The Hummus Market size was valued at USD 3.64 Billion in 2024 and the total Hummus revenue is expected to grow at a CAGR of 10.2% from 2025 to 2032, reaching nearly USD 7.93 Billion.Hummus Market Overview

Hummus is a Middle Eastern paste made from mashed chickpeas, tahini, olive oil, lemon juice, and garlic. It is a popular dip or snack food that is high in protein and fiber. The increasing recognition of hummus for its health benefits serves as a rich source of protein, dietary fiber, and various essential minerals and vitamins. The rising popularity of Mediterranean cuisine, characterized by its health-conscious components such as olive oil, whole grains, and legumes, also contributes significantly to the Hummus Market's Growth. The advancements in hummus manufacturing technologies, including automation in processes such as chickpea peeling, roasting, grinding, and packaging, enhance efficiency and meet the growing demand. According to the MMR Study report more than 9.3% of restaurants offer Hummus on their menus. Also, The Increasing trend of Veganism boosts the hummus market by aligning with plant-based dietary preferences. Hummus, a chickpea-based product, offers vegans a rich source of protein and nutrients. Its versatility, diverse flavors, and accessibility provide to the growing demand for convenient and nutritious vegan snacks, making hummus a popular choice in the plant-based lifestyle.To know about the Research Methodology :- Request Free Sample Report

Hummus Market Dynamics:

Driver Growing consumer awareness of health and wellness boosts Market Growth The easy access to health information online has heightened consumer awareness about well-being and shifted the demand towards healthier dietary choices such as hummus. Recognized for its nutritional benefits, hummus is a rich source of fiber, protein, and essential vitamins and minerals. Its adaptability and versatility make it a popular and enjoyable addition to various meals. The increasing embrace of plant-based and vegan diets has significantly contributed to the growing demand for hummus. As individuals prioritize health-conscious decisions, hummus stands out as a nutrient-dense option that supports weight management and digestive health. Packed with essential nutrients including iron, calcium, and vitamin B6, hummus addresses nutritional needs and aligns with the modern consumer's inclination towards well-rounded, plant-focused lifestyles, reflecting a broader societal trend towards mindful and health-oriented living. Hummus is a versatile ingredient that is enjoyed in various ways. It serves as a dip for vegetables, crackers, and pita bread. It is incorporated into sandwiches, wraps, and salads. Therefore the demand as well as consumption of Hummus is growing.The growing popularity of vegan and plant-based diets has accelerated demand for hummus. As individuals adopt meatless lifestyles, they seek alternatives to traditional animal-based protein sources. Hummus, with its high protein content and plant-based ingredients, has emerged as a popular choice for vegans and vegetarians. The 2022 MMR study reported a global vegan population of 79 million, driving demand for plant-based products. This surge in veganism has notably fueled the Hummus Market, as consumers seek protein-rich, plant-based alternatives. The growing preference for vegan options contributes to the expanding popularity and market growth of hummus worldwide.

