Kefir Market size was valued at US$ 1.44 Bn. in 2022 and the total revenue is expected to grow at 5.5% through 2023 to 2029, reaching nearly US$ 2.10 Bn.Global Kefir Market Overview:

Kefir is a fermented beverage prepared from yeasts and bacteria found in kefir grains. They are little, opaque, whitish, jelly-like orbs that resemble miniature cauliflower bits. Calcium, protein, niacin, vitamin B12, and folic acid are all abundant in kefir. Kefir's increased accessibility and popularity in recent years are most likely owing to its health benefits. Kefir's health advantages extend beyond its probiotics. According to one study, mice who took kefir for seven days had anti-inflammatory and healing properties. Another study discovered that kefir may help decrease cholesterol and boost the immune system.To know about the Research Methodology :- Request Free Sample Report

Global Kefir Market Dynamics:

Globalization and the international trade of various foods have played an important role in the acceptance of kefir in various countries. Twenty-to-thirty-year-olds and Generation Z, who account for a sizable portion of today's buyers, have a strong desire for high-quality food and beverages. As a result, kefir's popularity as a healthy beverage among consumers globally has grown. This ultimately persuades firms to exhibit new things in varied topographies while also experimenting with their taste and flavour. Kefir is no longer considered a specialty food since its popularity has grown year after year. It is used to manufacture a variety of products, including drinks, smoothies, cups, frozen, pockets, and supplements, and a variety of companies sell these items. GUTsy Captain, for example, sent out shimmering water kefir drinks in June 2019. The veggie lover drink is produced with leafy foods kefir grains and is available in four flavours: unique, ginger and lemon, Atlantic raspberry, and cola. The goods are available in 330mL jars at Sainsbury's, Wholefoods, and Grape Tree stores for GBP 1.80. Kefir has a lot of bacteria, which aids digestion and gives it a higher nutrient content than yoghurt. This, in turn, boosts the preference for kefir consumption among lactose-intolerant people all over the world. Furthermore, the health benefits of kefir consumption, including better immunity and cancer-fighting qualities, are viewed as a crucial element supporting the target market's growth in the near future. Organic kefir, which is widely accessible in the market, is lactose-free, gluten-free, and made from organic, non-GMO ingredients, which enhances its consumption due to consumers' self-proclaimed health views. The item is typically sweet with light acidity. It has a smooth top and smells like a combination of yogurt and cheesecake. To make the item financially profitable, it must gain prominence and a predisposition for its flavour. Numerous restaurants, cafés, and bistros have included kefir products on their menus. LEON restaurants Limited, a budget food business established in the United Kingdom, sells a strawberry banana kefir smoothie. The café says that the beverage is lactose-free and beneficial to the digestive system. However, high manufacturing costs for kefir, combined with a lack of manufacturers in many countries, are important factors limiting the global market growth.Kefir's health benefits are expected to drive the growth of the kefir market:

Kefir, a drink made from milk and fermented kefir grains, is a good source of probiotics. It has a large concentration of vitamins and minerals and is also a good source of protein. This is also high in vitamin K, calcium, vitamin B12, biotin, enzymes, vitamin B9, and other nutrients required for normal body function. Contains sufficient amounts of bacteria that aid in the healthy functioning of the digestive system. Kefir aids in the stimulation of the immune system as well as the reduction of cholesterol levels. It also aids in the regulation of blood sugar levels and the lowering of body weight. The fermentation process improves the health benefits of food, owing to the diverse variety of probiotics and enhanced bioavailability. Kefir has a variety of health advantages, including better digestive health, bone health, and skin health. It also has antifungal and antibacterial characteristics, which help in the fight against food-borne pathogens, as well as in the treatment and prevention of vaginal and gastrointestinal infections. It also possesses anticarcinogenic effects, which aid in the prevention of early-stage tumour progression. So, these major benefits drive the growth of the kefir market during the forecast period.COVID-19 Impact on Kefir market:

The COVID-19 epidemic and subsequent lockdown caused economic concern and supply chain disruption. Furthermore, throughout the epidemic, there was a shift in client spending patterns. Kefir demand has decreased as a result of regional lockdowns and a ban on international trade. Consumers choose to buy provisions, which slackened the demand for flavoured kefir milk and kefir yoghurt. The market for kefir, on the other hand, is projected to rebound as people's knowledge of health and fitness grows.Segment Analysis:

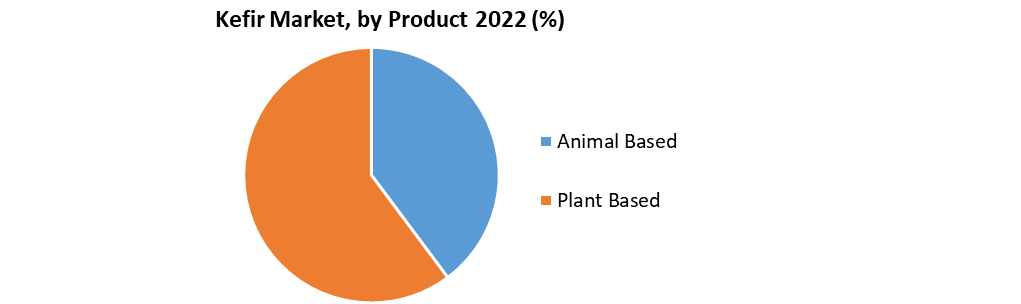

The global kefir market is segmented by Category, Product, and Distribution Channel. Based on Product, the global kefir Butter market is sub-segmented into Animal Based and Plant Based. The Animal Based segment held the largest market share of 73.81% in 2022. These items are gotten from dairy cattle milk and will stay a vital decision among the buyers of Scandinavia and Eastern European nations. The development of creature-based kefir items is credited to the first movers and high item entrance in quite a while. However, the plant-based segment is expected to grow at the highest CAGR of 5.45% during the forecast period. Developing reception of veganism is advancing the interest in plant-based kefir items. The item is likewise to a great extent reasonable for individuals who are oversensitive to drain and is consequently acquiring prevalence. SQUAMISH WATER KEFIR CO., a Canada-based organization, offers shining water kefir in four flavors, including hibiscus, lemon ginger, blood orange, and mint. Kefir, water, pure sweetener, and common enhancing specialists structure these beverages. Based on Distribution Channel, the global kefir market is sub-segmented into Online and Offline. The Offline segment held a largest share of xx% in 2022. The channel incorporates retail location, including a claim to fame stores, mother-and-pop stores, retail chains, odds and ends shops, hypermarkets, general stores, and superstores. The nearness of these stores, alongside the accessibility of a wide assortment of items, is a significant explanation for persuading individuals to purchase through disconnected channels. Moreover, the vast majority are inclined toward purchasing food supplies through these channels and profit the most extreme rebate. However, the online channel segment is expected to grow at the highest CAGR of 6.42% during the forecast period. The rising reliance of the recent college grads on internet business channels inferable from expanding need for comfort and developing occupied ways of life is impelling the pattern of shopping for food through online stages. Besides, kefir is certainly not a local food across Latin America and the Asia Pacific, and in this manner its accessibility is restricted in actual stores. In this manner, online channels are progressively liked for purchasing not-so-regular fixings.

Regional Insights:

Europe dominates the global Kefir Market during the forecast period 2023-2029. The Asia Pacific held the largest market share of 47% in 2020. Kefir is popular in Eastern European countries, where it is thought to assist balance of digestive systems and relieves irritable bowel syndrome symptoms. Consumers in the region are becoming more interested in kefir products and their nutritional and health benefits. In Germany, for example, individuals are increasingly drinking kefir for its added health benefits. Additionally, greater product awareness in the region is propelling the market growth. North America held the 2nd largest market share of xx% in 2022. The United States is North America's largest market, with major shifts in consumer tastes, particularly among high-income consumers. Rising health concerns in the area, together with the efficacy of probiotics in addressing health difficulties, are projected to be important drivers of probiotics market expansion. Increased disposable income, a broader probiotics portfolio, and greater product accessibility are all projected to help the industry demand yogurt and kefir. However, Asia Pacific is expected to grow at the highest CAGR of 5.7% in the global kefir market during the forecast period. Nations including Japan, Australia, and New Zealand are relied upon to drive the local market development because of expanding mindfulness among the shoppers with respect to matured milk items in the course of recent years. The objective of the report is to present a comprehensive analysis of the global Almond Butter Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also helps in understanding the global Almond Butter Market dynamic, structure by analyzing the market segments and project the global Almond Butter Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Almond Butter Market make the report investor’s guide.Kefir Market Scope: Inquire before buying

Kefir Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 1.44 Bn. Forecast Period 2023 to 2029 CAGR: 5.5 % Market Size in 2029: US $ 2.10 Bn. Segments Covered: by Category Flavored Non-Flavored by Product Animal Based Plant Based by Distribution Channel Online Offline by Nature Organic Conventional by Application Foods and beverages Pharmaceutical Kefir Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest)Kefir Market Key Players

1.The Iceland Milk and Skyr Corp. 2.Lifeway Foods, Inc. 3.The Hain Celestial Group, Inc. 4.Nestlé S.A. 5.Danone S.A. 6.Fresh Made Dairy 7.Green Valley Creamery 8.Maple Hill Creamery, LLC 9.Redwood Hill Farm & Creamery 10.DuPont 11.Liebert Corporation 12.Nourish Kefir 13.OSM Krasnystaw 14.Best of Farms LLC 15.Babushka Kefir 16.Valio Eesti AS 17.Bakoma Sp. z o. o. 18.Biotiful Dairy Ltd 19.Valio 20.Les Produits de marque liberte Inc.Frequently Asked Questions:

1] What segments are covered in Kefir Market report? Ans. The segments covered in Kefir Market report are based on Category, Product ,Application, Distribution Channel and Nature. 2] Which region is expected to hold the highest share in the global Kefir Market? Ans. Europe is expected to hold the highest share in the global Kefir Market. 3] What is the market size of global Kefir Market by 2029? Ans. The market size of global Kefir Market by 2029 is US $ 2.10 Bn. 4] Who are the top key players in the global Kefir Market? Ans. The Iceland Milk and Skyr Corp., Lifeway Foods, Inc., The Hain Celestial Group, Inc., Nestlé S.A., and Danone S.A. are the top key players in the global Kefir Market. 5] What was the market size of global Kefir Market in 2022? Ans. The market size of global Kefir Market in 2022 was US $ 1.44 Bn. 6] By Product, What segments are covered in global Kefir Market report? Ans. The segments covered in global Kefir Market report by Product are Animal Based and Plant Based.

1. Global Kefir Market: Research Methodology 2. Global Kefir Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Kefir Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Kefir Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Kefir Market Segmentation 4.1 Global Kefir Market, by Category (2022-2029) • Flavored • Non-Flavored 4.2 Global Kefir Market, by Product (2022-2029) • Animal Based • Plant Based 4.3 Global Kefir Market, by Distribution Channel (2022-2029) • Online • Offline 4.4 Global Kefir Market, by Nature (2022-2029) • Organic • Conventional 4.5 Global Kefir Market, by Application (2022-2029) • Foods and beverages • Pharmaceutical 5. North America Kefir Market(2022-2029) 5.1 North America Kefir Market, by Category (2022-2029) • Flavored • Non-Flavored 5.2 North America Kefir Market, by Product (2022-2029) • Animal Based • Plant Based 5.3 North America Kefir Market, by Distribution Channel (2022-2029) • Online • Offline 5.4 North America Kefir Market, by Nature (2022-2029) • Organic • Conventional 5.5 North America Kefir Market, by Application (2022-2029) • Foods and beverages • Pharmaceutical 5.6 North America Kefir Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Kefir Market (2022-2029) 6.1. European Kefir Market, by Category (2022-2029) 6.2. European Kefir Market, by Product (2022-2029) 6.3. European Kefir Market, by Distribution Channel (2022-2029) 6.4. European Kefir Market, by Nature (2022-2029) 6.5. European Kefir Market, by Application (2022-2029) 6.6. European Kefir Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Kefir Market (2022-2029) 7.1. Asia Pacific Kefir Market, by Category (2022-2029) 7.2. Asia Pacific Kefir Market, by Product (2022-2029) 7.3. Asia Pacific Kefir Market, by Distribution Channel (2022-2029) 7.4. Asia Pacific Kefir Market, by Nature (2022-2029) 7.5. Asia Pacific Kefir Market, by Application (2022-2029) 7.6. Asia Pacific Kefir Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Kefir Market (2022-2029) 8.1 Middle East and Africa Kefir Market, by Category (2022-2029) 8.2. Middle East and Africa Kefir Market, by Product (2022-2029) 8.3. Middle East and Africa Kefir Market, by Distribution Channel (2022-2029) 8.4. Middle East and Africa Kefir Market, by Nature (2022-2029) 8.5. Middle East and Africa Kefir Market, by Application (2022-2029) 8.6. Middle East and Africa Kefir Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Kefir Market (2022-2029) 9.1. South America Kefir Market, by Category (2022-2029) 9.2. South America Kefir Market, by Product (2022-2029) 9.3. South America Kefir Market, by Distribution Channel (2022-2029) 9.4. South America Kefir Market, by Nature (2022-2029) 9.5. South America Kefir Market, by Application (2022-2029) 9.6. South America Kefir Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 The Iceland Milk and Skyr Corp 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Lifeway Foods, Inc. 10.3 The Hain Celestial Group, Inc. 10.4 Nestlé S.A. 10.5 Danone S.A. 10.6 Fresh Made Dairy 10.7 Green Valley Creamery 10.8 Maple Hill Creamery, LLC 10.9 Redwood Hill Farm & Creamery 10.10 DuPont 10.11 Liebert Corporation 10.12 Nourish Kefir 10.13 OSM Krasnystaw 10.14 Best of Farms LLC 10.15 Babushka Kefir 10.16 Valio Eesti AS 10.17 Bakoma Sp. z o. o. 10.18 Biotiful Dairy Ltd 10.19 Valio 10.20 Les Produits de marque liberte Inc. 10.21 10.22 Organic 10.23 Conventional 10.24 BY aapp 10.25 Foods and beverages 10.26 Pharmaceutical