The Meat Substitutes Market size was valued at USD 2.24 Billion in 2023 and the total Meat Substitutes revenue is expected to grow at a CAGR of 13.5% from 2024 to 2030, reaching nearly USD 5.44 Billion by 2030.Meat Substitutes Market Overview:

These meat substitutes are manufactured from a variety of plant proteins, including soy protein, wheat protein, and pea protein. There is a wide range of nutrition data and ingredients in plant-based meats available these days. There are some health benefits associated with the consumption of Plant-based meat substitutes such as reducing the risk of cardiovascular disease, Decreasing inflammation, and reducing the risk of cancer. As a result, the health advantages linked with these substances have been a key reason driving the increasing demand for the meat substitutes market throughout the forecast period.To know about the Research Methodology :- Request Free Sample Report

Meat Substitutes Market Dynamics

Plant-based proteins are becoming more popular. The Meat Substitutes Market has witnessed a significant surge in demand globally over the past decade. In regions like Europe and North America, where meat consumption has traditionally been high, there is a growing shift toward plant-based protein foods. This shift is particularly pronounced in developed nations like the United States, Germany, France, and the United Kingdom, where health-conscious consumers are seeking alternatives to animal proteins. The rise in the vegan population in countries such as the United States and the United Kingdom is indicative of this changing trend. Consumers, increasingly aware of vegan food options, are turning to plant-based alternatives. According to the International Congress of Meat Science and Technology, concerns about fat consumption have driven individuals to perceive red meat as high in fat. In contrast, plant-based proteins used in products like burger patties are seen as a fat-free alternative, boosting the popularity of plant-based burgers and driving the growth of the Meat Substitutes Market. Moreover, the escalating fear of animal-borne illnesses has heightened consumer health concerns, leading to a decline in the consumption of animal products. With a growing awareness of the health risks associated with traditional meat consumption, people are changing their dietary habits to embrace healthier alternatives. This shift towards a healthier diet is expected to contribute to an increased demand for Meat Substitutes as consumers seek plant-based alternatives to address concerns related to diseases like heart disease, diabetes, and obesity.Meat Consumption by Countries 2022

Soy and gluten-free products are popular among consumers. The Meat Substitutes Market is witnessing significant growth, and one of the prominent trends in specialized foods contributing to this growth is the "free-from" movement. Soy and gluten-free diets have swiftly emerged as leading nutritional trends, driven by their perceived health and therapeutic benefits. The surge in the consumption of soy and gluten-free food products is primarily attributed to the increasing prevalence of food sensitivities, regional dietary preferences, and a rise in the diagnosis of celiac disease. However, despite the popularity of these dietary preferences, the prevalence of food allergies has grown in recent years, causing concern among both consumers and food producers. Allergic reactions or intolerances to soy protein, leading to symptoms like eye irritation and stomach troubles, have resulted in hospitalization in severe cases. The escalating demand for gluten-free products is largely associated with the increased prevalence of diseases like celiac disease. While the number of individuals with medical reasons to avoid gluten is limited, there is a notable segment of the population that opts to steer clear of foods containing or fortified with soy and wheat components. This evolving landscape, marked by increased consumer desire for soy-free food products globally, presents challenges to the Meat Substitutes Market, especially those based on soy and wheat proteins. The market must navigate these preferences and considerations to sustain global growth in soy and wheat protein-based meat alternatives. The labelling regulations for marketing may cause consumers confusion about the origin of the ingredients used. The regulatory landscape, inclusive of labeling and food law rules, plays a pivotal role in shaping the Meat Substitutes Market. Supportive financing policies, governmental investments, and strategic communication efforts are instrumental in encouraging meat consumers to transition to meat alternatives. Organizations such as the Plant-Based Foods Association (PBFA) have contributed significantly to this paradigm shift by proposing standardized terminology for the diverse array of