Global Flexible Display Market size was valued at USD 18.96 Bn. in 2023 and the total Flexible Display revenue is expected to grow by 28.6% from 2024 to 2030, reaching nearly USD 110.29 Bn.Flexible Display Market Overview:

In comparison to the usual flat screen displays found in most electronic devices, a flexible display or rollable display is an electronic visual display that is flexible in nature. Because the screens are printed on a flexible plastic membrane, they are incredibly thin and may easily be twisted. Instead of employing tempered glass, most devices have used a plastic-based material to cover the screen, retaining the foldable nature of the device.To know about the Research Methodology :- Request Free Sample Report The making of bendable displays is possible because of materials that are both flexible and lasting. This includes items like organic light-emitting diodes (OLEDs), electronic ink or E-ink, as well as flexible substrates made from plastic to metal foils and other similar elements. Roll-to-roll processing and inkjet printing methods for manufacturing, lessen the cost of production while increasing scale. The display's durability improves with factors like better resistance to bending, high resolution, and low power consumption; all characteristics that enhance its performance making it more suitable for various applications. Flexible displays are becoming more and more popular, especially in the areas of automotive, healthcare, and consumer electronics. For example, automobile makers are using these displays to improve the user experience within their vehicles. The healthcare field is also starting to use flexible screens in advanced medical gadgets. The government, especially in smart city schemes, is taking action to promote the use of flexible displays. Also, as 5G technology gets applied more widely there's a need for 5G-compatible devices that provide fast data exchange with less power consumption - this situation encourages advanced flexible display development. The flexible display market is led by Asia Pacific, and it's predicted to hold the largest market share in 2030. This area has many big display manufacturers such as Samsung, LG, Sony, AUO, and E Ink Holdings. The region benefits from a large number of smartphone users along with the increasing use of advanced technologies like augmented reality and 3D displays. North America is likely to grow quickly because people there want more devices that are long-lasting and lightweight. Europe, especially Germany, is one of the main exporters of flexible displays in this industry. The Middle East & Africa, with the UAE leading in technological advancements, is also an important market. Royole Corporation launched the Rokit which became the first worldwide open-platform flexible electronics development kit. LG Corporation introduced OLED EX technology that improves OLED TV technology using deuterium and personal algorithm-based technology.

Global Flexible Display Market Dynamics:

Drivers The global flexible display market is growing due to factors like the increasing usage of display-based consumer electronic devices and the rising need for lightweight, flexible, and energy-efficient devices. Furthermore, technological advancements have resulted in the launch of cutting-edge flexible displays, which are expected to provide new commercial growth potential for market players. Flexible displays are commonly used by consumer electronics manufacturers due to various advantages such as lightweight, non-fragility, and durability. Furthermore, due to its sophisticated characteristics, demand for Organic Light Emitting Diode (OLED)-based flexible displays is expected to increase at an exponential rate. Furthermore, during the forecast period, the increased usage of smart wearable devices is expected to drive market growth. As a result, manufacturers are working to boost their production facilities to satisfy the rising demand. In addition, the growing popularity of OLED-based devices such as virtual reality headsets, mobile phones, digital cameras, tablets, laptops, and televisions is predicted to boost market growth. However, for new entrants, the difficult manufacturing process and expensive investment required for OLED-based flexible displays can be a barrier. Flexible displays increasing popularity in the automotive, healthcare, and other industries is likely to open up new market opportunities. Automobile manufacturers are also focusing on integrating this display into vehicle interiors. These are the major key factors that are expected to drive the growth of the global market during the forecast period 2023-2030. Ensuring that the benefits of 5G systems are expected to eventually cater to all customers, telecommunications firms guarantee a positive experience for everyone. demonstrating that equipment manufacturers fully produce 5G-compatible smartphones and computer components. The innovation is expected to provide superb internet speeds to homes and devices, with tests that show the frameworks are more than 100x quicker than 4G. Considering how much faster the capabilities of these frameworks have become, it is clear that we are finally entering into a new era for Internet speed and performance, with the availability of smartphones and workstations, it appears logical that 5G will allow instant access to jobs from anywhere and users to execute more tasks on a single device than was before possible.Global Flexible Display Market Segment Analysis

Based on the Display Type, the market is segmented into LCD, OLED, EPD, E-Paper, and Quantum Dots. The OLED segment is expected to hold the largest market share of xx% by 2030. Due to their high flexibility and energy efficiency, OLED-based displays are widely utilized in smartphones. In comparison to LCD flexible screens, they are also lightweight and have a clean appearance. These are the major factors that drive the growth of this segment in the Global market during the forecast period 2023-2030.Based on the Application, the market is segmented into Smartphone, Smartwatch, Wearable, TV, Digital Signage, PC Monitor, and Automotive. The smartphone segment is expected to grow rapidly at a CAGR of 12.1% during the forecast period 2023-2030. During the forecast period, government initiatives for smart city projects, as well as the introduction of digital signs with flexible displays, are expected to become widely utilized for advertising and map displays.

