The Healthcare Facility Management Market size was valued at USD 7.11 Bn. in 2023 and the total revenue is expected to grow by 7.2% from 2024 to 2030, reaching nearly 11.58 Bn. Healthcare facilities management is the maintenance and oversight of a healthcare abilities' maintenance, development, security and operations. The management includes any building that offers healthcare services, like long-term facilities, clinics, surgical centers and hospitals, and covers every aspect of facility maintenance.To know about the Research Methodology :- Request Free Sample Report Healthcare has become one of the leading industries, thanks to the increasing number of patients and growing healthcare expenditure by the public, as well as private players in healthcare systems. According to the MMR study, in the US, national healthcare spending is expected to grow at an average rate of 6.2% per year during 2024-2030, to reach nearly USD 7.2 trillion by 2030. Healthcare expenditure is expected to grow 1% faster than the GDP per year, over 2024-2030. As a result, the healthcare share of GDP is projected to rise from nearly 18.2% in 2023 to 20.4% by 2030.

Healthcare Facility Management Market Dynamics:

The MMR report analyzes factors affecting market from both demand and supply side and further evaluates healthcare facility management market dynamics effecting the market during the 2024-2030 i.e., drivers, restraints, opportunities, and future trend. Growing Attention to Support Services Enhancing the Potential for Market Growth The demand for support services is growing rapidly in the industry as hospitals and other healthcare facilities focusing on providing patients with higher-quality care. A motivated and well-coordinated support service team can help medical facilities by reducing the workload for medical staff, allowing patients to heal more quickly, as well as by encouraging a safer atmosphere and enhancing the satisfaction of nurses, patients, and families. The majority of the healthcare organizations are also trusting heavily on IT and telecommunications service providers. Therefore, the growing implementation of telehealth and other technological systems in healthcare organizations is expected to provide additional opportunities for market contributors during the forecast period. Furthermore, healthcare IT could be influential in rising the accessibility to better-quality healthcare services. Therefore, the rapid growth of digitization in the healthcare sector is one of the key factors expected to drive the healthcare facility management market growth. Global Smart City Initiatives & Growing Hospitality Industry to Boost Market The facility management industry in world is expected to show major growth during the forecast period thanks to increase in government methods to develop smart cities in the various region. Furthermore, as smart cities are developed, there are more huge public facilities like airports, malls, universities, hospitals, and seaports, which has increased demand for these services. India's and China's fast growing building industries are anticipated to benefit the country's companies. The introduction of new technologies like the Internet of Things, artificial intelligence, robotics, and others is expected to cause the North American market to grow gradually. Furthermore, there has been a decline in the market from 2020 to 2021 as a result of following lockdowns in important states across the U.S. and Canada as a result of the COVID-19. However, due to the adoption of government-sponsored programmers, the market is anticipated to grow significantly over the course of the forecast period. This is because of a growing understanding of the importance of keeping the environment clean in order to repel the coronavirus. Similarly, Europe is likely to increase considerably in the next few years. This is attributed to the adoption of preventive measures by governments in many countries in the region. Service players will be able to increase their staff, productivity, and sales by taking these preemptive measures. AI and IoT Integration in Healthcare Facilities Hospital energy management systems are rapidly automating processes. Power quality is essential for hospitals and other healthcare facilities. AI and IoT support energy flow and optimization in a healthcare facility. In addition, the proliferation of smart goods brought about by the growing IoT adoption is fueling the growth of the healthcare facility management market. These goods have a wide range of uses in the healthcare industry and are incredibly well-liked by consumers. The installation of smart technology that enhances HVAC, door locks, security cameras, alarms, and other systems is one of the options available to facility managers. Building management is now less time-consuming and remote