Internet of Things (IoT) Agriculture Market was valued at USD 13.73 Billion in 2023, and it is expected to reach USD 25.58 Billion by 2030, exhibiting a CAGR of 9.29 % during the forecast period (2024-2030) Agriculture implements IoT over the use of drones, robots, sensors, and computer imaging integrated with analytical tools for receiving insights and monitoring the farms. Agriculture with physical equipment monitor and record data, which is subsequently used to gain insightful information. The IoT agriculture industry provides vendors with a large platform from which to meet the entire demand. There is more competition for agricultural IoT sales globally. As a result of increased competition, new vendors are meeting consumer demand for more affordable agriculture IoT by providing a range of alternatives at competitive prices. Among the top businesses in the agriculture IoT sector are DeLaval, Crop Metrics, Raven Industries, AeroFarms and SmartCultiva Corporation.To know about the Research Methodology :- Request Free Sample Report

Research Methodology:

The research methodology used to estimate and forecast the Internet of Things (IoT) Agriculture Market began with capturing data on key players revenues. The global market size of individual segments was determined through various secondary sources including industry associations, white papers, and journals. Key Players offerings were also taken into consideration to determine the market segmentation. The bottom-up approach was employed to arrive at the overall size of the IoT agriculture market, by considering the Internet of Things (IoT) Agriculture adoption rate and pricing by key players, which were then verified through primary research by conducting extensive interviews with key industry personnel, such as Vice Presidents (VPs), directors, and related executives in the market. To complete the overall market engineering process and determine the precise statistics for all segments and sub segments, data triangulation and market breakdown methods were used.Internet of Things (IoT) Agriculture Market Dynamics

The IoT agriculture report analyses factors affecting market from both demand and supply side and further estimates market dynamics effecting the global market during the forecast period i.e., drivers, restraints, opportunities, challenges and future trend. Changing Climate And Reduction Of Arable Land Are Expected To Witness Significant Growth During The Forecast Period. The world population and food consumption are growing at an alarming rate, even while the effects of climate change make ensuring sustainable food security more difficult. Using IoT technologies to sustainably grow food faster is crucial in a world that will increasingly confront food shortages. In contrast, over the past few years, significant amounts of arable farmland have been negatively impacted by climate changes. IoT is a significant development that is significantly altering current food production, much like AI and blockchain technology. IoT connects intelligent things to one another through a network using the Internet, enabling accurate monitoring. In order to track changes in agricultural surroundings, IoT in agriculture uses sensors and processors in fields, vineyards, orchards, and barns. Farmers must adapt to limit harm to crops and livestock as climate change accelerates. Government Programs to Promote Precision Farming: Various government organisations have increased their efforts and activities in the direction of smart farming as a result of growing awareness of the significance of precision agriculture methods, statistics management, data ownership, and access to open-source information. Examples of government efforts include: Gaofen far-reaching sensing satellites, 5G networks, and the Badious Navigation Satellite System (BDS) allowed China to implement precision agriculture technologies. To promote research and product creation by private companies and researchers, the Japanese Central Government modified its policies. Additionally, in 2018, law was created providing protective aid for UAVs. This legislation permitted autonomous drone flights over farms as long as they complied with safety requirements. The Ministry of Digital Policy, Telecommunications and Media created the Digital Transformation of Greek Agriculture initiative in collaboration with the Ministry of Agriculture, based primarily on precision farming technologies, with the goal of standardising farming practises in Greece and enabling data generated from the farms to be analysed at data centres to aid and support farmers. Restraints: High Initial Interest in the Newest Agriculture Equipment The major barrier to the growth of the farming IoT business is the interest for large initial uses. Rural IoT tools and devices are currently too expensive for less wealthy farmers in developed nations and the majority of ranchers in developing economies. In addition to a significant initial financial commitment, accuracy cultivation requires a qualified team to operate GPS, drones, GIS, VRT, and satellite equipment. Accurate domesticated animal cultivation advancements include high-starting-venture crowd-control programming, observing and detecting equipment, and computerised draining and caring robots. Farmers should invest heavily in automated hardware, conveyance carts, RFID or GPS-enabled domestic animal observation systems, and mechanisation and control equipment. The introduction and maintenance of these domesticated animals monitoring advancements is quite expensive. Additionally, due to accuracy in hydroponic farming technology, global positioning systems must be used at hydroponic ranches, raising the overall cost of the setup. Recent Trends and Innovations: A significant trend that is expected to fuel market growth over the forecast period is the advent and adoption of cutting-edge IoT technologies, like agricultural drones. Thanks to their superior observation capabilities, drones are crucial for conducting farming activities in advanced farming and crop management. Moreover, the majority of farming businesses are willing to use drones to improve services and promote intelligent farming. Field monitoring, soil assessment, irrigation and drainage, and harvest planning are all helped by drone technology when it is used in conjunction with other advanced technologies such as sensors, cameras, and other analytical tools.IoT Agriculture Market Challenges:

Information totalization is a big issue for the agriculture IoT industry. The knowledge gathered from ranches utilising clever agricultural tools is essential since it aids ranchers in making wise decisions. Accuracy cultivating consistently creates a lot of fundamental data related to planning, variable rate cultivating, soil testing, yield checking, and verifiable harvest turn. Since it is extremely necessary to have this information for analysing ranch conditions, it should be painstakingly saved and handled. For making wise homestead executive decisions and improving farming duties, information is essential. Makers face a challenging challenge because there is no industry standard for staying current with farming information. The challenge is to standardise the data in the board structure across the organisation to achieve functional consistency.

IoT Agriculture Market Segment Analysis:

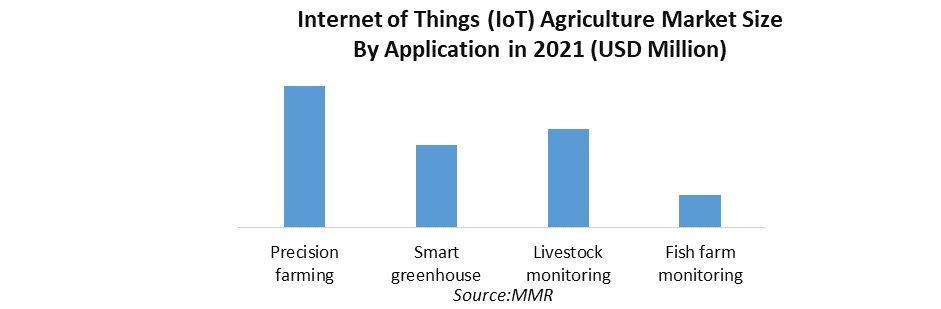

Growing Demand from Precision farming to Aid Market Growth- By application, precision farming segment is estimated to account for over 35% of the total market share in 2023. The rise in the market share of precision farming is being promoted by the IoT integration in the precision imaging for the monitoring of soil, water, and weather, along with the real-time data collection about the health of the equipment and farm's condition with the aid of drones' sensors, controllers, etc. Precision farming aims to assess data produced by sensors and respond appropriately. With the use of sensors, precision farming enables farmers to collect data, analyse it, and make quick, informed decisions. Numerous precision agricultural methods, including livestock management, vehicle monitoring, and irrigation management, all contribute significantly to raising productivity and effectiveness. However, the Livestock monitoring segment is expected to grow at the highest of 10.7% CAGR during the forecast period. The increased demand for disease detection and livestock monitoring, the expanding use of IoT sensors by dairy farmers, and the growing number of dairy farms all contribute to the growth of this market. Small Farms Type to Witness an Uptick- Based on Farm type, small farms segment commanded the largest share of the Internet of Things (IoT) Agriculture Market in 2023. Thanks to the declining cost of farm automation equipment and technological advancements that make it more practical to deploy automation tools even on smaller farms to achieve high returns on investments, small farms are anticipated to adopt automation and other advanced technologies at the fastest rate in the coming years. Likewise, the report will provide an accurate prediction of the contribution of the various segments to the growth of the r Internet of Things (IoT) Agriculture Market size.Internet of Things (IoT) Agriculture Market Regional Insights:

Regional analysis is another highly comprehensive part of the research and analysis study of the Global Internet of Things (IoT) Agriculture Market presented in the report. North America dominated the Internet of Things (IoT) Agriculture Market with a market share of 42.12% in 2023 In 2021, North America commanded the largest share of the IoT agriculture market, followed by APAC, Europe, South America, and the Middle East & Africa. During the forecast period, increasing government activities and regulations to improve the region's agriculture sector are anticipated to fuel regional demand in North America. The North America Climate Smart Agriculture Alliance (NACSAA), a platform for educating and equipping cultivators for sustainable agricultural productivity, was created by a number of agricultural groups. Governments in North America are actively offering subsidies to improve the applications of smart irrigation in response to the growing concern over water conservation. For instance, the Californian government has offered a discount on smart controllers. Asia Pacific to Retain Lead through 2030 Asia-Pacific region is expected to hold the largest growth rate in the forecast period of 2022 to 2029. Although smart farming is still in the early stages of adoption in APAC, rising government backing and cultivator awareness are anticipated to fuel regional demand over the course of the projection period. For instance, Japan's agriculture ministry has been funding the advancement of precision agriculture. Each nation's farmers' groups and community-based organisations do a lot to advance sustainable agriculture. As 90% of Singapore's total food consumption is imported, the market there is likewise anticipated to expand significantly. Small farmers in South America are increasingly embracing organic farming, which is likely to increase regional market demand during the forecast period.Competitive Landscape:

The competitive landscape section in the Internet of Things (IoT) Agriculture Market offers a deep dive into the profiles of the leading companies operating in the global market landscape. It offers captivating insights on the key developments, differential strategies, and other crucial aspects about the key players having a stronghold in the Internet of Things (IoT) Agriculture Market. Such as, Semtech Corporation, based in California, announced on February 3, 2022 that ICT International, a provider of IoT plans for environmental applications, has integrated Semtech's long-range devices and the long-range wide-area network standard into its water quality monitoring system. The creation of LoRaWAN takes into account long-range, low-power, wide-district networks, enabling these sensors to transmit assessed data to local shellfish growers, such as temperature, water level or tide, water pungency, and more. On February 15, 2022, Farmer Charlie, a UK-based provincial information and dominance provider, and Kacific Broadband Satellite Ltd., a Singapore-based provider of fast, dependable, and inexpensive satellite internet to homes, associations, and states across Asia Pacific, outlined plans to provide farmers in isolated and confined parts of Southeast Asia and the Pacific with satellite-controlled green information and expertise. Additionally, Farmer Charlie and Kacific will work together to provide smallholder farmers and agribusinesses with agrarian guidance, bound environment information, and agribusiness information by combining data from in-field sensors, with a final goal of assisting them with additional creating region the chiefs and food production using clever high level devices.Internet of Things (IoT) Agriculture Market Scope: Inquire before buying

Internet of Things (IoT) Agriculture Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US 13.73 Bn. Forecast Period 2024 to 2030 CAGR: 9.29 % Market Size in 2030: US 25.58 Bn. Segments Covered: by System Automation and control systems Sensing and monitoring devices Livestock monitoring Hardware Fish farming hardware Smart greenhouse hardware Software by Application Precision farming Livestock monitoring Smart greenhouse Fish farm monitoring byFarm Type Large Mid-Sized Small Farms Internet of Things (IoT) Agriculture Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Internet of Things (IoT) Agriculture Market Key Players

1. Deere & Company 2. Trimble, Inc. 3. Leica Geosystems 4. Raven Industries 5. AG Junction, Inc. 6. Agco Corporation 7. Precision Planting Inc. 8. The Climate Corporation 9. DeLaval 10.GEA Farm Technology 11.Lely 12.Antelliq 13.AG Leader Technology 14.Tigercat 15.Ponsse 16.Komatsu Forest AB 17.DICKEY-john Corporation 18.Hitachi, Ltd 19.Telit 20.Decisive Farming 21.OnFarm Systems Inc. 22.Farmers Edge Inc. 23.SlantRange, Inc. 24.SmartCultiva Corporation Frequently Asked Questions: 1] What segments are covered in the Global Internet of Things (IoT) Agriculture Market report? Ans. The segments covered in the Internet of Things (IoT) Agriculture Market report are based on System, Farm Type, and Application. 2] Which region is expected to hold the highest share in the Global Internet of Things (IoT) Agriculture Market? Ans. The North America region is expected to hold the highest share in the Internet of Things (IoT) Agriculture Market. 3] What is the market size of the Global Internet of Things (IoT) Agriculture Market by 2030? Ans. The market size of the Internet of Things (IoT) Agriculture Market by 2030 is expected to reach USD 25.58 Bn. 4] What is the forecast period for the Global Internet of Things (IoT) Agriculture Market? Ans. The forecast period for the Internet of Things (IoT) Agriculture Market is 2024-2030. 5] What was the market size of the Global Internet of Things (IoT) Agriculture Market in 2023? Ans. The market size of the Internet of Things (IoT) Agriculture Market in 2023 was valued at USD 13.73 Bn.

