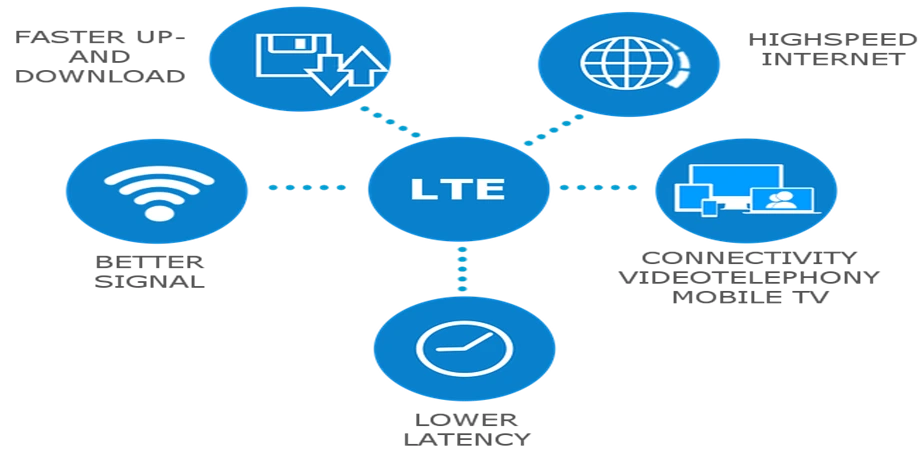

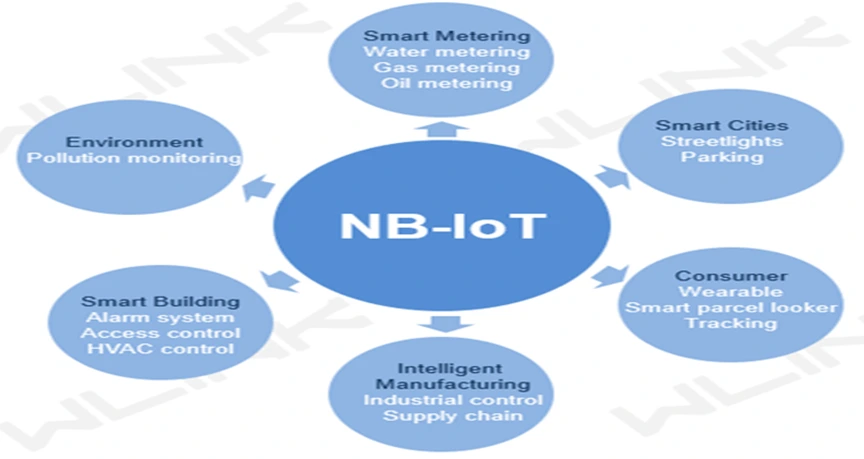

The LTE IoT Market size was valued at USD 2.52 billion in 2023 and the total LTE IoT Market revenue is expected to grow at a CAGR of 28.13 % from 2024 to 2030, reaching nearly USD 14.28 billion. LTE IoT, or Long-Term Evolution for the Internet of Things, encompasses a set of cellular communication technologies designed to enable connectivity for IoT devices over existing LTE networks. It includes two main technologies: NB-IoT (Narrowband IoT) and LTE-M (LTE-Machine Type Communication). NB-IoT focuses on providing low-power, wide-area coverage for IoT devices with long battery life, while LTE-M offers higher data rates, mobility support, and voice-over LTE capabilities for more diverse IoT applications. The LTE IoT market has witnessed significant growth in recent years, driven by the proliferation of IoT devices across various industries such as healthcare, agriculture, transportation, and manufacturing. As IoT deployments continue to expand, the demand for reliable and scalable connectivity solutions provided by LTE IoT technologies is expected to surge.To know about the Research Methodology :- Request Free Sample Report Urbanization trends and the growing need for industrial automation are driving the demand for IoT solutions powered by LTE connectivity in smart cities, industrial IoT (IIoT), and smart infrastructure projects. Continuous advancements in LTE-M and NB-IoT technologies, along with the development of ecosystem support and interoperability standards, are boosting the adoption of LTE IoT market. The healthcare sector is leveraging LTE IoT for remote patient monitoring, asset tracking, and healthcare logistics, while smart agriculture applications utilize IoT sensors for precision farming, crop monitoring, and livestock management. The integration of LTE IoT devices with edge computing and artificial intelligence (AI) technologies enables real-time data processing and analysis, enhancing the intelligence and efficiency of IoT applications. With the increasing connectivity of IoT devices, there is a growing emphasis on implementing robust security measures and ensuring data privacy to protect sensitive information from cyber threats. The global rollout of smart city initiatives presents a significant opportunity for LTE IoT deployment, enabling smart infrastructure, public safety, and environmental monitoring solutions. There is a growing demand for vertical-specific IoT solutions tailored to industries such as healthcare, agriculture, transportation, and manufacturing, offering opportunities for innovation and customization. Telecom operators are investing in enhancing their LTE IoT connectivity services, such as network coverage expansion, quality of service improvements, and the introduction of new pricing models to attract IoT deployments. Recent developments in the LTE IoT market include key players' strategic collaborations, product launches, and investments in research and development. For example, leading telecom operators are partnering with technology providers to offer integrated LTE IoT solutions, while IoT device manufacturers are introducing innovative LTE-M and NB-IoT-enabled devices tailored to specific industry requirements. Investments in 5G networks and infrastructure are expected to further accelerate the adoption of LTE IoT technologies, driving LTE IoT Market growth and innovation in the forecast period.

Market Dynamics:

High-Speed Wireless Connectivity Revolutionizes Home and Business Networks: Renesas' introduction of the RH1NS200 NB-IoT chipset for the Indian market taps into the massive potential of India's smart metering market, estimated at 250 million units over the next five years. By providing low-power, secure connectivity solutions tailored to specific regional needs, Renesas creates opportunities for IoT adoption in sectors such as utilities, asset tracking, and security, driving LTE IoT Market growth in India's burgeoning IoT ecosystem. The collaboration between Aeris Communications and Ericsson to create a comprehensive IoT platform offers seamless cellular connectivity to over 100 million IoT devices worldwide. This integration facilitates diverse IoT applications across various industries, including smart cities, agriculture, and healthcare. For example, smart city initiatives leverage this connectivity to monitor and manage urban infrastructure, leading to improved efficiency and sustainability. Qualcomm's launch of seven new IoT devices provides cutting-edge solutions for key industry segments such as transportation, warehousing, and healthcare. These advancements enable transformative IoT applications, such as real-time asset tracking in logistics, remote patient monitoring in healthcare, and predictive maintenance in manufacturing. Qualcomm's robust IoT portfolio drives LTE IoT Market growth by empowering enterprises to achieve operational efficiency and innovation. System Loco's adoption of Aeris' Intelligent IoT network ensures reliable connectivity for worldwide tracking and tracing of smart pallets. By offering LTE-M, NB-IoT, LTE, and 2G/3G coverage from 600 carriers globally, System Loco meets the connectivity demands of its customers across diverse geographical regions. This extensive network coverage fosters LTE IoT Market growth opportunities by enabling seamless IoT deployments in various industries, from supply chain management to asset tracking. UScellular's collaboration with Qualcomm and Inseego to launch 5G mmWave high-speed internet service opens new possibilities for high-speed wireless connectivity in homes and businesses. The deployment of Inseego's Wavemaker FW2010 outdoor CPE with multi-gigabit download speeds enables data-intensive applications such as immersive video streaming and virtual collaboration. This advancement in 5G-enabled IoT solutions paves the way for enhanced digital experiences and increased adoption of IoT technologies.Rapid Adoption of LTE-M and NB-IoT Technologies: Renesas' acquisition of Sequans Communications strengthens its position in the cellular IoT market and expands its IoT solution offering. By integrating Sequans' cellular connectivity products into its lineup, Renesas anticipates immediate growth in the WAN market, addressing the growing demand for IoT solutions in smart metering, asset tracking, and connected vehicles. This strategic acquisition creates opportunities for Renesas to diversify its revenue streams and drive LTE IoT Market growth. Telit Cinterion's introduction of first-generation RedCap IoT modules enabled by the Snapdragon X35 5G Modem-RF System offers a smooth evolution path from LTE to 5G. These modules provide worldwide coverage with LTE Cat 4 fallback, ensuring seamless connectivity for IoT applications across diverse regions. With premium throughput and backward compatibility, these modules cater to a wide range of IoT use cases, from industrial meters to IoT gateways, fueling LTE IoT Market growth through technological innovation. LTE-M and NB-IoT technologies are experiencing rapid adoption due to their low power consumption and long lifecycle suitability for IoT devices. As mobile operators phase out 4G LTE networks, the transition to LTE-M and NB-IoT becomes imperative for IoT deployments requiring extended connectivity longevity. This shift creates opportunities for LTE-M and NB-IoT module providers to capitalize on the growing demand for energy-efficient IoT solutions across industries like smart utilities and asset tracking. Soracom's collaboration with Sony Semiconductor Solutions to provide global IoT connectivity for SPRESENSE microcontrollers showcases the integration of AI and edge computing into IoT solutions. SPRESENSE's edge AI support enables advanced data processing and analysis at the device level, opening opportunities for real-time decision-making and autonomous operation