Restrain Price Volatility of Raw Materials limits the Hummus Market Growth Hummus production lies in key ingredients such as chickpeas, tahini, olive oil, garlic, and lemon juice. The vulnerability of these ingredients to external factors such as climate conditions and geopolitical events exposes the industry to price fluctuations. Chickpeas, a staple, are particularly susceptible to variations in yield due to weather patterns, creating a negative effect throughout the supply chain. Also, the high fluctuation in the raw material prices significantly impacts the production costs of hummus. As a staple in traditional hummus, chickpeas face challenges as their limited production struggles to keep pace with the rising global demand. This discrepancy has led to a substantial gap between supply and demand, causing scarcity and significant volatility in chickpea prices. The repercussions are evident in the marketplace, with supermarket prices for hummus surging by over 30%. This surge is a direct consequence of the increased demand for chickpeas, a crucial component in hummus production. The imbalance between limited chickpea availability and increased consumption underscores the challenges faced by the hummus industry, affecting both the supply chain and consumer affordability. The increasing demand for hummus products and the constantly fluctuating prices of raw materials affect the cost of the final product, which limits the growth of the hummus market. Opportunity Flavor Innovation in Hummus Creates Lucrative Growth Opportunities for the Hummus Market The hummus market has evolved from being a niche Middle Eastern dish to a global sensation, and flavor diversification has become a key strategy for companies seeking Innovation. Consumers today crave variety and unique taste experiences, and the hummus market has responded by introducing a wide array of innovative flavors. Traditional varieties classic, garlic, and roasted red pepper remain popular, but the market's dynamism stems from the introduction of bold and unconventional options. Diverse flavor profiles such as avocado, sun-dried tomato, olive tapenade, and spicy jalapeno showcase the innovative range of hummus, appealing to a wide array of taste preferences. This flavor diversity captivates existing hummus aficionados and intrigues newcomers who might have been hesitant to explore the product. The versatility of hummus as a base allows for endless experimentation, leading to the creation of fusion flavors that blend cultural influences and culinary trends. Whether infused with Mediterranean herbs, inspired by Asian spices, or incorporating trendy superfoods, these innovative flavors elevate hummus from a simple dip to a gourmet and culturally diverse culinary delight. The health-conscious consumer demographic has embraced hummus as a nutrient-dense snack and flavor innovation aligns with this trend by offering exciting yet wholesome options. Brands leverage this trend by emphasizing the use of natural ingredients, promoting nutritional benefits, and even creating specialty lines that provide specific dietary preferences, such as organic or gluten-free options.

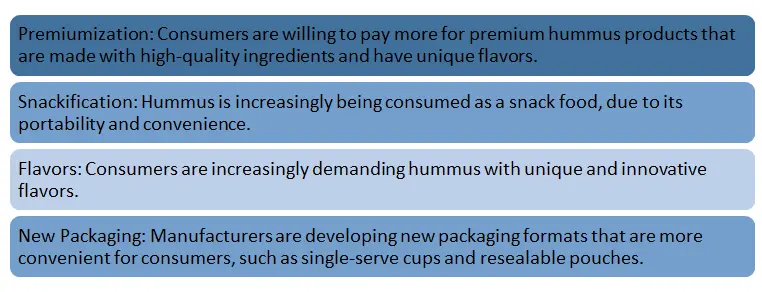

Hummus Market Trends

Hummus Market Segment Analysis:

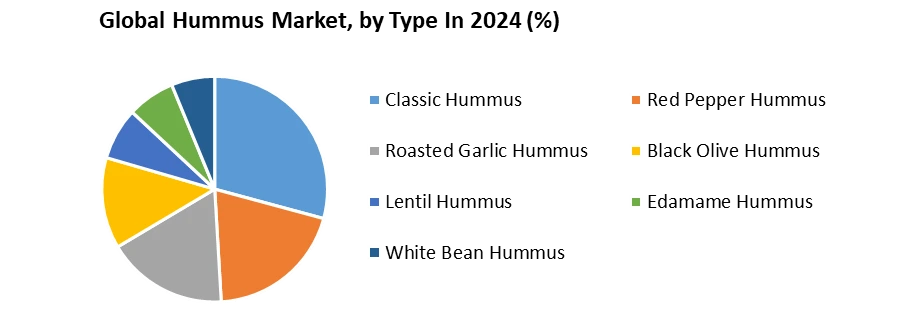

Based on Type, the classic hummus segment dominated the Hummus Market in the year 2024. Due to it’s primarily owing to its familiar and authentic taste that resonates with a broad spectrum of palates. Renowned for its smooth and creamy texture, well-balanced flavors, and remarkable versatility in complementing various foods, classic hummus has solidified its status as a kitchen staple in numerous households. Its widespread availability and established consumer preferences contribute significantly to the sustained demand for classic hummus. Functioning as a go-to dip, spread, and ingredient in diverse recipes, classic hummus has ingrained itself in culinary culture. Beyond its gastronomic appeal, the classic variant provides to different dietary preferences, aligning seamlessly with vegetarian and vegan diets. The enduring popularity of classic hummus highlights its enduring presence in the market. Its ability to meet diverse consumer needs, coupled with its culinary adaptability, positions classic hummus as a key player in the thriving hummus market.

