The Global Managed Security Service Market size was valued at USD 32.71 Bn in 2023 and the total Global Managed Security Service Market revenue is expected to grow at a CAGR of 14.01 % from 2024 to 2030, reaching nearly USD 81.90 Bn.Global Managed Security Service Market Overview

Cybersecurity services for individual devices and entire networks, whether public or private, are known as Managed Security Services (MSS). These services, which usually operate on a consumption-based model and incorporate security features like firewalls and real-time detection and analysis, are managed by outside providers. Security system and device management is outsourced by a managed security service provider or MSSP. Managed firewalls, intrusion detection, virtual private networks, vulnerability screening, and anti-viral services are examples of common services in the Global Managed Security Service Market. To reduce the amount of operational security staff that an organization must hire, train, and retain to maintain an acceptable security posture, MSSPs use high-availability security operation centers, which are located in their facilities or those of other data center providers. These services are offered around the clock. Government laws, the growing amount of consumer data, and the rise in new threats are the main drivers of the Global Managed Security Service Market growth. Cyberattacks now have plenty of new opportunities because of the digital revolution. Streamlining of technological advancement enhanced by the scarcities in the number of qualified workers in cybersecurity has created opportunities in the managed security service provision. Also, the increasing severity and variety of ransomware and the overall threat picture in the projected timeframe will create the need for managed security services.To know about the Research Methodology :- Request Free Sample Report

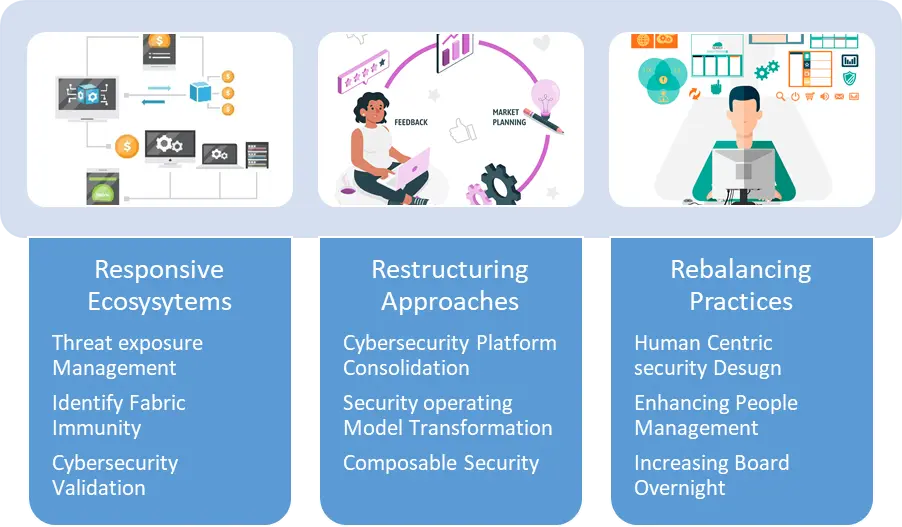

Global Managed Security Service Market Trend

AI-driven threat Detection and Response A new era of cybersecurity has been launched by artificial intelligence (AI). AI-driven MSS now more precisely identify and anticipate possible threats because of machine learning algorithms that continuously examine data trends in the Global Managed Security Service Market. By so doing it enhanced threat detection that will help the businesses to prevent possible invasions of their networks before they happen. Implementing emerging AI-powered threat detection decreases the false positive ratio by up to xx% which will lead to swifter detection of threats and identification of actual threats that may pose a danger to the firm. IBM Watson Health: Utilizes AI to continuously analyze data patterns, providing real-time threat detection and prevention. BM's QRadar Suite leverages AI to enhance threat detection and response. By integrating AI, the suite has improved the speed of alert investigation and triage by 55% in the first year. This suite uses AI-powered risk analysis to automate incident responses, reducing the time and effort needed for human intervention. GE Healthcare: Integrates AI-driven cybersecurity in its medical devices for real-time monitoring and threat identification. Cloud-Based Security Solutions As organizations embrace cloud technologies, cloud-focused security solutions are paramount. Cloud-based MSS provides the flexibility and scalability required to protect dynamic and distributed cloud environments effectively. By leveraging the power of the cloud, businesses strengthen their security posture and stay ahead of evolving cyber threats, Cloud-based security solutions offer a xx% reduction in time required to manage security infrastructure compared to traditional on-premises solutions, providing significant operational efficiencies in the Global Managed Security Service Market. Microsoft Azure: Offers advanced threat protection and compliance tools for healthcare data security in the cloud. Amazon Web Services (AWS): Provides encryption, threat detection, and compliance management to secure healthcare cloud environments. Cloud-based security solutions like IBM Security MaaS360 manage and secure enterprise devices, providing extensive visibility and control. These solutions use AI for predictive patching and risk-based policy enforcement, enhancing overall security posture while being cost-effective. Top Cybersecurity Trends in 2023

Global Managed Security Service Market Dynamics

