The Medical Terminology Software Market size was valued at USD 1.18 billion in 2023 and the total Medical Terminology Software Market revenue is expected to grow at a CAGR of 18.42 % from 2024 to 2030, reaching nearly USD 3.85 billion. Medical Terminology Software refers to specialized software solutions designed to facilitate the accurate and efficient management of medical terminology within healthcare settings. It encompasses various tools and systems that aid in the standardization, organization, and utilization of medical language, including terms, abbreviations, codes, and classifications. These software applications play a crucial role in enhancing communication, documentation, and decision-making processes among healthcare professionals by ensuring consistency, clarity, and precision in medical terminology usage. Rapid technological advancements, increasing healthcare digitization efforts worldwide, and a growing awareness of the importance of standardized medical terminology for enhancing patient care and safety. Key driving factors include the rising adoption of electronic health records (EHRs) and health information exchange (HIE) systems, government initiatives promoting healthcare IT infrastructure development, and the growing focus on interoperability and data standardization.To know about the Research Methodology:-Request Free Sample Report Continuous innovations in artificial intelligence (AI), machine learning, and natural language processing (NLP) are enhancing the capabilities of medical terminology software, enabling more accurate documentation, coding, and analysis of clinical data. Stringent regulations and initiatives aimed at promoting healthcare interoperability, such as the Health Information Technology for Economic and Clinical Health (HITECH) Act in the United States, are fueling the adoption of medical terminology software solutions that ensure compliance with data standards and privacy requirements. The rise in healthcare spending globally, coupled with the growing demand for efficient healthcare data management solutions, is driving the Medical Terminology Software Market for medical terminology software. The growth of healthcare IT infrastructure, particularly in emerging economies, presents significant opportunities for Medical Terminology Software Market players to introduce innovative software solutions that cater to the evolving needs of healthcare organizations. One recent development in the Medical Terminology Software Market is the acquisition of MModal's technology business by 3M for a total enterprise value of $1 billion. MModal's cloud-based AI-powered systems aim to streamline physician-patient interactions, improve care quality, and enhance documentation accuracy. This acquisition aligns with 3M's goal of enhancing its Health Information Systems capabilities and empowering physicians worldwide to enhance patient experiences. GE Healthcare announced its agreement to acquire MIM Software, a global medical imaging analysis and AI solutions provider, to strengthen its precision care strategy and digital solutions across various care areas, including oncology, urology, neurology, and cardiology. These developments reflect the Medical Terminology Software Market's ongoing evolution and the continuous efforts of key players to innovate and expand their product offerings to meet the changing needs of healthcare providers and patients.

Market Dynamics:

Rising Demand for Electronic Health Records (EHRs): Continuous advancements in medical terminology software technology drive Medical Terminology Software Market growth. For instance, the integration of artificial intelligence (AI) and machine learning algorithms into medical terminology software enhances its capabilities, allowing for more accurate and efficient analysis of medical data. As AI becomes increasingly sophisticated, it enables software to automate tasks, streamline workflows, and provide valuable insights to healthcare professionals, thus driving the Medical Terminology Software Market growth. The growing adoption of electronic health records (EHRs) globally fuels the demand for medical terminology software. Healthcare facilities require software solutions that accurately capture, store and manage patient data in compliance with regulatory standards. Medical terminology software plays a crucial role in this process by ensuring standardized and interoperable terminology usage, facilitating the seamless exchange of patient information between different healthcare systems. The rise in healthcare spending worldwide, driven by factors such as population growth, aging demographics, and the increasing prevalence of chronic diseases, contributes to the expansion of the medical terminology software market. Healthcare organizations allocate significant budgets for implementing advanced software solutions that enhance