Regional Insight

North America dominated the Hummus Market in the year 2024. The rise of health-conscious lifestyles and the increasing adoption of plant-based diets boost the popularity of hummus, known for its nutritional profile and versatility. In North America, the hummus market benefited from a cultural shift towards diverse and international cuisines. Hummus, originally a staple in Middle Eastern diets, found its place in the mainstream American and Canadian food scenes, becoming a favored dip, spread, or snack. The region's multicultural demographics and openness to culinary experimentation played an important role in the widespread acceptance of hummus. The food industry's response to the demand for innovative flavors and variations further accelerates North America's hummus market. Companies introduced unique and exotic hummus blends, Providing to the diverse taste preferences of consumers. The convenience factor, with pre-packaged hummus options and ready-to-eat formats, also contributed to the market's dominance. Competitive Landscape The hummus market is competitive, driven by continuous innovation, a surging demand for plant-based proteins, and an increasing focus on healthy eating habits. Key players in this landscape, such as Sabra, Tribe Hummus, and Cedar's Mediterranean Foods International, engage in intense competition, driving constant improvement and innovation in product offerings. These companies emphasize diversification through new flavors, textures, and ingredients, providing a wide array of consumer preferences. The hummus market is the emphasis on innovation and product development. As one of the largest manufacturers of hummus, Strauss Group has been focusing on innovation and product development to maintain its market position. The company has introduced new flavors and varieties to provide to diverse consumer preferences and expand its market reach. Companies such as Hope Foods are introducing new packaging options to enhance convenience and shelf-life, aligning with changing consumer needs. Hope Foods, for instance, has revamped its organic hummus packaging, incorporating vibrant designs and proudly highlighting its plastic-neutral certification, demonstrating a commitment to sustainability.Hummus Market Scope Table: Inquire Before Buying

Global Hummus Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 3.64 Bn. Forecast Period 2025 to 2032 CAGR: 10.2% Market Size in 2032: USD 7.93 Bn. Segments Covered: by Type Classic Hummus Red Pepper Hummus Roasted Garlic Hummus Black Olive Hummus Lentil Hummus Edamame Hummus White Bean Hummus by Packaging Type Tubes Cups Jars Bottles by Distribution Channel Supermarket/Hypermarket Convenience Stores Grocery Stores Online Retails Others Hummus Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Hummus Market, key players

1. Sabra Dipping Company, LLC 2. Nestlé S.A. 3. Blue Moose of Boulder 4. Tribe Hummus 5. Boar's Head 6. Hormel Foods Corporation 7. Fontaine Santé Foods Inc. 8. Cedar's Mediterranean Foods, Inc. 9. Hope Foods, LLC 10. Ithaca Cold-Crafted 11. Lantana Foods 12. Mediterranean Organic 13. Bakkavor Group 14. Yoghurt and Cheese 15. Hummus Goodness 16. Eat Well Embrace Life 17. Delighted By Hummus 18. Roots Hummus 19. AbuKass 20. PepsiCo, Inc. 1] What segments are covered in the Global Hummus Market report? Ans. The segments covered in the Hummus Market report are based on, Type, Packing Type, Distribution Channel, and Regions. 2] Which region is expected to hold the highest share of the Global Hummus Market? Ans. The North American region is expected to hold the highest share of the Hummus Market. 3] What is the market size of the Global Hummus Market by 2032? Ans. The market size of the Hummus Market by 2032 is expected to reach USD 7.93 Bn. 4] What was the Global Hummus Market size in 2024? Ans: The Global Hummus Market size was USD 3.64 Billion in 2024. 5] Key players in the Global Hummus Market. Ans. Sabra Dipping Company, LLC , Nestlé S.A. , Blue Moose of Boulder, Tribe Hummus and Boar's Head.

