The Global GDPR Software and Tools Market size was valued at USD 2.13 billion in 2023 and the total GDPR Software and Tools revenue is expected to grow at a CAGR of 7.8% from 2024 to 2030, reaching nearly USD 3.61 Billion GDPR software and tools play a crucial role in helping organizations comply with the General Data Protection Regulation (GDPR). This regulation grants individuals greater control and protection over their data, imposing responsibilities on both data controllers, who determine the purpose and means of processing personal data, and data processors, who carry out processing on behalf of controllers. To align with GDPR requirements, businesses need to integrate data security and privacy into their overall data management strategy. This involves implementing the appropriate technical and organizational measures to ensure secure data storage, maintenance, transfer, and usage. While this seems like an unnerving task that demands substantial resources, the GDPR software and tools software market provides a cost-effective and convenient solution. GDPR software and tools are designed to streamline compliance efforts. They offer features such as data mapping, consent management, risk assessment, and breach reporting, allowing organizations to efficiently manage and protect personal data. These tools often include data encryption, access controls, and audit trails to safeguard data integrity. Furthermore, GDPR software assists in automating tasks like data subject requests and privacy impact assessments, reducing manual workload. A suitable GDPR management software not only centralizes and secures data storage but also offers an adaptable approach to addressing GDPR governance, risk, and compliance challenges. These software solutions can deliver tailored, enterprise-level solutions for managing risks, ensuring compliance, and safeguarding data privacy. Small businesses, in particular, stand to gain significant advantages from GDPR management software, as it enables them to efficiently handle customer data and meet legal obligations with ease. Thus, it is expected to generate a lucrative GDPR Software and Tools Market demand in the technology and e-commerce sectors are witnessing significant growth in recent growth prospects throughout the forecast period.To know about the Research Methodology :- Request Free Sample Report GDPR Software and Tools Market Top Five Trends and Why It Matters Companies are now expected to be more open about handling data due to growing consumer demands for transparency. Privacy and data ethics are viewed as interconnected and crucial practices. This means that companies not only take consent seriously but also prioritize transparency, non-discrimination, and data security. Children's Privacy is a significant concern, especially with the widespread use of technology by young people on online platforms and social media. Regulations to safeguard children's data are already in place in the EU, USA, Canada, and Brazil. Other countries like India and Australia are swiftly following suit by introducing privacy laws specifically designed to protect minors. Data Localization Laws are on the rise globally, requiring data to be stored within a country's borders, particularly for national security reasons. Storing data on servers in the EU, for example, can offer better protection against data breaches and unauthorized access to robust security measures mandated by EU data protection laws. Therefore, for GDPR compliance and cookie usage, it's advisable to select a cookie consent tool that securely stores customer data. The Right to Be Forgotten, which allows individuals to request the removal of their data from search engine results and other public databases, is likely to expand into new areas. The EU's General Data Protection Regulation (GDPR) already includes provisions for this right, and other countries are considering similar measures. Some nations are contemplating extending this right to social media platforms, enabling users to request the deletion of their personal information from these platforms. Additionally, there is an exploration of applying the right to be forgotten to biometric data, granting individuals the ability to request the deletion of their biometric information held by organizations. There is a growing emphasis on the enforcement of privacy laws as data breaches become more frequent and severe for GDPR Software and Tools Market trend. Regulators are expected to intensify their efforts in enforcing data protection laws, which may include imposing larger fines, conducting more thorough examinations of data processing practices, and granting greater investigative and punitive powers to address non-compliance by companies.