operational efficiency, improve patient care, and comply with regulatory requirements. This increased investment in healthcare infrastructure fuels the demand for medical terminology software. Government initiatives aimed at promoting healthcare digitization and interoperability, along with stringent regulations on healthcare data management and patient privacy, propel the adoption of medical terminology software. For example, initiatives like the Health Information Technology for Economic and Clinical Health (HITECH) Act in the United States incentivize healthcare providers to adopt electronic health records systems, driving the demand for medical terminology software solutions that ensure compliance with regulatory standards. The growth of healthcare IT infrastructure, particularly in emerging economies, creates opportunities for Medical Terminology Software Market growth. As healthcare systems modernize and digitize their operations, there is an increased need for software solutions that support efficient data management, interoperability, and decision-making processes. Medical terminology software providers capitalize on this trend by offering scalable and customizable solutions that cater to the diverse needs of healthcare organizations.A Major Opportunity for Medical Terminology Software Market Growth Is That Data Integrity Is Becoming Increasingly Important. Healthcare organizations are increasingly in need of services that fully utilize clinical data from both within and outside of the EHR system. Preserving the integrity of the information provided within the healthcare business requires clean, reliable data. Hospitals, on the other hand, confront several challenges in keeping up with changes in standards, coding, and the interchange of patient information between different healthcare providers. The level of detail is lost during information sharing owing to human or machine reading mistakes if methods to adequately standardize, organize, clean, and manage clinical data are not implemented. The current crowded data environment inside EHRs creates questions regarding data quality and trust, making it difficult for EHR system users to make sense of the prevailing unorganized data. Healthcare ecosystems are now highly uneven in terms of content and infrastructure in the Medical Terminology Software Market. A healthcare company handles 50 or more distinct IT systems, each with its medical terminology content and architecture. Because of these linguistic barriers, companies find it difficult to utilize isolated clinical data, which influences downstream operations such as data analytics. When a healthcare system seeks to exchange data with other medical partners, the challenge becomes even worse. Essential data is spread among many healthcare institutions in numerous separate systems. The lack of a standard clinical language across many independent systems is a major impediment to initiatives to improve healthcare system integration, transparency, and cooperation. Aversion To Using Medical Terminology Solutions Over Traditional Procedures Is a Major Challenge to Medical Terminology Software Market Growth. Although the usage of medical terminology solutions is becoming more common, some healthcare practitioners are still hesitant to choose new solutions over traditional approaches. This is ascribed to healthcare practitioners' lack of technical understanding. Physicians and general practitioners, for example, are well-suited to complex spreadsheet groupings and have expertise in searching codes across many sources. As a result, many employees are hesitant to migrate from manual to automated terminology standardization. Also, numerous healthcare organizations that are prepared to move to automated terminology management either lack enough staff consensus or lack the necessary resources to sustain the additional cost burden. Physicians and other personnel must have the technical knowledge and abilities to enter patient medical information, notes, and prescriptions into the Medical Terminology Software Market system.

Medical Terminology Software Market Segment Analysis:

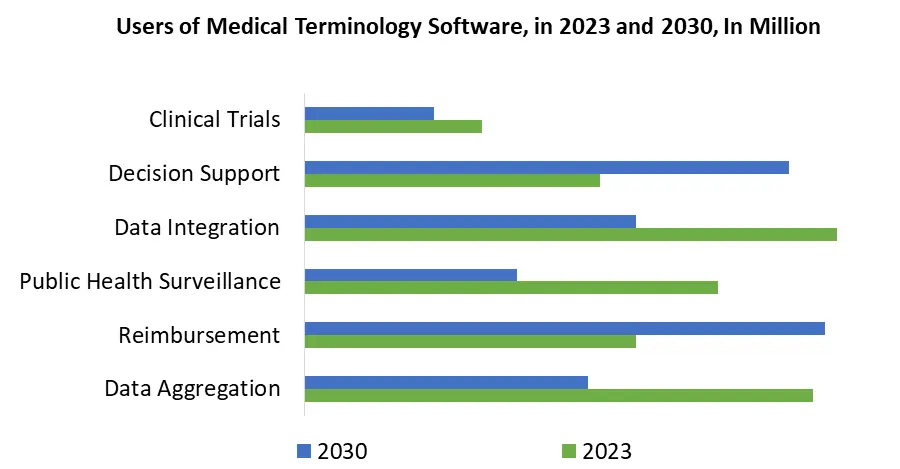