Global Managed Security Service Market Drivers The increasing complexity of cyber threats constantly The need for MSS is rising due to the variety of sophisticated threats that exist in the modern world in the Global Managed Security Service Market. Such measures are required to be incorporated because, in recent years, the protection has become multifaceted and multidimensional in nature with the onset of new and sophisticated attack vectors. Spyware, persistent threats, zero-day exploitation, and polymorphic viruses are some of the complicated approaches presently being used by hackers to sabotage organizational security systems. Global leaders in the Global Managed Security Service Market include FireEye, Palo Alto Networks, CrowdStrike, IBM Security, and Symantec, providing sophisticated anti-measures and complete security packages. Leveraging IBM Security’s X-Force, the IRIS comprises threat analysis and response services that neutralize APTs. QRadar Security Intelligence Platform is immensely used for threat and event correlation as well as for incident handling. These adversaries create more complex threats for organizations, thus increasing the need for IBM’s MSS offerings and the growth of the market. Rise in Cybercrime Cases Cybercrime has grown all over the world and is becoming more and more complex but firms still rely on old ways of data protection since the threats are more complex and the corporate IT infrastructure is comprehensively intricate. New trends like using personal devices, cell phones, social networking sites, and cloud computing have emerged to act as threats to data security while there exists a structured crime facilitated by organized cybercriminals who continue to financially truncate organizations’ resources and dent their reputations. Hospitals are facing increased cyber threats to health information technology systems and connected, implantable medical devices and monitors. These needs are well addressed in Cisco’s all-around solutions; they, therefore, foster Global Managed Security Service Market growth. A lot of healthcare networks are outdated standardized applications and operating systems; securing the edges of a network is expensive but mandatory as it protects from outside intruders and various hazardous software. Some of the security products that are provided by Cisco systems are; network security, endpoint security, and cloud security. The developments of cyber-attacks in healthcare facilities, which still run outdated systems have made it easier for Cisco to sell its sophisticated security systems. Lately, Cisco security solutions such as Cisco Umbrella for cloud security and endpoint security solution Cisco Secure Endpoint sales have grown rapidly. These have led to an increase in Cisco’s revenues in security products and services sales in the Global Managed Security Service Market. Global Managed Security Service Market Opportunity Growing adoption of cloud technology and IoT devices Efficient IoT systems refer to the connection of computing devices and machines, inclusive of agendas that transmit information through the Internet independently of human interaction, which is increasingly extending across industries and businesses, therefore implying higher rates of security risks since these devices contain weak points that hackers exploit. In such industries as automobiles, issues like self-driving cars that are highly dependent on software for automation expose the business to these threats in the Global Managed Security Service Market. To overcome this, there is an offering from Managed Security Services which is a continuous vigil and protection against cyber threats. At the same time, cloud computing is widely being adopted in SMEs and big corporations due to its low costs, and dynamic data access with added security features such as encryption and malware detection. The mentioned trend of utilizing cloud technology and IoT integration offers a great deal of opportunities for improving enterprises’ processes while maintaining security with the help of solutions provided by managed security service providers according to clients’ requirements. Products owned by Cisco including Cisco IoT Threat Defense and Cisco Umbrella include features of real-time monitoring. It is evident that the utilization of these services has been propelled by the business organizations that use cloud and IoT technologies and from them has flowed Cisco’s revenue. Remedial action alert is used comprehensively across cloud and IoT applications; the MSS market has grown due to constant supervision and prevention. Such solutions are very important to the growth of the Global Managed Security Service Market and are provided by Cisco. Challenges Cybersecurity Challenges and Operational Strategies Being an important component of the field of MSS, the current state of affairs is characterized by a large number of constantly emerging threats and the ability to use various types