The Data Preparation Tools Market size was valued at USD 4.80 Billion in 2023 and the total Data Preparation Tools revenue is expected to grow at a CAGR of 19.7 % from 2024 to 2030, reaching nearly USD 16.90 Billion by 2030.Data Preparation Tools Market Overview:

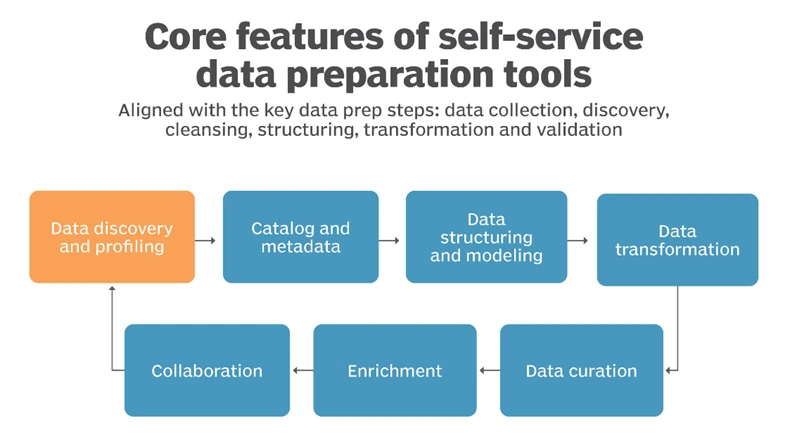

Data preparation is the process of cleaning, transforming, and organizing raw data into a format suitable for analysis. It involves tasks such as handling missing or inconsistent data, removing errors, standardizing formats, and ensuring data quality. The goal is to make the data ready for use in business intelligence, analytics, and other decision-making processes. The Data Preparation Tools Market encompasses the industry that provides software solutions designed to streamline and automate the data preparation process. These tools play a crucial role in addressing the challenges associated with managing and preparing vast and diverse datasets. The market has witnessed significant growth due to the increasing volume of data generated by businesses and the growing importance of deriving actionable insights from this data.To know about the Research Methodology :- Request Free Sample Report Data preparation tools include a range of software solutions designed to assist in data cleaning, transformation, and integration. These tools often leverage advanced technologies such as artificial intelligence and machine learning to enhance automation and efficiency. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global Data Preparation Tools Market.

Data Preparation Tools Market Dynamics

Increasing Volume of Data and Growing Adoption of Business Intelligence (BI) and Analytics Driving the Data Preparation Tools Market The explosive growth in data generated by businesses has become a primary driver for the Data Preparation Tools Market's growth. As organizations accumulate vast amounts of data, the need for efficient tools to prepare and process this data becomes crucial. These tools enable businesses to extract meaningful insights, uncover patterns, and make informed decisions based on the ever-enlarging datasets, contributing to the market's potential. The rising popularity of Business Intelligence (BI) and analytics tools is a significant driver for the demand in data preparation tools, enhancing the Data Preparation Tools Market's penetration. Organizations recognize the importance of having clean, integrated, and well-prepared data for accurate analysis. Data preparation tools ensure that raw data is transformed into a usable format, facilitating effective utilization in BI and analytics processes, leading to increased market share. The increasing awareness of the pivotal role played by high-quality and accurate data in decision-making processes propels the adoption of data preparation tools, positively impacting the Data Preparation Tools Market. Organizations understand that ensuring data cleanliness and integrity is essential for reliable insights and informed decision-making, making data preparation tools an integral part of their data management strategy and contributing to industry innovation. Integration of advanced technologies, such as machine learning and artificial intelligence (AI), into data preparation tools is driving efficiency in the data preparation process. Automation of tasks, acceleration of data processing, and improvement in overall efficiency are outcomes of incorporating these technologies, making data preparation more streamlined and effective. This technological innovation in the industry is a key factor influencing market fluctuation. The shift towards self-service analytics is driving the adoption of data preparation tools, creating opportunities for Data Preparation Tools market growth. These tools empower business users to independently prepare and analyze data without heavy reliance on IT or data specialists. The trend towards democratizing data access and analysis contributes to the growing demand for user-friendly data preparation solutions, presenting a significant market opportunity. Complexity and Skill Gap with Data Security and Privacy Concerns Restraining The Data Preparation Tool Market Growth The complexity of some data preparation tools poses a challenge, as they require specialized skills to operate effectively. The shortage of professionals with the necessary expertise hinder widespread adoption, limiting the accessibility and utilization of advanced data preparation tools. This skill gap represents a restraint on the Data Preparation Tools market's potential. The increasing emphasis on data security and privacy regulations acts as a restraint for the Data Preparation Tools Market. Organizations face challenges in ensuring that data preparation processes align with various regulatory requirements, especially those related to protecting sensitive information and maintaining privacy standards. Addressing these concerns is crucial for overcoming barriers to market penetration. Integrating data preparation tools with existing IT infrastructure and diverse data sources a barrier to adoption. Compatibility issues, particularly in complex and heterogeneous IT environments, arise, making seamless integration a key challenge for organizations looking to implement these tools effectively. Overcoming integration challenges is essential for maximizing the market share of data preparation tools. The initial costs associated with implementing data preparation tools, covering licensing, training, and infrastructure, a barrier for smaller businesses or organizations with budget constraints. The financial investment required limit the accessibility of advanced data preparation solutions, particularly for entities with limited resources. Pricing analysis and cost-effective solutions are crucial for addressing this restraint in the Data Preparation Tools market. Traditional methods of data preparation deeply ingrained in certain organizations lead to resistance when adopting new tools and methodologies. Overcoming resistance to change, cultural shifts, and ensuring effective training and communication are critical for successful integration of data preparation tools into existing workflows. Managing this resistance is vital for fully realizing the market's innovation potential.

Data Preparation Tools Market Segment Analysis

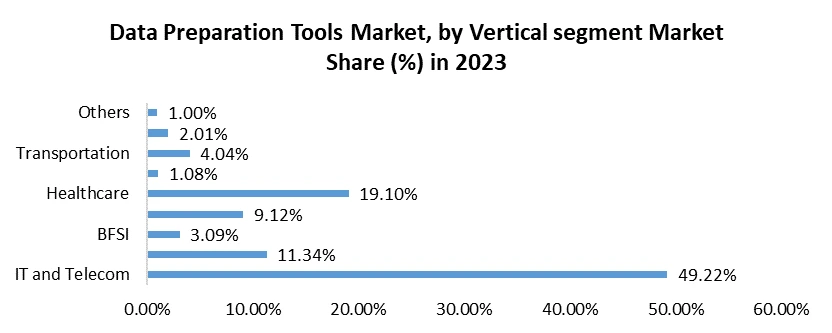

Platform: The self-service segment exhibits substantial growth potential as organizations increasingly prioritize empowering business users to prepare and analyze data independently. The ease of use and reduced dependence on IT specialists make self-service platforms a key driver in the Data Preparation Tools Market. Self-service platforms hold a significant market share, reflecting the demand for user-friendly tools that enable non-technical users to actively participate in data preparation processes. Data integration platforms play a crucial role in consolidating and harmonizing data from diverse sources. The demand for seamless integration across various data streams drives the penetration of these tools in the Data Preparation Tools market, especially in complex IT environments. Data integration tools continually innovate to address challenges related to heterogeneous data sources, providing solutions that enhance efficiency and interoperability in the evolving Data Preparation Tools Industry. Function: The data collection function experiences fluctuations in demand, closely tied to the evolving data landscape. As businesses diversify their data sources, tools that efficiently collect and consolidate data become essential, leading to market fluctuations. Data cataloging tools present a significant Data Preparation Tools market opportunity, especially with the increasing emphasis on organizing and cataloging vast datasets for better accessibility. The demand for tools that enhance data discoverability drives the growth of this segment. Ensuring high data quality remains a paramount concern for organizations. Data quality tools hold a substantial market share, as businesses recognize the importance of clean and accurate data for reliable analytics and decision-making. The growing awareness of data governance principles propels the demand for tools that ensure data compliance, security, and ethical use. The data governance segment experiences consistent growth as organizations prioritize robust data management practices. Data ingestion tools continually innovate to handle the increasing volume and variety of data sources. Innovations in real-time data ingestion capabilities contribute to the industry's evolution and market competitiveness. Data curation tools hold significant growth potential, especially as organizations focus on curating data to make it more valuable and actionable. These tools contribute to refining and enriching datasets for improved analysis and decision-making. Deployment Mode: On-premises deployment remains a significant choice for organizations with specific data security and control requirements. The Data Preparation Tools market share for on-premises solutions reflects the sustained demand for localized data preparation tools. Cloud deployment witnesses widespread adoption due to its scalability, flexibility, and cost-effectiveness. The market penetration of cloud-based data preparation tools continues to rise as organizations embrace digital transformation and seek agile solutions. Vertical: The IT and Telecom sector holds a substantial market share, driven by the industry's reliance on vast amounts of data. Data preparation tools in this sector focus on ensuring efficient data processing for diverse applications. The retail and e-commerce vertical experiences continuous Data Preparation Tools market growth as businesses leverage data preparation tools to optimize customer experiences, inventory management, and supply chain operations. The BFSI sector witnesses ongoing innovation in data preparation tools to address regulatory compliance, risk management, and customer-centric analytics. Tools in this vertical focus on ensuring data accuracy, security, and compliance. The government sector presents significant growth potential as data-driven governance becomes a priority. Data preparation tools cater to the unique needs of government entities, ensuring efficient data utilization for decision-making and public services. The healthcare sector experiences fluctuations in demand for data preparation tools, influenced by evolving healthcare data standards, privacy concerns, and the increasing need for data-driven healthcare solutions. The energy and utilities sector offer substantial Data Preparation Tools market opportunities for data preparation tools, especially as organizations seek to optimize operations, monitor equipment performance, and comply with environmental regulations through data-driven insights.

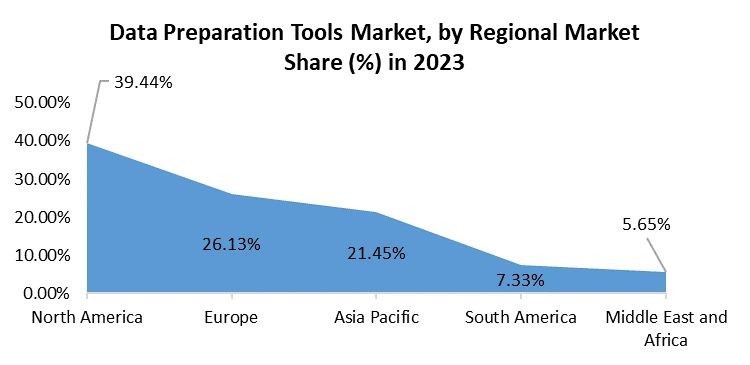

Data Preparation Tools Market Regional Analysis

North America, particularly the United States, drives significant regional growth in the Data Preparation Tools Market. The U.S. stands as a technology hub, fostering innovation and serving as a key for data preparation tools market solutions. The market share in North America is distributed across the U.S., Canada, and Mexico, with the U.S. holding a substantial share due to its large market size and advanced technological landscape. North America holds immense potential for the Data Preparation Tools Market, given the ongoing digital transformation initiatives, high adoption of analytics, and the constant pursuit of efficiency and data-driven decision-making. Major players in the data preparation sector, including key technology companies and emerging startups, are actively participating in the North American market. The presence of these key players contributes to the region's dynamic competitive landscape. Factors such as the rapid adoption of cloud-based solutions, the need for advanced analytics in various industries, and the focus on maintaining data privacy and compliance drive regional growth in North America. Asia Pacific experiences substantial regional growth in the Data Preparation Tools Market, with China and South Korea emerging as key contributors. Rapid industrialization and technological advancements fuel the adoption of data preparation solutions in these countries. While Brazil is not in the Asia Pacific region, it plays a significant role in the global market. The share of Data Preparation Tools in Brazil reflects the country's growing recognition of the importance of efficient data management. Asia Pacific holds immense market potential, driven by the increasing digital transformation initiatives and the growing awareness of the strategic value of data preparation tools. Industries in the region leverage these tools for enhanced decision-making. Key players in the data preparation sector actively engage in the Asia Pacific Data Preparation Tools market, aligning their solutions with the unique needs of diverse industries in countries like China, Japan, India, and South Korea. Factors contributing to regional growth include the expansion of data-driven economies, the rise of e-commerce and manufacturing sectors, and government initiatives promoting technological advancements in the Asia Pacific region. Europe, particularly Germany and France, showcases established regional growth in the Data Preparation Tools Market. These countries are at the forefront of technology adoption and have a mature for data-related tools market solutions. The market share in Europe is significant, with industries across countries like Germany, France, the UK, and others adopting data preparation tools to streamline their operations and gain actionable insights. Europe exhibits a steady Data Preparation Tools market potential, driven by the region's strong regulatory frameworks, emphasis on data privacy, and the continuous efforts of organizations to enhance data management practices. Key players in the data preparation sector actively participate in the European market, collaborating with industries to address specific regional challenges and compliance requirements. Growth factors in Europe include the emphasis on data governance, the need for data quality and integration solutions, and the growing recognition of data preparation tools as essential components of a robust data strategy. While the Data Preparation Tools market share in the Middle East and Africa (MEA) is relatively smaller compared to other regions, it is gradually enlarging. Countries in the region, including those in the Gulf Cooperation Council (GCC), are adopting data preparation tools for strategic decision-making. MEA represents an emerging Data Preparation Tools market, with regional growth driven by increasing digitalization initiatives, awareness of data analytics benefits, and the need for efficient data management in various sectors. The MEA region witnesses the active participation of key players in the data preparation sector, collaborating with local industries to address unique regional challenges. Regional growth factors in MEA include the exploration of self-service analytics, the adoption of data preparation tools in energy, government, and healthcare sectors, and the alignment of solutions with the evolving digital landscape.

Data Preparation Tools Market Scope: Inquire before buying

Data Preparation Tools Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 4.80 Bn. Forecast Period 2024 to 2030 CAGR: 19.7% Market Size in 2030: US $ 16.90 Bn. Segments Covered: by Platform Self-service Data integration by Function Data collection Data cataloging By Data quality Data governance By Data ingestion Data curation by Deployment Mode On-premises Cloud by Vertical IT and Telecom Retail and E-commerce BFSI Government Healthcare Energy and Utilities Transportation Manufacturing Others Data Preparation Tools Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Data Preparation Tools Market Key Players:

Major Global Key Players: 1. Alteryx, Inc. (United States) 2. Informatica Corporation (United States) 3. Datawatch Corporation (United States) 4. Trifacta (United States) Leading Key Players in North America: 1. Waterline Data (United States) 2. ThoughtSpot (United States) 3. International Business Machines Corporation (IBM) (United States) 4. Microsoft Corporation (United States) 5.InfluxData Inc. (United States) 6. MicroStrategy Incorporated (United States) 7. Qlik Technologies Inc. (United States) 8. SAS Institute Inc. (United States) 9. Tibco Software Inc. (United States) 10. Altair Engineering, Inc. (United States) 11. Tableau Software, Inc. (United States) Market Follower key Players in Europe: 1. SAP SE (Germany) 2. Talend (France) Prominent Key player Asia Pacific: 1. NICE Ltd. (Israel) 2. TIBCO Software Inc. (Singapore) 3. Tableau Software, Inc. (Singapore) 4. SAS Institute Inc. (Australia) 5. Alteryx, Inc. (Australia) 6. Qlik Technologies Inc. (Japan) 7. IBM Corporation (Japan) 8. Microsoft Corporation (India) 9. Informatica LLC (India) 10. Talend (Australia) Market Leader Key Players in Middle East and Africa: 1. SAP SE (South Africa) 2. Informatica LLC (United Arab Emirates) 3. Tableau Software, Inc. (South Africa) 4. Qlik Technologies Inc. (United Arab Emirates) 5. Microsoft Corporation (South Africa) 6. TIBCO Software Inc. (South Africa) 7. Alteryx, Inc. (Israel) 8. SAS Institute Inc. (United Arab Emirates) 9. Trifacta (South Africa) 10. Rapid Insight Inc. (South Africa) FAQ’s: 1. What Drives the Growth of the Data Preparation Tools Market? Ans: The market is driven by factors such as the increasing volume of data, growing adoption of business intelligence and analytics, the rising need for data quality, advancements in machine learning and AI technologies, and the focus on self-service analytics. 2. How Does Data Preparation Contribute to Business Intelligence (BI)? Ans: Data Preparation is the foundation of BI, ensuring that data is accurate and ready for analysis. It enhances the efficiency of BI tools and enables organizations to derive meaningful insights from their data. 3. What Challenges Does the Data Preparation Tools Market Face? Ans: Challenges include the complexity of tools, data security and privacy concerns, integration issues with existing IT infrastructure, the cost of implementation, and resistance to change within organizations. 4. What Verticals Benefit Most from Data Preparation Tools? Ans: Various industries benefit, including IT and Telecom, Retail and E-commerce, BFSI, Government, Healthcare, Energy and Utilities, Transportation, Manufacturing, and others. 5. Which Companies Are Key Players in the Data Preparation Tools Market? Ans: Key players include Alteryx, Inc., Informatica Corporation, Tableau Software, Inc., SAP SE, Microsoft Corporation, Qlik Technologies Inc., SAS Institute Inc., and others.

1. Data Preparation Tools Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Data Preparation Tools Market: Dynamics 2.1. Market Trends by Region 2.1.1. North America 2.1.2. Europe 2.1.3. Asia Pacific 2.1.4. Middle East and Africa 2.1.5. South America 2.2. Market Dynamics by Region 2.2.1. North America 2.2.1.1. Drivers 2.2.1.2. Restraints 2.2.1.3. Opportunities 2.2.1.4. Challenges 2.2.2. Europe 2.2.2.1. Drivers 2.2.2.2. Restraints 2.2.2.3. Opportunities 2.2.2.4. Challenges 2.2.3. Asia Pacific 2.2.3.1. Drivers 2.2.3.2. Restraints 2.2.3.3. Opportunities 2.2.3.4. Challenges 2.2.4. Middle East and Africa 2.2.4.1. Drivers 2.2.4.2. Restraints 2.2.4.3. Opportunities 2.2.4.4. Challenges 2.2.5. South America 2.2.5.1. Drivers 2.2.5.2. Restraints 2.2.5.3. Opportunities 2.2.5.4. Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Technological Roadmap 2.7. Regulatory Landscape by Region 2.7.1. North America 2.7.2. Europe 2.7.3. Asia Pacific 2.7.4. Middle East and Africa 2.7.5. South America 2.8. Analysis of Government Schemes and Initiatives For Data Preparation Tools Industry 2.9. Key Opinion Leader Analysis 2.10. The Global Pandemic Impact on Data Preparation Tools Market 3. Data Preparation Tools Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 3.1. Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 3.1.1. Self-service 3.1.2. Data integration 3.2. Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 3.2.1. Data collection 3.2.2. Data cataloging 3.2.3. By Data quality 3.2.4. Data governance 3.2.5. By Data ingestion 3.2.6. Data curation 3.3. Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 3.3.1. On-premises 3.3.2. Cloud 3.4. Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 3.4.1. IT and Telecom 3.4.2. Retail and E-commerce 3.4.3. BFSI 3.4.4. Government 3.4.5. Healthcare 3.4.6. Energy and Utilities 3.4.7. Transportation 3.4.8. Manufacturing 3.4.9. Others 3.5. Data Preparation Tools Market Size and Forecast, By Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Data Preparation Tools Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 4.1.1. Self-service 4.1.2. Data integration 4.2. North America Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 4.2.1. Data collection 4.2.2. Data cataloging 4.2.3. By Data quality 4.2.4. Data governance 4.2.5. By Data ingestion 4.2.6. Data curation 4.3. North America Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 4.3.1. On-premises 4.3.2. Cloud 4.4. North America Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 4.4.1. IT and Telecom 4.4.2. Retail and E-commerce 4.4.3. BFSI 4.4.4. Government 4.4.5. Healthcare 4.4.6. Energy and Utilities 4.4.7. Transportation 4.4.8. Manufacturing 4.4.9. Others 4.5. North America Data Preparation Tools Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 4.5.1.1.1. Self-service 4.5.1.1.2. Data integration 4.5.1.2. United States Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 4.5.1.2.1. Data collection 4.5.1.2.2. Data cataloging 4.5.1.2.3. By Data quality 4.5.1.2.4. Data governance 4.5.1.2.5. By Data ingestion 4.5.1.2.6. Data curation 4.5.1.3. United States Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 4.5.1.3.1. On-premises 4.5.1.3.2. Cloud 4.5.1.4. United States Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 4.5.1.4.1. IT and Telecom 4.5.1.4.2. Retail and E-commerce 4.5.1.4.3. BFSI 4.5.1.4.4. Government 4.5.1.4.5. Healthcare 4.5.1.4.6. Energy and Utilities 4.5.1.4.7. Transportation 4.5.1.4.8. Manufacturing 4.5.1.4.9. Others 4.5.2. Canada 4.5.2.1. Canada Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 4.5.2.1.1. Self-service 4.5.2.1.2. Data integration 4.5.2.2. Canada Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 4.5.2.2.1. Data collection 4.5.2.2.2. Data cataloging 4.5.2.2.3. By Data quality 4.5.2.2.4. Data governance 4.5.2.2.5. By Data ingestion 4.5.2.2.6. Data curation 4.5.2.3. Canada Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 4.5.2.3.1. On-premises 4.5.2.3.2. Cloud 4.5.2.4. Canada Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 4.5.2.4.1. IT and Telecom 4.5.2.4.2. Retail and E-commerce 4.5.2.4.3. BFSI 4.5.2.4.4. Government 4.5.2.4.5. Healthcare 4.5.2.4.6. Energy and Utilities 4.5.2.4.7. Transportation 4.5.2.4.8. Manufacturing 4.5.2.4.9. Others 4.5.3. Mexico 4.5.3.1. Mexico Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 4.5.3.1.1. Self-service 4.5.3.1.2. Data integration 4.5.3.2. Mexico Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 4.5.3.2.1. Data collection 4.5.3.2.2. Data cataloging 4.5.3.2.3. By Data quality 4.5.3.2.4. Data governance 4.5.3.2.5. By Data ingestion 4.5.3.2.6. Data curation 4.5.3.3. Mexico Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 4.5.3.3.1. On-premises 4.5.3.3.2. Cloud 4.5.3.4. Mexico Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 4.5.3.4.1. IT and Telecom 4.5.3.4.2. Retail and E-commerce 4.5.3.4.3. BFSI 4.5.3.4.4. Government 4.5.3.4.5. Healthcare 4.5.3.4.6. Energy and Utilities 4.5.3.4.7. Transportation 4.5.3.4.8. Manufacturing 4.5.3.4.9. Others 5. Europe Data Preparation Tools Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 5.1. Europe Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 5.2. Europe Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 5.3. Europe Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 5.4. Europe Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 5.5. Europe Data Preparation Tools Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 5.5.1.2. United Kingdom Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 5.5.1.3. United Kingdom Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 5.5.1.4. United Kingdom Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 5.5.2. France 5.5.2.1. France Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 5.5.2.2. France Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 5.5.2.3. France Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 5.5.2.4. France Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 5.5.3.2. Germany Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 5.5.3.3. Germany Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 5.5.3.4. Germany Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 5.5.4.2. Italy Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 5.5.4.3. Italy Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 5.5.4.4. Italy Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 5.5.5.2. Spain Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 5.5.5.3. Spain Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 5.5.5.4. Spain Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 5.5.6.2. Sweden Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 5.5.6.3. Sweden Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 5.5.6.4. Sweden Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 5.5.7.2. Austria Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 5.5.7.3. Austria Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 5.5.7.4. Austria Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 5.5.8.2. Rest of Europe Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 5.5.8.3. Rest of Europe Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 5.5.8.4. Rest of Europe Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 6. Asia Pacific Data Preparation Tools Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 6.2. Asia Pacific Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 6.3. Asia Pacific Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 6.4. Asia Pacific Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 6.5. Asia Pacific Data Preparation Tools Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 6.5.1.2. China Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 6.5.1.3. China Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 6.5.1.4. China Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 6.5.2.2. S Korea Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 6.5.2.3. S Korea Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 6.5.2.4. S Korea Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 6.5.3.2. Japan Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 6.5.3.3. Japan Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 6.5.3.4. Japan Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 6.5.4. India 6.5.4.1. India Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 6.5.4.2. India Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 6.5.4.3. India Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 6.5.4.4. India Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 6.5.5.2. Australia Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 6.5.5.3. Australia Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 6.5.5.4. Australia Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 6.5.6.2. Indonesia Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 6.5.6.3. Indonesia Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 6.5.6.4. Indonesia Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 6.5.7.2. Malaysia Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 6.5.7.3. Malaysia Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 6.5.7.4. Malaysia Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 6.5.8.2. Vietnam Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 6.5.8.3. Vietnam Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 6.5.8.4. Vietnam Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 6.5.9.2. Taiwan Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 6.5.9.3. Taiwan Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 6.5.9.4. Taiwan Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 