Fingerprint Module Market was valued at USD 5.44 Bn in 2023 and is expected to reach USD 16.33 Bn by 2030, at a CAGR of 17 % during the forecast period.Fingerprint Module Market Overview

A fingerprint module, also known as a fingerprint sensor or fingerprint scanner, is a biometric security device that captures and analyzes an individual's fingerprint for identification or authentication purposes. These modules are commonly used in various applications, including access control systems, time and attendance tracking, mobile devices, and personal computers, to enhance security and privacy. Fingerprint-based authentication is more secure and reliable than traditional methods, as each fingerprint is unique and difficult to replicate. Fingerprint modules can provide a detailed audit trail of user activity, including timestamps of fingerprint scans and access attempts, which is useful for security monitoring and compliance purposes.To know about the Research Methodology:-Request Free Sample Report The fingerprint module market has been experiencing steady growth over the past decade, driven by increasing concerns about security and privacy, growing adoption of biometric authentication solutions, and technological advancements in fingerprint sensing technology. With the increasing incidence of cyber-attacks, data breaches, identity theft, and unauthorized access, there is a growing demand for robust security solutions. Fingerprint modules offer a reliable and convenient method of authentication, enhancing security in various applications.

Fingerprint Module Market Dynamics

Rising Security Concerns to boost Fingerprint Module Market growth With the proliferation of digital transactions, online services, and sensitive data storage, there's a growing need for robust security measures. Fingerprint modules offer a highly secure method of authentication, as fingerprints are unique to each individual, making it difficult for unauthorized access. As security threats evolve, businesses and consumers alike are increasingly turning to biometric solutions such as fingerprint modules to safeguard their digital assets, which is expected to boost the Fingerprint Module Market growth. Governments worldwide are implementing biometric identification programs to enhance national security, improve law enforcement capabilities, and streamline public services. These initiatives often mandate the use of fingerprint modules for citizen identification, border control, voter registration, and criminal identification. Compliance with government regulations and standards is a significant driver for the adoption of fingerprint modules across various sectors, including healthcare, finance, and public administration. Continuous advancements in fingerprint sensing technology have led to improvements in accuracy, speed, and reliability. Optical sensors, capacitive sensors, ultrasonic sensors, and other emerging technologies have enabled fingerprint modules to offer high-resolution imaging, anti-spoofing measures, and fast recognition speeds. These technological advancements have expanded the use cases for fingerprint modules beyond traditional applications, driving market growth. The integration of fingerprint sensors into smartphones, tablets, and laptops has been a game-changer for the fingerprint module market. Fingerprint authentication has become a standard feature in modern mobile devices, enabling secure unlocking, mobile payments, app authentication, and data encryption. The widespread adoption of mobile biometrics has significantly expanded the addressable market for fingerprint modules, driving demand from both consumers and device manufacturers. Technical Limitations and Accuracy Issues to limit Fingerprint Module Market growth Fingerprint modules face challenges related to accuracy, especially in adverse conditions such as wet or dirty fingers, aging fingerprints, or variations in pressure during scanning. False rejection rates (FRR) and false acceptance rates (FAR) are important metrics for evaluating the performance of fingerprint modules, and improvements in these areas are essential for widespread adoption. Fingerprint modules are susceptible to spoofing attacks, where malicious actors attempt to replicate or manipulate fingerprint data to gain unauthorized access, which is expected to limit the Fingerprint Module Market growth. Common spoofing techniques include using artificial fingerprints, latent fingerprints, or 3D-printed molds. Addressing security vulnerabilities and implementing robust anti-spoofing measures is critical to maintaining the integrity and reliability of fingerprint authentication systems. The use of biometric data, including fingerprints, is subject to stringent regulations and privacy laws in many jurisdictions. Compliance with regulations such as GDPR (General Data Protection Regulation) in Europe and HIPAA (Health Insurance Portability and Accountability Act) in the United States requires careful handling and protection of biometric data to safeguard individuals' privacy rights. Ensuring transparency, consent, and data encryption are essential for mitigating privacy concerns and regulatory risks. The deployment of fingerprint modules often entails significant upfront costs, including hardware procurement, software development, integration with existing systems, and user training. For small and medium-sized businesses (SMBs) with limited budgets, the initial investment in fingerprint authentication solutions is prohibitive, which significantly limits the Fingerprint Module Market growth. Integration challenges, such as compatibility with legacy systems or interoperability with third-party software, can further complicate the implementation process and delay time-to-market.Fingerprint Module Market Segment Analysis

