Virtual Office Market was valued at USD 47.20 Billion in 2022, and it is expected to reach USD 137.64 Billion by 2029, exhibiting a CAGR of 16.52 % during the forecast period (2023-2029) Virtual offices are a part of the flexible workspace sector, which offers organisations a range of services, space, and/or technology without the high upfront expenditures of buying or leasing traditional offices. Virtual office services began as a serviced office and have grown to include a wide range of employees, physical space, digital storage, and communication services as technology has improved. Customers pay contract expenses for these services, which can be bought separately, as a package, or as a membership subscription. Organizations are bringing their business operations online for a variety of reasons. Companies nowadays want worldwide reputation, market share, and income. They are attempting to transcend standard commercial procedures. Businesses require a centralised workplace to assemble their workforce base, remote teams, and potential clients online. As a result, they want to strengthen their online presence with a virtual office.Research Methodology

The research report relies heavily on both primary and secondary data sources. The research process entails the investigation of various factors affecting the industry, such as government policy, market environment, competitive landscape, historical data, current market trends, technological innovation, upcoming technologies, and technical progress in related industries, as well as market risks, opportunities, market barriers, and challenges. All conceivable elements influencing the markets included in this research study have been considered, examined in depth, validated through primary research, and evaluated to provide the final quantitative and qualitative data. The market size for top-level markets and sub-segments is normalised, and the impact of inflation, economic downturns, regulatory & policy changes, and other variables is factored into the market forecast. This data is combined and added with detailed inputs and analysis, and presented in the report.To know about the Research Methodology :- Request Free Sample Report