of security measures. They have to adjust sound security measures to new threats regularly while integrating a high level of automation with the need for human approaches to complicated issues, as well as with necessary compliance requirements. More specifically, BM Security operates in the fully managed security services sphere with threat management, incident response with identity and access, and cloud security services. The company employs AI and machine learning in its business through the help of IBM Security QRadar. Consequently, IBM’s security revenue was $61.9 Billion in 2023 and 6 billion US dollars in 2020 due to its competitive advantage in the Global Managed Security Service Market. IBM offers comprehensive security management services for thousands of companies around the world, operating in the spheres of finance, healthcare retail, etc. Talent Shortage and Compliance Complexity Currently, MSS providers are struggling to acquire qualified cybersecurity employees, while the regulatory compliance procedures become progressively complex. They have to invent ways to recruit and retain the right talent for managing complex compliance requirements and to adequately secure clients’ data to minimize tremendous monetary and brand losses. It offers them managed security services in the spheres of threat detection and response, vulnerability management, and security consulting. Secureworks has its presence in over seventy countries and it has clients in more than four thousand four hundred companies. Secureworks was generating revenues close to $463.48 million in 2023 and has a solid standing in the Global Managed Security Service Market. The company focuses on threat intelligence for threat search and event detection to safeguard organizations against cyber threats.Global Managed Security Service Market Segment Analysis

Based on Service Type, Managed SIEM and log management are expected to hold the largest market shares in the Global Managed Security Service Market. Through organizations’ managed SIEM and log management services, organizations have been able to deal with pragmatic and complex cyber threats through the application of advanced technologies as well as specialized skills. The protection of sensitive data involves regulatory regulations in several businesses. This put in place managed SIEM and log management services to help businesses comply with these regulations. The market for managed SIEM and log management is mainly stimulated by the need to follow legislation such as GDPR, HIPAA, and others. Based on Vertical, Based on vertical BFSI segment dominates the Global Managed Security Service Market. BFSI institutions are subject to stringent data privacy and security regulations, creating immense pressure to implement comprehensive security measures in the Global Managed Security Service Market. MSS providers ensure continuous compliance monitoring and reporting, easing the burden for BFSI organizations. BFSI organizations often engage with third-party vendors for various services. Managed security services extend their oversight to assess and manage the security risks associated with third-party relationships. Based on Security, For the period under consideration, the managed DDoS category’s growth is envisioned to emerge at a CAGR of more than xx%. The expansion of the DDoS managed security services stems from the increasing demand for specialists’ advanced knowledge, lower costs, flexibility, and comprehensiveness in addressing the constantly evolving threat environment. Cybercriminals especially in the recent past have not ceased to launch DDoS assaults on various platforms. Hackers never cease to devise new strategies and tools for how they pull off a successful strike. DDoS assaults need to be effectively countered with specific knowledge and equipment. Many companies lack the in-house expertise and trained security personnel needed to stop these kinds of attacks in the Global Managed Security Service Market. Dedicated employees with extensive experience in DDoS mitigation are the goal of managed security service providers, who offer a more advanced level of security than what is achieved by firms on their own. Based on Organisation Size, The SME segment is expected to dominate over the forecast period. as a result of its growing use of managed security services. Even with lesser budgets than larger businesses, SMEs require assistance with data security. Cybersecurity firms want to provide SMEs with IT competency levels by providing straightforward, scalable solutions. SMEs are vulnerable to intrusions outside of usual business hours because they require greater resources to continuously check their systems. Managed security services are responding by providing rapid incident response and round-the-clock monitoring to guarantee that possible security incidents are promptly detected and resolved in the Global Managed Security Service Market.Global Managed Security Service Market Regional Insights