1. Hummus Market: Research Methodology 2. Hummus Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Hummus Market: Dynamics 3.1 Hummus Market Trends by Region 3.1.1 North America Hummus Market Trends 3.1.2 Europe Hummus Market Trends 3.1.3 Asia Pacific Hummus Market Trends 3.1.4 Middle East and Africa Hummus Market Trends 3.1.5 South America Hummus Market Trends 3.2 Hummus Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Hummus Market Drivers 3.2.1.2 North America Hummus Market Restraints 3.2.1.3 North America Hummus Market Opportunities 3.2.1.4 North America Hummus Market Challenges 3.2.2 Europe 3.2.2.1 Europe Hummus Market Drivers 3.2.2.2 Europe Hummus Market Restraints 3.2.2.3 Europe Hummus Market Opportunities 3.2.2.4 Europe Hummus Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Hummus Market Drivers 3.2.3.2 Asia Pacific Hummus Market Restraints 3.2.3.3 Asia Pacific Hummus Market Opportunities 3.2.3.4 Asia Pacific Hummus Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Hummus Market Drivers 3.2.4.2 Middle East and Africa Hummus Market Restraints 3.2.4.3 Middle East and Africa Hummus Market Opportunities 3.2.4.4 Middle East and Africa Hummus Market Challenges 3.2.5 South America 3.2.5.1 South America Hummus Market Drivers 3.2.5.2 South America Hummus Market Restraints 3.2.5.3 South America Hummus Market Opportunities 3.2.5.4 South America Hummus Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 North America 3.6.2 Europe 3.6.3 Asia Pacific 3.6.4 Middle East and Africa 3.6.5 South America 3.7 Analysis of Government Schemes and Initiatives For the Hummus Industry 3.8 The Global Pandemic and Redefining of The Hummus Industry Landscape 3.9 Price Trend Analysis 3.10 Technological Road Map 4. Global Hummus Market: Global Market Size and Forecast by (Value and Volume) (2024-2032) 4.1 Global Hummus Market Size and Forecast, by Type (2024-2032) 4.1.1 Classic Hummus 4.1.2 Red Pepper Hummus 4.1.3 Roasted Garlic Hummus 4.1.4 Black Olive Hummus 4.1.5 Lentil Hummus 4.1.6 Edamame Hummus 4.1.7 White Bean Hummus 4.2 Global Hummus Market Size and Forecast, by Packaging Type (2024-2032) 4.2.1 Tubes 4.2.2 Cups 4.2.3 Jars 4.2.4 Bottles 4.3 Global Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 4.3.1 Supermarket/Hypermarket 4.3.2 Convenience Stores 4.3.3 Grocery Stores 4.3.4 Online Retails 4.3.5 Others 4.4 Global Hummus Market Size and Forecast, by Region (2024-2032) 4.4.1 North America 4.4.2 Europe 4.4.3 Asia Pacific 4.4.4 Middle East and Africa 4.4.5 South America 5. North America Hummus Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2032) 5.1 North America Hummus Market Size and Forecast, by Type (2024-2032) 5.1.1 Classic Hummus 5.1.2 Red Pepper Hummus 5.1.3 Roasted Garlic Hummus 5.1.4 Black Olive Hummus 5.1.5 Lentil Hummus 5.1.6 Edamame Hummus 5.1.7 White Bean Hummus 5.2 North America Hummus Market Size and Forecast, by Packaging Type (2024-2032) 5.2.1 Tubes 5.2.2 Cups 5.2.3 Jars 5.2.4 Bottles 5.3 North America Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 5.3.1 Supermarket/Hypermarket 5.3.2 Convenience Stores 5.3.3 Grocery Stores 5.3.4 Online Retails 5.3.5 Others 5.4 North America Hummus Market Size and Forecast, by Country (2024-2032) 5.4.1 United States 5.4.1.1 United States Hummus Market Size and Forecast, by Type (2024-2032) 5.4.1.1.1 Classic Hummus 5.4.1.1.2 Red Pepper Hummus 5.4.1.1.3 Roasted Garlic Hummus 5.4.1.1.4 Black Olive Hummus 5.4.1.1.5 Lentil Hummus 5.4.1.1.6 Edamame Hummus 5.4.1.1.7 White Bean Hummus 5.4.1.2 United States Hummus Market Size