The Global Live Streaming Market is expected to reach at a 26.9% CAGR, increasing from USD 97.14 billion in 2025 to USD 517.65 billion by 2032, supported by rising digital adoption, growing demand for interactive streaming platforms, expanding esports consumption, wider use of enterprise virtual events, and continuous advancements in cloud-based streaming infrastructure worldwide.Live Streaming Market Overview:

Live streaming has evolved into a core digital communication medium, supporting real-time content delivery, audience interaction, and multi-device accessibility worldwide. The technology is widely adopted across entertainment, enterprise communication, education, esports, and public information ecosystems. The live streaming industry is expanding rapidly due to interactive platform innovation, rising esports and gaming viewership, enterprise virtual events, and scalable cloud-based streaming infrastructure.To know about the Research Methodology:-Request Free Sample Report

Key Highlights:

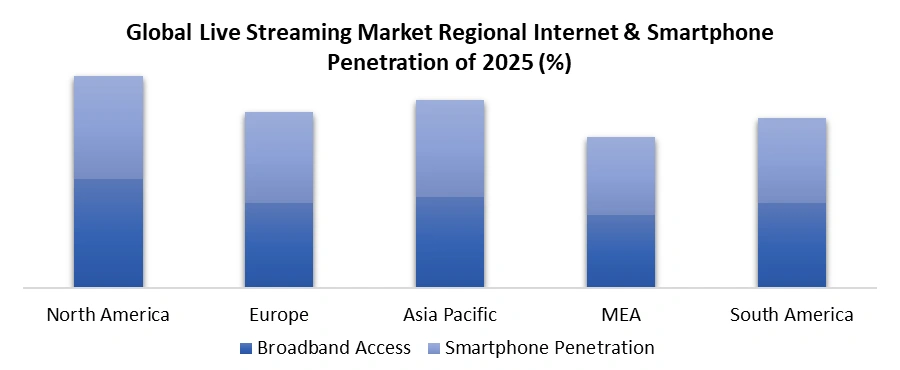

• By 2025, over 6 billion internet users representing nearly 75% of the global population enable large-scale adoption of live streaming across media, enterprise communication, and education. • The esports and gaming segment is supported by nearly 3 billion global gamers, including 1.2 billion weekly competitive players, reinforcing live streaming as a key real-time engagement channel. • Enterprise adoption is accelerating as live streaming platforms support over 50,000 concurrent participants, enabling global virtual events, hybrid meetings, and large-scale corporate communications. • Cloud-based deployment underpins market growth, with 41% of enterprises using cloud-based live streaming tools in 2025, ensuring scalable delivery, low latency, and secure real-time collaboration. • Regulatory compliance shapes market operations as frameworks such as GDPR, DSA, and national IT rules require continuous content moderation, reporting mechanisms, and governance investments for platform sustainability. • North America dominated the live streaming market in 2025 with 90% broadband access and over 85% smartphone penetration, leading global platform concentration and adoption.

Trends – Rise of Interactive Live Streaming Platforms with Real-Time Engagement Features

The rise of interactive live streaming platforms is reshaping global digital communication and content consumption patterns. By 2025, global internet adoption reached 6 billion users, representing 75% of the global population, up from 5.5 billion users in 2024. Expansion of mobile broadband and 5G networks has reduced latency and improved bandwidth reliability, enabling real-time chat, live polling, audience reactions, and two-way video participation. These trends establish interactive live streaming platforms market trends and opportunities as a strategic growth driver across media, enterprise communication, education, and public information, supporting the global live streaming market size and forecast. • Platforms as dynamic engagement ecosystems: Generate actionable real-time audience insights, boost session duration, and enhance audience retention for higher user engagement. • AI-powered analytics and personalization: Continuous data streams optimize platform performance and enable advanced, data-driven interactive live streaming solutions. • Global adoption and infrastructure growth: Enterprise, media, and educational use, combined with 4G continuity and 5G acceleration, unlock scalable growth in the global live streaming market.Drivers – Boom in Esports and Gaming Live Streaming Consumption