plant-based and vegetarian meat substitutes available in the market. These voluntary standards, devised by the PBFA, aim to promote consistency in labeling practices within the industry. In the United States, recent surveys highlight that a substantial 95 percent of individuals opting for veggie burgers in fast-food establishments are regular meat consumers, underscoring the increasing appeal and acceptance of meat substitutes in the broader market landscape. Pea protein is under pressure due to the high cost of peas. The Meat Substitutes Market faces challenges related to the production and availability of pea protein, a key ingredient in many plant-based alternatives. The production of pea protein is expensive, and climate change-induced shortages of peas contribute to increased costs. In response, manufacturers are investing in advanced pea protein extraction and processing technologies to enhance production capacity. However, the persistent shortage of pea protein continues to exert upward pressure on the prices of final meat substitute products. Consequently, in certain regions, meat replacements based on pea protein are perceived as luxury products due to their premium pricing within the Meat Substitutes Market. Gen Z and Millennials are playing a key role in driving this demand, motivated by health consciousness, climate change awareness, and animal welfare considerations. Manufacturers are strategically collaborating with brands to introduce innovative meat-free products, exemplified by the partnership between Tokyo-based Next Meats and Vegan Meat India in December 2021. This collaboration demonstrates the industry's commitment to offering diverse choices and inventive flavors aligned with consumer preferences. Notably, even non-vegetarian and non-vegan consumers are adopting plant-based alternatives for reasons such as improved nutrition, weight management, and environmental sustainability. Recent data from the Good Food Institute in 2021 underscores a significant increase in the adoption of plant-based meat, with 11.9% of American households purchasing such products, up from 10.5% the previous year. The trend of using whole veggies and grains in ingredient lists is gaining momentum, meeting the demands of health-conscious consumers prioritizing transparency in product labeling. The market is witnessing an increase in products featuring reputable third-party certificates, indicating attributes like non-GMO, gluten-free, vegan, and kosher. This transparency, coupled with the rising demand for plant-based alternatives and continued investments in innovative products, presents lucrative opportunities for market expansion.

Meat Substitutes Market Segment Analysis

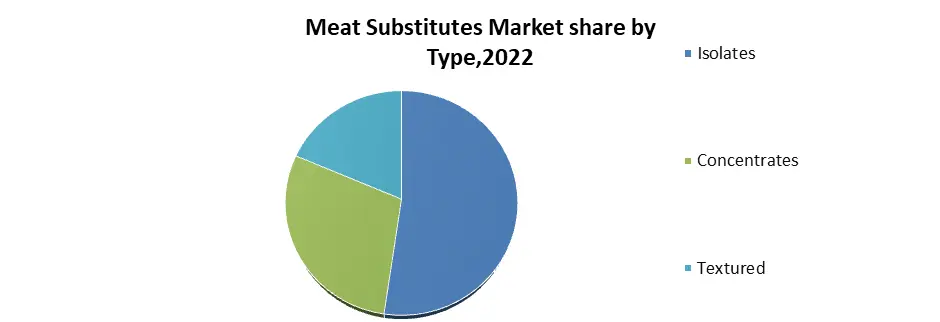

By Product, the Tofu segment is also known as soybean curd or bean curd. Curdled soy milk is a liquid that contains iron and is made from cooked soybeans. For decades, tofu has been a staple meal in Asian cuisines. Tofu has a great nutritional value and it provides a substantial quantity of iron, potassium, protein, calcium, and vitamin 12 all of which are essential for a healthy vegan diet. In China, Tofuis used in a variety of cuisines and recipes ranging from stir-fried meals to broths. Its capacity to be modified into any texture and shape has catapulted it to a significant share of the entire vegan food manufactured. By Source, the Wheat segment is one of the most widely consumed cereal grains on a global scale. Wheat protein is a low-fat protein that manufacturers of low-fat and high-protein foods favor in response to the growing popularity of low-fat diets. It is also used as a binder material in meatballs, meatloaf, and veggie burgers. Wheat proteins are affordable and may be utilized in a variety of food products, including nuggets, burger patties, and sausages, and they can be flavoured with ginger, garlic, soy sauce, paprika, and fennel. Several plant-based protein businesses are actively generating diverse plant proteins for food and beverage uses across the world. Wheat provides antioxidants, vitamins, minerals, and fiber to consumers who do not have food allergies concerns. By Type, the Isolates segment is the purest form of protein and contains the most Protein. Because of the protein content, meat alternatives are available in isolates or pure forms which are largely recognized and preferred by protein food and beverage manufacturers. Protein isolates can be obtained from soy, pea, rice, or canola. Protein-rich foods and meat substitutes have recently gained popularity due to the health and environmental benefits associated with them. This is boosting the need for protein isolates which are a good source of protein. Soy Protein Isolate (SPI) is the most often consumed type of isolate protein. It is isolated from soybean beans and contains 93-97% protein.