1. Global Internet of Things (IoT) Agriculture Market: Research Methodology 2. Global Internet of Things (IoT) Agriculture Market: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Internet of Things (IoT) Agriculture Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Internet of Things (IoT) Agriculture Market: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Internet of Things (IoT) Agriculture Market Segmentation 4.1. Global Internet of Things (IoT) Agriculture Market, By System (2023-2030) • Automation and control systems • Sensing and monitoring devices • Livestock monitoring Hardware • Fish farming hardware • Smart greenhouse hardware • Software 4.2. Global Internet of Things (IoT) Agriculture Market, By Farm Type (2023-2030) • Large • Mid-Sized • Small Farms 4.3. Global Internet of Things (IoT) Agriculture Market, By Application (2023-2030) • Precision farming • Livestock monitoring • Smart greenhouse • Fish farm monitoring 5. North America Internet of Things (IoT) Agriculture Market (2023-2030) 5.1. North America Internet of Things (IoT) Agriculture Market, By System (2023-2030) • Automation and control systems • Sensing and monitoring devices • Livestock monitoring Hardware • Fish farming hardware • Smart greenhouse hardware • Software 5.2. North America Internet of Things (IoT) Agriculture Market, By Farm Type (2023-2030) • Large • Mid-Sized • Small Farms 5.3. North America Internet of Things (IoT) Agriculture Market, By Application (2023-2030) • Precision farming • Livestock monitoring • Smart greenhouse • Fish farm monitoring 5.4. North America Internet of Things (IoT) Agriculture Market, by Country (2023-2030) • United States • Canada • Mexico 6. European Internet of Things (IoT) Agriculture Market (2023-2030) 6.1. European Internet of Things (IoT) Agriculture Market, By System (2023-2030) 6.2. European Internet of Things (IoT) Agriculture Market, By Farm Type (2023-2030) 6.3. European Internet of Things (IoT) Agriculture Market, By Application (2023-2030) 6.4. European Internet of Things (IoT) Agriculture Market, by Country (2023-2030) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Internet of Things (IoT) Agriculture Market (2023-2030) 7.1. Asia Pacific Internet of Things (IoT) Agriculture Market, By System (2023-2030) 7.2. Asia Pacific Internet of Things (IoT) Agriculture Market, By Farm Type (2023-2030) 7.3. Asia Pacific Internet of Things (IoT) Agriculture Market, By Application (2023-2030) 7.4. Asia Pacific Internet of Things (IoT) Agriculture Market, by Country (2023-2030) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Internet of Things (IoT) Agriculture Market (2023-2030) 8.1. Middle East and Africa Internet of Things (IoT) Agriculture Market, By System (2023-2030) 8.2. Middle East and Africa Internet of Things (IoT) Agriculture Market, By Farm Type (2023-2030) 8.3. Middle East and Africa Internet of Things (IoT) Agriculture Market, By Application (2023-2030) 8.4. Middle East and Africa Internet of Things (IoT) Agriculture Market, by Country (2023-2030) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Internet of Things (IoT) Agriculture Market (2023-2030) 9.1. South America Internet of Things (IoT) Agriculture Market, By System (2023-2030) 9.2. South America Internet of Things (IoT) Agriculture Market, By Farm Type (2023-2030) 9.3. South America Internet of Things (IoT) Agriculture Market, By Application (2023-2030) 9.4. South America Internet of Things (IoT) Agriculture Market, by Country (2023-2030) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Deere & Company. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Trimble, Inc. 10.3. Leica Geosystems 10.4. Raven Industries 10.5. AG Junction, Inc. 10.6. Agco Corporation 10.7. Precision Planting Inc. 10.8. The Climate Corporation 10.9. DeLaval 10.10. GEA Farm Technology 10.11. Lely 10.12. Antelliq 10.13. AG Leader Technology 10.14. Tigercat 10.15. Ponsse 10.16. Komatsu Forest AB 10.17. DICKEY-john Corporation 10.18. Hitachi, Ltd 10.19. Telit 10.20. Decisive Farming 10.21. OnFarm Systems Inc. 10.22. Farmers Edge Inc. 10.23. SlantRange, Inc. 10.24. SmartCultiva Corporation