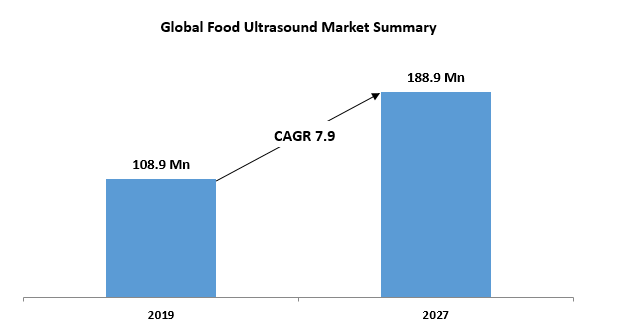

Global Food Ultrasound Market size was valued at US$ 136.80 Mn. in 2022 and the total revenue is expected to grow at 7.9% through 2023 to 2029, reaching nearly US$ 232.93 Mn.Global Food Ultrasound Market Overview:

The Global Food Ultrasound Market was estimated at US$ 136.80 Million in 2022, and it is expected to reach US$ 232.93 Million by 2029, at a CAGR of 7.9 % over the forecasting period of 2023-2029.To know about the Research Methodology :- Request Free Sample Report Ultrasound is a type of sound wave. Its frequency is higher than the upper limit of human hearing and is used in different fields. As we all know, food ultrasound has a significant impact on the speed of various processes in the food industry. It's used in a variety of food-processing applications, including crystallisation, freezing, bleaching, degassing, extraction, drying, and filtration. Food ultrasound is a useful tool for processing, preservation and extraction in the field of food processing.

Global Food Ultrasound Market Dynamics:

Increasing concerns about waste and high processing time, the food ultrasound market has become the most important part of the food and beverage industry. Food ultrasonic technology can help solve these two problems and make the process energy-efficient. It has many uses in the food industry, such as freezing, crystallization, bleaching, extraction, degassing, drying, and filtration. The tool can be used for food processing, preservation, and extraction in the processing department. In addition, it can also be used to treat wastewater from the food and beverage industry. These factors are expected to drive the demand and adoption of food ultrasound technology. Low-power ultrasound technology is considered a beneficial non-thermal method because it can overcome the problems that occur during heat treatment of food and beverage processing, such as physical and chemical changes, nutritional loss, and changes in sensory properties. Foods such as fruits and vegetables, sugar, dairy products, coffee and cocoa, fats and oils, flour, and meat are complex mixtures of vitamins, sugars, proteins and lipids, fibers, flavors, colors, antioxidants, and other compounds. These can be processed using ultrasonic technology before packaging and ensure longer shelf life. Increasing demand for frozen food is also help to grow the global food ultrasound market. Ultrasonic methods are used to evaluate the quality of such products that require a longer shelf life. It also helps remove specific allergens from processed food and beverage products. This is an important feature that is expected to increase the demand for this technology in the food and beverage industry, which is increasingly focusing on label-free products to better meet customer requirements.Global Food Ultrasound Market Segment Analysis:

On the basis of product, the global food ultrasound market is sub-segmented into dairy, beverages, fruits and vegetables, meat and seafood, backer, and confectionery. Meat & seafood is the dominant segment and it held xx% of the share in 2022. It has large demand because these products are most vulnerable to microbial contamination and it gives proteins and bone strength. Ultrasonic technologies help with the pickling process and reduce the time it takes to treat these products. The increased demand for process efficiency through decreased processing times and energy-saving technology is driving the market for ultrasonic food processing. The dairy product is a second dominant segment with CAGR of 9.4% during forecast period 2023-2029. Growing demand for dairy products in countries like the United States, China, and India is moving the dairy industry forward. Food ultrasound demand is growing at a quick rate of roughly 5.2% in the United States, and it is expected to continue to grow during the forecast period. On the basis of the frequency range, the global food ultrasound market is sub-segmented into High-frequency low-intensity, Low-frequency high-intensity. The high-frequency low-intensity segment is dominant and it held xx% of the share in 2022. The frequency range used to perform a food ultrasound is determined by the sample's sensitivity as well as the ultrasound's purpose. Both high and low ultrasound frequencies can be used to conduct most of the common purposes of an ultrasound. Cleaning, microbiological inactivation, and cutting can all be done with high or low ultrasound frequencies, depending on the sensitivity of the product being processed and the function that needs to be performed. On the basis of function type, the global food ultrasound market is sub-segmented into quality assurance, microbial enzyme inactivation, cutting, emulsification & homogenization, cleaning, others. The Microbial enzyme inactivation segment dominated the function type in the food ultrasound market and it held xx% of the share in 2022, owing to it required shorter heating time, Heat distribution inside food is more uniform, resulting in lower nutrition losses and more energy efficiency. Ultrasound technologies are increasingly being adopted in place of traditional ways because they do not degrade the quality of the food. Food products are exposed to high-frequency radiation during this process, which causes microbe cells to disintegrate. Due to increased health concerns and the frequency of viral infections in major nations throughout the world, it is expected that Microbial enzyme inactivation expected to continue to dominance the function sector during the forecast period 2023-2029.Global Food Ultrasound Market Regional Insights:

The NORTH AMERICAN market accounts for the major market share in terms of revenue and is expected to rapid growth during the forecast period. North America held xx% share of global market and demand of this region is increasing due to increased consumer consumption of packaged foods and beverages and the existence of a mature food processing industry are factors driving the market growth in this region. Canada is the second-largest food ultrasound market in the region, with total ultrasound food exports exceeding 12 million. Canada's urbanization rate is very high. It is expected that higher per capita disposable income will also promote the country's market growth. The Asia-Pacific market is expected to have the fastest growth in terms of revenue in the global market because of the increasing adoption of new technologies and growing consumer demand for processed foods in the region. In addition, it is expected that there will be more and more processed food manufacturing industries in emerging economies such as China and India, which will promote the growth of target markets in the Asia-Pacific region. The objective of the report is to present a comprehensive analysis of the global Food Ultrasound market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analysed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the global Food Ultrasound market dynamics, structure by analyzing the market segments and projects the global Food Ultrasound market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Food Ultrasound market make the report investor’s guide.Global Food Ultrasound Market Scope:Inquire before buying

Global Food Ultrasound Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 136.80 Mn. Forecast Period 2023 to 2029 CAGR: 7.9% Market Size in 2029: US $ 232.93 Mn. Segments Covered: by Product Dairy Beverages Fruits and Vegetables Meat and Seafood Backer and Confectionery by Frequency Range High-frequency low-intensity Low-frequency high-intensity by Function Quality assurance Microbial enzyme inactivation Cutting Emulsification & homogenization Cleaning Others Global Food Ultrasound Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Global Food Ultrasound Market, Key Players are

1. Hitachi Corporation 2. Bosch 3.•Buhler 4. Siemens Healthcare 5. Analogic Corporation 6. FUJIFILM Holdings Corporation 7. Koninklijke Philips N.V 8.Esaote S.p.A 9. Mindray Medical International Ltd. 10. Robert Bosch GmbH 11. Emerson Electric Co. 12. Buehler’s Fresh Foods 13. Dukane 14. Hielscher Ultrasonics GmbH 15. Newtech 16. Denny’s Franchisee Association 17. Rinco UltrasonicsFrequently Asked Questions:

1. Which region has the largest share in Global Food Ultrasound Market? Ans: North America region holds the highest share in 2022. 2. What is the growth rate of Global Food Ultrasound Market? Ans: The Global Food Ultrasound Market is growing at a CAGR of 7.9 % during forecasting period 2023-2029. 3. What segments are covered in Global Food Ultrasound market? Ans: Global Food Ultrasound market is segmented into product, frequency range, function and Region. 4. Who are the key players in Global Food Ultrasound market? Ans: The important key players in the Global Food Ultrasound market are - Hitachi Corporation, Bosch, Buhler, Siemens Healthcare, Analogic Corporation, FUJIFILM Holdings Corporation, Koninklijke Philips N.V, Esaote S.p.A, Mindray Medical International Ltd., Robert Bosch GmbH, Emerson Electric Co., Buehler’s Fresh Foods, Dukane, Hielscher Ultrasonics GmbH, Newtech, Denny’s Franchisee Association, and Rinco Ultrasonics. 5. What is the study period of this market? Ans: The Global Food Ultrasound market is studied from 2022 to 2029.