Based on Application, the reimbursement segment in the Medical Terminology Software Market is expected to grow at a CAGR during the forecast period. Growing patient volume and rising prescription drug costs are putting a strain on individuals, which is anticipated to drive segment growth. In addition, the ongoing rise in healthcare costs is increasing stakeholder interest in healthcare compensation. Healthcare spending is rising as expenses for medical consultations, treatment, and prescription medications rise. Modern lifestyles are increasing the prevalence of chronic diseases like cardiovascular disease, diabetes, and cancer, raising healthcare costs. Almost half of the American population has at least one of these disorders, which are costly to treat. Modern medicine advancements have reduced the cost of delivering healthcare while increasing people's life expectancy. Various efforts from both governmental and commercial entities have also played an important part in the segment's growth in the Medical Terminology Software Market. For example, the Affordable Care Act established in the United States focuses on providing health care coverage to low-income households. The law encourages new medical care delivery techniques that cut healthcare costs and make cheap health insurance available to more individuals. It might be tempting for many small and medium-sized businesses (SMBs) to handle employee health benefits on their own. While this appears to be the less expensive choice, any errors that cause a plan to be out of compliance cost employees and employers thousands of dollars. It is therefore advised to invest in compatible healthcare reimbursement software. Patient information is created in all departments and at all points of treatment within a healthcare organization, making the sector very information-intensive. However, obtaining reliable information by merging massive amounts of data is critical to building comprehensive and accurate patient records. Because diverse medical devices and diagnostic equipment are utilized inside healthcare systems, there is an increasing need to combine all these systems to help healthcare workers provide rapid responses at various care delivery points in the Medical Terminology Software Market. Imaging techniques, email management solutions, data structures, forms management solutions, clinical systems, employee management systems, portfolio management systems, content management, revenue cycle processes, diagnostic and non-clinical workflow systems, and customer relationship management systems are just a few of the information management applications that many healthcare organizations have invested in. As more healthcare organizations embrace various healthcare IT systems, there is a rising need to incorporate diverse types of IT systems into the organization's IT architecture to enable maximum usage of these systems and help in precise decision-making in the Medical Terminology Software Market.Medical Terminology Software Market Regional Insights:

The North American region led the Medical Terminology Software Market in 2023, followed by Europe. Aspects such as the mass acceptance of diagnostic device connectivity and integration solutions to reduce healthcare spending, the growing proportion of chronic patients in the US, and rigorous rules and guidelines set by regulatory government and non-government governing bodies such as the Federal Communications Commission and the Centres for Medicare and Medicaid Services are impacting the growth of the Medical Terminology Software Market. Patient data is complicated, private, and sometimes unstructured. Integrating this data into the healthcare delivery system is a hurdle that must be overcome to achieve prospects for enhanced patient care. Even though EHRs have been in use for more than a decade, the Medical Terminology Software Market has lately gained steam as a result of government measures in many nations to increase patient data protection. In the United States, for example, the Health Information Technology for Economic and Clinical Health Act, adopted as part of the American Recovery and Reinvestment Act, provided financing to hospitals and clinicians that demonstrated significant use of EHRs. Regulatory requirements have accelerated the use of EHRs and EMRs. Another significant factor in the country is the growing number of accountable care organizations, which raises the need for EHRs and EMRs. Federal initiatives in other countries, like Denmark, Sweden, and Canada, are also supporting the deployment of EHRs and enforcing their meaningful use to control rising healthcare costs and improve patient care quality.Competitive Landscape The acquisitions by GE Healthcare and 3M signify a shift towards advanced healthcare solutions, driving Medical Terminology Software Market growth. GE Healthcare's acquisition of MIM Software enhances its digital solutions, promising efficient and precise care delivery globally. Similarly, 3M's acquisition of MModal's technology business strengthens its Health Information Systems, aiming to improve healthcare documentation and operational efficiency. These developments underscore the increasing importance of AI-driven technologies in healthcare, facilitating streamlined workflows and improved patient experiences. As these companies integrate cutting-edge technologies into their offerings, they are poised to lead innovation and drive Medical Terminology Software Market growth by meeting the evolving needs of healthcare providers and patients. GE Healthcare, on Jan 08, 2024, declared its agreement to acquire MIM Software, enhancing its precision care strategy by bolstering digital solutions for diverse care pathways. MIM Software's AI-driven image analysis and workflow tools in oncology, urology, neurology, and cardiology align with GE HealthCare's aim to integrate medical imaging for precise, connected, and efficient care delivery. This move reinforces GE HealthCare's dedication to advancing medical imaging products. The acquisition is poised to leverage MIM Software's capabilities across care areas, promising accelerated innovation, and improved patient outcomes globally. 