Meat Substitutes Market Regional Analysis

Europe has a thriving market for meat Substitute Europe has emerged as a dominant force in the Meat Substitute Market, securing a significant revenue share of 39.60% in 2023. This prominence is attributed to the surging demand from both younger and older consumers, fueled by the expanding vegan and flexitarian consumer base and a heightened awareness regarding animal welfare. A decade ago, Germany witnessed minimal engagement with meat alternatives, but the landscape has transformed with the entry of renowned processed food companies. This evolution aligns German consumption patterns more closely with those of Americans, reflecting a growing affinity for meat substitutes. The intentional collaboration between McDonald's and Nestlé, major players in the meatless industry, to introduce a vegan burger in Germany underscores a strategic response to the shifting preferences and the flourishing Meat Substitute Market in the region. North America secured the second-largest revenue share, amounting to 33.8% in 2023, with a significant portion of the population relying on meat products for their daily protein needs. The region has witnessed a notable shift in consumer attitudes towards plant-based diets and sustainability, as more individuals embrace vegetarian, vegan, or flexitarian lifestyles, prioritizing healthier and environmentally friendly food choices. This increasing demand among health-conscious consumers is propelling the meat substitutes market's growth. Meat substitutes, offering a plant-based protein alternative, are often lower in saturated fat and cholesterol compared to animal meat. They also provide additional nutritional benefits, including being rich in fiber and containing various vitamins and minerals. A survey by the International Food Information Council revealed that nearly two out of three people (65%) reported consuming products with the same flavor and texture as animal protein but made solely from plant-based ingredients. Notably, 20% of respondents claimed to consume these products at least weekly, with a slightly higher percentage (22%) doing so every day. Asia Pacific emerges as the fastest-growing meat substitutes market, projecting a CAGR of 48.6% from 2024 to 2030, with countries like China and Australia contributing significantly to the region's share. Increasing health consciousness and the influence of social media have driven the heightened consumption of meat substitutes in these countries. The global trend shifting away from animal protein consumption towards plant-based diets is evident in the rising demand for high-quality plant-based alternatives. Historically, limited options for top-notch vegetarian and vegan substitutes often relied on unhealthy and heavily processed ingredients. The impact of the COVID-19 pandemic has amplified Asian consumers' concerns about food safety, health, and environmental impact, prompting proactive dietary modifications for healthier and more sustainable lifestyles. Recognizing this shift in preferences, ADM inaugurated a state-of-the-art plant-based innovation laboratory at the Biopolis research hub in Singapore in April 2021. This strategic move aims to meet the growing demand for food and beverage options in the region, with a focus on developing cutting-edge, trendy, and nutritious products to cater to the increasing meat substitutes market.Meat Substitute Market Scope: Inquire before buying

Global Meat Substitute Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.24 Bn. Forecast Period 2024 to 2030 CAGR: 13.5% Market Size in 2030: US $ 5.44 Bn. Segments Covered: by Type Isolates Concentrates Textured by Source Soy protein Wheat protein Pea protein Other sources by Product Tofu Tempeh Seitan Quorn Other types (risofu, valess, and lupine) g Meat Substitutes Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Meat Substitutes Market Key Players:

North America: 1. DuPont (US) 2. ADM (US) 3. Kerry Group (Ireland) 4. Ingredion Incorporated (US) 5. PURIS (US) 6. Cargill (US) 7. Axiom Foods (US) 8. A&B Ingredients (Canada) 9. Batory Foods (US) 10. The Green Labs LLC (US) Europe: 1. Roquette Frères (France). 2. Crespel&Deiters (Germany) 3. Sotexpro S.A (France) 4. All Organic Treasures GMBH (Germany) 5. Beneo (Germany) Asia Pacific: 1. Wilmar International Limited (Singapore) 2. Sonic Biochem Ltd (India) 3. The Nisshin OilliO Group, Ltd (Japan) 4. Shandong Jianyuan Group (China) 5. ET Chem (China) FAQs: 1. What is the current size of the Meat Substitute market? Ans: The global meat substitute market is valued at 2.24 USD billion in 2023 and is expected to witness substantial growth in the coming years. The increasing adoption of plant-based diets and the rising awareness of environmental and health concerns are key factors contributing to the market's expansion. 2. What factors are driving the growth of the Meat Substitute market? Ans: The growth of the Meat Substitute market is primarily driven by the growing demand for plant-based protein alternatives, health-conscious consumer choices, and concerns about the environmental impact of traditional meat production. Additionally, the rise in vegetarian, vegan, and flexitarian lifestyles has significantly contributed to the market's upward trajectory. 3. What types of Meat Substitutes are available in the market? Ans: The market offers a diverse range of meat substitutes, including soy-based products, tofu, tempeh, seitan, mycoprotein (fungus-based), and various plant-based protein blends. Innovations in food technology have led to the development of realistic and flavorful alternatives that closely resemble the taste and texture of conventional meat. 4. How are Meat Substitute products distributed? Ans: Meat substitute products are widely available through various distribution channels, including grocery stores, supermarkets, online retailers, and specialty health food stores. Many mainstream food companies and fast-food chains have also incorporated meat substitute options into their menus to cater to the growing demand for plant-based alternatives. 5. What are the challenges faced by the Meat Substitute market? Ans: Despite the market's growth, challenges include the need for continuous product innovation to enhance taste and texture, addressing concerns related to allergens, and ensuring cost competitiveness compared to traditional meat products. Additionally, market players must navigate regulatory frameworks and overcome consumer skepticism to achieve widespread acceptance.

1. Meat Substitutes Market: Research Methodology 2. Meat Substitutes Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Meat Substitutes Market: Dynamics 3.1. Meat Substitutes Market Trends by Region 3.1.1. North America Meat Substitutes Market Trends 3.1.2. Europe Meat Substitutes Market Trends 3.1.3. Asia Pacific Meat Substitutes Market Trends 3.1.4. Middle East and Africa Meat Substitutes Market Trends 3.1.5. South America Meat Substitutes Market Trends 3.2. Meat Substitutes Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Meat Substitutes Market Drivers 3.2.1.2. North America Meat Substitutes Market Restraints 3.2.1.3. North America Meat Substitutes Market Opportunities 3.2.1.4. North America Meat Substitutes Market Challenges 3.2.2. Europe 3.2.2.1. Europe Meat Substitutes Market Drivers 3.2.2.2. Europe Meat Substitutes Market Restraints 3.2.2.3. Europe Meat Substitutes Market Opportunities 3.2.2.4. Europe Meat Substitutes Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Meat Substitutes Market Drivers 3.2.3.2. Asia Pacific Meat Substitutes Market Restraints 3.2.3.3. Asia Pacific Meat Substitutes Market Opportunities 3.2.3.4. Asia Pacific Meat Substitutes Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Meat Substitutes Market Drivers 3.2.4.2. Middle East and Africa Meat Substitutes Market Restraints 3.2.4.3. Middle East and Africa Meat Substitutes Market Opportunities 3.2.4.4. Middle East and Africa Meat Substitutes Market Challenges 3.2.5. South America 3.2.5.1. South America Meat Substitutes Market Drivers 3.2.5.2. South America Meat Substitutes Market Restraints 3.2.5.3. South America Meat Substitutes Market