in IoT applications. This integration drives LTE IoT Market growth by empowering IoT devices with intelligence and autonomy, enhancing their value proposition across industries. Soracom's introduction of PlanP2 data plans tailored to Brazil's regulatory requirements highlights the importance of regulatory compliance and regional customization in IoT connectivity solutions. By offering fully compliant connectivity options for Brazil's dynamic IoT market, PlanP2 addresses regional restrictions and compliance challenges, creating opportunities for IoT deployments in industries such as agriculture, manufacturing, and smart cities. This focus on regulatory compliance and regional customization fosters LTE IoT Market growth by enabling seamless IoT connectivity solutions tailored to specific market needs and regulations.

High Initial Setup Costs Impede Small-Scale LTE IoT Adoption: Limited LTE-M and NB-IoT coverage in rural or remote areas hinders IoT deployments, restricting market growth. For example, areas with poor cellular coverage face connectivity issues, affecting applications like agricultural monitoring on remote farms. Initial setup costs for LTE IoT infrastructure, including hardware and network subscriptions, pose a barrier to entry for small-scale deployments, slowing LTE IoT Market growth. For instance, deploying LTE-M or NB-IoT networks in large-scale industrial facilities requires significant investment, limiting adoption. Lack of standardized protocols and interoperability issues among different LTE IoT devices and platforms complicate integration and limit scalability, restraining LTE IoT Market growth. For example, compatibility issues between LTE-M devices from different manufacturers hinder seamless connectivity. Vulnerabilities in LTE IoT networks and devices raise security concerns, deterring enterprises from adopting IoT solutions. Instances of cyberattacks targeting IoT devices, such as surveillance cameras and smart meters, highlight the need for robust security measures. Regulatory requirements and spectrum allocation policies vary across regions, leading to regulatory uncertainties and compliance challenges for LTE IoT deployments, slowing market growth. For example, differing regulatory frameworks for NB-IoT deployment across countries delay market growth. LTE-M and NB-IoT devices often require efficient power management to prolong battery life, limiting their use in applications requiring prolonged operation without frequent battery replacement or recharging. For example, IoT devices deployed in remote or inaccessible locations face challenges due to limited power sources. Scaling LTE IoT deployments to accommodate large volumes of connected devices encounters scalability challenges related to network congestion, data management, and processing capabilities, inhibiting LTE IoT Market growth. For instance, managing a network of thousands of LTE-M devices transmitting real-time data strains existing infrastructure. A shortage of skilled professionals with expertise in LTE IoT technologies and deployment hinders the implementation and maintenance of IoT solutions, slowing LTE IoT Market growth. For example, the demand for IoT engineers proficient in LTE-M and NB-IoT deployment exceeds the available workforce, leading to resource constraints. The collection and processing of sensitive data by LTE IoT devices raises privacy concerns among consumers and regulatory bodies, leading to reluctance to adopt IoT solutions. Instances of data breaches or misuse of personal information erode trust and dampen IoT adoption. Integration with existing legacy systems and infrastructure poses challenges for LTE IoT deployments, requiring additional investments in retrofitting or upgrading systems for compatibility, hindering LTE IoT Market growth. For example, retrofitting traditional utility meters with LTE-M-enabled smart meters requires significant modifications to existing infrastructure.

