The Last Mile Delivery Market size was valued at USD 31.42 Billion in 2023 and the total Last Mile Delivery revenue is expected to grow at a CAGR of 19.01 % from 2024 to 2030, reaching nearly USD 106.42 Billion by 2030.Last Mile Delivery Market Overview

Last Mile Delivery is the final phase of the supply chain, where goods are transported from a distribution hub to the end customer's location, emphasizing the crucial delivery stage ensuring prompt and efficient delivery to the doorstep. The Last Mile Delivery Market is expected significant growth during the forecast period, primarily driven by the exponential rise in e-commerce activities, prompting heightened demand for swift and efficient delivery services. The current scenario showcases a competitive landscape where Last Mile Delivery Market key players, including Amazon, UPS, FedEx, and DHL, continually invest in innovative technologies and logistical strategies to enhance delivery speed, accuracy, and customer experience. Factors driving this market's growth include the surge in online retail, necessitating faster deliveries to meet customer expectations, leading to increased investments in logistics infrastructure, route optimization technologies, and alternative delivery methods like drones and autonomous vehicles. Recent developments reflect a shift toward sustainable practices, with companies exploring eco-friendly delivery options such as electric vehicles and optimizing delivery routes to minimize carbon footprints. Advancements in real-time tracking, AI-powered predictive analytics, and the integration of smart delivery lockers contribute to improving operational efficiency, ensuring timely and secure deliveries while meeting the evolving needs of the modern consumer market.To know about the Research Methodology :- Request Free Sample Report

Last Mile Delivery Market Dynamics:

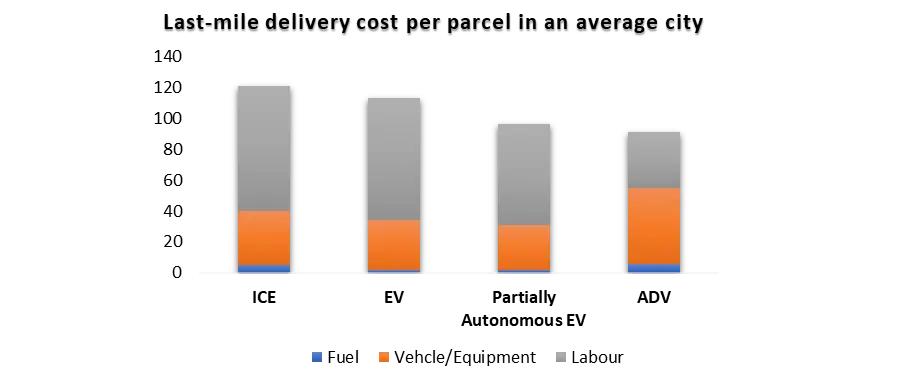

Automation, AI, and autonomous vehicles revolutionize delivery processes, enhancing efficiency and speed, Driving Last Mile Delivery Market Growth The Last Mile Delivery market is expected an accelerated evolution in technology across four distinct horizons, outpacing previous predictions. Over the past 18 months, technology in last-mile delivery has advanced considerably, transitioning from conceptualization and testing to full-scale production and deployment by numerous companies worldwide. Autonomous vans, electric delivery vehicles (EVs), robotic dogs, droids, and operational drone networks exemplify the rapid technological advancements in the last-mile ecosystem. For instance, electric delivery vans that were once in pilot phases are now in series production, marking a substantial shift within a couple of years. These developments align with consumer preferences for clean technology, as evidenced by various countries and cities implementing regulations favoring EVs. The technological landscape is segmented into four horizons, each depicting the future trajectory of last-mile delivery. In the near term (Horizon 2), semi-autonomous delivery vehicles that assist parcel delivery staff are anticipated to boost productivity and efficiency. Looking further ahead (Horizon 3), autonomous delivery vehicles (ADVs) and drones are projected to operate independently, addressing specific delivery needs, particularly in regions with limited road access or for emergency medical deliveries. Beyond 2030 (Horizon 4), robots are expected to handle the last leg of delivery directly to customers' front doors, although widespread deployment remains constrained by high costs and complex systems integration. These technological advancements are poised to reshape the last-mile landscape, fulfilling to evolving consumer demands while addressing cost-sensitive market dynamics. The shift towards tech-enabled solutions is imperative for last-mile market players to meet customer demands efficiently. While technology holds promise in reducing delivery costs, its impact varies across different segments. For instance, autonomous and semi-autonomous vehicles potentially reduce delivery costs in cities by 10 to 40 percent, whereas EVs may not significantly impact costs due to their smaller contribution to total last-mile expenses. Despite this, the adoption of EVs might become necessary to comply with stringent emissions regulations.AV Technology: Promising Cost Reductions in Last-Mile Delivery per Parcel