control of these systems is also conceivable thanks to such technology. The Internet of Things (IoT) provides a constant, real-time stream of data, facilitating improved decision-making and work process improvement. Moreover, the industry is growing as a result of consumers' increased desire to outsource procedures and businesses' growing emphasis on offering personalized and value-added services, such credibility and risk management. Collaboration with Prominent Local and Regional Players to Support Important Players in Growth of Existence The market players from healthcare facilities management are expected to have lucrative growth opportunities in the future with the growing demand for healthcare facilities management in the global market. To provide customers with quality assurance, Sodexo and Bureau Veritas collaborated in June 2020 to launch a hygiene verification label for Sodexo services. Catering services and on-site facility management are included in this cooperation. The label was first introduced in the United Kingdom, France, the United States, and Canada before being gradually carried out to other nations across the world. The merger between Turner & Townsend Holdings Limited and CBRE Group, Inc. was finalized in November 2022. By purchasing a 60% ownership position in the business, CBRE joined forces strategically with Turner & Townsend. Program management, cost consulting, project management, and advice consulting services are provided by Turner & Townsend to clients in 46 different countries. The three business sectors are real estate, infrastructure, and resources. Utilizing Technology Insufficiently and Using Poor Optimization Techniques to Restrain Market Growth Due to the lengthy duration of the contracts, a number of large facilities management service providers with a significant initial investment in facilities services virtually every experience issues with minimal technology usage. Large businesses frequently use cutting-edge technologies, like BIM (Building Information Modeling), to deliver hard and soft services, enabling them to offer better and upgraded services. On the other hand, small and medium-sized businesses are not properly incorporating the inputs at the early step, which is the designing stage, in many different countries. Due to the small and medium-sized businesses' lack of operation and maintenance (O&M) procedures, this causes sustainability-related issues in building facilities, particularly during the post-occupancy period. In addition, there are three significant challenges that service providers in both developed and emerging economies—including the United States, the United Kingdom, and Germany, and China- face when incorporating technological developments. The three main challenges are: 1. Lack of direction about the delivery and requirements for data 2. Inability to use technology effectively in their practice 3. Interoperability (i.e., technological problems) Facility Management Outsourcing Presents a Significant Opportunity for Service Providers The outsourcing sector accounted for more than 50% of the market in 2022. The adoption of electronic health records, the complexity of advanced ICD-10 medical coding systems, and rising healthcare costs are the key drivers behind the outsourcing of in-house services. Hospitals are being especially impacted by the rising patient volume, the requirement to verify insurance eligibility and consult patient check-in data, which has forced them to outsource a few services, including facility management. Health Facilities Management Market Trends: 1. The Internet of Things (IoT): IoT linkages will increasingly become the norm for hospital facility management, in 2022 and beyond. 2. Physical Distancing That Continues: Physically separating oneself from others because of fears about COVID-19 transmission was a trend that started in 2020 and is likely to persist far into 2022 and possibly even into the future. 3. Enhancing Incident Alerts for Public Health and Safety: With the growing awareness of a pandemic has come an even greater need to be able to disseminate messages quickly and simultaneously throughout facilities, which has already been an area of significant concentration in recent years.Healthcare Facility Management Market Segment Analysis:

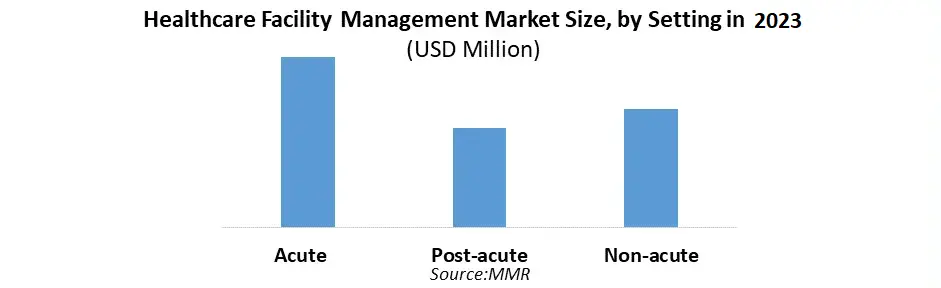

Acute Care Segment Held The Largest Market Share In 2023: In 2023, the acute segment acquired the highest revenue share in the healthcare facility management Market. Acute care is a kind of secondary healthcare in which a patient receives active but temporary therapy for a severe illness or injury, an urgent medical condition, or while recuperating from surgery. In medical terms, chronic care, also known as long-term care, is the polar opposite of acute care, also known as short-term care.

