Marine Big Data Market size was valued at US$ 874.43 Mn. in 2022 globally and revenue is expected to grow at 11.35 % from 2022 to 2029, reaching nearly US$ 1855.91 Mn.Marine Big Data Market Overview:

The term "marine big data" refers to the vast and expanding body of information gathered from or about the ocean, coastal regions, and Great Lakes. Big data from the marine environment is crucial because it can improve our knowledge of and management of the oceans. Big data from the marine environment can be utilized to manage fisheries, forecast weather patterns, and monitor marine ecosystems.To know about the Research Methodology :- Request Free Sample Report The amount of data produced and gathered by various gadgets have been multiplying globally in recent years at an astronomical rate. Countries all across the world have started monitoring initiatives including Argo, NEPTUNE, GOOS, and a number of marine observation satellites. Given the variety of observing methods and marine observation systems. The MMR research methodology started with gathering information on the key vendors' revenue through secondary and primary research in order to estimate and forecast the market for Marine Big Data. The study of various industry-affecting factors, such as government policy, the market environment, the competitive landscape, historical data, current market trends, technological development, upcoming technologies, and the rapid progress in related industries, as well as market risks, opportunities, barriers, and challenges, was a part of the research process. To divide the market into segments, by Component (Software (Data Analytics, Data Collection, Data Discovery, and Visualization, Data Management) Services (Consulting, System Integration, Operation, and Maintenance)), by Data Source (Environmental, Oceanographic, Geological Data, Economic, Others) vendors' offerings are taken into account. These segments were then confirmed through primary research by conducting in-depth interviews with important figures, including chief executive officers (CEOs), vice presidents (VPs), directors, and executives.

Marine Big Data Market Dynamics:

The MMR report contains a detailed study of factors that will drive and restrain the growth of the Marine Big Data market. The emergence of a vast generation of information has given rise to the revolutionary idea of "big data," which has taken over every industry due to its capacity for problem-solving and forecasting virtually precisely. 90% of global trade is handled by marine transportation, which generates a ton of data. Over the past few years, big data has helped the transportation and maritime industries in growing more rapidly. The effective use of big data has increased the operational effectiveness of ships and other boats. In addition, big data is utilized to manage ship sensors, find lost containers and ships, and develop trustworthy methods of delivering goods and commodities. The exponential growth of big data in the maritime industry, the rising demand for the digitalization of marine transportation, the rise in trade and transportation via ships and vessels, and the rising demand for more effective operational processes in the shipping industry will all be major market drivers during the forecast period. The development of globalized trade is another driver that will propel the marine big data market, along with increased government and organization investments in the maritime sector. Oil & gas held the greatest market share in 2022 as a result of the intense pricing competition in the industry. The market can be divided into environmental, oceanographic, geological, economic, and other categories depending on the type of data used. Among the data sources, the logistics, shipping, and economic sectors are anticipated to produce enormous amounts of data for the maritime sector. However, the complexity of finding new breakthroughs, rising R&D expenses, and a lack of technical understanding will hinder market expansion. Given the enormous demand for commodities, a fundamental constraint is the lack of supply. Exploring the tremendous biodiversity of the oceans is challenging, which is another barrier to expansion. Even though the COVID-19 pandemic impacts businesses and sectors, demand in the global maritime big data market is expected to reach new heights in the next years. There is minimal debate over the applicability of data-based research in high-end sectors including manufacturing, defense, and marine. For regional and international investors and stakeholders, the marine industry has turned out to be a veritable gold mine of opportunity. This is due to the marine industry's growing concerns over exploration and activities on the seabed. Industries and sectors experienced substantial operational delays as a result of the coronavirus pandemic. However, despite severe lockdowns, marine operations proceeded in various places of the world. For the vendors competing in the global marine big data market, this is also a robust dynamic of growth and advancement. Additionally, by using marine big data for research and analysis, maritime enterprises were able to benefit from the advantages of the digital revolution during the pandemic situation.Marine Big Data Market Segment Analysis

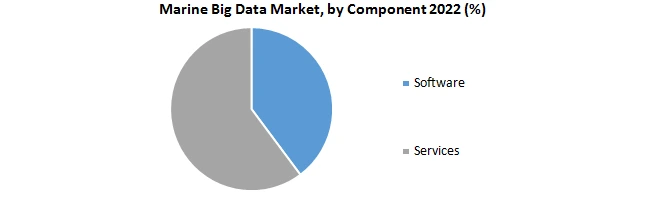

The MMR report will provide an accurate prediction of the contribution of the various segments to the growth of the Marine Big Data Market size. Component Segment is divided into two sub-segments such as software and services. Based on software, from 2022 to 2029, data analytics is anticipated to have the fastest market growth. By cutting down on time and lowering the negative effects of fossil fuel emissions on the environment, data analytics play a significant role in improving maritime operations. Data analytics identifies relationships between many factors in order to generate trends and forecasts that would improve the efficiency of shipping operations. Data analytics also offer ship operators solutions and performance forecasts for onboard equipment. The maritime big data market's largest revenue contributions are anticipated to come from the service sector. Another factor expected to contribute to the target market's expansion throughout the forecast period is the growing use of big data in marine as a service, which is becoming more popular due to its cost when compared to other software solutions.