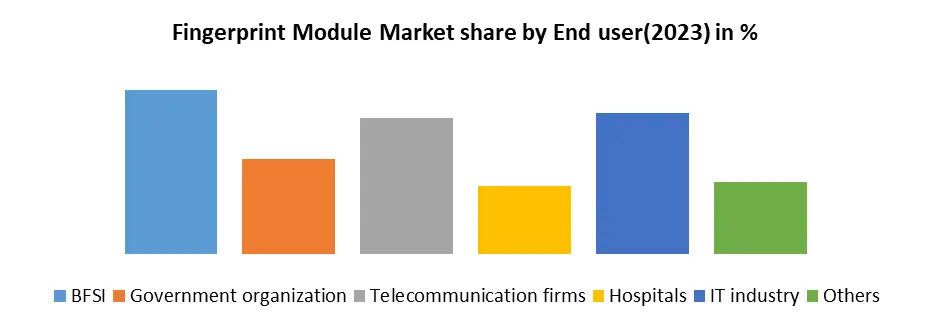

Based on Product, the market is segmented into Fingerprint reader, Fingerprint scanner, and others. Fingerprint scanner segment dominated the market in 2023 and is expected to hold the largest Fingerprint Module Market share over the forecast period. The fingerprint scanner segment is a crucial component of the fingerprint module industry, focusing specifically on the hardware and technology used to capture and analyze fingerprint data for identification and authentication purposes. Fingerprint scanners play an important role in various applications, ranging from access control systems and time and attendance tracking to mobile devices and biometric passports. Fingerprint scanners need to be compatible with existing systems and software applications for seamless integration. They may support standard interfaces such as USB, Ethernet, or RS-485, and communication protocols such as HID, Wiegand, or TCP/IP for interoperability with access control systems, time and attendance software, and other biometric applications.Based on End-user, the market is segmented into BFSI, Government organizations, Telecommunication firms, Hospitals, IT industry, and others. The BFSI segment is expected to hold the largest Fingerprint Module Market share over the forecast period. In the BFSI sector, ensuring secure access to financial accounts, sensitive data, and confidential information is paramount. Fingerprint modules offer a highly secure method of authentication, as fingerprints are unique to each individual and difficult to replicate. By integrating fingerprint scanners into banking applications, financial institutions can enhance security and prevent unauthorized access to customer accounts, transactions, and financial records. Fingerprint modules play a crucial role in fraud prevention and identity verification within the BFSI sector. By using biometric authentication, banks and financial institutions can verify the identity of customers more accurately and reliably compared to traditional methods such as passwords or PINs. Fingerprint-based authentication reduces the risk of identity theft, account takeover, and fraudulent transactions, thereby safeguarding both customers and financial institutions from financial losses and reputational damage.