LTE IoT Market Segment Analysis:

Based on Technology, NB-IoT holds a dominant position in 2023, particularly in applications where low power consumption and wide coverage are paramount, such as smart metering, asset tracking, and agricultural sensors. However, LTE-M is rapidly gaining traction, especially in applications requiring higher data rates and mobility support, such as wearables, connected vehicles, and industrial IoT deployments. Looking ahead, LTE-M is expected to further dominate the LTE IoT Market due to its versatility and suitability for a broad range of IoT applications, including those requiring real-time communication and moderate data rates. Additionally, as mobile operators phase out 2G and 3G networks, LTE-M's widespread adoption is anticipated to accelerate, further consolidating its dominance in the LTE IoT landscape. NB-IoT currently holds a significant share, LTE-M is poised to emerge as the dominant technology in the LTE IoT market, driven by its broader applicability and growing adoption across diverse industries and use cases. NB-IoT Applications:

LTE IoT Market Regional Insights:

The LTE IoT market shows distinct regional dominance and growth trends, with Asia-Pacific emerging as the leading region in both aspects. Asia-Pacific's dominance is driven by factors such as rapid urbanization, government initiatives promoting IoT adoption, and the presence of key LTE IoT Market players investing in IoT infrastructure. For instance, China's aggressive deployment of NB-IoT technology has propelled the region's dominance, with NB-IoT capturing significant market share. Increasing industrial automation and smart city projects in countries like South Korea and Japan further solidify Asia-Pacific's position as the dominant LTE IoT market. North America is expected to witness substantial growth, fueled by advancements in LTE-M technology and the proliferation of IoT applications in sectors such as healthcare, logistics, and smart agriculture. Real-time examples include the deployment of LTE-M-enabled asset tracking solutions by logistics companies like FedEx and UPS to improve supply chain visibility and efficiency. Europe is poised for significant growth driven by regulatory mandates promoting the adoption of IoT technologies, particularly in sectors like automotive and utilities. For instance, European automotive manufacturers are increasingly integrating LTE IoT connectivity into vehicles for enhanced safety features and telematics services. Asia-Pacific currently dominates the LTE IoT market, North America and Europe are expected to experience substantial growth, driven by technological advancements, and increasing adoption across various industries. Competitive Landscape The recent developments in LTE IoT technology, such as Renesas' NB-IoT chipset tailored for India, its acquisition of Sequans, and Soracom's innovative IoT solutions, including the LTE-M IoT button and PlanP2 data plan for Brazil, are poised to drive LTE IoT Market growth by expanding connectivity options and enabling diverse IoT applications. These advancements open doors for enhanced smart metering, asset tracking, and smart home solutions, creating opportunities for industry players to meet evolving market demands and capitalize on the growing IoT ecosystem for sustainable growth and innovation in the future. On April 26, 2023, Renesas Electronics Corporation introduced the RH1NS200 NB-IoT chipset tailored for the Indian market. This LTE NB-IoT modem chipset seamlessly operates on major Indian telecom carriers' networks, catering to the burgeoning smart metering market with an estimated 250 million units in the next five years. Featuring ultra-low power consumption and integrated security elements, the RH1NS200 facilitates diverse applications including asset tracking and security. August 7, 2023 - Renesas Electronics Corporation announced its acquisition of Sequans Communications S.A., a leader in 5G/4G cellular IoT technology, for