Global Fluid Sensors Market size was valued at USD 12.29 Bn. in 2023 and the total Fluid Sensors revenue is expected to grow by 8.15% from 2024 to 2030, reaching nearly USD 21.27 Bn.Fluid Sensors Market Overview:

A fluid sensor is defined as a device used for measuring and keeping track of factors such as flow, level, and pressure of fluids, the temperature in relevant systems, etc, to maintain the best operational and safety levels. Proper control of liquid-containing operations in and out of the automotive, oil & gas, and wastewater treatment industries relies on these sensors. The scope of the fluid sensor includes all these industries with enhanced use for automotive, oil and gas, water treatment, chemical industries, etc. Advanced sensor technologies have been made available by leading manufacturers and the market is growing at a global scale due to the rising need for accuracy and efficiency in every activity. The requirements for fluid sensors have been increasing due to the increasing levels of automation, enhanced safety requirements compliance, and the accurate measurement of fluids in industries such as automotive and wastewater treatment. Asia Pacific region is expected to dominate the Fluid Sensors Market due to growth in the automotive and industrial sectors. However, in North America and Europe, CO2 sensors are relatively strong given the rapid industrialization and construction enlargement. The demand for fluid sensors is high in the water-treated and oil and gas industries since these two segments dominate the fluid sensor market owing to the continuous need for active tracking for efficiency and safety. Other sectors, including automotive and chemicals, also play a significant role in the overall growth of the Fluid Sensors Industry, making it a critical component of industrial and manufacturing processes worldwide.To know about the Research Methodology:-Request Free Sample Report

Global Fluid Sensors Market Dynamics:

Automation, IoT Integration, and Regulatory Compliance Drive Fluid Sensors Market Growth Key drivers contributing to the strong growth of fluid sensors includes, industry demand for automation is steadily increasing across sectors such as oil & gas, manufacturing, and water treatment industries that depend upon fluid sensor manufacturers and fluid sensor suppliers to deliver advanced sensors for effective monitoring and control of critical processes which in turn drives the revenue/sales of these products. The growth into medical devices used for diagnostics and patient monitoring systems entices healthcare providers with real-time data acquisition solutions. Also, environmental regulations force industries to monitor trends/levels of fluid (especially when handling hazardous materials) thereby giving an additional push toward fluid sensor adoption. The integration of IoT technology has revolutionized the fluid sensors sector enabling predictive maintenance with seamless transmission of data and operational efficiency which also enhances the cost-benefit scale and profits of any business venture. High Production Costs and Data Security Concerns Challenge Fluid Sensors Market Growth Despite the growth, the Fluid Sensors Market has some challenges. One major challenge is the price of production and manufacturing costs related to advanced sensor technology. This acts as a discouragement for adoption in industries that are price-sensitive and also in emerging markets, as a result impacting the number of units sold. In addition, fluid sensor manufacturers and fluid sensor suppliers find difficulties in sensor calibration and maintenance due to their complexity and high cost. In particular, this challenge affects industries that operate in locations far from being easily accessed by technicians, hence increasing the costs further. The value chain analysis demonstrates that ultrasonic or electromagnetic sensors are worthy of being considered as substitutes since they offer cheaper or more accurate solutions in certain applications, thereby raising the level of competition. Also, the integration of fluid sensors into wider IoT networks has raised issues regarding data security and possible cyber threats, as industries are growing warier in exposing operational data that could be sensitive. Growth Opportunities for Fluid Sensors in Smart Water Management, Renewable Energy, and Miniaturized Technologies The Fluid Sensors Market is full of opportunities. Manufacturers could further implement their presence by providing solutions that track water usage and detect leak locations in real-time with the increased adoption of smart water management systems, especially in water-scarce regions. This can serve as a good opportunity for fluid sensor manufacturers and fluid sensor suppliers to expand their market presence. In addition, the renewable energy sector, especially in wind and solar power, presents opportunities for fluid sensors used to monitor the cooling systems of power generation equipment, creating growth avenues for companies within the industry. The ongoing Industry 4.0 trend also fuels demand for fluid sensors, as precision manufacturing and automation systems require real-time fluid monitoring. The advancements in wireless and miniaturized sensor technologies open up new markets, particularly in healthcare and wearable devices, which demand compact and accurate fluid sensors. These opportunities can lead to higher profit margins, EPS, and import-export activity, creating positive trends across the fluid sensors industry.Global Fluid Sensors Market Segment Analysis

