IoT Engineering Services Market size is estimated to grow at a CAGR of 22.5% during the forecast period.IoT Engineering Services Market Overview:

The IoT Engineering Services Market is projected to reach a value of US$ 88.11 Bn. by 2029, growing at a CAGR of around 22.5% during the forecast period. IoT engineering services are the specialized technical resources associated with the development and design of IoT products. They include product testing & optimization, software development, data analytics/visualization, etc.To know about the Research Methodology :- Request Free Sample Report Engineering service providers are progressively using industrial IoT to optimize and improve their production process with better energy usage, asset management, and resource allocation. For example, PureSoftware, an engineering service company, has positively integrated IoT into engineering services and built a steady IoT platform to increase speed and accuracy to retrieve data. India’s IoT industry reached $ 15.75 Bn. in 2021, accounting for nearly 5% of the global market.

IoT Engineering Services Market Dynamics:

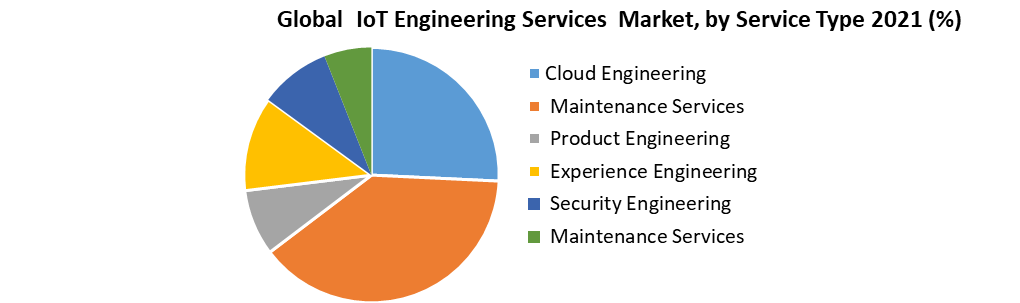

The increasing need for emerging industrial IoT solutions for smart manufacturing and the effective deployment of digital performance management tools and asset tracking systems may drive the growth of the IoT engineering service market. IoT engineering services are expected to bring a transformation in the manufacturing processes and may alter the cusp & phase of growth of the production sector during the forecast period. Moreover, with IoT engineering services linking physical & digital worlds in new ways, it is more likely that several industries may adopt it in the future. The need for improving customer relationship management services of an enterprise is expected to pave way for the IoT engineering services market demand over the forecasting period. With the evolution of novel concepts such as smart manufacturing, smart factories, and smart engineering, IoT engineering services are expected to be a catchphrase & increasing trend of the next-gen technology. On the flip side, a lack of awareness about IoT engineering services is expected to hinder the growth of the IoT engineering services market globally. Furthermore, some concerns related to the privacy of data is the main factor that could hamper the market growth. Major Players for IoT Engineering Services:Service Type Overview: The Cloud Engineering segment is expected to grow at the largest CAGR of 23.87% during the forecast period. The cloud computing demand is driven by various factors, such as flexibility, agility, lower costs, and security. With the rising penetration of cloud computing and related technologies, for example, edge computing, Internet of Things (IoT), and serverless architecture, the demand for cloud engineering services among organizations is gaining huge traction. End-User Overview: The small and medium enterprises segment held the largest market share of xx% in 2021.SMEs have become aware of the profits of immediate quick and responsible business decisions. SMEs are accepting market services to manage and monitor business operations and functions. Large enterprise is expected to grow at the highest CAGR of 24.01% during the forecast period. Large enterprises have various operating units, and IoT analytics aids these enterprises to integrate real-time and historical data. IBM, Wipro, and TCS are examples of some large enterprises offering these services.

IoT Engineering Services Market Regional Overview:

The APAC accounted for the largest market share in 2021, with a market value of US$ xx Bn; the regional market is expected to register a CAGR of xx% during 2021-2029. This goth is attributed to the availability of robust infrastructure in the economies like China, Japan, and Singapore. Moreover, IoT retailers are eager to exploit the strong growth potential in these economies by setting their bases in the AAPC. Rapid technological innovations and large-scale usage of connected devices along with the need for strong security features have driven the firms to hire IoT engineering services. Key Development: In recent years, major players in the IoT engineering services market have taken several strategic measures, like facility expansions and partnerships. Such as, in 2021, Wipro Company, an Indian software services exporter has acquired Eximius Design for US$80 Mn. The acquisition is projected to strengthen Wipro's market presence in the semiconductor ecosystem. The objective of the report is to present a comprehensive analysis of the global IoT Engineering Services Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the IoT Engineering Services Market dynamic, structure by analyzing the market segments and projecting the IoT Engineering Services Market size. Clear representation of competitive analysis of key players by Application, price, financial position, product portfolio, growth strategies, and regional presence in the IoT Engineering Services Market make the report investor’s guide.Global IoT Engineering Services Market Scope: Inquiry Before Buying