and Forecast, by Packaging Type (2024-2032) 5.4.1.2.1 Tubes 5.4.1.2.2 Cups 5.4.1.2.3 Jars 5.4.1.2.4 Bottles 5.4.1.3 United States Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.1.3.1 Supermarket/Hypermarket 5.4.1.3.2 Convenience Stores 5.4.1.3.3 Grocery Stores 5.4.1.3.4 Online Retails 5.4.1.3.5 Others 5.4.2 Canada 5.4.2.1 Canada Hummus Market Size and Forecast, by Type (2024-2032) 5.4.2.1.1 Classic Hummus 5.4.2.1.2 Red Pepper Hummus 5.4.2.1.3 Roasted Garlic Hummus 5.4.2.1.4 Black Olive Hummus 5.4.2.1.5 Lentil Hummus 5.4.2.1.6 Edamame Hummus 5.4.2.1.7 White Bean Hummus 5.4.2.2 Canada Hummus Market Size and Forecast, by Packaging Type (2024-2032) 5.4.2.2.1 Tubes 5.4.2.2.2 Cups 5.4.2.2.3 Jars 5.4.2.2.4 Bottles 5.4.2.3 Canada Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.2.3.1 Supermarket/Hypermarket 5.4.2.3.2 Convenience Stores 5.4.2.3.3 Grocery Stores 5.4.2.3.4 Online Retails 5.4.2.3.5 Others 5.4.3 Mexico 5.4.3.1 Mexico Hummus Market Size and Forecast, by Type (2024-2032) 5.4.3.1.1 Classic Hummus 5.4.3.1.2 Red Pepper Hummus 5.4.3.1.3 Roasted Garlic Hummus 5.4.3.1.4 Black Olive Hummus 5.4.3.1.5 Lentil Hummus 5.4.3.1.6 Edamame Hummus 5.4.3.1.7 White Bean Hummus 5.4.3.2 Mexico Hummus Market Size and Forecast, by Packaging Type (2024-2032) 5.4.3.2.1 Tubes 5.4.3.2.2 Cups 5.4.3.2.3 Jars 5.4.3.2.4 Bottles 5.4.3.3 Mexico Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.3.3.1 Supermarket/Hypermarket 5.4.3.3.2 Convenience Stores 5.4.3.3.3 Grocery Stores 5.4.3.3.4 Online Retails 5.4.3.3.5 Others 6. Europe Hummus Market Size and Forecast by Segmentation for (Value and Volume) (2024-2032) 6.1 Europe Hummus Market Size and Forecast, by Type (2024-2032) 6.2 Europe Hummus Market Size and Forecast, by Packaging Type (2024-2032) 6.3 Europe Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 6.4 Europe Hummus Market Size and Forecast, by Country (2024-2032) 6.4.1 United Kingdom 6.4.1.1 United Kingdom Hummus Market Size and Forecast, by Type (2024-2032) 6.4.1.2 United Kingdom Hummus Market Size and Forecast, by Packaging Type (2024-2032) 6.4.1.3 United Kingdom Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.2 France 6.4.2.1 France Hummus Market Size and Forecast, by Type (2024-2032) 6.4.2.2 France Hummus Market Size and Forecast, by Packaging Type (2024-2032) 6.4.2.3 France Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.3 Germany 6.4.3.1 Germany Hummus Market Size and Forecast, by Type (2024-2032) 6.4.3.2 Germany Hummus Market Size and Forecast, by Packaging Type (2024-2032) 6.4.3.3 Germany Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.4 Italy 6.4.4.1 Italy Hummus Market Size and Forecast, by Type (2024-2032) 6.4.4.2 Italy Hummus Market Size and Forecast, by Packaging Type (2024-2032) 6.4.4.3 Italy Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.5 Spain 6.4.5.1 Spain Hummus Market Size and Forecast, by Type (2024-2032) 6.4.5.2 Spain Hummus Market Size and Forecast, by Packaging Type (2024-2032) 6.4.5.3 Spain Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.6 Sweden 6.4.6.1 Sweden Hummus Market Size and Forecast, by Type (2024-2032) 6.4.6.2 Sweden Hummus Market Size and Forecast, by Packaging Type (2024-2032) 6.4.6.3 Sweden Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.7 Austria 6.4.7.1 Austria Hummus Market Size and Forecast, by Type (2024-2032) 6.4.7.2 Austria Hummus Market Size and Forecast, by Packaging Type (2024-2032) 6.4.7.3 Austria Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.8 Rest of Europe 6.4.8.1 Rest of Europe Hummus Market Size and Forecast, by Type (2024-2032) 6.4.8.2 Rest of Europe Hummus Market Size and Forecast, by Packaging Type (2024-2032). 