1. Food Ultrasound Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Food Ultrasound Market: Dynamics 2.1. Food Ultrasound Market Trends by Region 2.1.1. North America Food Ultrasound Market Trends 2.1.2. Europe Food Ultrasound Market Trends 2.1.3. Asia Pacific Food Ultrasound Market Trends 2.1.4. Middle East and Africa Food Ultrasound Market Trends 2.1.5. South America Food Ultrasound Market Trends 2.2. Food Ultrasound Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Food Ultrasound Market Drivers 2.2.1.2. North America Food Ultrasound Market Restraints 2.2.1.3. North America Food Ultrasound Market Opportunities 2.2.1.4. North America Food Ultrasound Market Challenges 2.2.2. Europe 2.2.2.1. Europe Food Ultrasound Market Drivers 2.2.2.2. Europe Food Ultrasound Market Restraints 2.2.2.3. Europe Food Ultrasound Market Opportunities 2.2.2.4. Europe Food Ultrasound Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Food Ultrasound Market Drivers 2.2.3.2. Asia Pacific Food Ultrasound Market Restraints 2.2.3.3. Asia Pacific Food Ultrasound Market Opportunities 2.2.3.4. Asia Pacific Food Ultrasound Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Food Ultrasound Market Drivers 2.2.4.2. Middle East and Africa Food Ultrasound Market Restraints 2.2.4.3. Middle East and Africa Food Ultrasound Market Opportunities 2.2.4.4. Middle East and Africa Food Ultrasound Market Challenges 2.2.5. South America 2.2.5.1. South America Food Ultrasound Market Drivers 2.2.5.2. South America Food Ultrasound Market Restraints 2.2.5.3. South America Food Ultrasound Market Opportunities 2.2.5.4. South America Food Ultrasound Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Food Ultrasound Industry 2.8. Analysis of Government Schemes and Initiatives For Food Ultrasound Industry 2.9. Food Ultrasound Market Trade Analysis 2.10. The Global Pandemic Impact on Food Ultrasound Market 3. Food Ultrasound Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Food Ultrasound Market Size and Forecast, by Product (2022-2029) 3.1.1. Dairy 3.1.2. Beverages 3.1.3. Fruits and Vegetables 3.1.4. Meat and Seafood 3.1.5. Backer and Confectionery 3.2. Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 3.2.1. High-frequency low-intensity 3.2.2. Low-frequency high-intensity 3.3. Food Ultrasound Market Size and Forecast, by Function (2022-2029) 3.3.1. Quality assurance 3.3.2. Microbial enzyme inactivation 3.3.3. Cutting 3.3.4. Emulsification & homogenization 3.3.5. Cleaning 3.3.6. Others 3.4. Food Ultrasound Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Food Ultrasound Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Food Ultrasound Market Size and Forecast, by Product (2022-2029) 4.1.1. Dairy 4.1.2. Beverages 4.1.3. Fruits and Vegetables 4.1.4. Meat and Seafood 4.1.5. Backer and Confectionery 4.2. North America Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 4.2.1. High-frequency low-intensity 4.2.2. Low-frequency high-intensity 4.3. North America Food Ultrasound Market Size and Forecast, by Function (2022-2029) 4.3.1. Quality assurance 4.3.2. Microbial enzyme inactivation 4.3.3. Cutting 4.3.4. Emulsification & homogenization 4.3.5. Cleaning 4.3.6. Others 4.4. North America Food Ultrasound Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Food Ultrasound Market Size and Forecast, by Product (2022-2029) 4.4.1.1.1. Dairy 4.4.1.1.2. Beverages 4.4.1.1.3. Fruits and Vegetables 4.4.1.1.4. Meat and Seafood 4.4.1.1.5. Backer and Confectionery 4.4.1.2. United States Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 4.4.1.2.1. High-frequency low-intensity 4.4.1.2.2. Low-frequency high-intensity 4.4.1.3. United States Food Ultrasound Market Size and Forecast, by Function (2022-2029) 4.4.1.3.1. Quality assurance 4.4.1.3.2. Microbial enzyme inactivation 4.4.1.3.3. Cutting 4.4.1.3.4. Emulsification & homogenization 4.4.1.3.5. Cleaning 4.4.1.3.6. Others 4.4.2. Canada 4.4.2.1. Canada Food Ultrasound Market Size and Forecast, by Product (2022-2029) 4.4.2.1.1. Dairy 4.4.2.1.2. Beverages 4.4.2.1.3. Fruits and Vegetables 4.4.2.1.4. Meat and Seafood 4.4.2.1.5. Backer and Confectionery 4.4.2.2. Canada Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 4.4.2.2.1. High-frequency low-intensity 4.4.2.2.2. Low-frequency high-intensity 4.4.2.3. Canada Food Ultrasound Market Size and Forecast, by Function (2022-2029) 4.4.2.3.1. Quality assurance 4.4.2.3.2. Microbial enzyme inactivation 4.4.2.3.3. Cutting 4.4.2.3.4. Emulsification & homogenization 4.4.2.3.5. Cleaning 4.4.2.3.6. Others 4.4.3. Mexico 4.4.3.1. Mexico Food Ultrasound Market Size and Forecast, by Product (2022-2029) 