The Global Logistics Market size was valued at USD 277.11 Bn in 2023 and is expected to reach USD 450.83 Bn by 2030, at a CAGR of 7.2%.Overview of the Logistics Market

The logistics market is the process of planning, implementing, and controlling the movement of materials and components from suppliers to customers. It also includes transferring all relevant information throughout the supply chain from manufacturing and origin up to final consumption. The aim of marketing logistics is to meet customer demands while still making a satisfactory profit. It is a key component for any business which ensures that the products are reached to the right set of customers along with all the product-related information. The graphical representation and structural exclusive information showed the dominating region of the Logistics Market. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Logistics Market.To know about the Research Methodology :- Request Free Sample Report

Logistics Market Dynamics

Globalization and Trade Liberalization with E-commerce Surge are the Growth Drivers for Logistics Market The logistics sector plays a pivotal role in facilitating international trade, becoming increasingly important in an era marked by globalization and trade liberalization. The ease of global trade, spurred by free trade agreements, has led to a heightened demand for logistics services. This trend is particularly evident in regions such as the United States, where the market flourishes amidst evolving global trade dynamics. The logistics industry is witnessing substantial growth due to the exponential rise of e-commerce. The continuous expansion of online shopping has resulted in an unprecedented demand for efficient logistics services. This trend is most pronounced in the rapidly expanding global e-commerce logistics market, underscoring the logistics industry's integral role in the digital age. The logistics sector is embracing a future characterized by technology-driven solutions. The adoption of Internet of Things (IoT) services and advanced technology is propelling the market into an era of growth and transformation. Notably, countries like China serve as prime examples where technology integration into logistics operations has significantly contributed to industry expansion. The logistics market is undergoing a transformation driven by innovative software solutions like Project44, FourKites, and FreightVerify. These state-of-the-art platforms are revolutionizing supply chain operations by enabling real-time issue resolution. The result is not only cost savings but also enhanced operational efficiency. Germany, a hub of technological innovation, exemplifies how technology is propelling the logistics market's growth. Economic Growth and Employment Prospects are Creating More Opportunities in the Logistics Market The logistics industry acts as an engine for economic growth and job creation. It has the potential to reduce poverty and generate numerous employment opportunities. In India, the logistics market provides a promising environment for substantial economic development and job creation. The future of the logistics market is closely tied to the escalating demand for online delivery services. As online shopping continues its robust expansion, the need for reliable logistics services surges. This scenario presents abundant opportunities, with India emerging as a promising landscape for significant growth in this segment. The logistics industry is at the forefront of technological innovation, offering opportunities to provide technology-driven solutions. Innovations such as route optimization and automation are rapidly transforming logistics operations, with the United Kingdom leading the way in this technological revolution. Heightened environmental awareness offers logistics companies an opportunity to adopt eco-friendly practices. Sustainable transportation options align with international commitments to reduce carbon emissions. France serves as a prime example of a market where eco-friendly logistics practices can thrive, catering to an environmentally conscious customer base. Logistical Inefficiencies and Environmental Impact are restraining the Logistics Market Logistical inefficiencies pose significant restraints on the logistics market's growth. These inefficiencies have the potential to limit job opportunities, particularly in rural areas. Overcoming these challenges is crucial for market expansion, especially in emerging economies like China. The logistics sector's substantial reliance on transportation contributes to environmental pollution, conflicting with global sustainability goals. Addressing this environmental impact is critical, with Germany, a champion of green logistics practices, confronting these concerns at the forefront. The logistics industry faces a multitude of complex challenges, including geopolitical intricacies and regulatory hurdles. These multifaceted issues can pose formidable obstacles to growth, affecting various regions worldwide. Navigating these complexities is essential to ensure the industry's continued success.Logistics Market Segment Analysis

Transportation Mode: The Logistics Market, an integral component of the broader transportation and logistics industry, is characterized by its segmentation into Railways, Roadways, Waterways, and Airways. In 2023, the Roadways Transportation segment emerged as the dominant force, securing the largest market share at 33.19%. Renowned for its extensive reach and cost-effectiveness, road transportation plays a pivotal role in distribution logistics within the marketing domain. It serves as a linchpin in the ever-expanding global e-commerce logistics market, contributing to its substantial growth. Notably, the Roadways transportation segment has experienced remarkable market expansion, with particular prominence in regions such as the United States. Concurrently, the Airways Transportation segment, a critical player in the global e-commerce market, is positioned for rapid expansion. This phenomenon underscores the increasing reliance on air transportation within the logistics sector, a trend observed on a global scale and transcending geographical boundaries. Logistics Type: Within the logistics market, logistics companies offer tailored services catering to various segments of the target market, presenting First Party, Second Party, and Third-Party logistics. Among these, the Third-Party logistics segment has asserted its dominance by capturing the largest market share at 39.24% during the forecast period. This segment not only aligns with the fundamental principles of market logistics and supply chain management but also offers invaluable solutions to a diverse array of industries. By allowing businesses to focus on other critical facets of their operations, including marketing logistics and distribution logistics, Third-Party logistics providers have emerged as significant contributors to the logistics market's dynamism. Their role spans regions globally, encompassing influential territories such as the United Kingdom and France. End-Use: The logistics market encompasses an array of end-use sectors, spanning Healthcare, Manufacturing, Aerospace, Telecommunication, Government & Public Utilities, Banking & Financial Services, Retail, Media & Entertainment, Technology, Trade & Transportation, and Others. Within this diverse landscape, the Manufacturing segment has taken the lead, securing a substantial market share of 29.81% in 2023. This ascendancy is attributed to the logistics market's instrumental role in supporting manufacturing activities, fortifying its presence in the realm of market logistics, particularly within the manufacturing sector. Simultaneously, the Healthcare segment is poised for significant expansion, with a projected Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period. This sector is pivotal within the market, ensuring the timely and efficient distribution of healthcare products. The logistics market is poised for global growth, making a substantial impact not only in India but on a worldwide scale.Logistics Market Regional Analysis

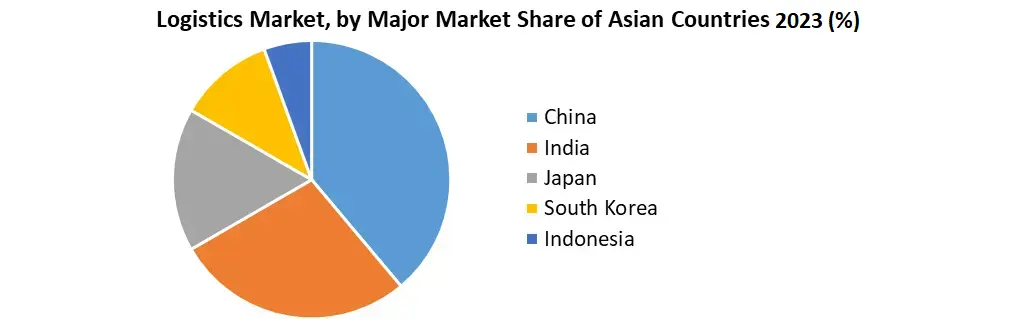

North America boasts a mature and highly competitive logistics market, with a keen focus on technological advancements and sustainability. The transportation and market in this region is marked by efficient road and rail networks, advanced air cargo facilities, and well-established ports. Companies such as FedEx, UPS, and XPO Logistics dominate the market, reflecting the prominent presence of logistics Amazon.com marketing strategies. Furthermore, e-commerce's impact is evident with a growing demand for same-day and next-day deliveries, fueling the market's growth, especially in the United States. The Asia Pacific region is experiencing a market boom, driven by the flourishing global e-commerce market and the expansion of the middle-class population. Key players, such as Alibaba's Cainiao and JD Logistics, are actively investing in technology-driven logistics solutions, aligning with the logistics Amazon.com marketing approach. China is a logistics giant, central to the global market, while India's market exhibits immense potential. Infrastructure development and government initiatives are fueling growth in this region, offering fertile ground for market expansion. Europe's market is well-established and recognized for its efficient transportation and supply chain networks. Sustainability and green logistics practices are prominent here, with a strong emphasis on reducing carbon emissions, aligning with global sustainability commitments. The European logistics market, shaped by Brexit-related challenges, exhibits an innovative approach to cross-border logistics, emphasizing efficiency and sustainability. Companies like DHL, DB Schenker, and CMA CGM are pivotal players in this landscape, resonating with the logistics market share of Germany. Latin America's logistics market presents a mix of unique challenges and opportunities. Infrastructure issues, regulatory complexities, and political instability are challenges that logistics companies are actively addressing with technology-driven solutions, similar to the logistics market penetration in China. Despite these challenges, the region is experiencing substantial growth, driven by the expanding e-commerce sector and the pressing need for more efficient logistics services. The Middle East and Africa are witnessing significant growth in the market, driven by substantial investments in infrastructure development. Dubai, a global logistics hub, symbolizes the region's strategic importance in connecting various continents, akin to the market growth in France and the United Kingdom. With a young and urbanizing population, Africa is emerging as a key growth area, with increasing consumer demand and the expanding e-commerce sector. Investments in technology and infrastructure are pivotal in addressing challenges related to political instability and security concerns.

Logistics Market Competitive Landscape

In a strategic partnership between FedEx Corp. (NYSE: FDX) and Floship, a globally recognized circular supply chain solutions provider for e-commerce brands, a significant alliance has been formed to empower e-tailers around the world. Backed by investment from the FedEx Innovation Lab (FIL), this venture aims to create a comprehensive digitalized fulfillment and return solution. The main objective is to enhance operational efficiency through optimized inventory management and the application of FedEx's top-tier delivery services. This endeavor is a testament to the ongoing evolution within the global e-commerce logistics market. Through this partnership, FedEx's e-commerce customers will have the privilege of accessing Floship's expansive global network of warehouses and the sophisticated capabilities of its robust logistics platform. This initiative will streamline and elevate their e-commerce fulfillment operations, aligning perfectly with the logistics market's focus on digital innovation and efficiency. Simultaneously, Floship's clientele will harness the vast global networks and diversified transportation options offered by FedEx, thereby fine-tuning their logistics operations. This collaboration showcases the global nature of the transportation and logistics market, enabling e-tailers to reach their target market more effectively. FedEx Corp., a longstanding partner of the University of Mississippi, has deepened its commitment to the institution with a substantial new investment that promises to create a lasting impact across various university departments and initiatives. This expanded partnership has established endowed funds, with one core focus being the expansion of the data science program within the Department of Computer and Information Science. Additionally, it will offer invaluable support to the FedEx Student-Athlete Academic Support Center, furthering the potential for student-athletes in the logistics field. Furthermore, it will enhance programs, lectures, and leadership development activities conducted by the Ole Miss Women’s Council for Philanthropy, which plays a pivotal role in the intersection of marketing logistics and philanthropic efforts. Moreover, it will contribute to promoting access and student success programs led by the Division of Diversity and Community Engagement, which is a vital step in expanding the target market of the logistics company in the academic realm.Logistics Market Scope: Inquiry Before Buying

Logistics Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 277.11 Bn. Forecast Period 2024 to 2030 CAGR: 7.2% Market Size in 2030: US $ 450.83 Bn. Segments Covered: by Transportation Mode Railways Roadways Waterways Airways by Logistics Type First Party Second Party Third Party by End Use Healthcare Manufacturing Aerospace Telecommunication Government & Public Utilities Banking & Financial Services Retail Media & Entertainment Technology Trade & Transportation Others Logistics Market, by Regions

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players of the Logistics Market

1. Ceva 2. Lineage Logistics 3. DHL 4. Geodis logistic. 5. Americold Logistics 6. C.H. Robinson Worldwide 7. Expeditors 8. DHL Supply Chain 9. Kerry Logistics 10. Expeditors International of Washington Inc 11. GXO Logistics 12. Kuehne + Nagel International AG 13. Maersk 14. DHL Service Point 15. J. B. Hunt 16. XPO 17. DSC Logistics 18. JD Logistics 19. APL Logistics 20. XPO Logistics 21. RyderFrequently Asked Questions

1. What is the Logistics Market? Ans: The Logistics Market refers to the industry involved in the management and transportation of goods and services, encompassing processes such as warehousing, distribution, and supply chain management. 2. What Drives Growth in the Logistics Market? Ans: Growth in the Logistics Market is primarily driven by factors like globalization, e-commerce expansion, technological advancements, and supply chain optimization. 3. Which Countries Exhibit High Logistics Market Growth? Ans: Countries like the United States, India, China, Germany, and certain parts of Europe show significant growth in the logistics market. 4. What Are Key Players in the Logistics Market? Ans: Key players include FedEx, UPS, DHL, and other global logistics and transportation companies. 5. What Are the Major Challenges in the Logistics Market? Ans: Challenges include logistical inefficiencies, environmental concerns, geopolitical issues, and regulatory complexities, which require innovative solutions for market growth.

1. Logistics Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Logistics Market: Dynamics 2.1. Key Trends in the Logistics Sector around the World Logistics Market Dynamics 2.1.1. Logistics Market Drivers 2.1.2. Logistics Market Restraints 2.1.3. Logistics Market Opportunities 2.1.4. Logistics Market Challenges 2.2. PORTER’s Five Forces Analysis 2.3. PESTLE Analysis 2.4. Value Chain Analysis of Logistics Industry 2.5. Regulatory Landscape by Region 2.5.1. North America 2.5.2. Europe 2.5.3. Asia Pacific 2.5.4. Middle East and Africa 2.5.5. South America 2.6. Key Opinion Leader Analysis for the Logistics Industry 2.7. Analysis of Government Schemes and Initiatives for Logistics Industry 2.8. The Global Pandemic Impact on Logistics Market 2.9. New-age startups in industry 2.10. Demand-Supply Gap Of Skilled Manpower In Logistics Sector 3. Logistics Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2023-2030) 3.1. Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 3.1.1. Railways 3.1.2. Roadways 3.1.3. Waterways 3.1.4. Airways 3.2. Logistics Market Size and Forecast, by Logistics Type (2023-2030) 3.2.1. First Party 3.2.2. Second Party 3.2.3. Third Party 3.3. Logistics Market Size and Forecast, by End Use (2023-2030) 3.3.1. Healthcare 3.3.2. Manufacturing 3.3.3. Aerospace 3.3.4. Telecommunication 3.3.5. Government & Public Utilities 3.3.6. Banking & Financial Services 3.3.7. Retail 3.3.8. Media & Entertainment 3.3.9. Technology 3.3.10. Trade & Transportation 3.3.11. Others 3.4. Logistics Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Logistics Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2023-2030) 4.1. North America Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 4.1.1. Railways 4.1.2. Roadways 4.1.3. Waterways 4.1.4. Airways 4.2. North America Logistics Market Size and Forecast, by Logistics Type (2023-2030) 4.2.1. First Party 4.2.2. Second Party 4.2.3. Third Party 4.3. North America Logistics Market Size and Forecast, by End Use (2023-2030) 4.3.1. Healthcare 4.3.2. Manufacturing 4.3.3. Aerospace 4.3.4. Telecommunication 4.3.5. Government & Public Utilities 4.3.6. Banking & Financial Services 4.3.7. Retail 4.3.8. Media & Entertainment 4.3.9. Technology 4.3.10. Trade & Transportation 4.3.11. Others 4.4. North America Logistics Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 4.4.1.1.1. Railways 4.4.1.1.2. Roadways 4.4.1.1.3. Waterways 4.4.1.1.4. Airways 4.4.1.2. United States Logistics Market Size and Forecast, by Logistics Type (2023-2030) 4.4.1.2.1. First Party 4.4.1.2.2. Second Party 4.4.1.2.3. Third Party 4.4.1.3. United States Logistics Market Size and Forecast, by End Use (2023-2030) 4.4.1.3.1. Healthcare 4.4.1.3.2. Manufacturing 4.4.1.3.3. Aerospace 4.4.1.3.4. Telecommunication 4.4.1.3.5. Government & Public Utilities 4.4.1.3.6. Banking & Financial Services 4.4.1.3.7. Retail 4.4.1.3.8. Media & Entertainment 4.4.1.3.9. Technology 4.4.1.3.10. Trade & Transportation 4.4.1.3.11. Others 4.4.2. Canada 4.4.2.1. Canada Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 4.4.2.1.1. Railways 4.4.2.1.2. Roadways 4.4.2.1.3. Waterways 4.4.2.1.4. Airways 4.4.2.2. Canada Logistics Market Size and Forecast, by Logistics Type (2023-2030) 4.4.2.2.1. First Party 4.4.2.2.2. Second Party 4.4.2.2.3. Third Party 4.4.2.3. Canada Logistics Market Size and Forecast, by End Use (2023-2030) 4.4.2.3.1. Healthcare 4.4.2.3.2. Manufacturing 4.4.2.3.3. Aerospace 4.4.2.3.4. Telecommunication 4.4.2.3.5. Government & Public Utilities 4.4.2.3.6. Banking & Financial Services 4.4.2.3.7. Retail 4.4.2.3.8. Media & Entertainment 4.4.2.3.9. Technology 4.4.2.3.10. Trade & Transportation 4.4.2.3.11. Others 4.4.3. Mexico 4.4.3.1. Mexico Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 4.4.3.1.1. Railways 4.4.3.1.2. Roadways 4.4.3.1.3. Waterways 4.4.3.1.4. Airways 4.4.3.2. Mexico Logistics Market Size and Forecast, by Logistics Type (2023-2030) 4.4.3.2.1. First Party 4.4.3.2.2. Second Party 4.4.3.2.3. Third Party 4.4.3.3. Mexico Logistics Market Size and Forecast, by End Use (2023-2030) 4.4.3.3.1. Healthcare 4.4.3.3.2. Manufacturing 4.4.3.3.3. Aerospace 4.4.3.3.4. Telecommunication 4.4.3.3.5. Government & Public Utilities 4.4.3.3.6. Banking & Financial Services 4.4.3.3.7. Retail 4.4.3.3.8. Media & Entertainment 4.4.3.3.9. Technology 4.4.3.3.10. Trade & Transportation 4.4.3.3.11. Others 5. Europe Logistics Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2023-2030) 5.1. Europe Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 5.2. Europe Logistics Market Size and Forecast, by Logistics Type (2023-2030) 5.3. Europe Logistics Market Size and Forecast, by End Use (2023-2030) 5.4. Europe Logistics Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 5.4.1.2. United Kingdom Logistics Market Size and Forecast, by Logistics Type (2023-2030) 5.4.1.3. United Kingdom Logistics Market Size and Forecast, by End Use (2023-2030) 5.4.2. France 5.4.2.1. France Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 5.4.2.2. France Logistics Market Size and Forecast, by Logistics Type (2023-2030) 5.4.2.3. France Logistics Market Size and Forecast, by End Use (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 5.4.3.2. Germany Logistics Market Size and Forecast, by Logistics Type (2023-2030) 5.4.3.3. Germany Logistics Market Size and Forecast, by End Use (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 5.4.4.2. Italy Logistics Market Size and Forecast, by Logistics Type (2023-2030) 5.4.4.3. Italy Logistics Market Size and Forecast, by End Use (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 5.4.5.2. Spain Logistics Market Size and Forecast, by Logistics Type (2023-2030) 5.4.5.3. Spain Logistics Market Size and Forecast, by End Use (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 5.4.6.2. Sweden Logistics Market Size and Forecast, by Logistics Type (2023-2030) 5.4.6.3. Sweden Logistics Market Size and Forecast, by End Use (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 5.4.7.2. Austria Logistics Market Size and Forecast, by Logistics Type (2023-2030) 5.4.7.3. Austria Logistics Market Size and Forecast, by End Use (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 5.4.8.2. Rest of Europe Logistics Market Size and Forecast, by Logistics Type (2023-2030) 5.4.8.3. Rest of Europe Logistics Market Size and Forecast, by End Use (2023-2030) 6. Asia Pacific Logistics Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2023-2030) 6.1. Asia Pacific Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 6.2. Asia Pacific Logistics Market Size and Forecast, by Logistics Type (2023-2030) 6.3. Asia Pacific Logistics Market Size and Forecast, by End Use (2023-2030) 6.4. Asia Pacific Logistics Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 6.4.1.2. China Logistics Market Size and Forecast, by Logistics Type (2023-2030) 6.4.1.3. China Logistics Market Size and Forecast, by End Use (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 6.4.2.2. S Korea Logistics Market Size and Forecast, by Logistics Type (2023-2030) 6.4.2.3. S Korea Logistics Market Size and Forecast, by End Use (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 6.4.3.2. Japan Logistics Market Size and Forecast, by Logistics Type (2023-2030) 6.4.3.3. Japan Logistics Market Size and Forecast, by End Use (2023-2030) 6.4.4. India 6.4.4.1. India Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 6.4.4.2. India Logistics Market Size and Forecast, by Logistics Type (2023-2030) 6.4.4.3. India Logistics Market Size and Forecast, by End Use (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 6.4.5.2. Australia Logistics Market Size and Forecast, by Logistics Type (2023-2030) 6.4.5.3. Australia Logistics Market Size and Forecast, by End Use (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 6.4.6.2. Indonesia Logistics Market Size and Forecast, by Logistics Type (2023-2030) 6.4.6.3. Indonesia Logistics Market Size and Forecast, by End Use (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 6.4.7.2. Malaysia Logistics Market Size and Forecast, by Logistics Type (2023-2030) 6.4.7.3. Malaysia Logistics Market Size and Forecast, by End Use (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 6.4.8.2. Vietnam Logistics Market Size and Forecast, by Logistics Type (2023-2030) 6.4.8.3. Vietnam Logistics Market Size and Forecast, by End Use (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 6.4.9.2. Taiwan Logistics Market Size and Forecast, by Logistics Type (2023-2030) 6.4.9.3. Taiwan Logistics Market Size and Forecast, by End Use (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 6.4.10.2. Rest of Asia Pacific Logistics Market Size and Forecast, by Logistics Type (2023-2030) 6.4.10.3. Rest of Asia Pacific Logistics Market Size and Forecast, by End Use (2023-2030) 7. Middle East and Africa Logistics Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2023-2030) 7.1. Middle East and Africa Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 7.2. Middle East and Africa Logistics Market Size and Forecast, by Logistics Type (2023-2030) 7.3. Middle East and Africa Logistics Market Size and Forecast, by End Use (2023-2030) 7.4. Middle East and Africa Logistics Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 7.4.1.2. South Africa Logistics Market Size and Forecast, by Logistics Type (2023-2030) 7.4.1.3. South Africa Logistics Market Size and Forecast, by End Use (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 7.4.2.2. GCC Logistics Market Size and Forecast, by Logistics Type (2023-2030) 7.4.2.3. GCC Logistics Market Size and Forecast, by End Use (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 7.4.3.2. Nigeria Logistics Market Size and Forecast, by Logistics Type (2023-2030) 7.4.3.3. Nigeria Logistics Market Size and Forecast, by End Use (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 7.4.4.2. Rest of ME&A Logistics Market Size and Forecast, by Logistics Type (2023-2030) 7.4.4.3. Rest of ME&A Logistics Market Size and Forecast, by End Use (2023-2030) 8. South America Logistics Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2023-2030) 8.1. South America Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 8.2. South America Logistics Market Size and Forecast, by Logistics Type (2023-2030) 8.3. South America Logistics Market Size and Forecast, by End Use (2023-2030) 8.4. South America Logistics Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 8.4.1.2. Brazil Logistics Market Size and Forecast, by Logistics Type (2023-2030) 8.4.1.3. Brazil Logistics Market Size and Forecast, by End Use (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 8.4.2.2. Argentina Logistics Market Size and Forecast, by Logistics Type (2023-2030) 8.4.2.3. Argentina Logistics Market Size and Forecast, by End Use (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Logistics Market Size and Forecast, by Transportation Mode (2023-2030) 8.4.3.2. Rest Of South America Logistics Market Size and Forecast, by Logistics Type (2023-2030) 8.4.3.3. Rest Of South America Logistics Market Size and Forecast, by End Use (2023-2030) 9. Global Logistics Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.3.6. Production Capacity 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Logistics Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Ceva 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Recent development 10.2. Lineage Logistics 10.3. DHL 10.4. Geodis logistic. 10.5. Americold Logistics 10.6. C.H. Robinson Worldwide 10.7. Expeditors 10.8. DHL Supply Chain 10.9. Kerry Logistics 10.10. Expeditors International of Washington Inc 10.11. GXO Logistics 10.12. Kuehne + Nagel International AG 10.13. Maersk 10.14. DHL Service Point 10.15. J. B. Hunt 10.16. XPO 10.17. DSC Logistics 10.18. JD Logistics 10.19. APL Logistics 10.20. XPO Logistics 10.21. Ryder 11. Key Findings 12. Industry Recommendations 13. Logistics Market: Research Methodology