Fingerprint Module Market Regional Insight

Rapid Technological Advancements in sensing technology to boost Asia Pacific Fingerprint Module Market growth Asia Pacific (APAC) is a hub for technological innovation and manufacturing, driving continuous advancements in fingerprint module technology. With countries like China, Japan, South Korea, and India leading the way in research and development, the region benefits from a steady stream of new fingerprint module products and solutions. These advancements attract investment and foster market growth, positioning APAC as a key player in the global fingerprint module market. Asia Pacific has witnessed a surge in mobile payments, e-commerce, and digital services, fueled by increasing smartphone penetration, rising internet connectivity, and evolving consumer preferences. Fingerprint modules integrated into smartphones and mobile devices enable secure and convenient authentication for mobile payments, app access, and online transactions. As digitalization accelerates across the region, the demand for fingerprint modules in mobile devices is expected to soar, driving market growth.China leads the APAC fingerprint module market, driven by its large population, robust manufacturing capabilities, and government initiatives for digitalization and security. Chinese companies are at the forefront of fingerprint module production, catering to both domestic and international markets. The number of Smartphone shipments in China is high. It is also expected to propel the region's fingerprint sensor industry, with nearly all recent smart phones including one, whether capacitive or optical. In 2022, China shipped 369 million smart phones, while distribution channels began clearing 4G inventories in preparation of 5G adoption in the coming year. 5G smart phones are predicted to exceed 150 million units in 2022, thanks to a greater rollout of 5G and more incentives provided by carriers this year. In the fourth quarter of 2022, Huawei alone shipped 33 million smart phones. Fingerprint Module Market Competitive Landscape In May 2022, OPPO unveiled the K9 5G Smartphone, which includes revolutionary technologies such as a Goodix in-display fingerprint sensor, highlighting the company's continuous relationship with the software and integrated chip design solution provider. Fingerprint Cards announced in February 2022 that their compact and curving capacitive touch sensor, FPC1542, would be integrated into Xiaomi's Redmi K40, K40 Pro, and K40 Pro+ Smartphone Applications, allowing for more streamlined mid-frame integration. Hyundai has taken steps to address security concerns related to its smart fingerprint technology. By utilizing capacitance recognition, which identifies variations in the electrical level across different areas of the fingertip, the fingerprint technology effectively safeguards against forgeries and fake fingerprints. Remarkably, the likelihood of the technology incorrectly recognizing another person's fingerprint as the driver's is merely 1 in 50,000, making it five times more reliable than traditional vehicle keys, including smart keys. Furthermore, with the support of a 'dynamic update' system enabling real-time learning of fingerprints, the fingerprint system can consistently enhance its success rate over time.

Fingerprint Module Market Scope: Inquire before buying

Fingerprint Module Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.44 Bn. Forecast Period 2024 to 2030 CAGR: 17% Market Size in 2030: US $ 16.33 Bn. Segments Covered: by Product Fingerprint reader Fingerprint scanner Other by Sensor Off-chip On-chip by End user BFSI Government organization Telecommunication firms Hospitals IT industry Others Fingerprint Module Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Fingerprint Module manufacturers include:

Asia-Pacific: 1. Suprema Inc. - Seoul, South Korea 2. Egis Technology Inc. - Taipei, Taiwan 3. Goodix Technology Inc. - Shenzhen, China 4. NEXT Biometrics Group ASA - Oslo, Norway 5. Shenzhen Newabel Electronic Co., Ltd. - Shenzhen, China 6. Mantra Softech India Pvt. Ltd. - Ahmedabad, India 7. Nitgen Co., Ltd. - Seoul, South Korea Europe: 8. Idemia - Courbevoie, France 9. Precise Biometrics AB - Lund, Sweden 10. IDEX Biometrics ASA - Oslo, Norway 11. Veridium Ltd. - London, United Kingdom 12. Green Bit S.p.A. - Turin, Italy 13. Touch Biometrix Ltd. - Manchester, United Kingdom 14. Neurotechnology - Vilnius, Lithuania 15. Fingerprint Cards AB - Gothenburg, Sweden North America: 16. Qualcomm Technologies, Inc. - San Diego, California, United States 17. Synaptics Incorporated - San Jose, California, United States 18. BIO-key International, Inc. - Wall, New Jersey, United States 19. Crossmatch - Palm Beach Gardens, Florida, United States 20. Integrated Biometrics - Spartanburg, South Carolina, United States 21. Aware, Inc. - Bedford, Massachusetts, United States 22. BIO-key International, Inc. - Wall, New Jersey, United States 23. SecuGen Corporation - Santa Clara, California, United States 24. HID Global - Austin, Texas, United States Frequently Asked Questions: 1. What are some key drivers of growth in the fingerprint module market? Ans: Rising security concerns, increasing adoption of biometric authentication solutions, and technological advancements in fingerprint sensing technology are key drivers of growth in the fingerprint module market. Additionally, government initiatives for national security and compliance with regulations contribute to market growth. 2. What are some challenges facing the fingerprint module market? Ans: Technical limitations and accuracy issues, such as false rejection rates and susceptibility to spoofing attacks, pose challenges to the widespread adoption of fingerprint modules. Compliance with privacy regulations and the high upfront costs associated with implementation are also significant challenges. 3. Which segment dominates the fingerprint module market, and why? Ans: The fingerprint scanner segment dominates the market due to its crucial role in capturing and analyzing fingerprint data for identification and authentication purposes. Fingerprint scanners are used in various applications, from access control systems to mobile devices, and require seamless integration with existing systems and software applications. 4. Which regions are driving growth in the fingerprint module market? Ans: Asia Pacific (APAC) is a key driver of growth in the fingerprint module market, fueled by rapid technological advancements, increasing smartphone penetration, and government initiatives for digitalization and security. China, in particular, leads the APAC market, with robust manufacturing capabilities and high demand for fingerprint sensors in smartphones.