6.4.8.3 Rest of Europe Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 7. Asia Pacific Hummus Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2032) 7.1 Asia Pacific Hummus Market Size and Forecast, by Type (2024-2032) 7.2 Asia Pacific Hummus Market Size and Forecast, by Packaging Type (2024-2032) 7.3 Asia Pacific Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 7.4 Asia Pacific Hummus Market Size and Forecast, by Country (2024-2032) 7.4.1 China 7.4.1.1 China Hummus Market Size and Forecast, by Type (2024-2032) 7.4.1.2 China Hummus Market Size and Forecast, by Packaging Type (2024-2032) 7.4.1.3 China Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.2 South Korea 7.4.2.1 S Korea Hummus Market Size and Forecast, by Type (2024-2032) 7.4.2.2 S Korea Hummus Market Size and Forecast, by Packaging Type (2024-2032) 7.4.2.3 S Korea Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.3 Japan 7.4.3.1 Japan Hummus Market Size and Forecast, by Type (2024-2032) 7.4.3.2 Japan Hummus Market Size and Forecast, by Packaging Type (2024-2032) 7.4.3.3 Japan Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.4 India 7.4.4.1 India Hummus Market Size and Forecast, by Type (2024-2032) 7.4.4.2 India Hummus Market Size and Forecast, by Packaging Type (2024-2032) 7.4.4.3 India Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.5 Australia 7.4.5.1 Australia Hummus Market Size and Forecast, by Type (2024-2032) 7.4.5.2 Australia Hummus Market Size and Forecast, by Packaging Type (2024-2032) 7.4.5.3 Australia Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.6 Indonesia 7.4.6.1 Indonesia Hummus Market Size and Forecast, by Type (2024-2032) 7.4.6.2 Indonesia Hummus Market Size and Forecast, by Packaging Type (2024-2032) 7.4.6.3 Indonesia Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.7 Malaysia 7.4.7.1 Malaysia Hummus Market Size and Forecast, by Type (2024-2032) 7.4.7.2 Malaysia Hummus Market Size and Forecast, by Packaging Type (2024-2032) 7.4.7.3 Malaysia Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.8 Vietnam 7.4.8.1 Vietnam Hummus Market Size and Forecast, by Type (2024-2032) 7.4.8.2 Vietnam Hummus Market Size and Forecast, by Packaging Type (2024-2032) 7.4.8.3 Vietnam Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.9 Taiwan 7.4.9.1 Taiwan Hummus Market Size and Forecast, by Type (2024-2032) 7.4.9.2 Taiwan Hummus Market Size and Forecast, by Packaging Type (2024-2032) 7.4.9.3 Taiwan Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.10 Bangladesh 7.4.10.1 Bangladesh Hummus Market Size and Forecast, by Type (2024-2032) 7.4.10.2 Bangladesh Hummus Market Size and Forecast, by Packaging Type (2024-2032) 7.4.10.3 Bangladesh Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.11 Pakistan 7.4.11.1 Pakistan Hummus Market Size and Forecast, by Type (2024-2032) 7.4.11.2 Pakistan Hummus Market Size and Forecast, by Packaging Type (2024-2032) 7.4.11.3 Pakistan Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.12 Rest of Asia Pacific 7.4.12.1 Rest of Asia Pacific Hummus Market Size and Forecast, by Type (2024-2032) 7.4.12.2 Rest of Asia PacificHummus Market Size and Forecast, by Packaging Type (2024-2032) 7.4.12.3 Rest of Asia Pacific Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 8. Middle East and Africa Hummus Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2032) 8.1 Middle East and Africa Hummus Market Size and Forecast, by