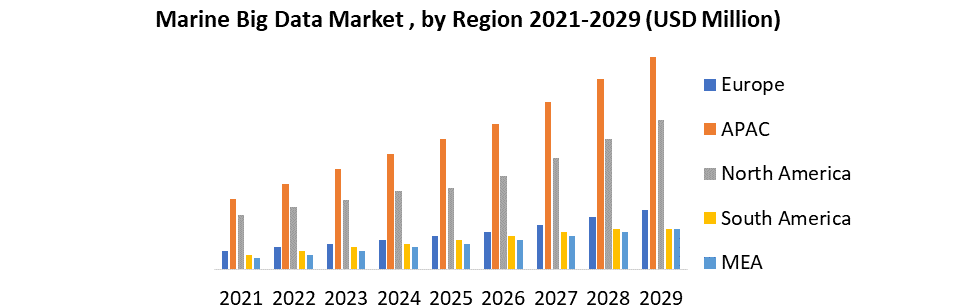

Marine Big Data Market Regional Insights:

In 2021, APAC led the Marine Big Data market and contributed more than 35% of all revenues: The marine big data market will be driven by quickly rising maritime export and import activity, increased technological advancements in the maritime sector, and significant expenditures made in the area by shipping companies. China had seen the greatest gain in the value of owning ships in 2021 among the top ten nations. Due to its extensive fleet of container ships and the recent upsurge in global trade, the nation now holds the top rank in terms of fleet value. Japan continues to rank second on this ranking. The continual development of new technologies by various maritime analytics industry players is anticipated to create new growth chances for the APAC marine analytics market. North America to Retain Lead through 2029 The market in the North American region is expanding primarily as a result of increased maritime trade and transportation, rising marine data collection from numerous sources, and rising need for logistics solutions for marine-based imports and exports.

Competitive Landscape:

Key players in the marine big data market have adopted various strategies to expand their global presence and increase their market shares. Partnerships, agreements, mergers and acquisitions, and new product developments are some of the major strategies adopted by the market players, to achieve growth in the marine big data market: 1. RightShip declared in November 2021 that it is concentrating on growing its footprint in uncharted territories, notably in the Asia Pacific. Japan is a pioneer in maritime decarburization. Building carbon-neutral vessels demand significant innovation and a dedication to decarbonizing its supply chain operations by 2030. 2. To provide consumers with improved marine due diligence services, RightShip teamed with Maritech Holdings Limited in September 2021. By allowing clients of Sea/trade to access RightShip's Safety Score, GHG Rating, and results of RightShip Dry Bulk Inspections without leaving the Sea/trade platform, digital agility is increased. Key Factors: 1. The Latest Trend in The Maritime Big Data Market Is the Investment in Research and Development Since It’s an Emerging Application of Analytics. 2. Demand For Data-Driven Insights to Improve Marine Operations Is Rising. 3. The Expansion of Sensors and Linked Devices Across the Maritime Ecosystem 4. Big Data Analytics and Artificial Intelligence (AI) Are Becoming More And More Popular for Use in Nautical Applications 5. The Development of Blockchain Technology for Efficient, Transparent, And Secure Data Sharing 6. Creation Of Autonomous Vessels Requiring Highly Complex Big Data Analytics to Control Vessel Performance The objective of the report is to present a comprehensive analysis of the Marine Big Data Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. The report also helps in understanding the Marine Big Data Market dynamics, and structure by analyzing the market segments and projecting the Marine Big Data Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Marine Big Data Market make the report investor’s guide.Marine Big Data Market Scope: Inquire before buying

Global Marine Big Data Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 874.43 Mn. Forecast Period 2023 to 2029 CAGR: 11.35 % Market Size in 2029: US $ 1855.91 Mn. Segments Covered: by Component Software Data Analytics Data Collection Data Discovery and Visualization Data Management Services Consulting System Integration Operation and Maintenance by Data Source Environmental Oceanographic Geological Data Economic Others by Application Renewable Energy Oil and Gas Fishery Whale Watching Marine Protected Area Marine Traffic Dredging Marine Big Data Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Marine Big Data Market Key Players

