Latin America Digital Transformation Market size was valued at USD 55.38 Billion in 2023 and the Latin America Digital Transformation Market revenue is expected to grow at a CAGR of 15.6% during the forecast period, reaching nearly USD 152.78 Billion.Latin America Digital Transformation Market Overview

Digital technologies are fundamentally altering almost every facet of daily existence. The consequences of this transformation are wide-ranging and ever-changing, encompassing increased productivity in various economic sectors, enhancements in the efficiency and quality of service provision, and the emergence of fresh sources of value. Within Latin America there exist significant opportunities across several fundamental pillars crucial for establishing a resilient digital economy. At the core of this digital economy lies the essential foundation of access to a meaningful internet connection and data that is both secure and affordable, promoting productivity and safety.To know about the Research Methodology :- Request Free Sample Report As per the study, the Latin America Digital Transformation Market has grown immensely and is expected to grow during the forecast period. This is attributed to the surge in smartphone adoption, accompanied by the emergence of a multitude of digital technologies that are being extensively applied across key industrial sectors.

Latin America Digital Transformation Market Dynamics

Driver: Increasing Technological Advancements Increasing access to high-speed internet, facilitated by the expansion of broadband infrastructure, is a fundamental driver of Latin America digital transformation market. This allows businesses and individuals to harness the power of digital technologies. Companies are undergoing a transformation driven by emerging technologies, not just in the tech sector but also within traditional industries in Latin America. This shift is observed as organizations seize the opportunity to strengthen their frameworks, undergo transformation, and foster growth. The significance of this trend was emphasized at an event hosted by Citi in Brazil, where prominent companies from the region gathered. More than 200 participants representing over 100 companies either based in Brazil or with a presence in the country engaged in discussions covering topics such as artificial intelligence, Central Bank Digital Currencies, and Corporate Venture Capital. Opportunity: Investments in Digital Transformation As per the study, the increasing investments in digital transformation is expected to boost the exports of six Latin American countries up to $140 billion annually, by 2030 – a four-fold increase over current levels. This is expected to drive the Latin America Digital Transformation Market growth during the forecast period. As per the study, the digital exports is expected to contribute to more than 2% of GDP to digital technologies by 2030 in Argentina, Brazil, Chile, Colombia, Mexico, and Uruguay. This marks a significant rise from the current expenditure of $34 billion, equivalent to 0.8% of their respective GDPs. As per 2020 Digital Sprinters framework, the emerging economies are expected to accelerate their digital transformation with investments in four key areas: 1. Infrastructure: Investment in digital connectivity and the development of secure and environmentally sustainable infrastructure, incorporating intelligent management practices. 2. People: Equipping individuals from all communities for future employment opportunities by providing training and skills development tailored for the digital economy. 3. Technological innovation: Implementing technological innovation to unlock novel opportunities and enhance economic growth through increased utilization of data, artificial intelligence, and cloud computing to drive efficiencies. 4. Public policies: Establishing a regulatory environment characterized by predictability that fosters competitiveness, open markets, interoperable regulatory standards, and tax regimes aligned with international standards. Challenge: Uneven access to and adoption of digital technologies The unequal access to and adoption of digital technologies in South America have the potential to worsen rather than alleviate existing high levels of inequality and social exclusion. This trend is widening the gap between those who actively participate in the digital economy and those who are left behind. Moreover, the adoption of these technologies brings forth new challenges, including concerns related to personal data protection, cybersecurity, and the rise of cybercrime. These concerns are key challenges for the Latin America Digital Transformation Market. Additionally, the expansion of digital infrastructure contribute to an increase in energy consumption. Notably, data centers are anticipated to soon surpass the aviation industry in terms of carbon footprint. The proliferation of broadband-enabled devices also contributes to the generation of electrical and electronic waste (e-waste), making it one of the fastest-growing waste streams in developed countries. As Big Tech extends its reach into developing countries, particularly where competition frameworks and institutions are weak, there is a risk of national markets being subjected to anti-competitive practices. Lastly, the growing volume of data, along with its associated economic benefits and risks, prompt governments to favor data localization policies. Such policies are likely to impact data flows and the overall efficiency of the system.Latin America Digital Transformation Market Segment Analysis