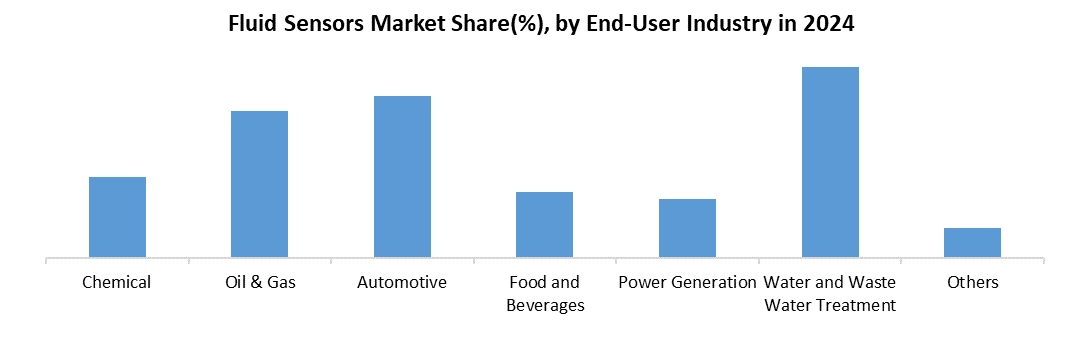

Based on End-User Industry, the Fluid sensors market is dominated by the Water and Wastewater Treatment segment which is driven by the demand for efficient tracing systems to help with water management and environmental conservation. The last few decades have witnessed an increase in the demand for fluid sensors in this sector as the issues of water scarcity become more severe and governments increase the water quality standards. The traders of fluid sensors and the manufacturers of fluid sensors are very important in averting extreme water treatment solutions by offering vital sensors that are used in holding, measuring, and checking the water quality to allow proper water treatment processes. The use of metropolitan smart water management systems in addition to regions prone to water scarcity also added impetus to the consumption of these sensors. There have been improvements in the operational efficiencies in treatment centers due to the cheap cost of making and production of advanced sensors together with the availability of real-time data measurement and monitoring and IoT capabilities. The import-export trade of fluid sensors has also grown as the global appetite increases thus providing a more profitable niche and sale satisfaction to the enterprise with fluid sensors provisions.

Fluid Sensors Market Regional Insights:

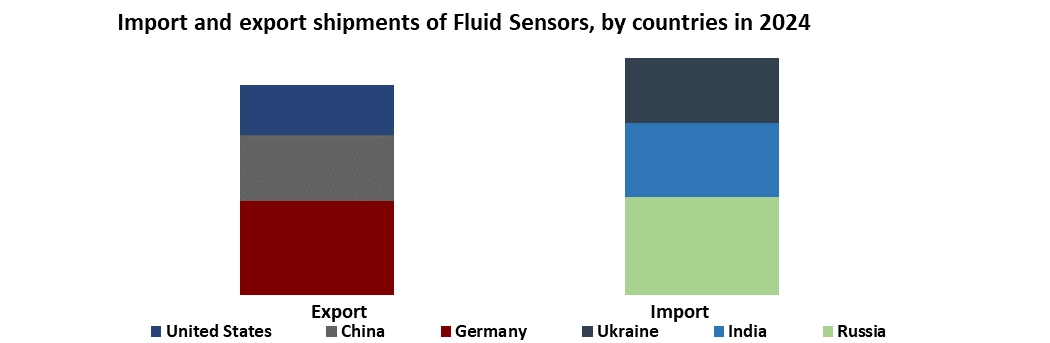

The Asia Pacific region holds the largest market share of the Fluid Sensors Market in the year 2023, enhanced by industrialization and the need for automation in industries such as automotive, oil and gas, and water treatment. Countries like China, India, and Japan are growing in terms of manufacturing and infrastructure which raises the demand for sophisticated fluid sensors. In this region, it is lower manufacturing and production costs that invite many global fluid sensor ideas manufacturers and suppliers. This brings about better cost-profit ratios and cost advantages to the companies operating in this region. There are also market growth factors which include an increased rate of adoption of IoT-enabled systems additionally strict environmental laws that foster the development of the market. Growth in imports and exports demonstrates trade growth, meanwhile, appealing margins and complex value chains enhance overall Revenue/Sales. It is these factors that make the Asia-Pacific even stronger in the fluid sensors market and more important as a source for further growth and investments. The period covering March 2023 and February 2024 has recorded a remarkable level of over 3,300 global shipments in the Fluid Sensors Market and more than 1,250 fluid sensor exporters to 1,130+ international buyers. Just in February 2024, over 140+ shipments were imported to different regions across the globe. The lead importers were Russia importing more than 3,790 shipments, next was India with over 2,850 shipments, and in third place was Ukraine with 2,520+ shipments. Export-wise sharp analysis showed Germany with dominance over the market with more than 3630+ shipments, China with over 2560+ shipments, and the United States stand at third with 1920+ shipments. This analysis covers the important issues concerning the gross trade mix of the chemical sensors, which demonstrate high levels of consumption and wide patterns across key regions.