1. Fingerprint Module Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Fingerprint Module Market: Dynamics 2.1. Fingerprint Module Market Trends by Region 2.1.1. North America Fingerprint Module Market Trends 2.1.2. Europe Fingerprint Module Market Trends 2.1.3. Asia Pacific Fingerprint Module Market Trends 2.1.4. Middle East and Africa Fingerprint Module Market Trends 2.1.5. South America Fingerprint Module Market Trends 2.2. Fingerprint Module Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Fingerprint Module Market Drivers 2.2.1.2. North America Fingerprint Module Market Restraints 2.2.1.3. North America Fingerprint Module Market Opportunities 2.2.1.4. North America Fingerprint Module Market Challenges 2.2.2. Europe 2.2.2.1. Europe Fingerprint Module Market Drivers 2.2.2.2. Europe Fingerprint Module Market Restraints 2.2.2.3. Europe Fingerprint Module Market Opportunities 2.2.2.4. Europe Fingerprint Module Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Fingerprint Module Market Drivers 2.2.3.2. Asia Pacific Fingerprint Module Market Restraints 2.2.3.3. Asia Pacific Fingerprint Module Market Opportunities 2.2.3.4. Asia Pacific Fingerprint Module Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Fingerprint Module Market Drivers 2.2.4.2. Middle East and Africa Fingerprint Module Market Restraints 2.2.4.3. Middle East and Africa Fingerprint Module Market Opportunities 2.2.4.4. Middle East and Africa Fingerprint Module Market Challenges 2.2.5. South America 2.2.5.1. South America Fingerprint Module Market Drivers 2.2.5.2. South America Fingerprint Module Market Restraints 2.2.5.3. South America Fingerprint Module Market Opportunities 2.2.5.4. South America Fingerprint Module Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Fingerprint Module Industry 2.8. Analysis of Government Schemes and Initiatives For Fingerprint Module Industry 2.9. Fingerprint Module Market Trade Analysis 2.10. The Global Pandemic Impact on Fingerprint Module Market 3. Fingerprint Module Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Fingerprint Module Market Size and Forecast, by Product (2023-2030) 3.1.1. Fingerprint reader 3.1.2. Fingerprint scanner 3.1.3. Other 3.2. Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 3.2.1. Off-chip 3.2.2. On-chip 3.3. Fingerprint Module Market Size and Forecast, by End User (2023-2030) 3.3.1. BFSI 3.3.2. Government organization 3.3.3. Telecommunication firms 3.3.4. Hospitals 3.3.5. IT industry 3.3.6. Others 3.4. Fingerprint Module Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Fingerprint Module Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Fingerprint Module Market Size and Forecast, by Product (2023-2030) 4.1.1. Fingerprint reader 4.1.2. Fingerprint scanner 4.1.3. Other 4.2. North America Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 4.2.1. Off-chip 4.2.2. On-chip 4.3. North America Fingerprint Module Market Size and Forecast, by End User (2023-2030) 4.3.1. BFSI 4.3.2. Government organization 4.3.3. Telecommunication firms 4.3.4. Hospitals 4.3.5. IT industry 4.3.6. Others 4.4. North America Fingerprint Module Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Fingerprint Module Market Size and Forecast, by Product (2023-2030) 4.4.1.1.1. Fingerprint reader 4.4.1.1.2. Fingerprint scanner 4.4.1.1.3. Other 4.4.1.2. United States Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 4.4.1.2.1. Off-chip 4.4.1.2.2. On-chip 4.4.1.3. United States Fingerprint Module Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. BFSI 4.4.1.3.2. Government organization 4.4.1.3.3. Telecommunication firms 4.4.1.3.4. Hospitals 4.4.1.3.5. IT industry 4.4.1.3.6. Others 4.4.2. Canada 4.4.2.1. Canada Fingerprint Module Market Size and Forecast, by Product (2023-2030) 4.4.2.1.1. Fingerprint reader 4.4.2.1.2. Fingerprint scanner 4.4.2.1.3. Other 4.4.2.2. Canada Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 4.4.2.2.1. Off-chip 4.4.2.2.2. On-chip 4.4.2.3. Canada Fingerprint Module Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. BFSI 4.4.2.3.2. Government organization 4.4.2.3.3. Telecommunication firms 4.4.2.3.4. Hospitals 4.4.2.3.5. IT industry 4.4.2.3.6. Others 4.4.3. Mexico 4.4.3.1. Mexico Fingerprint Module Market Size and Forecast, by Product (2023-2030) 4.4.3.1.1. Fingerprint reader 4.4.3.1.2. Fingerprint scanner 4.4.3.1.3. Other 4.4.3.2. Mexico Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 4.4.3.2.1. Off-chip 4.4.3.2.2. On-chip 4.4.3.3. Mexico