The automotive segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2030. This is due to the growing demand for navigation and infotainment systems to improve user experience; the flexible display market is expected to gain pace in the transportation and automotive sectors.

Flexible Display Market Regional Insights:

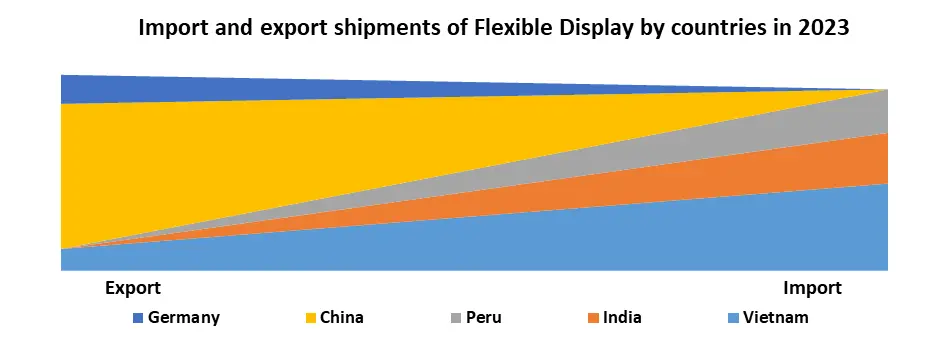

Asia Pacific dominates the Flexible Display market during the forecast period 2023-2030. Asia Pacific is expected to hold the largest market share of xx% by 2030. This is due to the key display manufacturers such as Samsung, LG, Sony, AUO, and E Ink Holdings being present in the region, the Asia-Pacific flexible display market is expected to grow rapidly in the forecast period. The increasing number of smartphone users, together with the implementation of advanced technologies like augmented reality and 3D display, is expected to boost market growth in this region. Flexible display manufacturing is dominated by countries such as India, Japan, China, and South Korea. Each year, the Chengdu facility in China produces approximately 70 million flexible sheets for phone screens. Countries from APAC such as Peru, Vietnam, India, and China are the leading countries in the import and export of the flexible display industry. These are the major factors that drive the growth of this region in the Global market during the forecast period 2023-2030. North America is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2030. This is due to the increasing demand for durable and lightweight technological devices in the North American region. Where as the Germany in Europe region is one of the top exporters of Flexible Displays. The Middle East & Africa Flexible Display Market is the largest market compared to South America, especially in countries such as UAE where the advancements in technology are booming.

Top 3 Importers of the Flexible Display Market (No. of Shipments) (2024) Vietnam 600+ India 350+ Peru 300+ Competitive Landscape: June 21, 2021- Royole Corporation a maker of flexible displays came up with Rokit. This is the initial open-platform flexible electronics development kit globally. December 29, 2021- LG Corporation, a global conglomerate, announced its latest OLED TV technology named "OLED EX." This OLED EX display of the next generation from LG Display uses deuterium and personalized algorithm-based "EX-Technology". April 19, 2022- Samsung Electronics, Ltd. is a multinational electronics company that has launched the stunning Neo QLED 8K and Neo QLED TVs These televisions come with the best picture quality and enveloping soundscapes to transform living spaces. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which gives a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global Flexible Display Market dynamic, and structure by analyzing the market segments and projecting the Global Flexible Display Market size. Clear representation of competitive analysis of key players By Price Range, price, financial position, product portfolio, growth strategies, and regional presence in the Global Flexible Display Market make the report an investor’s guide.