IoT Engineering Services Market Report Coverage Details Base Year: 2021 Forecast Period: 2022-2029 Historical Data: 2017 to 2021 Market Size in 2021: US $ 17.37 Bn. Forecast Period 2022 to 2029 CAGR: 22.5% Market Size in 2029: US $ 88.11 Bn. Segments Covered: by Service Type • Cloud Engineering • Maintenance Services • Product Engineering • Experience Engineering • Security Engineering • Maintenance Services by End-user • Small & Medium Enterprises • Large Enterprises by Vertical • Healthcare • IT & Telecom • Automotive • Energy & Utilities • Aerospace & Defense • Industrial Manufacturing • Transportation & Logistics IoT Engineering Services Market, by Region

• North America • Europe • Asia Pacific • Latin America • The Middle East and AfricaIoT Engineering Services Market Key Players are:

• Cisco System, Inc. • Dell Technologies • Tata Consultancy Services • Cognizant Technology Solutions • Infosys Technologies Pvt. Ltd. • Harman International Industries • Tech Mahindra • Tieto Corporation • Virtusa Corporation • Accenture PLC • Luxoft Holding, Inc • EPAM Systems, Inc • NIIT Technologies Frequently Asked Questions: 1] What segments are covered in the IoT Engineering Services Market report? Ans. The segments covered in the IoT engineering services market report are based on service type, end-user, and vertical. 2] Which region is expected to hold the highest share in the IoT Engineering Services Market? Ans. APAC region is expected to hold the highest share in the IoT engineering services market. 3] What is the market size of the IoT Engineering Services Market by 2029? Ans. The market size of the IoT Engineering Services Market by 2029 is expected to US$ 88.11 Bn. 4] What is the forecast period for the IoT Engineering Services Market? Ans. The forecast period for the IoT engineering services market is 2021-2029. 5] What is the CAGR of the Global IoT Engineering Services Market during the forecast period? Ans. The market CAGR of the global IoT engineering services market is 22.5% during the forecast period.

1. Global IoT Engineering Services Market: Research Methodology 2. Global IoT Engineering Services Market: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global IoT Engineering Services Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global IoT Engineering Services Market: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global IoT Engineering Services Market Segmentation 4.1. Global IoT Engineering Services Market, By End-user (2021-2029) • Small & Medium Enterprises • Large Enterprises 4.2. Global IoT Engineering Services Market, by Vertical (2021-2029) • Healthcare • IT & Telecom • Automotive • Energy & Utilities • Aerospace & Defense • Industrial Manufacturing • Transportation & Logistics 4.3. Global IoT Engineering Services Market, By Service Type (2021-2029) • Cloud Engineering • Maintenance Services • Product Engineering • Experience Engineering • Security Engineering • Maintenance Service 5. North America IoT Engineering Services Market (2021-2029) 5.1. North America IoT Engineering Services Market, By End-user (2021-2029) • Small & Medium Enterprises • Large Enterprises 5.2. North America IoT Engineering Services Market, by Vertical (2021-2029) • Healthcare • IT & Telecom • Automotive • Energy & Utilities • Aerospace & Defense • Industrial Manufacturing • Transportation & Logistics 5.3. North America IoT Engineering Services Market, By Service Type (2021-2029) • Cloud Engineering • Maintenance Services • Product Engineering • Experience Engineering • Security Engineering • Maintenance Services 5.4. North America IoT Engineering Services Market, by Country (2021-2029) • United States • Canada • Mexico 6. European IoT Engineering Services Market (2021-2029) 6.1. European IoT Engineering Services Market, By End-user (2021-2029) 6.2. European IoT Engineering Services Market, by Vertical (2021-2029) 6.3. European IoT Engineering Services Market, By Service Type (2021-2029) 6.4. European IoT Engineering Services Market, by Country (2021-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific IoT Engineering Services Market (2021-2029) 7.1. Asia Pacific IoT Engineering Services Market, By End-user (2021-2029) 7.2. Asia Pacific IoT Engineering Services Market, by Vertical (2021-2029) 7.3. Asia Pacific IoT Engineering Services Market, By Service Type (2021-2029) 7.4. Asia Pacific IoT Engineering Services Market, by Country (2021-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. The Middle East and Africa IoT Engineering Services Market (2021-2029) 8.1. The Middle East and Africa IoT Engineering Services Market, By End-user (2021-2029) 8.2. The Middle East and Africa IoT Engineering Services Market, by Vertical (2021-2029) 8.3. The Middle East and Africa IoT Engineering Services Market, By Service Type (2021-2029) 8.4. The Middle East and Africa IoT Engineering Services Market, by Country (2021-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America IoT Engineering Services Market (2021-2029) 9.1. South America IoT Engineering Services Market, By End-user (2021-2029) 9.2. South America IoT Engineering Services Market, by Vertical (2021-2029) 9.3. South America IoT Engineering Services Market, By Service Type (2021-2029) 9.4. South America IoT Engineering Services Market, by Country (2021-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Cisco System, Inc. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Dell Technologies 10.3. Tata Consultancy Services 10.4. Cognizant Technology Solutions 10.5. Infosys Technologies Pvt. Ltd. 10.6. Harman International Industries 10.7. Tech Mahindra 10.8. Tieto Corporation 10.9. Virtusa Corporation 10.10. Accenture PLC 10.11. Luxoft Holding, Inc 10.12. EPAM Systems, Inc 10.13. NIIT Technologies