Fingerprint Module Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. BFSI 4.4.3.3.2. Government organization 4.4.3.3.3. Telecommunication firms 4.4.3.3.4. Hospitals 4.4.3.3.5. IT industry 4.4.3.3.6. Others 5. Europe Fingerprint Module Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Fingerprint Module Market Size and Forecast, by Product (2023-2030) 5.2. Europe Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 5.3. Europe Fingerprint Module Market Size and Forecast, by End User (2023-2030) 5.4. Europe Fingerprint Module Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Fingerprint Module Market Size and Forecast, by Product (2023-2030) 5.4.1.2. United Kingdom Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 5.4.1.3. United Kingdom Fingerprint Module Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Fingerprint Module Market Size and Forecast, by Product (2023-2030) 5.4.2.2. France Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 5.4.2.3. France Fingerprint Module Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Fingerprint Module Market Size and Forecast, by Product (2023-2030) 5.4.3.2. Germany Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 5.4.3.3. Germany Fingerprint Module Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Fingerprint Module Market Size and Forecast, by Product (2023-2030) 5.4.4.2. Italy Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 5.4.4.3. Italy Fingerprint Module Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Fingerprint Module Market Size and Forecast, by Product (2023-2030) 5.4.5.2. Spain Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 5.4.5.3. Spain Fingerprint Module Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Fingerprint Module Market Size and Forecast, by Product (2023-2030) 5.4.6.2. Sweden Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 5.4.6.3. Sweden Fingerprint Module Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Fingerprint Module Market Size and Forecast, by Product (2023-2030) 5.4.7.2. Austria Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 5.4.7.3. Austria Fingerprint Module Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Fingerprint Module Market Size and Forecast, by Product (2023-2030) 5.4.8.2. Rest of Europe Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 5.4.8.3. Rest of Europe Fingerprint Module Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Fingerprint Module Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Fingerprint Module Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 6.3. Asia Pacific Fingerprint Module Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Fingerprint Module Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Fingerprint Module Market Size and Forecast, by Product (2023-2030) 6.4.1.2. China Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 6.4.1.3. China Fingerprint Module Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Fingerprint Module Market Size and Forecast, by Product (2023-2030) 6.4.2.2. S Korea Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 6.4.2.3. S Korea Fingerprint Module Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Fingerprint Module Market Size and Forecast, by Product (2023-2030) 6.4.3.2. Japan Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 6.4.3.3. Japan Fingerprint Module Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Fingerprint Module Market Size and Forecast, by Product (2023-2030) 6.4.4.2. India Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 6.4.4.3. India Fingerprint Module Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Fingerprint Module Market Size and Forecast, by Product (2023-2030) 6.4.5.2. Australia Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 6.4.5.3. Australia Fingerprint Module Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Fingerprint Module Market Size and Forecast, by Product (2023-2030) 6.4.6.2. Indonesia Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 6.4.6.3. Indonesia Fingerprint Module Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Fingerprint Module Market Size and Forecast, by Product (2023-2030) 6.4.7.2. Malaysia Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 6.4.7.3. Malaysia Fingerprint Module Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Fingerprint Module Market Size and Forecast, by Product (2023-2030) 6.4.8.2. Vietnam Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 6.4.8.3. Vietnam Fingerprint