4.4.3.1.1. Dairy 4.4.3.1.2. Beverages 4.4.3.1.3. Fruits and Vegetables 4.4.3.1.4. Meat and Seafood 4.4.3.1.5. Backer and Confectionery 4.4.3.2. Mexico Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 4.4.3.2.1. High-frequency low-intensity 4.4.3.2.2. Low-frequency high-intensity 4.4.3.3. Mexico Food Ultrasound Market Size and Forecast, by Function (2022-2029) 4.4.3.3.1. Quality assurance 4.4.3.3.2. Microbial enzyme inactivation 4.4.3.3.3. Cutting 4.4.3.3.4. Emulsification & homogenization 4.4.3.3.5. Cleaning 4.4.3.3.6. Others 5. Europe Food Ultrasound Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Food Ultrasound Market Size and Forecast, by Product (2022-2029) 5.2. Europe Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 5.3. Europe Food Ultrasound Market Size and Forecast, by Function (2022-2029) 5.4. Europe Food Ultrasound Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Food Ultrasound Market Size and Forecast, by Product (2022-2029) 5.4.1.2. United Kingdom Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 5.4.1.3. United Kingdom Food Ultrasound Market Size and Forecast, by Function (2022-2029) 5.4.2. France 5.4.2.1. France Food Ultrasound Market Size and Forecast, by Product (2022-2029) 5.4.2.2. France Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 5.4.2.3. France Food Ultrasound Market Size and Forecast, by Function (2022-2029) 5.4.3. Germany 5.4.3.1. Germany Food Ultrasound Market Size and Forecast, by Product (2022-2029) 5.4.3.2. Germany Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 5.4.3.3. Germany Food Ultrasound Market Size and Forecast, by Function (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Food Ultrasound Market Size and Forecast, by Product (2022-2029) 5.4.4.2. Italy Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 5.4.4.3. Italy Food Ultrasound Market Size and Forecast, by Function (2022-2029) 5.4.5. Spain 5.4.5.1. Spain Food Ultrasound Market Size and Forecast, by Product (2022-2029) 5.4.5.2. Spain Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 5.4.5.3. Spain Food Ultrasound Market Size and Forecast, by Function (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Food Ultrasound Market Size and Forecast, by Product (2022-2029) 5.4.6.2. Sweden Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 5.4.6.3. Sweden Food Ultrasound Market Size and Forecast, by Function (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Food Ultrasound Market Size and Forecast, by Product (2022-2029) 5.4.7.2. Austria Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 5.4.7.3. Austria Food Ultrasound Market Size and Forecast, by Function (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Food Ultrasound Market Size and Forecast, by Product (2022-2029) 5.4.8.2. Rest of Europe Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 5.4.8.3. Rest of Europe Food Ultrasound Market Size and Forecast, by Function (2022-2029) 6. Asia Pacific Food Ultrasound Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Food Ultrasound Market Size and Forecast, by Product (2022-2029) 6.2. Asia Pacific Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 6.3. Asia Pacific Food Ultrasound Market Size and Forecast, by Function (2022-2029) 6.4. Asia Pacific Food Ultrasound Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Food Ultrasound Market Size and Forecast, by Product (2022-2029) 6.4.1.2. China Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 6.4.1.3. China Food Ultrasound Market Size and Forecast, by Function (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Food Ultrasound Market Size and Forecast, by Product (2022-2029) 6.4.2.2. S Korea Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 6.4.2.3. S Korea Food Ultrasound Market Size and Forecast, by Function (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Food Ultrasound Market Size and Forecast, by Product (2022-2029) 6.4.3.2. Japan Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 6.4.3.3. Japan Food Ultrasound Market Size and Forecast, by Function (2022-2029) 6.4.4. India 6.4.4.1. India Food Ultrasound Market Size and Forecast, by Product (2022-2029) 6.4.4.2. India Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 6.4.4.3. India Food Ultrasound Market Size and Forecast, by Function (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Food Ultrasound Market Size and Forecast, by Product (2022-2029) 6.4.5.2. Australia Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 6.4.5.3. Australia Food Ultrasound Market Size and Forecast, by Function (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Food Ultrasound Market Size and