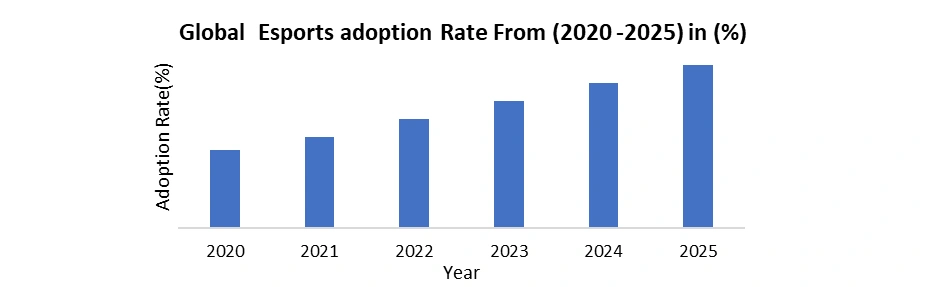

The rapid growth of esports and gaming live streaming is a key driver of the global live streaming market. By 2025, nearly 3 billion gamers exist worldwide, with 1.2 billion engaging in multiplayer or competitive online gaming weekly, creating high demand for interactive live streaming platforms and live streaming for esports and gaming. Real-time features such as live chat, audience reactions, and interactive overlays significantly enhance viewer engagement and retention. In 2025, North America hosts 180 million weekly gaming live stream viewers, while Asia Pacific sees 1.1 billion monthly gamers, nearly 450 million global esports spectators, and over 50% mobile gaming penetration, enabling on-the-go streaming globally.

Opportunities – Accelerated Adoption in Enterprise Communications and Virtual Events

• Enterprise Digital Transformation: Accelerated adoption of interactive live streaming platforms enables enterprises to modernize corporate communications, internal training, and virtual events, driving measurable operational efficiency and workforce engagement. • Scalable & Global Event Capabilities: Platforms support 50,000+ participants simultaneously, enabling global webinars, hybrid meetings, and large-scale enterprise communications without physical venue constraints. • Cloud-Enabled Adoption: With 41% of enterprises using cloud-based live streaming tools in 2025 organizations can ensure reliable real-time engagement and seamless content delivery. • Enhanced Stakeholder Engagement & ROI: As of 2025 the Interactive live streaming increased employee and client participation by up to 30%, while reducing travel and event costs by USD 1,200–1,800 per employee annually. • Strategic Market Growth Potential: Enterprise adoption positions global live streaming market platforms to capitalize on long-term revenue expansion, scalable engagement solutions, and transformative business outcomes.Restraints – Content Moderation and Regulatory Compliance Requirements

Global live streaming platforms face significant operational challenges due to evolving content moderation policies and regulatory requirements, impacting overall market competitiveness. Critical frameworks include the EU Digital Services Act (DSA, 2022–2024), India IT Rules & Digital Media Ethics Code (2021), UK Online Safety Act (2025), and EU GDPR (2018), mandating robust moderation, risk assessments, grievance mechanisms, officer appointments, data privacy, and detailed reporting. To mitigate compliance risks, platforms must deploy technology-driven content governance, scalable moderation workflows, and dedicated legal teams. Non-compliance increases exposure to fines, enforcement actions, and operational disruptions, emphasizing regulatory adherence as a strategic priority for sustainable growth in interactive live streaming.Segmentation Analysis – Global Live Streaming Market

