The Global Laminating Adhesives Market size was valued at USD 3.81 Billion in 2023 and the total Laminating Adhesives Market revenue is expected to grow at a CAGR of 6.0% from 2024 to 2030, reaching nearly USD 5.73 Billion.Laminating Adhesives Market Overview

Laminating adhesive is the process of combining two or more components to form a new substance. When commercially available materials do not meet requirements, converters are used to manufacture a material that meets the requirement. Laminating adhesives are rapidly being used in modern material processing and manufacturing industries. Laminating adhesives build strong bonds between the materials and delivers numerous advantages to product design and production. The laminating adhesives market is growing due to greater computability with various types of materials. Materials such as natural fibers, chemical fibers, glass fibers, and metal fibers are laminated using laminating adhesives. Laminating adhesives are used in various industries such as automotive, packaging, and consumer manufacturing devices. Applications across various industries drive the laminating adhesives market growth. Solventless laminating adhesives are increasing in demand due to processing efficiencies, they are primarily used in high-performance packaging and industrial applications. Demand for Water-based adhesives is growing as it is considered it have minimal impact on the environment such advancements and innovations boost the laminating adhesives market growth. 1.In 2023, Bostik a global adhesive specialist launched the world’s first RecyClass-approved laminating adhesive, which is named Bostik SF10M, it is a solvent-free aromatic polyurethane-based laminating adhesive, that are used in the food industry.To know about the Research Methodology :- Request Free Sample Report

Laminating Adhesives Market Dynamics-

Increased Application Across Various Industries Drives the Laminating Adhesives Market Growth. Laminating adhesives combined with foamed plastics, plastic films, rubber, metal foils, and other substrates, helps to make manufacturing and product designing more flexible and easier. Laminating adhesive is more cost-effective than traditional hot melt lamination or flame lamination. Laminating adhesive reduces the production cost. Solventless laminating adhesives are environment friendly as they help to solve problems related to irritating odor, residual solvents, and erosion, which increases demand for that product, which eventually helps the laminating adhesives market grow. Water-based laminating adhesives are highly versatile and are used to create strong bonds between a variety of materials. These laminating adhesives are used in food packaging, medical packaging, and industrial laminates. Laminating adhesives that are water-based have a huge demand for the packaging of snack food, frozen food, and microwaveable food. Due to changing lifestyles and increasing disposable income, demand for packaged food is rising which creates the need for laminating adhesives, which drives the laminating adhesives market growth. Improving Safety, Efficiency, And Sustainability In Laminating Adhesives Products Help to Market Grow The increased interest and consciousness about environmental responsibility has resulted in innovative innovations in the laminating adhesives sector. Solvent-free laminating adhesives are becoming increasingly popular because they promote an eco-friendly nature, user safety, and less environmental impact. Solvent-free laminating adhesives are used in various industries such as automotive where they are used in interior fittings, textiles, and shoes for holing up soles. Increased applications of such innovative products across different industries help the laminating adhesives market grow. Solvent-free laminating adhesives are more safe option as there is no use of organic solvents which are considered explosive during production. Innovation of more efficient options such as water-based adhesives helps to minimize the environmental impact. Use of water-based adhesives across industry statistics Dextrin and starch-based adhesives are widely used in the paper industry due to their durability when applied to specific materials. However, their plant-based composition makes them susceptible to deterioration when in contact with water. Despite this limitation, these adhesives are considered the most environmentally friendly among wet glues, as they are derived from renewable sources, biodegradable, and compostable. New technological advancements in the adhesive industry help to develop products that have properties such as zero VOC( volatile organic compounds), lightweight nature, and reduced health risk creating new opportunities.Potential Health And Environment-Related Risks And Regulatory Challenges Hinder The Laminating Adhesives Market Growth. Primary aromatic amines (PAAs) are substances that have potential to migrate from food packaging materials into the food itself. These substances are suspected to have carcinogenic properties in humans. PAAs are formed in multilayer packaging materials that contain aromatic polyurethane adhesives. The formation of PAAs occurs when residual isocyanic monomers, which have migrated to the surface of the inner layer of the packaging, react with water molecules that come into contact with the same plastic surface, such potential health risk creates hesitation among consumers about the product which negatively affect the laminating adhesives market growth. Solvent-based adhesives pose significant challenges due to their high volatile organic compound (VOC) emissions and potential health and environmental risks if not managed appropriately. Furthermore, the use of these adhesives is not recommended in indoor settings, as the presence of solvents can be harmful to air quality and resident well-being. As a result, manufacturers are forced to shift from solvent-based laminating adhesives to solventless or water-based laminating adhesives which slows down the laminating adhesives market growth. Regulatory authorities pose challenges to the chemical industry, as regulatory bodies like the U.S Environmental Protection Agency, put regulations to limit emissions of volatile organic compounds (VOCs) from adhesives, sealants, and primers through two basic components sale and manufacture restrictions that limit the VOC content of specified adhesives in the state and other using restrictions that apply generally to commercial and industrial applications which creates challenges for laminating adhesives sector.

Laminating Adhesives Market Segmentation-

Based on Technology- Based on technology Laminating adhesives market is segmented into solvent-based, solvent-less, water based segments Solvent-based adhesives held the largest share in the year 2023 as they are widely used in various industries, including packaging, tapes, and medical applications, because of their exceptional resistance to environmental factors and their ability to adhere to a wide range of substrates this has a positive impact on laminating adhesives market. These adhesives offer a versatile solution for both porous and non-porous surfaces, ensuring a strong bond once the solvent evaporates, leaving behind only the adhesive component. Their popularity stems from their effectiveness in creating secure connections that withstand various environmental stresses and conditions. Solvent-based adhesives are used in the manufacturing of various medical products, particularly tapes and devices. These adhesives are designed to provide a strong bond that is able to withstand exposure to chemicals and solvents, making them ideal for use in transdermal and drug delivery systems. The medical industry relies on these adhesives to ensure that their products maintain a stronghold, even in challenging environments for longer duration.Laminating Adhesives Market Regional Analysis-

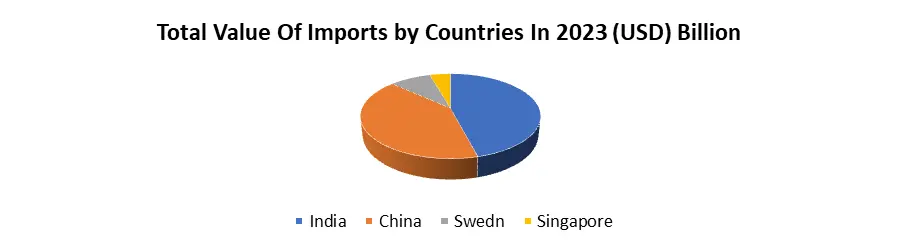

Asia-Pacific region dominates the laminating adhesives market. In 2022, China accounted for xx % of global chemical production and xx% of capital investment. China is the world's largest consumer of adhesives and sealants, accounting for xx% of the total global consumption of 19 million tons in 2019. The paper and packaging industry is the world's largest end-user of adhesives, accounting for xx% of total consumption. Asia Pacific region is the largest consumer of the packaging industry. The government's initiatives to support the food processing sector, India's food sector attracted $ 4.18 billion in foreign direct investment between April 2014 and March 2020. Huge investments and an increased number of flexible packaging in countries like China, India, and Japan boost the laminating adhesives market growth in the Asia Pacific region. India is the largest importer of lamination adhesives followed by China.

The Scope of the Report for Global Laminating Adhesives Market:Inquire before buying

Global Laminating Adhesives Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 3.81 Bn. Forecast Period 2024 to 2030 CAGR: 6% Market Size in 2030: US $ 5.73 Bn. Segments Covered: by Technology Solvent-based Solvent less Water-based Others by Resin Polyurethane Acrylic Polyester Others by End Use Packaging Automotive & Transportation Industrial Others Laminating Adhesives Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest) South America (Brazil, Argentina Rest of South America)Key Players in the Laminating Adhesives Market

1. CEMEX, S.A.B. de C.V. (Mexico), 2. Henkel AG 3. H.B.Fuller 4. 3M 5. Ashland 6. Arkema (Bostik) 7. Coim Group 8. Vimasco Corporation 9. Flint Group 10. DIC Corporation 11. L.D.Davis 12. Masterbond 13. Paramelt 14. Franklin International 15. Weicon 16. Toyochem 17. Sapici 18. Fujifilm Corporation 19. RLA Polymers 20. Intertronics 21. Huber Group 22. Weilburger Holding. 23. Uflex Limited 24. Beijing Comens New Materials Frequently Asked Questions: 1. What is the growth rate of the Global Trencher Equipment market during the forecast period? Ans - The Global Laminating Adhesives Market is estimated to grow at a CAGR of 6.0% during the forecast period 2023-2030. 2. What is the Expected growth of the Global Trencher Equipment Market size from 2023 to 2030? Ans- The global laminating Adhesives Market size is estimated at US$ 3.81 billion in 2023. It is projected to reach US$ 5.73 billion by 2030. 3. Which region held the largest Laminating adhesives Market share in 2023? Ans-. The Asia Pacific region held the largest Laminating adhesives Market share in 2023. 4. What are the major trends that would shape the future Global laminating adhesives market? Ans- The emergence of solvent-less adhesives, and the shift towards ecofriendly options such as water-based adhesives are the future trends that are driving the market growth during the forecasted period. 5. What segments are covered in the Global Laminating adhesives Market report? Ans. The segments covered in the Laminating adhesives Market report are based on Technology, End-Use, resin, and Region.

1. Laminating Adhesives Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Laminating Adhesives Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2023) 2.3.5. Company Locations 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market FolAcrylicers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Laminating Adhesives Market: Dynamics 3.1. Laminating Adhesives Market Trends 3.2. Laminating Adhesives Market Dynamics 3.2.1. Laminating Adhesives Market Drivers 3.2.2. Laminating Adhesives Market Restraints 3.2.3. Laminating Adhesives Market Opportunities 3.2.4. Laminating Adhesives Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape 3.7. Key Opinion Leader Analysis for Laminating Adhesives Industry 3.8. Analysis of Government Schemes and Initiatives for Laminating Adhesives Industry 3.9. Laminating Adhesives Market Trade Analysis 3.10. The Global Pandemic Impact on Laminating Adhesives Market 4. Laminating Adhesives Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 4.1.1. Solvent-Based 4.1.2. Solvent-Less 4.1.3. Water-Based 4.1.4. Others 4.2. Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 4.2.1. Polyurethane 4.2.2. Acrylic 4.2.3. Polyester 4.2.4. Others 4.3. Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 4.3.1. Packaging 4.3.2. Automotive & Transportation 4.3.3. Industrial 4.3.4. Others 4.4. Laminating Adhesives Market Size and Forecast, by Region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Laminating Adhesives Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 5.1.1. Solvent-Based 5.1.2. Solvent-Less 5.1.3. Water-Based 5.1.4. Others 5.2. North America Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 5.2.1. Polyurethane 5.2.2. Acrylic 5.2.3. Polyester 5.2.4. Others 5.3. Others North America Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 5.3.1. Packaging 5.3.2. Automotive & Transportation 5.3.3. Industrial 5.3.4. Others 5.4. North America Laminating Adhesives Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Laminating Adhesives Market Size and Forecast, By Technology(2023-2030) 5.4.1.1.1. Solvent-Based 5.4.1.1.2. Solvent-Less 5.4.1.1.3. Water-Based 5.4.1.1.4. Others 5.4.1.2. United States Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 5.4.1.2.1. Polyurethane 5.4.1.2.2. Acrylic 5.4.1.2.3. Polyester 5.4.1.2.4. Others 5.4.1.3. United States Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 5.4.1.3.1. Packaging 5.4.1.3.2. Automotive & Transportation 5.4.1.3.3. Industrial 5.4.1.3.4. Others 5.4.2. Canada 5.4.2.1. Canada Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 5.4.2.1.1. Solvent-Based 5.4.2.1.2. Solvent-Less 5.4.2.1.3. Water-Based 5.4.2.1.4. Others 5.4.2.2. Canada Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 5.4.2.2.1. Polyurethane 5.4.2.2.2. Acrylic 5.4.2.2.3. Polyester 5.4.2.2.4. Others 5.4.2.3. Canada Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 5.4.2.3.1. Packaging 5.4.2.3.2. Automotive & Transportation 5.4.2.3.3. Industrial 5.4.2.3.4. Others 5.4.3. Mexico 5.4.3.1. Mexico Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 5.4.3.1.1. Solvent-Based 5.4.3.1.2. Solvent-Less 5.4.3.1.3. Water-Based 5.4.3.1.4. Others 5.4.3.2. Mexico Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 5.4.3.2.1. Polyurethane 5.4.3.2.2. Acrylic 5.4.3.2.3. Polyester 5.4.3.2.4. Others 5.4.3.3. Mexico Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 5.4.3.3.1. Packaging 5.4.3.3.2. Automotive & Transportation 5.4.3.3.3. Industrial 5.4.3.3.4. Others 6. Europe Laminating Adhesives Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 6.2. Europe Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 6.3. Europe Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 6.4. Europe Laminating Adhesives Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 6.4.1.2. United Kingdom Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 6.4.1.3. United Kingdom Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 6.4.2. France 6.4.2.1. France Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 6.4.2.2. France Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 6.4.2.3. France Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 6.4.3.2. Germany Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 6.4.3.3. Germany Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 6.4.4.2. Italy Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 6.4.4.3. Italy Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 6.4.5.2. Spain Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 6.4.5.3. Spain Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 6.4.6.2. Sweden Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 6.4.6.3. Sweden Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 6.4.7. Russia 6.4.7.1. Russia Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 6.4.7.2. Russia Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 6.4.7.3. Russia Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 6.4.8.2. Rest of Europe Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 6.4.8.3. Rest of Europe Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 7. Asia Pacific Laminating Adhesives Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 7.2. Asia Pacific Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 7.3. Asia Pacific Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 7.4. Asia Pacific Laminating Adhesives Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 7.4.1.2. China Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 7.4.1.3. China Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 7.4.2.2. S Korea Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 7.4.2.3. S Korea Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 7.4.3.2. Japan Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 7.4.3.3. Japan Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 7.4.4. India 7.4.4.1. India Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 7.4.4.2. India Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 7.4.4.3. India Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 7.4.5.2. Australia Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 7.4.5.3. Australia Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 7.4.6. ASEAN 7.4.6.1. ASEAN Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 7.4.6.2. ASEAN Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 7.4.6.3. ASEAN Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 7.4.7. Rest of Asia Pacific 7.4.7.1. Rest of Asia Pacific Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 7.4.7.2. Rest of Asia Pacific Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 7.4.7.3. Rest of Asia Pacific Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 8. Middle East and Africa Laminating Adhesives Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 8.2. Middle East and Africa Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 8.3. Middle East and Africa Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 8.4. Middle East and Africa Laminating Adhesives Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 8.4.1.2. South Africa Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 8.4.1.3. South Africa Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 8.4.2.2. GCC Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 8.4.2.3. GCC Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 8.4.3. Rest of ME&A 8.4.3.1. Rest of ME&A Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 8.4.3.2. Rest of ME&A Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 8.4.3.3. Rest of ME&A Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 9. South America Laminating Adhesives Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 9.1. South America Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 9.2. South America Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 9.3. South America Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 9.4. South America Laminating Adhesives Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 9.4.1.2. Brazil Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 9.4.1.3. Brazil Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 9.4.2.2. Argentina Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 9.4.2.3. Argentina Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Laminating Adhesives Market Size and Forecast, By Technology (2023-2030) 9.4.3.2. Rest Of South America Laminating Adhesives Market Size and Forecast, By Resins(2023-2030) 9.4.3.3. Rest Of South America Laminating Adhesives Market Size and Forecast, By End-Use (2023-2030) 10. Company Profile: Key Players 10.1. Vishay (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Henkel 10.3. H.B.Fuller 10.4. 3M 10.5. Ashland 10.6. Arkema (Bostik) 10.7. Coim Group 10.8. Vimasco Corporation 10.9. Flint Group 10.10. DIC Corporation 10.11. L.D.Davis 10.12. Masterbond 10.13. Paramelt 10.14. Franklin International 10.15. Weicon 10.16. Toyochem 10.17. Bond Tech Industries 10.18. Sapici 10.19. Fujifilm Corporation 10.20. RLA Polymers 10.21. Intertronics 10.22. Huber Group 10.23. Weilburger Holding. 10.24. Uflex Limited 10.25. Beijing Comens New Materials 11. Key Findings 12. Analyst Recommendations 13. Laminating Adhesives Market: Research Methodology