approximately $249 million. This strategic move aims to enhance Renesas' IoT solution offering by integrating Sequans' cellular connectivity products into its lineup. With this acquisition, Renesas anticipates immediate expansion into the Wide Area Network (WAN) market, catering to the growing demand for smart meters, asset tracking, smart homes, and connected vehicles. February 21, 2023 - Soracom and UnaBiz introduced a groundbreaking LTE-M IoT button, leveraging Soracom's eSIM technology and cloud-native connectivity platform. This collaborative effort marks a significant advancement in IoT solutions, offering a configurable button for diverse applications. Operating on LTE-M, the button simplifies operations with a single press, transmitting data to Soracom or UnaBiz platforms for extensive functionality and versatility in IoT deployments. June 7, 2022 - Soracom and Sony Semiconductor Solutions (SSS) collaborate, adding Soracom's global IoT connectivity to the recommended LTE operator list for SSS's PRESENCE microcontrollers. SPRESENSE, with its 6-core microcontroller board, boasts edge AI support, internal GPS, and ultra-low power consumption, catering to professional IoT applications. The SPRESENSE LTE extension board, featuring LTE Cat-M1 connectivity, offers global coverage and seamless integration with Soracom's IoT services for enhanced connectivity and management capabilities worldwide. August 29, 2023 - Soracom introduces PlanP2, a new IoT data plan tailored to Brazil's regulatory requirements, enabling seamless connectivity with local carriers. This plan enables the use of Soracom IoT SIM for global multicarrier coverage and compliant 2G/3G/4G/NB-IoT connection in Brazil. Leveraging the Subscription Container feature, it supports multiple network profiles, suitable for devices distributed globally. PlanP2 ensures uninterrupted connectivity, catering to diverse IoT applications in Brazil's dynamic market.LTE IoT Market Scope: Inquire before buying

Global LTE IoT Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.52 Bn. Forecast Period 2024 to 2030 CAGR: 28.13% Market Size in 2030: US $ 14.28 Bn. Segments Covered: by Technology NB-IoT LTE-M by Service Professional Services Managed Services by Industry Manufacturing Energy and Utilities Transportation and Logistics Healthcare Agriculture LTE IoT Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)LTE IoT Market Key Players:

Key Players in North America: 1. Qualcomm Technologies, Inc. (California, United States) 2. Sierra Wireless (Columbia, Canada) 3. Link Labs (Maryland, United States) 4. T-Mobile (Washington, United States) 5. Cisco Systems (California, United States) Key Players in Europe: 6. Ericsson (Stockholm, Sweden) 7. Sequans Communications S.A. (Paris, France) 8. Nokia Corporation (Espoo, Finland) 9. Telensa (Cambridge, United Kingdom) Key Players in Asia Pacific: 10. MediaTek (Hsinchu, Taiwan) 11. Athonet (Rome, Italy) 12. Telstra (Victoria, Australia) FAQs: 1. What are the growth drivers for the LTE IoT Market? Ans. High-Speed Wireless Connectivity Revolutionizes Home and Business Networks and is expected to be the major driver for the LTE IoT Market. 2. What is the major Opportunity for the LTE IoT Market growth? Ans. Rapid Adoption of LTE-M and NB-IoT Technologies is expected to be the major Opportunity in the LTE IoT Market. 3. Which country is expected to lead the global LTE IoT Market during the forecast period? Ans. Asia Pacific is expected to lead the LTE IoT Market during the forecast period. 4. What is the projected market size and growth rate of the LTE IoT Market? Ans. The LTE IoT Market size was valued at USD 2.52 billion in 2023 and the total LTE IoT Market revenue is expected to grow at a CAGR of 28.13 % from 2024 to 2030, reaching nearly USD 14.28 billion. 5. What segments are covered in the LTE IoT Market report? Ans. The segments covered in the LTE IoT Market report are by Technology, Service, Industry Manufacturing, and Region.

1. LTE IoT Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. LTE IoT Market: Dynamics 2.1. LTE IoT Market Trends by Region 2.1.1. North America LTE IoT Market Trends 2.1.2. Europe LTE IoT Market Trends 2.1.3. Asia Pacific LTE IoT Market Trends 2.1.4. Middle East and Africa LTE IoT Market Trends 2.1.5. South America LTE IoT Market Trends 2.2. LTE IoT Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America LTE IoT Market Drivers 2.2.1.2. North America LTE IoT Market Restraints 2.2.1.3. North America LTE IoT Market Opportunities 2.2.1.4. North America LTE IoT Market Challenges 2.2.2. Europe 2.2.2.1. Europe LTE IoT Market Drivers 2.2.2.2. Europe LTE IoT Market Restraints 2.2.2.3. Europe LTE IoT Market Opportunities 2.2.2.4. Europe LTE IoT Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific LTE IoT Market Drivers 2.2.3.2. Asia Pacific LTE IoT Market Restraints 2.2.3.3. Asia Pacific LTE IoT Market Opportunities 2.2.3.4. Asia Pacific LTE IoT Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa LTE IoT Market Drivers 2.2.4.2. Middle East and Africa LTE IoT Market Restraints 2.2.4.3. Middle East and Africa LTE IoT Market Opportunities 2.2.4.4. Middle East and Africa LTE IoT Market Challenges 2.2.5. South America 2.2.5.1. South America LTE IoT Market Drivers 2.2.5.2. South America LTE IoT Market Restraints 2.2.5.3. South America LTE IoT Market Opportunities 2.2.5.4. South America LTE IoT Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For LTE IoT Industry 2.8. Analysis of Government Schemes and Initiatives For LTE IoT Industry 2.9. LTE IoT Market Trade Analysis 2.10. The Global Pandemic Impact on LTE IoT Market 3. LTE IoT Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. LTE IoT Market Size and Forecast, by Technology (2023-2030) 3.1.1. NB-IoT 3.1.2. LTE-M 3.2. LTE IoT Market Size and Forecast, by Service (2023-2030) 3.2.1. Professional Services 3.2.2. Managed Services 3.3. LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 3.3.1. Energy and Utilities 3.3.2. Transportation and Logistics 3.3.3. Healthcare 3.3.4. Agriculture 3.4. LTE IoT Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America LTE IoT Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America LTE IoT Market Size and Forecast, by Technology (2023-2030) 4.1.1. NB-IoT 4.1.2. LTE-M 4.2. North America LTE IoT Market Size and Forecast, by Service (2023-2030) 4.2.1. Professional Services 4.2.2. Managed Services 4.3. North America LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 4.3.1. Energy and Utilities 4.3.2. Transportation and Logistics 4.3.3. Healthcare 4.3.4. Agriculture 4.4. North America LTE IoT Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States LTE IoT Market Size and Forecast, by Technology (2023-2030) 4.4.1.1.1. NB-IoT 4.4.1.1.2. LTE-M 4.4.1.2. United States LTE IoT Market Size and Forecast, by Service (2023-2030) 4.4.1.2.1. Professional Services 4.4.1.2.2. Managed Services 4.4.1.3. United States LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 4.4.1.3.1. Energy and Utilities 4.4.1.3.2. Transportation and Logistics 4.4.1.3.3. Healthcare 4.4.1.3.4. Agriculture 4.4.2. Canada 4.4.2.1. Canada LTE IoT Market Size and Forecast, by Technology (2023-2030) 4.4.2.1.1. NB-IoT 4.4.2.1.2. LTE-M 4.4.2.2. Canada LTE IoT Market Size and Forecast, by Service (2023-2030) 4.4.2.2.1. Professional Services 4.4.2.2.2. Managed Services 4.4.2.3. Canada LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 4.4.2.3.1. Energy and Utilities 4.4.2.3.2. Transportation and Logistics 4.4.2.3.3. Healthcare 4.4.2.3.4. Agriculture 4.4.3. Mexico 4.4.3.1. Mexico LTE IoT Market Size and Forecast, by Technology (2023-2030) 4.4.3.1.1. NB-IoT 4.4.3.1.2. LTE-M 4.4.3.2. Mexico LTE IoT Market Size and Forecast, by Service (2023-2030) 4.4.3.2.1. Professional Services 4.4.3.2.2. Managed Services 4.4.3.3. Mexico LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 4.4.3.3.1. Energy and Utilities 4.4.3.3.2. Transportation