Top 3 Exporters of the Flexible Display Market (No. of Shipments) China 1000+ Germany 200+ Vietnam 150+ Flexible Display Market Scope: Inquire before buying

Flexible Display Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 18.96 Bn. Forecast Period 2024 to 2030 CAGR: 28.6% Market Size in 2030: US $ 110.29 Bn. Segments Covered: by Display Type LCD OLED EPD E-Paper Quantum Dots by Application Smartphone Smartwatch Wearable TV Digital Signage PC Monitor Automotive Flexible Display Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America) Flexible Display Market Key Players for North America 1. Acuity Brands Lighting [United States] 2. Corning Incorporated [United States] 3. Kateeva [United States] Flexible Display Market Key Players for Europe 1. Osram Licht AG [Germany] 2. Koninklijke Philips N.V. [Netherlands] 3. FlexEnable [United Kingdom] Flexible Display Market Key Players for Asia Pacific 1. Panasonic Corporation [Japan] 2. Samsung Electronics [South Korea] 3. Japan Display [Japan] 4. Pioneer Corporation [Japan] 5. LG Display [South Korea] 6. BOE Technology Group [China] 7. AU Optronics Corporation [Taiwan] 8. Sharp Corporation [Japan] 9. Innolux Corporation [Taiwan] 10. Hannstar Display Corporation [Taiwan] 11. Ritek Corporation [Taiwan] 12. Chunghwa Picture Tubes [Taiwan] 13. Royole Corporation [China] 14. E Ink Holdings [Taiwan] Frequently Asked Questions: 1] What segments are covered in the Global Flexible Display Market report? Ans. The segments covered in the Flexible Display Relay Market report are based on Display Type and Application. 2] Which region is expected to hold the highest share in the Global Flexible Display Market? Ans. Asia Pacific is expected to hold the highest share of the Global Flexible Display Market. 3] Who are the top key players in the Global Flexible Display Market? Ans. Panasonic Corporation, Samsung Electronics Co. Ltd, Japan Display Inc., Osram Licht AG, and Pioneer Corporation are the top key players in the Global Flexible Display Market. 4] Which segment will hold the largest market share in the Global Flexible Display market by 2030? Ans. The OLED segment hold the largest market share in the Global Flexible Display market by 2030. 5] What is the market size of the Global Flexible Display market by 2030? Ans. The market size of the Global Flexible Display market is US $ 110.29 Bn. by 2030. 6] What was the market size of the Global Flexible Display market in 2023? Ans. The market size of the Global Flexible Display market was worth US $ 18.87 Bn. in 2023.