3M has finalized the acquisition of MModal's technology business for $1 billion, enhancing its Health Information Systems capabilities. MModal's cloud-based AI systems aim to streamline physician-patient interactions, boosting care quality. With an estimated annual revenue of $200 million, this acquisition aligns with 3M's goal to improve healthcare documentation and operational efficiency. By integrating M*Modal's technology, 3M aims to empower physicians worldwide to enhance patient experiences, ensuring accurate documentation and efficient healthcare delivery for providers and payers alike.

Medical Terminology Software Market Scope: Inquire before buying

Medical Terminology Software Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.18 Bn. Forecast Period 2024 to 2030 CAGR: 18.42% Market Size in 2030: US $ 3.85 Bn. Segments Covered: by Type Platform Services by End-User Healthcare Providers Healthcare Payers Healthcare IT Vendors Others by Application Data Aggregation Reimbursement Public Health Surveillance Data Integration Decision Support Clinical Trials Quality Reporting Clinical Guidelines Medical Terminology Software Market, by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Medical Terminology Software Market Key Players:

In the Medical Terminology Software Market, key players such as 3M, renowned for its extensive range of healthcare solutions and strong R&D capabilities, facing opportunities in expanding emerging markets and integrating advanced technologies. Wolters Kluwer offers comprehensive professional information and software solutions with a focus on innovation and regulatory compliance. Intelligent Medical Objects specializes in providing medical terminology management tools, enhancing clinical documentation and coding accuracy. Clinical Architecture is known for its expertise in improving healthcare data quality through robust terminology management systems. Bitac and BT Clinical Computing provide specialized software solutions tailored to healthcare data management and terminology. HiveWorx delivers advanced terminology solutions for clinical and research applications. Informatics Healthcare Pte Ltd. focuses on healthcare informatics solutions, while Medocomp Systems Inc offers tools for medical terminology and coding. Spellex is recognized for its medical spelling and terminology software. Apelon, based in Europe, provides interoperability solutions through its terminology services, and B2i Healthcare in Asia Pacific offers a range of medical terminology solutions adapted to regional needs. Key Players in North America 1. 3M (United States) 2. Wolters Kluwer (United States) 3. Intelligent Medical Objects (United States) 4. Clinical Architecture (United States) 5. Bitac (United States) 6. BT Clinical Computing (United States) 7. HiveWorx (United States) 8. Informatics Healthcare Pte Ltd. (United States) 9. Medocomp Systems Inc (United States) 10. Spellex (United States). Key Players in Europe 11. Apelon (Europe) Key Players in Asia Pacific: 12. B2i Healthcare (Asia Pacific) FAQs: 1. What are the growth drivers for the Medical Terminology Software Market? Ans. Rising Demand for Electronic Health Records (EHRs) is expected to be the major driver for the Medical Terminology Software Market. 2. What is the major Opportunity for the Medical Terminology Software Market growth? Ans. Data Integrity Is Becoming Increasingly Important and is expected to be the major Opportunity in the Medical Terminology Software Market. 3. Which country is expected to lead the global Medical Terminology Software Market during the forecast period? Ans. North America is expected to lead the Medical Terminology Software Market during the forecast period. 4. What is the projected market size and growth rate of the Medical Terminology Software Market? Ans. The Medical Terminology Software Market size was valued at USD 1.18 billion in 2023 and the total Medical Terminology Software Market revenue is expected to grow at a CAGR of 18.42 % from 2024 to 2030, reaching nearly USD 3.85 billion. 5. What segments are covered in the Medical Terminology Software Market report? Ans. The segments covered in the Medical Terminology Software Market report are by Type, End-User, Application, and Region.

