IoT in Construction Market size was valued at USD 10.64 Billion in 2023 and IoT in Construction Revenue is expected to grow at a CAGR of 15.35% from 2024 to 2030, reaching nearly USD 28.91 Billion in 2030.IoT in Construction Market Overview:

IoT technologies are key to digitalization in the construction industry. Sensors, asset monitors, wearables, and integration with building information modeling (BIM) all improve safety, productivity, and, therefore, profit margins. IoT has diverse applications in construction, from wearables for worker safety to sensors for structural health monitoring. The IoT solutions are designed to enhance project management and industry efficiency, ensuring that construction projects are completed on time and within budget. However, the construction industry has been relatively slow in adopting and capitalizing on new technologies like IoT.To know about the Research Methodology :- Request Free Sample Report The IoT in Construction Market report delivers a thorough examination of the sector, detailing market divisions based on type, application, and geographical region. The Report presents information on market size, market share, growth trajectory, the competitive framework, and primary motivating and limiting factors. The study also delves into key industry patterns, market movements, and the competitive advantages that influence market growth. 1. In March 2023, Autodesk introduced facility monitoring Beta for Tandem, a digital twin application of Autodesk for AEC. Tandem go deep into the data lake and get useful information, identify usage patterns and trends, and zero in on problems. The workers analyze the performance of offices remotely and observe how everything is developed, installed, and connected because of a digital twin with facilities monitoring capabilities.

IoT in Construction Market Dynamics:

Transforming Construction Safety and Efficiency to Drive the IoT in Construction Market IoT in construction is reshaping construction site safety significantly. The construction industry is using IoT devices, like smart helmets and drones, to protect workers from hazards. These IoT solutions monitor environmental risks, sending alerts about hazardous conditions like high carbon monoxide levels, extreme temperatures, or noise. The IoT technology used in drones allows construction companies to inspect the stability of structures on construction sites, negating the need for workers to risk climbing high structures. IoT enables the production of a digital real-time job site map, complete with updated dangers associated with the activity, and alerts every worker when they are approaching a risk or entering a dangerous environment. Ongoing cost reductions in IoT in Construction production and installation, driven by economies of scale, technological advancements, and increased competition, make these solutions more affordable and accessible. Integrating IoT in construction has revolutionized the management of resources and budgeting in the construction industry. IoT devices, especially IoT sensors, provide real-time data, enabling construction companies to optimize power and fuel usage, minimize waste, and enhance construction project efficiency. At construction sites, these sensors monitor material conditions, ensuring suitability and preventing damages caused by environmental factors. Construction firms now leverage IoT technology to monitor equipment and machinery, maximizing utilization and ensuring construction site safety. Also, rising awareness about environmental sustainability and the need to reduce carbon emissions drive the IoT in Construction solutions.Overcoming Challenges in IoT Adoption for Construction Construction is a traditional industry that has been slow to adopt new technologies. Many construction companies and workers resist the adoption of IoT devices thanks to unfamiliarity with the technology or a perceived lack of benefits. IoT devices rely on reliable internet connectivity, which is limited in some construction sites. The lack of infrastructure limits the use of IoT devices, particularly in remote or rural areas. Security represents a critical component for enabling the widespread adoption of IoT technologies and applications. Without guarantees in terms of system-level confidentiality, authenticity, and privacy the relevant stakeholders are unlikely to adopt IoT solutions on a large scale. Additionally, in the IoT vision, a prominent role is played by wireless communication technologies. The ubiquitous adoption of the wireless medium for exchanging data poses new issues in terms of privacy violation. Wireless channel increases the risk of violation thanks to the remote access capabilities, which potentially expose the system to eavesdropping and masking attacks. Also, the Characteristics of IoT devices and the ways they are used redefine the debate about privacy issues, because they dramatically change how personal data is collected, analyzed, used, and protected.