Top 3 Importers of the Fluid Sensors (No. of Shipments) (2024) Russia 3790+ India 2850+ Ukraine 2520+ Competitive Landscape: The fluid sensors market is highly competitive with leading companies like Omron Corporation, Panasonic Corporation, Texas Instruments NXP Semiconductors N.V., And General Electric Company vying for market share through innovation, efficient production methods, and specialization in sectors, like automotive, oil & gas, and water treatment. Omron Corporation utilizes its knowledge, in automation and sensor technology with a focus on monitoring solutions while Panasonic Corporation highlights IoT-connected sensors and energy-efficient designs at competitive prices. Texas Instruments is at the forefront of semiconductor-based sensor solutions due to its research and development efforts and integration with microcontrollers. NXP Semiconductors N.V. specifically targets industrial uses by offering high-performing sensors, for essential systems. General Electric Company (GE) a player, in the industrial and energy fields excels, in providing sensors for extensive infrastructure developments and renewable energy initiatives. These individuals concentrate on growing their presence by enhancing their distribution networks and streamlining production costs to uphold their edge in profits and market presence.

Top 3 Exporters of the Fluid Sensors (No. of Shipments) (2024) Germany 3630+ China 2560+ United States 1920+ PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which gives a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global Fluid Sensors Market dynamic, and structure by analyzing the market segments and projecting the Global Fluid Sensors Market size. Clear representation of competitive analysis of key players By Price Range, price, financial position, product portfolio, growth strategies, and regional presence in the Global Fluid Sensors Market make the report an investor’s guide.

Fluid Sensors Market Scope: Inquire before buying

Global Fluid Sensors Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 12.29 Bn. Forecast Period 2024 to 2030 CAGR: 8.15% Market Size in 2030: US $ 21.27 Bn. Segments Covered: by Product Type Pressure Sensors Level Sensors Temperature Sensors Flow Sensors Others by Detection Method Contact Non-contact by End-Use Industry Chemical Oil & Gas Automotive Food and Beverages Power Generation Water and Waste Water Treatment Others Fluid Sensors Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America) North America Fluid Sensors Market Key Players 1. Texas Instruments [USA] 2. Emerson Electric Company [USA] 3. Rockwell Automation, Inc. [USA] 4. Gems Sensors, Inc. [USA] 5. Honeywell International Inc. [USA] 6. General Electric Company [USA] 7. Analog Devices [USA] Europe Fluid Sensors Market Key Players 1. NXP Semiconductors N.V. [Netherlands] 2. Bosch Sensortec [Germany] 3. Schneider Electric SE [France] 4. Sensata Technologies Holding N.V. [Netherlands] 5. Sick AG [Germany] 6. TE Connectivity [Switzerland] 7. STMicroelectronics [Switzerland] 8. ABB [Switzerland] 9. Siemens AG [Germany] 10. Delphi Automotive [Ireland] Asia Pacific Fluid Sensors Market Key Players 1. Yokogawa Electric Corporation [Japan] 2. Omron Corporation [Japan] 3. Panasonic Corporation [Japan] Middle East and Africa Fluid Sensors Market Key Players 1. Omron Corporation [Dubai] 2. Emerson Electric Company [Dubai] South America Fluid Sensors Market Key Players 1. General Electric Company [Brazil] Frequently Asked Questions: 1. Which region has the largest share in the Global Fluid Sensors Market? Ans: The Asia Pacific region held the highest share in 2023. 2. What is the growth rate of the Global Fluid Sensors Market? Ans: The Global Market is expected to grow at a CAGR of 8.15% during the forecast period 2024-2030. 3. What is the scope of the Global Fluid Sensors Market report? Ans: The Global Fluid Sensors Market report helps with the PESTEL, PORTER, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in the Global Fluid Sensors Market? Ans: The important key players in the Global Fluid Sensors Market are – Omron Corporation, Panasonic Corporation, Texas Instruments NXP Semiconductors N.V., and General Electric Company, etc. 5. What is the study period of this market? Ans: The Global Fluid Sensors Market is studied from 2023 to 2030.