Opportunities 3.2.5.4. South America Meat Substitutes Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Source Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Meat Substitutes Market 3.8. Analysis of Government Schemes and Initiatives For Meat Substitutes Market 3.9. The Global Pandemic Impact on Meat Substitutes Market 4. Meat Substitutes Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Meat Substitutes Market Size and Forecast, by Type (2023-2030) 4.1.1. Isolates 4.1.2. Concentrates 4.1.3. Textured 4.2. Meat Substitutes Market Size and Forecast, by Source (2023-2030) 4.2.1. Soy protein 4.2.2. Wheat protein 4.2.3. Pea protein 4.2.4. Other sources 4.3. Meat Substitutes Market Size and Forecast, by Product (2023-2030) 4.3.1. Tofu 4.3.2. Tempeh 4.3.3. Seitan 4.3.4. Quorn 4.3.5. Other types (risofu, valess, and lupine) 4.4. Meat Substitutes Market Size and Forecast, by Region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Meat Substitutes Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Meat Substitutes Market Size and Forecast, by Type (2023-2030) 5.1.1. Isolates 5.1.2. Concentrates 5.1.3. Textured 5.2. North America Meat Substitutes Market Size and Forecast, by Source (2023-2030) 5.2.1. Soy protein 5.2.2. Wheat protein 5.2.3. Pea protein 5.2.4. Other sources 5.3. North America Meat Substitutes Market Size and Forecast, by Product (2023-2030) 5.3.1. Tofu 5.3.2. Tempeh 5.3.3. Seitan 5.3.4. Quorn 5.3.5. Other types (risofu, valess, and lupine) 5.4. North America Meat Substitutes Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Meat Substitutes Market Size and Forecast, by Type (2023-2030) 5.4.1.1.1. Isolates 5.4.1.1.2. Concentrates 5.4.1.1.3. Textured 5.4.1.2. United States Meat Substitutes Market Size and Forecast, by Source (2023-2030) 5.4.1.2.1. Soy protein 5.4.1.2.2. Wheat protein 5.4.1.2.3. Pea protein 5.4.1.2.4. Other sources 5.4.1.3. United States Meat Substitutes Market Size and Forecast, by Product (2023-2030) 5.4.1.3.1. Tofu 5.4.1.3.2. Tempeh 5.4.1.3.3. Seitan 5.4.1.3.4. Quorn 5.4.1.3.5. Other types (risofu, valess, and lupine) 5.4.2. Canada 5.4.2.1. Canada Meat Substitutes Market Size and Forecast, by Type (2023-2030) 5.4.2.1.1. Isolates 5.4.2.1.2. Concentrates 5.4.2.1.3. Textured 5.4.2.2. Canada Meat Substitutes Market Size and Forecast, by Source (2023-2030) 5.4.2.2.1. Soy protein 5.4.2.2.2. Wheat protein 5.4.2.2.3. Pea protein 5.4.2.2.4. Other sources 5.4.2.3. Canada Meat Substitutes Market Size and Forecast, by Product (2023-2030) 5.4.2.3.1. Tofu 5.4.2.3.2. Tempeh 5.4.2.3.3. Seitan 5.4.2.3.4. Quorn 5.4.2.3.5. Other types (risofu, valess, and lupine) 5.4.3. Mexico 5.4.3.1. Mexico Meat Substitutes Market Size and Forecast, by Type (2023-2030) 5.4.3.1.1. Isolates 5.4.3.1.2. Concentrates 5.4.3.1.3. Textured 5.4.3.2. Mexico Meat Substitutes Market Size and Forecast, by Source (2023-2030) 5.4.3.2.1. Soy protein 5.4.3.2.2. Wheat protein 5.4.3.2.3. Pea protein 5.4.3.2.4. Other sources 5.4.3.3. Mexico Meat Substitutes Market Size and Forecast, by Product (2023-2030) 5.4.3.3.1. Tofu 5.4.3.3.2. Tempeh 5.4.3.3.3. Seitan 5.4.3.3.4. Quorn 5.4.3.3.5. Other types (risofu, valess, and lupine) 6. Europe Meat Substitutes Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Meat Substitutes Market Size and Forecast, by Type (2023-2030) 6.2. Europe Meat Substitutes Market Size and Forecast, by Source (2023-2030) 6.3. Europe Meat Substitutes Market Size and Forecast, by Product (2023-2030) 6.4. Europe Meat Substitutes Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Meat Substitutes Market Size and Forecast, by Type (2023-2030) 6.4.1.2. United Kingdom Meat Substitutes Market Size and Forecast, by Source (2023-2030) 6.4.1.3. United Kingdom Meat Substitutes Market Size and Forecast, by Product (2023-2030) 6.4.2. France 6.4.2.1. France Meat Substitutes Market Size and Forecast, by Type (2023-2030) 6.4.2.2. France Meat Substitutes Market Size and Forecast, by Source (2023-2030) 6.4.2.3. France Meat Substitutes Market Size and Forecast, by Product (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Meat