Virtual Office Market Dynamics

Technological Advancement & Importance of Digital Systems: A virtual workplace already has the necessary equipment and tools. The demand, on the other hand, is increasing by the day. Indeed, it is getting more inexpensive not just for huge corporations, but also for startups and small businesses. Surprisingly, virtual software allows several companies to utilise the platform as their virtual office. Each firm obtains login credentials so that its employees may quickly sign in to their workplace from anywhere at any time. To stay connected, the company only need a robust internet connection and a smart gadget. The growing importance of digital systems, as well as the necessity to complete knowledge-intensive jobs, has resulted in an increase in employee desire to work from home or from a preferred location. This has allowed businesses to make better use of their office space, cut employee travel time, and raise employee satisfaction, all of which have increased job efficiency and production. In the near future, this will assist the flexible office market in reaching new growth destinations. Additionally, the necessity to tap into employees' enormous potential necessitates workplace flexibility in terms of where and when office staff should work or do their jobs. Metaverse (AR & VR) in Virtual Office: The term "metaverse," which refers to an extension of the virtual office, was coined by combining "meta," which denotes a higher level, and "universe," which refers to the cosmos or space. It is a technology that is gaining traction as more IT firms across the world announce their entry into the market. Smart glasses and head-mounted displays are boosting the adoption of AR and VR display devices, and training programmes that use AR and VR to compensate for labour shortages are expected to become more popular in the future. The Consumer Electronics Show (CES), one of the world's premier technology exhibitions, was hosted in the United States in January 2022, where metaverse-related innovations drew notice. Japanese firms also made an appearance, with a general electronics manufacturer's group company announcing VR eyewear that allow customers to explore virtual environments with high-definition video. A rising number of businesses now trust in the metaverse for employment. They want to overcome the physical constraints of driving down to an office and working in a tight place for the entire day. The hybrid work paradigm is encouraged by gathering the employee base in a virtual office. The workers may easily come down to the actual workplace or login in to their virtual office. Furthermore, each individual is given the opportunity to represent themselves in the form of a digital avatar. This provides everyone with a more immersive and thorough working experience. Low Price & Workplace Flexibility: A virtual office has a two-fold appeal for users. For starters, a virtual office is significantly less expensive than a typical office on a monthly basis. After all, it doesn't need to be staffed and doesn't require any maintenance or upkeep. A month-to-month lease can be used to acquire a virtual office, giving users more flexibility if their company needs change (no waiting for a lease to expire or incurring the cost of a broken lease). A virtual office might cost anywhere from $40 to $200 per month. The more services anyone add, the more money anyone can invest. Besides that, the growing importance of creative and analytical professions necessitates workplace flexibility, since these personnel require a quiet working environment and flexible workspace arrangements in order to focus on their tasks and provide results on time. As a result, organisations will be more likely to adopt the flexible office concept successfully. Change in Remote Work Due to COVID-19: COVID-19 has compelled enterprises to adopt new methods of working, and now they must redefine their work and the role of workplaces in ensuring that people have safe, productive, and happy employment and lives. Due to the COVID-19, an increasing number of enterprises have begun to operate remotely this year. Small firms didn't make sense in the pre-pandemic era to sign a costly lease for office space when they could work as a team remotely. Some may claim that a home-based business owner misses out on some of the benefits of having a physical location. Employers and employees can still take advantage of these benefits and tailor their use to the needs of the organisation with a virtual office. The COVID-19 pandemic has served as a precious experiment in both the feasibility and the desirability of remote work. However, the full allegations of the results may not be clear yet, it looks almost certain that telecommuting will remain firmly deep-rooted in 2022 and elsewhere. According to maximize research, 67% of IT administrators expect remote policies to stay in place either long-term or eternally, a significant growth from 38% who state the same at the beginning of the epidemic. The major two influences which fuel such swings in Outlooks. Primary and leading are cost-effective remunerations. By reducing office space and its related overhead, firms could be saving an average of $11,000 per half-time telecommuter every year. Total savings could also come from lower salaries given that 62 % of US labours specified they would be willing to take a pay cut in order to work remotely.Changing Preference of Employees: Employees are also the other major factor that will drive the virtual office market. While about 75% of employees surveyed in the UK felt that their corporation must quite maintain an office, 86 % of them wanted to have the option to work remotely at just one day a week, and just over 90 % demanded to have steady more positive views about working from home during the epidemic. Parents, specifically, conveyed fairly strong feelings about the change, with 86 % of them now wanting to have remote flexibility, compared to just 46 % pre-pandemic. It has seemed that 78 % of employees would be eager to take a five % pay cut in order to work remotely at least some of the time, with 20% eager to take more than a 10 % cut for the benefit. However, the entire dependence on the internet for work is a huge key barrier here. Interruptions in internet access may cause the entire organisation to cease operating, resulting in a loss of time and cash. The growing demand for human contact for training and monitoring employee performance is a major constraint to the Global Virtual Office Market's growth.