6.5.10.2. Rest of Asia Pacific Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 6.5.10.3. Rest of Asia Pacific Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 6.5.10.4. Rest of Asia Pacific Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 7. Middle East and Africa Data Preparation Tools Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030 7.1. Middle East and Africa Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 7.2. Middle East and Africa Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 7.3. Middle East and Africa Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 7.4. Middle East and Africa Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 7.5. Middle East and Africa Data Preparation Tools Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 7.5.1.2. South Africa Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 7.5.1.3. South Africa Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 7.5.1.4. South Africa Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 7.5.2.2. GCC Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 7.5.2.3. GCC Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 7.5.2.4. GCC Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 7.5.3.2. Nigeria Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 7.5.3.3. Nigeria Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 7.5.3.4. Nigeria Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 7.5.4.2. Rest of ME&A Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 7.5.4.3. Rest of ME&A Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 7.5.4.4. Rest of ME&A Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 8. South America Data Preparation Tools Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030 8.1. South America Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 8.2. South America Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 8.3. South America Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 8.4. South America Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 8.5. South America Data Preparation Tools Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 8.5.1.2. Brazil Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 8.5.1.3. Brazil Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 8.5.1.4. Brazil Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 8.5.2.2. Argentina Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 8.5.2.3. Argentina Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 8.5.2.4. Argentina Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Data Preparation Tools Market Size and Forecast, By Platform (2023-2030) 8.5.3.2. Rest Of South America Data Preparation Tools Market Size and Forecast, By Function (2023-2030) 8.5.3.3. Rest Of South America Data Preparation Tools Market Size and Forecast, By Deployment Mode (2023-2030) 8.5.3.4. Rest Of South America Data Preparation Tools Market Size and Forecast, By Vertical (2023-2030) 9. Global Data Preparation Tools Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Service Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Manufacturing Locations 9.4. Leading Data Preparation Tools Market Companies, by Market Capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Alteryx, Inc. (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Informatica Corporation (United States) 10.3. Datawatch Corporation (United States) 10.4. Trifacta (United States) 10.5. Waterline Data (United States) 10.6. ThoughtSpot (United States) 10.7. International Business Machines Corporation (IBM) (United States) 10.8. Microsoft Corporation (United States) 10.9. InfluxData Inc. (United States) 10.10. MicroStrategy Incorporated (United States) 10.11. Qlik Technologies Inc. (United States) 10.12. SAP SE (Germany) 10.13. SAS Institute Inc. (United States) 10.14. Tibco Software Inc. (United States) 10.15. Altair Engineering, Inc. (United States) 10.16. Tableau Software, Inc. (United States) 10.17. Talend (France) 10.18. NICE Ltd. (Israel) 10.19. TIBCO Software Inc. (Singapore) 10.20. Tableau Software, Inc. (Singapore) 10.21. SAS Institute Inc. (Australia) 10.22. Alteryx, Inc. (Australia) 10.23. Qlik Technologies Inc. (Japan) 10.24. IBM Corporation (Japan) 10.25. Microsoft Corporation (India) 10.26. Informatica LLC (India) 10.27. Talend (Australia) 10.28. Informatica LLC (United Arab Emirates) 10.29. Tableau Software, Inc. (South Africa) 10.30. Qlik Technologies Inc. (United Arab Emirates) 10.31. Microsoft Corporation (South Africa) 10.32. TIBCO Software Inc. (South Africa) 10.33. Alteryx, Inc. (Israel) 10.34. SAS Institute Inc. (United Arab Emirates) 10.35. Trifacta (South Africa) 10.36. Rapid Insight Inc. (South Africa) 11. Key Findings 12. Industry Recommendations 13. Data Preparation Tools Market: Research Methodology.