Construction Services Expected to Hold Significant Share:

In 2023, the construction services segment accounted for the largest market share, thanks to the huge expenditure related to the construction services for the healthcare buildings. For the healthcare faculties, it also covers services for building construction, maintenance, relocation, and refurbishment. Due to the rising emphasis on efficient healthcare HVAC, ventilation, mechanical, and electrical services, the hard services segment is anticipated to expand at the greatest CAGR during the projection period. The performance of these services is improved by the incorporation of cutting-edge technology like IoT and artificial intelligence. Top Companies for Healthcare Facility Management Market

Companies Overview Combustion Engine CBRE Group, Inc., an American provider of real estate services, was established in 1906. The corporation, which employs more than 100,000 people, expects to earn USD 23.8 billion in revenue in 2020. Sodexo The corporation reported revenues of EUR 22.0 billion in 2020. In response to the COVID-19 pandemic, Sodexo launched Rise with Sodexo, a tool that helps businesses modernise their operating procedures. Aramark Aramark Corporation is one of the leading American foodservice, uniform, and facility service providers. Johnson Controls In April 2021, Johnson Controls secured USD 91 million projects from the U.S. General Services Administration (GSA). The company will focus on improving facilities and energy efficiencies of landmark buildings.

Healthcare Facility Management Industry Regional Insights:

North America is the global leader in healthcare facility management market. In 2023, it accounted for around 38% of the market share. The strong healthcare system and the adoption of various technologies for healthcare facilities are to thank for this increase. In North America, there are many differences in the overall healthcare system. Currently, some hospitals have established strong market positions, while others have understood the fundamentals of healthcare facility management. According to the American Cancer Society, there will be over 1.8 million new cancer cases discovered and roughly 606,520 cancer deaths in the United States year 2023. In the near future, it is anticipated that increased chronic diseases and an ageing population in the region will support the growth of the healthcare facilities management industry. In Europe, the healthcare industry generates more than 22% of the revenue from managing healthcare facilities. Growing financial strain on government agencies could change how healthcare is provided, leading to a decentralized delivery model. Affordable access to high-quality and specialized treatments would encourage consumers and healthcare providers to change their delivery demands from cure-based to prevention-based. Developing markets such as Asia Pacific and Middle East & Africa offer alluring market prospects new in case of health care facility management service providers. These countries are undergoing entry of small companies in the market. It is expected that the market for healthcare facilities management in these countries will rise rapidly as a result of the rapid increase in medical tourism in growing markets like China and India. Country Perspectives: United State: Thanks to the U.S. economy's recovery, new firms are launching its services, and employees are returning to their workplaces. Companies are encouraging their workers to return to the workplace by offering better working conditions. The American government is also leading the charge to boost corporate activity by offering long-term economic packages and significant infrastructure improvements. India: The facility management industry is incredibly fragmented in India, however this tendency is quickly changing and the organized sector is gradually gaining market share. Amidst the rising urbanization, facility management businesses are becoming more and more popular.Healthcare Facility Management Market Scope: Inquire before buying

Healthcare Facility Management Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 7.11 Bn. Forecast Period 2024 to 2030 CAGR: 7.2% Market Size in 2030: US $ 11.58 Bn. Segments Covered: by Location 1. On-site Facility Management 2. Off-site Facility Management by Service 1. Hard Services 2. Construction Services 3. Energy Management by Setting 1. Acute 2. Post-acute 3. Non-acute by End User 1. Hospitals and Clinics 2. Long Term Care Facilities 3. Others Healthcare Facility Management Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Healthcare Facility Management Market Key Players are:

1. Ecolab USA Inc. (US) 2. CBRE(US) 3. GSH GROUP(US) 4. Jones Lang LaSalle (US) 5. Oracle(US) 6. Trimble(US) 7. Accruent(US) 8. MRI Software(US) 9. Vanguard Resources(US) 10. Aramark(US) 11. Founders3 Real Estate Services(US) 12. Medxcel Facilities Management(US) 13. ABM(US) 14. OCS Group(UK) 15. Mitie Group Plc (UK) 16. Compass Group Plc.(UK) 17. Sodexo,Inc. (France) 18. ISS World Services A/S (Denmark) 19. SAP (Germany) 20. Planon (India) 21. JOHNSON CONTROLS (Ireland) FAQs: 1. What is the study period of the market? Ans. The Global Healthcare Facility Management Market is studied from 2023-2030 2. What is the growth rate of the Healthcare Facility Management Market? Ans. The Healthcare Facility Management Market is growing at a CAGR of 7.2% over forecast the period. 3. What is the market size of the Healthcare Facility Management Market by 2030? Ans. The market size of the Information Technology Market by 2030 is expected to reach at 11.58 Bn. 4. What is the forecast period for the Healthcare Facility Management Market? Ans. The forecast period for the Healthcare Facility Management Market is 2024-2030 5. What was the market size of the Healthcare Facility Management Market in 2023? Ans. The market size of the Healthcare Facility Management Market in 2023 was valued at USD 7.11 Bn.