Virtual Office Market Segment Analysis

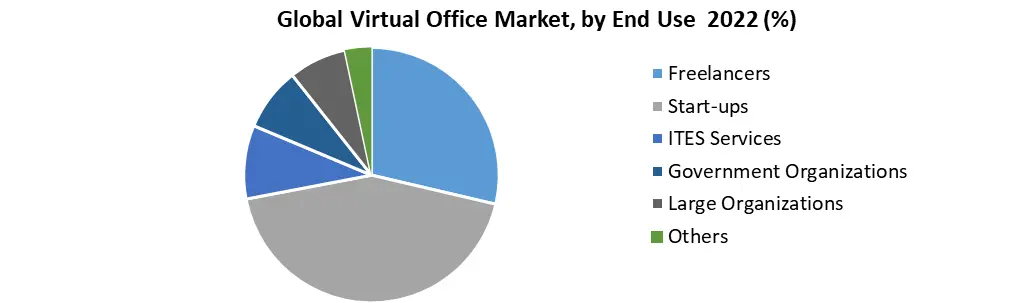

Based on the Type, the global Virtual Office market is sub-segmented into Cloud Based, Web Based and Others. The Cloud Based segment held the largest market share of xx% in 2022. SD-WAN, a cloud-based product, is specifically suited for companies who are migrating to or expanding their distributed workforce. Virtual Office provides IT teams with network access, control, and insight into the work-at-home environment, as well as a secure network experience that is as near to being on the corporate WAN as feasible for remote workers. Based on the End-User, the global Virtual Office market is sub-segmented into Freelancers, Start-ups, ITES Services, Government Organizations, Large Organizations and Others. The Large Organization segment held the largest market share of xx% in 2022. Virtual office provides the possibility to test new markets for larger or established enterprises. Companies that want to grow into a new market can use a virtual office to test their ideas without risking financial loss. A virtual office eliminates the need for a costly long-term lease in an unfamiliar location. Companies that need to decrease their traditional office space can also use a virtual office to manage workflow and direction changes. According to recent surveys, almost 60% of large organisations now allow their staff to work from home. This is due to a variety of factors, including lower overhead and more productive personnel. Furthermore, the amount of face-to-face meetings has decreased dramatically in favour of technology, conference calls, and convenience throughout the years. People can now work remotely and at different hours thanks to the same technological advancements.

Virtual Office Market Regional Insights

North America followed by Europe dominated the global virtual office market in 2022. The increasing consumer appetite for flexible working might be related to the rise in these locations. The virtual office market in the United Kingdom and the United States is mainly mature. In these countries, factors such as rigid lease terms, the expansion of the IT sector, and a scarcity of traditional office space fueled demand for virtual office services. In Europe, EU law permits enterprises from EU member states to provide services across Europe, which has resulted of a significant surge in virtual office arrangements in recent years. According to Office Suites Club, virtual offices in EU member states give a cost-effective business option while maintaining their position in the aftermath of Brexit. Furthermore, the 12.5% corporation tax rate in Ireland attracts foreign businesses. In the long run, such factors are expected to drive demand for virtual offices. Furthermore, rising investment in micro, small, and medium-sized companies (MSME) is expected to boost global service demand. For example, the Innovative Small and Medium Enterprises (iSME) initiative in Lebanon invested around USD 10.23 million in 22 enterprises. Furthermore, the Small Industries Development Bank of India (SIDBI) intends to disburse USD 1.5 billion to start-ups indirectly by 2025. Growing investments in micro, small, and medium-sized companies (MSME) and their high adoption of hybrid working models are expected to boost virtual office market expansion further. Asia Pacific is expected to grow at the significant CAGR of xx% in the global Virtual Office market during the forecast period. Asia, Increased knowledge of the benefits of implementing an efficient workspace flexibility plan, such as higher returns on real estate investments, lower occupancy costs, and the retention of high-performing staff, will propel the flexible office market in the Asia Pacific to new heights. Employees in nations like Indonesia, India, and South Korea were found to be more productive when working from home or from remote locations, according to a poll. Furthermore, the presence of a high number of co-working units and flexible working spaces in countries such as Australia in recent years is expected to contribute significantly to Asia Pacific flexible office market growth during the forecast period.Report Scope:

The Virtual Office Market research report covers product classification, product application, development trend, product technology, competitive landscape, industrial chain structure, industry overview, national policy and planning analysis of the industry, and the most recent dynamic analysis, among other things. The report discusses the global market's drivers, opportunities, and limitations. It discusses the influence of various drivers, trends, and restraints on market demand during the forecast period. The research also outlines market potential on a global scale. The research includes the production time, base distribution, technical characteristics, research and development trends, technology sources, and raw material sources of main Virtual Office Market firms in terms of production bases and technologies. The more precise study also contains the primary market and consumer application sectors, significant regions and consumption, major producers, distributors, raw material suppliers, equipment providers, and their contact information, as well as an industry chain relationship analysis. This report's study also contains product specifications, manufacturing processes, cost structure, and data information organised by area, technology, and application.Virtual Office Market Scope: Inquire before buying

Virtual Office Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 47.20 Bn. Forecast Period 2023 to 2029 CAGR: 16.52% Market Size in 2029: US $ 137.64 Bn. Segments Covered: by Type Cloud Based Web Based Others by Services Teleconferencing Videoconferencing Team Apps Remote Working Access Cloud Storage Others by End-User Freelancers Start-ups ITES Services Government Organizations Large Organizations Others Virtual Office Market, by Region

