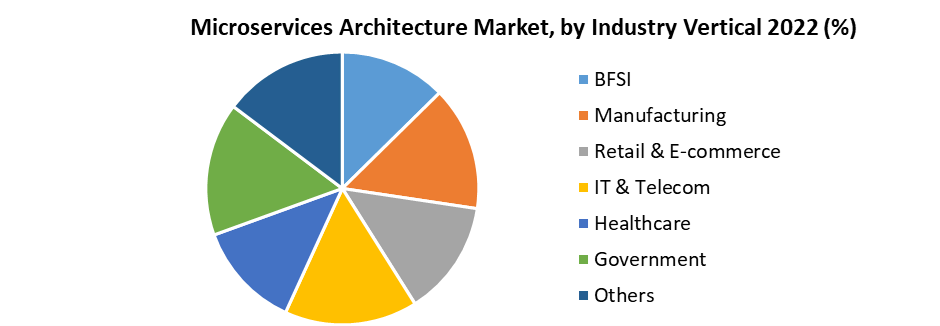

Based on the Component, the global Microservices Architecture market is sub-segmented into Solution and Services. The Solution segment held the largest market share of xx% in 2022. The growing usage of microservices architecture across organisations is attributed with the segment's growth. Because of updated technologies and digital revolution trends, businesses are focusing more on optimising application development processes. As a result, enterprises prefer to use microservices solutions to boost business process agility and reduce time to market. Based on the Industry Vertical, the global Microservices Architecture market is sub-segmented into BFSI, Manufacturing, Retail & E-commerce, IT & Telecom, Healthcare, Government and Others. The Manufacturing segment held the largest market share of xx% in 2022. As intelligent technology progresses and the old automation pyramid disintegrate, microservice cloud is becoming more popular in the manufacturing segment. In addition, manufacturing IT is moving toward a service and app-based approach. In the industrial industry, Microsoft is a key supplier of essential technologies. It gives manufacturers a digital replica of their OPC (Open Platform Communication) UA machine and improves security and certification management dramatically.

Microservices Architecture Market Regional Insights:

North America held the largest market share of xx% in 2022. Due to the increasing use of advanced technologies, the region is gaining a high market share. In addition, the demand from North American companies is increasing because they have adopted microservice architectures in finance, e-commerce, and travel services, which help store information and data cost-effectively, and improve agility, efficiency, and scalability. According to research, investment in innovative technologies such as cognitive/artificial intelligence (AI) systems, IoT, upcoming safety, wearable technology or virtual reality, 3D printing, and robotics, which drives cloud microservices, is expected to exceed USD 16 billion in Canada. Asia Pacific is expected to grow at a highest CAGR of 23.8% in the global Microservices Architecture market during the forecast period. Microservices architecture is being adopted by a huge number of organisations to address contemporary application development challenges. The objective of the report is to present a comprehensive analysis of the global Microservices Architecture Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also helps in understanding the global Microservices Architecture Market dynamic, structure by analyzing the market segments and project the global Microservices Architecture Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Microservices Architecture Market make the report investor’s guide.Microservices Architecture Market Scope: Inquiry Before Buying

Microservices Architecture Market Base Year 2022 Forecast Period 2023-2029 Historical Data CAGR Market Size in 2022 Market Size in 2029 2018 to 2022 18.82% US$ 4131.96 Mn US$ 13816.03 Mn Segments Covered by Component Solution Services by Organization Size Large Enterprises Small & Medium Enterprises by Deployment Mode On-premise Cloud by Industry Vertical BFSI Manufacturing Retail & E-commerce IT & Telecom Healthcare Government Others Regions Covered North America United States Canada Mexico Europe UK France Germany Italy Spain Sweden Austria Rest of Europe Asia Pacific China S Korea Japan India Australia Indonesia Malaysia Vietnam Taiwan Bangladesh Pakistan Rest of APAC Middle East and Africa South Africa GCC Egypt Nigeria Rest of ME&A South America Brazil Argentina Rest of South America Microservices Architecture Market Key Players are:

1. Amazon Web Services Inc. 2. Microsoft Corporation 3. IBM Corporation 4. Salesforce.com Inc. 5. Tata Consultancy Services Limited 6. Broadcom Inc. (CA Technologies) 7. VMware Inc. (Pivotal Software Inc.) 8. Infosys Ltd 9. Oracle Corporation 10.NGINX Inc. 11.Syntel Inc. 12.Idexcel Inc. 13.RapidValue IT Services Private Limited 14.Software AG 15.F5, Inc. (NGINX) 16.Datawire 17.Atlassian 18.MuleSoft Inc. Frequently Asked Questions: 1] What segments are covered in Microservices Architecture Market report? Ans. The segments covered in Microservices Architecture Market report are based on Component, Organization Size, Deployment Mode and Industry Vertical. 2] Which region is expected to hold the highest share in the Microservices Architecture Market? Ans. North America is expected to hold the highest share in the Microservices Architecture Market. 3] What is the market size of Microservices Architecture Market by 2029? Ans. The market size of Microservices Architecture Market is expected to reach US $ 13816.03 Mn. by 2029. 4] Who are the top key players in the Microservices Architecture Market? Ans. Amazon Web Services Inc., Microsoft Corporation, IBM Corporation, Salesforce.com Inc., Tata Consultancy Services Limited, Broadcom Inc. (CA Technologies) and VMware Inc. (Pivotal Software Inc.) are the top key players in the global Microservices Architecture Market. 5] What was the market size of Microservices Architecture Market in 2022? Ans. The market size of Microservices Architecture Market in 2022 was US $ 4131.96 Mn.

1. Global Microservices Architecture Market: Research Methodology 2. Global Microservices Architecture Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Microservices Architecture Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Global Microservices Architecture Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12 COVID-19 Impact 4. Global Microservices Architecture Market Segmentation 4.1 Global Microservices Architecture Market, by Component (2022-2029) • Solution • Services 4.2 Global Microservices Architecture Market, by Organization Size (2022-2029) • Large Enterprises • Small & Medium Enterprises 4.3 Global Microservices Architecture Market, by Deployment Mode (2022-2029) • On-premise • Cloud 4.4 Global Microservices Architecture Market, by Industry Vertical (2022-2029) • BFSI • Manufacturing • Retail & E-commerce • IT & Telecom • Healthcare • Government • Others 5. North America Microservices Architecture Market(2022-2029) 5.1 Global Microservices Architecture Market, by Component (2022-2029) • Solution • Services 5.2 Global Microservices Architecture Market, by Organization Size (2022-2029) • Large Enterprises • Small & Medium Enterprises 5.3 Global Microservices Architecture Market, by Deployment Mode (2022-2029) • On-premise • Cloud 5.4 Global Microservices Architecture Market, by Industry Vertical (2022-2029) • BFSI • Manufacturing • Retail & E-commerce • IT & Telecom • Healthcare • Government • Others 5.4 North America Microservices Architecture Market, by Country (2022-2029) • United States • Canada • Mexico 6. Asia Pacific Microservices Architecture Market (2022-2029) 6.1. Asia Pacific Microservices Architecture Market, by Component (2022-2029) 6.2. Asia Pacific Microservices Architecture Market, by Organization Size (2022-2029) 6.3. Global Microservices Architecture Market, by Deployment Mode (2022-2029) 6.4. Asia Pacific Microservices Architecture Market, by Industry Vertical (2022-2029) 6.4. Asia Pacific Microservices Architecture Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 7. Middle East and Africa Microservices Architecture Market (2022-2029) 7.1 Middle East and Africa Microservices Architecture Market, by Component (2022-2029) 7.2. Middle East and Africa Microservices Architecture Market, by Organization Size (2022-2029) 7.3. Middle East and Africa Microservices Architecture Market, by Deployment Mode (2022-2029) 7.4. Middle East and Africa Microservices Architecture Market, by Industry Vertical (2022-2029) 7.5. Middle East and Africa Microservices Architecture Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 8. Latin America Microservices Architecture Market (2022-2029) 8.1. Latin America Microservices Architecture Market, by Component (2022-2029) 8.2. Latin America Microservices Architecture Market, by Organization Size (2022-2029) 8.3. Latin America Microservices Architecture Market, by Deployment Mode (2022-2029) 8.4. Latin America Microservices Architecture Market, by Industry Vertical (2022-2029) 8.5 Latin America Microservices Architecture Market, by Country (2022-2029) • Brazil • Argentina • Rest Of Latin America 9. European Microservices Architecture Market (2022-2029) 9.1. European Microservices Architecture Market, by Component (2022-2029) 9.2. European Microservices Architecture Market, by Organization Size (2022-2029) 9.3. European Microservices Architecture Market, by Deployment Mode (2022-2029) 9.4. Latin America Microservices Architecture Market, by Industry Vertical (2022-2029) 9.5. European Microservices Architecture Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 10. Company Profile: Key players 10.1. Amazon Web Services Inc. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Microsoft Corporation 10.3. IBM Corporation 10.4. Salesforce.com Inc. 10.5. Tata Consultancy Services Limited 10.6. Broadcom Inc. (CA Technologies) 10.7. VMware Inc. (Pivotal Software Inc.) 10.8. Infosys Ltd 10.9. Oracle Corporation 10.10. NGINX Inc. 10.11. Syntel Inc. 10.12. Idexcel Inc. 10.13. RapidValue IT Services Private Limited 10.14. Software AG 10.15. F5, Inc. (NGINX) 10.16. Datawire 10.17. Atlassian 10.18. MuleSoft Inc