1. Healthcare Facility Management Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Healthcare Facility Management Market: Dynamics 2.1. Healthcare Facility Management Market Trends by Region 2.1.1. North America Healthcare Facility Management Market Trends 2.1.2. Europe Healthcare Facility Management Market Trends 2.1.3. Asia Pacific Healthcare Facility Management Market Trends 2.1.4. Middle East and Africa Healthcare Facility Management Market Trends 2.1.5. South America Healthcare Facility Management Market Trends 2.2. Healthcare Facility Management Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Healthcare Facility Management Market Drivers 2.2.1.2. North America Healthcare Facility Management Market Restraints 2.2.1.3. North America Healthcare Facility Management Market Opportunities 2.2.1.4. North America Healthcare Facility Management Market Challenges 2.2.2. Europe 2.2.2.1. Europe Healthcare Facility Management Market Drivers 2.2.2.2. Europe Healthcare Facility Management Market Restraints 2.2.2.3. Europe Healthcare Facility Management Market Opportunities 2.2.2.4. Europe Healthcare Facility Management Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Healthcare Facility Management Market Drivers 2.2.3.2. Asia Pacific Healthcare Facility Management Market Restraints 2.2.3.3. Asia Pacific Healthcare Facility Management Market Opportunities 2.2.3.4. Asia Pacific Healthcare Facility Management Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Healthcare Facility Management Market Drivers 2.2.4.2. Middle East and Africa Healthcare Facility Management Market Restraints 2.2.4.3. Middle East and Africa Healthcare Facility Management Market Opportunities 2.2.4.4. Middle East and Africa Healthcare Facility Management Market Challenges 2.2.5. South America 2.2.5.1. South America Healthcare Facility Management Market Drivers 2.2.5.2. South America Healthcare Facility Management Market Restraints 2.2.5.3. South America Healthcare Facility Management Market Opportunities 2.2.5.4. South America Healthcare Facility Management Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Healthcare Facility Management Industry 2.8. Analysis of Government Schemes and Initiatives For Healthcare Facility Management Industry 2.9. Healthcare Facility Management Market Trade Analysis 2.10. The Global Pandemic Impact on Healthcare Facility Management Market 3. Healthcare Facility Management Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 3.1.1. On-site Facility Management 3.1.2. Off-site Facility Management 3.2. Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 3.2.1. Hard Services 3.2.2. Construction Services 3.2.3. Energy Management 3.3. Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 3.3.1. Acute 3.3.2. Post-acute 3.3.3. Non-acute 3.4. Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 3.4.1. Hospitals and Clinics 3.4.2. Long Term Care Facilities 3.4.3. Others 3.5. Healthcare Facility Management Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Healthcare Facility Management Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 4.1.1. On-site Facility Management 4.1.2. Off-site Facility Management 4.2. North America Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 4.2.1. Hard Services 4.2.2. Construction Services 4.2.3. Energy Management 4.3. North America Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 4.3.1. Acute 4.3.2. Post-acute 4.3.3. Non-acute 4.4. North America Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 4.4.1. Hospitals and Clinics 4.4.2. Long Term Care Facilities 4.4.3. Others 4.5. North America Healthcare Facility Management Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 4.5.1.1.1. On-site Facility Management 4.5.1.1.2. Off-site Facility Management 4.5.1.2. United States Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 4.5.1.2.1. Hard Services 4.5.1.2.2. Construction Services 4.5.1.2.3. Energy Management 4.5.1.3. United States Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 4.5.1.3.1. Acute 4.5.1.3.2. Post-acute 4.5.1.3.3. Non-acute 4.5.1.4. United States Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 4.5.1.4.1. Hospitals and Clinics 4.5.1.4.2. Long Term Care Facilities 4.5.1.4.3. Others 4.5.2. Canada 4.5.2.1. Canada Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 4.5.2.1.1. On-site Facility Management 4.5.2.1.2. Off-site Facility Management 4.5.2.2. Canada Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 4.5.2.2.1. Hard Services 4.5.2.2.2. Construction Services 4.5.2.2.3. Energy Management 4.5.2.3. Canada Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 4.5.2.3.1. Acute 4.5.2.3.2. Post-acute 4.5.2.3.3. Non-acute 4.5.2.4. Canada Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 4.5.2.4.1. Hospitals and Clinics 4.5.2.4.2. Long Term Care Facilities 4.5.2.4.3. Others 4.5.3. Mexico 4.5.3.1. Mexico Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 4.5.3.1.1. On-site Facility Management 4.5.3.1.2. Off-site Facility Management 4.5.3.2. Mexico Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 4.5.3.2.1. Hard Services 4.5.3.2.2. Construction Services 4.5.3.2.3. Energy Management 4.5.3.3. Mexico Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 4.5.3.3.1. Acute 4.5.3.3.2. Post-acute 4.5.3.3.3. Non-acute 4.5.3.4. Mexico Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 4.5.3.4.1. Hospitals and Clinics 4.5.3.4.2. Long Term Care Facilities 4.5.3.4.3. Others 5. Europe Healthcare Facility Management Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 5.2. Europe Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 5.3. Europe Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 5.4. Europe Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 5.5. Europe Healthcare Facility Management Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 5.5.1.2. United Kingdom Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 5.5.1.3. United Kingdom Healthcare Facility Management Market Size and Forecast, by Setting(2023-2030) 5.5.1.4. United Kingdom Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 5.5.2. France 5.5.2.1. France Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 5.5.2.2. France Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 5.5.2.3. France Healthcare Facility Management Market Size and Forecast, by Setting(2023-2030) 5.5.2.4. France Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 5.5.3.2. Germany Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 5.5.3.3. Germany Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 5.5.3.4. Germany Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 5.5.4.2. Italy Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 5.5.4.3. Italy Healthcare Facility Management Market Size and Forecast, by Setting(2023-2030) 5.5.4.4. Italy Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 5.5.5.2. Spain Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 5.5.5.3. Spain Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 