and Logistics 4.4.3.3.3. Healthcare 4.4.3.3.4. Agriculture 5. Europe LTE IoT Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe LTE IoT Market Size and Forecast, by Technology (2023-2030) 5.2. Europe LTE IoT Market Size and Forecast, by Service (2023-2030) 5.3. Europe LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 5.4. Europe LTE IoT Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom LTE IoT Market Size and Forecast, by Technology (2023-2030) 5.4.1.2. United Kingdom LTE IoT Market Size and Forecast, by Service (2023-2030) 5.4.1.3. United Kingdom LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 5.4.2. France 5.4.2.1. France LTE IoT Market Size and Forecast, by Technology (2023-2030) 5.4.2.2. France LTE IoT Market Size and Forecast, by Service (2023-2030) 5.4.2.3. France LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 5.4.3. Germany 5.4.3.1. Germany LTE IoT Market Size and Forecast, by Technology (2023-2030) 5.4.3.2. Germany LTE IoT Market Size and Forecast, by Service (2023-2030) 5.4.3.3. Germany LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 5.4.4. Italy 5.4.4.1. Italy LTE IoT Market Size and Forecast, by Technology (2023-2030) 5.4.4.2. Italy LTE IoT Market Size and Forecast, by Service (2023-2030) 5.4.4.3. Italy LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 5.4.5. Spain 5.4.5.1. Spain LTE IoT Market Size and Forecast, by Technology (2023-2030) 5.4.5.2. Spain LTE IoT Market Size and Forecast, by Service (2023-2030) 5.4.5.3. Spain LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden LTE IoT Market Size and Forecast, by Technology (2023-2030) 5.4.6.2. Sweden LTE IoT Market Size and Forecast, by Service (2023-2030) 5.4.6.3. Sweden LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 5.4.7. Austria 5.4.7.1. Austria LTE IoT Market Size and Forecast, by Technology (2023-2030) 5.4.7.2. Austria LTE IoT Market Size and Forecast, by Service (2023-2030) 5.4.7.3. Austria LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe LTE IoT Market Size and Forecast, by Technology (2023-2030) 5.4.8.2. Rest of Europe LTE IoT Market Size and Forecast, by Service (2023-2030) 5.4.8.3. Rest of Europe LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 6. Asia Pacific LTE IoT Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific LTE IoT Market Size and Forecast, by Technology (2023-2030) 6.2. Asia Pacific LTE IoT Market Size and Forecast, by Service (2023-2030) 6.3. Asia Pacific LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 6.4. Asia Pacific LTE IoT Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China LTE IoT Market Size and Forecast, by Technology (2023-2030) 6.4.1.2. China LTE IoT Market Size and Forecast, by Service (2023-2030) 6.4.1.3. China LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea LTE IoT Market Size and Forecast, by Technology (2023-2030) 6.4.2.2. S Korea LTE IoT Market Size and Forecast, by Service (2023-2030) 6.4.2.3. S Korea LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 6.4.3. Japan 6.4.3.1. Japan LTE IoT Market Size and Forecast, by Technology (2023-2030) 6.4.3.2. Japan LTE IoT Market Size and Forecast, by Service (2023-2030) 6.4.3.3. Japan LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 6.4.4. India 6.4.4.1. India LTE IoT Market Size and Forecast, by Technology (2023-2030) 6.4.4.2. India LTE IoT Market Size and Forecast, by Service (2023-2030) 6.4.4.3. India LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 6.4.5. Australia 6.4.5.1. Australia LTE IoT Market Size and Forecast, by Technology (2023-2030) 6.4.5.2. Australia LTE IoT Market Size and Forecast, by Service (2023-2030) 6.4.5.3. Australia LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia LTE IoT Market Size and Forecast, by Technology (2023-2030) 6.4.6.2. Indonesia LTE IoT Market Size and Forecast, by Service (2023-2030) 6.4.6.3. Indonesia LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia LTE IoT Market Size and