1. Fluid Sensors Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Fluid Sensors Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Product Segment 2.3.3. End-user Segment 2.3.4. Revenue (2023) 2.4. Leading Fluid Sensors Market Companies, by Market Capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Fluid Sensors Market: Dynamics 3.1. Fluid Sensors Market Trends by Region 3.1.1. North America Fluid Sensors Market Trends 3.1.2. Europe Fluid Sensors Market Trends 3.1.3. Asia Pacific Fluid Sensors Market Trends 3.1.4. Middle East & Africa Fluid Sensors Market Trends 3.1.5. South America Fluid Sensors Market Trends 3.2. Fluid Sensors Market Dynamics by Global 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Value Chain Analysis 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East & Africa 3.6.5. South America 3.7. Analysis of Government Schemes and Initiatives for the Fluid Sensors Industry 3.8. Import and Export data by region 3.8.1. North America 3.8.2. Europe 3.8.3. China 3.8.4. Rest of APAC 3.8.5. Middle East & Africa 3.8.6. South America 4. Fluid Sensors Market: Global Market Size and Forecast by Segmentation (by Value USD Mn) (2023-2030) 4.1. Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 4.1.1. Pressure Sensors 4.1.2. Level Sensors 4.1.3. Temperature Sensors 4.1.4. Flow Sensors 4.1.5. Others 4.2. Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 4.2.1. Contact 4.2.2. Non-contact 4.3. Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 4.3.1. Chemical 4.3.2. Oil & Gas 4.3.3. Automotive 4.3.4. Food and Beverages 4.3.5. Power Generation 4.3.6. Water and Waste Water Treatment 4.3.7. Others 4.4. Fluid Sensors Market Size and Forecast, By Region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East & Africa 4.4.5. South America 5. North America Fluid Sensors Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2023-2030) 5.1. North America Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 5.1.1. Pressure Sensors 5.1.2. Level Sensors 5.1.3. Temperature Sensors 5.1.4. Flow Sensors 5.1.5. Others 5.2. North America Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 5.2.1. Contact 5.2.2. Non-contact 5.3. North America Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 5.3.1. Chemical 5.3.2. Oil & Gas 5.3.3. Automotive 5.3.4. Food and Beverages 5.3.5. Power Generation 5.3.6. Water and Waste Water Treatment 5.3.7. Others 5.4. North America Fluid Sensors Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 5.4.1.1.1. Pressure Sensors 5.4.1.1.2. Level Sensors 5.4.1.1.3. Temperature Sensors 5.4.1.1.4. Flow Sensors 5.4.1.1.5. Others 5.4.1.2. United States United States Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 5.4.1.2.1. Contact 5.4.1.2.2. Non-contact 5.4.1.3. United States Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 5.4.1.3.1. Chemical 5.4.1.3.2. Oil & Gas 5.4.1.3.3. Automotive 5.4.1.3.4. Food and Beverages 5.4.1.3.5. Power Generation 5.4.1.3.6. Water and Waste Water Treatment 5.4.1.3.7. Others 5.4.2. Canada 5.4.2.1. Canada Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 5.4.2.1.1. Pressure Sensors 5.4.2.1.2. Level Sensors 5.4.2.1.3. Temperature Sensors 5.4.2.1.4. Flow Sensors 5.4.2.1.5. Others 5.4.2.2. Canada Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 5.4.2.2.1. Contact 5.4.2.2.2. Non-contact 5.4.2.3. Canada Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 5.4.2.3.1. Chemical 5.4.2.3.2. Oil & Gas 5.4.2.3.3. Automotive 5.4.2.3.4. Food and Beverages 5.4.2.3.5. Power Generation 5.4.2.3.6. Water and Waste Water Treatment 5.4.2.3.7. Others 5.4.3. Mexico 5.4.3.1. Mexico Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 5.4.3.1.1. Pressure Sensors 5.4.3.1.2. Level Sensors 5.4.3.1.3. Temperature Sensors 5.4.3.1.4. Flow Sensors 5.4.3.1.5. Others 5.4.3.2. Mexico Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 5.4.3.2.1. Contact 5.4.3.2.2. Non-contact 5.4.3.3. Mexico Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 5.4.3.3.1. Chemical 5.4.3.3.2. Oil & Gas 5.4.3.3.3. Automotive 5.4.3.3.4. Food and Beverages 5.4.3.3.5. Power Generation 5.4.3.3.6. Water and Waste Water Treatment 5.4.3.3.7. Others 6. Europe Fluid Sensors Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2023-2030) 6.1. Europe Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 6.2. Europe Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 6.3. Europe Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 6.4. Europe Fluid Sensors Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 6.4.1.2. United Kingdom Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 6.4.1.3. United Kingdom Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 6.4.2. France 6.4.2.1. France Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 6.4.2.2. France Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 6.4.2.3. France Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 6.4.3.2. Germany Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 6.4.3.3. Germany Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 6.4.4.2. Italy Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 6.4.4.3. Italy Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 6.4.5.2. Spain Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 6.4.5.3. Spain Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 6.4.6.2. Sweden Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 6.4.6.3. Sweden Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 6.4.7. Austria 6.4.7.1. Austria Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 6.4.7.2. Austria Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 6.4.7.3. Austria Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 6.4.8.2. Rest of Europe Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 6.4.8.3. Rest of Europe Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 7. Asia Pacific Fluid Sensors Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2023-2030) 7.1. Asia Pacific Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 7.2. Asia Pacific Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 7.3. Asia Pacific Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 7.4. Asia Pacific Fluid Sensors Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 7.4.1.2. China Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 7.4.1.3. China Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 7.4.2.2. S Korea Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 7.4.2.3. S Korea Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 7.4.3.2. Japan Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 7.4.3.3. Japan Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 7.4.4. India 7.4.4.1. India Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 7.4.4.2. India Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 7.4.4.3. India Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 7.4.5.2. Australia Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 7.4.5.3. Australia Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 7.4.6. ASEAN 7.4.6.1. ASEAN Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 7.4.6.2. ASEAN Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 7.4.6.3. ASEAN Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 7.4.7. Rest of Asia Pacific 7.4.7.1. Rest of Asia Pacific Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 7.4.7.2. Rest of Asia Pacific Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 7.4.7.3. Rest of Asia Pacific Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 8. Middle East and Africa Fluid Sensors Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2023-2030) 8.1. Middle East and Africa Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 8.2. Middle East and Africa Fluid Sensors Market Size and Forecast, By Detection Method Model (2023-2030) 8.3. Middle East and Africa Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 8.4. Middle East and Africa Fluid Sensors Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 8.4.1.2. South Africa Fluid Sensors Market Size and Forecast, By Detection Method Model (2023-2030) 8.4.1.3. South Africa Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 8.4.2.2. GCC Fluid Sensors Market Size and Forecast, By Detection Method Model (2023-2030) 8.4.2.3. GCC Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 8.4.3.2. Nigeria Fluid Sensors Market Size and Forecast, By Detection Method Model (2023-2030) 8.4.3.3. Nigeria Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 8.4.4.2. Rest of ME&A Fluid Sensors Market Size and Forecast, By Detection Method Model (2023-2030) 8.4.4.3. Rest of ME&A Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 9. South America Fluid Sensors Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn.) (2023-2030) 9.1. South America Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 9.2. South America Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 9.3. South America Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 9.4. South America Fluid Sensors Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 9.4.1.2. Brazil Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 9.4.1.3. Brazil Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 9.4.2.2. Argentina Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 9.4.2.3. Argentina Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Fluid Sensors Market Size and Forecast, By Product Type (2023-2030) 9.4.3.2. Rest Of South America Fluid Sensors Market Size and Forecast, By Detection Method (2023-2030) 9.4.3.3. Rest Of South America Fluid Sensors Market Size and Forecast, By End-User Industry (2023-2030) 10. Company Profile: Key Players 10.1. Omron Corporation 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Panasonic Corporation. 10.3. Texas Instruments 10.4. Emerson Electric Company 10.5. Rockwell Automation, Inc. 10.6. Gems Sensors, Inc. 10.7. NXP Semiconductors N.V. 10.8. Yokogawa Electric Corporation 10.9. General Electric Company 10.10. Honeywell International Inc. 10.11. Bosch Sensortec 10.12. Schneider Electric SE 10.13. Sensata Technologies Holding N.V. 10.14. Sick AG 10.15. TE Connectivity 10.16. STMicroelectronics 10.17. Analog Devices 10.18. ABB 10.19. Siemens AG 10.20. Delphi Automotive 11. Key Findings & Analyst Recommendations 12. Fluid Sensors Market: Research Methodology