Substitutes Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Germany Meat Substitutes Market Size and Forecast, by Source (2023-2030) 6.4.3.3. Germany Meat Substitutes Market Size and Forecast, by Product (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Meat Substitutes Market Size and Forecast, by Type (2023-2030) 6.4.4.2. Italy Meat Substitutes Market Size and Forecast, by Source (2023-2030) 6.4.4.3. Italy Meat Substitutes Market Size and Forecast, by Product (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Meat Substitutes Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Spain Meat Substitutes Market Size and Forecast, by Source (2023-2030) 6.4.5.3. Spain Meat Substitutes Market Size and Forecast, by Product (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Meat Substitutes Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Sweden Meat Substitutes Market Size and Forecast, by Source (2023-2030) 6.4.6.3. Sweden Meat Substitutes Market Size and Forecast, by Product (2023-2030) 6.4.7. Austria 6.4.7.1. Austria Meat Substitutes Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Austria Meat Substitutes Market Size and Forecast, by Source (2023-2030) 6.4.7.3. Austria Meat Substitutes Market Size and Forecast, by Product (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Meat Substitutes Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Rest of Europe Meat Substitutes Market Size and Forecast, by Source (2023-2030) 6.4.8.3. Rest of Europe Meat Substitutes Market Size and Forecast, by Product (2023-2030) 7. Asia Pacific Meat Substitutes Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Meat Substitutes Market Size and Forecast, by Type (2023-2030) 7.2. Asia Pacific Meat Substitutes Market Size and Forecast, by Source (2023-2030) 7.3. Asia Pacific Meat Substitutes Market Size and Forecast, by Product (2023-2030) 7.4. Asia Pacific Meat Substitutes Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Meat Substitutes Market Size and Forecast, by Type (2023-2030) 7.4.1.2. China Meat Substitutes Market Size and Forecast, by Source (2023-2030) 7.4.1.3. China Meat Substitutes Market Size and Forecast, by Product (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Meat Substitutes Market Size and Forecast, by Type (2023-2030) 7.4.2.2. S Korea Meat Substitutes Market Size and Forecast, by Source (2023-2030) 7.4.2.3. S Korea Meat Substitutes Market Size and Forecast, by Product (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Meat Substitutes Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Japan Meat Substitutes Market Size and Forecast, by Source (2023-2030) 7.4.3.3. Japan Meat Substitutes Market Size and Forecast, by Product (2023-2030) 7.4.4. India 7.4.4.1. India Meat Substitutes Market Size and Forecast, by Type (2023-2030) 7.4.4.2. India Meat Substitutes Market Size and Forecast, by Source (2023-2030) 7.4.4.3. India Meat Substitutes Market Size and Forecast, by Product (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Meat Substitutes Market Size and Forecast, by Type (2023-2030) 7.4.5.2. Australia Meat Substitutes Market Size and Forecast, by Source (2023-2030) 7.4.5.3. Australia Meat Substitutes Market Size and Forecast, by Product (2023-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia Meat Substitutes Market Size and Forecast, by Type (2023-2030) 7.4.6.2. Indonesia Meat Substitutes Market Size and Forecast, by Source (2023-2030) 7.4.6.3. Indonesia Meat Substitutes Market Size and Forecast, by Product (2023-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia Meat Substitutes Market Size and Forecast, by Type (2023-2030) 7.4.7.2. Malaysia Meat Substitutes Market Size and Forecast, by Source (2023-2030) 7.4.7.3. Malaysia Meat Substitutes Market Size and Forecast, by Product (2023-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam Meat Substitutes Market Size and Forecast, by Type (2023-2030) 7.4.8.2. Vietnam Meat Substitutes Market Size and Forecast, by Source (2023-2030) 7.4.8.3. Vietnam Meat Substitutes Market Size and Forecast, by Product (2023-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan Meat