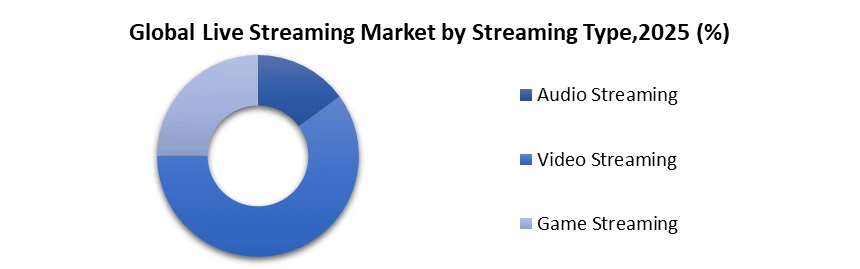

The Global Live Streaming Market segmentation emphasizes platform functionalities, streaming types, revenue models, and end-user adoption, enabling enterprises and content providers to optimize interactive engagement and drive strategic digital growth. By Component Platforms segment dominated the Live Streaming Market in 2025.It serve as the backbone of live streaming, enabling real-time viewing, interaction, and analytics. Services provide managed, creative, and technical support for corporate, media, and entertainment use cases. Video production enhances interactive broadcasts through professional capture, editing, and encoding, while subscription services and advertisements monetize premium content and audience engagement effectively.By Streaming Type: Video segment dominated the Live Streaming Market in 2025. While audio streaming captures weekly listeners through podcasts and live music. Game streaming leverages esports and competitive play to drive highly interactive real-time experiences, aligning content delivery with audience preferences.

Regional Insights – Global Live Streaming Market

The global live streaming market shows significant regional variation driven by internet penetration, mobile adoption, and digital infrastructure development. In 2025, North America dominated the market with 90% broadband access and over 85% smartphone penetration, establishing it as the leading region for platform concentration and interactive adoption. Europe follows with an average of 87% penetration, while Asia Pacific experiences the fastest growth, with 65–85% penetration and rapid mobile-first infrastructure expansion. The Middle East, Africa, and South America, with nearly 70–75% penetration, represent emerging opportunities supported by expanding digital connectivity and mobile adoption.

Competitive Landscape – Global Live Streaming Market

• Technological Innovation & Consumer Platforms as Cloud computing, CDNs, AI-powered analytics, interactive engagement tools, and hybrid monetization models (ad-supported, subscription, pay-per-view) drive platform differentiation and revenue growth. Key consumer platforms include Twitch, YouTube Live, Douyin/TikTok Live, Bigo Live, Facebook/Instagram Live, Dailymotion, Rumble, Kick, and Vimeo. • Regional & Enterprise Adoption where North America leads in platform concentration, while Asia Pacific expands via mobile-first, e-commerce, and influencer-led streaming. Enterprises leverage scalable cloud solutions supported by IBM Cloud Video, Brightcove, Kaltura, BoxCast, StreamShark, JW Player, Microsoft Stream, Zoom Live, and LinkedIn Live.Recent Developments – Global Live Streaming Market

Company Year Recent Development Impact / Business Implication Twitch 2025 Vertical livestreaming, dual-format streams, 2K (1440p) resolution, rewind feature Enhanced multi-format engagement, improved retention and monetization YouTube Live 2025 AI-powered video highlights, interactive mini-games, flexible ad placements Boosted interactivity, new monetization models, strengthened competitiveness Microsoft Stream 2025 Enterprise live streaming integration with Microsoft 365 Enabled secure large-scale virtual events, improved communications, hybrid workforce engagement Zoom Live Streaming 2025 Advanced webinar streaming, real-time analytics, multi-platform integration Improved virtual event management, engagement, scalability, ROI for enterprises LinkedIn Live 2025 Interactive Q&A, polling, advanced audience analytics Strengthened B2B engagement, data-driven content, improved live event effectiveness Live Streaming Market Scope:Inquire before buying

Global Live Streaming Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 97.14 Bn. Forecast Period 2026 to 2032 CAGR: 27% Market Size in 2032: USD 517.65 Bn. Segments Covered: by Component Platforms Services Video Production& Content Creation Services Subscription Services Advertisements by Streaming Type Audio Streaming Video Streaming Game Streaming by Revenue Model Ad-Supported Subscription-Based Pay-Per-View by Offering Model Business-to-Business(B2B) Business-to-Consumer(B2C) by End Use Gaming Media & Entertainment Education & Corporate Training. Sports News & Events Others Live Streaming Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key players of Live Streaming Market:

1) Twitch 2) YouTube Live 3) Vimeo 4) Brightcove 5) IBM Cloud Video 6) Dacast 7) BoxCast 8) Kick 9) Microsoft Stream 10) StreamYard 11) Dailymotion 12) Kaltura 13) Flux Broadcast 14) EventStreaming.TV 15) Huya 16) Douyin/TikTok Live 17) Bigo Live 18) AfreecaTV 19) Naver TV / V Live 20) Bilibili Live 21) StreamShark 22) Wowsome XR 23) Restream 24) Wowza 25) JW Player 26) Mediaspace 27) Zoom Live Streaming 28) LinkedIn Live 29) Facebook/Instagram Live 30) Rumble 31) Other FAQs of Live Streaming Market: Q1. What is the Global Live Streaming Market? A: The global live streaming market includes platforms and technologies that enable real-time video and audio streaming across entertainment, esports, enterprise communication, education, and virtual events worldwide. Q2. What factors are driving growth in the live streaming market? A: Growth in the live streaming market is driven by increasing internet penetration, interactive streaming features, rising esports and gaming viewership, enterprise virtual events, and cloud-based streaming solutions. Q3. How does esports and gaming impact the live streaming market? A: Esports and gaming significantly impact the live streaming market by generating high real-time engagement from nearly 3 billion global gamers using interactive live streaming platforms. Q4. Why are enterprises adopting live streaming platforms? A: Enterprises are adopting live streaming platforms to conduct large-scale virtual events, corporate training, and internal communications with support for thousands of concurrent participants. Q5. Which region leads the Global Live Streaming Market? A: North America leads the Global Live Streaming Market due to high broadband penetration, strong smartphone usage, advanced cloud infrastructure, and early adoption of live streaming technologies.