• North America • Europe • Asia Pacific • South America • Middle East and AfricaVirtual Office Market Key Players

• Young Living Essential Oils • ASEA, LLC • Regus Group • VirtualOffice.com • WorkSocial • CISCO • ecos • OBC Suisse AG • DDS Conferencing and Catering GmbH • MEET/N/WORK • Intelligent Office • i2Office Ltd. • METRO OFFICES • CLOUDVO • CARR Workplaces • Expansive Workplace • THINKSPACEFrequently Asked Questions:

1] What segments are covered in Virtual Office Market report? Ans. The segments covered in Virtual Office Market report are based on Type, Services, and End-User. 2] Which region is expected to hold the highest share in the global Virtual Office Market? Ans. Asia Pacific is expected to hold the highest share in the global Virtual Office Market. 3] What is the market size of global Virtual Office Market by 2029? Ans. The market size of global Virtual Office Market is expected to reach US $137.64 Bn. by 2029. 4] Who are the top key players in the global Virtual Office Market? Ans. Young Living Essential Oils, ASEA, LLC, Regus Group, VirtualOffice.com, Work Social and CISCO are the top key players in the global Virtual Office Market. 5] What was the market size of global Virtual Office Market in 2022? Ans. The market size of global Virtual Office Market in 2022 was US $ 47.20 Bn.