Principal Catalyst of GDPR Software and Tools Market

The GDPR (General Data Protection Regulation) has fundamentally reshaped the landscape of data management and governance, and this transformation is driving the growth of the GDPR software and tools market growth. GDPR governs the handling of personal information (PI), which includes data related to customers, employees, and contractors, and applies to organizations operating in EU member states. The regulation has brought about a harmonization of data processing requirements across the EU, with a strong focus on data privacy and documentation. To comply with GDPR, organizations are required to maintain robust documentation to demonstrate their adherence to the regulation. This need for comprehensive documentation and compliance has become a strong driver for the adoption of data management and governance tools. Under GDPR, organizations must clearly state the purpose for collecting PI and obtain consent from individuals. Individuals have the right to access their data, request data deletion, and seek data rectification. They request data portability and demand privacy to be integrated into technology design Additionally, organizations are required to demonstrate accountability to Data Protection Authorities (DPAs) conduct data protection impact assessments for security risks, and promptly notify individuals and DPAs of data breaches within 72 hours. Special provisions are mandated for the processing of children's PI, including age verification and obtaining parental or guardian consent. Non-compliance with GDPR can result in substantial financial penalties, which can be as high as 20 million EUR or up to 4% of the annual worldwide turnover, depending on which is greater. This potential for significant penalties has drawn the attention of company executives and stakeholders across various industries. As a result, organizations are recognizing GDPR compliance as a strategic enterprise-wide issue, and they are seeking solutions to ensure adherence to the regulation. This has transformed GDPR software and tools from being considered desirable good practices into essential components of data management practices. The introduction of GDPR has created a compelling business driver for the adoption of these tools, as organizations strive to avoid penalties, protect their reputation, and establish comprehensive data governance practices. This growing awareness of the importance of GDPR compliance is fuelling the expansion of the GDPR software and tools market demand, as businesses seek effective solutions to navigate the complexities of data protection and privacy regulations. As a result, the demand for Rising Concerns about data privacy has been on the rise in recent years, driving the GDPR software and Tools market growth.

GDPR Data Protection Principles Features Lawfulness, Fairness, and Transparency Personal data must be processed lawfully, fairly, and transparently. Purpose Limitation Data should be collected for specified, explicit, and legitimate purposes. Data Minimisation Only necessary data should be processed for the intended purpose. Accuracy Data must be accurate and kept up to date where necessary. Storage Limitations Data should not be kept longer than necessary for the purpose. Integrity and Confidentiality Data must be processed securely to ensure confidentiality and integrity. Accountability Controllers are responsible for demonstrating compliance with GDPR. Future of GDPR Software and Tools Market

The GDPR Software and Tools Market is witnessing a significant opportunity for businesses to achieve long-term cost savings in administration and data management. eBoss offers a comprehensive suite of data security tools that provide end-to-end solutions, whether as an out-of-the-box solution or customized to fit specific enterprise needs. eBoss is dedicated to delivering robust and cost-effective GDPR compliance solutions for recruiters, catering to a wide range of budgetary constraints. The suite of GDPR tools includes real-time reporting for tracking every action, offering a live compliance status for each completed task. Automation is a key feature of GDPR tools, allowing for the automated and logged management of data permission requests based on customer contact preferences. These tools efficiently handle data subjects' decisions to either provide consent or opt-out. As a result, GDPR services generate comprehensive records of data management activities, providing auditors with evidence that businesses have taken proactive steps toward full compliance from the outset. In recent times, GDPR has thrust data protection into the spotlight, transforming it from a peripheral concern to an urgent issue demanding immediate attention. GDPR has simultaneously emerged as a lucrative opportunity for savvy companies that positioned themselves to meet the surging demand for data compliance solutions. The personal data of technology company customers has become increasingly valuable, akin to "the new oil," the advancements in data processing systems and artificial intelligence. Nevertheless, recent scandals involving companies like Cambridge Analytica and Facebook have underscored the potential misuse of personal data. The timing of GDPR's introduction aligns precisely with consumers' heightened concerns about the security of their data. GDPR has introduced a stringent set of regulations governing the collection, storage, and utilization of EU citizens' data for business purposes, accompanied by substantial fines for non-compliance. Consequently, businesses, whether large or small, are reevaluating their customer interactions and data management practices. However, a survey by data analytics firm SAS reveals that only 53 percent of EU companies and 30 percent of US companies are expected to meet the compliance deadline. Many companies are adopting a cautious approach, waiting to see how GDPR unfolds. With GDPR now officially in effect, companies specializing in compliance and data management are capitalizing on the business opportunity it presents. The demand for GDPR-related services has surged, spanning a range of offerings such as consultancy services, data mapping software, and personal information management solutions. Zyte (formerly Scrapinghub), a leading provider of data extraction and web crawling solutions, has observed firsthand the diverse range of technologies that companies are developing to seize this lucrative opportunity. All these factors are projected to boost the GDPR Software and Tools Market opportunities during the forecast period.GDPR Software and Tools Market Segment Analysis:

Based on type the market has been divided into cloud and on-premises. Among these, the cloud sub-segment witnessed the highest market share in the global GDPR software and tools market in 2023. Cloud services offer scalability, cost-effectiveness, and flexibility, making them an attractive choice for data storage and processing. However, when handling personal data governed by GDPR, organizations must navigate compliance considerations. Cloud services often involve data storage across multiple servers and geographic locations. GDPR mandates that organizations understand where their data resides and ensure that cross-border data transfers comply with the regulation's requirements. Organizations using cloud providers as data processors must establish GDPR-compliant data processing agreements. These agreements outline the responsibilities of both parties in safeguarding personal data. Encryption is a critical measure for protecting data in the cloud. GDPR recognizes encryption as a means of ensuring the confidentiality and integrity of personal data. Cloud platforms offer robust access control mechanisms, allowing organizations to limit data access to authorized individuals. Implementing strict access controls is crucial for GDPR compliance. GDPR grants data subjects the right to data portability, enabling them to request their data in a machine-readable format. Cloud providers must support this capability to facilitate compliance. Organizations choose cloud providers that are GDPR-compliant and transparent about their data processing practices. Cloud-based systems allow organizations to set data retention policies and facilitate the timely deletion of personal data when it is no longer necessary. Cloud platforms often offer auditing and monitoring tools that help organizations track data processing activities and access to personal data, aiding in GDPR compliance efforts. GDPR encourages the concept of "privacy by design." When using cloud services, organizations incorporate privacy considerations from the outset, ensuring data protection is integral to their processes.GDPR Software and Tools Market Regional Insights:

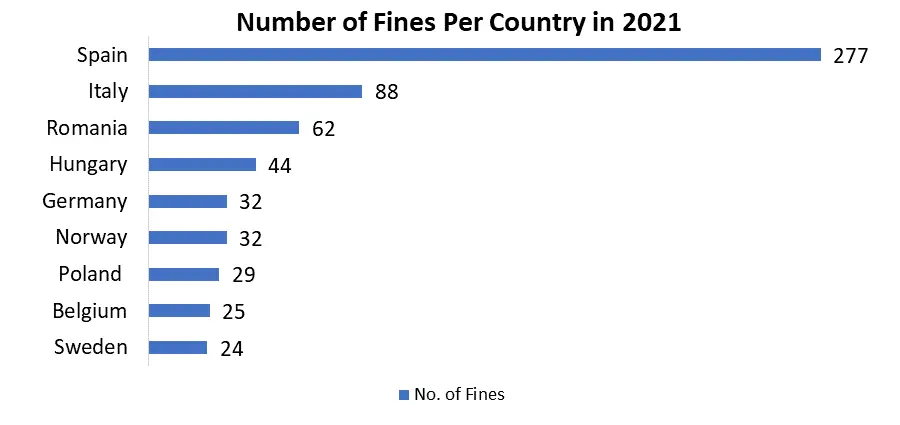

Europe held a market share in the global GDPR software and tools market in 2023 and is expected to grow at the highest CAGR during the forecast period. Europe is poised to hold a significant share of the GDPR services market, primarily due to its robust acceptance of GDPR regulations. The region is actively pursuing a data-driven approach, fostering widespread adoption of GDPR services by organizations mandated to comply with GDPR requirements. European privacy authorities have reported nearly 65,000 data breach notifications since the implementation of the EU's new privacy law. Additionally, regulatory bodies in 11 European countries have imposed fines totaling USD 63 million for GDPR violations. This underscores a notable increase in data breach notifications compared to the first year of the EU GDPR, as reported by Linklaters. As the drive for data collection and sharing intensifies to harness emerging technologies like artificial intelligence, governments, businesses, and organizations are increasingly recognizing the necessity for robust data management tools. These tools are crucial not only for protecting data owners' rights but also for achieving common data-related objectives. Consequently, governments are exploring innovative measures to facilitate ethical and equitable data sharing among various players in the data ecosystem. Moreover, the region is witnessing a growing demand for IoT-connected cars and smart metering solutions, both of which involve the use of individual data that can potentially enable personal tracking and energy consumption analysis. With the GDPR in effect, safeguarding user data has become imperative for companies serving diverse end-users through connected solutions. This is expected to drive the demand for GDPR services in the European region.GDPR Fines