1. Live Streaming Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Live Streaming Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Headquarter 2.2.3. Component Segment 2.2.4. End-User Segment 2.2.5. Revenue Details in 2025 2.2.6. Market Share (%) 2.2.7. Growth Rate (%) 2.2.8. Return on Investment (%) 2.2.9. Technological Capabilities 2.2.10. Geographical Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. Live Streaming Market: Dynamics 3.1. Live Streaming Market Trends 3.2. Live Streaming Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Technology & Infrastructure Landscape 4.1. Role of 5G, AI, Edge Computing, and Blockchain 4.2. CDN & Cloud Infrastructure Provider Ecosystem 4.3. Latency, Scalability, and Real-Time Streaming Innovations 4.4. Adaptive Bitrate Streaming (ABR) & Multi-device Compatibility 4.5. Integrations with AR/VR and Extended Reality (XR) for Immersive Streaming 4.6. Infrastructure Cost Breakdown & Impact on Platform Economics 4.7. API and SDK Ecosystems: Enabling Developer-Focused Innovation 5. Creator Economy & Content Monetization 5.1. Rise of Independent Streamers and Micro-Creators 5.2. Tipping, Subscriptions, Virtual Gifts, and Affiliate Models 5.3. Creator Retention Strategies and Platform Incentive Models 5.4. Creator Onboarding Costs & Lifetime Value (CLTV) Analysis 5.5. Brand Collaborations, Sponsorships & Influencer Marketing Trends 5.6. Regional Disparities in Monetization Opportunities 5.7. Tools & Platforms for Creator Analytics, Performance Tracking & Community Building. 6. Consumer Behavior & Engagement Trends 6.1. Viewer Demographics and Content Preferences 6.2. Watch Time, Stream Abandonment, and Engagement KPIs 6.3. Personalization, Gamification, and Community-Building Features 6.4. Impact of Real-time Interactions (Polls, Chat, Q&A) 6.5. Device & Access Pattern Trends (Mobile, Smart TV, Desktop) 6.6. Shift in Viewing Habits: Short-Form vs. Long-Form Streaming 6.7. Localization & Multi-language Streaming Preferences 7. Regulatory and ESG Compliance Landscape 7.1. Data Privacy, Content Moderation & Regional Streaming Laws 7.2. Accessibility in Streaming (Captions, Multi-language, Adaptive UX) 7.3. Green Streaming & Platform Sustainability Initiatives 7.4. Cross-border Licensing & Intellectual Property Challenges 7.5. Platform Transparency, Algorithmic Fairness & Digital Ethics 7.6. ESG Reporting Requirements for Streaming Platforms 7.7. Compliance Cost Impact on Profitability & Platform Strategy 8. Live Streaming Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032) 8.1. Live Streaming Market Size and Forecast, By Component (2025-2032) 8.1.1. Platforms 8.1.2. Services 8.1.2.1. Video Production& Content Creation Services 8.1.2.2. Subscription Services 8.1.2.3. Advertisements 8.2. Live Streaming Market Size and Forecast, By Streaming Type (2025-2032) 8.2.1. Audio Streaming 8.2.2. Video Streaming 8.2.3. Game Streaming 8.3. Live Streaming Market Size and Forecast, By Revenue Model (2025-2032) 8.3.1. Ad-Supported 8.3.2. Subscription-Based 8.3.3. Pay-Per-View 8.4. Live Streaming Market Size and Forecast, By Offering Model (2025-2032) 8.4.1. Business-to-Business(B2B) 8.4.2. Business-to-Consumer(B2C) 8.5. Live Streaming Market Size and Forecast, By End Use (2025-2032) 8.5.1. Gaming 8.5.2. Media & Entertainment 8.5.3. Education & Corporate Training. 8.5.4. Sports 8.5.5. News & Events 8.5.6. Others 8.6. Live Streaming Market Size and Forecast, By Region (2025-2032) 8.6.1. North America 8.6.2. Europe 8.6.3. Asia Pacific 8.6.4. Middle East and Africa 8.6.5. South America 9. North America Live Streaming Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032) 9.1. North America Live Streaming Market Size and Forecast, By Component (2025-2032) 9.1.1. Platforms 9.1.2. Services 9.1.2.1. Video Production& Content Creation Services 9.1.2.2. Subscription Services 9.1.2.3. Advertisements 9.2. North America Live Streaming Market Size and Forecast, By Streaming Type (2025-2032) 9.2.1. Audio Streaming 9.2.2. Video Streaming 9.2.3. Game Streaming 9.3. North America Live Streaming Market Size and Forecast, By Revenue Model (2025-2032) 9.3.1. Ad-Supported 9.3.2. Subscription-Based 9.3.3. Pay-Per-View 9.4. North America Live Streaming Market Size and Forecast, By Offering Model (2025-2032) 9.4.1. Business-to-Business(B2B) 9.4.2. Business-to-Consumer(B2C) 9.5. North America Live Streaming Market Size and Forecast, By End Use (2025-2032) 9.5.1. Gaming 9.5.2. Media & Entertainment 9.5.3. Education & Corporate Training. 