The Global Light Fidelity Market was valued at USD 420.6 Mn in 2023 Light Fidelity (Li-Fi) revenue will grow by 45.2% from 2023 to 2030, reaching nearly USD 5723.16 Mn.Light Fidelity Market Overview

Light Fidelity (Li-Fi) is an innovative wireless optical networking technology that utilizes light-emitting diodes (LEDs) to transmit data. Unlike traditional Wi-Fi, Li-Fi converts LED lights into data-transmitting hubs, revolutionizing connectivity in both residential and commercial spaces. The high power of LEDs, Li-Fi enables high-speed communication and paves the way for the development of 5G Visible Light Communication systems. This technology is particularly beneficial in connecting remote and inaccessible areas that cannot be reached through traditional optical fibers. For example, Li-Fi finds extensive applications across various industries such as healthcare, automotive, aerospace, electronics, information technology (IT), and defense. Unlike Wi-Fi, Li-Fi employs light-intensity modulation for data transfer, offering the promise of significantly faster internet speeds. This has generated widespread excitement and is driving the growth of the Light Fidelity Market. The increasing prevalence of LED bulbs as data hotspots further contributes to the growth of the market, providing users with enhanced data rates. The key advantages of the Light Fidelity Market are its secure and easily controlled network connections.To know about the Research Methodology :- Request Free Sample Report

Light Fidelity Market Dynamics:

High Data Transfer Speeds Boost the Light Fidelity Market Growth Li-Fi's dominance in wireless communication arises from its unparalleled data transmission speeds, surpassing 100 GB per second and surpassing the capabilities of traditional Wi-Fi. This advantage is crucial in sectors such as healthcare and finance, where rapid data transfer is of utmost importance. Li-Fi excels in crowded environments, enhancing user experiences in public spaces and offices with high population density. The use of smart devices increases, existing technologies such as Wi-Fi and 5G face challenges. In this scenario, Li-Fi emerges as a solution, offering superior connectivity, increased capacity, and enhanced security. This factor significantly boosts the Light Fidelity Market. Ongoing research on Li-Fi networking approaches, combined with global energy efficiency initiatives, align with the development of smart homes and cities, creating significant opportunities for Li-Fi. The integration of Li-Fi with LED lamps in buildings increases its applications, providing all-in-one internet access for occupants without the need for additional hardware. In healthcare, Li-Fi resolves issues related to overlapping radio waves, ensuring reliable internet access for patient monitoring. These factors position Li-Fi as a transformative force, attracting businesses and industries in search of advanced connectivity solutions, thereby driving its adoption and Light Fidelity Market prominence. For Instance, the increasing demand for smartphones significantly escalated the demand for Li-Fi technology which is responsible for the Light Fidelity Market.High Implementation Cost Restrain the Light Fidelity Market Growth High implementation costs limit a substantial barrier to the widespread adoption of Li-Fi (Light Fidelity) technology. The need for new infrastructure, including Li-Fi-enabled LED lights and compatible devices, contributes to elevated expenses. Installation, maintenance, and the limited range of Li-Fi further escalate costs, necessitating more access points for comprehensive coverage. This factor hampers restrains the Light Fidelity Market. The technology faces competition from established Wi-Fi systems, making businesses cautious about investing in unproven alternatives. To branch Light Fidelity Market growth, ongoing research and development efforts are crucial for cost reduction, increased efficiency, and enhanced capabilities. Collaboration between Li-Fi providers and industry stakeholders is essential to address these challenges and build confidence in the technology. Technology advances Create Lucrative Growth Opportunities for Market growth. The advancement of Li-Fi technology, with its remarkable data transfer rates reaching up to 10 Gbps, stands as a catalyst for profound growth in the Light Fidelity Market. Offering a transformative force, Li-Fi ensures secure data transmission, safeguarding sensitive information from unauthorized access and cyber threats. Its resilience to interference in environments where traditional Wi-Fi falters—such as hospitals, aircraft cabins, and military installations—presents a unique market advantage. Li-Fi's energy efficiency, requiring less power compared to traditional Wi-Fi, positions it as a sustainable and cost-effective solution. The development of visible light communication systems further distinguishes Li-Fi by enabling data transmission with maintained human visibility, eliminating the need for additional infrared light sources. Embracing existing lighting infrastructure, Li-Fi emerges as a green communication method, aligning with eco-friendly practices and eliminating the necessity for extra power sources. In essence, the multifaceted strengths of Li-Fi create a compelling narrative for its Light Fidelity Market growth, spanning from enhanced security to eco-conscious connectivity solutions.

Light Fidelity Market segment analysis

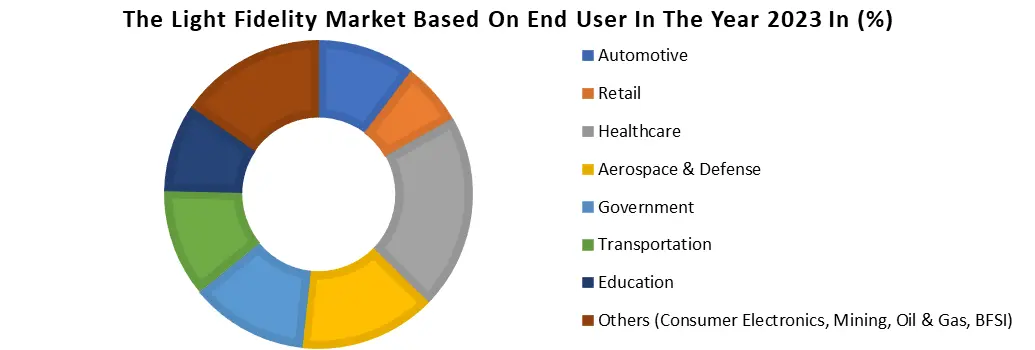

Based on Component, the LED sub-segment dominated the component segment of the Light Fidelity Market in the year 2023.LEDs are widely recognized as a fundamental component in Li-Fi technology, as it is for transmitting both light and information. LEDs were primarily used for localized illumination, but with the integration of LED capabilities with the Internet of Things (IoT), they now enable simultaneous illumination and data provision. The semiconductor nature of LEDs allows for high-frequency modulation, which is crucial for data transmission and has contributed to the growth of the LED segment within the Light Fidelity Market. The microcontroller segment is expected to fastest growth during the forecast period. Microcontrollers are used in modulating LEDs, enabling them to switch between ON and OFF states. This modulation is then interpreted by photodetectors as 0 or 1, facilitating the data transfer process. Microcontrollers are essential components operating at both the transmitter and receiver ends, as they precisely control light sources and detect subtle modulations. This capability positions microcontrollers as key contributors to the evolution of Li-Fi technology and is expected to drive their increased adoption. These factors significantly help to contribute to the growth of the Light Fidelity Market.Based On End User, The Healthcare subsegment dominated the end-user segment of the Light Fidelity Market in the year 2023. Li-Fi technology, with its unique requirements and advantages, presents numerous benefits for the healthcare sector. Utilizing light waves for wireless data transmission, Li-Fi offers a secure and interference-free solution in sensitive environments such as hospitals, where traditional Wi-Fi is susceptible to radio frequency interference. The high-speed data transfer capabilities of Li-Fi are important for efficiently transmitting large medical files, enabling real-time communication, and supporting advanced healthcare applications. With its reliability, security, and high bandwidth, Li-Fi is extremely well-suited for enhancing connectivity in healthcare environments. As a result, it has established a dominant position in the end-user landscape of the Light Fidelity Li-Fi market within the healthcare subsegment.

Light Fidelity Market Regional Analysis:

The Asia-Pacific region dominated the Light Fidelity Market in the year 2023. Due to substantial investments in technology to enhance internet infrastructure. This trend creates ample opportunities for the vendors in focus. Li-Fi, an innovative contender against Wi-Fi in this region, leverages visible light for wireless signal transmission, aligning with the crucial role of Wi-Fi in shaping the digital economy of Asia-Pacific. Industry experts suggest that integrating Li-Fi alongside Wi-Fi significantly augments bandwidth, alleviating network congestion and elevating streaming and downloading speeds. The potential for Li-Fi is underscored by the pursuit of faster and more cost-effective visible light communication systems, with advancements showcased by companies such as Kyocera SLD Laser. Their LiFi system demonstrated an impressive data rate of 90 Gbps at CES 2022, reflecting the rapid progress in Li-Fi technology. Also, country such as China is investing in research and development, exemplified by the government's initiatives.Light Fidelity Market Scope: Inquiry Before Buying

Light Fidelity Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 420.6 Mn. Forecast Period 2024 to 2030 CAGR: 45.2% Market Size in 2030: US $ 5723.16 Mn. Segments Covered: by Component LED Photodetector Microcontrollers Others (Antenna, and Wireless Communication Module) by End User Automotive Retail Healthcare Aerospace & Defense Government Transportation Education Others (Consumer Electronics, Mining, Oil & Gas, BFSI) Light Fidelity Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Light Fidelity Market Key Players

North America 1. Acuity Brands, Inc. (United States) 2. Axrtek (Mexico) 3. LightPointe Communications, Inc. (United States) 4. IBSENtelecom (Norway) 5. ByteLight, Inc. (United States) 6. FSOna Networks Corp. (Canada) 7. LVX System (United States) 8. VLNComm (United States) 9. General Electric (United States) 10. Ruckus Networks (United States) 11. Qualcomm Technologies, Inc. (United States) Europe 1. Fraunhofer HHI (Germany) 2. Lucibel (France) 3. Signify (Netherlands) 4. Oledcomm (France) Asia Pacific 1. Casio Computer Co., Ltd. (Japan) 2. Wipro Limited (India) 3. Panasonic Corporation (Japan)Frequently Asked Questions:

1] What segments are covered in the Global Light Fidelity Market report? Ans. The segments covered in the market report are based on Components, End-Users, and Regions. 2] Which region is expected to hold the highest share in the Global Light Fidelity Market? Ans. The Asia Pacific region is expected to hold the largest share of the Light Fidelity Market. 3] What is the market size of the Global Light Fidelity Market by 2030? Ans. The market size of the Light Fidelity Market by 2030 is expected to reach US$ 5723.16 Mn. 4] What is the forecast period for the Global Light Fidelity Market? Ans. The forecast period for the market is 2024-2030. 5] What was the market size of the Global Light Fidelity Market in 2023? Ans. The market size of the market in 2023 was valued at US$ 420.6 Mn.

1. Light Fidelity Market: Research Methodology 2. Light Fidelity Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Light Fidelity Market: Dynamics 3.1. Light Fidelity Market Trends by Region 3.1.1. North America Light Fidelity Market Trends 3.1.2. Europe Light Fidelity Market Trends 3.1.3. Asia Pacific Light Fidelity Market Trends 3.1.4. Middle East and Africa Light Fidelity Market Trends 3.1.5. South America Light Fidelity Market Trends 3.2. Light Fidelity Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Light Fidelity Market Drivers 3.2.1.2. North America Light Fidelity Market Restraints 3.2.1.3. North America Light Fidelity Market Opportunities 3.2.1.4. North America Light Fidelity Market Challenges 3.2.2. Europe 3.2.2.1. Europe Light Fidelity Market Drivers 3.2.2.2. Europe Light Fidelity Market Restraints 3.2.2.3. Europe Light Fidelity Market Opportunities 3.2.2.4. Europe Light Fidelity Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Light Fidelity Market Drivers 3.2.3.2. Asia Pacific Light Fidelity Market Restraints 3.2.3.3. Asia Pacific Light Fidelity Market Opportunities 3.2.3.4. Asia Pacific Light Fidelity Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Light Fidelity Market Drivers 3.2.4.2. Middle East and Africa Light Fidelity Market Restraints 3.2.4.3. Middle East and Africa Light Fidelity Market Opportunities 3.2.4.4. Middle East and Africa Light Fidelity Market Challenges 3.2.5. South America 3.2.5.1. South America Light Fidelity Market Drivers 3.2.5.2. South America Light Fidelity Market Restraints 3.2.5.3. South America Light Fidelity Market Opportunities 3.2.5.4. South America Light Fidelity Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis for Light Fidelity Market 3.8. Analysis of Government Schemes and Initiatives for the Light Fidelity Market 3.9. The Global Pandemic Impact on the Light Fidelity Market 4. Light Fidelity Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 4.1. Light Fidelity Market Size and Forecast, By Component (2023-2030) 4.1.1. LED 4.1.2. Photodetector 4.1.3. Microcontrollers 4.1.4. Others (Antenna, and Wireless Communication Module) 4.2. Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 4.2.1. Automotive 4.2.2. Retail 4.2.3. Healthcare 4.2.4. Aerospace & Defense 4.2.5. Government 4.2.6. Transportation 4.2.7. Education 4.2.8. Others (Consumer Electronics, Mining, Oil & Gas, BFSI) 4.3. Light Fidelity Market Size and Forecast, by Region (2023-2030) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Light Fidelity Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 5.1. North America Light Fidelity Market Size and Forecast, By Component (2023-2030) 5.1.1. LED 5.1.2. Photodetector 5.1.3. Microcontrollers 5.1.4. Others (Antenna, and Wireless Communication Module) 5.2. North America Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 5.2.1. Automotive 5.2.2. Retail 5.2.3. Healthcare 5.2.4. Aerospace & Defense 5.2.5. Government 5.2.6. Transportation 5.2.7. Education 5.2.8. Others (Consumer Electronics, Mining, Oil & Gas, BFSI) 5.3. North America Light Fidelity Market Size and Forecast, by Country (2023-2030) 5.3.1. United States 5.3.1.1. United States Light Fidelity Market Size and Forecast, By Component (2023-2030) 5.3.1.1.1. LED 5.3.1.1.2. Photodetector 5.3.1.1.3. Microcontrollers 5.3.1.1.4. Others (Antenna, and Wireless Communication Module) 5.3.1.2. United States Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 5.3.1.2.1. Automotive 5.3.1.2.2. Retail 5.3.1.2.3. Healthcare 5.3.1.2.4. Aerospace & Defense 5.3.1.2.5. Government 5.3.1.2.6. Transportation 5.3.1.2.7. Education 5.3.1.2.8. Others (Consumer Electronics, Mining, Oil & Gas, BFSI) 5.3.2. Canada 5.3.2.1. Canada Light Fidelity Market Size and Forecast, By Component (2023-2030) 5.3.2.1.1. LED 5.3.2.1.2. Photodetector 5.3.2.1.3. Microcontrollers 5.3.2.1.4. Others (Antenna, and Wireless Communication Module) 5.3.2.2. Canada Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 5.3.2.2.1. Automotive 5.3.2.2.2. Retail 5.3.2.2.3. Healthcare 5.3.2.2.4. Aerospace & Defense 5.3.2.2.5. Government 5.3.2.2.6. Transportation 5.3.2.2.7. Education 5.3.2.2.8. Others (Consumer Electronics, Mining, Oil & Gas, BFSI) 5.3.2.2.9. 5.3.3. Mexico 5.3.3.1. Mexico Light Fidelity Market Size and Forecast, By Component (2023-2030) 5.3.3.1.1. LED 5.3.3.1.2. Photodetector 5.3.3.1.3. Microcontrollers 5.3.3.1.4. Others (Antenna, and Wireless Communication Module) 5.3.3.2. Mexico Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 5.3.3.2.1. Automotive 5.3.3.2.2. Retail 5.3.3.2.3. Healthcare 5.3.3.2.4. Aerospace & Defense 5.3.3.2.5. Government 5.3.3.2.6. Transportation 5.3.3.2.7. Education 5.3.3.2.8. Others (Consumer Electronics, Mining, Oil & Gas, BFSI) 6. Europe Light Fidelity Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 6.1. Europe Light Fidelity Market Size and Forecast, By Component (2023-2030) 6.2. Europe Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 6.3. Europe Light Fidelity Market Size and Forecast, by Country (2023-2030) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Light Fidelity Market Size and Forecast, By Component (2023-2030) 6.3.1.2. United Kingdom Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 6.3.2. France 6.3.2.1. France Light Fidelity Market Size and Forecast, By Component (2023-2030) 6.3.2.2. France Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 6.3.3. Germany 6.3.3.1. Germany Light Fidelity Market Size and Forecast, By Component (2023-2030) 6.3.3.2. Germany Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 6.3.4. Italy 6.3.4.1. Italy Light Fidelity Market Size and Forecast, By Component (2023-2030) 6.3.4.2. Italy Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 6.3.5. Spain 6.3.5.1. Spain Light Fidelity Market Size and Forecast, By Component (2023-2030) 6.3.5.2. Spain Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 6.3.6. Sweden 6.3.6.1. Sweden Light Fidelity Market Size and Forecast, By Component (2023-2030) 6.3.6.2. Sweden Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 6.3.7. Austria 6.3.7.1. Austria Light Fidelity Market Size and Forecast, By Component (2023-2030) 6.3.7.2. Austria Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Light Fidelity Market Size and Forecast, By Component (2023-2030) 6.3.8.2. Rest of Europe Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 7. Asia Pacific Light Fidelity Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 7.1. Asia Pacific Light Fidelity Market Size and Forecast, By Component (2023-2030) 7.2. Asia Pacific Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 7.3. Asia Pacific Light Fidelity Market Size and Forecast, by Country (2023-2030) 7.3.1. China 7.3.1.1. China Light Fidelity Market Size and Forecast, By Component (2023-2030) 7.3.1.2. China Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 7.3.2. S Korea 7.3.2.1. S Korea Light Fidelity Market Size and Forecast, By Component (2023-2030) 7.3.2.2. S Korea Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 7.3.3. Japan 7.3.3.1. Japan Light Fidelity Market Size and Forecast, By Component (2023-2030) 7.3.3.2. Japan Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 7.3.4. India 7.3.4.1. India Light Fidelity Market Size and Forecast, By Component (2023-2030) 7.3.4.2. India Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 7.3.5. Australia 7.3.5.1. Australia Light Fidelity Market Size and Forecast, By Component (2023-2030) 7.3.5.2. Australia Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 7.3.6. Indonesia 7.3.6.1. Indonesia Light Fidelity Market Size and Forecast, By Component (2023-2030) 7.3.6.2. Indonesia Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 7.3.7. Malaysia 7.3.7.1. Malaysia Light Fidelity Market Size and Forecast, By Component (2023-2030) 7.3.7.2. Malaysia Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 7.3.8. Vietnam 7.3.8.1. Vietnam Light Fidelity Market Size and Forecast, By Component (2023-2030) 7.3.8.2. Vietnam Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 7.3.9. Taiwan 7.3.9.1. Taiwan Light Fidelity Market Size and Forecast, By Component (2023-2030) 7.3.9.2. Taiwan Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 7.3.10. Rest of Asia Pacific 7.3.10.1. Rest of Asia Pacific Light Fidelity Market Size and Forecast, By Component (2023-2030) 7.3.10.2. Rest of Asia Pacific Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 8. Middle East and Africa Light Fidelity Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2022-2030) 8.1. Middle East and Africa Light Fidelity Market Size and Forecast, By Component (2023-2030) 8.2. Middle East and Africa Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 8.3. Middle East and Africa Light Fidelity Market Size and Forecast, by Country (2023-2030) 8.3.1. South Africa 8.3.1.1. South Africa Light Fidelity Market Size and Forecast, By Component (2023-2030) 8.3.1.2. South Africa Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 8.3.2. GCC 8.3.2.1. GCC Light Fidelity Market Size and Forecast, By Component (2023-2030) 8.3.2.2. GCC Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 8.3.3. Nigeria 8.3.3.1. Nigeria Light Fidelity Market Size and Forecast, By Component (2023-2030) 8.3.3.2. Nigeria Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 8.3.4. Rest of ME&A 8.3.4.1. Rest of ME&A Light Fidelity Market Size and Forecast, By Component (2023-2030) 8.3.4.2. Rest of ME&A Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 9. South America Light Fidelity Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2022-2029 9.1. South America Light Fidelity Market Size and Forecast, By Component (2023-2030) 9.2. South America Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 9.3. South America Light Fidelity Market Size and Forecast, by Country (2023-2030) 9.3.1. Brazil 9.3.1.1. Brazil Light Fidelity Market Size and Forecast, By Component (2023-2030) 9.3.1.2. Brazil Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 9.3.2. Argentina 9.3.2.1. Argentina Light Fidelity Market Size and Forecast, By Component (2023-2030) 9.3.2.2. Argentina Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 9.3.3. Rest Of South America 9.3.3.1. Rest Of South America Light Fidelity Market Size and Forecast, By Component (2023-2030) 9.3.3.2. Rest Of South America Light Fidelity Market Size and Forecast, By Industry Vertical (2023-2030) 10. Global Light Fidelity Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Light Fidelity Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Oledcomm (France) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Details on Partnership 11.1.7. Recent Developments 11.2. Signify (Netherlands) 11.3. Acuity Brands, Inc. (United States) 11.4. Velmenni (Estonia) 11.5. Axrtek (Mexico) 11.6. Panasonic Corporation (Japan) 11.7. Lucibel (France) 11.8. LightPointe Communications, Inc. (United States) 11.9. IBSENtelecom (Norway) 11.10. ByteLight, Inc. (United States) 11.11. FSOna Networks Corp. (Canada) 11.12. LVX System (United States) 11.13. VLNComm (United States) 11.14. Casio Computer Co., Ltd. (Japan) 11.15. Wipro Limited (India) 11.16. General Electric (United States) 11.17. Ruckus Networks (United States) 11.18. Qualcomm Technologies, Inc. (United States) 11.19. Fraunhofer HHI (Germany) 12. Key Findings 13. Analyst Recommendations