GDPR fines are intended to encourage organizations to take data protection seriously and to deter them from mishandling personal data. Fines can be imposed for various GDPR violations, including failure to obtain proper consent for data processing, inadequate data security measures, not notifying data breaches promptly, and transferring data to third countries without adequate safeguards. Fines can be imposed for various GDPR violations, including failure to obtain proper consent for data processing, inadequate data security measures, not notifying data breaches promptly, and transferring data to third countries without adequate safeguards.Competitive Landscape:

The global GDPR (General Data Protection Regulation) Software and Tools Market is characterized by a mix of established players and emerging vendors. Key players like IBM, Microsoft, SAP, and Oracle dominate the market with comprehensive GDPR compliance solutions. Numerous smaller companies and startups offer specialized tools and consulting services, fostering innovation in the sector. The market is highly competitive, driven by increasing regulatory demands, data privacy concerns, and the need for effective data protection solutions, creating opportunities for both established and niche players to thrive. For instance, In November 2022, Informatica, a leading enterprise cloud data management company, declared the availability of its Intelligent Data Management Cloud (IDMC) platform for state and local government use during the Informatica World Tour held in Washington, DC. The IDMC platform, with a monthly processing capacity of over 44 trillion cloud transactions, is designed to support state and local government agencies in delivering prompt and effective public services.In the initial 20 months following the implementation of GDPR, fines totaling over €114 million have been imposed for violations, as reported by GDPR.eu. The highest fine recorded for GDPR breaches in 2022 came from the Luxembourg Data Protection Authority, amounting to a staggering 746 million Euros, and it was levied against Amazon Europe.

GDPR Software and Tools Market Scope: Inquiry Before Buying

GDPR Software and Tools Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.13 Bn. Forecast Period 2024 to 2030 CAGR: 7.8% Market Size in 2030: US $ 3.61 Bn. Segments Covered: by Type Cloud On-Premises by Application Small And Medium-sized Enterprises Large Enterprises Global GDPR Software and Tools Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Global GDPR Software and Tools Market Key Players:

1. SAP 2. SAS Institute 3. Oracle 4. Onetrust 5. IBM 6. Informatica 7. Nymity 8. Proofpoint 9. Symantec 10. Actiance 11. Snow Software 12. Talend 13. Swascan 14. AWS 15. Micro Focus 16. Mimecast 17. Protegrity 18. Capgemini 19. Hitachi Systems Security 20. Microsoft 21. Absolute Software 22. MetricStream FAQs: 1. What are the growth drivers for the GDPR Software and Tools Market? Ans. Increasing awareness and enforcement of data privacy regulations, necessitating compliance solutions. Growing volumes of digital data and cyber threats, driving demand for data protection tools. Evolving consumer expectations for data privacy, prompting businesses to invest in GDPR compliance software to build trust. 2. What is the major Opportunity for the GDPR Software and Tools Market growth? Ans. One major opportunity in the GDPR Software and Tools market is the unexploited potential in international expansion, as regions outside North America show growing interest in GDPR Software and Tools. Additionally, the convergence of GDPR Software and Tools with emerging technologies like virtual reality and blockchain presents a promising avenue for innovation and market growth. 3. Which Region is expected to lead the global GDPR Software and Tools Market during the forecast period? Ans. The Europe is expected to lead the GDPR Software and Tools Market during the forecast period. 4. What is the projected market size and growth rate of the GDPR Software and Tools Market? Ans. The GDPR Software and Tools Market size was valued at USD 2.13 Billion in 2023 and the total GDPR Software and Tools Market revenue is expected to grow at a CAGR of 7.8 % from 2024 to 2030, reaching nearly USD 3.61 Billion. 5. What segments are covered in the GDPR Software and Tools Market report? Ans. The segments covered in the GDPR Software and Tools Market report are Type and Application.