Substitutes Market Size and Forecast, by Type (2023-2030) 7.4.9.2. Taiwan Meat Substitutes Market Size and Forecast, by Source (2023-2030) 7.4.9.3. Taiwan Meat Substitutes Market Size and Forecast, by Product (2023-2030) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Meat Substitutes Market Size and Forecast, by Type (2023-2030) 7.4.10.2. Rest of Asia Pacific Meat Substitutes Market Size and Forecast, by Source (2023-2030) 7.4.10.3. Rest of Asia Pacific Meat Substitutes Market Size and Forecast, by Product (2023-2030) 8. Middle East and Africa Meat Substitutes Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 8.1. Middle East and Africa Meat Substitutes Market Size and Forecast, by Type (2023-2030) 8.2. Middle East and Africa Meat Substitutes Market Size and Forecast, by Source (2023-2030) 8.3. Middle East and Africa Meat Substitutes Market Size and Forecast, by Product (2023-2030) 8.4. Middle East and Africa Meat Substitutes Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Meat Substitutes Market Size and Forecast, by Type (2023-2030) 8.4.1.2. South Africa Meat Substitutes Market Size and Forecast, by Source (2023-2030) 8.4.1.3. South Africa Meat Substitutes Market Size and Forecast, by Product (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Meat Substitutes Market Size and Forecast, by Type (2023-2030) 8.4.2.2. GCC Meat Substitutes Market Size and Forecast, by Source (2023-2030) 8.4.2.3. GCC Meat Substitutes Market Size and Forecast, by Product (2023-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Meat Substitutes Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Nigeria Meat Substitutes Market Size and Forecast, by Source (2023-2030) 8.4.3.3. Nigeria Meat Substitutes Market Size and Forecast, by Product (2023-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Meat Substitutes Market Size and Forecast, by Type (2023-2030) 8.4.4.2. Rest of ME&A Meat Substitutes Market Size and Forecast, by Source (2023-2030) 8.4.4.3. Rest of ME&A Meat Substitutes Market Size and Forecast, by Product (2023-2030) 9. South America Meat Substitutes Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 9.1. South America Meat Substitutes Market Size and Forecast, by Type (2023-2030) 9.2. South America Meat Substitutes Market Size and Forecast, by Source (2023-2030) 9.3. South America Meat Substitutes Market Size and Forecast, by Product (2023-2030) 9.4. South America Meat Substitutes Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Meat Substitutes Market Size and Forecast, by Type (2023-2030) 9.4.1.2. Brazil Meat Substitutes Market Size and Forecast, by Source (2023-2030) 9.4.1.3. Brazil Meat Substitutes Market Size and Forecast, by Product (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Meat Substitutes Market Size and Forecast, by Type (2023-2030) 9.4.2.2. Argentina Meat Substitutes Market Size and Forecast, by Source (2023-2030) 9.4.2.3. Argentina Meat Substitutes Market Size and Forecast, by Product (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Meat Substitutes Market Size and Forecast, by Type (2023-2030) 9.4.3.2. Rest Of South America Meat Substitutes Market Size and Forecast, by Source (2023-2030) 9.4.3.3. Rest Of South America Meat Substitutes Market Size and Forecast, by Product (2023-2030) 10. Global Meat Substitutes Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Meat Substitutes Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. DuPont. 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. ADM (US) 11.3. Kerry Group (Ireland) 11.4. . Ingredion Incorporated (US) 11.5. PURIS (US) 11.6. Cargill (US) 11.7. Axiom Foods (US) 11.8. A&B Ingredients (Canada) 11.9. Batory Foods (US) 11.10. The Green Labs LLC (US) 11.11. Roquette Frères (France) 11.12. Crespel&Deiters (Germany) 11.13. Sotexpro S.A (France) 11.14. All Organic Treasures GMBH (Germany) 11.15. Beneo (Germany) 11.16. Wilmar International Limited (Singapore) 11.17. Sonic Biochem Ltd (India) 11.18. The Nisshin OilliO Group, Ltd (Japan) 11.19. Shandong Jianyuan Group (China) 11.20. ET Chem (China). 12. Key Findings 13. Product Recommendations