IoT in Construction Market Segment Analysis:

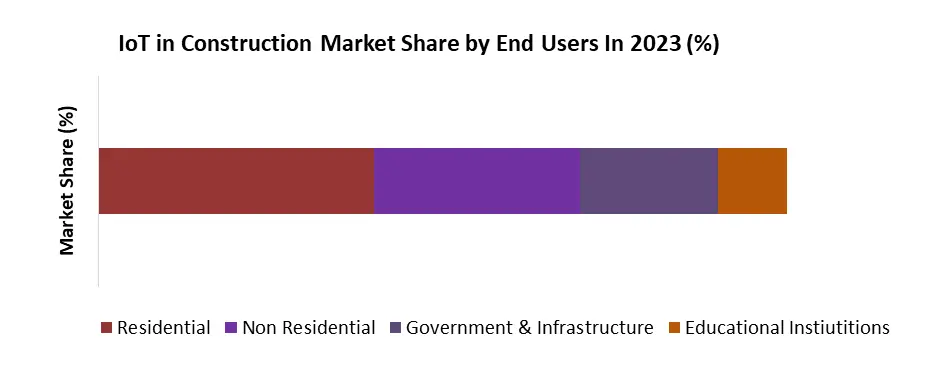

By End Users, Government, and Public Infrastructure segment held 20 % market share in IoT inConstruction Market. The Internet of Things (IoT) holds significant transformative potential in governance by revolutionizing the way governments and public institutions operate. IoT devices gather real-time data on various aspects of governance, such as traffic flow, energy consumption, and air quality, enabling better decision-making through data-driven insights. The city has implemented an Advanced Traffic Management System that uses real-time data from cameras and sensors to optimize traffic signal timings, reduce congestion, and improve overall traffic flow. The SFpark program uses sensors and real-time data to help drivers find available parking spaces. It reduces traffic congestion and fuel consumption by minimizing the time spent searching for parking. Governments around the world are focused on building resilience. 5G and IoT provide solutions in critical areas like food resilience. For farmers, that means producing more food with fewer resources (water, fertilizer, pesticides, and more). A technology-first approach helps to pull data from sensors, artificial intelligence creates predictive models to reduce risk and inefficiency. The systems also monitor crops and soil conditions, providing farmers with real-time data to adjust and deploy resources and even run farming tasks remotely. According to the American Society of Civil Engineers (ASCE), pipes lost the equivalent of $7.6 billion of treated water in 2019. 5 With 5G, leaks are quickly detected using smart water monitoring that collects real-time data on pipes, pumps, valves, motors, and more. Gathering watershed and treatment plant data and achieving a better understanding of pollution and quality issues, acting faster to address the root cause. Real-world examples of IoT in smart cities are practically endless. San Diego, for example, deployed a four-phase initiative to install smart stoplights that share data to reduce commuting time by almost 25%. According to the Los Angeles Times, a collaboration between the city of Los Angeles, Google, and Caltech used IoT sensors and machine learning to identify and count the city's trees to support efforts in urban forestation. Not just the big metropolitan areas reap the benefits the city of Beverly, Massachusetts, has partnered with Verizon in deploying 3,500 connected lights that leverage Verizon's Intelligent Lighting controls and cellular network.

IoT in Construction Market Regional Insight:

North America has dominated in IoT Construction Market. The Internet of Things (IoT) is an emerging technological innovation that offers the construction market insights and practical advantages. Internet-connected devices on construction sites provide data on actions, conditions (including weather) performance, and even skills, allowing better-informed decisions to be made on a day-by-day basis, and when planning projects. In North America, Atkins Realis is pioneering the use of IoT sensors to develop better maintenance strategies, more efficient materials use, finer-tuned logistics, and safer working practices. The maturation of IoT is used to support defragmentation in a sector that often struggles to streamline project management. The ability to use aggregated real-time data to underpin decision-making is a fundamental change in the construction market. United States has a higher adoption rate of technology followed by Canada and Mexico. Asia Pacific is fastest fastest-growing region in IoT in the Construction Market. The Chinese government is actively attempting to influence international technical standards for the IoT that benefit Chinese companies at the expense of U.S. and other foreign counterparts. As information technology (IT) industry precedents have shown, the competition over technical standards touches on a larger contest about intellectual property ownership, market advantage, international prestige, and approaches to privacy, security, and control of data. China is currently leveraging a more coordinated and comprehensive strategy than the United States to influence relevant standards for the IoT, and U.S. entities are often absent from key international standardization processes. China has increased its participation in international standards institutions, where it shows a preference for multilateral (one country, one vote) standards institutions over U.S.-backed multi-stakeholder institutions. Chinese nominees leading the organizations work in tandem with national Chinese standards development efforts and push China’s agenda from their official platforms. A large amount of investment is required to modernize the energy infrastructure in Asia and the Pacific to achieve the benefits of IoT. It’s noted that the investment is much less than the larger infrastructure investment.IoT in Construction Market Competitive Landscape: 1. In May 2023, NTT Communication announced plans to invest USD 59 billion in data centers, Artificial Intelligence (AI), and other growth areas in the next five years. It has allocated around USD 11 billion to building or modernizing its data centers and approximately USD 22 billion to the digital business segment which includes AI 7 robotics. 2. Mar-2023, Topcon Positioning Systems took over Digital Construction Works, a construction software and data integration and services company. Being a part of Topcon, the DCW integrations platform improves the value of Topcon's compatibility with outside software that is frequently used to carry out machine-guided tasks.

IoT in Construction Market Report Scope: Inquire before buying

IoT in Construction Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 10.64 Bn. Forecast Period 2024 to 2030 CAGR: 15.35% Market Size in 2030: US $ 28.91 Bn. Segments Covered: by Product Hardware Software Services Others by Application Safety Asset Monitoring Predictive Maintenance Wearable’s Remote Operations Fleet Management Others by End User Residential Non-Residential Government and Public Infrastructure Educational Institutions IoT in Construction Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)IoT in Construction Market Key Players

1. Bosch - Germany 2. Caterpillar - United States 3. Trimble - United States 4. Procore Technologies - United States 5. Autodesk - United States 6. Oracle - United States 7. Siemens - Germany 8. Hilti - Liechtenstein 9. IBM - United States 10. Johnson Controls - Ireland 11. Schneider Electric - France 12. Honeywell - United States 13. Dell Technologies - United States 14. Microsoft - United States 15. DeWalt (Stanley Black & Decker) - United States 16. Hewlett Packard Enterprise (HPE) - United States 17. Cisco Systems - United States 18. Emerson Electric Co. - United States 19. Fluke Corporation - United States 20. Hitachi - Japan Frequently Asked Questions: 1] What segments are covered in the IoT in Construction Market report? Ans. The segments covered in the IoT in Construction Market report is by Product, Applications, End-User and End-User. 2] Which region is expected to hold the highest share in the IoT in Construction Market? Ans. The North American region is expected to hold the highest share of the IoT in Construction Market. 3] What is the market size of the IoT in Construction Market by 2030? Ans. The market size of the IoT in Construction Market by 2030 will be $ 28.91 Billion. 4] What is the forecast period for the IoT in Construction Market? Ans. The Forecast period for the IoT in Construction Market is 2024- 2030.

1. IoT in Construction Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. IoT in Construction Market: Dynamics 2.1. IoT in Construction Market Trends by Region 2.1.1. North America IoT in Construction Market Trends 2.1.2. Europe IoT in Construction Market Trends 2.1.3. Asia Pacific IoT in Construction Market Trends 2.1.4. Middle East and Africa IoT in Construction Market Trends 2.1.5. South America IoT in Construction Market Trends 2.2. IoT in Construction Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America IoT in Construction Market Drivers 2.2.1.2. North America IoT in Construction Market Restraints 2.2.1.3. North America IoT in Construction Market Opportunities 2.2.1.4. North America IoT in Construction Market Challenges 2.2.2. Europe 2.2.2.1. Europe IoT in Construction Market Drivers 2.2.2.2. Europe IoT in Construction Market Restraints 2.2.2.3. Europe IoT in Construction Market Opportunities 2.2.2.4. Europe IoT in Construction Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific IoT in Construction Market Drivers 2.2.3.2. Asia Pacific IoT in Construction Market Restraints 2.2.3.3. Asia Pacific IoT in Construction Market Opportunities 2.2.3.4. Asia Pacific IoT in Construction Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa IoT in Construction Market Drivers 2.2.4.2. Middle East and Africa IoT in Construction Market Restraints 2.2.4.3. Middle East and Africa IoT in Construction Market Opportunities 2.2.4.4. Middle East and Africa IoT in Construction Market Challenges 2.2.5. South America 2.2.5.1. South America IoT in Construction Market Drivers 2.2.5.2. South America IoT in Construction Market Restraints 2.2.5.3. South America IoT in Construction Market Opportunities 2.2.5.4. South America IoT in Construction Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For IoT in Construction Industry 2.8. Analysis of Government Schemes and Initiatives For IoT in Construction Industry 2.9. IoT in Construction Market Trade Analysis 2.10. The Global Pandemic Impact on IoT in Construction Market 3. IoT in Construction Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. IoT in Construction Market Size and Forecast, by Product (2023-2030) 3.1.1. Hardware 3.1.2. Software 3.1.3. Services 3.1.4. Others 3.2. IoT in Construction Market Size and Forecast, by Application (2023-2030) 3.2.1. Safety 3.2.2. Asset Monitoring 3.2.3. Predictive Maintenance 3.2.4. Wearable’s 3.2.5. Remote Operations 3.2.6. Fleet Management 3.2.7. Others 3.3. IoT in Construction Market Size and Forecast, by End User (2023-2030) 3.3.1. Residential 3.3.2. Non-Residential 3.3.3. Government and Public Infrastructure 3.3.4. Educational Institutions 3.4. IoT in Construction Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America IoT in Construction Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America IoT in Construction Market Size and Forecast, by Product (2023-2030) 4.1.1. Hardware 4.1.2. Software 4.1.3. Services 4.1.4. Others 4.2. North America IoT in Construction Market Size and Forecast, by Application (2023-2030) 4.2.1. Safety 4.2.2. Asset Monitoring 4.2.3. Predictive Maintenance 4.2.4. Wearable’s 4.2.5. Remote Operations 4.2.6. Fleet Management 4.2.7. Others 4.3. North America IoT in Construction Market Size and Forecast, by End User (2023-2030) 4.3.1. Residential 4.3.2. Non-Residential 4.3.3. Government and Public Infrastructure 4.3.4. Educational Institutions 4.4. North America IoT in Construction Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States IoT in Construction Market Size and Forecast, by Product (2023-2030) 4.4.1.1.1. Hardware 4.4.1.1.2. Software 4.4.1.1.3. Services 4.4.1.1.4. Others 4.4.1.2. United States IoT in Construction Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Safety 4.4.1.2.2. Asset Monitoring 4.4.1.2.3. Predictive Maintenance 4.4.1.2.4. Wearable’s 4.4.1.2.5. Remote Operations 4.4.1.2.6. Fleet Management 4.4.1.2.7. Others 4.4.1.3. United States IoT in Construction Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Residential 4.4.1.3.2. Non-Residential 4.4.1.3.3. Government and Public Infrastructure 4.4.1.3.4. Educational Institutions 4.4.2. Canada 4.4.2.1. Canada IoT in Construction Market Size and Forecast, by Product (2023-2030) 4.4.2.1.1. Hardware 4.4.2.1.2. Software 4.4.2.1.3. Services 4.4.2.1.4. Others 4.4.2.2. Canada IoT in Construction Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Safety 4.4.2.2.2. Asset Monitoring 4.4.2.2.3. Predictive Maintenance 4.4.2.2.4. Wearable’s 4.4.2.2.5. Remote Operations 4.4.2.2.6. Fleet Management 4.4.2.2.7. Others 4.4.2.3. Canada IoT in Construction Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Residential 4.4.2.3.2. Non-Residential 4.4.2.3.3. Government and Public Infrastructure 4.4.2.3.4. Educational Institutions 4.4.3. Mexico 4.4.3.1. Mexico IoT in Construction Market Size and Forecast, by Product (2023-2030) 4.4.3.1.1. Hardware 4.4.3.1.2. Software 4.4.3.1.3. Services 4.4.3.1.4. Others 4.4.3.2. Mexico IoT in Construction Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Safety 4.4.3.2.2. Asset Monitoring 4.4.3.2.3. Predictive Maintenance 4.4.3.2.4. Wearable’s 4.4.3.2.5. Remote Operations 4.4.3.2.6. Fleet Management 4.4.3.2.7. Others 4.4.3.3. Mexico IoT in Construction Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Residential 4.4.3.3.2. Non-Residential 4.4.3.3.3. Government and Public Infrastructure 4.4.3.3.4. Educational Institutions 5. Europe IoT in Construction Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe IoT in Construction Market Size and Forecast, by Product (2023-2030) 5.2. Europe IoT in Construction Market Size and Forecast, by Application (2023-2030) 5.3. Europe IoT in Construction Market Size and Forecast, by End User (2023-2030) 5.4. Europe IoT in Construction Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom IoT in Construction Market Size and Forecast, by Product (2023-2030) 5.4.1.2. United Kingdom IoT in Construction Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom IoT in Construction Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France IoT in Construction Market Size and Forecast, by Product (2023-2030) 5.4.2.2. France IoT in Construction Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France IoT in Construction Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany IoT in Construction Market Size and Forecast, by Product (2023-2030) 5.4.3.2. Germany IoT in Construction Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany IoT in Construction Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy IoT in Construction Market Size and Forecast, by Product (2023-2030) 5.4.4.2. Italy IoT in Construction Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy IoT in Construction Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain IoT in Construction Market Size and Forecast, by Product (2023-2030) 5.4.5.2. Spain IoT in Construction Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain IoT in Construction Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden IoT in Construction Market Size and Forecast, by Product (2023-2030) 5.4.6.2. Sweden IoT in Construction Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden IoT in Construction Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria IoT in Construction Market Size and Forecast, by Product (2023-2030) 5.4.7.2. Austria IoT in Construction Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria IoT in Construction Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe IoT in Construction Market Size and Forecast, by Product (2023-2030) 5.4.8.2. Rest of Europe IoT in Construction Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe IoT in Construction Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific IoT in Construction Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific IoT in Construction Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific IoT in Construction Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific IoT in Construction Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific IoT in Construction Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China IoT in Construction Market Size and Forecast, by Product (2023-2030) 6.4.1.2. China IoT in Construction Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China IoT in Construction Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea IoT in Construction Market Size and Forecast, by Product (2023-2030) 6.4.2.2. S Korea IoT in Construction Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea IoT in Construction Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan IoT in Construction Market Size and Forecast, by Product (2023-2030) 6.4.3.2. Japan IoT in Construction Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan IoT in Construction Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India IoT in Construction Market Size and Forecast, by Product (2023-2030) 6.4.4.2. India IoT in Construction Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India IoT in Construction Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia IoT in Construction Market Size and Forecast, by Product (2023-2030) 6.4.5.2. Australia IoT in Construction Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia IoT in Construction Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia IoT in Construction Market Size and Forecast, by Product (2023-2030) 6.4.6.2. Indonesia IoT in Construction Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia IoT in Construction Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia IoT in Construction Market Size and Forecast, by Product (2023-2030) 6.4.7.2. Malaysia IoT in Construction Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia IoT in Construction Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam IoT in Construction Market Size and Forecast, by Product (2023-2030) 6.4.8.2. Vietnam IoT in Construction Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam IoT in Construction Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan IoT in Construction Market Size and Forecast, by Product (2023-2030) 6.4.9.2. Taiwan IoT in Construction Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan IoT in Construction Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific IoT in Construction Market Size and Forecast, by Product (2023-2030) 6.4.10.2. Rest of Asia Pacific IoT in Construction Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific IoT in Construction Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa IoT in Construction Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa IoT in Construction Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa IoT in Construction Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa IoT in Construction Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa IoT in Construction Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa IoT in Construction Market Size and Forecast, by Product (2023-2030) 7.4.1.2. South Africa IoT in Construction Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa IoT in Construction Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC IoT in Construction Market Size and Forecast, by Product (2023-2030) 7.4.2.2. GCC IoT in Construction Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC IoT in Construction Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria IoT in Construction Market Size and Forecast, by Product (2023-2030) 7.4.3.2. Nigeria IoT in Construction Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria IoT in Construction Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A IoT in Construction Market Size and Forecast, by Product (2023-2030) 7.4.4.2. Rest of ME&A IoT in Construction Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A IoT in Construction Market Size and Forecast, by End User (2023-2030) 8. South America IoT in Construction Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America IoT in Construction Market Size and Forecast, by Product (2023-2030) 8.2. South America IoT in Construction Market Size and Forecast, by Application (2023-2030) 8.3. South America IoT in Construction Market Size and Forecast, by End User (2023-2030) 8.4. South America IoT in Construction Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil IoT in Construction Market Size and Forecast, by Product (2023-2030) 8.4.1.2. Brazil IoT in Construction Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil IoT in Construction Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina IoT in Construction Market Size and Forecast, by Product (2023-2030) 8.4.2.2. Argentina IoT in Construction Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina IoT in Construction Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America IoT in Construction Market Size and Forecast, by Product (2023-2030) 8.4.3.2. Rest Of South America IoT in Construction Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America IoT in Construction Market Size and Forecast, by End User (2023-2030) 9. Global IoT in Construction Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading IoT in Construction Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Bosch - Germany 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Caterpillar - United States 10.3. Trimble - United States 10.4. Procore Technologies - United States 10.5. Autodesk - United States 10.6. Oracle - United States 10.7. Siemens - Germany 10.8. Hilti - Liechtenstein 10.9. IBM - United States 10.10. Johnson Controls - Ireland 10.11. Schneider Electric - France 10.12. Honeywell - United States 10.13. Dell Technologies - United States 10.14. Microsoft - United States 10.15. DeWalt (Stanley Black & Decker) - United States 10.16. Hewlett Packard Enterprise (HPE) - United States 10.17. Cisco Systems - United States 10.18. Emerson Electric Co. - United States 10.19. Fluke Corporation - United States 10.20. Hitachi - Japan 11. Key Findings 12. Industry Recommendations 13. IoT in Construction Market: Research Methodology 14. Terms and Glossary