1. Medical Terminology Software Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Medical Terminology Software Market: Dynamics 2.1. Medical Terminology Software Market Trends by Region 2.1.1. North America Medical Terminology Software Market Trends 2.1.2. Europe Medical Terminology Software Market Trends 2.1.3. Asia Pacific Medical Terminology Software Market Trends 2.1.4. Middle East and Africa Medical Terminology Software Market Trends 2.1.5. South America Medical Terminology Software Market Trends 2.2. Medical Terminology Software Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Medical Terminology Software Market Drivers 2.2.1.2. North America Medical Terminology Software Market Restraints 2.2.1.3. North America Medical Terminology Software Market Opportunities 2.2.1.4. North America Medical Terminology Software Market Challenges 2.2.2. Europe 2.2.2.1. Europe Medical Terminology Software Market Drivers 2.2.2.2. Europe Medical Terminology Software Market Restraints 2.2.2.3. Europe Medical Terminology Software Market Opportunities 2.2.2.4. Europe Medical Terminology Software Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Medical Terminology Software Market Drivers 2.2.3.2. Asia Pacific Medical Terminology Software Market Restraints 2.2.3.3. Asia Pacific Medical Terminology Software Market Opportunities 2.2.3.4. Asia Pacific Medical Terminology Software Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Medical Terminology Software Market Drivers 2.2.4.2. Middle East and Africa Medical Terminology Software Market Restraints 2.2.4.3. Middle East and Africa Medical Terminology Software Market Opportunities 2.2.4.4. Middle East and Africa Medical Terminology Software Market Challenges 2.2.5. South America 2.2.5.1. South America Medical Terminology Software Market Drivers 2.2.5.2. South America Medical Terminology Software Market Restraints 2.2.5.3. South America Medical Terminology Software Market Opportunities 2.2.5.4. South America Medical Terminology Software Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Medical Terminology Software Industry 2.8. Analysis of Government Schemes and Initiatives For Medical Terminology Software Industry 2.9. Medical Terminology Software Market Trade Analysis 2.10. The Global Pandemic Impact on Medical Terminology Software Market 3. Medical Terminology Software Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 3.1.1. Platform 3.1.2. Services 3.2. Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 3.2.1. Healthcare Providers 3.2.2. Healthcare Payers 3.2.3. Healthcare IT Vendors 3.2.4. Others 3.3. Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 3.3.1. Data Aggregation 3.3.2. Reimbursement 3.3.3. Public Health Surveillance 3.3.4. Data Integration 3.3.5. Decision Support 3.3.6. Clinical Trials 3.3.7. Quality Reporting 3.3.8. Clinical Guidelines 3.4. Medical Terminology Software Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Medical Terminology Software Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 4.1.1. Platform 4.1.2. Services 4.2. North America Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 4.2.1. Healthcare Providers 4.2.2. Healthcare Payers 4.2.3. Healthcare IT Vendors 4.2.4. Others 4.3. North America Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 4.3.1. Data Aggregation 4.3.2. Reimbursement 4.3.3. Public Health Surveillance 4.3.4. Data Integration 4.3.5. Decision Support 4.3.6. Clinical Trials 4.3.7. Quality Reporting 4.3.8. Clinical Guidelines 4.4. North America Medical Terminology Software Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Platform 4.4.1.1.2. Services 4.4.1.2. United States Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 4.4.1.2.1. Healthcare Providers 4.4.1.2.2. Healthcare Payers 4.4.1.2.3. Healthcare IT Vendors 4.4.1.2.4. Others 4.4.1.3. United States Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 4.4.1.3.1. Data Aggregation 4.4.1.3.2. Reimbursement 4.4.1.3.3. Public Health Surveillance 4.4.1.3.4. Data Integration 4.4.1.3.5. Decision Support 4.4.1.3.6. Clinical Trials 4.4.1.3.7. Quality Reporting 4.4.1.3.8. Clinical Guidelines 4.4.2. Canada 4.4.2.1. Canada Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Platform 4.4.2.1.2. Services 4.4.2.2. Canada Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 4.4.2.2.1. Healthcare Providers 4.4.2.2.2. Healthcare Payers 4.4.2.2.3. Healthcare IT Vendors 4.4.2.2.4. Others 4.4.2.3. Canada Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 4.4.2.3.1. Data Aggregation 4.4.2.3.2. Reimbursement 4.4.2.3.3. Public Health Surveillance 4.4.2.3.4. Data Integration 4.4.2.3.5. Decision Support 4.4.2.3.6. Clinical Trials 4.4.2.3.7. Quality Reporting 4.4.2.3.8. Clinical