According to estimation, North America is expected to maintain the largest market share over the projected time in the Global Managed Security Service Market. Because of the rising need for outsourcing services from numerous tech companies, the region is predicted to maintain its dominant position. Regional growth is anticipated to be further supported by managed service options that better cater to individual needs as well as the growing demand for cloud computing, network security, and data protection. Similar to previous years, the increase in quantity and diversity of cyber threats, as well as their complexity targeting larger exposure footprint, is the motivation behind the market. Cybersecurity innovation is focused on North America because prime corporations such as Palo Alto Networks, Cisco, and CrowdStrike are located here, contributing to the invention of innovative approaches and tools. The cybersecurity threat in North America is a constant threat exacerbated by strong cyberattacks and data breaches. Also, the rising adoption of cloud technologies is further driving the demand for specialized cloud security within managed security service offerings. The Asia Pacific market is expected to register the highest CAGR due to the increasing demand for outsourcing services from third parties in the Global Managed Security Service Market. The lack of qualified cyber professionals in the APAC area is another major factor driving MSS's rise. Numerous sizable corporations have set up their own Security Operations Centers (SOCs), but staffing them requires additional manpower. Because they are outsourcing services from MSSP suppliers, these centers operate at their best. Due to their lack of financial flexibility, SMEs usually rely on affordable outsourcing for their cybersecurity operations and management.Managed Security Service Market Scope: Inquire before buying

Managed Security Service Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 32.71 Bn. Forecast Period 2024 to 2030 CAGR: 14.01% Market Size in 2030: US $ 81.90 Bn. Segments Covered: by Security Type Managed IAM Managed Vulnerability Management Managed Risk and compliance Managed detection and response Managed Firewall Managed SIEM and Log Management Managed UTM Managed DDoS Managed XDR Other service type by Type Fully Managed Co-Managed by Organization Size Large Enterprises SMEs by Security Type Network Security Cloud Security Endpoint Security Application Security Data Security Others by Vertical BFSI Government & Defense Healthcare & Life Sciences Telecommunications IT and ITeS Retail and eCommerce Energy and Utilities Manufacturing Other Verticals Managed Security Service Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Managed Security Service Market, Key Players are:

1. IBM (US) 2. DXC Technology (US) 3. SecureWorks Inc. (US) 4. Trustwave (US) 5. AT&T (US) 6. Verizon (US) 7. HPE (US) 8. Cisco (US) 9. Ascend Technologies (US) 10. Avertium (US) 11. Accenture (Ireland) 12. Atos (France) 13. Orange Cyberdefense (France) 14. Capgemini (France) 15. Kudelski Security (Switzerland) 16. Nokia Networks (Finland) 17. DigitalXRAID (UK) 18. NTT (Japan) 19. Fujitsu (Japan) 20. TCS (India) 21. Infosys (India) 22. Trend Micro (Japan) 23. SecurityHQ (UAE) Frequently Asked Questions: 1] What is the growth rate of the Global Managed Security Service Market? Ans. The Global Managed Security Service Market is growing at a significant rate of 14.01 % during the forecast period. 2] Which region is expected to dominate the Global Managed Security Service Market? Ans. North America is expected to dominate the Global Managed Security Service Market during the forecast period. 3] What is the expected Global Managed Security Service Market size by 2030? Ans. The Global Managed Security Service Market size is expected to reach USD 81.90 Billion by 2030. 4] Which are the top players in the Global Global Managed Security Service Market? Ans. The major top players in the Global Managed Security Service Market are IBM (US), NTT (Japan), Accenture (Ireland), DXC Technology (US), Secureworks (US), Trustwave (US), Atos (France), Orange Cyberdefense (France), Fujitsu (Japan) and others. 5] What are the factors driving the Global Managed Security Service Market growth? Ans The increasing complexity of cyber threats constantly and the Rise in Cybercrime Cases are expected to drive market growth during the forecast period.