Type (2024-2032) 8.2 Middle East and Africa Hummus Market Size and Forecast, by Packaging Type (2024-2032) 8.3 Middle East and Africa Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 8.4 Middle East and Africa Hummus Market Size and Forecast, by Country (2024-2032) 8.4.1 South Africa 8.4.1.1 South Africa Hummus Market Size and Forecast, by Type (2024-2032) 8.4.1.2 South Africa Hummus Market Size and Forecast, by Packaging Type (2024-2032) 8.4.1.3 South Africa Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 8.4.2 GCC 8.4.2.1 GCC Hummus Market Size and Forecast, by Type (2024-2032) 8.4.2.2 GCC Hummus Market Size and Forecast, by Packaging Type (2024-2032) 8.4.2.3 GCC Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 8.4.3 Egypt 8.4.3.1 Egypt Hummus Market Size and Forecast, by Type (2024-2032) 8.4.3.2 Egypt Hummus Market Size and Forecast, by Packaging Type (2024-2032) 8.4.3.3 Egypt Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 8.4.4 Nigeria 8.4.4.1 Nigeria Hummus Market Size and Forecast, by Type (2024-2032) 8.4.4.2 Nigeria Hummus Market Size and Forecast, by Packaging Type (2024-2032) 8.4.4.3 Nigeria Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 8.4.5 Rest of ME&A 8.4.5.1 Rest of ME&A Hummus Market Size and Forecast, by Type (2024-2032) 8.4.5.2 Rest of ME&A Hummus Market Size and Forecast, by Packaging Type (2024-2032) 8.4.5.3 Rest of ME&A Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 9. South America Hummus Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2032) 9.1 South America Hummus Market Size and Forecast, by Type (2024-2032) 9.2 South America Hummus Market Size and Forecast, by Packaging Type (2024-2032) 9.3 South America Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 9.4 South America Hummus Market Size and Forecast, by Country (2024-2032) 9.4.1 Brazil 9.4.1.1 Brazil Hummus Market Size and Forecast, by Type (2024-2032) 9.4.1.2 Brazil Hummus Market Size and Forecast, by Packaging Type (2024-2032) 9.4.1.3 Brazil Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 9.4.2 Argentina 9.4.2.1 Argentina Hummus Market Size and Forecast, by Type (2024-2032) 9.4.2.2 Argentina Hummus Market Size and Forecast, by Packaging Type (2024-2032) 9.4.2.3 Argentina Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 9.4.3 Rest Of South America 9.4.3.1 Rest Of South America Hummus Market Size and Forecast, by Type (2024-2032) 9.4.3.2 Rest Of South America Hummus Market Size and Forecast, by Packaging Type (2024-2032) 9.4.3.3 Rest Of South America Hummus Market Size and Forecast, by Distribution Channel (2024-2032) 10. Global Hummus Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 Distribution Channelr Segment 10.3.4 Revenue (2022) 10.3.5 Manufacturing Locations 10.4 Leading Hummus Global Companies, by market capitalization 10.5 Market Structure 10.5.1 Market Leaders 10.5.2 Market Followers 10.5.3 Emerging Players 10.6 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Sabra Dipping Company, LLC 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Nestlé S.A. 11.3 Blue Moose of Boulder 11.4 Tribe Hummus 11.5 Boar's Head 11.6 Hormel Foods Corporation 11.7 Fontaine Santé Foods Inc. 11.8 Cedar's Mediterranean Foods, Inc. 11.9 Hope Foods, LLC 11.10 Ithaca Cold-Crafted 11.11 Lantana Foods 11.12 Mediterranean Organic 11.13 Bakkavor Group 11.14 Yoghurt and Cheese 11.15 Hummus Goodness 11.16 Eat Well Embrace Life 11.17 Delighted By Hummus 11.18 Roots Hummus 11.19 AbuKass 11.20 PepsiCo, Inc 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary