Milk Alternatives Market size is expected to reach nearly US$ 54.18 Bn by 2029 with the CAGR of 10% during the forecast period. The Global Milk Alternatives market report is a comprehensive analysis of the industry, market, and key players. The report has covered the market by demand and supply-side by segments. The global Hominy Feed market report also provides trends by market segments, technology, and investment with a competitive landscape.To know about the Research Methodology :- Request Free Sample Report

Milk Alternatives Market Overview

Prevalence of health issues caused due to consumption of high-calorie milk impacted positive growth of milk alternatives. Milk alternatives are substitutes or replacements of original milk that people drink. many people have stopped taking cow milk because of a variety of reasons such as some are allergic, some follow vegan & ethical diet, some found ethical issues while consuming animals based product, and many others According to the reports of the National Institutes of Health around 65% of the human population finds it difficult to digest lactose, a type of sugar found in milk. Milk alternatives are low in fat, calories, sugar, and more water content. Being available in different types, milk alternatives are gaining popularity over cow milk and other dairy products but are expensive. Each alternative has its own nutritional, calcium, mineral, texture, and protein value making people choose from a wide range of available milk alternatives. Different brand will have different compositions of nutrition.Milk Alternatives Market Dynamics

Rising consumer awareness and added health benefits of consumption of milk alternatives’ impacted positively on markets growth. With rapid urbanization and increasing incidences of health problems like obesity, diabetes, high cholesterol level, blood sugar especially in the Asian pacific region the market for milk alternatives has grown. Development in the production of more milk substitutes in developed nations has led to more demand for organic, natural and healthy milk alternatives. Because of its compositions, milk alternatives are consumed in different quantities. Moreover, increased per capita income and shift in lifestyle with high availability of milk alternatives has fueled the market growth. Perceiving increased demand in the market for milk alternatives, investment by key market players for innovation and development has increased resulting in the production of new milk substitutes, with means of new technologically advanced methods has driven the growth of the milk alternatives market. Increased use of Milk Alternatives in various end-user industry owning to its benefits and mineral properties combined with growing consumer and end-user knowledge about the presence of natural and genetically modified hormones in milk has impacted cow’s milk to be considered as a part of a healthy diet and has grown milk alternatives market. Furthermore, consumption of every type of milk whether it's of cow, ox, goat, or any other alternative has a negative impact on the body. Although milk alternatives are low in calories and sugar but still have some amount of sugar which can lead to several health issues like heart disease, Type 2 diabetes, obesity, increased risk of ovarian & breast cancer, and others that are affecting markets growth.Milk Alternatives Market Segment Analysis:

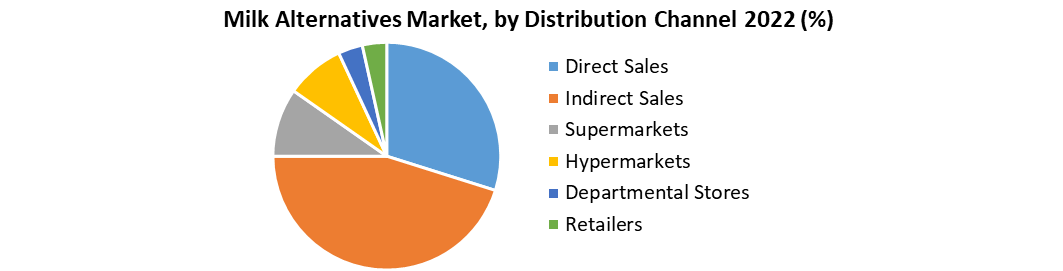

By type, soy milk dominated the global milk alternative market for over a decade due to its health benefits such as lowering heart disease and having nutritional value similar to cow milk. Soy milk is the most preferred choice of the consumer as a milk alternative because of its high protein richness, soy milk offers 7 grams of protein per cup served as compared to of cow milk at 8 grams per cup. It is available in different varieties and calorie versions which makes it the most preferred choice of milk alternative. Followed by almond milk which is gaining popularity among the young population due to its richness in iron, zinc, phosphorus, and copper. Coconut milk and cashew milk are witnessing growth as well and high preference as a milk alternative. Though they both are new in the market but offer yielded nutritional value and fewer fats. Cashew milk is the newest type of alternative in the market. A creamy liquid obtained by blending cashew with water, offering calcium and vitamin A, D, and B12. Coconut milk is creamy and sweet, offering 30% of daily needed vitamin D and 50% of Vitamin B-12 making it a part of a healthy diet. By distribution channel, indirect sales held the largest market share in recent years due to market expansion, increased population and rising demand of all types of consumers. Moreover, availability of alternatives, space, and low cost of commencing the segment of a supermarket and departmental stores dominated the market. With indirect channel companies gain more competitive advantage, more access to the large consumer base without disturbing consumer choices to gain more insight on product and market development. The retail segment is growing as well due to the increased preference of customers to buy from a near and local store at affordable prices.

Regional Insights:

Asia-Pacific held the largest market share for milk alternatives for more than 40% of global revenue. Rising per capita income in developing economies like India, japan impacted positively on market growth. Moreover, the prevalence of health issues like blood sugar, high blood pressure, obesity, and cardiovascular problems in these nations are high which prompted the consumption of lactose-free, chemical, and fat-free milk in the region. Milk alternatives can play a part as inexpensive substitutes of milk for the poor class in these economies which played a role of catalyzer for the market growth of the region. North America and Europe are the developing regions in the market due to an increase in the consumption of milk alternatives by the young population owing to its nutritional and mineral value. Increased demand for flavored milk alternatives such as almond milk, soy milk, coconut milk, and others and further use of milk alternatives for the production of various food items has grown the North American region's market. The European market is anticipated to yield the fastest market growth because of increased demand for flavored milk and the prevalence of chronic health problems in the region. South America and the Middle East and Africa are witnessing growth as well primarily due to rapid urbanization in the region. Increased consumer choice for consuming less calorie beverage, rise in industrial development and preference for more non-dairy-based product impacted positively market growth of South America. Moreover, more consumption of milk alternatives as a beverage in the Middle East nation due to its tastes and health benefits has grown the market. The objective of the report is to present a comprehensive analysis of the Global Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Global Market dynamics, structure by analyzing the market segments and project the Global Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Global Market make the report investor’s guide.Milk Alternatives Market Scope: Inquire before buying

Milk Alternatives Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 27.80 Bn. Forecast Period 2023 to 2029 CAGR: 10% Market Size in 2029: US $ 54.18 Bn. Segments Covered: by Type Soy Milk Coconut Milk Cashew Milk Almond Milk Rice Milk Pea Milk Hemp Milk by Distribution Channel Direct Sales Indirect Sales Supermarkets Hypermarkets Departmental Stores Retailers Milk Alternatives Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Holland, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, New Zealand, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Key Players:

1. Edward & Sons Trading Co. 2. Earth's Own Food Company 3. Goya Foods Inc. 4. Eden Foods Inc. 5. Califia Farms 6. Ripple Foods 7. Hudson River Foods 8. Freedom Fruit Group Ltd 9. Kikkoman Corporation 10 Campbell soup Company 11 Vitasoy International Holdings 12 Group Danone 13 The Whitewaves Food Company 14 Living Harvest Food Frequently Asked Questions: 1. Which region has the largest share in Global Milk Alternatives Market? Ans: Asia Pacific region holds the highest share in 2022. 2. What is the growth rate of Global Milk Alternatives Market? Ans: The Global Milk Alternatives Market is growing at a CAGR of 10% during forecasting period 2023-2029. 3. What is scope of the Global Milk Alternatives market report? Ans: Global Milk Alternatives Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Milk Alternatives market? Ans: The important key players in the Global Milk Alternatives Market are – Edward & Sons Trading Co., Earth's Own Food Company, Goya Foods Inc., Eden Foods Inc., Califia Farms, Ripple Foods, Hudson River Foods, Freedom Fruit Group Ltd, Kikkoman Corporation, Campbell soup Company, 5. What is the study period of this market? Ans: The Global Milk Alternatives Market is studied from 2022 to 2029.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Milk Alternatives Market Size, by Market Value (US$ Mn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2022 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Milk Alternatives Products Market 3.4. Geographical Snapshot of the Milk Alternatives Products Market, By Manufacturer share 4. Global Milk Alternatives Market Overview, 2022-2029 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Global Milk Alternatives Market 5. Supply Side and Demand Side Indicators 6. Global Milk Alternatives Market Analysis and Forecast, 2022-2029 6.1 Milk Alternatives Market Size & Y-o-Y Growth Analysis 7. Global Milk Alternatives Market Analysis and Forecasts, 2022-2029 7.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 7.1.1. Soy Milk 7.1.2. Coconut Milk 7.1.3. Cashew Milk 7.1.4. Almond Milk 7.1.5. Rice Milk 7.1.6. Pea Milk 7.1.7. Hemp Milk 7.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 7.2.1. Direct Sales 7.2.2. Indirect Sales 7.2.2.1 Supermarkets 7.2.2.2 Hypermarkets 7.2.3.3 Departmental Stores 7.2.3.4 Retailers 7.3. Market Size (Value) Estimates & Forecast by Region, 2022-2029 7.3.1. North America 7.3.2. South America 7.3.3. Europe 7.3.4. Asia Pacific 7.3.5. Middle East and Africa 8. North America Milk Alternatives Market Analysis and Forecasts, 2022-2029 8.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 8.1.1. Soy Milk 8.1.2. Coconut Milk 8.1.3. Cashew Milk 8.1.4. Almond Milk 8.1.5. Rice Milk 8.1.6. Pea Milk 8.1.7. Hemp Milk 8.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 8.2.1. Direct Sales 8.2.2. Indirect Sales 8.2.2.1 Supermarkets 8.2.2.2 Hypermarkets 8.2.3.3 Departmental Stores 8.2.3.4 Retailers 9. North America Milk Alternatives Market Analysis and Forecasts, By Country 9.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 9.1.1. US 9.1.2. Canada 9.1.3. Mexico 10. U.S. Milk Alternatives Market Analysis and Forecasts, 2022-2029 10.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 10.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 11. Canada Milk Alternatives Market Analysis and Forecasts, 2022-2029 11.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 11.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 12. Mexico Milk Alternatives Market Analysis and Forecasts, 2022-2029 12.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 12.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 13. Europe Milk Alternatives Market Analysis and Forecasts, 2022-2029 13.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 13.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 14. Europe Milk Alternatives Market Analysis and Forecasts, By Country 14.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 14.1.1. U.K 14.1.2. France 14.1.3. Germany 14.1.4. Italy 14.1.5. Spain 14.1.6. Sweden 14.1.7. CIS Countries 14.1.8. Rest of Europe 15. U.K. Milk Alternatives Market Analysis and Forecasts, 2022-2029 15.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 15.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 16. France Milk Alternatives Market Analysis and Forecasts, 2022-2029 16.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 16.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 17. Germany Milk Alternatives Market Analysis and Forecasts, 2022-2029 17.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 17.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 18. Italy Milk Alternatives Market Analysis and Forecasts, 2022-2029 18.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 18.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 19. Spain Milk Alternatives Market Analysis and Forecasts, 2022-2029 19.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 19.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 20. Sweden Milk Alternatives Market Analysis and Forecasts, 2022-2029 20.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 20.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 21. CIS Countries Milk Alternatives Market Analysis and Forecasts, 2022-2029 21.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 21.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 22. Rest of Europe Milk Alternatives Market Analysis and Forecasts, 2022-2029 22.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 22.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 23. Asia Pacific Milk Alternatives Market Analysis and Forecasts, 2022-2029 23.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 23.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 24. Asia Pacific Milk Alternatives Market Analysis and Forecasts, by Country 24.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 24.1.1. China 24.1.2. India 24.1.3. Japan 24.1.4. South Korea 24.1.5. Australia 24.1.6. ASEAN 24.1.7. Rest of Asia Pacific 25. China Milk Alternatives Market Analysis and Forecasts, 2022-2029 25.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 25.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 26. India Milk Alternatives Market Analysis and Forecasts, 2022-2029 26.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 26.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 27. Japan Milk Alternatives Market Analysis and Forecasts, 2022-2029 27.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 27.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 28. South Korea Milk Alternatives Market Analysis and Forecasts, 2022-2029 28.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 28.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 29. Australia Milk Alternatives Market Analysis and Forecasts, 2022-2029 29.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 29.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 30. ASEAN Milk Alternatives Market Analysis and Forecasts, 2022-2029 30.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 30.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 31. Rest of Asia Pacific Milk Alternatives Market Analysis and Forecasts, 2022-2029 31.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 31.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 32. Middle East Africa Milk Alternatives Market Analysis and Forecasts, 2022-2029 32.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 32.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 33. Middle East Africa Milk Alternatives Market Analysis and Forecasts, by Country 33.1. Market Size (Value) Estimates & Forecast by Country, 2022-2029 33.1.1. South Africa 33.1.2. GCC Countries 33.1.3. Egypt 33.1.4. Nigeria 33.1.5. Rest of ME&A 34. South Africa Milk Alternatives Market Analysis and Forecasts, 2022-2029 34.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 34.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 35. GCC Countries Milk Alternatives Market Analysis and Forecasts, 2022-2029 35.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 35.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 36. Egypt Milk Alternatives Market Analysis and Forecasts, 2022-2029 36.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 36.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 37. Nigeria Milk Alternatives Market Analysis and Forecasts, 2022-2029 37.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 37.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 38. Rest of ME&A Milk Alternatives Market Analysis and Forecasts, 2022-2029 38.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 38.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 39. South America Milk Alternatives Market Analysis and Forecasts, 2022-2029 39.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 39.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 40. South America Milk Alternatives Market Analysis and Forecasts, by Country 40.1. Market Size (Value) Estimates & Forecast by Country, 2022-2029 40.1.1. Brazil 40.1.2. Argentina 40.1.3. Rest of South America 41. Brazil Milk Alternatives Market Analysis and Forecasts, 2022-2029 41.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 41.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 42. Argentina Milk Alternatives Market Analysis and Forecasts, 2022-2029 42.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 42.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 43. Rest of South America Milk Alternatives Market Analysis and Forecasts, 2022-2029 43.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 43.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2022-2029 44. Competitive Landscape 44.1. Geographic Footprint of Major Players in the Global Milk Alternatives Market 44.2. Competition Matrix 44.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Distribution Channels and R&D Investment 44.2.2. New Product Launches and Product Enhancements 44.2.3. Market Consolidation 44.2.3.1. M&A by Regions, Investment and Verticals 44.2.3.2. M&A, Forward Integration and Backward Integration 44.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 44.3. Company Profile : Key Players 44.3.1. Campbell soup Company 44.3.1.1. Company Overview 44.3.1.2. Financial Overview 44.3.1.3. Geographic Footprint 44.3.1.4. Product Portfolio 44.3.1.5. Business Strategy 44.3.1.6. Recent Developments 45.3.2 Edward & Sons Trading Co. 45.3.3 Earth's Own Food Company 45.3.4 Goya Foods Inc. 45.3.5 Eden Foods Inc. 45.3.6 Califia Farms 45.3.7 Ripple Foods 45.3.8 Hudson River Foods 45.3.9 Freedom Fruit Group Ltd 45.3.10 Kikkoman Corporation 45.3.11 Vitasoy International Holdings 45.3.12 Group DANONE 45.3.13 The Whitewaves Food Company 45.3.14 Living Harvest Food 45.3.15 Eden Foods 46 Primary Key Insight