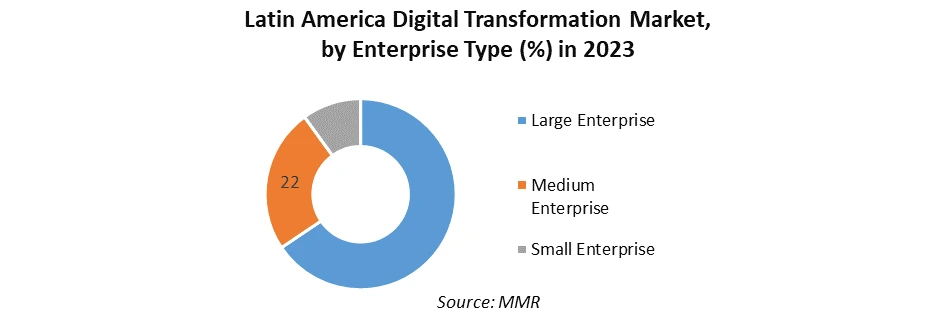

Based on Enterprise Type: The market is segmented into Large Enterprise, Medium Enterprise and Small Enterprise. The Large Enterprise held the largest Latin America Digital Transformation Market share in 2023. This is attributed to the greater financial resources, established infrastructure and early adoption of emerging technologies of the large enterprises. The Medium Enterprise is expected to grow at a high rate during the forecast period. This is due to the rising awareness about the benefits of digital transformation for agility, competitiveness, and customer engagement.

Latin America Digital Transformation Market Regional Insights

Brazil Digital Transformation Market dominated the regional market in 2023 and is expected to retain its dominance during the forecast period. Brazil stands as a thriving hub for startups, boasting a remarkable 18,000 companies, which constitute a substantial 77 percent of all startups in Latin America. Moreover, the nation attracts a significant share of startup investments in the region, with over 70 percent flowing into Brazilian ventures. The country's diverse economy and expansive consumer base make it an appealing prospect for exporters seeking collaborations with startups and exploring opportunities within the realm of digital transformation. Notably, Brazil is now the headquarters for 60 percent of all unicorns in Latin America, underlining its status as a key player in the startup ecosystem. The State of São Paulo, in particular, has made substantial strides in research and development, investing a noteworthy sum of over $1.22 billion in the last decade. The digital economy in Brazil showcases robust growth potential in both the medium and long term, which is resulting to a high contribution in the Market growth. This trajectory not only signifies opportunities for U.S. products, services, and financial investments but also hints at prospects for educational exchanges. As Brazil's expertise in digital transformation continues to expand, it presents a promising landscape for sustained growth, offering abundant opportunities for collaboration and engagement in the future.Latin America Digital Transformation Market Scope : Inquire Before Buying

Latin America Digital Transformation Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 55.38 Bn. Forecast Period 2024 to 2030 CAGR: 15.6% Market Size in 2030: US $ 152.78 Bn. Segments Covered: by Component Solution Cloud Computing Big Data and Analytics Mobility Disruptive Technology Social Media Services Professional Services System Integration by Deployment Type On-Premises Cloud by Enterprise Type Large Enterprise Medium Enterprise Small Enterprise by End-User Banking, Financial Services and Insurance (BFSI) Telecom & IT Automotive Education Retail & Consumer Goods Media & Entertainment Manufacturing Government Aviation & Defense Transportation Others Latin America Digital Transformation Key players

1. Accenture PLC 2. Adobe Systems Incorporated 3. Capgemini 4. Cognizant 5. Dell 6. Google Inc 7. IBM Corporation 8. Microsoft Corporation 9. Oracle Corporation 10. SAP SE FAQs: 1. What are the growth drivers for the Latin America Digital Transformation Market? Ans. Expansion of E-commerce with the Rise of FinTech and Digital Payments are the growth drivers of the Latin America Digital Transformation Market. 2. What is the major restraint for the Latin America Digital Transformation Market growth? Ans. Cybersecurity Concerns and Digital Skills Gap are the restraining factor of the Latin America Digital Transformation Market growth. 3. Which country is expected to lead the Latin America Digital Transformation Market during the forecast period? Ans. The Brazil is expected to lead the Latin America Digital Transformation Market during the forecast period. 4. What is the expected Market size by 2030? Ans. The Market size is expected to reach USD 152.78 Bn by 2030. 5. What segments are covered in the Latin America Digital Transformation Market report? Ans. The segments covered in the Latin America Digital Transformation Market Component, Deployment Type, Enterprise Type, End User and Region.

1. Latin America Digital Transformation Market: Research Methodology 2. Latin America Digital Transformation Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Latin America Digital Transformation Market: Dynamics 3.1. Latin America Digital Transformation Market Trends by Region 3.1.1. Brazil Digital Transformation Market Trends 3.1.2. Argentina Digital Transformation Market Trends 3.1.3. Rest of Latin America Digital Transformation Market Trends 3.2. Latin America Digital Transformation Market Dynamics by Region 3.2.1. Latin America 3.2.1.1. Latin America Digital Transformation Market Drivers 3.2.1.2. Latin America Digital Transformation Market Restraints 3.2.1.3. Latin America Digital Transformation Market Opportunities 3.2.1.4. Latin America Digital Transformation Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technological Roadmap 3.6. Regulatory Landscape 3.7. Key Opinion Leader Analysis For Digital Transformation Market 3.8. Analysis of Government Schemes and Initiatives 3.9. The Global Pandemic Impact on Latin America Digital Transformation Market 4. Latin America Digital Transformation Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Latin America Digital Transformation Market Size and Forecast, by Component (2023-2030) 4.1.1. Solutions 4.1.1.1. Cloud Computing 4.1.1.2. Big Data and Analytics 4.1.1.3. Mobility 4.1.1.4. Disruptive Technology 4.1.1.5. Social Media 4.1.2. Services 4.1.2.1. Professional Services 4.1.2.2. System Integration 4.2. Latin America Digital Transformation Market Size and Forecast, by Deployment Type (2023-2030) 4.2.1. On-Premises 4.2.2. Cloud 4.3. Latin America Digital Transformation Market Size and Forecast, Enterprise Type (2023-2030) 4.3.1. Large Enterprise 4.3.2. Medium Enterprise 4.3.3. Small Enterprise 4.4. Argentina Digital Transformation Market Size and Forecast, End User (2023-2030) 4.4.1. Banking, Financial Services and Insurance (BFSI) 4.4.2. Telecom & IT 4.4.3. Automotive 4.4.4. Education 4.4.5. Retail & Consumer Goods 4.4.6. Media & Entertainment 4.4.7. Manufacturing 4.4.8. Government 4.4.9. Aviation & Defense 4.4.10. Transportation 4.4.11. Others 4.5. Latin America Digital Transformation Market Size and Forecast, by Country (2023-2030) 4.5.1. Brazil 4.5.1.1. Brazil Digital Transformation Market Size and Forecast, by Component (2023-2030) 4.5.1.1.1. Solutions 4.5.1.1.1.1. Cloud Computing 4.5.1.1.1.2. Big Data and Analytics 4.5.1.1.1.3. Mobility 4.5.1.1.1.4. Disruptive Technology 4.5.1.1.1.5. Social Media 4.5.1.1.2. Services 4.5.1.1.2.1. Professional Services 4.5.1.1.2.2. System Integration 4.5.1.2. Brazil Digital Transformation Market Size and Forecast, by Deployment Type (2023-2030) 4.5.1.2.1. On-Premises 4.5.1.2.2. Cloud 4.5.1.3. Brazil Digital Transformation Market Size and Forecast, Enterprise Type (2023-2030) 4.5.1.3.1. Large Enterprise 4.5.1.3.2. Medium Enterprise 4.5.1.3.3. Small Enterprise 4.5.1.4. Brazil Digital Transformation Market Size and Forecast, End User (2023-2030) 4.5.1.4.1. Banking, Financial Services and Insurance (BFSI) 4.5.1.4.2. Telecom & IT 4.5.1.4.3. Automotive 4.5.1.4.4. Education 4.5.1.4.5. Retail & Consumer Goods 4.5.1.4.6. Media & Entertainment 4.5.1.4.7. Manufacturing 4.5.1.4.8. Government 4.5.1.4.9. Aviation & Defense 4.5.1.4.10. Transportation 4.5.1.4.11. Others 4.5.2. Argentina 4.5.2.1. Argentina Digital Transformation Market Size and Forecast, by Component (2023-2030) 4.5.2.1.1. Solutions 4.5.2.1.1.1. Cloud Computing 4.5.2.1.1.2. Big Data and Analytics 4.5.2.1.1.3. Mobility 4.5.2.1.1.4. Disruptive Technology 4.5.2.1.1.5. Social Media 4.5.2.1.2. Services 4.5.2.1.2.1. Professional Services 4.5.2.1.2.2. System Integration 4.5.2.2. Argentina Digital Transformation Market Size and Forecast, by Deployment Type (2023-2030) 4.5.2.2.1. On-Premises 4.5.2.2.2. Cloud 4.5.2.3. Argentina Digital Transformation Market Size and Forecast, Enterprise Type (2023-2030) 4.5.2.3.1. Large Enterprise 4.5.2.3.2. Medium Enterprise 4.5.2.3.3. Small Enterprise 4.5.2.4. Argentina Digital Transformation Market Size and Forecast, End User (2023-2030) 4.5.2.4.1. Banking, Financial Services and Insurance (BFSI) 4.5.2.4.2. Telecom & IT 4.5.2.4.3. Automotive 4.5.2.4.4. Education 4.5.2.4.5. Retail & Consumer Goods 4.5.2.4.6. Media & Entertainment 4.5.2.4.7. Manufacturing 4.5.2.4.8. Government 4.5.2.4.9. Aviation & Defense 4.5.2.4.10. Transportation 4.5.2.4.11. Others 4.5.3. Rest of Latin America 4.5.3.1. Rest of Latin America Digital Transformation Market Size and Forecast, by Component (2023-2030) 4.5.3.1.1. Solutions 4.5.3.1.1.1. Cloud Computing 4.5.3.1.1.2. Big Data and Analytics 4.5.3.1.1.3. Mobility 4.5.3.1.1.4. Disruptive Technology 4.5.3.1.1.5. Social Media 4.5.3.1.2. Services 4.5.3.1.2.1. Professional Services 4.5.3.1.2.2. System Integration 4.5.3.2. Rest of Latin America Digital Transformation Market Size and Forecast, by Deployment Type (2023-2030) 4.5.3.2.1. On-Premises 4.5.3.2.2. Cloud 4.5.3.3. Rest of Latin America Digital Transformation Market Size and Forecast, Enterprise Type (2023-2030) 4.5.3.3.1. Large Enterprise 4.5.3.3.2. Medium Enterprise 4.5.3.3.3. Small Enterprise 4.5.3.4. Rest of Latin America Digital Transformation Market Size and Forecast, End User (2023-2030) 4.5.3.4.1. Banking, Financial Services and Insurance (BFSI) 4.5.3.4.2. Telecom & IT 4.5.3.4.3. Automotive 4.5.3.4.4. Education 4.5.3.4.5. Retail & Consumer Goods 4.5.3.4.6. Media & Entertainment 4.5.3.4.7. Manufacturing 4.5.3.4.8. Government 4.5.3.4.9. Aviation & Defense 4.5.3.4.10. Transportation 4.5.3.4.11. Others 5. Latin America Digital Transformation Market: Competitive Landscape 5.1. MMR Competition Matrix 5.2. Competitive Landscape 5.3. Key Players Benchmarking 5.3.1. Company Name 5.3.2. Service Segment 5.3.3. End-user Segment 5.3.4. Component (2022) 5.3.5. Company Locations 5.4. Leading Latin America Digital Transformation Market Companies, by Market Capitalization 5.5. Market Structure 5.5.1. Market Leaders 5.5.2. Market Followers 5.5.3. Emerging Players 5.6. Mergers and Acquisitions Details 6. Company Profile: Key Players 6.1. Accenture PLC 6.1.1. Company Overview 6.1.2. Business Portfolio 6.1.3. Financial Overview 6.1.4. SWOT Analysis 6.1.5. Strategic Analysis 6.1.6. Recent Developments 6.2. Adobe Systems Incorporated 6.3. Capgemini 6.4. Cognizant 6.5. Dell 6.6. Google Inc 6.7. IBM Corporation 6.8. Microsoft Corporation 6.9. Oracle Corporation 6.10. SAP SE 7. Key Findings 8. Industry Recommendations