1. Virtual Office Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Virtual Office Market: Dynamics 2.1. Virtual Office Market Trends by Region 2.1.1. North America Virtual Office Market Trends 2.1.2. Europe Virtual Office Market Trends 2.1.3. Asia Pacific Virtual Office Market Trends 2.1.4. Middle East and Africa Virtual Office Market Trends 2.1.5. South America Virtual Office Market Trends 2.2. Virtual Office Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Virtual Office Market Drivers 2.2.1.2. North America Virtual Office Market Restraints 2.2.1.3. North America Virtual Office Market Opportunities 2.2.1.4. North America Virtual Office Market Challenges 2.2.2. Europe 2.2.2.1. Europe Virtual Office Market Drivers 2.2.2.2. Europe Virtual Office Market Restraints 2.2.2.3. Europe Virtual Office Market Opportunities 2.2.2.4. Europe Virtual Office Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Virtual Office Market Drivers 2.2.3.2. Asia Pacific Virtual Office Market Restraints 2.2.3.3. Asia Pacific Virtual Office Market Opportunities 2.2.3.4. Asia Pacific Virtual Office Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Virtual Office Market Drivers 2.2.4.2. Middle East and Africa Virtual Office Market Restraints 2.2.4.3. Middle East and Africa Virtual Office Market Opportunities 2.2.4.4. Middle East and Africa Virtual Office Market Challenges 2.2.5. South America 2.2.5.1. South America Virtual Office Market Drivers 2.2.5.2. South America Virtual Office Market Restraints 2.2.5.3. South America Virtual Office Market Opportunities 2.2.5.4. South America Virtual Office Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Virtual Office Industry 2.8. Analysis of Government Schemes and Initiatives For Virtual Office Industry 2.9. Virtual Office Market Trade Analysis 2.10. The Global Pandemic Impact on Virtual Office Market 3. Virtual Office Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Virtual Office Market Size and Forecast, by Type (2022-2029) 3.1.1. Cloud Based 3.1.2. Web Based 3.1.3. Others 3.2. Virtual Office Market Size and Forecast, by Services (2022-2029) 3.2.1. Teleconferencing 3.2.2. Videoconferencing 3.2.3. Team Apps 3.2.4. Remote Working Access 3.2.5. Cloud Storage 3.2.6. Others 3.3. Virtual Office Market Size and Forecast, by End-User (2022-2029) 3.3.1. Freelancers 3.3.2. Start-ups 3.3.3. ITES Services 3.3.4. Government Organizations 3.3.5. Large Organizations 3.3.6. Others 3.4. Virtual Office Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Virtual Office Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Virtual Office Market Size and Forecast, by Type (2022-2029) 4.1.1. Cloud Based 4.1.2. Web Based 4.1.3. Others 4.2. North America Virtual Office Market Size and Forecast, by Services (2022-2029) 4.2.1. Teleconferencing 4.2.2. Videoconferencing 4.2.3. Team Apps 4.2.4. Remote Working Access 4.2.5. Cloud Storage 4.2.6. Others 4.3. North America Virtual Office Market Size and Forecast, by End-User (2022-2029) 4.3.1. Freelancers 4.3.2. Start-ups 4.3.3. ITES Services 4.3.4. Government Organizations 4.3.5. Large Organizations 4.3.6. Others 4.4. North America Virtual Office Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Virtual Office Market Size and Forecast, by Type (2022-2029) 4.4.1.1.1. Cloud Based 4.4.1.1.2. Web Based 4.4.1.1.3. Others 4.4.1.2. United States Virtual Office Market Size and Forecast, by Services (2022-2029) 4.4.1.2.1. Teleconferencing 4.4.1.2.2. Videoconferencing 4.4.1.2.3. Team Apps 4.4.1.2.4. Remote Working Access 4.4.1.2.5. Cloud Storage 4.4.1.2.6. Others 4.4.1.3. United States Virtual Office Market Size and Forecast, by End-User (2022-2029) 4.4.1.3.1. Freelancers 4.4.1.3.2. Start-ups 4.4.1.3.3. ITES Services 4.4.1.3.4. Government Organizations 4.4.1.3.5. Large Organizations 4.4.1.3.6. Others 4.4.2. Canada 4.4.2.1. Canada Virtual Office Market Size and Forecast, by Type (2022-2029) 4.4.2.1.1. Cloud Based 4.4.2.1.2. Web Based 4.4.2.1.3. Others 4.4.2.2. Canada Virtual Office Market Size and Forecast, by Services (2022-2029) 4.4.2.2.1. Teleconferencing 4.4.2.2.2. Videoconferencing 4.4.2.2.3. Team Apps 4.4.2.2.4. Remote Working Access 4.4.2.2.5. Cloud Storage 4.4.2.2.6. Others 4.4.2.3. Canada Virtual Office Market Size and Forecast, by End-User (2022-2029) 4.4.2.3.1. Freelancers 4.4.2.3.2. Start-ups 4.4.2.3.3. ITES Services 4.4.2.3.4. Government Organizations 4.4.2.3.5. Large Organizations 4.4.2.3.6. Others 4.4.3. Mexico 4.4.3.1. Mexico Virtual Office Market Size and Forecast, by Type (2022-2029) 4.4.3.1.1. Cloud Based 4.4.3.1.2. Web Based 4.4.3.1.3. Others 4.4.3.2. Mexico Virtual Office