1. GDPR Software and Tools Market: Research Methodology 2. GDPR Software and Tools Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. GDPR Software and Tools Market: Dynamics 3.1 GDPR Software and Tools Market Trends by Region 3.1.1 Global GDPR Software and Tools Market Trends 3.1.2 North America GDPR Software and Tools Market Trends 3.1.3 Europe GDPR Software and Tools Market Trends 3.1.4 Asia Pacific GDPR Software and Tools Market Trends 3.1.5 Middle East and Africa GDPR Software and Tools Market Trends 3.1.6 South America GDPR Software and Tools Market Trends 3.2 GDPR Software and Tools Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America GDPR Software and Tools Market Drivers 3.2.1.2 North America GDPR Software and Tools Market Restraints 3.2.1.3 North America GDPR Software and Tools Market Opportunities 3.2.1.4 North America GDPR Software and Tools Market Challenges 3.2.2 Europe 3.2.2.1 Europe GDPR Software and Tools Market Drivers 3.2.2.2 Europe GDPR Software and Tools Market Restraints 3.2.2.3 Europe GDPR Software and Tools Market Opportunities 3.2.2.4 Europe GDPR Software and Tools Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific GDPR Software and Tools Market Market Drivers 3.2.3.2 Asia Pacific GDPR Software and Tools Market Restraints 3.2.3.3 Asia Pacific GDPR Software and Tools Market Opportunities 3.2.3.4 Asia Pacific GDPR Software and Tools Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa GDPR Software and Tools Market Drivers 3.2.4.2 Middle East and Africa GDPR Software and Tools Market Restraints 3.2.4.3 Middle East and Africa GDPR Software and Tools Market Opportunities 3.2.4.4 Middle East and Africa GDPR Software and Tools Market Challenges 3.2.5 South America 3.2.5.1 South America GDPR Software and Tools Market Drivers 3.2.5.2 South America GDPR Software and Tools Market Restraints 3.2.5.3 South America GDPR Software and Tools Market Opportunities 3.2.5.4 South America GDPR Software and Tools Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 Global 3.6.2 North America 3.6.3 Europe 3.6.4 Asia Pacific 3.6.5 Middle East and Africa 3.6.6 South America 3.7 Analysis of Government Schemes and Initiatives for the GDPR Software and Tools Industry 3.8 The Global Pandemic and Redefining of The GDPR Software and Tools Industry Landscape 3.9 Price Trend Analysis 3.10 Technological Road Map 3.11 Global GDPR Software and Tools Trade Analysis (2017-2023) 3.11.1 Global Import of GDPR Software and Tools 3.11.2 Global Export of GDPR Software and Tools 3.12 Global GDPR Software and Tools Production Capacity Analysis 3.12.1 Chapter Overview 3.12.2 Key Assumptions and Methodology 3.12.3 Analysis by Size of Manufacturer 4. Global GDPR Software and Tools Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2023-2030) 4.1 Global GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 4.1.1 Cloud 4.1.2 On Premises 4.2 Global GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 4.2.1 Small And Medium-sized Enterprises 4.2.2 Large Enterprises 4.3 Global GDPR Software and Tools Market Size and Forecast, By Region (2023-2030) 4.3.1 North America 4.3.2 Europe 4.3.3 Asia Pacific 4.3.4 Middle East and Africa 4.3.5 South America 5. North America GDPR Software and Tools Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2023-2030) 5.1 North America GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 5.1.1 Cloud 5.1.2 On Premise 5.2 North America GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 5.2.1 Small And Medium-sized Enterprises 5.2.2 Large Enterprises 5.3 North America GDPR Software and Tools Market Size and Forecast, by Country (2023-2030) 5.3.1 United States 5.3.1.1 United States GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 5.3.1.1.1 Cloud 5.3.1.1.2 On Premises 5.3.1.2 United States GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 5.3.1.2.1 Small And Medium-sized Enterprises 5.3.1.2.2 Large Enterprises 5.3.2 Canada 5.3.2.1 Canada GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 5.3.2.1.1 Cloud 5.3.2.1.2 On Premise 5.3.2.2 Canada GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 5.3.2.2.1 Small And Medium-sized Enterprises 5.3.2.2.2 Large Enterprises 5.3.3 Mexico 5.3.3.1 Mexico GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 5.3.3.1.1 Cloud 5.3.3.1.2 On Premises 5.3.3.2 Mexico GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 5.3.3.2.1 Small And Medium-sized Enterprises 5.3.3.2.2 Large Enterprises 6. Europe GDPR Software and Tools Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2023-2030) 6.1 Europe GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 6.2 Europe GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 6.3 Europe GDPR Software and Tools Market Size and Forecast, by Country (2023-2030) 6.3.1 United Kingdom 6.3.1.1 United Kingdom GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 6.3.1.2 United Kingdom GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 6.3.2 France 6.3.2.1 France GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 6.3.2.2 France GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 6.3.3 Germany 6.3.3.1 Germany GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 6.3.3.2 Germany GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 6.3.4 Italy 6.3.4.1 Italy GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 6.3.4.2 Italy GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 6.3.5 Spain 6.3.5.1 Spain GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 6.3.5.2 Spain GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 6.3.6 Sweden 6.3.6.1 Sweden GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 6.3.6.2 Sweden GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 6.3.7 Austria 6.3.7.1 Austria GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 6.3.7.2 Austria GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 6.3.8 Rest of Europe 6.3.8.1 Rest of Europe GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 6.3.8.2 Rest of Europe GDPR Software and Tools Market Size and Forecast, By Application (2023-2030). 