ECG Sensor Market size was valued at US$ 9.03 Bn. in 2022 and the total ECG Sensor revenue is expected to grow at 6.4% through 2023 to 2029, reaching nearly US$ 13.94Bn.ECG Sensor Market Overview:

Nowadays cardiovascular or heart-related disease is one of the major causes of death. Cardiologists frequently use an electrocardiogram (ECG) sensor to identify and detect signs of heart disease in patients. In ECG electrodes are connected to the patient's skin and the patient's heart that track the signals of heartbeats via ECG sensors. People can now track their heart and other health-related activity using an ECG device using their smartphones. People can monitor their health and pay attention to their heartbeats using an ECG device and a smartphone. The use of an ECG sensor patch is important in modern healthcare since it helps in the early diagnosis of asymptomatic atrial fibrillation (AFib). For continuous monitoring of the heartbeat in cardiac patients, the sensor monitor is based on numerous parameters. Manufacturers are focusing on finding new ECG sensor technologies via wearable and mobile devices. The dynamic nature of the heartbeat, as well as the wireless connectivity and portability of smartphone-enabled ECG sensors, are propelling the global ECG sensor market during the forecast period.ECG Sensor Market Snapshot

To know about the Research Methodology :- Request Free Sample Report ECG Sensor Market size was valued at US$ 9.03 Bn. in 2022 and the total ECG Sensor revenue is expected to grow at 6.4% through 2023 to 2029, reaching nearly US$ 13.94 Bn.

ECG Sensor Market Overview:

Nowadays cardiovascular or heart-related disease is one of the major causes of death. Cardiologists frequently use an electrocardiogram (ECG) sensor to identify and detect signs of heart disease in patients. In ECG electrodes are connected to the patient's skin and the patient's heart that track the signals of heartbeats via ECG sensors. People can now track their heart and other health-related activity using an ECG device using their smartphones. People can monitor their health and pay attention to their heartbeats using an ECG device and a smartphone. The use of an ECG sensor patch is important in modern healthcare since it helps in the early diagnosis of asymptomatic atrial fibrillation (AFib). For continuous monitoring of the heartbeat in cardiac patients, the sensor monitor is based on numerous parameters. Manufacturers are focusing on finding new ECG sensor technologies via wearable and mobile devices. The dynamic nature of the heartbeat, as well as the wireless connectivity and portability of smartphone-enabled ECG sensors, are propelling the global ECG sensor market during the forecast period. In this report, the ECG Sensor market's growth reasons, as well as the market's many segments (Type, Connectivity, End User, and Region.), are discussed. Data has been given by market players, regions, and specific requirements. This market report includes a comprehensive overview of all the significant improvements that are presently prevailing in all market segments. Key data analysis is presented in the form of statistics, infographics, and presentations. The study discusses the ECG Sensor market's Drivers, Restraints, Opportunities, and Challenges. The report helps to assess the market growth drivers and determines how to use these drivers as a tool. The report also helps to rectify and resolve issues related to the global ECG Sensor market situation.ECG Sensor Market Dynamics:

Increasing Heart Disease and rising medical checkups amongst the people may lead to the growth of the ECG sensors market Cardiologists use an ECG sensor to check for abnormal cardiac rhythm and symptoms of potential heart disease immediately and without intervention. According to the World Health Organization (WHO), heart disease takes the lives of over 17.5 million people each year. To avoid rapid death from a heart attack or cardiac arrest, it is essential to diagnose and recognize heart disease early. As a result, many advancements in ECG sensors have been developed in recent years to reduce rates of death and assist cardiologists in making timely, accurate, and quality decisions. ECG hardware, signal pre-processing techniques, automatic identification of heart disease algorithms using ECG graphs, and data format interoperability are some of the developments in ECG. These factors are propelling the growth of the ECG sensor market over the forecast period. Rise in ECG monitoring system in Healthcare center ECG monitoring systems have been developed and widely utilized in the healthcare sector over many decades, and many smart technologies have arrived significantly over time. ECG monitoring devices are now often employed in hospitals, homes, and ambulances. Now ECG monitoring systems can utilize by the use of a variety of technologies, including the Internet of Things, edge computing, and mobile computing. This technological innovation offers a range of analytical parameters. Other than disease detection and control, they've developed to meet a variety of goals and targets, including daily activities, sports, and even mode-related purposes. The rise in Demand for ECG Sensors amongst Health Conscious people The increased awareness of people about their health is one of the major key factors for driving the global ECG sensor market. Athletes and sports players who are concerned about their health buy heart rate monitoring equipment to keep track of their heartbeats which may boost the ECG sensor market. ECG Sensors consume less power and provide accurate real-time monitoring of the heartbeats are all contributing factors to the growth of the ECG sensor market. Furthermore, the growing usage of smartphones and other body-worn sensors for heart monitoring is propelling the growth of the ECG sensor market during the forecast period. Restraint for the ECG sensor market The poor electrode connected to the patient skin results in poor ECG signal quality as well as false alarms. It can not give accurate results. Furthermore, the ECG sensor with the monitor facility is expensive. These factors may hamper the market growth during the forecast period.

ECG Sensor Market Segment Analysis:

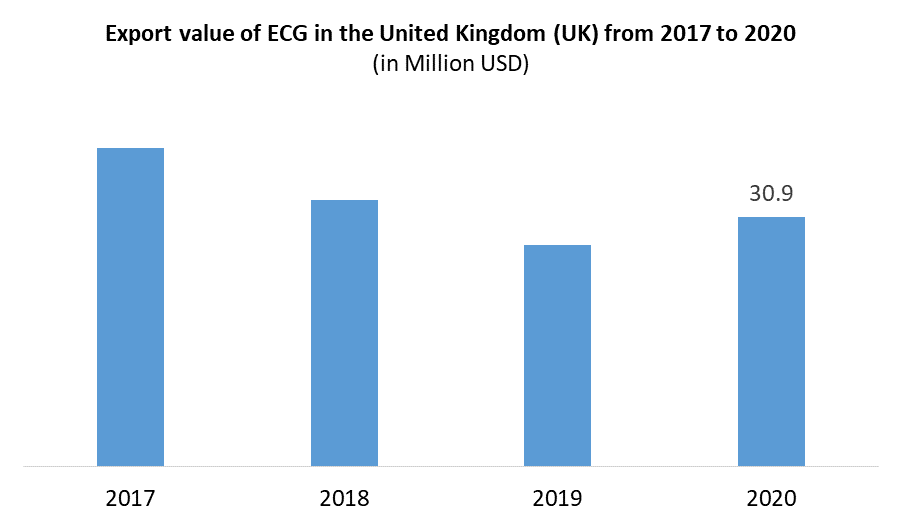

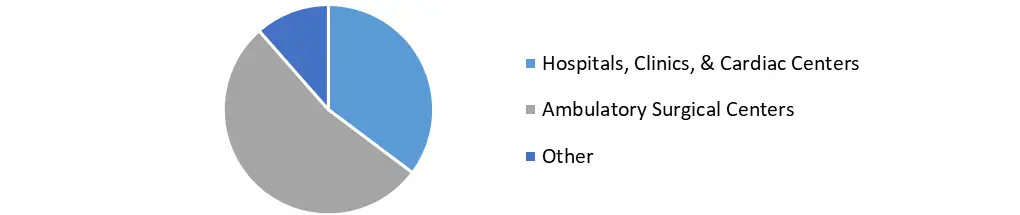

By Type, the Digital ECG sensors are a trending innovation widely used all over the world and it is predicted to grow at a rapid pace over the forecast period owing to the pandemic effect and growing heart-related issues among the people. This device can be used by anyone. The digital ECG is a useful tool when access to a medical specialist is not possible in case of an emergency. By Connectivity, the Wireless ECG segment is a type of ECG that uses wireless technology, such as Bluetooth and smartphones. With the use of this device, information can also be sent to a doctor or cardiac technician through communication apps or email. Wireless ECGs can provide voice alarm messages when any abnormalities related to the heart occur and can record this information and it can be saved for future reference. By End User, the segment of hospitals, clinics, and cardiac care facilities held the largest share of xx% ECG market in 2021. The growing burden of cardiovascular diseases increases the need for quality cardiology care. Patient visits to physician clinics for CVD diagnosis lead to a growth of this segment over the forecast period.ECG Sensor Market, by End User in 2022 (%)

ECG Sensor Market Regional Insights:

In the North American region, ECG Sensor Market has the highest market share and is likely to maintain this position during the forecast period. The ECG sensor market is dominated by the United States and Canada. Large-scale usage of ECG sensors in smartphones, wearable fitness devices, and other wearable devices such as smartwatches is attributed to the growth. Furthermore, the market is growing due to an increase in the number of cases of heart problems and the adoption of various ECG equipment in this region. Asia Pacific is expected to register the highest growth over the forecast period. Factors such as the growing incidence of chronic diseases, rising healthcare spending, and rising demand for advanced technologies in medical facilities are fueling the demand for ECG sensor devices in the Asia Pacific region. The objective of the report is to present a comprehensive analysis of the ECG Sensor market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the ECG Sensor market dynamics, and structure by analyzing the market segments and projecting the ECG Sensor market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the ECG Sensor market make the report investor’s guide.ECG Sensor Market Scope: Inquiry Before Buying

Global ECG Sensor Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 9.03 Bn. Forecast Period 2023 to 2029 CAGR: 6.4 % Market Size in 2029: US $ 13.94 Bn. Segments Covered: by Type Simulation Sensor Digital Sensor by Connectivity Wired Wireless by End User Hospitals, Clinics, & Cardiac Centers Ambulatory Surgical Centers Other ECG Sensor Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)ECG Sensor Market, Key Players are

1.Texas Instruments Inc. 2.Movesense 3. Unimed Medical Supplies Inc. 4. APK Technology Co., Ltd. 5. Shenzhen Amydi-med Electronic Technology Co., Ltd 6. Monitor Health 7. Mobile Sense Technologies, Inc. 8. VitalSignum Oy 9. RONSEDA ELECTRONICS CO.,LTD 10. KEBORUI 11. Analog Devices Inc. 12. Shimmer. 13. MikroElektronika D.O.O 14. Medtronic Plc 15. GE Healthcare 16. Philips Healthcare 17. GE Healthcare 18. Siemens Healthcare 19. NeuroSky 20. iMotions FAQs: 1. Which is the potential market for the ECG Sensor in terms of the region? Ans. In the APAC region, the growing incidence of chronic diseases, rising healthcare spending, and rising demand for advanced technologies in medical facilities are fueling the demand for the ECG sensor market. 2. What is expected to drive the growth of the ECG Sensor market in the forecast period? Ans. Increasing Heart Disease and rising medical checkups amongst the people may lead to the growth of the ECG sensors market during the forecast period. 3. What is the projected market size & growth rate of the ECG Sensor Market? Ans. ECG Sensor Market size was valued at US$ 9.03 Bn. in 2022 and the total ECG Sensor revenue is expected to grow at xx% through 2023 to 2029, reaching nearly US$ 13.94 Bn. 4. What segments are covered in the ECG Sensor Market report? Ans. The segments covered are Type, Connectivity, End User, and Region.

1. ECG Sensor Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. ECG Sensor Market: Dynamics 2.1. ECG Sensor Market Trends by Region 2.1.1. North America ECG Sensor Market Trends 2.1.2. Europe ECG Sensor Market Trends 2.1.3. Asia Pacific ECG Sensor Market Trends 2.1.4. Middle East and Africa ECG Sensor Market Trends 2.1.5. South America ECG Sensor Market Trends 2.2. ECG Sensor Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America ECG Sensor Market Drivers 2.2.1.2. North America ECG Sensor Market Restraints 2.2.1.3. North America ECG Sensor Market Opportunities 2.2.1.4. North America ECG Sensor Market Challenges 2.2.2. Europe 2.2.2.1. Europe ECG Sensor Market Drivers 2.2.2.2. Europe ECG Sensor Market Restraints 2.2.2.3. Europe ECG Sensor Market Opportunities 2.2.2.4. Europe ECG Sensor Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific ECG Sensor Market Drivers 2.2.3.2. Asia Pacific ECG Sensor Market Restraints 2.2.3.3. Asia Pacific ECG Sensor Market Opportunities 2.2.3.4. Asia Pacific ECG Sensor Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa ECG Sensor Market Drivers 2.2.4.2. Middle East and Africa ECG Sensor Market Restraints 2.2.4.3. Middle East and Africa ECG Sensor Market Opportunities 2.2.4.4. Middle East and Africa ECG Sensor Market Challenges 2.2.5. South America 2.2.5.1. South America ECG Sensor Market Drivers 2.2.5.2. South America ECG Sensor Market Restraints 2.2.5.3. South America ECG Sensor Market Opportunities 2.2.5.4. South America ECG Sensor Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For ECG Sensor Industry 2.8. Analysis of Government Schemes and Initiatives For ECG Sensor Industry 2.9. ECG Sensor Market Trade Analysis 2.10. The Global Pandemic Impact on ECG Sensor Market 3. ECG Sensor Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. ECG Sensor Market Size and Forecast, by Type (2022-2029) 3.1.1. Simulation Sensor 3.1.2. Digital Sensor 3.2. ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 3.2.1. Wired 3.2.2. Wireless 3.3. ECG Sensor Market Size and Forecast, by End User (2022-2029) 3.3.1. Hospitals, Clinics, & Cardiac Centers 3.3.2. Ambulatory Surgical Centers 3.3.3. Other 3.4. ECG Sensor Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America ECG Sensor Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America ECG Sensor Market Size and Forecast, by Type (2022-2029) 4.1.1. Simulation Sensor 4.1.2. Digital Sensor 4.2. North America ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 4.2.1. Wired 4.2.2. Wireless 4.3. North America ECG Sensor Market Size and Forecast, by End User (2022-2029) 4.3.1. Hospitals, Clinics, & Cardiac Centers 4.3.2. Ambulatory Surgical Centers 4.3.3. Other 4.4. North America ECG Sensor Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States ECG Sensor Market Size and Forecast, by Type (2022-2029) 4.4.1.1.1. Simulation Sensor 4.4.1.1.2. Digital Sensor 4.4.1.2. United States ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 4.4.1.2.1. Wired 4.4.1.2.2. Wireless 4.4.1.3. United States ECG Sensor Market Size and Forecast, by End User (2022-2029) 4.4.1.3.1. Hospitals, Clinics, & Cardiac Centers 4.4.1.3.2. Ambulatory Surgical Centers 4.4.1.3.3. Other 4.4.2. Canada 4.4.2.1. Canada ECG Sensor Market Size and Forecast, by Type (2022-2029) 4.4.2.1.1. Simulation Sensor 4.4.2.1.2. Digital Sensor 4.4.2.2. Canada ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 4.4.2.2.1. Wired 4.4.2.2.2. Wireless 4.4.2.3. Canada ECG Sensor Market Size and Forecast, by End User (2022-2029) 4.4.2.3.1. Hospitals, Clinics, & Cardiac Centers 4.4.2.3.2. Ambulatory Surgical Centers 4.4.2.3.3. Other 4.4.3. Mexico 4.4.3.1. Mexico ECG Sensor Market Size and Forecast, by Type (2022-2029) 4.4.3.1.1. Simulation Sensor 4.4.3.1.2. Digital Sensor 4.4.3.2. Mexico ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 4.4.3.2.1. Wired 4.4.3.2.2. Wireless 4.4.3.3. Mexico ECG Sensor Market Size and Forecast, by End User (2022-2029) 4.4.3.3.1. Hospitals, Clinics, & Cardiac Centers 4.4.3.3.2. Ambulatory Surgical Centers 4.4.3.3.3. Other 5. Europe ECG Sensor Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe ECG Sensor Market Size and Forecast, by Type (2022-2029) 5.2. Europe ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 5.3. Europe ECG Sensor Market Size and Forecast, by End User (2022-2029) 5.4. Europe ECG Sensor Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom ECG Sensor Market Size and Forecast, by Type (2022-2029) 5.4.1.2. United Kingdom ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 5.4.1.3. United Kingdom ECG Sensor Market Size and Forecast, by End User(2022-2029) 5.4.2. France 5.4.2.1. France ECG Sensor Market Size and Forecast, by Type (2022-2029) 5.4.2.2. France ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 5.4.2.3. France ECG Sensor Market Size and Forecast, by End User(2022-2029) 5.4.3. Germany 5.4.3.1. Germany ECG Sensor Market Size and Forecast, by Type (2022-2029) 5.4.3.2. Germany ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 5.4.3.3. Germany ECG Sensor Market Size and Forecast, by End User (2022-2029) 5.4.4. Italy 5.4.4.1. Italy ECG Sensor Market Size and Forecast, by Type (2022-2029) 5.4.4.2. Italy ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 5.4.4.3. Italy ECG Sensor Market Size and Forecast, by End User(2022-2029) 5.4.5. Spain 5.4.5.1. Spain ECG Sensor Market Size and Forecast, by Type (2022-2029) 5.4.5.2. Spain ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 5.4.5.3. Spain ECG Sensor Market Size and Forecast, by End User (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden ECG Sensor Market Size and Forecast, by Type (2022-2029) 5.4.6.2. Sweden ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 5.4.6.3. Sweden ECG Sensor Market Size and Forecast, by End User (2022-2029) 5.4.7. Austria 5.4.7.1. Austria ECG Sensor Market Size and Forecast, by Type (2022-2029) 5.4.7.2. Austria ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 5.4.7.3. Austria ECG Sensor Market Size and Forecast, by End User (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe ECG Sensor Market Size and Forecast, by Type (2022-2029) 5.4.8.2. Rest of Europe ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 5.4.8.3. Rest of Europe ECG Sensor Market Size and Forecast, by End User (2022-2029) 6. Asia Pacific ECG Sensor Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific ECG Sensor Market Size and Forecast, by Type (2022-2029) 6.2. Asia Pacific ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 6.3. Asia Pacific ECG Sensor Market Size and Forecast, by End User (2022-2029) 6.4. Asia Pacific ECG Sensor Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China ECG Sensor Market Size and Forecast, by Type (2022-2029) 6.4.1.2. China ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 6.4.1.3. China ECG Sensor Market Size and Forecast, by End User (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea ECG Sensor Market Size and Forecast, by Type (2022-2029) 6.4.2.2. S Korea ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 6.4.2.3. S Korea ECG Sensor Market Size and Forecast, by End User (2022-2029) 6.4.3. Japan 6.4.3.1. Japan ECG Sensor Market Size and Forecast, by Type (2022-2029) 6.4.3.2. Japan ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 6.4.3.3. Japan ECG Sensor Market Size and Forecast, by End User (2022-2029) 6.4.4. India 6.4.4.1. India ECG Sensor Market Size and Forecast, by Type (2022-2029) 6.4.4.2. India ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 6.4.4.3. India ECG Sensor Market Size and Forecast, by End User (2022-2029) 6.4.5. Australia 6.4.5.1. Australia ECG Sensor Market Size and Forecast, by Type (2022-2029) 6.4.5.2. Australia ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 6.4.5.3. Australia ECG Sensor Market Size and Forecast, by End User (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia ECG Sensor Market Size and Forecast, by Type (2022-2029) 6.4.6.2. Indonesia ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 6.4.6.3. Indonesia ECG Sensor Market Size and Forecast, by End User (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia ECG Sensor Market Size and Forecast, by Type (2022-2029) 6.4.7.2. Malaysia ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 6.4.7.3. Malaysia ECG Sensor Market Size and Forecast, by End User (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam ECG Sensor Market Size and Forecast, by Type (2022-2029) 6.4.8.2. Vietnam ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 6.4.8.3. Vietnam ECG Sensor Market Size and Forecast, by End User(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan ECG Sensor Market Size and Forecast, by Type (2022-2029) 6.4.9.2. Taiwan ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 6.4.9.3. Taiwan ECG Sensor Market Size and Forecast, by End User (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific ECG Sensor Market Size and Forecast, by Type (2022-2029) 6.4.10.2. Rest of Asia Pacific ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 6.4.10.3. Rest of Asia Pacific ECG Sensor Market Size and Forecast, by End User (2022-2029) 7. Middle East and Africa ECG Sensor Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa ECG Sensor Market Size and Forecast, by Type (2022-2029) 7.2. Middle East and Africa ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 7.3. Middle East and Africa ECG Sensor Market Size and Forecast, by End User (2022-2029) 7.4. Middle East and Africa ECG Sensor Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa ECG Sensor Market Size and Forecast, by Type (2022-2029) 7.4.1.2. South Africa ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 7.4.1.3. South Africa ECG Sensor Market Size and Forecast, by End User (2022-2029) 7.4.2. GCC 7.4.2.1. GCC ECG Sensor Market Size and Forecast, by Type (2022-2029) 7.4.2.2. GCC ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 7.4.2.3. GCC ECG Sensor Market Size and Forecast, by End User (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria ECG Sensor Market Size and Forecast, by Type (2022-2029) 7.4.3.2. Nigeria ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 7.4.3.3. Nigeria ECG Sensor Market Size and Forecast, by End User (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A ECG Sensor Market Size and Forecast, by Type (2022-2029) 7.4.4.2. Rest of ME&A ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 7.4.4.3. Rest of ME&A ECG Sensor Market Size and Forecast, by End User (2022-2029) 8. South America ECG Sensor Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America ECG Sensor Market Size and Forecast, by Type (2022-2029) 8.2. South America ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 8.3. South America ECG Sensor Market Size and Forecast, by End User(2022-2029) 8.4. South America ECG Sensor Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil ECG Sensor Market Size and Forecast, by Type (2022-2029) 8.4.1.2. Brazil ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 8.4.1.3. Brazil ECG Sensor Market Size and Forecast, by End User (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina ECG Sensor Market Size and Forecast, by Type (2022-2029) 8.4.2.2. Argentina ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 8.4.2.3. Argentina ECG Sensor Market Size and Forecast, by End User (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America ECG Sensor Market Size and Forecast, by Type (2022-2029) 8.4.3.2. Rest Of South America ECG Sensor Market Size and Forecast, by Connectivity (2022-2029) 8.4.3.3. Rest Of South America ECG Sensor Market Size and Forecast, by End User (2022-2029) 9. Global ECG Sensor Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading ECG Sensor Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Texas Instruments Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Movesense 10.3. Unimed Medical Supplies Inc. 10.4. APK Technology Co., Ltd. 10.5. Shenzhen Amydi-med Electronic Technology Co., Ltd 10.6. Monitor Health 10.7. Mobile Sense Technologies, Inc. 10.8. VitalSignum Oy 10.9. RONSEDA ELECTRONICS CO.,LTD 10.10. KEBORUI 10.11. Analog Devices Inc. 10.12. Shimmer. 10.13. MikroElektronika D.O.O 10.14. Medtronic Plc 10.15. GE Healthcare 10.16. Philips Healthcare 10.17. GE Healthcare 10.18. Siemens Healthcare 10.19. NeuroSky 10.20. iMotions 11. Key Findings 12. Industry Recommendations 13. ECG Sensor Market: Research Methodology 14. Terms and Glossary