The Industrial Valve Market size was valued at USD 86.71 Billion in 2024 and the total industrial valve revenue is expected to grow at a CAGR of 4.3% from 2025 to 2032, reaching nearly USD 121.43 Billion by 2032.Industrial Valve Market Overview:

An industrial valve is a mechanical device used to control, regulate, or stop the flow of liquids, gases, or slurries within pipelines and industrial systems. It ensures safe, efficient operation across industries such as oil & gas, power, chemicals, water treatment, and manufacturing. This is attributable to infrastructure development, expanding industrialization, as well as rising demand in oil & gas valves, chemical valves, water treatment valves, power generation valves, and pharmaceutical valves. They are highly crucial for controlling fluid flow, pressure, and temperature, ensuring operational efficiency and safety. The rising adoption of automation in industrial valves, IoT-enabled valves, and smart digitally monitored valves, and the enhancement of precision are anticipated to open more opportunities for market development. Rapid urbanization, industrial modernization, and the requirement for reliable fluid control systems drive the Industrial Valve Market growth.To know about the Research Methodology:-Request Free Sample Report

Industrial Valve Market Dynamics:

Rapid Industrialization in Emerging Economies Propels the Industrial Valve Market Development There are some critical changes taking place in the industrial valve industry due to various aspects such as regional economic activities, infrastructure growth, and technology evolution. Soaring infrastructure projects and brisk industrialization in emerging economies, especially China and India, are propelling the Industrial Valve Market demand for new valve installation. Compare that to regions such as North America and Western Europe, where even as valve replacement and aftermarket components experience some level of activity, organic growth is essentially non-existent. Specific industry concentrations then compound the regional demands for valves; North America's hydraulic fracturing boom has ramped pipeline valve demand, while Asia's semiconductor manufacturing dominance increases demand for ultra-pure engineered-plastic chemical valves. Rising Energy Sector Activities Drive the Industrial Valve Market Growth About 10.1 billion per year is the value of industrial valve manufacturers of the United States that export their respective products out of the country. Despite the dollar strengthening over the last five years, these export revenues have seen steady growth. With respect to the destinations of its exports, they include Mexico, East Asian nations and oil-exporters. The energy sector in Mexico is the main driver behind that demand, just as it is for Middle Eastern oil producers. China’s imports of U.S. valves are for more general manufacturing applications, but South Korea focuses on advanced energy sector applications. Interestingly, Canada is the No. 1 destination for U.S.-made industrial valves.Industrial Valve Market Segment Analysis:

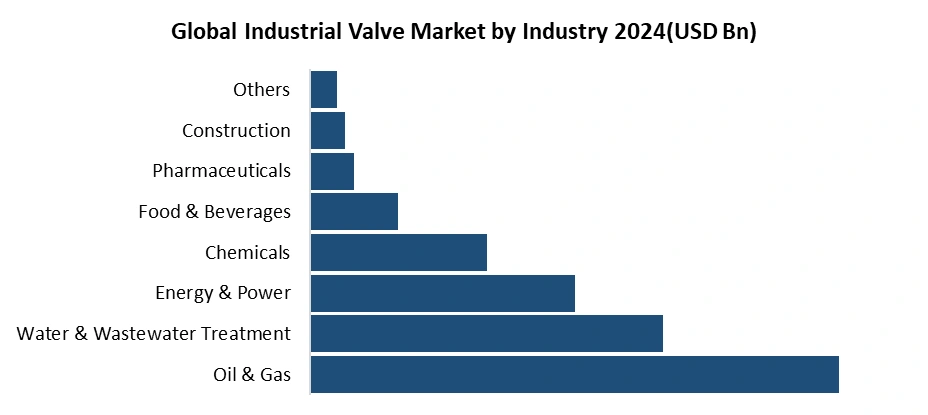

Based on material type, the market is fragmented into cast iron, stainless steel, cryogenic, alloy-based, and others. Steel valve is expected to hold the leading Industrial Valve Market share owing to its strength, durability, and resistance to elevated temperatures and pressures. Stainless steel variants are particularly valued for their corrosion resistance, making them ideal for critical industries such as oil & gas, chemical processing, and power generation.Based on industry, the market is fragmented into oil & gas, water & wastewater treatment, energy & power, chemicals, food & beverages, pharmaceuticals, construction, agriculture, pulp & paper, metals & mining, and others. The oil & gas segment is held by the industry in the Industrial Valve Market. This is attributable to the product segment being highly critical across the entire oil & gas value chain, from production and exploration, as well as refining and transport. The strict safety standards and the requirement for accurate flow control make advanced valve solutions automated and indispensable.

Industrial Valve Market Regional Insight:

The Asia-Pacific holds the highest demand in the industrial valve market due to several compelling factors. Rapid industrialization in APAC countries, including China, India, Japan, and Southeast Asia, has driven massive infrastructure development, boosting the need for pipeline valves, power plant valves, chemical plant valves, and water treatment valves. The oil & gas valve market in the region is expanding significantly, with new refineries, petrochemical plants, and LNG projects requiring high volumes of industrial valves for process control and safety applications. The power generation industry, including thermal, nuclear, and renewable energy plants, contributes to sustained demand for fluid control valves. Increasing investments in energy infrastructure, municipal water projects, and industrial automation further strengthen the Asia-Pacific industrial valve market. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which gives a clear, futuristic view of the industry to the decision-makers. The report also helps in understanding the Industrial Valve market dynamics, structure by analyzing the market segments and projecting the Industrial Valve market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Industrial Valve market makes the report an investor’s guide.Competitive Landscape

Leading players in the industrial valve market are increasingly focusing on expanding their product portfolios with high-performance, customized valves to address diverse industrial requirements. Adoption of digital monitoring, IoT-enabled actuators, and predictive maintenance solutions enhances operational efficiency and reliability. Market dynamics are influenced by fluctuations in raw material availability, particularly stainless steel and alloys, impacting production costs. Companies prioritize sectors with high growth potential, such as oil & gas, water treatment, and energy, to strengthen their Industrial Valve Market position. Sustainable manufacturing practices, including waste reduction and eco-friendly coatings, are gaining prominence. Strategic partnerships, mergers, and acquisitions further enable companies to broaden geographic reach and technological capabilities, ensuring competitive resilience.Recent Development

• On 4 June 2025, Chart, an industrial valve manufacturer, announced that it had merged with Flowserve under a USD 19 billion merger agreement. This merger is anticipated to have a positive impact for both parties in burdening and enhancing their product offerings, including industrial valve products. • On 27 June 2025, DNOW declared the acquisition of MRC, a distributor of industrial products, including valves. This acquisition is anticipated to assist both DNOW as well as MRC in reaching out to a large consumer base. The combined firm will operate over 350 service and distribution centers in more than 20 countries, servicing customers from the upstream, midstream, downstream, gas utility, and broader industrial sectors.Industrial Valves Market Scope : Inquire before buying

Global Industrial Valves Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 86.71 Bn. Forecast Period 2025 to 2032 CAGR: 4.3% Market Size in 2032: USD 121.43 Bn. Segments Covered: by Material Type Stainless Steel Cast Iron Alloy Based Cryogenic Others by Size 1” to 6” Up to 1” 6” to 25” 25” to 50” 50” and Larger by Valve Type Gate Valves Ball Valves Globe Valves Butterfly Valves Check Valves Safety Valves Others by Industry Oil & Gas Water & Wastewater Treatment Energy & Power Chemicals Food & Beverages Pharmaceuticals Construction Others Industrial Valve Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Industrial Valve Market, Key Players

1. Emerson 2. Weir Group PLC 3. Flowserve 4. Cameron - Schlumberger 5. IMI PLC 6. Spirax Sarco 7. Crane Co. 8. Kitz Corporation 9. Metso Corporation 10. Neway Valve (Suzhou) Co., Ltd. 11. Velan Inc. 12. Samson AG 13. AVK Holding A/S 14. Avcon Controls 15. Forbes Marshall 16. Swagelok 17. Ham–Let 18. Dwyer Instruments 19. KIM Valves 20. Apollo Valves 21. Schlumberger Limited. 22. GE VALVE 23. Curtiss-Wright Corporation 24. McWane, Inc. 25. ALFA LAVAL 26. Rotork 27. KSB SE & Co. KGaA.Frequently Asked Questions:

1] What segments are covered in the Market report? Ans. The segments covered in the Market report are based on Material Type, Size, Valve Type, Industry, and region 2] Which region is expected to hold the highest share of the Market? Ans. The Asia Pacific region is expected to hold the highest share of the IMarket. 3] What is the market size of the Industrial Valve Market by 2032? Ans. The market size of the Industrial Valve Market by 2032 is USD 121.43 Bn. 4] What is the growth rate of the Industrial Valve Market? Ans. The Global Industrial Valve Market is growing at a CAGR of 4.3 % during the forecasting period 2025-2032. 5] What was the market size of the Industrial Valve Market in 2024? Ans. The market size of the Industrial Valve Market in 2024 was USD 86.71 Bn.

1. Industrial Valve Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Industrial Valve Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Industrial Valve Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Industrial Valve Market: Dynamics 3.1. Industrial Valve Market Trends by Region 3.1.1. North America Industrial Valve Market Trends 3.1.2. Europe Industrial Valve Market Trends 3.1.3. Asia Pacific Industrial Valve Market Trends 3.1.4. Middle East and Africa Industrial Valve Market Trends 3.1.5. South America Industrial Valve Market Trends 3.2. Industrial Valve Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Industrial Valve Market Drivers 3.2.1.2. North America Industrial Valve Market Restraints 3.2.1.3. North America Industrial Valve Market Opportunities 3.2.1.4. North America Industrial Valve Market Challenges 3.2.2. Europe 3.2.2.1. Europe Industrial Valve Market Drivers 3.2.2.2. Europe Industrial Valve Market Restraints 3.2.2.3. Europe Industrial Valve Market Opportunities 3.2.2.4. Europe Industrial Valve Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Industrial Valve Market Drivers 3.2.3.2. Asia Pacific Industrial Valve Market Restraints 3.2.3.3. Asia Pacific Industrial Valve Market Opportunities 3.2.3.4. Asia Pacific Industrial Valve Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Industrial Valve Market Drivers 3.2.4.2. Middle East and Africa Industrial Valve Market Restraints 3.2.4.3. Middle East and Africa Industrial Valve Market Opportunities 3.2.4.4. Middle East and Africa Industrial Valve Market Challenges 3.2.5. South America 3.2.5.1. South America Industrial Valve Market Drivers 3.2.5.2. South America Industrial Valve Market Restraints 3.2.5.3. South America Industrial Valve Market Opportunities 3.2.5.4. South America Industrial Valve Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Industrial Valve Industry 3.8. Analysis of Government Schemes and Initiatives For Industrial Valve Industry 3.9. Industrial Valve Market Trade Analysis 3.10. The Global Pandemic Impact on Industrial Valve Market 4. Industrial Valve Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 4.1.1. Stainless Steel 4.1.2. Cast Iron 4.1.3. Alloy Based 4.1.4. Cryogenic 4.1.5. Others 4.2. Industrial Valve Market Size and Forecast, by Size (2024-2032) 4.2.1. 1” to 6” 4.2.2. Up to 1” 4.2.3. 6” to 25” 4.2.4. 25” to 50” 4.2.5. 50” and Larger 4.3. Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 4.3.1. Gate Valves 4.3.2. Ball Valves 4.3.3. Globe Valves 4.3.4. Butterfly Valves 4.3.5. Check Valves 4.3.6. Safety Valves 4.3.7. Others 4.4. Industrial Valve Market Size and Forecast, by Industry (2024-2032) 4.4.1. Oil & Gas 4.4.2. Water & Wastewater Treatment 4.4.3. Energy & Power 4.4.4. Chemicals 4.4.5. Food & Beverages 4.4.6. Pharmaceuticals 4.4.7. Construction 4.4.8. Others 4.5. Industrial Valve Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Industrial Valve Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 5.1.1. Stainless Steel 5.1.2. Cast Iron 5.1.3. Alloy Based 5.1.4. Cryogenic 5.1.5. Others 5.2. North America Industrial Valve Market Size and Forecast, by Size (2024-2032) 5.2.1. 1” to 6” 5.2.2. Up to 1” 5.2.3. 6” to 25” 5.2.4. 25” to 50” 5.2.5. 50” and Larger 5.3. North America Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 5.3.1. Gate Valves 5.3.2. Ball Valves 5.3.3. Globe Valves 5.3.4. Butterfly Valves 5.3.5. Check Valves 5.3.6. Safety Valves 5.3.7. Others 5.4. North America Industrial Valve Market Size and Forecast, by Industry (2024-2032) 5.4.1. Oil & Gas 5.4.2. Water & Wastewater Treatment 5.4.3. Energy & Power 5.4.4. Chemicals 5.4.5. Food & Beverages 5.4.6. Pharmaceuticals 5.4.7. Construction 5.4.8. Others 5.5. North America Industrial Valve Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 5.5.1.1.1. Stainless Steel 5.5.1.1.2. Cast Iron 5.5.1.1.3. Alloy Based 5.5.1.1.4. Cryogenic 5.5.1.1.5. Others 5.5.1.2. United States Industrial Valve Market Size and Forecast, by Size (2024-2032) 5.5.1.2.1. 1” to 6” 5.5.1.2.2. Up to 1” 5.5.1.2.3. 6” to 25” 5.5.1.2.4. 25” to 50” 5.5.1.2.5. 50” and Larger 5.5.1.3. United States Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 5.5.1.3.1. Gate Valves 5.5.1.3.2. Ball Valves 5.5.1.3.3. Globe Valves 5.5.1.3.4. Butterfly Valves 5.5.1.3.5. Check Valves 5.5.1.3.6. Safety Valves 5.5.1.3.7. Others 5.5.1.4. United States Industrial Valve Market Size and Forecast, by Industry (2024-2032) 5.5.1.4.1. Oil & Gas 5.5.1.4.2. Water & Wastewater Treatment 5.5.1.4.3. Energy & Power 5.5.1.4.4. Chemicals 5.5.1.4.5. Food & Beverages 5.5.1.4.6. Pharmaceuticals 5.5.1.4.7. Construction 5.5.1.4.8. Others 5.5.2. Canada 5.5.2.1. Canada Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 5.5.2.1.1. Stainless Steel 5.5.2.1.2. Cast Iron 5.5.2.1.3. Alloy Based 5.5.2.1.4. Cryogenic 5.5.2.1.5. Others 5.5.2.2. Canada Industrial Valve Market Size and Forecast, by Size (2024-2032) 5.5.2.2.1. 1” to 6” 5.5.2.2.2. Up to 1” 5.5.2.2.3. 6” to 25” 5.5.2.2.4. 25” to 50” 5.5.2.2.5. 50” and Larger 5.5.2.3. Canada Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 5.5.2.3.1. Gate Valves 5.5.2.3.2. Ball Valves 5.5.2.3.3. Globe Valves 5.5.2.3.4. Butterfly Valves 5.5.2.3.5. Check Valves 5.5.2.3.6. Safety Valves 5.5.2.3.7. Others 5.5.2.4. Canada Industrial Valve Market Size and Forecast, by Industry (2024-2032) 5.5.2.4.1. Oil & Gas 5.5.2.4.2. Water & Wastewater Treatment 5.5.2.4.3. Energy & Power 5.5.2.4.4. Chemicals 5.5.2.4.5. Food & Beverages 5.5.2.4.6. Pharmaceuticals 5.5.2.4.7. Construction 5.5.2.4.8. Others 5.5.3. Mexico 5.5.3.1. Mexico Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 5.5.3.1.1. Stainless Steel 5.5.3.1.2. Cast Iron 5.5.3.1.3. Alloy Based 5.5.3.1.4. Cryogenic 5.5.3.1.5. Others 5.5.3.2. Mexico Industrial Valve Market Size and Forecast, by Size (2024-2032) 5.5.3.2.1. 1” to 6” 5.5.3.2.2. Up to 1” 5.5.3.2.3. 6” to 25” 5.5.3.2.4. 25” to 50” 5.5.3.2.5. 50” and Larger 5.5.3.3. Mexico Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 5.5.3.3.1. Gate Valves 5.5.3.3.2. Ball Valves 5.5.3.3.3. Globe Valves 5.5.3.3.4. Butterfly Valves 5.5.3.3.5. Check Valves 5.5.3.3.6. Safety Valves 5.5.3.3.7. Others 5.5.3.4. Mexico Industrial Valve Market Size and Forecast, by Industry (2024-2032) 5.5.3.4.1. Oil & Gas 5.5.3.4.2. Water & Wastewater Treatment 5.5.3.4.3. Energy & Power 5.5.3.4.4. Chemicals 5.5.3.4.5. Food & Beverages 5.5.3.4.6. Pharmaceuticals 5.5.3.4.7. Construction 5.5.3.4.8. Others 6. Europe Industrial Valve Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 6.2. Europe Industrial Valve Market Size and Forecast, by Size (2024-2032) 6.3. Europe Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 6.4. Europe Industrial Valve Market Size and Forecast, by Industry (2024-2032) 6.5. Europe Industrial Valve Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 6.5.1.2. United Kingdom Industrial Valve Market Size and Forecast, by Size (2024-2032) 6.5.1.3. United Kingdom Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 6.5.1.4. United Kingdom Industrial Valve Market Size and Forecast, by Industry (2024-2032) 6.5.2. France 6.5.2.1. France Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 6.5.2.2. France Industrial Valve Market Size and Forecast, by Size (2024-2032) 6.5.2.3. France Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 6.5.2.4. France Industrial Valve Market Size and Forecast, by Industry (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 6.5.3.2. Germany Industrial Valve Market Size and Forecast, by Size (2024-2032) 6.5.3.3. Germany Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 6.5.3.4. Germany Industrial Valve Market Size and Forecast, by Industry (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 6.5.4.2. Italy Industrial Valve Market Size and Forecast, by Size (2024-2032) 6.5.4.3. Italy Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 6.5.4.4. Italy Industrial Valve Market Size and Forecast, by Industry (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 6.5.5.2. Spain Industrial Valve Market Size and Forecast, by Size (2024-2032) 6.5.5.3. Spain Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 6.5.5.4. Spain Industrial Valve Market Size and Forecast, by Industry (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 6.5.6.2. Sweden Industrial Valve Market Size and Forecast, by Size (2024-2032) 6.5.6.3. Sweden Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 6.5.6.4. Sweden Industrial Valve Market Size and Forecast, by Industry (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 6.5.7.2. Austria Industrial Valve Market Size and Forecast, by Size (2024-2032) 6.5.7.3. Austria Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 6.5.7.4. Austria Industrial Valve Market Size and Forecast, by Industry (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 6.5.8.2. Rest of Europe Industrial Valve Market Size and Forecast, by Size (2024-2032) 6.5.8.3. Rest of Europe Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 6.5.8.4. Rest of Europe Industrial Valve Market Size and Forecast, by Industry (2024-2032) 7. Asia Pacific Industrial Valve Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 7.2. Asia Pacific Industrial Valve Market Size and Forecast, by Size (2024-2032) 7.3. Asia Pacific Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 7.4. Asia Pacific Industrial Valve Market Size and Forecast, by Industry (2024-2032) 7.5. Asia Pacific Industrial Valve Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 7.5.1.2. China Industrial Valve Market Size and Forecast, by Size (2024-2032) 7.5.1.3. China Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 7.5.1.4. China Industrial Valve Market Size and Forecast, by Industry (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 7.5.2.2. S Korea Industrial Valve Market Size and Forecast, by Size (2024-2032) 7.5.2.3. S Korea Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 7.5.2.4. S Korea Industrial Valve Market Size and Forecast, by Industry (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 7.5.3.2. Japan Industrial Valve Market Size and Forecast, by Size (2024-2032) 7.5.3.3. Japan Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 7.5.3.4. Japan Industrial Valve Market Size and Forecast, by Industry (2024-2032) 7.5.4. India 7.5.4.1. India Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 7.5.4.2. India Industrial Valve Market Size and Forecast, by Size (2024-2032) 7.5.4.3. India Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 7.5.4.4. India Industrial Valve Market Size and Forecast, by Industry (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 7.5.5.2. Australia Industrial Valve Market Size and Forecast, by Size (2024-2032) 7.5.5.3. Australia Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 7.5.5.4. Australia Industrial Valve Market Size and Forecast, by Industry (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 7.5.6.2. Indonesia Industrial Valve Market Size and Forecast, by Size (2024-2032) 7.5.6.3. Indonesia Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 7.5.6.4. Indonesia Industrial Valve Market Size and Forecast, by Industry (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 7.5.7.2. Malaysia Industrial Valve Market Size and Forecast, by Size (2024-2032) 7.5.7.3. Malaysia Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 7.5.7.4. Malaysia Industrial Valve Market Size and Forecast, by Industry (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 7.5.8.2. Vietnam Industrial Valve Market Size and Forecast, by Size (2024-2032) 7.5.8.3. Vietnam Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 7.5.8.4. Vietnam Industrial Valve Market Size and Forecast, by Industry (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 7.5.9.2. Taiwan Industrial Valve Market Size and Forecast, by Size (2024-2032) 7.5.9.3. Taiwan Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 7.5.9.4. Taiwan Industrial Valve Market Size and Forecast, by Industry (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 7.5.10.2. Rest of Asia Pacific Industrial Valve Market Size and Forecast, by Size (2024-2032) 7.5.10.3. Rest of Asia Pacific Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 7.5.10.4. Rest of Asia Pacific Industrial Valve Market Size and Forecast, by Industry (2024-2032) 8. Middle East and Africa Industrial Valve Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 8.2. Middle East and Africa Industrial Valve Market Size and Forecast, by Size (2024-2032) 8.3. Middle East and Africa Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 8.4. Middle East and Africa Industrial Valve Market Size and Forecast, by Industry (2024-2032) 8.5. Middle East and Africa Industrial Valve Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 8.5.1.2. South Africa Industrial Valve Market Size and Forecast, by Size (2024-2032) 8.5.1.3. South Africa Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 8.5.1.4. South Africa Industrial Valve Market Size and Forecast, by Industry (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 8.5.2.2. GCC Industrial Valve Market Size and Forecast, by Size (2024-2032) 8.5.2.3. GCC Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 8.5.2.4. GCC Industrial Valve Market Size and Forecast, by Industry (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 8.5.3.2. Nigeria Industrial Valve Market Size and Forecast, by Size (2024-2032) 8.5.3.3. Nigeria Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 8.5.3.4. Nigeria Industrial Valve Market Size and Forecast, by Industry (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 8.5.4.2. Rest of ME&A Industrial Valve Market Size and Forecast, by Size (2024-2032) 8.5.4.3. Rest of ME&A Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 8.5.4.4. Rest of ME&A Industrial Valve Market Size and Forecast, by Industry (2024-2032) 9. South America Industrial Valve Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 9.2. South America Industrial Valve Market Size and Forecast, by Size (2024-2032) 9.3. South America Industrial Valve Market Size and Forecast, by Valve Type(2024-2032) 9.4. South America Industrial Valve Market Size and Forecast, by Industry (2024-2032) 9.5. South America Industrial Valve Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 9.5.1.2. Brazil Industrial Valve Market Size and Forecast, by Size (2024-2032) 9.5.1.3. Brazil Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 9.5.1.4. Brazil Industrial Valve Market Size and Forecast, by Industry (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 9.5.2.2. Argentina Industrial Valve Market Size and Forecast, by Size (2024-2032) 9.5.2.3. Argentina Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 9.5.2.4. Argentina Industrial Valve Market Size and Forecast, by Industry (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Industrial Valve Market Size and Forecast, by Material Type (2024-2032) 9.5.3.2. Rest Of South America Industrial Valve Market Size and Forecast, by Size (2024-2032) 9.5.3.3. Rest Of South America Industrial Valve Market Size and Forecast, by Valve Type (2024-2032) 9.5.3.4. Rest Of South America Industrial Valve Market Size and Forecast, by Industry (2024-2032) 10. Company Profile: Key Players 10.1. Emerson 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Weir Group PLC 10.3. Flowserve 10.4. Cameron - Schlumberger 10.5. IMI PLC 10.6. Spirax Sarco 10.7. Crane Co. 10.8. Kitz Corporation 10.9. Metso Corporation 10.10. Neway Valve (Suzhou) Co., Ltd. 10.11. Velan Inc. 10.12. Samson AG 10.13. AVK Holding A/S 10.14. Avcon Controls 10.15. Forbes Marshall 10.16. Swagelok 10.17. Ham–Let 10.18. Dwyer Instruments 10.19. KIM Valves 10.20. Apollo Valves 10.21. Schlumberger Limited. 10.22. GE VALVE 10.23. Curtiss-Wright Corporation 10.24. McWane, Inc. 10.25. ALFA LAVAL 10.26. Rotork 10.27. KSB SE & Co. KGaA. 11. Key Findings 12. Industry Recommendations 13. Industrial Valve Market: Research Methodology 14. Terms and Glossary