7. Asia Pacific GDPR Software and Tools Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2023-2030) 7.1 Asia Pacific GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 7.2 Asia Pacific GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 7.3 Asia Pacific GDPR Software and Tools Market Size and Forecast, by Country (2023-2030) 7.3.1 China 7.3.1.1 China GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 7.3.1.2 China GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 7.3.2 South Korea 7.3.2.1 S Korea GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 7.3.2.2 S Korea GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 7.3.3 Japan 7.3.3.1 Japan GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 7.3.3.2 Japan GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 7.3.4 India 7.3.4.1 India GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 7.3.4.2 India GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 7.3.5 Australia 7.3.5.1 Australia GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 7.3.5.2 Australia GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 7.3.6 Indonesia 7.3.6.1 Indonesia GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 7.3.6.2 Indonesia GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 7.3.7 Malaysia 7.3.7.1 Malaysia GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 7.3.7.2 Malaysia GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 7.3.8 Vietnam 7.3.8.1 Vietnam GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 7.3.8.2 Vietnam GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 7.3.9 Taiwan 7.3.9.1 Taiwan GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 7.3.9.2 Taiwan GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 7.3.10 Bangladesh 7.3.10.1 Bangladesh GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 7.3.10.2 Bangladesh GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 7.3.11 Pakistan 7.3.11.1 Pakistan GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 7.3.11.2 Pakistan GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 7.3.12 Rest of Asia Pacific 7.3.12.1 Rest of Asia Pacific GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 7.3.12.2 Rest of Asia Pacific GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 8. Middle East and Africa GDPR Software and Tools Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2023-2030) 8.1 Middle East and Africa GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 8.2 Middle East and Africa GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 8.3 Middle East and Africa GDPR Software and Tools Market Size and Forecast, by Country (2023-2030) 8.3.1 South Africa 8.3.1.1 South Africa GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 8.3.1.2 South Africa GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 8.3.2 GCC 8.3.2.1 GCC GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 8.3.2.2 GCC GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 8.3.3 Egypt 8.3.3.1 Egypt GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 8.3.3.2 Egypt GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 8.3.4 Nigeria 8.3.4.1 Nigeria GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 8.3.4.2 Nigeria GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 8.3.5 Rest of ME&A 8.3.5.1 Rest of ME&A GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 8.3.5.2 Rest of ME&A GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 9. South America GDPR Software and Tools Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2023-2030) 9.1 South America GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 9.2 South America GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 9.3 South America GDPR Software and Tools Market Size and Forecast, by Country (2023-2030) 9.3.1 Brazil 9.3.1.1 Brazil GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 9.3.1.2 Brazil GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 9.3.2 Argentina 9.3.2.1 Argentina GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 9.3.2.2 Argentina GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 9.3.3 Rest Of South America 9.3.3.1 Rest Of South America GDPR Software and Tools Market Size and Forecast, By Type (2023-2030) 9.3.3.2 Rest Of South America GDPR Software and Tools Market Size and Forecast, By Application (2023-2030) 10. Global GDPR Software and Tools Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.3.6 SKU Details 10.3.7 Production Capacity 10.3.8 Production for 2023 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading GDPR Software and Tools Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 SAP 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 SAS Institute 11.3 Oracle 11.4 Onetrust 11.5 IBM 11.6 Informatica 11.7 Nymity 11.8 Proofpoint 11.9 Symantec 11.10 Actiance 11.11 Snow Software 11.12 Talend 11.13 Swascan 11.14 AWS 11.15 Micro Focus 11.16 Mimecast 11.17 Protegrity 11.18 Capgemini 11.19 Hitachi Systems Security 11.20 Microsoft 11.21 Absolute Software 11.22 Metricstream 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary