Debt Financing Market size was valued at USD 17.5 Bn. in 2022 and the total Debt Financing revenue is expected to grow by 10.2 % from 2023 to 2029, reaching nearly USD 18.8 Bn.Debt Financing Market Overview:

The debt financing market refers to the global market where companies and governments raise funds by issuing debt securities to investors. Debt financing allows firms to borrow money from lenders with the promise to repay the borrowed amount plus interest at a later date, making it a more appealing option than issuing stocks to investors. It is particularly popular among startup companies and smaller businesses seeking funds for expansion while retaining ownership. One of the primary advantages of debt financing is the tax deductibility of interest costs, which can lead to substantial savings for companies. Unlike equity financing, debt financing allows businesses to maintain control and ownership as there is typically no transfer of ownership to lenders. This is advantageous for entrepreneurs who want to retain decision-making authority and have autonomy over their company's operations. Furthermore, the debt financing market provides stability in budgeting and planning due to fixed interest rates and predetermined repayment terms. This predictability enables businesses to effectively manage their cash flows, allocate resources, and plan for their financial obligations. Structured repayment schedules allow for accurate budgeting, contributing to financial stability. It is crucial to remember that debt financing has implications and hazards. The borrowers are responsible for making sure they have enough cash flow to cover interest payments and return the principal sum according to the specified conditions. Financial stress and possible default can occur from failing to pay these responsibilities. Creditworthiness is also a key factor for lenders when determining a borrower's capacity to repay debt. Weaker credit profiles may lead to less favorable terms or higher interest rates.To Know About The Research Methodology :- Request Free Sample Report

Debt Financing Market Dynamics

Debt Financing Market Drivers Increasing Demand for Capital Drives Growth in the Debt Financing Market The debt financing market is undergoing a significant expansion fueled by the escalating demand for capital from both businesses and governments. With JPMorgan Chase and Bank of America aiming to grow their operations, undertake new projects, or optimize their financial structures, the requirement for funds has become increasingly critical. Debt financing emerges as a practical solution by enabling companies to borrow money from lenders and commit to repaying it along with interest over a specified period. The driving force behind the remarkable growth of the debt financing market is the mounting capital needs among organizations. Businesses seek capital to finance diverse activities such as business expansion, working capital management, research and development, acquisitions, and infrastructure development. Debt financing provides a convenient and flexible avenue to swiftly access the required funds. Governments also employ debt financing to finance public projects, stimulate economic growth, or bridge budgetary gaps. This involves issuing government bonds or other debt instruments to raise capital from investors. The demand for funds to support infrastructure development, social welfare programs, and other public initiatives propels the need for debt financing in the public sector as well. The escalating demand for capital reflects the growth aspirations and investment opportunities prevalent in the global economy. Companies across industries acknowledge the significance of accessing funds to fuel growth, maintain competitiveness, and seize market opportunities. Debt financing serves as a catalyst by offering readily available capital that can be tailored to meet specific financial needs and objectives. Consequently, the debt financing market experiences substantial growth as businesses and governments turn to this avenue to secure the necessary funds. This growth is driven by the recognition of debt financing as a viable and cost-effective alternative compared to other options such as equity financing or bank loans. Debt financing presents advantages including flexibility in repayment terms, tax benefits, and the ability to retain ownership and control. Debt Financing Market Restraints Economic Uncertainty and Rising Interest Rates Pose Challenges to the Debt Financing Market Global economic fluctuations, geopolitical conflicts, and unforeseen occurrences like natural catastrophes or pandemics are just a few of the causes that contribute to economic uncertainty. Businesses and governments typically take extra care when taking on new debt during uncertain times. They may adopt a more conservative approach, delaying investment decisions and reducing the demand for debt financing. Uncertainty also affects investor confidence, leading to decreased participation in the debt financing market and potentially higher borrowing costs for entities seeking funds. The impact of rising interest rates is yet another barrier the debt finance sector must overcome. Interest rates may be raised by central banks and monetary authorities in reaction to inflationary pressures or to control economic development. Increased interest rates significantly impact how much it costs for governments and corporations to borrow money. Rising interest rates result in higher costs for repaying existing debt, which could put a financial hardship on borrowers. Furthermore, because rising interest rates would require borrowers to pay greater interest charges, they might find fresh debt issuances to be less appealing. The need for debt financing could decrease as a result of this. Lenders' and investors' perceptions of risk are influenced by the interaction between rising interest rates and economic uncertainty. Lenders tend to exercise caution by tightening lending criteria and terms and becoming more selective in extending credit. The heightened risk may prompt investors to demand higher returns as a result, raising the cost of borrowing for both firms and governments. Together, these factors hinder the debt financing market from growing, making it more difficult for borrowers to find inexpensive credit solutions. Debt Financing Market Opportunity Growing Debt Financing Market Creates Opportunities for Startups and Small Businesses The debt financing market is developing to open up additional opportunities for startups and small businesses, giving them a practical choice for obtaining the capital they want for their endeavors. It would detail how debt finance may be a vital component in assisting small firms, allowing them to start out, purchase necessary tools and technology, recruit personnel, and develop their operations. The article will examine the particular debt financing alternatives that are tailored to the particular requirements of start-ups and small businesses. To highlight financing options such as microloans, crowdfunding, and alternative lending platforms that have emerged to specifically address the financial requirements of these entities. Moreover how these alternative financing options can offer greater flexibility, accommodating terms, and reduced stringency compared to traditional lending channels, making them more suitable for startups and small businesses. Furthermore, the benefits of debt financing for startups and small businesses. It would discuss how debt financing allows these entities to maintain ownership and control over their enterprises while leveraging debt as a means to fuel growth and achieve their business objectives. Additionally, it would highlight how responsible borrowing and prudent financial management are essential for ensuring the long-term sustainability and success of these businesses.Debt Financing Market Segment Analysis:

Based on Sources, the private segment dominated the debt financing market in the year 2022 and is expected to continue its dominance during the forecast period. Private debt financing's flexibility and specialized funding options make up its defining feature. Private lenders are able to tailor loan conditions to the individual requirements of the borrower. This covers elements like the loan's term, interest rates, required collateral, and repayment plans. Because private debt financing is individualized, borrowers can obtain finances that complement their particular needs, company models, and expansion plans. Private debt financing becomes an appealing option for SMEs and startups that may have difficulties accessing public capital markets. It allows these organizations to get finance for a variety of goals, including expanding operations, managing working capital, funding mergers and acquisitions, and refinancing existing debt. Private debt financing's flexibility allows small businesses to tailor the terms of the loan to their specific demands and financial capabilities.Based on the Type, the bank loans segment is dominating the debt financing market in the year 2022, due to their widespread availability, flexibility, and ease of access for borrowers. Bank loans are a common and important type of debt financing whereby borrowers obtain money from banks or other financial entities. Consumers can classify these loans as unsecured or secured. In contrast to unsecured loans, which rely on the borrower's creditworthiness and financial stability, secured bank loans are supported by the collateral asset. The popularity and dominance of bank loans stem from several advantages they offer. Firstly, bank loans often come with competitive interest rates, making them an attractive option for borrowers seeking affordable financing. Additionally, banks provide manageable repayment terms, allowing borrowers to structure payments according to their financial capabilities and cash flow. The streamlined application process of bank loans further enhances their appeal, enabling borrowers to access funds relatively quickly.

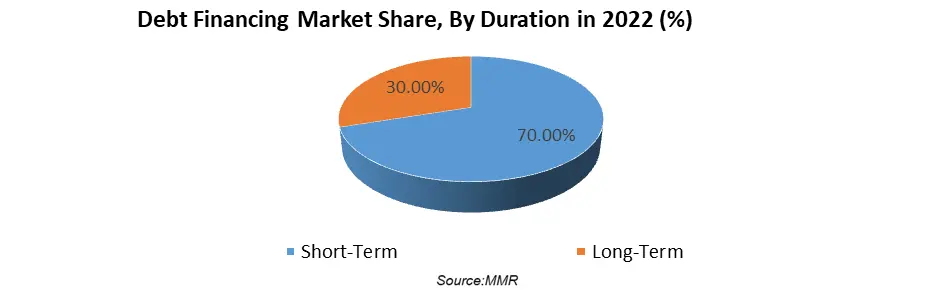

Based on the Duration, the short-term segment dominated the debt financing market in the year 2022 and is expected to continue its dominance during the forecast period. Short-term debt refers to borrowing arrangements that have a repayment period typically ranging from a few months to a few years. This type of debt financing is commonly used by businesses to meet immediate funding needs, address working capital requirements, or cover short-term expenses. It is often secured by the borrower's assets or backed by a line of credit. The dominating aspect of short-term debt is its flexibility and suitability for managing temporary financial obligations. Businesses rely on short-term debt to finance inventory purchases, meet payroll obligations, settle accounts payable, or handle other operational expenses. It provides them with the necessary liquidity to smoothly conduct day-to-day operations and seize short-term growth opportunities. Short-term debt is commonly obtained from banks or financial institutions through revolving credit facilities, trade credit arrangements, or short-term loans. It offers several advantages, including quick access to capital, lower interest rates compared to long-term debt, and the ability to adjust borrowing levels based on the evolving needs of the business. However, it is crucial for borrowers to handle short-term debt responsibly to avoid becoming overly reliant on it and potential challenges related to liquidity.

Debt Financing Market Regional Insights:

North America Dominated the market with a market share of 45.2% in the year 2022 and is expected to continue its dominance during the forecast period. North America, particularly the United States, plays a pivotal role in the debt financing market due to its status as the largest global economy and its well-established financial system. The United States boasts a strong banking industry, well-developed capital markets, and a favorable business environment. Its highly liquid debt markets offer a wide array of funding opportunities for both corporations and governments. In the United States debt financing market Several important elements have a major role in the dominance of. Thanks to its stable political environment and strong economic base, the United States draws both domestic and foreign businesses. There is a stronger demand for debt financing options, as a result of increased investor trust in the market. A wide variety of debt financing options are available in the US country, including bank loans, municipal bonds, corporate bonds, asset-backed securities, and other financial instruments. Due to the wide variety, borrowers can choose financing products that are flexible and suited to their individual requirements. The United States also has a strong regulatory system that guarantees the safety of investors, market efficiency, and transparency. The general trust and confidence in the debt finance sector are increased by these restrictions, supporting the region's supremacy. Canada and Mexico, two nations in the North American region with sophisticated financial systems and capital markets, make a substantial contribution to the debt financing industry by providing enterprises and governments with a range of debt financing options. It's important to understand that despite North America, and particularly the United States, having considerable influence there, other regions, such as South America, the Middle East, Africa, Asia Pacific, and Europe, have a substantial presence in the debt finance industry. The market dynamics, significant players, and regulatory frameworks that are unique to each location influence the overall landscape of debt finance globally.Debt Financing Market Scope: Inquire Before Buying

Global Debt Financing Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 17.5 Bn. Forecast Period 2023 to 2029 CAGR: 10.2% Market Size in 2029: US $ 18.8 Bn. Segments Covered: by Sources Private Public by Type Bank loans Bonds Debenture Bearer bond Others by Duration Short-Term Long-Term Debt Financing Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Debt Financing Market Key Players

1. JPMorgan Chase 2. Bank of America 3. Citigroup 4. Wells Fargo 5. Goldman Sachs 6. Morgan Stanley 7. Barclays 8. Deutsche Bank 9. Credit Suisse 10. UBS 11. HSBC 12. BNP Paribas 13. Societe Generale 14. Industrial and Commercial Bank of China (ICBC) 15. Agricultural Bank of China 16. China Construction Bank 17. Mitsubishi UFJ Financial Group (MUFG) 18. Sumitomo Mitsui Financial Group (SMFG) 19. Mizuho Financial Group 20. Nomura HoldingsFrequently Asked Questions:

1] What segments are covered in the Global Debt Financing Market report? Ans. The segments covered in the Debt Financing Market report are based on Sources, Type, Duration, and Regions. 2] Which region is expected to hold the highest share in the Global Debt Financing Market? Ans. The Europe region is expected to hold the highest share of the Debt Financing Market. 3] What is the market size of the Global Debt Financing Market by 2029? Ans. The market size of the Debt Financing Market by 2029 is expected to reach US$ 18.8 Bn. 4] What is the forecast period for the Global Debt Financing Market? Ans. The forecast period for the Debt Financing Market is 2023-2029. 5] What was the market size of the Global Debt Financing Market in 2022? Ans. The market size of the Debt Financing Market in 2022 was valued at US$ 17.5 Bn.

1. Debt Financing Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Debt Financing Market: Dynamics 2.1. Debt Financing Market Trends by Region 2.1.1. North America Debt Financing Market Trends 2.1.2. Europe Debt Financing Market Trends 2.1.3. Asia Pacific Debt Financing Market Trends 2.1.4. Middle East and Africa Debt Financing Market Trends 2.1.5. South America Debt Financing Market Trends 2.2. Debt Financing Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Debt Financing Market Drivers 2.2.1.2. North America Debt Financing Market Restraints 2.2.1.3. North America Debt Financing Market Opportunities 2.2.1.4. North America Debt Financing Market Challenges 2.2.2. Europe 2.2.2.1. Europe Debt Financing Market Drivers 2.2.2.2. Europe Debt Financing Market Restraints 2.2.2.3. Europe Debt Financing Market Opportunities 2.2.2.4. Europe Debt Financing Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Debt Financing Market Drivers 2.2.3.2. Asia Pacific Debt Financing Market Restraints 2.2.3.3. Asia Pacific Debt Financing Market Opportunities 2.2.3.4. Asia Pacific Debt Financing Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Debt Financing Market Drivers 2.2.4.2. Middle East and Africa Debt Financing Market Restraints 2.2.4.3. Middle East and Africa Debt Financing Market Opportunities 2.2.4.4. Middle East and Africa Debt Financing Market Challenges 2.2.5. South America 2.2.5.1. South America Debt Financing Market Drivers 2.2.5.2. South America Debt Financing Market Restraints 2.2.5.3. South America Debt Financing Market Opportunities 2.2.5.4. South America Debt Financing Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Debt Financing Industry 2.8. Analysis of Government Schemes and Initiatives For Debt Financing Industry 2.9. Debt Financing Market Trade Analysis 2.10. The Global Pandemic Impact on Debt Financing Market 3. Debt Financing Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Debt Financing Market Size and Forecast, by Sources (2022-2029) 3.1.1. Private 3.1.2. Public 3.2. Debt Financing Market Size and Forecast, by Type (2022-2029) 3.2.1. Bank loans 3.2.2. Bonds 3.2.3. Debenture 3.2.4. Bearer bond 3.2.5. Others 3.3. Debt Financing Market Size and Forecast, by Duration (2022-2029) 3.3.1. Short-Term 3.3.2. Long-Term 3.4. Debt Financing Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Debt Financing Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Debt Financing Market Size and Forecast, by Sources (2022-2029) 4.1.1. Private 4.1.2. Public 4.2. North America Debt Financing Market Size and Forecast, by Type (2022-2029) 4.2.1. Bank loans 4.2.2. Bonds 4.2.3. Debenture 4.2.4. Bearer bond 4.2.5. Others 4.3. North America Debt Financing Market Size and Forecast, by Duration (2022-2029) 4.3.1. Short-Term 4.3.2. Long-Term 4.4. North America Debt Financing Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Debt Financing Market Size and Forecast, by Sources (2022-2029) 4.4.1.1.1. Private 4.4.1.1.2. Public 4.4.1.2. United States Debt Financing Market Size and Forecast, by Type (2022-2029) 4.4.1.2.1. Bank loans 4.4.1.2.2. Bonds 4.4.1.2.3. Debenture 4.4.1.2.4. Bearer bond 4.4.1.2.5. Others 4.4.1.3. United States Debt Financing Market Size and Forecast, by Duration (2022-2029) 4.4.1.3.1. Short-Term 4.4.1.3.2. Long-Term 4.4.2. Canada 4.4.2.1. Canada Debt Financing Market Size and Forecast, by Sources (2022-2029) 4.4.2.1.1. Private 4.4.2.1.2. Public 4.4.2.2. Canada Debt Financing Market Size and Forecast, by Type (2022-2029) 4.4.2.2.1. Bank loans 4.4.2.2.2. Bonds 4.4.2.2.3. Debenture 4.4.2.2.4. Bearer bond 4.4.2.2.5. Others 4.4.2.3. Canada Debt Financing Market Size and Forecast, by Duration (2022-2029) 4.4.2.3.1. Short-Term 4.4.2.3.2. Long-Term 4.4.3. Mexico 4.4.3.1. Mexico Debt Financing Market Size and Forecast, by Sources (2022-2029) 4.4.3.1.1. Private 4.4.3.1.2. Public 4.4.3.2. Mexico Debt Financing Market Size and Forecast, by Type (2022-2029) 4.4.3.2.1. Bank loans 4.4.3.2.2. Bonds 4.4.3.2.3. Debenture 4.4.3.2.4. Bearer bond 4.4.3.2.5. Others 4.4.3.3. Mexico Debt Financing Market Size and Forecast, by Duration (2022-2029) 4.4.3.3.1. Short-Term 4.4.3.3.2. Long-Term 5. Europe Debt Financing Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Debt Financing Market Size and Forecast, by Sources (2022-2029) 5.1. Europe Debt Financing Market Size and Forecast, by Type (2022-2029) 5.1. Europe Debt Financing Market Size and Forecast, by Duration (2022-2029) 5.4. Europe Debt Financing Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Debt Financing Market Size and Forecast, by Sources (2022-2029) 5.4.1.2. United Kingdom Debt Financing Market Size and Forecast, by Type (2022-2029) 5.4.1.3. United Kingdom Debt Financing Market Size and Forecast, by Duration (2022-2029) 5.4.2. France 5.4.2.1. France Debt Financing Market Size and Forecast, by Sources (2022-2029) 5.4.2.2. France Debt Financing Market Size and Forecast, by Type (2022-2029) 5.4.2.3. France Debt Financing Market Size and Forecast, by Duration (2022-2029) 5.4.3. Germany 5.4.3.1. Germany Debt Financing Market Size and Forecast, by Sources (2022-2029) 5.4.3.2. Germany Debt Financing Market Size and Forecast, by Type (2022-2029) 5.4.3.3. Germany Debt Financing Market Size and Forecast, by Duration (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Debt Financing Market Size and Forecast, by Sources (2022-2029) 5.4.4.2. Italy Debt Financing Market Size and Forecast, by Type (2022-2029) 5.4.4.3. Italy Debt Financing Market Size and Forecast, by Duration (2022-2029) 5.4.5. Spain 5.4.5.1. Spain Debt Financing Market Size and Forecast, by Sources (2022-2029) 5.4.5.2. Spain Debt Financing Market Size and Forecast, by Type (2022-2029) 5.4.5.3. Spain Debt Financing Market Size and Forecast, by Duration (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Debt Financing Market Size and Forecast, by Sources (2022-2029) 5.4.6.2. Sweden Debt Financing Market Size and Forecast, by Type (2022-2029) 5.4.6.3. Sweden Debt Financing Market Size and Forecast, by Duration (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Debt Financing Market Size and Forecast, by Sources (2022-2029) 5.4.7.2. Austria Debt Financing Market Size and Forecast, by Type (2022-2029) 5.4.7.3. Austria Debt Financing Market Size and Forecast, by Duration (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Debt Financing Market Size and Forecast, by Sources (2022-2029) 5.4.8.2. Rest of Europe Debt Financing Market Size and Forecast, by Type (2022-2029) 5.4.8.3. Rest of Europe Debt Financing Market Size and Forecast, by Duration (2022-2029) 6. Asia Pacific Debt Financing Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Debt Financing Market Size and Forecast, by Sources (2022-2029) 6.2. Asia Pacific Debt Financing Market Size and Forecast, by Type (2022-2029) 6.3. Asia Pacific Debt Financing Market Size and Forecast, by Duration (2022-2029) 6.4. Asia Pacific Debt Financing Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Debt Financing Market Size and Forecast, by Sources (2022-2029) 6.4.1.2. China Debt Financing Market Size and Forecast, by Type (2022-2029) 6.4.1.3. China Debt Financing Market Size and Forecast, by Duration (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Debt Financing Market Size and Forecast, by Sources (2022-2029) 6.4.2.2. S Korea Debt Financing Market Size and Forecast, by Type (2022-2029) 6.4.2.3. S Korea Debt Financing Market Size and Forecast, by Duration (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Debt Financing Market Size and Forecast, by Sources (2022-2029) 6.4.3.2. Japan Debt Financing Market Size and Forecast, by Type (2022-2029) 6.4.3.3. Japan Debt Financing Market Size and Forecast, by Duration (2022-2029) 6.4.4. India 6.4.4.1. India Debt Financing Market Size and Forecast, by Sources (2022-2029) 6.4.4.2. India Debt Financing Market Size and Forecast, by Type (2022-2029) 6.4.4.3. India Debt Financing Market Size and Forecast, by Duration (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Debt Financing Market Size and Forecast, by Sources (2022-2029) 6.4.5.2. Australia Debt Financing Market Size and Forecast, by Type (2022-2029) 6.4.5.3. Australia Debt Financing Market Size and Forecast, by Duration (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Debt Financing Market Size and Forecast, by Sources (2022-2029) 6.4.6.2. Indonesia Debt Financing Market Size and Forecast, by Type (2022-2029) 6.4.6.3. Indonesia Debt Financing Market Size and Forecast, by Duration (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Debt Financing Market Size and Forecast, by Sources (2022-2029) 6.4.7.2. Malaysia Debt Financing Market Size and Forecast, by Type (2022-2029) 6.4.7.3. Malaysia Debt Financing Market Size and Forecast, by Duration (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Debt Financing Market Size and Forecast, by Sources (2022-2029) 6.4.8.2. Vietnam Debt Financing Market Size and Forecast, by Type (2022-2029) 6.4.8.3. Vietnam Debt Financing Market Size and Forecast, by Duration (2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Debt Financing Market Size and Forecast, by Sources (2022-2029) 6.4.9.2. Taiwan Debt Financing Market Size and Forecast, by Type (2022-2029) 6.4.9.3. Taiwan Debt Financing Market Size and Forecast, by Duration (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Debt Financing Market Size and Forecast, by Sources (2022-2029) 6.4.10.2. Rest of Asia Pacific Debt Financing Market Size and Forecast, by Type (2022-2029) 6.4.10.3. Rest of Asia Pacific Debt Financing Market Size and Forecast, by Duration (2022-2029) 7. Middle East and Africa Debt Financing Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Debt Financing Market Size and Forecast, by Sources (2022-2029) 7.2. Middle East and Africa Debt Financing Market Size and Forecast, by Type (2022-2029) 7.3. Middle East and Africa Debt Financing Market Size and Forecast, by Duration (2022-2029) 7.4. Middle East and Africa Debt Financing Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Debt Financing Market Size and Forecast, by Sources (2022-2029) 7.4.1.2. South Africa Debt Financing Market Size and Forecast, by Type (2022-2029) 7.4.1.3. South Africa Debt Financing Market Size and Forecast, by Duration (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Debt Financing Market Size and Forecast, by Sources (2022-2029) 7.4.2.2. GCC Debt Financing Market Size and Forecast, by Type (2022-2029) 7.4.2.3. GCC Debt Financing Market Size and Forecast, by Duration (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Debt Financing Market Size and Forecast, by Sources (2022-2029) 7.4.3.2. Nigeria Debt Financing Market Size and Forecast, by Type (2022-2029) 7.4.3.3. Nigeria Debt Financing Market Size and Forecast, by Duration (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Debt Financing Market Size and Forecast, by Sources (2022-2029) 7.4.4.2. Rest of ME&A Debt Financing Market Size and Forecast, by Type (2022-2029) 7.4.4.3. Rest of ME&A Debt Financing Market Size and Forecast, by Duration (2022-2029) 8. South America Debt Financing Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Debt Financing Market Size and Forecast, by Sources (2022-2029) 8.2. South America Debt Financing Market Size and Forecast, by Type (2022-2029) 8.3. South America Debt Financing Market Size and Forecast, by Duration(2022-2029) 8.4. South America Debt Financing Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Debt Financing Market Size and Forecast, by Sources (2022-2029) 8.4.1.2. Brazil Debt Financing Market Size and Forecast, by Type (2022-2029) 8.4.1.3. Brazil Debt Financing Market Size and Forecast, by Duration (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Debt Financing Market Size and Forecast, by Sources (2022-2029) 8.4.2.2. Argentina Debt Financing Market Size and Forecast, by Type (2022-2029) 8.4.2.3. Argentina Debt Financing Market Size and Forecast, by Duration (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Debt Financing Market Size and Forecast, by Sources (2022-2029) 8.4.3.2. Rest Of South America Debt Financing Market Size and Forecast, by Type (2022-2029) 8.4.3.3. Rest Of South America Debt Financing Market Size and Forecast, by Duration (2022-2029) 9. Global Debt Financing Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Debt Financing Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. JPMorgan Chase 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Bank of America 10.3. Citigroup 10.4. Wells Fargo 10.5. Goldman Sachs 10.6. Morgan Stanley 10.7. Barclays 10.8. Deutsche Bank 10.9. Credit Suisse 10.10. UBS 10.11. HSBC 10.12. BNP Paribas 10.13. Societe Generale 10.14. Industrial and Commercial Bank of China (ICBC) 10.15. Agricultural Bank of China 10.16. China Construction Bank 10.17. Mitsubishi UFJ Financial Group (MUFG) 10.18. Sumitomo Mitsui Financial Group (SMFG) 10.19. Mizuho Financial Group 10.20. Nomura Holdings 11. Key Findings 12. Industry Recommendations 13. Debt Financing Market: Research Methodology 14. Terms and Glossary