Module Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Fingerprint Module Market Size and Forecast, by Product (2023-2030) 6.4.9.2. Taiwan Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 6.4.9.3. Taiwan Fingerprint Module Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Fingerprint Module Market Size and Forecast, by Product (2023-2030) 6.4.10.2. Rest of Asia Pacific Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 6.4.10.3. Rest of Asia Pacific Fingerprint Module Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Fingerprint Module Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Fingerprint Module Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 7.3. Middle East and Africa Fingerprint Module Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Fingerprint Module Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Fingerprint Module Market Size and Forecast, by Product (2023-2030) 7.4.1.2. South Africa Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 7.4.1.3. South Africa Fingerprint Module Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Fingerprint Module Market Size and Forecast, by Product (2023-2030) 7.4.2.2. GCC Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 7.4.2.3. GCC Fingerprint Module Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Fingerprint Module Market Size and Forecast, by Product (2023-2030) 7.4.3.2. Nigeria Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 7.4.3.3. Nigeria Fingerprint Module Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Fingerprint Module Market Size and Forecast, by Product (2023-2030) 7.4.4.2. Rest of ME&A Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 7.4.4.3. Rest of ME&A Fingerprint Module Market Size and Forecast, by End User (2023-2030) 8. South America Fingerprint Module Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Fingerprint Module Market Size and Forecast, by Product (2023-2030) 8.2. South America Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 8.3. South America Fingerprint Module Market Size and Forecast, by End User(2023-2030) 8.4. South America Fingerprint Module Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Fingerprint Module Market Size and Forecast, by Product (2023-2030) 8.4.1.2. Brazil Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 8.4.1.3. Brazil Fingerprint Module Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Fingerprint Module Market Size and Forecast, by Product (2023-2030) 8.4.2.2. Argentina Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 8.4.2.3. Argentina Fingerprint Module Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Fingerprint Module Market Size and Forecast, by Product (2023-2030) 8.4.3.2. Rest Of South America Fingerprint Module Market Size and Forecast, by Sensor (2023-2030) 8.4.3.3. Rest Of South America Fingerprint Module Market Size and Forecast, by End User (2023-2030) 9. Global Fingerprint Module Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Fingerprint Module Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Suprema Inc. - Seoul, South Korea 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Egis Technology Inc. - Taipei, Taiwan 10.3. Goodix Technology Inc. - Shenzhen, China 10.4. NEXT Biometrics Group ASA - Oslo, Norway 10.5. Shenzhen Newabel Electronic Co., Ltd. - Shenzhen, China 10.6. Mantra Softech India Pvt. Ltd. - Ahmedabad, India 10.7. Nitgen Co., Ltd. - Seoul, South Korea 10.8. Idemia - Courbevoie, France 10.9. Precise Biometrics AB - Lund, Sweden 10.10. IDEX Biometrics ASA - Oslo, Norway 10.11. Veridium Ltd. - London, United Kingdom 10.12. Green Bit S.p.A. - Turin, Italy 10.13. Touch Biometrix Ltd. - Manchester, United Kingdom 10.14. Neurotechnology - Vilnius, Lithuania 10.15. Fingerprint Cards AB - Gothenburg, Sweden 10.16. Qualcomm Technologies, Inc. - San Diego, California, United States 10.17. Synaptics Incorporated - San Jose, California, United States 10.18. BIO-key International, Inc. - Wall, New Jersey, United States 10.19. Crossmatch - Palm Beach Gardens, Florida, United States 10.20. Integrated Biometrics - Spartanburg, South Carolina, United States 10.21. Aware, Inc. - Bedford, Massachusetts, United States 10.22. BIO-key International, Inc. - Wall, New Jersey, United States 10.23. SecuGen Corporation - Santa Clara, California, United States 10.24. HID Global - Austin, Texas, United States 11. Key Findings 12. Industry Recommendations 13. Fingerprint Module Market: Research Methodology 14. Terms and Glossary