1. Flexible Display Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Flexible Display Market: Dynamics 2.1. Flexible Display Market Trends by Region 2.1.1. North America Flexible Display Market Trends 2.1.2. Europe Flexible Display Market Trends 2.1.3. Asia Pacific Flexible Display Market Trends 2.1.4. Middle East and Africa Flexible Display Market Trends 2.1.5. South America Flexible Display Market Trends 2.2. Flexible Display Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Flexible Display Market Drivers 2.2.1.2. North America Flexible Display Market Restraints 2.2.1.3. North America Flexible Display Market Opportunities 2.2.1.4. North America Flexible Display Market Challenges 2.2.2. Europe 2.2.2.1. Europe Flexible Display Market Drivers 2.2.2.2. Europe Flexible Display Market Restraints 2.2.2.3. Europe Flexible Display Market Opportunities 2.2.2.4. Europe Flexible Display Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Flexible Display Market Drivers 2.2.3.2. Asia Pacific Flexible Display Market Restraints 2.2.3.3. Asia Pacific Flexible Display Market Opportunities 2.2.3.4. Asia Pacific Flexible Display Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Flexible Display Market Drivers 2.2.4.2. Middle East and Africa Flexible Display Market Restraints 2.2.4.3. Middle East and Africa Flexible Display Market Opportunities 2.2.4.4. Middle East and Africa Flexible Display Market Challenges 2.2.5. South America 2.2.5.1. South America Flexible Display Market Drivers 2.2.5.2. South America Flexible Display Market Restraints 2.2.5.3. South America Flexible Display Market Opportunities 2.2.5.4. South America Flexible Display Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Flexible Display Industry 2.8. Analysis of Government Schemes and Initiatives For Flexible Display Industry 2.9. Flexible Display Market Trade Analysis 2.10. The Global Pandemic Impact on Flexible Display Market 3. Flexible Display Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Flexible Display Market Size and Forecast, by Display Type (2023-2030) 3.1.1. LCD 3.1.2. OLED 3.1.3. EPD 3.1.4. E-Paper 3.1.5. Quantum Dots 3.2. Flexible Display Market Size and Forecast, by Application (2023-2030) 3.2.1. Smartphone 3.2.2. Smartwatch 3.2.3. Wearable 3.2.4. TV 3.2.5. Digital Signage 3.2.6. PC Monitor 3.2.7. Automotive 3.3. Flexible Display Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Flexible Display Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Flexible Display Market Size and Forecast, by Display Type (2023-2030) 4.1.1. LCD 4.1.2. OLED 4.1.3. EPD 4.1.4. E-Paper 4.1.5. Quantum Dots 4.2. North America Flexible Display Market Size and Forecast, by Application (2023-2030) 4.2.1. Smartphone 4.2.2. Smartwatch 4.2.3. Wearable 4.2.4. TV 4.2.5. Digital Signage 4.2.6. PC Monitor 4.2.7. Automotive 4.3. North America Flexible Display Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Flexible Display Market Size and Forecast, by Display Type (2023-2030) 4.3.1.1.1. LCD 4.3.1.1.2. OLED 4.3.1.1.3. EPD 4.3.1.1.4. E-Paper 4.3.1.1.5. Quantum Dots 4.3.1.2. United States Flexible Display Market Size and Forecast, by Application (2023-2030) 4.3.1.2.1. Smartphone 4.3.1.2.2. Smartwatch 4.3.1.2.3. Wearable 4.3.1.2.4. TV 4.3.1.2.5. Digital Signage 4.3.1.2.6. PC Monitor 4.3.1.2.7. Automotive 4.3.2. Canada 4.3.2.1. Canada Flexible Display Market Size and Forecast, by Display Type (2023-2030) 4.3.2.1.1. LCD 4.3.2.1.2. OLED 4.3.2.1.3. EPD 4.3.2.1.4. E-Paper 4.3.2.1.5. Quantum Dots 4.3.2.2. Canada Flexible Display Market Size and Forecast, by Application (2023-2030) 4.3.2.2.1. Smartphone 4.3.2.2.2. Smartwatch 4.3.2.2.3. Wearable 4.3.2.2.4. TV 4.3.2.2.5. Digital Signage 4.3.2.2.6. PC Monitor 4.3.2.2.7. Automotive 4.3.3. Mexico 4.3.3.1. Mexico Flexible Display Market Size and Forecast, by Display Type (2023-2030) 4.3.3.1.1. LCD 4.3.3.1.2. OLED 4.3.3.1.3. EPD 4.3.3.1.4. E-Paper 4.3.3.1.5. Quantum Dots 4.3.3.2. Mexico Flexible Display Market Size and Forecast, by Application (2023-2030) 4.3.3.2.1. Smartphone 4.3.3.2.2. Smartwatch 4.3.3.2.3. Wearable 4.3.3.2.4. TV 4.3.3.2.5. Digital Signage 4.3.3.2.6. PC Monitor 4.3.3.2.7. Automotive 5. Europe Flexible Display Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Flexible Display Market Size and Forecast, by Display Type (2023-2030) 5.2. Europe Flexible Display Market Size and Forecast, by Application (2023-2030) 5.3. Europe Flexible Display Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Flexible Display Market Size and Forecast, by Display Type (2023-2030) 5.3.1.2. United Kingdom Flexible Display Market Size and Forecast, by Application (2023-2030) 5.3.2. France 5.3.2.1. France Flexible Display Market Size and Forecast, by Display Type (2023-2030) 5.3.2.2. France Flexible Display Market Size and Forecast, by Application (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Flexible Display Market Size and Forecast, by Display Type (2023-2030) 5.3.3.2. Germany Flexible Display Market Size and Forecast, by Application (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Flexible Display Market Size and Forecast, by Display Type (2023-2030) 5.3.4.2. Italy Flexible Display Market Size and Forecast, by Application (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Flexible Display Market Size and Forecast, by Display Type (2023-2030) 5.3.5.2. Spain Flexible Display Market Size and Forecast, by Application (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Flexible Display Market Size and Forecast, by Display Type (2023-2030) 5.3.6.2. Sweden Flexible Display Market Size and Forecast, by Application (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Flexible