5.5.5.4. Spain Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 5.5.6.2. Sweden Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 5.5.6.3. Sweden Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 5.5.6.4. Sweden Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 5.5.7.2. Austria Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 5.5.7.3. Austria Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 5.5.7.4. Austria Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 5.5.8.2. Rest of Europe Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 5.5.8.3. Rest of Europe Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 5.5.8.4. Rest of Europe Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Healthcare Facility Management Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 6.2. Asia Pacific Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 6.3. Asia Pacific Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 6.4. Asia Pacific Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 6.5. Asia Pacific Healthcare Facility Management Market Size and Forecast, by Country (2023-2030) 6.7.1. China 6.5.1.1. China Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 6.5.1.2. China Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 6.5.1.3. China Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 6.5.1.4. China Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 6.5.2.2. S Korea Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 6.5.2.3. S Korea Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 6.5.2.4. S Korea Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 6.5.3.2. Japan Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 6.5.3.3. Japan Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 6.5.3.4. Japan Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 6.5.4. India 6.5.4.1. India Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 6.5.4.2. India Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 6.5.4.3. India Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 6.5.4.4. India Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 6.5.5.2. Australia Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 6.5.5.3. Australia Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 6.5.5.4. Australia Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 6.5.6.2. Indonesia Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 6.5.6.3. Indonesia Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 6.5.6.4. Indonesia Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 6.5.7.2. Malaysia Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 6.5.7.3. Malaysia Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 6.5.7.4. Malaysia Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 6.5.8.2. Vietnam Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 6.5.8.3. Vietnam Healthcare Facility Management Market Size and Forecast, by Setting(2023-2030) 6.5.8.4. Vietnam Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 6.5.9.2. Taiwan Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 6.5.9.3. Taiwan Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 6.5.9.4. Taiwan Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 6.5.10.2. Rest of Asia Pacific Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 6.5.10.3. Rest of Asia Pacific Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 6.5.10.4. Rest of Asia Pacific Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Healthcare Facility Management Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 7.2. Middle East and Africa Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 7.3. Middle East and Africa Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 7.4. Middle East and Africa Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 7.5. Middle East and Africa Healthcare Facility Management Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 7.5.1.2. South Africa Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 7.5.1.3. South Africa Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 7.5.1.4. South Africa Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 7.5.2.2. GCC Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 7.5.2.3. GCC Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 7.5.2.4. GCC Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 7.5.3.2. Nigeria Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 7.5.3.3. Nigeria Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 7.5.3.4. Nigeria Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 7.5.4.2. Rest of ME&A Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 7.5.4.3. Rest of ME&A Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 7.5.4.4. Rest of ME&A Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 8. South America Healthcare Facility Management Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 8.2. South America Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 8.3. South America Healthcare Facility Management Market Size and Forecast, by Setting(2023-2030) 8.4. South America Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 8.5. South America Healthcare Facility Management Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 8.5.1.2. Brazil Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 8.5.1.3. Brazil Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 8.5.1.4. Brazil Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 8.5.2.2. Argentina Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 8.5.2.3. Argentina Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 8.5.2.4. Argentina Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Healthcare Facility Management Market Size and Forecast, by Location (2023-2030) 8.5.3.2. Rest Of South America Healthcare Facility Management Market Size and Forecast, by Service (2023-2030) 8.5.3.3. Rest Of South America Healthcare Facility Management Market Size and Forecast, by Setting (2023-2030) 8.5.3.4. Rest Of South America Healthcare Facility Management Market Size and Forecast, by End User (2023-2030) 9. Global Healthcare Facility Management Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Healthcare Facility Management Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Ecolab USA Inc. (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. CBRE(US) 10.3. GSH GROUP(US) 10.4. Jones Lang LaSalle (US) 10.5. Oracle(US) 10.6. Trimble(US) 10.7. Accruent(US) 10.8. MRI Software(US) 10.9. Vanguard Resources(US) 10.10. Aramark(US) 10.11. Founders3 Real Estate Services(US) 10.12. Medxcel Facilities Management(US) 10.13. ABM(US) 10.14. OCS Group(UK) 10.15. Mitie Group Plc (UK) 10.16. Compass Group Plc.(UK) 10.17. Sodexo,Inc. (France) 10.18. ISS World Services A/S (Denmark) 10.19. SAP (Germany) 10.20. Planon (India) 10.21. JOHNSON CONTROLS (Ireland) 11. Key Findings 12. Industry Recommendations 13. Healthcare Facility Management Market: Research Methodology 14. Terms and Glossary