1. Global Managed Security Service Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Managed Security Service Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Product Segment 2.3.3. End-user Segment 2.3.4. Revenue (2023) 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Global Managed Security Service Market: Dynamics 3.1. Global Managed Security Service Market Trends 3.2. Global Managed Security Service Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Latin America 3.5.5. Middle East and Africa 3.6. Analysis of Government Schemes and Initiatives For the Managed Security Service Market 4. Global Managed Security Service Market: Global Market Size and Forecast by Segmentation (by Value USD Mn) (2023-2030) 4.1. Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 4.1.1. Managed IAM 4.1.2. Managed Vulnerability Management 4.1.3. Managed Risk and compliance 4.1.4. Managed detection and response 4.1.5. Managed Firewall 4.1.6. Managed SIEM and Log Management 4.1.7. Managed UTM 4.1.8. Managed DDoS 4.1.9. Managed XDR 4.1.10. another service type 4.2. Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 4.2.1. Fully Managed 4.2.2. Co-Managed 4.3. Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 4.3.1. Large Enterprises 4.3.2. SMEs 4.4. Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 4.4.1. Network Security 4.4.2. Cloud Security 4.4.3. Endpoint Security 4.4.4. Application Security 4.4.5. Data Security 4.4.6. Others 4.5. Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 4.5.1. BFSI 4.5.2. Government & Defense 4.5.3. Healthcare & Life Sciences 4.5.4. Telecommunications 4.5.5. IT and ITeS 4.5.6. Retail and eCommerce 4.5.7. Energy and Utilities 4.5.8. Manufacturing 4.5.9. Other Verticals 4.6. Global Managed Security Service Market Size and Forecast, by Region (2023-2030) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. South America 4.6.5. Middle East and Africa 5. North America Global Managed Security Service Market Size and Forecast by Segmentation (by Value USD Mn) (2023-2030) 5.1. North America Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 5.1.1. Managed IAM 5.1.2. Managed Vulnerability Management 5.1.3. Managed Risk and compliance 5.1.4. Managed detection and response 5.1.5. Managed Firewall 5.1.6. Managed SIEM and Log Management 5.1.7. Managed UTM 5.1.8. Managed DDoS 5.1.9. Managed XDR 5.1.10. Other service type 5.2. North America Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 5.2.1. Fully Managed 5.2.2. Co-Managed 5.3. North America Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 5.3.1. Large Enterprises 5.3.2. SMEs 5.4. North America Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 5.4.1. Network Security 5.4.2. Cloud Security 5.4.3. Endpoint Security 5.4.4. Application Security 5.4.5. Data Security 5.4.6. Others 5.5. North America Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 5.5.1. BFSI 5.5.2. Government & Defense 5.5.3. Healthcare & Life Sciences 5.5.4. Telecommunications 5.5.5. IT and ITeS 5.5.6. Retail and eCommerce 5.5.7. Energy and Utilities 5.5.8. Manufacturing 5.5.9. Other Verticals 5.6. North America Global Managed Security Service Market Size and Forecast, by Country (2023-2030) 5.6.1. United States 5.6.1.1. United States Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 5.6.1.1.1. Managed IAM 5.6.1.1.2. Managed Vulnerability Management 5.6.1.1.3. Managed Risk and compliance 5.6.1.1.4. Managed detection and response 5.6.1.1.5. Managed Firewall 5.6.1.1.6. Managed SIEM and Log Management 5.6.1.1.7. Managed UTM 5.6.1.1.8. Managed DDoS 5.6.1.1.9. Managed XDR 5.6.1.1.10. Other service type 5.6.1.2. United States Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 5.6.1.2.1. Fully Managed 5.6.1.2.2. Co-Managed 5.6.1.3. United States Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 5.6.1.3.1. Large Enterprises 5.6.1.3.2. SMEs 5.6.1.4. United States Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 5.6.1.4.1. Network Security 5.6.1.4.2. Cloud Security 5.6.1.4.3. Endpoint Security 5.6.1.4.4. Application Security 5.6.1.4.5. Data Security 5.6.1.4.6. Others 5.6.1.5. United States Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 5.6.1.5.1. BFSI 5.6.1.5.2. Government & Defense 5.6.1.5.3. Healthcare & Life Sciences 5.6.1.5.4. Telecommunications 5.6.1.5.5. IT and ITeS 5.6.1.5.6. Retail and eCommerce 5.6.1.5.7. Energy and Utilities 5.6.1.5.8. Manufacturing 5.6.1.5.9. Other Verticals 5.6.2. Canada 5.6.2.1. Canada Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 5.6.2.1.1. Managed IAM 5.6.2.1.2. Managed Vulnerability Management 5.6.2.1.3. Managed Risk and compliance 5.6.2.1.4. Managed detection and response 5.6.2.1.5. Managed Firewall 5.6.2.1.6. Managed SIEM and Log Management 5.6.2.1.7. Managed UTM 5.6.2.1.8. Managed DDoS 5.6.2.1.9. Managed XDR 5.6.2.1.10. Other service type 5.6.2.2. Canada Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 5.6.2.2.1. Fully Managed 5.6.2.2.2. Co-Managed 5.6.2.3. Canada Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 5.6.2.3.1. Large Enterprises 5.6.2.3.2. SMEs 5.6.2.4. Canada Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 5.6.2.4.1. Network Security 5.6.2.4.2. Cloud Security 5.6.2.4.3. Endpoint Security 5.6.2.4.4. Application Security 5.6.2.4.5. Data Security 5.6.2.4.6. Others 5.6.2.5. Canada Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 5.6.2.5.1. BFSI 5.6.2.5.2. Government & Defense 5.6.2.5.3. Healthcare & Life Sciences 5.6.2.5.4. Telecommunications 5.6.2.5.5. IT and ITeS 5.6.2.5.6. Retail and eCommerce 5.6.2.5.7. Energy and Utilities 5.6.2.5.8. Manufacturing 5.6.2.5.9. Other Verticals 5.6.3. Mexico 5.6.3.1. Mexico Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 5.6.3.1.1. Managed IAM 5.6.3.1.2. Managed Vulnerability Management 5.6.3.1.3. Managed Risk and compliance 5.6.3.1.4. Managed detection and response 5.6.3.1.5. Managed Firewall 5.6.3.1.6. Managed SIEM and Log Management 5.6.3.1.7. Managed UTM 5.6.3.1.8. Managed DDoS 5.6.3.1.9. Managed XDR 5.6.3.1.10. Other service type 5.6.3.2. Mexico Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 5.6.3.2.1. Fully Managed 5.6.3.2.2. Co-Managed 5.6.3.3. Mexico Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 5.6.3.3.1. Large Enterprises 5.6.3.3.2. SMEs 5.6.3.4. Mexico Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 5.6.3.4.1. Network Security 5.6.3.4.2. Cloud Security 5.6.3.4.3. Endpoint Security 5.6.3.4.4. Application Security 5.6.3.4.5. Data Security 5.6.3.4.6. Others 5.6.3.5. Mexico Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 5.6.3.5.1. BFSI 5.6.3.5.2. Government & Defense 5.6.3.5.3. Healthcare & Life Sciences 5.6.3.5.4. Telecommunications 5.6.3.5.5. IT and ITeS 5.6.3.5.6. Retail and eCommerce 5.6.3.5.7. Energy and Utilities 5.6.3.5.8. Manufacturing 5.6.3.5.9. Other Verticals 6. Europe Global Managed Security Service Market Size and Forecast by Segmentation (by Value USD Mn) (2023-2030) 6.1. Europe Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 6.2. Europe Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 6.3. Europe Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 6.4. Europe Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 6.5. Europe Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 6.6. Europe Global Managed Security Service Market Size and Forecast, by Country (2023-2030) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 6.6.1.2. United Kingdom Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 6.6.1.3. United Kingdom Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 6.6.1.4. United Kingdom Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 6.6.1.5. United Kingdom Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 6.6.2. France 6.6.2.1. France Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 6.6.2.2. France Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 6.6.2.3. France Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 6.6.2.4. France Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 6.6.2.5. France Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 6.6.3. Germany 6.6.3.1. Germany Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 6.6.3.2. Germany Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 6.6.3.3. Germany Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 6.6.3.4. Germany Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 6.6.3.5. Germany Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 6.6.4. Italy 6.6.4.1. Italy Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 6.6.4.2. Italy Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 6.6.4.3. Italy Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 6.6.4.4. Italy Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 6.6.4.5. Italy Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 6.6.5. Spain 6.6.5.1. Spain Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 6.6.5.2. Spain Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 6.6.5.3. Spain Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 6.6.5.4. Spain Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 6.6.5.5. Spain Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 6.6.6. Sweden 6.6.6.1. Sweden Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 6.6.6.2. Sweden Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 6.6.6.3. Sweden Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 6.6.6.4. Sweden Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 