Guidelines 4.4.3. Mexico 4.4.3.1. Mexico Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. Platform 4.4.3.1.2. Services 4.4.3.2. Mexico Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 4.4.3.2.1. Healthcare Providers 4.4.3.2.2. Healthcare Payers 4.4.3.2.3. Healthcare IT Vendors 4.4.3.2.4. Others 4.4.3.3. Mexico Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 4.4.3.3.1. Data Aggregation 4.4.3.3.2. Reimbursement 4.4.3.3.3. Public Health Surveillance 4.4.3.3.4. Data Integration 4.4.3.3.5. Decision Support 4.4.3.3.6. Clinical Trials 4.4.3.3.7. Quality Reporting 4.4.3.3.8. Clinical Guidelines 5. Europe Medical Terminology Software Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 5.2. Europe Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 5.3. Europe Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 5.4. Europe Medical Terminology Software Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 5.4.1.3. United Kingdom Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 5.4.2. France 5.4.2.1. France Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 5.4.2.3. France Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 5.4.3.3. Germany Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 5.4.4.3. Italy Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 5.4.5.3. Spain Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 5.4.6.3. Sweden Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 5.4.7.3. Austria Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 5.4.8.3. Rest of Europe Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Medical Terminology Software Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 6.3. Asia Pacific Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Medical Terminology Software Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 6.4.1.3. China Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 6.4.2.3. S Korea Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 6.4.3.3. Japan Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 6.4.4. India 6.4.4.1. India Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 6.4.4.3. India Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 6.4.5.3. Australia Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 6.4.6.3. Indonesia Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 6.4.7.3. Malaysia Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 6.4.8.3. Vietnam Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 6.4.9.3. Taiwan Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 6.4.10.3. Rest of Asia Pacific Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Medical Terminology Software Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 7.3. Middle East and Africa Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Medical Terminology Software Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 7.4.1.3. South Africa Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 7.4.2.3. GCC Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 7.4.3.3. Nigeria Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 7.4.4.3. Rest of ME&A Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 8. South America Medical Terminology Software Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 8.2. South America Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 8.3. South America Medical Terminology Software Market Size and Forecast, by Application(2023-2030) 8.4. South America Medical Terminology Software Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 8.4.1.3. Brazil Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 8.4.2.3. Argentina Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Medical Terminology Software Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Medical Terminology Software Market Size and Forecast, by End User (2023-2030) 8.4.3.3. Rest Of South America Medical Terminology Software Market Size and Forecast, by Application (2023-2030) 9. Global Medical Terminology Software Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Medical Terminology Software Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. 3M (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Wolters Kluwer (United States) 10.3. Intelligent Medical Objects (United States) 10.4. Clinical Architecture (United States) 10.5. Bitac (United States) 10.6. BT Clinical Computing (United States) 10.7. HiveWorx (United States) 10.8. Informatics Healthcare Pte Ltd. (United States) 10.9. Medocomp Systems Inc (United States) 10.10. Spellex (United States). 10.11. Apelon (Europe) 10.12. B2i Healthcare (Asia Pacific) 11. Key Findings 12. Industry Recommendations 13. Medical Terminology Software Market: Research Methodology 14. Terms and Glossary