Market Size and Forecast, by Services (2022-2029) 4.4.3.2.1. Teleconferencing 4.4.3.2.2. Videoconferencing 4.4.3.2.3. Team Apps 4.4.3.2.4. Remote Working Access 4.4.3.2.5. Cloud Storage 4.4.3.2.6. Others 4.4.3.3. Mexico Virtual Office Market Size and Forecast, by End-User (2022-2029) 4.4.3.3.1. Freelancers 4.4.3.3.2. Start-ups 4.4.3.3.3. ITES Services 4.4.3.3.4. Government Organizations 4.4.3.3.5. Large Organizations 4.4.3.3.6. Others 5. Europe Virtual Office Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Virtual Office Market Size and Forecast, by Type (2022-2029) 5.2. Europe Virtual Office Market Size and Forecast, by Services (2022-2029) 5.3. Europe Virtual Office Market Size and Forecast, by End-User (2022-2029) 5.4. Europe Virtual Office Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Virtual Office Market Size and Forecast, by Type (2022-2029) 5.4.1.2. United Kingdom Virtual Office Market Size and Forecast, by Services (2022-2029) 5.4.1.3. United Kingdom Virtual Office Market Size and Forecast, by End-User(2022-2029) 5.4.2. France 5.4.2.1. France Virtual Office Market Size and Forecast, by Type (2022-2029) 5.4.2.2. France Virtual Office Market Size and Forecast, by Services (2022-2029) 5.4.2.3. France Virtual Office Market Size and Forecast, by End-User(2022-2029) 5.4.3. Germany 5.4.3.1. Germany Virtual Office Market Size and Forecast, by Type (2022-2029) 5.4.3.2. Germany Virtual Office Market Size and Forecast, by Services (2022-2029) 5.4.3.3. Germany Virtual Office Market Size and Forecast, by End-User (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Virtual Office Market Size and Forecast, by Type (2022-2029) 5.4.4.2. Italy Virtual Office Market Size and Forecast, by Services (2022-2029) 5.4.4.3. Italy Virtual Office Market Size and Forecast, by End-User(2022-2029) 5.4.5. Spain 5.4.5.1. Spain Virtual Office Market Size and Forecast, by Type (2022-2029) 5.4.5.2. Spain Virtual Office Market Size and Forecast, by Services (2022-2029) 5.4.5.3. Spain Virtual Office Market Size and Forecast, by End-User (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Virtual Office Market Size and Forecast, by Type (2022-2029) 5.4.6.2. Sweden Virtual Office Market Size and Forecast, by Services (2022-2029) 5.4.6.3. Sweden Virtual Office Market Size and Forecast, by End-User (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Virtual Office Market Size and Forecast, by Type (2022-2029) 5.4.7.2. Austria Virtual Office Market Size and Forecast, by Services (2022-2029) 5.4.7.3. Austria Virtual Office Market Size and Forecast, by End-User (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Virtual Office Market Size and Forecast, by Type (2022-2029) 5.4.8.2. Rest of Europe Virtual Office Market Size and Forecast, by Services (2022-2029) 5.4.8.3. Rest of Europe Virtual Office Market Size and Forecast, by End-User (2022-2029) 6. Asia Pacific Virtual Office Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Virtual Office Market Size and Forecast, by Type (2022-2029) 6.2. Asia Pacific Virtual Office Market Size and Forecast, by Services (2022-2029) 6.3. Asia Pacific Virtual Office Market Size and Forecast, by End-User (2022-2029) 6.4. Asia Pacific Virtual Office Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Virtual Office Market Size and Forecast, by Type (2022-2029) 6.4.1.2. China Virtual Office Market Size and Forecast, by Services (2022-2029) 6.4.1.3. China Virtual Office Market Size and Forecast, by End-User (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Virtual Office Market Size and Forecast, by Type (2022-2029) 6.4.2.2. S Korea Virtual Office Market Size and Forecast, by Services (2022-2029) 6.4.2.3. S Korea Virtual Office Market Size and Forecast, by End-User (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Virtual Office Market Size and Forecast, by Type (2022-2029) 6.4.3.2. Japan Virtual Office Market Size and Forecast, by Services (2022-2029) 6.4.3.3. Japan Virtual Office Market Size and Forecast, by End-User (2022-2029) 6.4.4. India 6.4.4.1. India Virtual Office Market Size and Forecast, by Type (2022-2029) 6.4.4.2. India Virtual Office Market Size and Forecast, by Services (2022-2029) 6.4.4.3. India Virtual Office Market Size and Forecast, by End-User (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Virtual Office Market Size and Forecast, by Type (2022-2029) 6.4.5.2. Australia Virtual Office Market Size and Forecast, by Services (2022-2029) 6.4.5.3. Australia Virtual Office Market Size and Forecast, by End-User (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Virtual Office Market Size and Forecast, by Type (2022-2029) 6.4.6.2. Indonesia Virtual Office Market Size and Forecast, by Services (2022-2029) 6.4.6.3. Indonesia Virtual Office Market Size and Forecast, by End-User (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Virtual Office Market Size and Forecast, by Type (2022-2029) 6.4.7.2. Malaysia Virtual Office Market Size and Forecast, by Services (2022-2029) 6.4.7.3. Malaysia Virtual Office Market Size and Forecast, by End-User (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Virtual Office Market Size and Forecast, by Type (2022-2029) 6.4.8.2. Vietnam Virtual Office Market Size and Forecast, by Services (2022-2029) 6.4.8.3. Vietnam Virtual Office Market Size and Forecast, by End-User(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Virtual Office Market Size and Forecast, by Type (2022-2029) 6.4.9.2. Taiwan Virtual Office Market Size and Forecast, by Services (2022-2029) 6.4.9.3. Taiwan Virtual Office Market Size and Forecast, by End-User (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Virtual Office Market Size and Forecast, by Type (2022-2029) 6.4.10.2. Rest of Asia Pacific Virtual Office Market Size and Forecast, by Services (2022-2029) 6.4.10.3. Rest of Asia Pacific Virtual Office Market Size and Forecast, by End-User (2022-2029) 7. Middle East and Africa Virtual Office Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Virtual Office Market Size and Forecast, by Type (2022-2029) 7.2. Middle East and Africa Virtual Office Market Size and Forecast, by Services (2022-2029) 7.3. Middle East and Africa Virtual Office Market Size and Forecast, by End-User (2022-2029) 7.4. Middle East and Africa Virtual Office Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Virtual Office Market Size and Forecast, by Type (2022-2029) 7.4.1.2. South Africa Virtual Office Market Size and Forecast, by Services (2022-2029) 7.4.1.3. South Africa Virtual Office Market Size and Forecast, by End-User (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Virtual Office Market Size and Forecast, by Type (2022-2029) 7.4.2.2. GCC Virtual Office Market Size and Forecast, by Services (2022-2029) 7.4.2.3. GCC Virtual Office Market Size and Forecast, by End-User (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Virtual Office Market Size and Forecast, by Type (2022-2029) 7.4.3.2. Nigeria Virtual Office Market Size and Forecast, by Services (2022-2029) 7.4.3.3. Nigeria Virtual Office Market Size and Forecast, by End-User (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Virtual Office Market Size and Forecast, by Type (2022-2029) 7.4.4.2. Rest of ME&A Virtual Office Market Size and Forecast, by Services (2022-2029) 7.4.4.3. Rest of ME&A Virtual Office Market Size and Forecast, by End-User (2022-2029) 8. South America Virtual Office Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Virtual Office Market Size and Forecast, by Type (2022-2029) 8.2. South America Virtual Office Market Size and Forecast, by Services (2022-2029) 8.3. South America Virtual Office Market Size and Forecast, by End-User(2022-2029) 8.4. South America Virtual Office Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Virtual Office Market Size and Forecast, by Type (2022-2029) 8.4.1.2. Brazil Virtual Office Market Size and Forecast, by Services (2022-2029) 8.4.1.3. Brazil Virtual Office Market Size and Forecast, by End-User (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Virtual Office Market Size and Forecast, by Type (2022-2029) 8.4.2.2. Argentina Virtual Office Market Size and Forecast, by Services (2022-2029) 8.4.2.3. Argentina Virtual Office Market Size and Forecast, by End-User (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Virtual Office Market Size and Forecast, by Type (2022-2029) 8.4.3.2. Rest Of South America Virtual Office Market Size and Forecast, by Services (2022-2029) 8.4.3.3. Rest Of South America Virtual Office Market Size and Forecast, by End-User (2022-2029) 9. Global Virtual Office Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Virtual Office Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Young Living Essential Oils 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. ASEA, LLC 10.3. Regus Group 10.4. VirtualOffice.com 10.5. WorkSocial 10.6. CISCO 10.7. ecos 10.8. OBC Suisse AG 10.9. DDS Conferencing and Catering GmbH 10.10. MEET/N/WORK 10.11. Intelligent Office 10.12. i2Office Ltd. 10.13. METRO OFFICES 10.14. CLOUDVO 10.15. CARR Workplaces 10.16. Expansive Workplace 10.17. THINKSPACE 11. Key Findings 12. Industry Recommendations 13. Virtual Office Market: Research Methodology 14. Terms and Glossary