6.6.6.5. Sweden Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 6.6.7. Austria 6.6.7.1. Austria Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 6.6.7.2. Austria Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 6.6.7.3. Austria Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 6.6.7.4. Austria Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 6.6.7.5. Austria Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 6.6.8.2. Rest of Europe Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 6.6.8.3. Rest of Europe Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 6.6.8.4. Rest of Europe Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 6.6.8.5. Rest of Europe Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 7. Asia Pacific Global Managed Security Service Market Size and Forecast by Segmentation (by Value USD Mn) (2023-2030) 7.1. Asia Pacific Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 7.2. Asia Pacific Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 7.3. Asia Pacific Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 7.4. Asia Pacific Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 7.5. Asia Pacific Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 7.6. Asia Pacific Global Managed Security Service Market Size and Forecast, by Country (2023-2030) 7.6.1. China 7.6.1.1. China Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 7.6.1.2. China Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 7.6.1.3. China Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 7.6.1.4. China Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 7.6.1.5. China Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 7.6.2. S Korea 7.6.2.1. S Korea Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 7.6.2.2. S Korea Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 7.6.2.3. S Korea Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 7.6.2.4. S Korea Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 7.6.2.5. S Korea Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 7.6.3. Japan 7.6.3.1. Japan Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 7.6.3.2. Japan Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 7.6.3.3. Japan Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 7.6.3.4. Japan Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 7.6.3.5. Japan Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 7.6.4. India 7.6.4.1. India Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 7.6.4.2. India Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 7.6.4.3. India Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 7.6.4.4. India Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 7.6.4.5. India Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 7.6.5. Australia 7.6.5.1. Australia Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 7.6.5.2. Australia Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 7.6.5.3. Australia Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 7.6.5.4. Australia Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 7.6.5.5. Australia Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 7.6.6. Indonesia 7.6.6.1. Indonesia Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 7.6.6.2. Indonesia Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 7.6.6.3. Indonesia Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 7.6.6.4. Indonesia Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 7.6.6.5. Indonesia Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 7.6.7. Malaysia 7.6.7.1. Malaysia Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 7.6.7.2. Malaysia Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 7.6.7.3. Malaysia Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 7.6.7.4. Malaysia Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 7.6.7.5. Malaysia Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 7.6.8. Vietnam 7.6.8.1. Vietnam Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 7.6.8.2. Vietnam Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 7.6.8.3. Vietnam Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 7.6.8.4. Vietnam Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 7.6.8.5. Vietnam Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 7.6.9. Taiwan 7.6.9.1. Taiwan Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 7.6.9.2. Taiwan Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 7.6.9.3. Taiwan Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 7.6.9.4. Taiwan Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 7.6.9.5. Taiwan Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 7.6.10.2. Rest of Asia Pacific Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 7.6.10.3. Rest of Asia Pacific Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 7.6.10.4. Rest of Asia Pacific Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 7.6.10.5. Rest of Asia Pacific Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 8. Latin America Global Managed Security Service Market Size and Forecast by Segmentation (by Value USD Mn) (2023-2030) 8.1. Latin America Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 8.2. Latin America Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 8.3. Latin America Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 8.4. Latin America Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 8.5. Latin America Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 8.6. Latin America Global Managed Security Service Market Size and Forecast, by Country (2023-2030) 8.6.1. Brazil 8.6.1.1. Brazil Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 8.6.1.2. Brazil Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 8.6.1.3. Brazil Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 8.6.1.4. Brazil Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 8.6.1.5. Brazil Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 8.6.2. Argentina 8.6.2.1. Argentina Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 8.6.2.2. Argentina Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 8.6.2.3. Argentina Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 8.6.2.4. Argentina Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 8.6.2.5. Argentina Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 8.6.3. Rest Of Latin America 8.6.3.1. Rest Of Latin America Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 8.6.3.2. Rest Of Latin America Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 8.6.3.3. Rest Of Latin America Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 8.6.3.4. Rest Of Latin America Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 8.6.3.5. Rest Of Latin America Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 9. Middle East and Africa Global Managed Security Service Market Size and Forecast by Segmentation (by Value USD Mn) (2023-2030) 9.1. Middle East and Africa Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 9.2. Middle East and Africa Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 9.3. Middle East and Africa Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 9.4. Middle East and Africa Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 9.5. Middle East and Africa Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 9.6. Middle East and Africa Global Managed Security Service Market Size and Forecast, by Country (2023-2030) 9.6.1. South Africa 9.6.1.1. South Africa Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 9.6.1.2. South Africa Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 9.6.1.3. South Africa Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 9.6.1.4. South Africa Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 9.6.1.5. South Africa Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 9.6.2. GCC 9.6.2.1. GCC Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 9.6.2.2. GCC Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 9.6.2.3. GCC Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 9.6.2.4. GCC Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 9.6.2.5. GCC Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 9.6.3. Rest Of South Africa 9.6.3.1. Rest Of South Africa Global Managed Security Service Market Size and Forecast, By Service Type (2023-2030) 9.6.3.2. Rest Of South Africa Global Managed Security Service Market Size and Forecast, By Type (2023-2030) 9.6.3.3. Rest Of South Africa Global Managed Security Service Market Size and Forecast, By Organization Size (2023-2030) 9.6.3.4. Rest Of South Africa Global Managed Security Service Market Size and Forecast, By Security Type (2023-2030) 9.6.3.5. Rest Of South Africa Global Managed Security Service Market Size and Forecast, By Vertical (2023-2030) 10. Company Profile: Key Players 10.1. IBM (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. DXC Technology (US) 10.3. Secureworks (US) 10.4. Trustwave (US) 10.5. AT&T (US) 10.6. Verizon (US) 10.7. HPE (US) 10.8. Cisco (US) 10.9. Ascend Technologies (US) 10.10. .Avertium (US) 10.11. .Accenture (Ireland) 10.12. .Atos (France) 10.13. .Orange Cyberdefense (France) 10.14. .Capgemini (France) 10.15. .Kudelski Security (Switzerland) 10.16. .Nokia Networks (Finland) 10.17. .DigitalXRAID (UK) 10.18. .NTT (Japan) 10.19. .Fujitsu (Japan) 10.20. .TCS (India) 10.21. .Infosys (India) 10.22. .Trend Micro (Japan) 10.23. .SecurityHQ (UAE) 11. Key Findings and Analyst Recommendations 12. Global Managed Security Service Market: Research Methodology