Forecast, by Technology (2023-2030) 6.4.7.2. Malaysia LTE IoT Market Size and Forecast, by Service (2023-2030) 6.4.7.3. Malaysia LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam LTE IoT Market Size and Forecast, by Technology (2023-2030) 6.4.8.2. Vietnam LTE IoT Market Size and Forecast, by Service (2023-2030) 6.4.8.3. Vietnam LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan LTE IoT Market Size and Forecast, by Technology (2023-2030) 6.4.9.2. Taiwan LTE IoT Market Size and Forecast, by Service (2023-2030) 6.4.9.3. Taiwan LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific LTE IoT Market Size and Forecast, by Technology (2023-2030) 6.4.10.2. Rest of Asia Pacific LTE IoT Market Size and Forecast, by Service (2023-2030) 6.4.10.3. Rest of Asia Pacific LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 7. Middle East and Africa LTE IoT Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa LTE IoT Market Size and Forecast, by Technology (2023-2030) 7.2. Middle East and Africa LTE IoT Market Size and Forecast, by Service (2023-2030) 7.3. Middle East and Africa LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 7.4. Middle East and Africa LTE IoT Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa LTE IoT Market Size and Forecast, by Technology (2023-2030) 7.4.1.2. South Africa LTE IoT Market Size and Forecast, by Service (2023-2030) 7.4.1.3. South Africa LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 7.4.2. GCC 7.4.2.1. GCC LTE IoT Market Size and Forecast, by Technology (2023-2030) 7.4.2.2. GCC LTE IoT Market Size and Forecast, by Service (2023-2030) 7.4.2.3. GCC LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria LTE IoT Market Size and Forecast, by Technology (2023-2030) 7.4.3.2. Nigeria LTE IoT Market Size and Forecast, by Service (2023-2030) 7.4.3.3. Nigeria LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A LTE IoT Market Size and Forecast, by Technology (2023-2030) 7.4.4.2. Rest of ME&A LTE IoT Market Size and Forecast, by Service (2023-2030) 7.4.4.3. Rest of ME&A LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 8. South America LTE IoT Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America LTE IoT Market Size and Forecast, by Technology (2023-2030) 8.2. South America LTE IoT Market Size and Forecast, by Service (2023-2030) 8.3. South America LTE IoT Market Size and Forecast, by Industry Manufacturing(2023-2030) 8.4. South America LTE IoT Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil LTE IoT Market Size and Forecast, by Technology (2023-2030) 8.4.1.2. Brazil LTE IoT Market Size and Forecast, by Service (2023-2030) 8.4.1.3. Brazil LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina LTE IoT Market Size and Forecast, by Technology (2023-2030) 8.4.2.2. Argentina LTE IoT Market Size and Forecast, by Service (2023-2030) 8.4.2.3. Argentina LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America LTE IoT Market Size and Forecast, by Technology (2023-2030) 8.4.3.2. Rest Of South America LTE IoT Market Size and Forecast, by Service (2023-2030) 8.4.3.3. Rest Of South America LTE IoT Market Size and Forecast, by Industry Manufacturing (2023-2030) 9. Global LTE IoT Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading LTE IoT Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Qualcomm Technologies, Inc. (California, United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Sierra Wireless (Columbia, Canada) 10.3. Link Labs (Maryland, United States) 10.4. T-Mobile (Washington, United States) 10.5. Cisco Systems (California, United States) 10.6. Ericsson (Stockholm, Sweden) 10.7. Sequans Communications S.A. (Paris, France) 10.8. Nokia Corporation (Espoo, Finland) 10.9. Telensa (Cambridge, United Kingdom) 10.10. MediaTek (Hsinchu, Taiwan) 10.11. Athonet (Rome, Italy) 10.12. Telstra (Victoria, Australia) 11. Key Findings 12. Industry Recommendations 13. LTE IoT Market: Research Methodology 14. Terms and Glossary