9.5.4. Sports 9.5.5. News & Events 9.5.6. Others 9.6. North America Live Streaming Market Size and Forecast, by Country (2025-2032) 9.6.1. United States 9.6.2. Canada 9.6.3. Mexico 10. Europe Live Streaming Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032) 10.1. Europe Live Streaming Market Size and Forecast, By Component (2025-2032) 10.2. Europe Live Streaming Market Size and Forecast, By Streaming Type (2025-2032) 10.3. Europe Live Streaming Market Size and Forecast, By Revenue Model (2025-2032) 10.4. Europe Live Streaming Market Size and Forecast, By Offering Model (2025-2032) 10.5. Europe Live Streaming Market Size and Forecast, By End Use (2025-2032) 10.6. Europe Live Streaming Market Size and Forecast, by Country (2025-2032) 10.6.1. United Kingdom 10.6.1.1. United Kingdom Live Streaming Market Size and Forecast, By Component (2025-2032) 10.6.1.2. United Kingdom Live Streaming Market Size and Forecast, By Streaming Type (2025-2032) 10.6.1.3. United Kingdom Live Streaming Market Size and Forecast, By Revenue Model (2025-2032) 10.6.1.4. United Kingdom Live Streaming Market Size and Forecast, By Offering Model (2025-2032) 10.6.1.5. United Kingdom Live Streaming Market Size and Forecast, By End Use (2025-2032) 10.6.2. France 10.6.3. Germany 10.6.4. Italy 10.6.5. Spain 10.6.6. Sweden 10.6.7. Russia 10.6.8. Rest of Europe 11. Asia Pacific Live Streaming Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032) 11.1. Asia Pacific Live Streaming Market Size and Forecast, By Component (2025-2032) 11.2. Asia Pacific Live Streaming Market Size and Forecast, By Streaming Type (2025-2032) 11.3. Asia Pacific Live Streaming Market Size and Forecast, By Revenue Model (2025-2032) 11.4. Asia Pacific Live Streaming Market Size and Forecast, By Offering Model (2025-2032) 11.5. Asia Pacific Live Streaming Market Size and Forecast, By End Use (2025-2032) 11.6. Asia Pacific Live Streaming Market Size and Forecast, by Country (2025-2032) 11.6.1. China 11.6.2. S Korea 11.6.3. Japan 11.6.4. India 11.6.5. Australia 11.6.6. Indonesia 11.6.7. Malaysia 11.6.8. Philippines 11.6.9. Thailand 11.6.10. Vietnam 11.6.11. Rest of Asia Pacific 12. Middle East and Africa Live Streaming Market Size and Forecast (by Value in USD Million and Volume in Units) (2025-2032) 12.1. Middle East and Africa Live Streaming Market Size and Forecast, By Component (2025-2032) 12.2. Middle East and Africa Live Streaming Market Size and Forecast, By Streaming Type (2025-2032) 12.3. Middle East and Africa Live Streaming Market Size and Forecast, By Revenue Model (2025-2032) 12.4. Middle East and Africa Live Streaming Market Size and Forecast, By Offering Model (2025-2032) 12.5. Middle East and Africa Live Streaming Market Size and Forecast, By End Use (2025-2032) 12.6. Middle East and Africa Live Streaming Market Size and Forecast, by Country (2025-2032) 12.6.1. South Africa 12.6.2. GCC 12.6.3. Egypt 12.6.4. Nigeria 12.6.5. Rest of ME&A 13. South America Live Streaming Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032) 13.1. South America Live Streaming Market Size and Forecast, By Component (2025-2032) 13.2. South America Live Streaming Market Size and Forecast, By Streaming Type (2025-2032) 13.3. South America Live Streaming Market Size and Forecast, By Revenue Model (2025-2032) 13.4. South America Live Streaming Market Size and Forecast, By Offering Model (2025-2032) 13.5. South America Live Streaming Market Size and Forecast, By End Use (2025-2032) 13.6. South America Live Streaming Market Size and Forecast, by Country (2025-2032) 13.6.1. Brazil 13.6.2. Argentina 13.6.3. Colombia 13.6.4. Chile 13.6.5. Rest Of South America 14. Company Profile: Key Players 14.1. Twitch 14.1.1. Company Overview 14.1.2. Business Portfolio 14.1.3. Financial Overview 14.1.4. SWOT Analysis 14.1.5. Strategic Analysis 14.1.6. Recent Developments 14.2. YouTube Live 14.3. Vimeo 14.4. Brightcove 14.5. IBM Cloud Video 14.6. Dacast 14.7. BoxCast 14.8. Kick 14.9. Microsoft Stream 14.10. StreamYard 14.11. Dailymotion 14.12. Kaltura 14.13. Flux Broadcast 14.14. EventStreaming.TV 14.15. Huya 14.16. Douyin/TikTok Live 14.17. Bigo Live 14.18. AfreecaTV 14.19. Naver TV / V Live 14.20. Bilibili Live 14.21. StreamShark 14.22. Wowsome XR 14.23. Restream 14.24. Wowza 14.25. JW Player 14.26. Mediaspace 14.27. Zoom Live Streaming 14.28. LinkedIn Live 14.29. Facebook/Instagram Live 14.30. Rumble 15. Key Findings 16. Analyst Recommendations 17. Live Streaming Market: Research Methodology