Forecast, by Product (2022-2029) 6.4.6.2. Indonesia Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 6.4.6.3. Indonesia Food Ultrasound Market Size and Forecast, by Function (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Food Ultrasound Market Size and Forecast, by Product (2022-2029) 6.4.7.2. Malaysia Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 6.4.7.3. Malaysia Food Ultrasound Market Size and Forecast, by Function (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Food Ultrasound Market Size and Forecast, by Product (2022-2029) 6.4.8.2. Vietnam Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 6.4.8.3. Vietnam Food Ultrasound Market Size and Forecast, by Function (2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Food Ultrasound Market Size and Forecast, by Product (2022-2029) 6.4.9.2. Taiwan Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 6.4.9.3. Taiwan Food Ultrasound Market Size and Forecast, by Function (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Food Ultrasound Market Size and Forecast, by Product (2022-2029) 6.4.10.2. Rest of Asia Pacific Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 6.4.10.3. Rest of Asia Pacific Food Ultrasound Market Size and Forecast, by Function (2022-2029) 7. Middle East and Africa Food Ultrasound Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Food Ultrasound Market Size and Forecast, by Product (2022-2029) 7.2. Middle East and Africa Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 7.3. Middle East and Africa Food Ultrasound Market Size and Forecast, by Function (2022-2029) 7.4. Middle East and Africa Food Ultrasound Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Food Ultrasound Market Size and Forecast, by Product (2022-2029) 7.4.1.2. South Africa Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 7.4.1.3. South Africa Food Ultrasound Market Size and Forecast, by Function (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Food Ultrasound Market Size and Forecast, by Product (2022-2029) 7.4.2.2. GCC Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 7.4.2.3. GCC Food Ultrasound Market Size and Forecast, by Function (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Food Ultrasound Market Size and Forecast, by Product (2022-2029) 7.4.3.2. Nigeria Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 7.4.3.3. Nigeria Food Ultrasound Market Size and Forecast, by Function (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Food Ultrasound Market Size and Forecast, by Product (2022-2029) 7.4.4.2. Rest of ME&A Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 7.4.4.3. Rest of ME&A Food Ultrasound Market Size and Forecast, by Function (2022-2029) 8. South America Food Ultrasound Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Food Ultrasound Market Size and Forecast, by Product (2022-2029) 8.2. South America Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 8.3. South America Food Ultrasound Market Size and Forecast, by Function(2022-2029) 8.4. South America Food Ultrasound Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Food Ultrasound Market Size and Forecast, by Product (2022-2029) 8.4.1.2. Brazil Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 8.4.1.3. Brazil Food Ultrasound Market Size and Forecast, by Function (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Food Ultrasound Market Size and Forecast, by Product (2022-2029) 8.4.2.2. Argentina Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 8.4.2.3. Argentina Food Ultrasound Market Size and Forecast, by Function (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Food Ultrasound Market Size and Forecast, by Product (2022-2029) 8.4.3.2. Rest Of South America Food Ultrasound Market Size and Forecast, by Frequency Range (2022-2029) 8.4.3.3. Rest Of South America Food Ultrasound Market Size and Forecast, by Function (2022-2029) 9. Global Food Ultrasound Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Food Ultrasound Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Hitachi Corporation 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Bosch 10.3. Buhler 10.4. Siemens Healthcare 10.5. Analogic Corporation 10.6. FUJIFILM Holdings Corporation 10.7. Koninklijke Philips N.V 10.8. Esaote S.p.A 10.9. Mindray Medical International Ltd. 10.10. Robert Bosch GmbH 10.11. Emerson Electric Co. 10.12. Buehler’s Fresh Foods 10.13. Dukane 10.14. Hielscher Ultrasonics GmbH 10.15. Newtech 10.16. Denny’s Franchisee Association 10.17. Rinco Ultrasonics 11. Key Findings 12. Industry Recommendations 13. Food Ultrasound Market: Research Methodology 14. Terms and Glossary