1. Teradata 2. Splunk, Inc. 3. AIMS-Sinay 4. Oceanwise 5. Intertrust Technologies Corporation 6. MarineFIND 7. BigOceanData 8. Avenca Limited 9. BMT Group Ltd. 10.Datameer Inc. 11.Databricks Inc. 12.Nautical Control Solutions, LP 13.Ocean Networks Canada 14.Smart Ocean and Open Ocean 15.IBM 16.A.P. Moller-Maersk 17.Microsoft Corporation 18.Hitachi Vantara Corporation 19.SAP 20.TIBCO Software Frequently Asked Questions: 1] What segments are covered in the Marine Big Data Market report? Ans. The segments covered in the Marine Big Data Market report are based on Component, Data Source. 2] Which region is expected to hold the highest share in the Marine Big Data Market? Ans. APAC region is expected to hold the highest share in the Marine Big Data Market. 3] What is the market size of the Marine Big Data Market by 2029? Ans. The market size of the Marine Big Data Market by 2029 is US$ 1855.91 Mn. 4] What is the forecast period for the Marine Big Data Market? Ans. The forecast period for the Marine Big Data Market is 2023-2029. 5] What was the market size of the Marine Big Data Market in 2022? Ans. The market size of the Marine Big Data Market in 2022 was US$ 874.43 Mn.

1. Global Marine Big Data Market: Research Methodology 2. Global Marine Big Data Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Marine Big Data Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Marine Big Data Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Marine Big Data Market Segmentation 4.1 Global Marine Big Data Market, by Component (2022-2029) • Software o Data Analytics o Data Collection o Data Discovery and Visualization o Data Management • Services o Consulting o System Integration o Operation and Maintenance 4.2 Global Marine Big Data Market, by Data Source (2022-2029) • Environmental • Oceanographic • Geological Data • Economic • Others 4.3 Global Marine Big Data Market, by Application (2022-2029) • Renewable Energy • Oil and Gas • Fishery • Whale Watching • Marine Protected Area • Marine Traffic • Dredging 5. North America Marine Big Data Market(2022-2029) 5.1 North America Marine Big Data Market, by Component (2022-2029) • Software o Data Analytics o Data Collection o Data Discovery and Visualization o Data Management • Services o Consulting o System Integration o Operation and Maintenance 5.2 North America Marine Big Data Market, by Data Source (2022-2029) • Environmental • Oceanographic • Geological Data • Economic • Others 5.3 North America Marine Big Data Market, by Application (2022-2029) • Renewable Energy • Oil and Gas • Fishery • Whale Watching • Marine Protected Area • Marine Traffic • Dredging 5.4 North America Marine Big Data Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Marine Big Data Market (2022-2029) 6.1. European Marine Big Data Market, by Component (2022-2029) 6.2. European Marine Big Data Market, by Data Source (2022-2029) 6.3. European Marine Big Data Market, by Application (2022-2029) 6.4. European Marine Big Data Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Marine Big Data Market (2022-2029) 7.1. Asia Pacific Marine Big Data Market, by Component (2022-2029) 7.2. Asia Pacific Marine Big Data Market, by Data Source (2022-2029) 7.3. Asia Pacific Marine Big Data Market, by Application (2022-2029) 7.4. Asia Pacific Marine Big Data Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Marine Big Data Market (2022-2029) 8.1 Middle East and Africa Marine Big Data Market, by Component (2022-2029) 8.2. Middle East and Africa Marine Big Data Market, by Data Source (2022-2029) 8.3. Middle East and Africa Marine Big Data Market, by Application (2022-2029) 8.4. Middle East and Africa Marine Big Data Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Marine Big Data Market (2022-2029) 9.1. South America Marine Big Data Market, by Component (2022-2029) 9.2. South America Marine Big Data Market, by Data Source (2022-2029) 9.3. South America Marine Big Data Market, by Application (2022-2029) 9.4 South America Marine Big Data Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Teradata 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Splunk, Inc. 10.3 AIMS-Sinay 10.4 Oceanwise 10.5 Intertrust Technologies Corporation 10.6 MarineFIND 10.7 BigOceanData 10.8 Avenca Limited 10.9 BMT Group Ltd. 10.10 Datameer Inc. 10.11 Databricks Inc. 10.12 Nautical Control Solutions, LP 10.13 Ocean Networks Canada 10.14 Smart Ocean and Open Ocean 10.15 IBM 10.16 A.P. Moller-Maersk 10.17 Microsoft Corporation 10.18 Hitachi Vantara Corporation 10.19 SAP 10.20 TIBCO Software