Display Market Size and Forecast, by Display Type (2023-2030) 5.3.7.2. Austria Flexible Display Market Size and Forecast, by Application (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Flexible Display Market Size and Forecast, by Display Type (2023-2030) 5.3.8.2. Rest of Europe Flexible Display Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Flexible Display Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Flexible Display Market Size and Forecast, by Display Type (2023-2030) 6.2. Asia Pacific Flexible Display Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Flexible Display Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Flexible Display Market Size and Forecast, by Display Type (2023-2030) 6.3.1.2. China Flexible Display Market Size and Forecast, by Application (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Flexible Display Market Size and Forecast, by Display Type (2023-2030) 6.3.2.2. S Korea Flexible Display Market Size and Forecast, by Application (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Flexible Display Market Size and Forecast, by Display Type (2023-2030) 6.3.3.2. Japan Flexible Display Market Size and Forecast, by Application (2023-2030) 6.3.4. India 6.3.4.1. India Flexible Display Market Size and Forecast, by Display Type (2023-2030) 6.3.4.2. India Flexible Display Market Size and Forecast, by Application (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Flexible Display Market Size and Forecast, by Display Type (2023-2030) 6.3.5.2. Australia Flexible Display Market Size and Forecast, by Application (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Flexible Display Market Size and Forecast, by Display Type (2023-2030) 6.3.6.2. Indonesia Flexible Display Market Size and Forecast, by Application (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Flexible Display Market Size and Forecast, by Display Type (2023-2030) 6.3.7.2. Malaysia Flexible Display Market Size and Forecast, by Application (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Flexible Display Market Size and Forecast, by Display Type (2023-2030) 6.3.8.2. Vietnam Flexible Display Market Size and Forecast, by Application (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Flexible Display Market Size and Forecast, by Display Type (2023-2030) 6.3.9.2. Taiwan Flexible Display Market Size and Forecast, by Application (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Flexible Display Market Size and Forecast, by Display Type (2023-2030) 6.3.10.2. Rest of Asia Pacific Flexible Display Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Flexible Display Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Flexible Display Market Size and Forecast, by Display Type (2023-2030) 7.2. Middle East and Africa Flexible Display Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Flexible Display Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Flexible Display Market Size and Forecast, by Display Type (2023-2030) 7.3.1.2. South Africa Flexible Display Market Size and Forecast, by Application (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Flexible Display Market Size and Forecast, by Display Type (2023-2030) 7.3.2.2. GCC Flexible Display Market Size and Forecast, by Application (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Flexible Display Market Size and Forecast, by Display Type (2023-2030) 7.3.3.2. Nigeria Flexible Display Market Size and Forecast, by Application (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Flexible Display Market Size and Forecast, by Display Type (2023-2030) 7.3.4.2. Rest of ME&A Flexible Display Market Size and Forecast, by Application (2023-2030) 8. South America Flexible Display Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Flexible Display Market Size and Forecast, by Display Type (2023-2030) 8.2. South America Flexible Display Market Size and Forecast, by Application (2023-2030) 8.3. South America Flexible Display Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Flexible Display Market Size and Forecast, by Display Type (2023-2030) 8.3.1.2. Brazil Flexible Display Market Size and Forecast, by Application (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Flexible Display Market Size and Forecast, by Display Type (2023-2030) 8.3.2.2. Argentina Flexible Display Market Size and Forecast, by Application (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Flexible Display Market Size and Forecast, by Display Type (2023-2030) 8.3.3.2. Rest Of South America Flexible Display Market Size and Forecast, by Application (2023-2030) 9. Global Flexible Display Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Flexible Display Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Acuity Brands Lighting [United States] 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Corning Incorporated [United States] 10.3. Kateeva [United States] 10.4. Osram Licht AG [Germany] 10.5. Koninklijke Philips N.V. [Netherlands] 10.6. FlexEnable [United Kingdom] 10.7. Panasonic Corporation [Japan] 10.8. Samsung Electronics [South Korea] 10.9. Japan Display [Japan] 10.10. Pioneer Corporation [Japan] 10.11. LG Display [South Korea] 10.12. BOE Technology Group [China] 10.13. AU Optronics Corporation [Taiwan] 10.14. Sharp Corporation [Japan] 10.15. Innolux Corporation [Taiwan] 10.16. Hannstar Display Corporation [Taiwan] 10.17. Ritek Corporation [Taiwan] 10.18. Chunghwa Picture Tubes [Taiwan] 10.19. Royole Corporation [China] 10.20. E Ink Holdings [Taiwan] 11. Key Findings 12. Industry Recommendations 13. Flexible Display Market: Research Methodology 14. Terms and Glossary