The increasing demand for enhanced delivery services driven by customer expectations and increase Last Mile Delivery Market competition necessitates immediate technology adoption in the last-mile sector. While traditional CEP players are expected to retain dominance, the emergence of large retailers venturing into last-mile delivery for selected services in high-density cities might influence market dynamics.Technology-Driven Innovations Revolutionizing Last-Mile Delivery

Increasingly demanding customers seek complimentary services such as free deliveries, and rapid same-day delivery for larger items, necessitating constant adaptation hindering market growth The growing eCommerce has ushered in competition among the Last Mile Delivery Market players, triggering reduced customer loyalty and higher cart abandonment rates. This escalating competition has compelled businesses to seek profitability amidst diverse customer demands, rapid delivery requisites, and technological disruptions. Companies are pressed to stay profitable while striving to meet the varied demands and expectations of an evolving market. For instance, grocery delivery services, such as Google Express or Instacart, have garnered praise from 65% of consumers for providing superior delivery services compared to traditional retailers. Supply chain disruptions, exacerbated by the COVID-19 pandemic, intensified the need for digitization and automation, particularly in last-mile logistics. This forced a shift toward contactless deliveries, on-demand services, and ultra-fast delivery windows of less than 30 minutes. Customers, having witnessed the possibility of such swift deliveries, now demand more, seeking complimentary services like free deliveries, white-glove experiences, and same-day delivery and installation for larger items such as appliances and furniture. Sustainability has emerged as a crucial concern, especially in the context of escalating emissions in the last-mile delivery segment. Despite the projected fivefold increase in national freight activity in India by 2050, the current emissions per delivery stand at 285 gCO2, significantly surpassing the global average of 204 gCO2. This has pushed the need for eco-friendly last-mile delivery systems. Smart last-mile logistics software in India, aimed at reducing fuel consumption and optimizing deliveries, has become increasingly vital. Additionally, the escalating volume of returns in parallel with the growth of eCommerce has created challenges in returns management, significantly impacting operational costs for businesses. Address accuracy remains a persistent challenge, particularly in densely populated areas with inadequate location markers and imprecise addresses. Navigating such regions leads to extended delivery times, affecting operational accuracy and necessitating increased communication between riders and customers. Innovative AI-powered software solutions have emerged as a potential remedy, automatically converting delivery locations into geo-coordinates, thereby facilitating precise and swifter deliveries. These challenges within the Last Mile Delivery market necessitate strategic interventions, such as collaboration with grocery delivery services, a shift in focus toward genuine customer needs, and the adoption of automation in warehouse operations, to enhance efficiency and meet evolving customer expectations. Regulatory initiatives by governments globally have aimed to address efficiency, emissions reduction, and technology-driven advancements in the logistics sector, emphasizing the growing significance of sustainable and technologically advanced last-mile delivery systems.

Technology Innovation Description Company/Partnership Drones Successful drone delivery completion in July 2015, piloted by several retailers including Amazon. 7-Eleven, Flirtey, Amazon Autonomous Vehicle Collaboration between Ford, Walmart, and Postmates to design autonomous vehicle delivery service by 2021, aimed at reducing last-mile delivery costs. Ford, Walmart, Postmates Self-service Lockers Implementation by retailers like Amazon, Home Depot, and Walmart allowing customers to select locker locations as delivery addresses and retrieve parcels using unique codes. Amazon, Home Depot, Walmart Delivery to Car Service enabling couriers to deliver packages inside customers' vehicles, trialed by John Lewis in partnership with Jaguar Land Rover and later launched by Amazon with General Motors and Volvo. John Lewis, Amazon, Jaguar Land Rover, General Motors, Volvo Delivery Inside Home Service allowing couriers to enter homes and leave packages, tested by Waitrose in Britain and experimented with by Albert Heijn in the Netherlands. Waitrose, Albert Heijn Last Mile Delivery Market Segment Analysis:

Based on Vehicle types, Motorcycles dominated the Last Mile Delivery Market in 2023 as it is popular for urban deliveries, offer agility and speed, ideal for congested areas but limited in capacity. LCVs, larger in size, cater to medium-scale deliveries, balancing capacity and manoeuvrability. HCVs, with expansive load capabilities, excel in bulk deliveries but face challenges in navigating tight urban spaces. Drones, although innovative, are still in nascent stages due to regulatory hurdles but show promise in remote or inaccessible areas. Motorcycle adoption remains high in dense urban zones, while LCVs dominate medium-scale logistics. HCVs are prevalent for bulk deliveries in suburban or rural regions. Drones, while promising for specialized deliveries, await regulatory clarity for widespread adoption in various delivery scenarios.Based on Application, E-commerce dominated the Last Mile Delivery Market and is expected to maintain its dominance over the forecast period. Its demand for rapid, reliable deliveries has spurred innovations and investments. Retail and FMCG (Fast-Moving Consumer Goods) sectors follow closely, driven by the need for timely and efficient delivery of perishable goods and daily essentials. Healthcare, with its demand for precise, quick deliveries of medical supplies and prescriptions, is emerging as a significant segment. Mails and packages, spanning across businesses and individuals, also contribute significantly to last-mile delivery demands. Other segments encompass a range of unique delivery needs, including specialty items, electronics, and specific service-based requirements. Each segment exhibits varied adoption rates based on their distinct needs, with e-commerce and retail/FMCG dominating due to their high volume and urgency, while healthcare and specialized services show promising growth with their increasing reliance on efficient last-mile logistics.

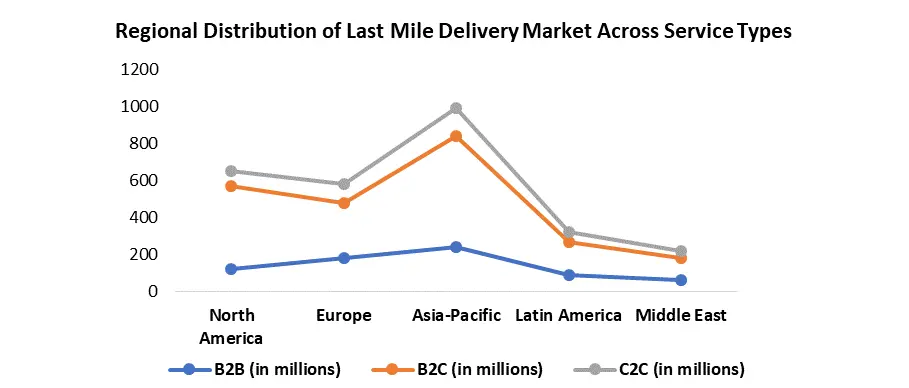

North America Dominance in the Last Mile Delivery Market North America dominated the last mile delivery market in 2023 and is expected to maintain its dominance over the forecast period. In North America, tech-driven innovations spearhead the last-mile sector. Cities like San Francisco and Seattle have been at the forefront of autonomous delivery trials, showcasing futuristic solutions using drones and self-driving vehicles. For instance, companies like Amazon have piloted drone delivery services in select regions of the United States, amplifying the market's technological advancement. Furthermore, the region's customer base demands rapid and efficient deliveries, especially in metropolitan areas, driving companies to experiment with same-day delivery models. This has spurred partnerships between delivery providers and eCommerce giants, amplifying the adoption of cutting-edge logistics solutions. European Last Mile Delivery Market sustainability and environmental consciousness in last-mile logistics. Cities like London and Amsterdam have implemented stringent regulations to curb emissions, promoting the adoption of electric vehicles (EVs) and low-emission zones. For instance, DHL in Germany has invested significantly in a fleet of electric delivery vans, aligning with the region's eco-friendly initiatives. Additionally, Europe's focus on urban density has led to innovative last-mile solutions like smart lockers and alternative delivery points, enhancing convenience while reducing carbon footprints. The region's emphasis on eco-friendly options and efficient urban deliveries showcases a market inclined towards environmental responsibility. In both cases, regional market trends highlight the interplay between technological advancements, consumer demands, and environmental consciousness. These factors shape the strategies adopted by key players in the Last Mile Delivery Market, propelling innovations and fostering a need for more sustainable, tech-driven solutions.

Last Mile Delivery Market Regional Insights:

Global Last Mile Delivery Market Scope: Inquire before buying

Global Last Mile Delivery Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 31.42 Bn. Forecast Period 2024 to 2030 CAGR: 19.01% Market Size in 2030: US $ 106.42 Bn. Segments Covered: By Destination Short Range (< 20 km) Long Range (> 20 km) By Service Type Hardware Software Service By Vehicle Type Motorcycle LCV HCV Drones By Application E Commerce Retail and FMCG Healthcare Mails and Packages Others Global Last Mile Delivery Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Last Mile Delivery Market Key Players:

Major Contributors in the Last Mile Delivery Industry in North America: 1. Amazon Logistics - Seattle, Washington, USA 2. FedEx Corporation - Memphis, Tennessee, USA 3. United Parcel Service (UPS) - Atlanta, Georgia, USA 4. Uber Eats - San Francisco, California, USA 5. USPS (United States Postal Service) - Washington, D.C., USA 6. Postmates - San Francisco, California, USA 7. DoorDash - San Francisco, California, USA 8. Grubhub - Chicago, Illinois, USA 9. Instacart - San Francisco, California, USA 10. SEKO Logistics - Itasca, Illinois, USA Leading players in the Europe Last Mile Delivery Market: 1. DHL Express - Bonn, Germany 2. Hermes Group - Hamburg, Germany 3. Yodel - Hatfield, United Kingdom 4. Hermes UK - Rugby, United Kingdom 5. Just Eat Takeaway - Amsterdam, Netherlands 6. DPD Group - Paris, France 7. PostNord - Solna, Sweden 8. Bring - Oslo, Norway 9. DHL eCommerce - Bonn, Germany Key players driving the Asia-Pacific Last Mile Delivery Market: 1. Blue Dart Express - Mumbai, India 2. Zomato - Gurugram, India 3. Swiggy - Bangalore, India 4. Ecom Express - New Delhi, Delhi 5. XpressBees - Pune, Maharashtra 6. DotZot - Bangalore, Karnataka 7. Ekart - Bangalore, Karnataka 8. SF Express Co., Ltd. - Shenzhen 9. Alibaba's Cainiao Network - Hangzhou 10. JD Logistics - BeijingFAQs:

1] What Major Key players in the Global Last Mile Delivery Market report? Ans. The Major Key players covered in the Last Mile Delivery Market report are Amazon Logistics - Seattle, Washington, USA, FedEx Corporation - Memphis, Tennessee, USA, United Parcel Service (UPS) - Atlanta, Georgia, USA, Uber Eats - San Francisco, California, USA 2] Which region is expected to hold the highest share in the Global Last Mile Delivery Market? Ans. North America region is expected to hold the highest share in the Last Mile Delivery Market. 3] What is the market size of the Global Last Mile Delivery Market by 2030? Ans. The market size of the Last Mile Delivery Market by 2030 is expected to reach US$ 106.42 Billion. 4] What is the forecast period for the Global Last Mile Delivery Market? Ans. The forecast period for the Last Mile Delivery Market is 2024-2030. 5] What was the market size of the Global Last Mile Delivery Market in 2023? Ans. The market size of the Last Mile Delivery Market in 2023 was valued at US$ 31.42 Billion.

1. Last Mile Delivery Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Last Mile Delivery Market: Dynamics 2.1. Market Trends by Region 2.1.1. North America 2.1.2. Europe 2.1.3. Asia Pacific 2.1.4. Middle East and Africa 2.1.5. South America 2.2. Market Dynamics by Region 2.2.1. North America 2.2.1.1. Drivers 2.2.1.2. Restraints 2.2.1.3. Opportunities 2.2.1.4. Challenges 2.2.2. Europe 2.2.2.1. Drivers 2.2.2.2. Restraints 2.2.2.3. Opportunities 2.2.2.4. Challenges 2.2.3. Asia Pacific 2.2.3.1. Drivers 2.2.3.2. Restraints 2.2.3.3. Opportunities 2.2.3.4. Challenges 2.2.4. Middle East and Africa 2.2.4.1. Drivers 2.2.4.2. Restraints 2.2.4.3. Opportunities 2.2.4.4. Challenges 2.2.5. South America 2.2.5.1. Drivers 2.2.5.2. Restraints 2.2.5.3. Opportunities 2.2.5.4. Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Technological Roadmap 2.7. Regulatory Landscape by Region 2.7.1. North America 2.7.2. Europe 2.7.3. Asia Pacific 2.7.4. Middle East and Africa 2.7.5. South America 2.8. Analysis of Government Schemes and Initiatives For Last Mile Delivery Industry 2.9. Key Opinion Leader Analysis 2.10. The Global Pandemic Impact on Last Mile Delivery Market 3. Last Mile Delivery Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 3.1. Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 3.1.1. Short Destination (< 20 km) 3.1.2. Long Destination (> 20 km) 3.2. Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 3.2.1. Hardware 3.2.2. Software 3.2.3. Service 3.3. Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 3.3.1. Aerial Delivery Drones 3.3.2. Ground Delivery Bots 3.3.3. Self-driving trucks & vans 3.4. Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 3.4.1. Logistics 3.4.2. Healthcare & Pharmaceuticals 3.4.3. Food & Beverages 3.4.4. Retail 3.4.5. Other Applications 3.5. Last Mile Delivery Market Size and Forecast, By Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Last Mile Delivery Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 4.1.1. Domestic 4.1.2. International 4.2. North America Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 4.2.1. Business-To-Business (B2B) 4.2.2. Business-To-Consumer (B2C) 4.2.3. Customer-To-Customer (C2C) 4.3. North America Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 4.3.1. Motorcycle 4.3.2. LCV 4.3.3. HCV 4.3.4. Drones 4.4. North America Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 4.4.1. E Commerce 4.4.2. Retail and FMCG 4.4.3. Healthcare 4.4.4. Mails and Packages 4.4.5. Others 4.5. North America Last Mile Delivery Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 4.5.1.1.1. Domestic 4.5.1.1.2. International 4.5.1.2. United States Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 4.5.1.2.1. Business-To-Business (B2B) 4.5.1.2.2. Business-To-Consumer (B2C) 4.5.1.2.3. Customer-To-Customer (C2C) 4.5.1.3. United States Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 4.5.1.3.1. Motorcycle 4.5.1.3.2. LCV 4.5.1.3.3. HCV 4.5.1.3.4. Drones 4.5.1.4. United States Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 4.5.1.4.1. E Commerce 4.5.1.4.2. Retail and FMCG 4.5.1.4.3. Healthcare 4.5.1.4.4. Mails and Packages 4.5.1.4.5. Others 4.5.2. Canada 4.5.2.1. Canada Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 4.5.2.1.1. Domestic 4.5.2.1.2. International 4.5.2.2. Canada Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 4.5.2.2.1. Business-To-Business (B2B) 4.5.2.2.2. Business-To-Consumer (B2C) 4.5.2.2.3. Customer-To-Customer (C2C) 4.5.2.3. Canada Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 4.5.2.3.1. Motorcycle 4.5.2.3.2. LCV 4.5.2.3.3. HCV 4.5.2.3.4. Drones 4.5.2.4. Canada Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 4.5.2.4.1. E Commerce 4.5.2.4.2. Retail and FMCG 4.5.2.4.3. Healthcare 4.5.2.4.4. Mails and Packages 4.5.2.4.5. Others 4.5.3. Mexico 4.5.3.1. Mexico Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 4.5.3.1.1. Domestic 4.5.3.1.2. International 4.5.3.2. Mexico Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 4.5.3.2.1. Business-To-Business (B2B) 4.5.3.2.2. Business-To-Consumer (B2C) 4.5.3.2.3. Customer-To-Customer (C2C) 4.5.3.3. Mexico Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 4.5.3.3.1. Motorcycle 4.5.3.3.2. LCV 4.5.3.3.3. HCV 4.5.3.3.4. Drones 4.5.3.4. Mexico Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 4.5.3.4.1. E Commerce 4.5.3.4.2. Retail and FMCG 4.5.3.4.3. Healthcare 4.5.3.4.4. Mails and Packages 4.5.3.4.5. Others 5. Europe Last Mile Delivery Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 5.1. Europe Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 5.2. Europe Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 5.3. Europe Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 5.4. Europe Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 5.5. Europe Last Mile Delivery Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 5.5.1.2. United Kingdom Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 5.5.1.3. United Kingdom Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 5.5.1.4. United Kingdom Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 5.5.2. France 5.5.2.1. France Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 5.5.2.2. France Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 5.5.2.3. France Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 5.5.2.4. France Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 5.5.3.2. Germany Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 5.5.3.3. Germany Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 5.5.3.4. Germany Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 5.5.4.2. Italy Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 5.5.4.3. Italy Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 5.5.4.4. Italy Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 5.5.5.2. Spain Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 5.5.5.3. Spain Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 5.5.5.4. Spain Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 5.5.6.2. Sweden Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 5.5.6.3. Sweden Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 5.5.6.4. Sweden Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 5.5.7.2. Austria Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 5.5.7.3. Austria Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 5.5.7.4. Austria Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 5.5.8.2. Rest of Europe Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 5.5.8.3. Rest of Europe Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 5.5.8.4. Rest of Europe Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 6. Asia Pacific Last Mile Delivery Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 6.2. Asia Pacific Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 6.3. Asia Pacific Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 6.4. Asia Pacific Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 6.5. Asia Pacific Last Mile Delivery Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 6.5.1.2. China Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 6.5.1.3. China Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 6.5.1.4. China Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 6.5.2.2. S Korea Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 6.5.2.3. S Korea Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 6.5.2.4. S Korea Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 6.5.3.2. Japan Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 6.5.3.3. Japan Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 6.5.3.4. Japan Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 6.5.4. India 6.5.4.1. India Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 6.5.4.2. India Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 6.5.4.3. India Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 6.5.4.4. India Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 6.5.5.2. Australia Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 6.5.5.3. Australia Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 6.5.5.4. Australia Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 6.5.6.2. Indonesia Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 6.5.6.3. Indonesia Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 6.5.6.4. Indonesia Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 6.5.7.2. Malaysia Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 6.5.7.3. Malaysia Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 6.5.7.4. Malaysia Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 6.5.8.2. Vietnam Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 6.5.8.3. Vietnam Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 6.5.8.4. Vietnam Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 6.5.9.2. Taiwan Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 6.5.9.3. Taiwan Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 6.5.9.4. Taiwan Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 6.5.10.2. Rest of Asia Pacific Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 6.5.10.3. Rest of Asia Pacific Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 6.5.10.4. Rest of Asia Pacific Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 7. Middle East and Africa Last Mile Delivery Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 7.1. Middle East and Africa Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 7.2. Middle East and Africa Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 7.3. Middle East and Africa Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 7.4. Middle East and Africa Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 7.5. Middle East and Africa Last Mile Delivery Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 7.5.1.2. South Africa Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 7.5.1.3. South Africa Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 7.5.1.4. South Africa Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 7.5.2.2. GCC Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 7.5.2.3. GCC Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 7.5.2.4. GCC Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 7.5.3.2. Nigeria Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 7.5.3.3. Nigeria Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 7.5.3.4. Nigeria Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 7.5.4.2. Rest of ME&A Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 7.5.4.3. Rest of ME&A Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 7.5.4.4. Rest of ME&A Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 8. South America Last Mile Delivery Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 8.1. South America Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 8.2. South America Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 8.3. South America Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 8.4. South America Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 8.5. South America Last Mile Delivery Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 8.5.1.2. Brazil Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 8.5.1.3. Brazil Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 8.5.1.4. Brazil Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 8.5.2.2. Argentina Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 8.5.2.3. Argentina Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 8.5.2.4. Argentina Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Last Mile Delivery Market Size and Forecast, By Destination (2023-2030) 8.5.3.2. Rest Of South America Last Mile Delivery Market Size and Forecast, By Service Type (2023-2030) 8.5.3.3. Rest Of South America Last Mile Delivery Market Size and Forecast, By Vehicle Type (2023-2030) 8.5.3.4. Rest Of South America Last Mile Delivery Market Size and Forecast, By Application (2023-2030) 9. Global Last Mile Delivery Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Service Segment 9.3.3. End Use Segment 9.3.4. Revenue (2022) 9.3.5. Manufacturing Locations 9.4. Leading Last Mile Delivery Market Companies, by Market Capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Amazon Logistics - Seattle, Washington, USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. FedEx Corporation - Memphis, Tennessee, USA 10.3. United Parcel Service (UPS) - Atlanta, Georgia, USA 10.4. Uber Eats - San Francisco, California, USA 10.5. USPS (United States Postal Service) - Washington, D.C., USA 10.6. Postmates - San Francisco, California, USA 10.7. DoorDash - San Francisco, California, USA 10.8. Grubhub - Chicago, Illinois, USA 10.9. Instacart - San Francisco, California, USA 10.10. SEKO Logistics - Itasca, Illinois, USA 10.11. XPO Logistics - Greenwich, Connecticut, USA 10.12. DHL Express - Bonn, Germany 10.13. Hermes Group - Hamburg, Germany 10.14. Yodel - Hatfield, United Kingdom 10.15. Hermes UK - Rugby, United Kingdom 10.16. Just Eat Takeaway - Amsterdam, Netherlands 10.17. DPD Group - Paris, France 10.18. PostNord - Solna, Sweden 10.19. Bring - Oslo, Norway 10.20. DHL eCommerce - Bonn, Germany 10.21. Blue Dart Express - Mumbai, India 10.22. Zomato - Gurugram, India 10.23. Swiggy - Bangalore, India 10.24. Ecom Express - New Delhi, Delhi 10.25. XpressBees - Pune, Maharashtra 10.26. DotZot - Bangalore, Karnataka 10.27. Ekart - Bangalore, Karnataka 10.28. SF Express Co., Ltd. - Shenzhen 10.29. Alibaba's Cainiao Network - Hangzhou 10.30. JD Logistics - Beijing 10.31. YTO Express Group Co., Ltd. - Shanghai 11. Key Findings 12. Industry Recommendations 13. Last Mile Delivery Market: Research Methodology.